Mister Car Wash Successfully Completes Debt Refinancing

01 April 2024 - 12:00PM

Business Wire

Mister Car Wash, Inc. (the “Company”) (NYSE: MCW) announced the

completion of a series of related transactions in support of a

comprehensive plan to refinance its capital structure. Through

these transactions, the Company extended its debt maturities and

improved liquidity to support continued Company growth.

Summary of Transactions

- Upsized, Amended & Extended the $901 million Term Loan B to

$925 million now due in 2031 and removed a 0.10% credit spread

adjustment to the SOFR benchmark for all available interest

periods

- Upsized, Amended & Extended the $150 million Revolving

Credit Facility to $300 million now due in 2029, removed a 0.10%

credit spread adjustment to the SOFR benchmark for all available

interest periods and reduced the cost of borrowings under the

facility

- Proceeds of the transaction were used to refinance the existing

Mister Car Wash Term Loan B due in 2026 and the existing Mister Car

Wash Revolving Credit Facility due in 2026

- The transactions extend Mister Car Wash’s debt maturities and

increase available liquidity in line with Company growth

“We are thrilled with the execution and outcome of our recent

debt amendment and extension. The transactions were well

oversubscribed and priced favorably to our current deals. Both are

a testament to Mister’s strong business and reputation in the

capital markets. The transaction provides some added flexibility

and liquidity to help drive our planned Mister brand expansion and

profitable growth,” said Jed Gold, Chief Financial Officer at

Mister Car Wash.

The $925 million Term Loan B facility, privately placed with

institutional investors, will accrue interest at an annual rate of

SOFR+300, subject to a leverage-based pricing grid, and will mature

on March 27, 2031.

The $300 million Revolving Credit Facility will mature on March

27, 2029.

The Company will provide more details about the terms and

conditions in a Form 8-K filing with the Securities and Exchange

Commission (SEC).

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. We intend such forward-looking statements to be covered by

the safe harbor provisions for forward-looking statements contained

in Section 27A of the Securities Act of 1933, as amended and

Section 21E of the Securities Exchange Act of 1934, as amended. All

statements contained in this press release other than statements of

historical fact, including, without limitation, statements

regarding Mister Car Wash’s expansion efforts and expected growth

and financial and operational results for fiscal 2024 are

forward-looking statements. Words including “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intend,”

“may,” “might,” “plan,” “potential,” “predict,” “seek,” or

“should,” or the negative thereof or other variations thereon or

comparable terminology are intended to identify forward-looking

statements, though not all forward-looking statements use these

words or expressions. In addition, any statements or information

that refer to expectations, beliefs, plans, projections,

objectives, performance or other characterizations of future events

or circumstances, including any underlying assumptions, are

forward-looking.

These forward-looking statements are based on management’s

current expectations and beliefs. These statements are neither

promises nor guarantees, but involve known and unknown risks,

uncertainties and other important factors that may cause the

Company’s actual results, performance or achievements to be

materially different from those expressed or implied by the

forward-looking statements, including, but not limited to: our

inability to attract new customers, retain existing customers and

maintain or grow the number of UWC members, which could adversely

affect our business, financial condition and results of operations

and rate of growth; our failure to acquire, or open and operate new

locations in a timely and cost-effective manner, and enter into new

markets or leverage new technologies, may materially and adversely

affect our competitive advantage or financial performance; our

inability to successfully implement our growth strategies on a

timely basis or at all; we are subject to a number of risks and

regulations related to credit card and debit card payments we

accept; an overall decline in the health of the economy and other

factors impacting consumer spending, such as natural disasters and

fluctuations in inflation, may affect consumer purchases, reduce

demand for our services and materially and adversely affect our

business, results of operations and financial condition; inflation,

supply chain disruption and other increased operating costs could

materially and adversely affect our results of operations; our

locations may experience difficulty hiring and retaining qualified

personnel, resulting in higher labor costs; we lease or sublease

the land and buildings where a number of our locations are

situated, which could expose us to possible liabilities and losses;

our indebtedness could adversely affect our financial health and

competitive position; our business is subject to various laws and

regulations and changes in such laws and regulations, or failure to

comply with existing or future laws and regulations, may result in

litigation, investigation or claims by third parties or employees

that could adversely affect our business; our locations are subject

to certain environmental laws and regulations; we are subject to

data security and privacy risks that could negatively impact our

results of operations or reputation; we may be unable to adequately

protect, and we may incur significant costs in enforcing or

defending, our intellectual property and other proprietary rights;

stockholders’ ability to influence corporate matters may be limited

because a small number of stockholders beneficially own a

substantial amount of our common stock and continue to have

substantial control over us; our stock price may be volatile or may

decline regardless of our operating performance, resulting in

substantial losses for investors purchasing shares of our common

stock; and the other important factors discussed under the caption

“Risk Factors” in the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2023, as such factors may be updated

from time to time in its other filings with the SEC accessible on

the SEC’s website at www.sec.gov and the Investors Relations

section of the Company’s website at www.mistercarwash.com.

Any forward-looking statement that the Company makes in this

press release speaks only as of the date hereof. Except as required

by law, the Company does not undertake any obligation to update or

revise, or to publicly announce any update or revision to, any of

the forward-looking statements, whether as a result of new

information, future events or otherwise.

About Mister Car Wash® | Inspiring People to Shine®

Headquartered in Tucson, Arizona, Mister Car Wash, Inc. (NYSE:

MCW) operates over 450 locations and has the largest car wash

subscription program in North America. With a passionate team of

professionals, advanced technology, and a commitment to exceptional

customer experiences, Mister Car Wash is dedicated to providing a

clean, shiny, and dry vehicle every time. The Mister brand is

deeply rooted in delivering quality service, fostering

friendliness, and demonstrating a genuine commitment to the

communities it serves while prioritizing responsible environmental

practices and resource management. To learn more visit

www.mistercarwash.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240401144302/en/

John Rouleau ICR IR@mistercarwash.com

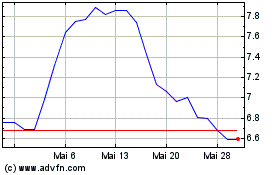

Mister Car Wash (NYSE:MCW)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

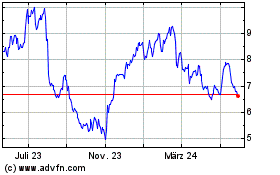

Mister Car Wash (NYSE:MCW)

Historical Stock Chart

Von Nov 2023 bis Nov 2024