Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

23 September 2024 - 6:59PM

Edgar (US Regulatory)

Pioneer Municipal High Income Fund,

Inc.

Schedule of Investments | 7/31/24

(unaudited)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| UNAFFILIATED ISSUERS — 122.6%

|

|

|

| Municipal Bonds — 120.7% of Net Assets(a)

|

|

|

| Alabama — 0.6%

|

|

| 1,250,000

| Mobile County Industrial Development Authority, Calvert LLC Project, Series A, 5.00%, 6/1/54

| $ 1,285,350

|

|

| Total Alabama

| $1,285,350

|

|

|

|

|

|

| Arizona — 0.9%

|

|

| 2,220,000

| Industrial Development Authority of the City of Phoenix, 3rd & Indian School Assisted Living Project, 5.40%, 10/1/36

| $ 2,005,082

|

|

| Total Arizona

| $2,005,082

|

|

|

|

|

|

| Arkansas — 4.5%

|

|

| 10,200,000

| Arkansas Development Finance Authority, Green Bond, 5.45%, 9/1/52

| $ 10,325,154

|

|

| Total Arkansas

| $10,325,154

|

|

|

|

|

|

| California — 6.0%

|

|

| 10,000,000(b)

| California County Tobacco Securitization Agency, Capital Appreciation, Stanislaus County, Subordinated, Series A, 6/1/46

| $ 2,708,400

|

| 2,200,000(c)

| California Infrastructure & Economic Development Bank, Brightline West Passenger Rail Project, Series A-4, 8.00%, 1/1/50 (144A)

| 2,226,334

|

| 750,000

| California Municipal Finance Authority, Westside Neighborhood School Project, 6.375%, 6/15/64 (144A)

|

814,935

|

| 300,000

| California School Finance Authority, Envision Education – Obligated Group, Series A, 5.00%, 6/1/54 (144A)

|

305,445

|

| 1,400,000

| California Statewide Communities Development Authority, Lancer Plaza Project, 5.625%, 11/1/33

| 1,401,176

|

| 2,000,000

| California Statewide Communities Development Authority, Loma Linda University Medical Center, 5.50%, 12/1/58 (144A)

| 2,065,180

|

| 4,000,000

| San Diego County Regional Airport Authority, Private Activity, Series B, 5.25%, 7/1/58

| 4,301,120

|

|

| Total California

| $13,822,590

|

|

|

|

|

|

| Colorado — 2.6%

|

|

| 1,000,000

| Aerotropolis Regional Transportation Authority, 4.375%, 12/1/52

| $ 889,520

|

1Pioneer Municipal High Income Fund, Inc. | 7/31/24

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Colorado — (continued)

|

|

| 2,450,000

| Dominion Water & Sanitation District, 5.875%, 12/1/52

| $ 2,464,382

|

| 2,500,000

| Nine Mile Metropolitan District, 5.125%, 12/1/40

| 2,545,825

|

|

| Total Colorado

| $5,899,727

|

|

|

|

|

|

| District of Columbia — 5.1%

|

|

| 500,000

| District of Columbia, Union Market Project, Series A, 5.125%, 6/1/34 (144A)

| $ 502,755

|

| 500,000(c)

| District of Columbia, Union Market Project, Series B, 6/1/49 (144A)

|

285,140

|

| 5,025,000

| District of Columbia Tobacco Settlement Financing Corp., Asset-Backed, 6.75%, 5/15/40

| 5,192,785

|

| 10,000,000(b)

| District of Columbia Tobacco Settlement Financing Corp., Capital Appreciation, Asset-Backed, Series A, 6/15/46

| 2,241,000

|

| 3,250,000

| Washington Metropolitan Area Transit Authority Dedicated Revenue, Climate Transition Bonds, Series A, 5.25%, 7/15/59

| 3,558,490

|

|

| Total District of Columbia

| $11,780,170

|

|

|

|

|

|

| Florida — 3.4%

|

|

| 3,220,000

| City of Tampa, Hospital Revenue Bonds (H. Lee Moffit Cancer Center Project), Series B, 4.00%, 7/1/45

| $ 3,044,156

|

| 2,000,000

| Florida Development Finance Corp., Brightline Florida Passenger Rail Project, 5.50%, 7/1/53

| 2,079,300

|

| 1,000,000(c)

| Florida Development Finance Corp., Brightline Florida Passenger Rail Project, 12.00%, 7/15/32 (144A)

| 1,063,260

|

| 500,000

| Florida Development Finance Corp., The Henry Project, Series A-1, 5.25%, 6/1/54 (144A)

|

512,355

|

| 1,000,000

| Florida Development Finance Corp., The Henry Project, Series B, 6.50%, 6/1/59 (144A)

| 1,026,920

|

|

| Total Florida

| $7,725,991

|

|

|

|

|

|

| Georgia — 4.4%

|

|

| 10,000,000

| Brookhaven Development Authority, Children's Healthcare Of Atlanta, Inc., Series A, 4.00%, 7/1/44

| $ 10,007,000

|

|

| Total Georgia

| $10,007,000

|

|

|

|

|

|

| Idaho — 2.2%

|

|

| 5,000,000

| Power County Industrial Development Corp., FMC Corp. Project, 6.45%, 8/1/32

| $ 5,014,400

|

|

| Total Idaho

| $5,014,400

|

|

|

|

|

|

| Illinois — 6.4%

|

|

| 2,000,000(d)

| Chicago Board of Education, Series A, 5.00%, 12/1/47

| $ 2,050,660

|

Pioneer Municipal High Income Fund,

Inc. | 7/31/242

Schedule of Investments | 7/31/24

(unaudited) (continued)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Illinois — (continued)

|

|

| 2,000,000(d)

| Chicago Board of Education, Series H, 5.00%, 12/1/46

| $ 2,008,220

|

| 704,519(b)(e)

| Illinois Finance Authority, Cabs Clare Oaks Project, Series B-1, 11/15/52

|

28,181

|

| 1,116,010(c)(e)

| Illinois Finance Authority, Clare Oaks Project, Series A-3, 4.00%, 11/15/52

|

725,406

|

| 3,500,000

| Illinois Finance Authority, The Admiral at the Lake Project, 5.25%, 5/15/42

| 2,691,745

|

| 4,000,000

| Illinois Finance Authority, The Admiral at the Lake Project, 5.50%, 5/15/54

| 2,915,000

|

| 915,000

| Illinois Housing Development Authority, Series B, 2.15%, 10/1/41 (GNMA FNMA FHLMC COLL Insured)

|

650,281

|

| 2,000,000

| Metropolitan Pier & Exposition Authority, McCormick Place Expansion, 4.00%, 6/15/50

| 1,893,020

|

| 1,205,000

| Metropolitan Pier & Exposition Authority, McCormick Place Expansion, 5.00%, 6/15/57

| 1,216,773

|

| 695,000(e)

| Southwestern Illinois Development Authority, Village of Sauget Project, 5.625%, 11/1/26

| 486,500

|

|

| Total Illinois

| $14,665,786

|

|

|

|

|

|

| Indiana — 1.8%

|

|

| 2,000,000

| City of Evansville, Silver Birch Evansville Project, 5.45%, 1/1/38

| $ 1,899,720

|

| 1,500,000

| City of Mishawaka, Silver Birch Mishawaka Project, 5.375%, 1/1/38 (144A)

| 1,304,520

|

| 1,000,000

| Indiana Finance Authority, Multipurpose Educational Facilities, Avondale Meadows Academy Project, 5.375%, 7/1/47

| 1,002,430

|

|

| Total Indiana

| $4,206,670

|

|

|

|

|

|

| Iowa — 4.2%

|

|

| 9,675,000

| Iowa Finance Authority, Alcoa Inc. Projects, 4.75%, 8/1/42

| $ 9,667,066

|

|

| Total Iowa

| $9,667,066

|

|

|

|

|

|

| Maine — 1.3%

|

|

| 3,000,000

| Maine Health & Higher Educational Facilities Authority, Series A, 4.00%, 7/1/50

| $ 2,881,740

|

|

| Total Maine

| $2,881,740

|

|

|

|

|

|

| Maryland — 1.1%

|

|

| 3,000,000

| Maryland State Transportation Authority, Series A, 3.00%, 7/1/47

| $ 2,422,140

|

|

| Total Maryland

| $2,422,140

|

|

|

|

|

3Pioneer Municipal High Income Fund, Inc. | 7/31/24

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Massachusetts — 7.3%

|

|

| 2,500,000

| Massachusetts Development Finance Agency, Series A, 5.00%, 7/1/44

| $ 2,513,275

|

| 3,000,000

| Massachusetts Development Finance Agency, Lowell General Hospital, Series G, 5.00%, 7/1/44

| 3,000,090

|

| 7,100,000

| Massachusetts Development Finance Agency, WGBH Educational Foundation, Series A, 5.75%, 1/1/42 (AMBAC Insured)

| 8,943,018

|

| 2,270,000(d)

| Town of Millbury, 4.00%, 8/15/51

| 2,177,293

|

|

| Total Massachusetts

| $16,633,676

|

|

|

|

|

|

| Michigan — 0.4%

|

|

| 970,000

| David Ellis Academy-West, 5.25%, 6/1/45

| $ 893,768

|

|

| Total Michigan

| $893,768

|

|

|

|

|

|

| Minnesota — 0.4%

|

|

| 1,000,000

| City of Ham Lake, DaVinci Academy, Series A, 5.00%, 7/1/47

| $ 966,570

|

|

| Total Minnesota

| $966,570

|

|

|

|

|

|

| Montana — 0.0%†

|

|

| 1,600,000(e)

| Two Rivers Authority, 7.375%, 11/1/27

| $ 64,000

|

|

| Total Montana

| $64,000

|

|

|

|

|

|

| New Hampshire — 3.0%

|

|

| 375,000

| New Hampshire Health and Education Facilities Authority Act, Catholic Medical Centre, 3.75%, 7/1/40

| $ 319,132

|

| 6,000,000

| New Hampshire Health and Education Facilities Authority Act, Dartmouth Health, Series A, 5.00%, 8/1/59 (BAM-TCRS Insured)

| 6,528,540

|

|

| Total New Hampshire

| $6,847,672

|

|

|

|

|

|

| New Jersey — 1.0%

|

|

| 2,200,000

| New Jersey Economic Development Authority, Continental Airlines, 5.75%, 9/15/27

| $ 2,204,356

|

|

| Total New Jersey

| $2,204,356

|

|

|

|

|

|

| New Mexico — 1.0%

|

|

| 2,540,000(c)

| County of Otero, Otero County Jail Project, Certificate Participation, 9.00%, 4/1/28

| $ 2,400,300

|

|

| Total New Mexico

| $2,400,300

|

|

|

|

|

|

| New York — 18.0%

|

|

| 2,000,000

| Erie Tobacco Asset Securitization Corp., Asset-Backed, Series A, 5.00%, 6/1/45

| $ 1,897,000

|

Pioneer Municipal High Income Fund,

Inc. | 7/31/244

Schedule of Investments | 7/31/24

(unaudited) (continued)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| New York — (continued)

|

|

| 6,175,000

| Metropolitan Transportation Authority, Green Bond, Series C-1, 4.75%, 11/15/45

| $ 6,394,027

|

| 2,000,000

| Metropolitan Transportation Authority, Green Bond, Series C-1, 5.25%, 11/15/55

| 2,104,240

|

| 2,000,000

| Metropolitan Transportation Authority, Green Bond, Series D-2, 4.00%, 11/15/48

| 1,914,740

|

| 2,500,000

| New York Counties Tobacco Trust IV, Settlement pass through, Series A, 5.00%, 6/1/45

| 2,314,000

|

| 2,500,000

| New York Transportation Development Corp., Series A, 5.25%, 1/1/50

| 2,501,025

|

| 11,330,000

| New York Transportation Development Corp., Delta Airlines Inc-LaGuardia, 5.00%, 10/1/40

| 11,848,801

|

| 1,750,000

| New York Transportation Development Corp., Green Bond, 5.375%, 6/30/60

| 1,809,552

|

| 5,500,000

| New York Transportation Development Corp., Green Bond, 5.50%, 6/30/60

| 5,850,295

|

| 1,000,000

| Suffolk Regional Off-Track Betting Co., 6.00%, 12/1/53

| 1,049,500

|

| 2,500,000

| Triborough Bridge & Tunnel Authority Sales Tax Revenue, Series A-1, 5.25%, 5/15/59

| 2,750,850

|

| 1,000,000

| Westchester County Local Development Corp., Purchase Senior Learning Community, Inc. Project, 4.50%, 7/1/56 (144A)

| 887,080

|

|

| Total New York

| $41,321,110

|

|

|

|

|

|

| North Carolina — 0.6%

|

|

| 1,400,000

| North Carolina Medical Care Commission, Carolina Meadows, 5.25%, 12/1/49

| $ 1,494,262

|

|

| Total North Carolina

| $1,494,262

|

|

|

|

|

|

| Ohio — 6.4%

|

|

| 13,375,000

| Buckeye Tobacco Settlement Financing Authority, Senior Class 2, Series B-2, 5.00%, 6/1/55

| $ 12,386,186

|

| 1,000,000

| Ohio Housing Finance Agency, Sanctuary Springboro Project, 5.45%, 1/1/38 (144A)

|

840,210

|

| 1,540,000

| State of Ohio, 5.00%, 12/31/39

| 1,549,286

|

|

| Total Ohio

| $14,775,682

|

|

|

|

|

|

| Oregon — 1.6%

|

|

| 5,000,000

| Oregon Health & Science University, Green Bond, Series A, 3.00%, 7/1/51

| $ 3,772,050

|

|

| Total Oregon

| $3,772,050

|

|

|

|

|

5Pioneer Municipal High Income Fund, Inc. | 7/31/24

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Pennsylvania — 5.0%

|

|

| 1,250,000

| Allentown Neighborhood Improvement Zone Development Authority, Waterfront - 30 E. Allen Street Project, Series A, 5.25%, 5/1/32 (144A)

| $ 1,317,988

|

| 5,000,000

| Montgomery County Higher Education and Health Authority, Thomas Jefferson University, Series B, 4.00%, 5/1/52

| 4,645,200

|

| 3,500,000

| Montgomery County Higher Education and Health Authority, Thomas Jefferson University, Series B, 5.00%, 5/1/57

| 3,624,740

|

| 500,000

| Philadelphia Authority for Industrial Development, 5.50%, 6/1/49 (144A)

|

501,735

|

| 1,000,000

| Philadelphia Authority for Industrial Development, Global Leadership Academy Charter School Project, Series A, 5.00%, 11/15/50

|

871,180

|

| 460,000

| Philadelphia Authority for Industrial Development, Greater Philadelphia Health Action, Inc., Project, Series A, 6.625%, 6/1/50

| 454,475

|

|

| Total Pennsylvania

| $11,415,318

|

|

|

|

|

|

| Puerto Rico — 14.2%

|

|

| 2,929,538(c)

| Commonwealth of Puerto Rico, 11/1/43

| $ 1,794,342

|

| 5,267,777(d)

| Commonwealth of Puerto Rico, Restructured Series A-1, 4.00%, 7/1/41

| 4,935,907

|

| 3,000,000(d)

| Commonwealth of Puerto Rico, Restructured Series A-1, 4.00%, 7/1/46

| 2,742,000

|

| 5,000,000

| GDB Debt Recovery Authority of Puerto Rico, 7.50%, 8/20/40

| 4,850,000

|

| 7,500,000

| Puerto Rico Commonwealth Aqueduct & Sewer Authority, Series A, 5.00%, 7/1/47 (144A)

| 7,546,725

|

| 2,500,000

| Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Series 2, 4.784%, 7/1/58

| 2,470,375

|

| 8,191,000

| Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Series A-1, 5.00%, 7/1/58

| 8,225,238

|

|

| Total Puerto Rico

| $32,564,587

|

|

|

|

|

|

| Rhode Island — 1.0%

|

|

| 5,900,000(e)

| Central Falls Detention Facility Corp., 7.25%, 7/15/35

| $ 2,360,000

|

|

| Total Rhode Island

| $2,360,000

|

|

|

|

|

Pioneer Municipal High Income Fund,

Inc. | 7/31/246

Schedule of Investments | 7/31/24

(unaudited) (continued)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Tennessee — 0.3%

|

|

| 550,000

| Knox County Health Educational & Housing Facility Board, University of Tennessee Project, Series B-1, 5.25%, 7/1/64 (BAM Insured)

| $ 580,795

|

|

| Total Tennessee

| $580,795

|

|

|

|

|

|

| Texas — 7.6%

|

|

| 450,000

| Arlington Higher Education Finance Corp., Basis Texas Charter Schools, Inc., 4.875%, 6/15/54 (144A)

| $ 450,410

|

| 300,000

| Arlington Higher Education Finance Corp., Great Hearts America, Series A, 5.00%, 8/15/54

|

300,987

|

| 500,000

| Arlington Higher Education Finance Corp., LTTS Charter School, Universal Academy, 5.45%, 3/1/49 (144A)

|

528,875

|

| 1,000,000

| Arlington Higher Education Finance Corp., Universal Academy, Series A, 7.00%, 3/1/34

| 1,001,570

|

| 3,000,000(d)

| Cedar Hill Independent School District, Dallas County, Texas, 4.00%, 2/15/50 (PSF-GTD Insured)

| 2,878,230

|

| 8,000,000

| City of Houston Airport System Revenue, 4.00%, 7/15/41

| 7,600,160

|

| 2,500,000

| Greater Texas Cultural Education Facilities Finance Corp., Texas Bipmedical Research Institute Project, Series A, 5.25%, 6/1/54

| 2,638,900

|

| 1,500,000

| New Hope Cultural Education Facilities Finance Corp., Sanctuary LTC Project, Series A-1, 5.50%, 1/1/57

| 1,426,545

|

| 550,000

| Port of Beaumont Navigation District, Jefferson Gulf Coast Energy Project, Series A, 5.125%, 1/1/44 (144A)

| 556,187

|

|

| Total Texas

| $17,381,864

|

|

|

|

|

|

| Virgin Islands — 0.4%

|

|

| 1,000,000

| Matching Fund Special Purpose Securitization Corp., Series A, 5.00%, 10/1/39

| $ 1,037,180

|

|

| Total Virgin Islands

| $1,037,180

|

|

|

|

|

|

| Virginia — 7.0%

|

|

| 2,650,000

| Tobacco Settlement Financing Corp., Series A-1, 6.706%, 6/1/46

| $ 2,307,567

|

| 2,000,000

| Virginia Small Business Financing Authority, Senior Lien, 5.00%, 12/31/42

| 2,087,540

|

| 1,000,000

| Virginia Small Business Financing Authority, Senior Lien, 5.00%, 12/31/47

| 1,000,800

|

| 1,000,000

| Virginia Small Business Financing Authority, Senior Lien 95 Express Lanes LLC Project, 4.00%, 1/1/48

|

926,830

|

7Pioneer Municipal High Income Fund, Inc. | 7/31/24

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Virginia — (continued)

|

|

| 3,500,000

| Virginia Small Business Financing Authority, Transform 66-P3 Project, 5.00%, 12/31/49

| $ 3,499,790

|

| 6,100,000

| Virginia Small Business Financing Authority, Transform 66-P3 Project, 5.00%, 12/31/56

| 6,121,777

|

|

| Total Virginia

| $15,944,304

|

|

|

|

|

|

| Wisconsin — 1.0%

|

|

| 1,500,000

| Public Finance Authority, Gardner Webb University, 5.00%, 7/1/31 (144A)

| $ 1,559,250

|

| 750,000

| Public Finance Authority, Roseman University Health Sciences Project, 5.875%, 4/1/45

| 756,488

|

|

| Total Wisconsin

| $2,315,738

|

|

|

|

|

|

| Total Municipal Bonds

(Cost $273,861,850)

| $276,682,098

|

|

|

|

|

|

| U.S. Government and Agency

Obligations — 1.9% of Net Assets

|

|

| 4,300,000(b)

| U.S. Treasury Bills, 8/13/24

| $ 4,292,429

|

|

| Total U.S. Government and Agency Obligations

(Cost $4,292,464)

| $4,292,429

|

|

|

|

|

|

| TOTAL INVESTMENTS IN UNAFFILIATED ISSUERS — 122.6%

(Cost $278,154,314)

| $280,974,527

|

|

| OTHER ASSETS AND LIABILITIES — (22.6)%

| $(51,712,666)

|

|

| net assets applicable to common stockholders — 100.0%

| $229,261,861

|

|

|

|

|

|

|

|

|

| AMBAC

| Ambac Assurance Corporation.

|

| BAM

| Build America Mutual Assurance Company.

|

| COLL

| Collateral.

|

| FHLMC

| Federal Home Loan Mortgage Corporation.

|

| FNMA

| Federal National Mortgage Association.

|

| GNMA

| Government National Mortgage Association.

|

| PSF-GTD

| Permanent School Fund Guaranteed.

|

| TCRS

| Transferable Custodial Receipts.

|

Pioneer Municipal High Income Fund,

Inc. | 7/31/248

Schedule of Investments | 7/31/24

(unaudited) (continued)

| (144A)

| The resale of such security is exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold normally to qualified institutional buyers. At July 31, 2024, the value of

these securities amounted to $24,295,304, or 10.6% of net assets applicable to common stockholders.

|

| (a)

| Consists of Revenue Bonds unless otherwise indicated.

|

| (b)

| Security issued with a zero coupon. Income is recognized through accretion of discount.

|

| (c)

| The interest rate is subject to change periodically. The interest rate and/or reference index and spread shown at July 31, 2024.

|

| (d)

| Represents a General Obligation Bond.

|

| (e)

| Security is in default.

|

| †

| Amount rounds to less than 0.1%.

|

The concentration of investments as

a percentage of total investments by type of obligation/market sector is as follows:

| Revenue Bonds:

|

|

| Development Revenue

| 25.5%

|

| Health Revenue

| 21.0

|

| Transportation Revenue

| 18.8

|

| Tobacco Revenue

| 10.3

|

| Other Revenue

| 8.0

|

| Education Revenue

| 4.1

|

| Water Revenue

| 3.6

|

| Facilities Revenue

| 1.7

|

| General Revenue

| 0.4

|

|

| 93.4%

|

| General Obligation Bonds:

| 6.6%

|

|

| 100.0%

|

FUTURES

CONTRACTS

FIXED INCOME INDEX FUTURES CONTRACTS

Number of

Contracts

Long

| Description

| Expiration

Date

| Notional

Amount

| Market

Value

| Unrealized

Appreciation

|

| 87

| U.S. Long Bond (CBT)

| 9/19/24

| $10,168,581

| $10,507,969

| $339,388

|

| TOTAL FUTURES CONTRACTS

| $10,168,581

| $10,507,969

| $339,388

|

| CBT

| Chicago Board of Trade.

|

9Pioneer Municipal High Income Fund, Inc. | 7/31/24

Various inputs are used in

determining the value of the Fund’s investments. These inputs are summarized in the three broad levels below.

| Level 1

| –

| unadjusted quoted prices in active markets for identical securities.

|

| Level 2

| –

| other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

|

| Level 3

| –

| significant unobservable inputs (including the Adviser’s own assumptions in determining fair value of investments).

|

The following is a summary of the

inputs used as of July 31, 2024 in valuing the Fund’s investments:

|

| Level 1

| Level 2

| Level 3

| Total

|

| Municipal Bonds

| $—

| $276,682,098

| $—

| $276,682,098

|

| U.S. Government and Agency Obligations

| —

| 4,292,429

| —

| 4,292,429

|

| Total Investments in Securities

| $—

| $280,974,527

| $—

| $280,974,527

|

| Other Financial Instruments

|

|

|

|

|

| Net unrealized appreciation on futures contracts

| $339,388

| $—

| $—

| $339,388

|

| Total Other Financial Instruments

| $339,388

| $—

| $—

| $339,388

|

During the six months ended July

31, 2024, there were no transfers in or out of Level 3.

Pioneer Municipal High Income Fund,

Inc. | 7/31/2410

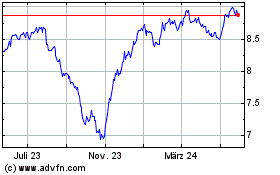

Pioneer Municipal High I... (NYSE:MHI)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

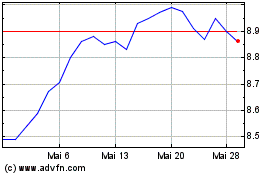

Pioneer Municipal High I... (NYSE:MHI)

Historical Stock Chart

Von Nov 2023 bis Nov 2024