As filed with the Securities and Exchange Commission on October 27, 2023

Registration No. 333-274926

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

KIMCO REALTY CORPORATION

(Exact name of registrant as specified in its charter)

Maryland | | | 6798 | | | 13-2744380 |

(State or other jurisdiction of

incorporation or organization) | | | (Primary Standard Industrial

Classification Code Number) | | | (I.R.S. Employer

Identification No.) |

500 North Broadway, Suite 201

Jericho, New York 11753

(516) 869-9000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Conor C. Flynn

Bruce Rubenstein, Esq.

500 North Broadway, Suite 201

Jericho, New York 11753

(516) 869-9000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

David E. Shapiro, Esq.

Steven R. Green, Esq.

Wachtell, Lipton, Rosen & Katz

51 West 52nd Street

New York, New York 10019

(212) 403-1000 | | | Brian L. Harper

President and Chief Executive Officer

RPT Realty

19 W 44th Street, Suite 1002

New York, New York 10036

(212) 221-1261 | | | Mark S. Opper, Esq.

Blake Liggio, Esq.

Caitlin Tompkins, Esq.

Goodwin Procter LLP

100 Northern Avenue

Boston, MA 02210

(617) 570-1000 |

Approximate date of commencement of the proposed sale of the securities to the public: As soon as practicable after this Registration Statement becomes effective and all other conditions to the proposed merger described in the enclosed document have been satisfied or waived.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, as amended, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | | | ☒ | | | Accelerated filer | | | ☐ |

Non-accelerated filer | | | ☐ | | | Smaller reporting company | | | ☐ |

| | | | | | Emerging growth company | | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Explanatory Note

Kimco Realty Corporation is filing this Amendment No. 1 (this “Amendment”) to its Registration Statement on Form S-4 (File No. 333-274926) (the “Registration Statement”) as an exhibit-only filing to file Exhibit 8.1, Exhibit 8.2, Exhibit 8.3 and Exhibit 8.4 to the Registration Statement. Accordingly, this Amendment consists of only the cover page, this explanatory note, Part II of the Registration Statement, the signature page to the Registration Statement, Exhibit 8.1, Exhibit 8.2, Exhibit 8.3 and Exhibit 8.4. The proxy statement/prospectus contained in the Registration Statement is unchanged and has been omitted.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 20.

| Indemnification of Directors and Officers |

The Maryland General Corporation Law (the “MGCL”) permits a Maryland corporation to include in its charter a provision eliminating the liability of its directors and officers to the corporation and its stockholders for money damages, except for liability resulting from (a) actual receipt of an improper benefit or profit in money, property or services or (b) active and deliberate dishonesty established by a final judgment as being material to the cause of action. Kimco’s charter contains such a provision which eliminates such liability to the maximum extent permitted by Maryland law.

Kimco’s charter authorizes it, to the maximum extent permitted by Maryland law, to obligate itself to indemnify and to pay or reimburse reasonable expenses in advance of final disposition of a proceeding to (a) any individual who is a present or former director or officer or (b) any individual who, while a director of Kimco and at the request of Kimco, serves or has served another corporation, partnership, joint venture, trust, employee benefit plan or any other enterprise as a director, officer, partner or trustee of such corporation, partnership, joint venture, trust, employee benefit plan or other enterprise. Kimco’s bylaws obligate it, to the maximum extent permitted by Maryland law and without requiring a preliminary determination as to entitlement, to indemnify and to pay or reimburse reasonable expenses in advance of final disposition of a proceeding to (a) any individual who is a present or former director or officer who is made or threatened to be made a party to the proceeding by reason of his or her service in that capacity or (b) any individual who, while a director or officer of Kimco and at the request of Kimco, serves or has served another corporation, real estate investment trust, partnership, joint venture, trust, employee benefit plan or any other enterprise as a director, officer, partner or trustee of such corporation, partnership, joint venture, trust, employee benefit plan or any other enterprise and who is made or threatened to be made a party to the proceeding by reason of his or her service in that capacity. The charter and bylaws also permit Kimco, with the approval of the Kimco board of directors, to indemnify and advance expenses to any person who served a predecessor of Kimco in any of the capacities described above and to any employee or agent of Kimco or a predecessor of Kimco.

The MGCL requires a Maryland corporation (unless its charter provides otherwise, which Kimco’s charter does not) to indemnify a director or officer who has been successful, on the merits or otherwise, in the defense of any proceeding to which he or she is made or threatened to be made a party by reason of his or her service in that capacity. The MGCL permits a Maryland corporation to indemnify its present and former directors and officers, among others, against judgments, penalties, fines, settlements and reasonable expenses actually incurred by them in connection with any proceeding to which they may be made or threatened to be made a party to or witness in by reason of their service in those or other capacities unless it is established that (a) the act or omission of the director or officer was material to the matter giving rise to the proceeding and (i) was committed in bad faith or (ii) was the result of active and deliberate dishonesty, (b) the director or officer actually received an improper personal benefit in money, property or services or (c) in the case of any criminal proceeding, the director or officer had reasonable cause to believe that the act or omission was unlawful. However, under Maryland law, a Maryland corporation may not indemnify for an adverse judgment in a suit by or in the right of the corporation or for a judgment of liability on the basis that personal benefit was improperly received, unless in either case a court orders indemnification, and then only for expenses. In addition, the MGCL requires Kimco, as a condition to advancing expenses, to obtain (a) a written affirmation by the director or officer of his or her good faith belief that he or she has met the standard of conduct necessary for indemnification by Kimco as authorized by the bylaws and (b) a written undertaking by him or her or on his or her behalf to repay the amount paid or reimbursed by Kimco if it shall ultimately be determined that the standard of conduct was not met.

Kimco has also entered into indemnification agreements with each of its directors, executive officers, and such other employees or consultants of Kimco or any subsidiary as may be determined from time to time as Kimco’s chief executive officer may in his discretion determine.

The indemnification agreements provide that Kimco will indemnify each covered person, or indemnitee, against any and all expenses, judgments, penalties, fines and amounts paid in settlement (collectively referred to as losses) actually and necessarily incurred by the indemnitee or on his behalf, to the fullest extent permitted by law, in connection with any present or future threatened, pending or completed proceeding based upon, arising from, relating to or by reason of the indemnitee’s status as a director, officer, employee, agent or fiduciary of Kimco or any other entity the indemnitee serves at the request of Kimco. The indemnitee will also be indemnified against all expenses actually and reasonably incurred by him in connection with a proceeding if the indemnitee is, by reason of his service to Kimco or other entity at Kimco’s request, a witness in any such proceeding to which he is not a party.

No indemnification shall be made under the indemnification agreement on account of indemnitee’s conduct in respect of any proceeding charging improper personal benefit to the indemnitee, whether or not involving action in the indemnitee’s official capacity, in which the indemnitee was adjudged to be liable on the basis that personal benefit was improperly received. In addition to certain other exclusions set forth in the indemnification agreement, Kimco will also not be obligated to make any indemnity or advance in connection with any claim made against the indemnitee (a) for which payment has been made to the indemnitee under any insurance policy or other indemnity provision, (b) for an accounting of short-swing profits made by indemnitee from securities of Kimco within the meaning of Section 16(b) of the Exchange Act, or, subject to certain exceptions, (c) prior to a change in control of Kimco, in connection with any proceeding initiated by indemnitee against Kimco or its directors, officers, employees or other indemnitees.

Kimco will advance, to the extent not prohibited by law, the expenses incurred by the indemnitee (or reasonably expected by the indemnitee to be incurred within three months) in connection with any proceeding. The indemnification agreement provides procedures for determining the indemnitee’s entitlement to indemnification and advancement of expenses in the event of a claim. The indemnitee is required to deliver to Kimco a written affirmation of the indemnitee’s good faith belief that the standard of conduct necessary for indemnification by Kimco as authorized by law has been met and a written undertaking to reimburse any expenses if it shall ultimately be established that the standard of conduct has not been met.

To the fullest extent permitted by applicable law, if the indemnification provided for in the indemnification agreement is unavailable to the indemnitee for any reason, then Kimco, in lieu of indemnifying and holding harmless the indemnitee, shall pay the entire amount of losses incurred by the indemnitee in connection with any proceeding without requiring the indemnitee to contribute to such payment, and Kimco further waives and relinquishes any right of contribution it may have at any time against the indemnitee. Kimco shall not enter into any settlement of any proceeding in which Kimco is jointly liable with the indemnitee (or would be if joined in such proceeding) unless such settlement provides for a full and final release of all claims asserted against the indemnitee. Furthermore, Kimco shall fully indemnify and hold harmless the indemnitee from any claims for contribution which may be brought by directors, officers or employees of Kimco other than the indemnitee who may be jointly liable with the indemnitee.

The limited liability company agreement of Kimco OP (which we refer to as the “LLC Agreement”) provides that the managing member is not liable to Kimco OP or any member for any action or omission taken in its capacity as managing member, for the debts or liabilities of Kimco OP or for the obligations of Kimco OP under the LLC Agreement, except for liability for its fraud, willful misconduct or gross negligence, pursuant to any express indemnity the managing member may give to Kimco OP or in connection with a redemption. The LLC Agreement also provides that any obligation or liability in its capacity as the managing member of Kimco OP that may arise at any time under the LLC Agreement or any other instrument, transaction or undertaking contemplated by the LLC Agreement will be satisfied, if at all, out of its assets or the assets of Kimco OP only, and no such obligation or liability will be personally binding upon any of its directors, stockholders, officers, employees or agents.

In addition, the LLC Agreement requires Kimco OP, to the fullest extent a Maryland corporation may indemnify and advance expenses to directors and officers of a Maryland corporation under the laws of the State of Maryland, to indemnify, and to pay or reimburse the reasonable expenses in advance of a final disposition of a proceeding to, the managing member, its directors and officers, officers of Kimco OP and any other person designated by the managing member, who is made or threatened to be made a party to, or witness in, a proceeding by reason of his or her service to Kimco OP. Kimco OP is not required to indemnify or advance funds to any person with respect to any action initiated by the person seeking indemnification without its approval (except for any proceeding brought to enforce such person's right to indemnification under the LLC Agreement) or if the person is found to be liable to Kimco OP on any portion of any claim in the action.

Item 21.

| Exhibits and Financial Statement Schedules |

| | | Agreement and Plan of Merger, dated as of August 28, 2023, by and among Kimco Realty Corporation, Kimco Realty OP, LLC, Tarpon Acquisition Sub, LLC, Tarpon OP Acquisition Sub, LLC, RPT Realty and RPT Realty, L.P. (included as Annex A to the proxy statement/prospectus forming a part of this registration statement and incorporated herein by reference). |

| | | |

| | | Articles of Amendment and Restatement of Kimco Realty Corporation (incorporated by reference to Exhibit 3.1 to Kimco’s Form 8-K12B filed on January 3, 2023). |

| | | |

| | | Amended and Restated Bylaws of Kimco Realty Corporation (incorporated by reference to Exhibit 3.1 to Kimco’s Form 8-K12B filed on February 2, 2023). |

| | | |

| | | Articles of Merger (incorporated by reference to Exhibit 3.5 to Kimco’s Form 8-K12B filed on January 3, 2023). |

| | | |

| | | Form of Articles Supplementary of Kimco Realty Corporation with respect to the Class N Preferred Stock of Kimco Realty Corporation (included as Annex B to the proxy statement/prospectus forming a part of this registration statement and incorporated herein by reference). |

| | | |

4.2* | | | Form of Deposit Agreement with respect to the Class N Preferred Stock of Kimco Realty Corporation. |

| | | |

5.1* | | | Opinion of Venable LLP. |

| | | |

| | | Form of Opinion of Wachtell, Lipton, Rosen & Katz, as to certain material U.S. federal tax matters. |

| | | |

| | | Form of Opinion of Goodwin Procter LLP, as to certain material U.S. federal tax matters. |

| | | |

| | | Form of Opinion of Latham & Watkins LLP, as to the qualification of Kimco Realty Corporation as a real estate investment trust |

| | | |

| | | Form of Opinion of Goodwin Procter LLP, as to the qualification of RPT Realty as a real estate investment trust |

| | | |

23.1* | | | Consent of Venable LLP (included in the opinion filed as Exhibit 5.1 hereto and incorporated herein by reference). |

| | | |

| | | Consent of Wachtell, Lipton, Rosen & Katz (included in the opinion filed as Exhibit 8.1 hereto and incorporated herein by reference). |

| | | |

| | | Consent of Goodwin Procter LLP (included in the opinion filed as Exhibit 8.2 hereto and incorporated herein by reference). |

| | | |

| | | Consent of Independent Registered Public Accounting Firm of Kimco Realty Corporation, PricewaterhouseCoopers LLP. |

| | | |

| | | Consent of Independent Registered Public Accounting Firm of RPT Realty, Grant Thornton LLP. |

| | | |

| | | Consent of Latham & Watkins LLP (included in the opinion filed as Exhibit 8.3 hereto and incorporated herein by reference). |

| | | |

| | | Consent of Goodwin Procter LLP (included in the opinion filed as Exhibit 8.4 hereto and incorporated herein by reference). |

| | | |

| | | Power of Attorney (included in signature page). |

| | | |

| | | Consent of Lazard Frères & Co. LLC. |

| | | |

99.2* | | | Form of Proxy Card of RPT Realty |

| | | |

| | | Filing Fee Table. |

†

| Indicates exhibits previously filed |

+

| Indicates exhibits filed herewith |

*

| To be filed by amendment. |

The undersigned registrant hereby undertakes:

(a)

| to file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

(1)

| to include any prospectus required by section 10(a)(3) of the Securities Act; |

(2)

| to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in the volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and |

(3)

| to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement; |

(b)

| that, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; |

(c)

| to remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering; |

(d)

| that, for the purpose of determining liability under the Securities Act to any purchaser: |

(1)

| each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and |

(2)

| each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date. |

(e)

| that, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser: |

(3)

| any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424; |

(4)

| any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant; |

(5)

| the portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and |

(6)

| any other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

(f)

| that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; |

(g)

| that, prior to any public reoffering of the securities registered hereunder through use of a prospectus which is a part of this registration statement, by any person or party who is deemed to be an underwriter within the meaning of Rule 145(c), the issuer undertakes that such reoffering prospectus will contain the information called for by the applicable registration form with respect to reofferings by persons who may be deemed underwriters, in addition to the information called for by the other Items of the applicable form; |

(h)

| that, every prospectus that (i) is filed pursuant to paragraph (g) immediately preceding, or (ii) purports to meet the requirements of section 10(a)(3) of the Securities Act and is used in connection with an offering of securities subject to Rule 415, will be filed as a part of an amendment to this registration statement and will not be used until such amendment is effective, and that, for purposes of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; |

(i)

| insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue; |

(j)

| to respond to requests for information that is incorporated by reference into the prospectus pursuant to Items 4, 10(b), 11 or 13 of this form, within one business day of receipt of such request, and to send the incorporated documents by first class mail or other equally prompt means. This includes information contained in documents filed subsequent to the effective date of the registration statement through the date of responding to the request; and |

(k)

| to supply by means of a post-effective amendment all information concerning a transaction, and the company being acquired involved therein, that was not the subject of and included in this registration statement when it became effective. |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Jericho, State of New York, on October 27, 2023.

| | | KIMCO REALTY CORPORATION

|

| | | By: | | | /s/ Glenn G. Cohen |

| | | | | | Name: | | | Glenn G. Cohen |

| | | | | | Title: | | | Chief Financial Officer |

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities indicated on October 27, 2023.

| | | | | | |

* | | | Chief Executive Officer and Director

(Principal Executive Officer) | | | October 27, 2023 |

Conor C. Flynn | |

| | | | | | |

/s/ Glenn G. Cohen | | | Executive Vice President –

Chief Financial Officer and Treasurer

(Principal Financial Officer) | | | October 27, 2023 |

Glenn G. Cohen | |

| | | | | | |

* | | | Vice President – Chief Accounting Officer (Principal Accounting Officer) | | | October 27, 2023 |

Paul Westbrook | |

| | | | | | |

* | | | Executive Chairman of the Board | | | October 27, 2023 |

Milton Cooper | |

| | | | | | |

* | | | Director | | | October 27, 2023 |

Philip Coviello | |

| | | | | | |

* | | | Director | | | October 27, 2023 |

Frank Lourenso | |

| | | | | | |

* | | | Director | | | October 27, 2023 |

Henry Moniz | |

| | | | | | |

* | | | Director | | | October 27, 2023 |

Mary Hogan Preusse | |

| | | | | | |

* | | | Director | | | October 27, 2023 |

Valerie Richardson | |

| | | | | | |

* | | | Director | | | October 27, 2023 |

Richard Saltzman | |

* | | | By: | | | /s/ Glenn G. Cohen | | | |

| | | Name: | | | Glenn G. Cohen | | | |

| | | Title: | | | Attorney-in-Fact | | | |

Exhibit 8.1

[LETTERHEAD OF WACHTELL, LIPTON, ROSEN & KATZ]

[●], 2023

Kimco Realty Corporation

500 N. Broadway, Suite 201

Jericho, New York 11753

Ladies and Gentlemen:

Reference is made to the Registration Statement on Form S-4 (as amended or supplemented through the date hereof, the “Registration Statement”) of Kimco Realty Corporation, a Maryland corporation (“Kimco”),

including the proxy statement/prospectus forming a part thereof, relating to the proposed transactions by and among Kimco, Kimco Realty OP, LLC, a Delaware limited liability company, Tarpon Acquisition Sub, LLC, a Delaware limited liability company,

Tarpon OP Acquisition Sub, LLC, a Delaware limited liability company, RPT Realty, a Maryland real estate investment trust, and RPT Realty, L.P., a Delaware limited partnership.

We have participated in the preparation of the discussion set forth in the section entitled “MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES

OF THE COMPANY MERGER” in the Registration Statement. In our opinion, such discussion of those consequences, insofar as it summarizes United States federal income tax law, and subject to the qualifications, exceptions, assumptions and limitations

described therein, is accurate in all material respects.

We hereby consent to the filing of this opinion with the Securities and Exchange Commission as an exhibit to the Registration Statement,

and to the references therein to us. In giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended.

Exhibit 8.2

[Goodwin Procter Letterhead]

[ ], 2023

RPT Realty

19 W 44th Street

Suite 1002

New York, NY 10036

Ladies and Gentlemen:

This opinion letter is delivered to you in connection with the proxy statement/prospectus included as part of the registration statement on Form S-4 filed with the Securities and Exchange Commission (as amended or

supplemented through the date hereof, the “Registration Statement”) in respect of the proposed merger of RPT Realty, a Maryland real estate investment trust (the “Company”),

with and into Tarpon Acquisition Sub, LLC, a Delaware limited liability company (“Parent Merger Sub”), pursuant to the Agreement and Plan of Merger, dated as of August 27, 2023 (the “Merger Agreement”), by and among Kimco Realty Corporation, a Maryland corporation that has elected to be treated as a real estate investment trust for U.S. federal income tax purposes (“Parent”),

Kimco Realty OP, LLC, a Delaware limited liability company (“Parent OP”), Tarpon OP Acquisition Sub, LLC, a Delaware limited liability company and direct wholly owned subsidiary of Parent OP, Parent Merger Sub,

the Company, and RPT Realty, L.P., a Delaware limited partnership. The opinion herein relates to the accuracy of the discussion set forth in the section entitled “MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE COMPANY MERGER” in the

Registration Statement. Capitalized terms not defined herein shall have the meanings ascribed to such terms in the Merger Agreement.

For purposes of the opinion set forth below, we have reviewed and relied upon, without independent investigation thereof, the Merger Agreement and the Registration Statement.

We also have assumed the genuineness of all signatures, the authenticity of all documents submitted to us as originals, the conformity to the original documents of all documents submitted to us as copies, the authority

and capacity of the individual or individuals who executed any such documents on behalf of any person, the conformity to the final documents of all documents submitted to us as drafts and the accuracy and completeness of all records made available to

us.

Based upon and subject to the assumptions and qualifications set forth herein, it is our opinion that the discussion set forth in the section entitled “MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE COMPANY MERGER”

in the Registration Statement, insofar as it summarizes United States federal income tax law, is accurate in all material respects.

* * * * *

RPT Realty

As of [ ], 2023

Page 2

We express no opinion herein other than the opinion expressly set forth above.

The opinion set forth in this letter is based on relevant current provisions of the Internal Revenue Code of 1986, as amended, and the Treasury Regulations thereunder (including proposed and temporary Treasury

Regulations), and interpretations of the foregoing as expressed in court decisions, applicable legislative history, and the administrative rulings and practices of the Internal Revenue Service (the “IRS”), all

as of the date hereof and all of which are subject to change (possibly with retroactive effect). Changes in applicable law could adversely affect our opinion. We do not undertake to advise you as to any changes in applicable law after the date

hereof that may affect our opinion.

Any inaccuracy in, or breach of, any of the aforementioned statements, representations, warranties, covenants, agreements or assumptions could adversely affect our opinion.

Our opinion is not binding on the IRS, and the IRS, or a court of law, may disagree with the opinion contained herein. No ruling has been or will be sought from the IRS by any party to the Merger Agreement as to the

accuracy of the discussion set forth in the section entitled “MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE COMPANY MERGER” in the Registration Statement.

We hereby consent to the filing of this opinion letter as an exhibit to the Registration Statement. In giving this consent, we do not admit that we are experts within the meaning of Section 11 of the Securities Act or

within the category of persons whose consent is required under Section 7 of the Securities Act.

[Signature Page Follows]

RPT Realty

As of [ ], 2023

Page 3

Very truly yours,

Exhibit 8.3

|

|

|

10250 Constellation Blvd., Suite 1100

Los Angeles, California 90067

Tel: +1.424.653.5500 Fax: +1.424.653.5501

www.lw.com

FIRM / AFFILIATE OFFICES

|

Austin

|

Milan

|

Beijing

|

Munich |

Boston

|

New York |

Brussels

|

Orange County |

Century City

|

Paris

|

Chicago

|

Riyadh |

Dubai

|

San Diego |

Düsseldorf

|

San Francisco |

Frankfurt

|

Seoul |

|

|

|

Hamburg

|

Shanghai |

|

|

Hong Kong

|

Silicon Valley |

| |

|

Houston

|

Singapore |

| [ ● ], 2023 |

|

London

|

Tel Aviv |

|

|

|

Los Angeles

|

Tokyo |

|

|

Madrid

|

Washington, D.C. |

RPT Realty

19 W 44th Street

Suite 1002

New York, NY 10036

|

|

Re:

|

Kimco Realty Corporation

Registration Statement on Form S-4

|

To the addressee set forth above:

Reference is hereby made to the Agreement and Plan of Merger, dated as of August 28, 2023, by and between Kimco Realty Corporation, a Maryland corporation

(“Parent”), Tarpon Acquisition Sub, LLC, a Delaware limited liability company and direct wholly owned subsidiary of Parent (“Parent

Merger Sub”), Kimco Realty OP, LLC, a Delaware limited liability company (“Parent OP”), Tarpon OP Acquisition Sub, LLC, a Delaware limited liability company and direct wholly owned

subsidiary of Parent OP, RPT Realty, a Maryland real estate investment trust (the “Company”), and RPT Realty, L.P., a Delaware limited partnership, with respect to the merger of the Company

with and into Parent Merger Sub, with Parent Merger Sub surviving the merger, and certain other transactions.

Pursuant to a reorganization on January 1, 2023, a newly formed subsidiary of Parent merged with and into the company formerly known as Kimco Realty

Corporation (the “Predecessor”), and the Predecessor became a wholly owned subsidiary of Parent.

You have requested our opinion (to be filed as an exhibit to the Registration Statement, defined below) concerning each of Parent’s and the Predecessor’s

election to be treated as a “real estate investment trust” (a “REIT”) under the Internal Revenue Code of 1986, as amended (the “Code”).

This opinion is based on certain assumptions and factual representations concerning the business, assets and governing documents of Parent, the Predecessor and their subsidiaries, including the facts set forth in the registration statement on Form

S-4, Registration No. [ ● ], initially filed by Parent with the Securities and Exchange Commission (the “Commission”) on October 10, 2023

(together with the documents incorporated by reference therein and including the joint proxy statement/prospectus contained therein), as amended through the date hereof (collectively, the “Registration

Statement”), under the Securities Act of 1933, as amended. We have also been furnished with, and with your consent have relied upon, (i) certain representations made by Parent and its subsidiaries with respect to certain factual matters

through a certificate of an officer of Parent, dated as of the date hereof (the “Parent Officer’s Certificate”), and (ii) certain representations made by the Company and its subsidiaries

with respect to certain factual matters through a certificate of an officer of the Company, dated as of the date hereof (such certificate, together with the Parent Officer’s Certificate, the “Officer’s

Certificates”).

[ ● ], 2023

Page 2

In our capacity as special tax counsel to Parent, we have made such legal and factual examinations and inquiries, including an examination of originals or

copies certified or otherwise identified to our satisfaction of such documents, corporate records and other instruments, as we have deemed necessary or appropriate for purposes of this opinion. For purposes of our opinion, we have not made an

independent investigation or audit of the facts set forth in the above-referenced documents or in the Officer’s Certificates. In addition, in rendering this opinion we have assumed the truth and accuracy of all representations and statements made to

us or in the Officer’s Certificates that are qualified as to knowledge or belief, without regard to such qualification. In our examination, we have assumed the authenticity of all documents submitted to us as originals, the genuineness of all

signatures thereon, the legal capacity of natural persons executing such documents, and the conformity to authentic original documents of all documents submitted to us as copies.

We are opining herein only with respect to the federal income tax laws of the United States, and we express no opinion with respect to the applicability

thereto, or the effect thereon, of other federal laws, the laws of any state or other jurisdiction or as to any matters of municipal law or the laws of any other local agencies within any state.

Based on such facts and subject to the qualifications, assumptions, representations and limitations set forth herein and in the Registration Statement and

the Officer’s Certificates, it is our opinion that:

1. Commencing with the Predecessor’s taxable year ended December 31, 2015 through its taxable year ended December 31, 2022, the Predecessor was organized and operated in conformity with the requirements for

qualification and taxation as a REIT under the Code.

2. Commencing with Parent’s taxable year ending December 31, 2023, Parent has been organized and has operated in conformity with the requirements for qualification and taxation as a REIT under the Code, and its proposed

method of operation will enable Parent to continue to meet the require-ments for qualification and taxation as a REIT under the Code.

No opinion is expressed as to any matter not discussed herein.

[ ● ], 2023

Page 3

This opinion is rendered to you as of the date of this letter, and we undertake no obligation to update this opinion subsequent to the date hereof. This

opinion is based on various statutory provisions, regulations promulgated thereunder and interpretations thereof by the Internal Revenue Service and the courts having jurisdiction over such matters, all of which are subject to change either

prospectively or retroactively. Any such change may affect the conclusions stated herein. Also, any variation or difference in the facts from those set forth in the Registration Statement or the Officer’s Certificates may affect the conclusions

stated herein. As described in the Registration Statement, Parent’s and the Predecessor’s qualification and taxation as a REIT depend upon their ability to meet the various requirements imposed under the Code, including through actual annual

operating results, asset diversification, distribution levels and diversity of stock ownership, the results of which have not been and will not be reviewed by Latham & Watkins LLP. Accordingly, no assurance can be given that the actual results of

Parent’s or the Predecessor’s operation for any taxable year have satisfied or will satisfy such requirements. In addition, the opinion set forth above does not foreclose the possibility that Parent may have to pay a deficiency dividend, or an

excise or penalty tax, which could be significant in amount, in order to maintain its REIT qualification.

This opinion is rendered in connection with the Parent’s filing of the Registration Statement. We consent to the filing of this opinion as an exhibit to

the Registration Statement and to the reference to our firm under the heading “Legal Matters.” In giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act of

1933, as amended, or the rules and regulations of the Commission thereunder.

Exhibit 8.4

[Goodwin Procter Letterhead]

[_______], 2023

Kimco Realty Corporation

500 North Broadway

Suite 201

Jericho, NY 11753

Re: RPT Realty

Ladies and Gentlemen:

We have acted as counsel for RPT Realty, a Maryland real estate investment trust (the “Company”), in connection with the merger (the “Company Merger”) of the Company with and into Tarpon Acquisition Sub,

LLC, a Delaware limited liability company (“Parent Merger Sub”), pursuant to the Agreement and Plan of Merger, dated as of August 27, 2023 (the “Merger Agreement”), by and among Kimco Realty Corporation, a Maryland corporation that has

elected to be treated as a real estate investment trust for U.S. federal income tax purposes (“Parent”), Kimco Realty OP, LLC, a Delaware limited liability company (“Parent OP”), Tarpon OP Acquisition Sub, LLC, a Delaware limited

liability company and direct wholly owned subsidiary of Parent OP (“Parent OP Merger Sub”), Parent Merger Sub, the Company, and RPT Realty, L.P., a Delaware limited partnership (the “Partnership”). We are providing this opinion letter

to be filed as an exhibit to the registration statements on Form S-4 filed with the Securities and Exchange Commission on October 10, 2023 with respect to the transactions contemplated by the Merger Agreement, including the Joint Proxy

Statement/Prospectus of Parent and the Company (as amended or supplemented through the date hereof, the “Registration Statements”). This opinion relates to the Company’s qualification for U.S. federal income tax purposes as a real estate

investment trust (a “REIT”) under the Internal Revenue Code of 1986, as amended (the “Code”), for taxable years commencing with the Company’s taxable year ended December 31, 2015 through the Company’s taxable year ending with the

Company Merger. Capitalized terms not otherwise defined herein shall have the meaning ascribed to them in the Merger Agreement.

In rendering the following opinion, we have reviewed and relied upon the Company’s Declaration of Trust and the Amended and Restated Bylaws of the Company, in each case as amended or amended and restated and as in effect

from time to time through the date hereof, and the Amended and Restated Agreement of Limited Partnership of RPT Realty, L.P. (f/k/a Ramco-Gershenson Properties, L.P.) as amended or amended and restated and as in effect from time to time through the

date hereof. In addition, we have reviewed and relied upon the Merger Agreement and the Registration Statements. For purposes of this opinion letter, we have assumed (i) the genuineness of all signatures on documents we have examined, (ii) the

authenticity of all documents submitted to us as originals, (iii) the conformity to the original documents of all documents submitted to us as copies, (iv) the conformity to the original documents of copies obtained by us from filings with the

Securities and Exchange Commission, (v) the conformity, to the extent relevant to our opinion, of final documents to all documents submitted to us as drafts, (vi) the authority and capacity of the individual or individuals who executed any such

documents on behalf of any person, (vii) due execution and delivery of all such documents by all the parties thereto, (viii) the compliance of each party with all material provisions of such documents, (ix) that we have been provided copies of any

relevant amendments to the documents we have reviewed (as described above) that may have been made following the execution of the Merger Agreement, and (x) the accuracy and completeness of all records made available to us.

Kimco Realty Corporation

As of [________], 2023

Page 2 of 4

We also assume that (i) each of the Company Merger, the Partnership Merger and the Contribution will be consummated in accordance with the Merger Agreement without waiver or modification of any conditions or other

requirements that would be material to our opinion, (ii) the Company Merger will constitute a reorganization within the meaning of Section 368(a) of the Code in which the Company does not recognize income or gain for U.S. federal income tax

purposes, (iii) beginning with the date of its formation until the Partnership Merger Effective Time, each of Parent OP and Parent OP Merger Sub has been and will be disregarded as an entity separate from its owner for U.S. federal income tax

purposes, (iv) Parent OP Merger Sub will not have any assets for U.S. federal income tax purposes at the time of the Partnership Merger, (v) no transaction, agreement or

other action has been or will be taken prior to the Company Merger Effective Time pursuant to Section 3.10 or Section 7.21 of the Merger Agreement that causes any representation or covenant in the REIT Certificate (as defined below) to be incorrect

or incomplete, (vi) to the extent necessary to satisfy the Company’s distribution requirements under Section 857(a) of the Code, Parent will cause the Company to elect to apply the safe harbor provided in Rev. Proc. 2011-29 to any fee paid by the

Company on or after the Closing to any investment banker that is contingent on the successful closing of the transactions contemplated by the Merger Agreement (“Success-Based Fee”) such that 70% of any such Success-Based Fee is deductible by

the Company in its taxable year ending on the date of the Company Merger, and (vii) following the Company Merger, Parent and its affiliates shall not take any action, or fail to take any action, within their control which would cause the Company to

fail to qualify for taxation as a REIT for any Company taxable year.

We also have reviewed and relied upon the representations, statements and covenants of the Company and the Partnership contained in a letter that they provided to us in connection with the preparation of this opinion

letter, a copy of which we have previously provided to your counsel (the “REIT Certificate”), regarding the formation, organization, ownership and operations of the Company and the Partnership, and other matters affecting the Company’s

ability to qualify as a REIT. We assume that each of the representations, statements and covenants in the REIT Certificate has been, is and will be true, correct and complete, that the Company and its subsidiaries have been, are and will be owned

and operated in accordance with the REIT Certificate, and that all representations, representations and covenants that speak to the best of knowledge and belief (or mere knowledge and/or belief) of any person(s) or party(ies), or are subject to

similar qualification, have been, are and will continue to be true, correct and complete as if made without such qualification. To the extent such representations, statements and covenants speak to the intended or future ownership or operations of

any entity, we assume that such entity has been and will in fact be owned and operated in accordance with such stated intent.

Kimco Realty Corporation

As of [________], 2023

Page 3 of 4

Based upon the foregoing and subject to the limitations set forth herein, we are of the opinion that:

|

i. |

Commencing with its taxable year ended December 31, 2015, the Company has been organized in conformity with the requirements for qualification and taxation as a REIT under the Code; and

|

|

ii. |

The Company’s prior, current and proposed ownership, organization and method of operations as described in the REIT Certificate have allowed and will continue to allow the Company to satisfy the requirements for qualification and taxation

as a REIT under the Code commencing with its taxable year ended December 31, 2015 through its taxable year ending with the Company Merger.

|

* * * * *

We express no opinion other than the opinion expressly set forth herein. In rendering our opinion, we have relied solely on the documents we have reviewed (as set forth above), the REIT Certificate, and the assumptions

set forth herein. For purposes of our opinion, we have not investigated or verified the accuracy of any of the representations, statements and covenants in the REIT Certificate or any of our assumptions set forth herein. We also have not

investigated or verified the ability of the Company and its subsidiaries to operate in compliance with the REIT Certificate or our assumptions. Differences between the actual ownership and operations of such entities and the prior, proposed and

intended ownership and operations described in the REIT Certificate or our assumptions could result in U.S. federal income tax treatment of the Company that differs materially and adversely from the treatment described herein. The Company’s actual

qualification as a REIT depends on the Company meeting and having met, in its actual ownership and operations, the applicable asset composition, source of income, shareholder diversification, distribution and other requirements of the Code necessary

for a corporation to qualify as a REIT. We have not monitored and will not monitor actual results and have not verified and will not verify the Company’s compliance with the requirements for qualification and taxation as a REIT, and no assurance can

be given that the actual ownership and operations of the Company and its affiliates have satisfied or will satisfy those requirements.

Our opinion is based upon the Code, the Income Tax Regulations and Procedure and Administration Regulations promulgated thereunder and existing administrative and judicial interpretations thereof (including the practices

and policies of the IRS in issuing private letter rulings, which are not binding on the IRS except with respect to a taxpayer that receives such a ruling), all as in effect as of the date of this opinion letter or, to the extent different and

relevant for a prior taxable year or other period, as in effect for the applicable taxable year or period. Changes in applicable law could cause the U.S. federal income tax treatment of the Company to differ materially and adversely from the

treatment described herein.

Kimco Realty Corporation

As of [________], 2023

Page 4 of 4

Our opinion is not binding on the Internal Revenue Service (the “IRS”) or a court. The IRS may disagree with and challenge our conclusions, and a court could sustain such a challenge. Our opinion does not

preclude the possibility that the Company (or its successors, including Parent and Parent Merger Sub, on behalf of the Company) may need to utilize one or more of the various “savings provisions” under the Code and the regulations thereunder that

would permit the Company to cure certain violations of the requirements for qualification and taxation as a REIT, and we assume that Parent and its affiliates will take such actions as may be needed in order to utilize any such savings provisions for

the Company. Utilizing such savings provisions could require the Company (or its successors) to pay significant penalty or excise taxes and/or interest charges and/or make additional distributions to shareholders that otherwise would not be made.

This opinion letter speaks only as of the date hereof, and we undertake no obligation to update this opinion letter or to notify any person of any changes in facts, circumstances or applicable law (including without

limitation any discovery of any facts that are inconsistent with the REIT Certificate or our assumptions).

We are rendering this opinion letter to you solely for purposes of filing this opinion as an exhibit to the Registration Statements. We hereby consent to the filing of this opinion letter as an exhibit to the

Registration Statements. In giving this consent, we do not admit that we are experts within the meaning of Section 11 of the Securities Act or within the category of persons whose consent is required under Section 7 of the Securities Act.

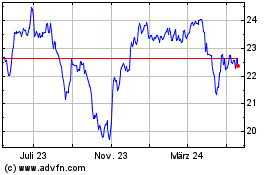

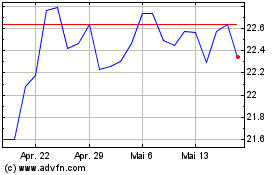

Kimco Realty (NYSE:KIM-M)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Kimco Realty (NYSE:KIM-M)

Historical Stock Chart

Von Mai 2023 bis Mai 2024