OMB APPROVAL

OMB Number: 3235-0570

Expires: August 31, 2010

Estimated average burden

hours per response.....18.9

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21321

Pioneer Municipal High Income Trust

(Exact name of registrant as specified in charter)

60 State Street, Boston, MA 02109

(Address of principal executive offices) (ZIP code)

Dorothy E. Bourassa, Pioneer Investment Management, Inc.,

60 State Street, Boston, MA 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: (617) 742-7825

Date of fiscal year end: April 30

Date of reporting period: May 1, 2009 through October 31, 2009

Form N-CSR is to be used by management investment companies to file reports with

the Commission not later than 10 days after the transmission to stockholders of

any report that is required to be transmitted to stockholders under Rule 30e-1

under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may

use the information provided on Form N-CSR in its regulatory, disclosure review,

inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR,

and the Commission will make this information public. A registrant is not

required to respond to the collection of information contained in Form N-CSR

unless the Form displays a currently valid Office of Management and Budget

("OMB") control number. Please direct comments concerning the accuracy of the

information collection burden estimate and any suggestions for reducing the

burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW,

Washington, DC 20549-0609. The OMB has reviewed this collection of information

under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO SHAREOWNERS.

Pioneer Municipal High

Income Trust

Semiannual Report | October 31, 2009

Ticker Symbol: MHI

[LOGO] PIONEER

Investments(R)

visit us: pioneerinvestments.com

Table of Contents

Letter to Shareowners 2

Portfolio Management Discussion 4

Portfolio Summary 8

Prices and Distributions 9

Performance Update 10

Schedule of Investments 11

Financial Statements 21

Financial Highlights 24

Notes to Financial Statements 26

Trustees, Officers and Service Providers 33

|

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09 1

President's Letter

Dear Shareowner,

Stock and bond markets around the globe have begun to recover this year from

one of their most tumultuous periods in history. This is a welcome relief, and

we are generally optimistic about the prospects for the economy going forward.

Still, challenges remain. Unemployment is high. Consumer demand and loan growth

are weak. And housing has not yet returned to normal.

At Pioneer, we have long advocated the benefits of investing for the long term.

This strategy has generally performed well for many investors. Those who

remained invested in the market during the downturn have most likely seen their

portfolios start to recover this year as the Dow Jones Industrial Average

climbed back towards the 10,000 level. Many bond investors have similarly seen

a strong rebound, with a broad-based recovery across many different fixed-income

asset classes. The riskiest asset classes, such as high-yield bonds, have

outperformed other fixed-income asset classes for most of 2009.

At Pioneer, we are not changing the approach to investing that we have used for

more than 80 years. We remain focused on company fundamentals and risk

management. Our investment process is based on careful research into individual

companies, quantitative analysis, and active portfolio management. This

three-pillared process, which we apply to each of our portfolios, is supported

by an integrated team approach and is designed to carefully balance risk and

reward. While we see potential opportunities for making money in many corners

of the markets around the globe, it takes research and experience to separate

solid investment opportunities from speculation.

Following this difficult period, many investors are rethinking their approach

to investing and risk management. Some are questioning whether the basic

investment principles they were taught in the past are still useful in today's

markets. Complicating matters is that financial markets remain unpredictable.

Our advice, as always, is to work closely with a trusted financial advisor to

discuss your goals and work together to develop an investment strategy that

meets your individual needs. There is no single best strategy that works for

every investor.

2 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09

We invite you to learn more about Pioneer and our time-tested approach to

investing by consulting with your financial advisor or visiting us online at

www.pioneerinvestments.com. We greatly appreciate you putting your trust in us

and we thank you for investing with Pioneer.

Sincerely,

/s/ Daniel K. Kingsbury

Daniel K. Kingsbury

President and CEO

Pioneer Investment Management USA Inc.

|

Any information in this shareowner report regarding market or economic trends

or the factors influencing the Trust's historical or future performance are

statements of the opinion of Trust management as of the date of this report.

These statements should not be relied upon for any other purposes. Past

performance is no guarantee of future results, and there is no guarantee that

market forecasts discussed will be realized.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09 3

Portfolio Management Discussion | 10/31/09

Municipal bond investors were rewarded over the six months ended October 31,

2009, with relatively solid performance, as the municipal bond market recovered

from one of the most turbulent periods in history. In the following interview,

David Eurkus, who is responsible for the daily management of Pioneer Municipal

High Income Trust, discusses some of the factors that had an impact on the

municipal bond market and the Trust's performance over the six-month period

ended October 31, 2009.

Q How did the Trust perform over the past six months?

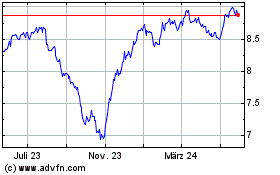

A For the six-month period ended October 31, 2009, Pioneer Municipal High

Income Trust produced a total return of 22.36% at net asset value and 31.93%

at market price. As of October 31, 2009, the Trust was selling at a premium

of market price to net asset value of 0.3%. Over the same six-month period,

the Trust's benchmarks, the Barclays Capital (formerly Lehman Brothers)

Municipal Bond Index, which tracks the performance of investment-grade bonds,

returned 4.99%, and the Barclays Capital High Yield Municipal Bond Index

returned 19.55%. While the Trust invested in municipal securities with a

broad range of maturities and credit ratings, it maintained a dollar-weighted

average portfolio credit quality of A- as of October 31, 2009. At the end of

the six-month period, the Trust held 116 issues in 34 states and the District

of Columbia.

During the period, investors also earned a relatively high level of

dividend income. As of October 31, 2009, the Trust's 30-day SEC yield was

8.68%, and its current dividend yield, based on market close, was 7.27%.

This translates into a taxable equivalent yield of 11.18%, based on the

maximum Federal income tax rate of 35%. Approximately 12% of the Trust's

investments were subject to the Federal Alternative Minimum Tax (AMT).

Q What was the investment environment like during the six months ended October

31, 2009?

A After weathering one of the most difficult periods in history, the municipal

bond market staged a dramatic rally over the past six months, as investors

moved out of low-yielding tax-exempt money market funds and sought the higher

yields that tax-exempt bonds can provide. The substantial increase in

investor demand came at a time when there was a sharp reduction in newly

issued tax-exempt bonds, as roughly one-third of new municipal bonds were

taxable Build America Bonds, which are subsidized by the U.S. Treasury. The

reduction in supply and robust demand for tax-exempt bonds benefited both the

investment-grade and the high-yield tax-exempt areas of the market.

4 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09

Q How did you manage the Trust during the six months ended October 31, 2009?

A We did not make any material changes to the portfolio during the period. As

has been the case in the past, the Trust was invested primarily in sectors

that support the U.S. economy. As of October 31, 2009, health care was the

Trust's biggest sector position, 29.7% of the total investment portfolio.

Airport revenue also was a relatively large position, at 12.6% of the total

investment portfolio, and tobacco bonds accounted for approximately 12.5% of

the total investment portfolio. The Trust also had investments in education,

housing, and pollution control bonds. Below-investment-grade securities

accounted for 53.3% of the Trust's total investment portfolio, and

investment-grade securities accounted for 45.1% of the total investment

portfolio. The Trust's cash position was 1.6%.

Q What factors most affected the Trust's performance during the six months

ended October 31, 2009?

A The performance of high-yield bonds, as measured by the Barclays Capital High

Yield Municipal Bond Index, outpaced that of investment-grade bonds during

the period. As a result, the Trust benefited from its position in high-yield

securities. Although the airline industry has been one of the hardest-hit

areas of the economy, and prices of airline bonds had experienced sharp

declines, airline bonds did well. By cutting costs, reducing the number of

flights and raising ticket prices, some airlines are now on a more stable

footing, and as a result investors bid up the prices of their bonds.

Investment-grade bonds, as measured by the Barclays Capital Municipal Bond

Index, were positive during the six months ended October 31, 2009; and the

Trust's holdings of these higher-quality securities aided performance. A

substantial weight in health care bonds was a key contributor to the

Trust's relative outperformance during the six-month period ended October

31, 2009. In addition, the performance of tobacco bonds, whose prices had

declined substantially in the first quarter of 2009, was particularly

noteworthy. As bond prices rose, the Trust's relatively long duration (or

sensitivity to changes in interest rates) also helped boost returns.

The Trust's high-quality pre-refunded escrow bonds were a slight

disappointment during the period. While they generated a positive return,

they underperformed the Barclays Capital Municipal Bond Index. (When

interest rates decline, bond issuers often pre-refund, or "call" their

bonds before they mature in order to reduce their interest costs. The

proceeds from the sales of the pre-refunded bonds are invested in Treasury

obligations, which are the highest-quality securities.)

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09 5

Q What is your outlook?

A The tax-exempt municipal market has had a substantial run-up, and while we

believe conditions may moderate, we continue to be constructive in our

outlook for municipal bonds and the Trust. The investment environment for the

securities remains positive. We believe the economy is improving modestly,

while inflation has remained benign and the Federal Reserve Board appears to

be holding interest rates within the 0.00% to 0.25% range. As we look ahead,

we believe that municipal bonds may continue to have the potential to provide

capital appreciation and a relatively high level of tax-free income.

|

Please refer to the Schedule of Investments on pages 11-20 for a full listing

of Trust securities.

Investments in high-yield or lower-rated securities are subject to

greater-than-average risk. The Trust may invest in securities of issuers that

are in default or that are in bankruptcy.

A portion of income may be subject to state, federal, and/or alternative

minimum tax. Capital gains, if any, are subject to a capital gains tax. When

interest rates rise, the prices of fixed-income securities held by the Trust

will generally fall. Conversely, when interest rates fall the prices of

fixed-income securities held by the Trust generally will rise. By concentrating

in municipal securities, the Trust is more susceptible to adverse economic,

political or regulatory developments than is a portfolio that invests more

broadly. Investments in the Trust are subject to possible loss due to the

financial failure of underlying securities and their issuer's inability to meet

their debt obligations.

The Trust uses leverage through the issuance of preferred shares with an

aggregate liquidation preference of up to 25% of the Trust's total assets after

such issuance. Leverage creates significant risks, including the risk that the

Trust's income or capital appreciation will not be sufficient to cover the cost

of leverage, which may adversely affect the return for the holders of common

shares.

The Trust is required to maintain certain regulatory and rating agency asset

coverage requirements in connection with its outstanding preferred shares. In

order to maintain required asset coverage levels, the Trust may be required to

alter the composition of its investment portfolio or take other actions, such

as redeeming preferred shares with the proceeds from portfolio transactions, at

what might be inopportune times in the market. Such actions could reduce the

net earnings or returns to holders of the Trust's common shares over time.

Risks of investing in the Trust are discussed in greater detail in the Trust's

original offering prospectus relating to its common shares and in shareholder

reports issued from time to time.

Past performance is no guarantee of future results, and there is no guarantee

that market forecasts discussed will be realized.

6 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09

Any information in this shareowner report regarding market or economic trends

or the factors influencing the Trust's historical or future performance are

statements of the opinion of Trust management as of the date of this report.

These statements should not be relied upon for any other purposes.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09 7

Portfolio Summary | 10/31/09

Portfolio Diversification

(As a percentage of total investment portfolio)

[The following data was represented as a pie chart in the printed material]

Health Revenue 29.7%

Airport Revenue 12.6%

Tobacco Revenue 12.5%

Other Revenue 12.0%

Insured 11.9%

Pollution Control Revenue 4.4%

Facilities Revenue 4.1%

Education Revenue 3.8%

Development Revenue 3.7%

Transportation Revenue 2.7%

Gaming Revenue 1.0%

Utilities Revenue 0.9%

Airline Revenue 0.4%

Housing Revenue 0.3%

|

Portfolio Quality

(As a percentage of total investment portfolio; based on S&P ratings)

[The following data was represented as a pie chart in the printed material]

AAA 16.9%

AA 3.2%

A 5.0%

BBB 20.0%

BB 3.6%

B 8.8%

CCC 1.3%

C 0.1%

Not Rated 39.5%

Cash Equivalents 1.6%

|

10 Largest Holdings

(As a percentage of long-term holdings)*

1. Allegheny County Hospital Development Authority Revenue, 9.25%, 11/15/30 3.61%

2. Metropolitan Pier & Exposition Authority Dedicated State Tax Revenue, 0.0%, 6/15/22 3.43

3. Tobacco Settlement Financing Corp., 6.75%, 6/1/39 3.11

4. Connecticut Health & Educational Facilities Authority Revenue, RIB, 11.289%,

7/1/42 (144A) 3.07

5. New Jersey Economic Development Authority Revenue, 6.25%, 9/15/29 3.01

6. North Texas Tollway Authority Revenue, 5.75%, 1/1/33 2.69

7. New York State Dormitory Authority Revenue, RIB, 12.79%, 7/1/26 (144A) 2.38

8. Golden State Tobacco Securitization Corp., 7.875%, 6/1/42 2.23

9. Washington State General Obligation, 0.0%, 6/1/22 2.20

10. Johnson City Health & Educational Facilities Board Hospital Revenue, 7.5%, 7/1/33 2.10

|

* This list excludes temporary cash. The portfolio is actively managed, and

currently holdings may be different. The holdings listed should not be

considered recommendations to buy or sell any security listed.

8 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09

Prices and Distributions | 10/31/09

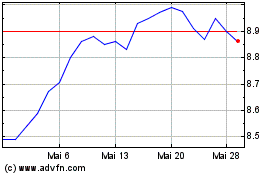

Market Value per Common Share

--------------------------------------------------------------------------------

10/31/09 4/30/09

--------------------------------------------------------------------------------

$ 13.21 $ 10.40

--------------------------------------------------------------------------------

|

Net Asset Value per Common Share

--------------------------------------------------------------------------------

10/31/09 4/30/09

--------------------------------------------------------------------------------

$ 13.17 $ 11.18

--------------------------------------------------------------------------------

|

Distributions per Common Share: 5/1/09-10/31/09

--------------------------------------------------------------------------------

Net

Investment Short-Term Long-Term

Income Capital Gains Capital Gains

--------------------------------------------------------------------------------

$ 0.4600 $ -- $ --

--------------------------------------------------------------------------------

|

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09 9

Performance Update | 10/31/09

Investment Returns

The mountain chart on the right shows the change in market value, including

reinvestment of dividends and distributions, of a $10,000 investment made in

common shares of Pioneer Municipal High Income Trust, compared to that of the

Barclays Capital Municipal Bond Index and Barclays Capital High Yield Municipal

Bond Index.

Cumulative Total Returns

(As of October 31, 2009)

--------------------------------------------------------------------------------

Net Asset Market

Period Value Price

--------------------------------------------------------------------------------

Life-of-Class

(7/17/2003) 39.80% 33.95%

5 Years 22.73 27.53

1 Year 32.51 51.10

--------------------------------------------------------------------------------

|

[The following data was represented as a mountain chart in the printed material]

Value of $10,000 Investment

Barclays

Pioneer Capital Barclays

Municipal High Yield Capital

High Income Municipal Municipal

Trust Bond Index Bond Index

7/03 $10,000 $10,000 $10,000

10/03 10,363 10,319 10,166

10/04 11,390 10,941 10,112

10/05 12,148 11,219 9,990

10/06 13,858 11,863 10,092

10/07 14,046 12,209 10,033

10/08 10,549 11,805 9,042

10/09 13,979 13,411 9,905

|

Call 1-800-225-6292 or visit www.pioneerinvestments.com for the most recent

month-end performance results. Current performance may be lower or higher than

the performance data quoted.

Performance data shown represents past performance. Past performance is no

guarantee of future results. Investment return and market price will fluctuate,

and your shares may trade below net asset value ("NAV") due to such factors as

interest rate changes and the perceived credit quality of borrowers.

Total investment return does not reflect broker sales charges or commissions.

All performance is for common shares of the Trust.

Closed-end funds, unlike open-end funds, are not continuously offered. There is

a one-time public offering and once issued, shares of closed-end funds are sold

in the open market through a stock exchange and frequently trade at prices

lower than their NAV. NAV is total assets less total liabilities which includes

preferred shares, divided by the number of common shares outstanding.

When NAV is lower than market price, dividends are assumed to be reinvested at

the greater of NAV or 95% of the market price. When NAV is higher, dividends

are assumed to be reinvested at prices obtained under the Trust's dividend

reinvestment plan.

The performance table and graph do not reflect the deduction of fees and taxes

that a shareowner would pay on Trust distributions or the sale of Trust shares.

The Barclays Capital Municipal Bond Index is a broad measure of the municipal

bond market. The Barclays Capital High Yield Municipal Bond Index totals over

$26 billion in market value and maintains over 1300 securities. Municipal bonds

in this index have the following requirements: maturities of one year or

greater, sub investment grade (below Baa or non-rated), fixed coupon rate,

issued after 12/31/90, deal size over $20 million, and maturity size of at

least $3 million. Index returns are calculated monthly, assume reinvestment of

dividends and, unlike Trust returns, do not reflect any fees, expenses or sales

charges. The indices are not leveraged. You cannot invest directly in the

indices.

10 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09

Schedule of Investments | 10/31/09 (unaudited)

-----------------------------------------------------------------------------------------------------

S&P/Moody's

Principal Ratings

Amount (unaudited) Value

TAX EXEMPT OBLIGATIONS -- 126.5% of Net Assets

Alabama -- 0.8%

$ 1,000,000 NR/NR Huntsville-Redstone Village Special Care Facilities

Financing Authority, 5.5%, 1/1/28 $ 811,700

2,000,000 NR/NR Huntsville-Redstone Village Special Care Facilities

Financing Authority, 5.5%, 1/1/43 1,454,820

------------

$ 2,266,520

-----------------------------------------------------------------------------------------------------

Arizona -- 2.2%

5,000,000 BBB-/Baa3 Apache County Industrial Development Authority,

5.85%, 3/1/28 $ 4,999,500

970,000 NR/Baa3 Pima County Industrial Development Authority,

7.25%, 7/1/31 905,398

500,000 BBB-/Baa2 Yavapai County Industrial Development Authority,

6.0%, 8/1/33 496,190

------------

$ 6,401,088

-----------------------------------------------------------------------------------------------------

California -- 9.8%

7,885,000(a) AAA/NR California State University Revenue, RIB, 7.479%,

11/1/39 (144A) $ 7,903,372

4,500,000 NR/NR California Statewide Communities Development

Authority Environmental Facilities Revenue,

9.0%, 12/1/38 3,635,865

1,000,000 BB+/NR California Statewide Communities Development

Authority Revenue, 7.25%, 10/1/38 1,004,790

5,150,000+ AAA/Aaa Golden State Tobacco Securitization Corp.,

7.8%, 6/1/42 6,198,025

7,000,000+ AAA/Aaa Golden State Tobacco Securitization Corp.,

7.875%, 6/1/42 8,441,790

1,000,000 AA/Aa1 University of California Revenue, 5.0%, 5/15/25 1,035,240

655,000 C/NR Valley Health System Hospital Revenue,

6.5%, 5/15/25 360,709

------------

$ 28,579,791

-----------------------------------------------------------------------------------------------------

Connecticut -- 5.3%

10,335,000(a) NR/Aaa Connecticut Health & Educational Facilities Authority

Revenue, RIB, 11.289%, 7/1/42 (144A) $ 11,625,738

5,000,000 B+/NR Mohegan Tribe Indians Gaming Authority,

6.25%, 1/1/31 3,874,800

------------

$ 15,500,538

-----------------------------------------------------------------------------------------------------

Delaware -- 0.4%

765,000 NR/NR Sussex County Delaware Revenue, 5.9%, 1/1/26 $ 677,461

600,000 NR/NR Sussex County Delaware Revenue, 6.0%, 1/1/35 492,360

------------

$ 1,169,821

-----------------------------------------------------------------------------------------------------

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09 11

Schedule of Investments | 10/31/09 (unaudited) (continued)

-----------------------------------------------------------------------------------------------------

S&P/Moody's

Principal Ratings

Amount (unaudited) Value

-----------------------------------------------------------------------------------------------------

District of Columbia -- 3.6%

$ 5,000,000 BBB/Baa3 District of Columbia Tobacco Settlement Financing

Corp., 6.5%, 5/15/33 $ 4,713,350

6,000,000 BBB/Baa3 District of Columbia Tobacco Settlement Financing

Corp., 6.75%, 5/15/40 5,811,660

------------

$ 10,525,010

-----------------------------------------------------------------------------------------------------

Florida -- 5.5%

1,700,000 NR/NR Beacon Lakes Community Development,

6.9%, 5/1/35 $ 1,458,804

2,000,000 A-/A3 Brevard County Health Facilities Authority Revenue,

5.0%, 4/1/36 1,782,480

1,000,000 BBB/Baa3 Hillsborough County Industrial Development Authority

Revenue, 8.0%, 8/15/32 1,114,140

2,445,000 NR/NR Liberty County Subordinate Revenue,

8.25%, 7/1/28 2,084,876

2,500,000 A-/A2 Miami-Dade County Aviation Revenue,

5.5%, 10/1/41 2,519,075

1,000,000 NR/NR St. Johns County Industrial Development Authority

Revenue, 5.25%, 1/1/26 758,030

2,000,000 NR/NR St. Johns County Industrial Development Authority

Revenue, 5.375%, 1/1/40 1,389,560

5,000,000 NR/Baa2 Tallahassee Health Facilities Revenue,

6.375%, 12/1/30 5,017,550

------------

$ 16,124,515

-----------------------------------------------------------------------------------------------------

Georgia -- 2.4%

4,240,000(a) NR/Aa3 Atlanta Georgia Water & Waste Revenue, RIB, 7.2%,

11/1/43 (144A) $ 3,728,232

2,400,000 NR/NR Fulton County Residential Care Facilities Revenue,

5.0%, 7/1/27 1,735,584

1,100,000 NR/NR Fulton County Residential Care Facilities Revenue,

5.125%, 7/1/42 711,447

1,000,000 NR/NR Rockdale County Development Authority Revenue,

6.125%, 1/1/34 802,480

------------

$ 6,977,743

-----------------------------------------------------------------------------------------------------

Idaho -- 1.7%

5,000,000 BBB+/Baa2 Power County Industrial Development Corp.,

6.45%, 8/1/32 $ 5,009,200

-----------------------------------------------------------------------------------------------------

Illinois -- 10.2%

2,000,000(b) NR/NR Centerpoint Intermodal Center, 10.0%,

6/15/23 (144A) $ 1,052,120

12,000,000 NR/Caa2 Chicago O'Hare International Airport Special Facility

Revenue Refunding Bonds, 5.5%, 12/1/30 7,794,600

1,000,000 NR/NR Illinois Finance Authority Revenue, 6.0%, 11/15/27 822,200

2,000,000 AA+/Aa2 Illinois Finance Authority Revenue, 6.0%, 8/15/39 2,153,180

|

The accompanying notes are an integral part of these financial statements.

12 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09

----------------------------------------------------------------------------------------------------

S&P/Moody's

Principal Ratings

Amount (unaudited) Value

Illinois -- (continued)

$ 4,000,000 NR/NR Illinois Finance Authority Revenue, 6.0%, 11/15/39 $ 2,987,680

1,500,000(c) NR/NR Illinois Health Facilities Authority Revenue,

6.9%, 11/15/33 662,250

16,880,000(d) AAA/A2 Metropolitan Pier & Exposition Authority Dedicated

State Tax Revenue, 0.0%, 6/15/22 12,975,487

1,745,000 NR/NR Southwestern Illinois Development Authority

Revenue, 5.625%, 11/1/26 1,230,051

------------

$ 29,677,568

----------------------------------------------------------------------------------------------------

Indiana -- 4.9%

5,000,000 A+/A2 Indiana Health & Educational Facility Financing

Authority Hospital Revenue, 5.0%, 2/15/39 $ 4,471,350

1,000,000 BBB+/Baa1 Indiana State Development Finance Authority

Revenue, 5.6%, 12/1/32 999,920

4,300,000 BBB/NR Indiana State Development Finance Authority

Revenue, 5.75%, 10/1/11 4,189,748

2,500,000(b) BBB/Baa2 Rockport Pollution Control Revenue, 6.25%, 6/1/25 2,715,025

2,570,000 NR/NR Vigo County Hospital Authority Revenue, 5.8%,

9/1/47 (144A) 1,969,391

------------

$ 14,345,434

----------------------------------------------------------------------------------------------------

Louisiana -- 2.1%

1,500,000 BB/Ba3 Louisiana Local Government Environmental Facilities

Revenue, 6.75%, 11/1/32 $ 1,437,630

5,000,000 NR/A3 Louisiana Public Facilities Authority Revenue,

5.5%, 5/15/47 4,665,650

------------

$ 6,103,280

----------------------------------------------------------------------------------------------------

Massachusetts -- 4.5%

2,385,000 NR/NR Massachusetts Development Finance Agency

Revenue, 7.1%, 7/1/32 $ 1,857,533

1,000,000 AA/NR Massachusetts Educational Financing Authority

Revenue, 6.0%, 1/1/28 1,053,600

3,500,000 BBB/Baa3 Massachusetts Health & Educational Facilities

Authority Revenue, 6.25%, 7/1/22 3,518,935

2,500,000 NR/NR Massachusetts Health & Educational Facilities

Authority Revenue, 6.5%, 1/15/38 2,163,900

5,000,000 BB-/NR Massachusetts Health & Educational Facilities

Authority Revenue, 6.75%, 10/1/33 4,461,550

------------

$ 13,055,518

----------------------------------------------------------------------------------------------------

Michigan -- 3.7%

935,000 NR/NR Doctor Charles Drew Academy, 5.7%, 11/1/36 $ 518,906

1,525,000 NR/Ba1 Flint Michigan Hospital Building Authority Revenue,

5.25%, 7/1/16 1,402,466

1,500,000 BB/NR John Tolfree Health System Corp., 6.0%, 9/15/23 1,321,980

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09 13

Schedule of Investments | 10/31/09 (unaudited) (continued)

----------------------------------------------------------------------------------------------------

S&P/Moody's

Principal Ratings

Amount (unaudited) Value

----------------------------------------------------------------------------------------------------

Michigan -- (continued)

$ 2,000,000 BB-/Ba3 Michigan State Hospital Finance Authority Revenue,

5.5%, 8/15/23 $ 1,705,560

5,830,000 BBB/NR Michigan Tobacco Settlement Finance Authority,

6.0%, 6/1/48 4,431,733

1,470,000 BBB/NR Star International Academy Certificates of

Participation, 6.125%, 3/1/37 1,330,571

------------

$ 10,711,216

----------------------------------------------------------------------------------------------------

Minnesota -- 0.6%

1,675,000 BB-/NR Duluth Economic Development Authority Health Care

Facilities Revenue, 7.25%, 6/15/32 $ 1,695,736

----------------------------------------------------------------------------------------------------

Mississippi -- 1.0%

3,000,000 BBB/Ba1 Mississippi Business Finance Corp. Pollution Control

Revenue, 5.9%, 5/1/22 $ 3,003,090

----------------------------------------------------------------------------------------------------

Montana -- 0.1%

1,600,000(c) NR/NR Two Rivers Authority, Inc. Correctional Facility

Improvement Revenue, 7.375%, 11/1/27 $ 247,904

----------------------------------------------------------------------------------------------------

Nebraska -- 0.5%

2,000,000 NR/NR Grand Island Solid Waste Disposal Facilities

Revenue, 7.0%, 6/1/23 $ 1,364,540

----------------------------------------------------------------------------------------------------

Nevada -- 0.0%

2,000,000(c) NR/NR Nevada State Department of Business & Industry,

7.25%, 1/1/23 $ 100,000

----------------------------------------------------------------------------------------------------

New Jersey -- 12.2%

2,000,000 B/B3 New Jersey Economic Development Authority

Revenue, 6.25%, 9/15/19 $ 1,803,040

13,350,000 B/B3 New Jersey Economic Development Authority

Revenue, 6.25%, 9/15/29 11,406,640

1,000,000 B/B3 New Jersey Economic Development Authority

Revenue, 6.4%, 9/15/23 891,020

6,150,000(b) B/B3 New Jersey Economic Development Authority

Revenue, 7.0%, 11/15/30 5,710,644

10,370,000 AAA/Aa1 New Jersey Transportation Trust Fund Authority,

0.0%, 12/15/27 4,082,462

10,000,000+ AAA/Aaa Tobacco Settlement Financing Corp.,

6.75%, 6/1/39 11,776,200

------------

$ 35,670,006

----------------------------------------------------------------------------------------------------

New Mexico -- 1.2%

1,500,000 NR/NR Otero County New Mexico Project Revenue,

6.0%, 4/1/23 $ 1,239,000

2,960,000 NR/NR Otero County New Mexico Project Revenue,

6.0%, 4/1/28 2,292,727

------------

$ 3,531,727

----------------------------------------------------------------------------------------------------

|

The accompanying notes are an integral part of these financial statements.

14 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09

----------------------------------------------------------------------------------------------------

S&P/Moody's

Principal Ratings

Amount (unaudited) Value

----------------------------------------------------------------------------------------------------

New York -- 8.6%

$ 2,500,000 BBB+/Baa2 Albany New York Industrial Development Agency

Civic Facilities Revenue, 5.25%, 11/15/27 $ 2,468,375

3,000,000 NR/NR Dutchess County Industrial Development Agency

Revenue, 7.5%, 3/1/29 2,916,240

2,450,000 NR/NR Nassau County New York Industrial Development

Agency Revenue, 6.7%, 1/1/43 2,093,427

2,000,000 BBB/Baa1 New York City Industrial Development Agency,

5.375%, 6/1/23 2,015,420

990,000 CCC+/Caa2 New York City Industrial Development Agency,

6.9%, 8/1/24 770,814

7,040,000(a) NR/Aaa New York State Dormitory Authority Revenue, RIB,

12.79%, 7/1/26 (144A) 8,994,656

2,000,000 NR/NR Suffolk County Industrial Development Agency,

7.25%, 1/1/30 1,815,600

4,000,000 A+/Aa3 Triborough Bridge & Tunnel Authority Revenue,

5.25%, 11/15/30 4,129,040

------------

$ 25,203,572

----------------------------------------------------------------------------------------------------

North Carolina -- 2.9%

4,790,000 NR/NR Charlotte North Carolina Special Facilities Revenue,

5.6%, 7/1/27 $ 3,348,737

5,740,000 NR/NR Charlotte North Carolina Special Facilities Revenue,

7.75%, 2/1/28 5,082,770

------------

$ 8,431,507

----------------------------------------------------------------------------------------------------

Oklahoma -- 1.8%

1,225,000 B-/Caa2 Tulsa Municipal Airport Revenue, 6.25%, 6/1/20 $ 1,038,751

4,350,000 B-/Caa2 Tulsa Municipal Airport Revenue, 7.35%, 12/1/11 4,263,783

------------

$ 5,302,534

----------------------------------------------------------------------------------------------------

Pennsylvania -- 8.3%

3,000,000 BB/Ba3 Allegheny County Hospital Development Authority

Revenue, 5.0%, 11/15/28 $ 2,373,990

1,550,000 NR/Baa2 Allegheny County Hospital Development Authority

Revenue, 5.125%, 5/1/25 1,391,233

12,300,000+ AAA/NR Allegheny County Hospital Development Authority

Revenue, 9.25%, 11/15/30 13,665,669

1,000,000 B-/NR Columbia County Hospital Authority Health Care

Revenue, 5.9%, 6/1/29 821,900

845,000 BBB/Ba2 Hazleton Health Services Authority Hospital Revenue,

5.625%, 7/1/17 767,978

1,280,000 NR/Caa3 Langhorne Manor Borough Higher Education &

Health Authority Revenue, 7.35%, 7/1/22 961,536

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09 15

Schedule of Investments | 10/31/09 (unaudited) (continued)

---------------------------------------------------------------------------------------------------

S&P/Moody's

Principal Ratings

Amount (unaudited) Value

---------------------------------------------------------------------------------------------------

Pennsylvania -- (continued)

$ 5,000,000 B+/Caa1 Pennsylvania Economic Development Financing

Authority Solid Waste Disposal Revenue,

6.0%, 6/1/31 $ 3,895,650

500,000 BBB+/NR Pennsylvania Higher Educational Facilities Authority

Revenue, 5.4%, 7/15/36 468,455

-----------

$24,346,411

---------------------------------------------------------------------------------------------------

Rhode Island -- 1.8%

6,000,000 NR/NR Central Falls Detention Facilities Revenue,

7.25%, 7/15/35 $ 5,091,540

---------------------------------------------------------------------------------------------------

South Carolina -- 2.3%

5,185,000+ BBB+/Baa1 South Carolina Jobs Economic Development

Authority Revenue, 6.375%, 8/1/34 $ 6,009,778

665,000+ BBB+/Baa1 South Carolina Jobs Economic Development

Authority Revenue, 6.375%, 8/1/34 773,402

-----------

$ 6,783,180

---------------------------------------------------------------------------------------------------

Tennessee -- 4.9%

7,000,000+ NR/A2 Johnson City Health & Educational Facilities Board

Hospital Revenue, 7.5%, 7/1/33 $ 7,935,410

2,480,000 NR/A1 Knox County Health, Educational & Housing Facilities

Board Hospital Revenue, 6.375%, 4/15/22 2,560,005

4,600,000 BBB+/NR Sullivan County Health, Educational & Housing

Facilities Board Hospital Revenue,

5.25%, 9/1/36 3,823,382

-----------

$14,318,797

---------------------------------------------------------------------------------------------------

Texas -- 13.8%

1,345,000 NR/Ba2 Bexar County Housing Finance Corp.,

8.0%, 12/1/36 $ 1,008,051

1,000,000 CCC+/Caa2 Dallas-Fort Worth International Airport Revenue,

6.0%, 11/1/14 855,930

4,000,000 NR/NR Decatur Hospital Authority Revenue, 7.0%, 9/1/25 3,869,680

2,000,000 NR/NR Gulf Coast Industrial Development Authority

Revenue, 7.0%, 12/1/36 1,007,080

3,750,000 CCC+/B3 Houston Airport System Special Facilities Revenue,

5.7%, 7/15/29 2,972,850

5,340,000 NR/NR Lubbock Health Facilities Development Corp.,

6.625%, 7/1/36 4,635,601

10,000,000 BBB+/A3 North Texas Tollway Authority Revenue,

5.75%, 1/1/33 10,175,000

2,810,000(a) NR/Aa2 Northside Independent School District, RIB,

11.113%, 6/15/33 (144A) 3,057,308

500,000 CCC/Caa3 Sabine River Authority Pollution Control Revenue,

6.15%, 8/1/22 258,635

|

The accompanying notes are an integral part of these financial statements.

16 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09

-----------------------------------------------------------------------------------------------------------

S&P/Moody's

Principal Ratings

Amount (unaudited) Value

-----------------------------------------------------------------------------------------------------------

Texas -- (continued)

$ 7,040,000(a) NR/Aa1 Texas State, RIB, 11.986%, 4/1/30 (144A) $ 7,915,635

630,000 NR/NR Willacy County Local Government Corp. Revenue,

6.0%, 9/1/10 625,155

5,130,000 NR/NR Willacy County Local Government Corp. Revenue,

6.875%, 9/1/28 4,045,723

------------

$ 40,426,648

-----------------------------------------------------------------------------------------------------------

Utah -- 0.2%

800,000 NR/NR Spanish Fork City Charter School Revenue, 5.55%,

11/15/26 (144A) $ 660,632

-----------------------------------------------------------------------------------------------------------

Vermont -- 0.5%

1,500,000 A-/A3 Vermont Educational & Health Buildings Financing

Agency Revenue, 6.0%, 10/1/28 $ 1,550,025

-----------------------------------------------------------------------------------------------------------

Virginia -- 0.4%

1,000,000 BBB/Baa2 Peninsula Ports Authority, 6.0%, 4/1/33 $ 1,019,330

-----------------------------------------------------------------------------------------------------------

Washington -- 8.3%

4,710,000 A+/A2 Spokane Public Facilities District Hotel/Motel Tax &

Sales, 5.75%, 12/1/27 $ 4,902,356

7,025,000 BBB/Baa3 Tobacco Settlement Authority Revenue,

6.625%, 6/1/32 6,883,587

14,315,000 AA+/Aa1 Washington State General Obligation, 0.0%, 6/1/22 8,311,003

5,000,000 NR/NR Washington State Housing Finance Committee

Nonprofit Revenue, 5.625%, 1/1/27 4,021,050

------------

$ 24,117,996

-----------------------------------------------------------------------------------------------------------

Wisconsin -- 0.0%

2,320,000 NR/NR Aztalan Wisconsin Exempt Facilities Revenue,

7.5%, 5/1/18 $ 92,800

-----------------------------------------------------------------------------------------------------------

TOTAL TAX-EXEMPT OBLIGATIONS

(Cost $371,353,257) $369,405,217

-----------------------------------------------------------------------------------------------------------

MUNICIPAL COLLATERALIZED DEBT OBLIGATION -- 2.5% of

Net Assets

10,000,000(b)(e) NR/NR Non-Profit Preferred Funding Trust I,12.0%,

9/15/37 (144A) $ 7,403,300

-----------------------------------------------------------------------------------------------------------

TOTAL MUNICIPAL COLLATERALIZED

DEBT OBLIGATION

(Cost $10,000,000) $ 7,403,300

-----------------------------------------------------------------------------------------------------------

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09 17

Schedule of Investments | 10/31/09 (unaudited) (continued)

--------------------------------------------------------------------------------------------

S&P/Moody's

Ratings

Shares (unaudited) Value

--------------------------------------------------------------------------------------------

COMMON STOCK -- 0.6% of Net Assets

248,558(f) Delta Air Lines, Inc. $ 1,774,704

--------------------------------------------------------------------------------------------

TOTAL COMMON STOCK

(Cost $6,612,756) $ 1,774,704

--------------------------------------------------------------------------------------------

TAX-EXEMPT MONEY MARKET MUTUAL FUND -- 2.1% of

Net Assets

6,000,000 BlackRock Liquidity Funds MuniFund Portfolio $ 6,000,000

--------------------------------------------------------------------------------------------

TOTAL TAX-EXEMPT MONEY MARKET

MUTUAL FUND

(Cost $6,000,000) $ 6,000,000

--------------------------------------------------------------------------------------------

TOTAL INVESTMENTS IN SECURITIES -- 131.7%

(Cost $393,966,013)(g)(h) $ 384,583,221

--------------------------------------------------------------------------------------------

OTHER ASSETS AND LIABILITIES 2.9% $ 8,492,557

--------------------------------------------------------------------------------------------

PREFERRED SHARES AT REDEMPTION VALUE,

INCLUDING DIVIDENDS PAYABLE -- (34.6)% $(101,004,135)

--------------------------------------------------------------------------------------------

NET ASSETS APPLICABLE TO COMMON

SHAREOWNERS -- 100.0% $ 292,071,643

============================================================================================

|

RIB Residual Interest Bonds

NR Security not rated by S&P or Moody's.

(144A) Security is exempt from registration under Rule 144A of the Securities

Act of 1933. Such securities may be resold normally to qualified

institutional buyers in a transaction exempt from registration. At

October 31, 2009 the value of these securities amounted to $54,310,384 or

18.6% of net assets applicable to common shareowners.

+ Prerefunded bonds have been collateralized by U.S. Treasury securities or

U.S. Government Agencies which are held in escrow to pay interest and

principal on the tax exempt issue and to retire the bonds in full at the

earliest refunding date.

(a) The interest rate is subject to change periodically and inversely based

upon prevailing market rates. The interest rate shown is the coupon rate

at October 31, 2009.

(b) The interest rate is subject to change periodically. The interest rate

shown is the coupon rate at October 31, 2009.

(c) Security is in default and is non-income producing.

(d) Debt obligation initially issued at one coupon which converts to a higher

coupon at a specific date. The rate shown is the coupon rate at October

31, 2009.

(e) Indicates a security that has been deemed illiquid. The aggregate cost of

illiquid securities is $10,000,000. The aggregate value $7,403,300

represents 2.5% of net assets applicable to common shareowners.

(f) Non-income producing.

The accompanying notes are an integral part of these financial statements.

18 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09

(g) The concentration of investments by type of obligation/market sector is

as follows:

Insured:

NATL-RE 7.9%

MBIA 1.1

FSA 1.0

ACA 0.9

PSF 0.8

AMBAC 0.3

Revenue Bonds:

Health Revenue 29.8

Airport Revenue 12.6

Tobacco Revenue 12.6

Other Revenue 12.0

Pollution Control Revenue 4.5

Facilities Revenue 4.1

Education Revenue 3.8

Development Revenue 3.7

Transportation Revenue 2.7

Gaming Revenue 1.0

Utilities Revenue 0.9

Housing Revenue 0.3

-----

100.0%

=====

|

(h) At October 31, 2009, the net unrealized loss on investments based on cost

for federal income tax purposes of $392,172,049 was as follows:

Aggregate gross unrealized gain for all investments in which there is an

excess of value over tax cost $26,595,348

Aggregate gross unrealized loss for all investments in which there is an

excess of tax cost over value (34,184,176)

-----------

Net unrealized loss $(7,588,828)

===========

|

For financial reporting purposes net unrealized loss on investments was

$9,382,792 and cost of investments aggregated $393,966,013.

Purchases and sales of securities (excluding temporary cash investments) for

the period ended October 31, 2009, aggregated $22,362,691 and $28,099,575,

respectively.

Various inputs are used in determining the value of the Trust's investments.

These inputs are summarized in the three broad levels listed below.

Highest priority is given to Level 1 inputs and lowest priority is given to

Level 3.

Level 1 -- quoted prices in active markets for identical securities

Level 2 -- other significant observable inputs (including quoted prices for

similar securities, interest rates, prepayment speeds, credit

risk, etc.)

Level 3 -- significant unobservable inputs (including the Trust's own

assumptions in determining fair value of investments)

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09 19

Schedule of Investments | 10/31/09 (unaudited) (continued)

The following is a summary of the inputs used as of October 31, 2009, in

valuing the Trust's investments:

--------------------------------------------------------------------------------------------------------

Level 1 Level 2 Level 3 Total

--------------------------------------------------------------------------------------------------------

Municipal bonds $ -- $369,405,217 $ -- $369,405,217

Municipal collateralized debt obligation -- 7,403,300 -- 7,403,300

Common stock 1,774,704 -- -- 1,774,704

Temporary cash investments 6,000,000 -- -- 6,000,000

--------------------------------------------------------------------------------------------------------

Total $7,774,704 $376,808,517 $ -- $384,583,221

========================================================================================================

|

The accompanying notes are an integral part of these financial statements.

20 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09

Statement of Assets and Liabilities | 10/31/09 (unaudited)

ASSETS:

Investments in securities, at value (cost $393,966,013) $384,583,221

Receivables --

Investment securities sold 70,000

Interest 9,056,650

Reinvestment of distributions 165,007

Prepaid expenses 32,533

---------------------------------------------------------------------------------

Total assets $393,907,411

---------------------------------------------------------------------------------

LIABILITIES:

Due to custodian $ 511,111

Due to affiliates 214,178

Administration fee payable 23,798

Accrued expenses 82,546

---------------------------------------------------------------------------------

Total liabilities $ 831,633

---------------------------------------------------------------------------------

PREFERRED SHARES AT REDEMPTION VALUE:

$25,000 liquidation value per share applicable to 4,040 shares,

including dividends payable of $4,135 $101,004,135

---------------------------------------------------------------------------------

NET ASSETS APPLICABLE TO COMMON SHAREOWNERS:

Paid-in capital $315,886,211

Undistributed net investment income 10,008,929

Accumulated net realized loss on investments (24,440,705)

Net unrealized loss on investments (9,382,792)

---------------------------------------------------------------------------------

Net assets applicable to common shareowners $292,071,643

---------------------------------------------------------------------------------

NET ASSET VALUE PER SHARE:

No par value, (unlimited number of shares authorized)

Based on $292,071,643/22,177,337 common shares $ 13.17

=================================================================================

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09 21

Statement of Operations (unaudited)

For the Six Months Ended 10/31/09

INVESTMENT INCOME:

Interest $14,665,409

------------------------------------------------------------------------------------------------

EXPENSES:

Management fees $ 1,128,499

Administration fees 197,185

Transfer agent fees and expenses 20,896

Auction agent fees 135,189

Custodian fees 6,957

Registration fees 11,972

Professional fees 44,981

Printing expense 15,013

Trustees' fees 6,200

Pricing fees 7,608

Miscellaneous 18,208

------------------------------------------------------------------------------------------------

Total expenses $ 1,592,708

------------------------------------------------------------------------------------------------

Net investment income $13,072,701

------------------------------------------------------------------------------------------------

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS:

Net realized loss from investments $ (1,715,675)

Change in net unrealized loss from investments 43,167,502

------------------------------------------------------------------------------------------------

Net gain on investments $41,451,827

------------------------------------------------------------------------------------------------

DISTRIBUTIONS TO PREFERRED SHAREOWNERS FROM NET

INVESTMENT INCOME: $ (273,848)

------------------------------------------------------------------------------------------------

Net increase in net assets applicable to common shareowners

resulting from operations $54,250,680

================================================================================================

|

The accompanying notes are an integral part of these financial statements.

22 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09

Statement of Changes in Net Assets

For the Six Months Ended 10/31/09 and Year Ended 4/30/09, respectively

----------------------------------------------------------------------------------------------

Six Months

Ended Year

10/31/09 Ended

(unaudited) 4/30/09

----------------------------------------------------------------------------------------------

FROM OPERATIONS:

Net investment income $ 13,072,701 $ 24,807,728

Net realized loss on investments (1,715,675) (6,389,854)

Change in net unrealized gain (loss) on investments 43,167,502 (60,921,177)

Distributions to preferred shareowners from net

investment income (273,848) (2,525,210)

----------------------------------------------------------------------------------------------

Net increase (decrease) in net assets applicable to

common shareowners resulting from operations $ 54,250,680 $(45,028,513)

----------------------------------------------------------------------------------------------

DISTRIBUTIONS TO COMMON SHAREOWNERS:

Net investment income

($0.46 and $0.85 per share, respectively) $(10,190,348) $(18,817,657)

----------------------------------------------------------------------------------------------

Total distributions to common shareowners $(10,190,348) $(18,817,657)

----------------------------------------------------------------------------------------------

FROM TRUST SHARE TRANSACTIONS:

Reinvestment of distributions $ 451,303 $ 175,511

----------------------------------------------------------------------------------------------

Net increase in net assets applicable to common

shareowners resulting from Trust share transactions $ 451,303 $ 175,511

----------------------------------------------------------------------------------------------

Net increase (decrease) in net assets applicable to

common shareowners $ 44,511,635 $(63,670,659)

NET ASSETS APPLICABLE TO COMMON SHAREOWNERS:

Beginning of period 247,560,008 311,230,667

----------------------------------------------------------------------------------------------

End of period $292,071,643 $247,560,008

----------------------------------------------------------------------------------------------

Undistributed net investment income $ 10,008,929 $ 7,400,424

==============================================================================================

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09 23

Financial Highlights

---------------------------------------------------------------------------------------------------------

For the Six Months

Ended Year

10/31/09 Ended

(unaudited) 4/30/09

---------------------------------------------------------------------------------------------------------

Per Common Share Operating Performance

Net asset value, beginning of period $ 11.18 $ 14.07

---------------------------------------------------------------------------------------------------------

Increase (decrease) from investment operations:(a)

Net investment income $ 0.59 $ 1.12

Net realized and unrealized gain (loss) on investments and interest

rate swaps 1.87 (3.05)

Dividends and distributions to preferred shareowners from:

Net investment income (0.01) (0.11)

Net realized gains -- --

---------------------------------------------------------------------------------------------------------

Net increase (decrease) from investment operations $ 2.45 $ (2.04)

Dividends and distributions to common shareowners from:

Net investment income (0.46) (0.85)

Net realized gains -- --

Capital charge with respect to issuance of:

Common shares -- --

---------------------------------------------------------------------------------------------------------

Net increase (decrease) in net asset value $ 1.99 $ (2.89)

---------------------------------------------------------------------------------------------------------

Net asset value, end of period(b) $ 13.17 $ 11.18

---------------------------------------------------------------------------------------------------------

Market value, end of period(b) $ 13.21 $ 10.40

=========================================================================================================

Total return at market value(c) 31.93% (18.85)%

Ratios to average net assets of common shareowners

Net expenses(d) 1.16%(e) 1.19%

Net investment income before preferred share dividends 9.53%(e) 9.36%

Preferred share dividends 0.20%(e) 0.95%

Net investment income available to common shareowners 9.33%(e) 8.41%

Financial Highlights

-------------------------------------------------------------------------------------------------------------------------

Year Year Year Year

Ended Ended Ended Ended

4/30/08 4/30/07 4/30/06 4/30/05

-------------------------------------------------------------------------------------------------------------------------

Per Common Share Operating Performance

Net asset value, beginning of period $ 16.02 $ 15.15 $ 15.62 $ 14.76

-------------------------------------------------------------------------------------------------------------------------

Increase (decrease) from investment operations:(a)

Net investment income $ 1.08 $ 1.02 $ 1.02 $ 1.14

Net realized and unrealized gain (loss) on investments and interest

rate swaps (2.03) 0.78 (0.48) 0.95

Dividends and distributions to preferred shareowners from:

Net investment income (0.17) (0.16) (0.12) (0.07)

Net realized gains -- -- -- 0.00(b)

-------------------------------------------------------------------------------------------------------------------------

Net increase (decrease) from investment operations $ (1.12) $ 1.64 $ 0.42 $ 2.02

Dividends and distributions to common shareowners from:

Net investment income (0.83) (0.77) (0.89) (1.07)

Net realized gains -- -- -- (0.09)

Capital charge with respect to issuance of:

Common shares -- -- -- 0.00(b)

-------------------------------------------------------------------------------------------------------------------------

Net increase (decrease) in net asset value $ (1.95) $ 0.87 $ (0.47) $ 0.86

-------------------------------------------------------------------------------------------------------------------------

Net asset value, end of period(b) $ 14.07 $ 16.02 $ 15.15 $ 15.62

-------------------------------------------------------------------------------------------------------------------------

Market value, end of period(b) $ 13.88 $ 15.05 $ 13.22 $ 14.33

=========================================================================================================================

Total return at market value(c) (2.28)% 20.04% (1.85)% 13.34%

Ratios to average net assets of common shareowners

Net expenses(d) 1.03% 1.06% 1.03% 1.04%

Net investment income before preferred share dividends 7.17% 6.49% 6.64% 7.60%

Preferred share dividends 1.13% 1.01% 0.80% 0.43%

Net investment income available to common shareowners 6.04% 5.48% 5.84% 7.17%

|

The accompanying notes are an integral part of these financial statements.

24 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09

---------------------------------------------------------------------------------------------------------

For the Six Months

Ended Year

10/31/09 Ended

(unaudited) 4/30/09

---------------------------------------------------------------------------------------------------------

Portfolio turnover 6% 16%

Net assets of common shareowners, end of period (in thousands) $ 292,072 $247,560

Preferred shares outstanding (in thousands) $ 101,000 $101,000

Asset coverage per preferred share, end of period(f) $ 97,296 $ 86,278

Average market value per preferred share $ 25,000 $ 25,000

Liquidation value, including dividends payable, per preferred share $ 25,001 $ 25,001

Ratios to average net assets of common shareowners before waivers

and reimbursement of expenses

Net expenses(d) 1.16%(e) 1.19%

Net investment income before preferred share dividends 9.53%(e) 9.36%

Preferred share dividends 0.20%(e) 0.95%

Net investment income available to common shareowners 9.33%(e) 8.41%

---------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------------------------------------

Year Year Year Year

Ended Ended Ended Ended

4/30/08 4/30/07 4/30/06 4/30/05

-------------------------------------------------------------------------------------------------------------------------

Portfolio turnover 17% 18% 20% 25%

Net assets of common shareowners, end of period (in thousands) $311,231 $354,486 $335,121 $345,555

Preferred shares outstanding (in thousands) $101,000 $101,000 $101,000 $101,000

Asset coverage per preferred share, end of period(f) $102,047 $112,759 $107,962 $110,533

Average market value per preferred share $ 25,000 $ 25,000 $ 25,000 $ 25,000

Liquidation value, including dividends payable, per preferred share $ 25,010 $ 25,014 $ 25,011 $ 25,000

Ratios to average net assets of common shareowners before waivers and

reimbursement of expenses

Net expenses(d) 1.03% 1.06% 1.03% 1.04%

Net investment income before preferred share dividends 7.17% 6.49% 6.64% 7.60%

Preferred share dividends 1.13% 1.01% 0.80% 0.43%

Net investment income available to common shareowners 6.04% 5.48% 5.84% 7.17%

-------------------------------------------------------------------------------------------------------------------------

|

(a) The per common share data presented above is based upon the average common

shares outstanding for the periods presented.

(b) Net asset value and market value are published in Barron's on Saturday, The

Wall Street Journal on Monday and The New York Times on Monday and

Saturday.

(c) Total investment return is calculated assuming a purchase of common shares

at the current market value on the first day and a sale at the current

market value on the last day of the periods reported. Dividends and

distributions, if any, are assumed for purposes of this calculation to be

reinvested at prices obtained under the Trust's dividend reinvestment plan.

Total investment returns covering less than a full period are not

annualized. Total investment return does not reflect brokerage commissions.

Past performance is not a guarantee of future results.

(d) Expense ratios do not reflect the effect of dividend payments to preferred

shareowners.

(e) Annualized.

(f) Market value is redemption value without an active market.

The information above represents the operating performance data for a

common share outstanding, total investment return, ratios to average net

assets and other supplemental data for the periods indicated. This

information has been determined based upon financial information provided

in the financial statements and market value data for the Trust's common

shares.

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09 25

Notes to Financial Statements | 10/31/09 (unaudited)

1. Organization and Significant Accounting Policies

Pioneer Municipal High Income Trust (the Trust) was organized as a Delaware

statutory trust on March 13, 2003. Prior to commencing operations on July 21,

2003, the Trust had no operations other than matters relating to its

organization and registration as a diversified, closed-end management

investment company under the Investment Company Act of 1940, as amended. The

primary investment objective of the Trust is to seek a high level of current

income exempt from regular federal income tax and, as a secondary investment

objective, the Trust may seek capital appreciation to the extent consistent

with its primary investment objective.

The Trust may invest in both investment and below investment grade (high-yield)

municipal securities with a broad range of maturities and credit ratings. Debt

securities rated below investment grade are commonly referred to as "junk

bonds" and are considered speculative. These securities involve greater risk of

loss, are subject to greater price volatility, and are less liquid, especially

during periods of economic uncertainty or change, than higher rated debt

securities.

Information regarding the Trust's principal risks is contained in the Trust's

original offering prospectus with additional information included in the

Trust's shareowner reports from time to time. Please refer to those documents

when considering the Trust's risks. At times, the Trust's investments may

represent industries or industry sectors that are interrelated or have common

risks, making it more susceptible to any economic, political, or regulatory

developments or other risks affecting those industries and sectors.

The Trust's financial statements have been prepared in conformity with U.S.

generally accepted accounting principles that require the management of the

Trust to, among other things, make estimates and assumptions that affect the

reported amounts of assets and liabilities, and the reported amounts of income,

expenses and gains and losses on investments during the reporting year. Actual

results could differ from those estimates.

The following is a summary of significant accounting policies followed by the

Trust in the preparation of its financial statements, which are consistent with

those policies generally accepted in the investment company industry:

26 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09

A. Security Valuation

Security transactions are recorded as of trade date. Securities are valued at

prices supplied by independent pricing services, which consider such factors

as Treasury spreads, yields, maturities and ratings. Valuations may be

supplemented by values obtained from dealers and other sources, as required.

The values of interest rate swaps are determined by obtaining dealer

quotations. Securities for which there are no other readily available

valuation methods are valued using fair value methods pursuant to procedures

adopted by the Board of Trustees (board determined). The Trust may also use

fair value methods to value a security including a non-U.S. security, when

the closing market price on the principal exchange where the security is

traded no longer reflects the value of the security. Temporary cash

investments are valued at amortized cost which approximates market value. At

October 31, 2009, there were no securities valued at prices that were board

determined.

Dividend income is recorded on the ex-dividend date, except that certain

dividends from foreign securities where the ex-dividend date may have passed

are recorded as soon as the Trust becomes aware of the ex-dividend data in

the exercise of reasonable diligence. Discount and premium on debt securities

are accreted or amortized, respectively, daily on an effective yield to

maturity basis and are included in interest income. Interest income,

including interest bearing cash accounts, is recorded on an accrual basis.

Gains and losses on sales of investments are calculated on the identified

cost method for both financial reporting and federal income tax purposes.

B. Federal Income Taxes

It is the Trust's policy to comply with the requirements of the Internal

Revenue Code applicable to regulated investment companies and to distribute

all of its taxable income and net realized capital gains, if any, to its

shareowners. Therefore, no federal income tax provision is required. Tax

years for the prior three fiscal years remain subject to examination by tax

authorities.

The amounts and characterizations of distributions to shareowners for

financial reporting purposes are determined in accordance with federal income

tax rules. Therefore, the sources of the Trust's distributions may be shown

in the accompanying financial statements as either from or in excess of net

investment income or as from net realized gain (loss) on investment

transactions, or as from paid in-capital, depending on the type of book/tax

differences that may exist.

The tax character of distributions paid to common and preferred shareowners

will be determined at the end of the fiscal year. Distributions during the

year ended April 30, 2009 were as follows:

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09 27

------------------------------------------------

2009

------------------------------------------------

Distributions paid from:

Tax exempt income $21,171,440

Ordinary income 171,427

------------------------------------------------

Total $21,342,867

================================================

|

The following shows the components of distributable earnings (losses) on a

federal income tax basis at April 30, 2009.

-------------------------------------------------------

2009

-------------------------------------------------------

Distributable earnings:

Undistributed tax-exempt income $ 5,302,103

Undistributed ordinary income 118,898

Capital loss carryforward (15,079,753)

Post-October loss deferred (7,564,631)

Dividend payable (3,430)

Unrealized depreciation (50,648,087)

-------------------------------------------------------

Total $ (67,874,900)

=======================================================

|

The difference between book-basis and tax-basis unrealized depreciation is

primarily attributable to the difference between book and tax amortization

methods for premiums and discounts on fixed income securities, book/tax

difference in the accrual of income on securities in default and other

temporary differences.

C. Automatic Dividend Reinvestment Plan

All common shareowners automatically participate in the Automatic Dividend

Reinvestment Plan (the Plan), under which participants receive all dividends

and capital gain distributions (collectively, dividends) in full and

fractional common shares of the Trust in lieu of cash. Shareowners may elect

not to participate in the Plan. Shareowners not participating in the Plan

receive all dividends and capital gain distributions in cash. Participation

in the Plan is completely voluntary and may be terminated or resumed at any

time without penalty by notifying American Stock Transfer & Trust Company,

the agent for shareowners in administering the Plan (the Plan Agent), in

writing prior to any dividend record date; otherwise such termination or

resumption will be effective with respect to any subsequently declared

dividend or other distribution.

Whenever the Trust declares a dividend on common shares payable in cash,

participants in the Plan will receive the equivalent in common shares

acquired by the Plan Agent either (i) through receipt of additional unissued

but authorized common shares from the Trust or (ii) by purchase of

outstanding common shares on the New York Stock Exchange or elsewhere. If, on

the payment date for any dividend, the net asset value per common share is

equal to or less than the market price per share plus estimated brokerage

28 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09

trading fees (market premium), the Plan Agent will invest the dividend amount

in newly issued common shares. The number of newly issued common shares to be

credited to each account will be determined by dividing the dollar amount of

the dividend by the net asset value per common share on the date the shares

are issued, provided that the maximum discount from the then current market

price per share on the date of issuance does not exceed 5%. If, on the

payment date for any dividend, the net asset value per common share is

greater than the market value (market discount), the Plan Agent will invest

the dividend amount in common shares acquired in open-market purchases. There

are no brokerage charges with respect to newly issued common shares. However,

each participant will pay a pro rata share of brokerage trading fees incurred

with respect to the Plan Agent's open-market purchases. Participating in the

Plan does not relieve shareowners from any federal, state or local taxes

which may be due on dividends paid in any taxable year. Shareowners holding

Plan shares in a brokerage account may not be able to transfer the shares to

another broker and continue to participate in the Plan.

2. Management Agreement

Pioneer Investment Management, Inc. (PIM), a wholly owned indirect subsidiary

of UniCredit S.p.A. (UniCredit), manages the Trust's portfolio. Management fees

payable under the Trust's Advisory Agreement with PIM are calculated daily at

the annual rate of 0.60% of the Trust's average daily managed assets. "Managed

assets" means (a) the total assets of the Trust, including any form of

investment leverage, minus (b) all accrued liabilities incurred in the normal

course of operations, which shall not include any liabilities or obligations

attributable to investment leverage obtained through (i) indebtedness of any

type (including, without limitation, borrowing through a credit facility or the

issuance of debt securities), (ii) the issuance of preferred stock or other

similar preference securities, and/or (iii) any other means. For the six months

ended October 31, 2009, the net management fee was equivalent to 0.60% of the

Trust's average daily managed assets, which was equivalent to 0.82% of the

Trust's average daily net assets attributable to the common shareowners.

In addition, under PIM's management and administration agreements, certain

other services and costs are paid by PIM and reimbursed by the Trust. At

October 31, 2009, $214,178 was payable to PIM related to management costs,

administrative costs and certain other services and is included in "Due to

Affiliates" on the Statement of Assets and Liabilities.

The Trust has retained Princeton Administrators, LLC (Princeton) to provide

certain administrative and accounting services to the Trust on its behalf. The

Trust pays Princeton a monthly fee at an annual rate of 0.07% of the average

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/09 29

daily value of the Trust's managed assets up to $500 million and 0.03% of

average daily managed assets in excess of $500 million, subject to a minimum

monthly fee of $10,000.

3. Transfer Agents