UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Information

Required in Proxy Statement

Schedule

14A Information

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐

Definitive Proxy Statement

☒

Definitive Additional Materials

☐

Soliciting Material Pursuant to §240.14a-12

INFINT

ACQUISITION CORPORATION

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

☒

No fee required.

☐

Fee paid previously with preliminary materials.

☐

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11.

Infint

Acquisition Corporation Announces Plan to Make Additional Contributions to Trust Account in Support of Extension Amendment Proposal

NEW

YORK--(BUSINESS WIRE)--INFINT Acquisition Corporation (“INFINT”) (NYSE: IFIN, IFIN.WS), announced

today that it affirmed its intention to support the proposal to amend the Company’s Amended and Restated Memorandum and Articles

of Association (the “Charter”) to extend the date by which the Company must consummate a business combination (the “Extension”)

from November 23, 2022 to March 23, 2023 (the “Extension Proposal”). The purpose of the Extension is to allow the Company

more time to complete its previously announced business combination by and among the Company, FINTECH Merger Sub Corp., a Cayman Islands

exempted company and a wholly owned subsidiary of INFINT and Seamless Group Inc., a Cayman Islands exempted company (“Seamless”).

In order to support this proposal, the Company, INFINT Capital LLC (the “Sponsor”) and Seamless have agreed that, if the

proposal is approved, Seamless will deposit (or cause to be deposited) into the trust account for the Extension, the lesser of: (x) $900,000

or (y) $0.18 per share multiplied by the number of public shares that are not redeemed in connection with the extraordinary general meeting

on November 22, 2022 (an “Extension Contribution”). The Company expects to consent to the reversal of any previously received

redemptions until 2:00 p.m. Eastern Time on Tuesday, November 22, 2022.

The

Extension Contribution will be deposited in the trust account on November 22, 2022. In the event the extension is approved by the Company’s

shareholders and Seamless does not fund an Extension Contribution, the Company will be required to dissolve and liquidate, unless the

Sponsor or its designee deposits additional funds for a three month extension as permitted by the Charter. Pursuant to the terms of the

business combination agreement, as amended, Seamless has an obligation to provide such additional funds for a three month extension to

the Sponsor.

The

Extension Proposal will be voted on by shareholders at the upcoming special meeting of stockholders on November 22, 2022 (the “Extraordinary

General Meeting”) and is described in further detail in the Company’s Definitive Proxy Statement on Schedule 14A (the “Proxy

Statement”), filed with the U.S. Securities and Exchange Commission on November 2, 2022.

The

Extraordinary General Meeting will be held virtually at 2:00 p.m. Eastern Time on November 22, 2022, at https://www.cstproxy.com/infintspac/2022,

or at such other time, on such other date and at such other place at which the meeting may be adjourned or postponed. Further detail

related to attendance and voting is described in the Company’s Proxy Statement.

About

INFINT Acquisition Corporation

INFINT

Acquisition Corporation is a Special Purpose Acquisition Corporation (SPAC) company on a mission to bring the most promising financial

technology company from North America, Asia, Latin America, Europe and Israel to the U.S. public market. As a result of the pandemic,

the world is changing rapidly, and in unique, unexpected ways. Thanks to growth and investment in the global digital infrastructure,

legal, healthcare, automotive, financial, and other fields are evolving at a faster rate than ever before. INFINT believes the greatest

opportunities in the near future lie in the global fintech space and are looking forward to merging with an exceptional international

fintech company.

Cautionary

Statement Regarding Forward-Looking Statements

This

release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. The Company’s actual results may differ from its expectations, estimates and projections

and consequently, you should not rely on these forward looking statements as predictions of future events. Words such as “expect,”

“estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,”

“plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,”

“potential,” “continue,” and similar expressions (or the negative versions of such words or expressions) are

intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the timing of the

Company’s consent to redemption reversals. These forward-looking statements involve significant risks and uncertainties that could

cause the actual results to differ materially from the expected results. Most of these factors are outside the Company’s control

and are difficult to predict. The Company cautions investors not to place undue reliance upon any forward-looking statements, which speak

only as of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions

to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which

any such statement is based.

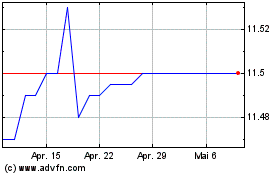

InFinT Acquisition (NYSE:IFIN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

InFinT Acquisition (NYSE:IFIN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024