INFINT Acquisition Corporation Announces Plan to Make Additional Contributions to Trust Account in Support of Extension Amendment Proposal

21 November 2022 - 2:30PM

Business Wire

INFINT Acquisition Corporation (“INFINT”) (NYSE: IFIN, IFIN.WS),

announced today that it affirmed its intention to support the

proposal to amend the Company’s Amended and Restated Memorandum and

Articles of Association (the “Charter”) to extend the date by which

the Company must consummate a business combination (the

“Extension”) from November 23, 2022 to March 23, 2023 (the

“Extension Proposal”). The purpose of the Extension is to allow the

Company more time to complete its previously announced business

combination by and among the Company, FINTECH Merger Sub Corp., a

Cayman Islands exempted company and a wholly owned subsidiary of

INFINT and Seamless Group Inc., a Cayman Islands exempted company

(“Seamless”). In order to support this proposal, the Company,

INFINT Capital LLC (the “Sponsor”) and Seamless have agreed that,

if the proposal is approved, Seamless will deposit (or cause to be

deposited) into the trust account for the Extension, the lesser of:

(x) $900,000 or (y) $0.18 per share multiplied by the number of

public shares that are not redeemed in connection with the

extraordinary general meeting on November 22, 2022 (an “Extension

Contribution”). The Company expects to consent to the reversal of

any previously received redemptions until 2:00 p.m. Eastern Time on

Tuesday, November 22, 2022.

The Extension Contribution will be deposited in the trust

account on November 22, 2022. In the event the extension is

approved by the Company's shareholders and Seamless does not fund

an Extension Contribution, the Company will be required to dissolve

and liquidate, unless the Sponsor or its designee deposits

additional funds for a three month extension as permitted by the

Charter. Pursuant to the terms of the business combination

agreement, as amended, Seamless has an obligation to provide such

additional funds for a three month extension to the Sponsor.

The Extension Proposal will be voted on by shareholders at the

upcoming special meeting of stockholders on November 22, 2022 (the

“Extraordinary General Meeting”) and is described in further detail

in the Company's Definitive Proxy Statement on Schedule 14A (the

“Proxy Statement”), filed with the U.S. Securities and Exchange

Commission on November 2, 2022.

The Extraordinary General Meeting will be held virtually at 2:00

p.m. Eastern Time on November 22, 2022, at

https://www.cstproxy.com/infintspac/2022, or at such other time, on

such other date and at such other place at which the meeting may be

adjourned or postponed. Further detail related to attendance and

voting is described in the Company's Proxy Statement.

About INFINT Acquisition Corporation

INFINT Acquisition Corporation is a Special Purpose Acquisition

Corporation (SPAC) company on a mission to bring the most promising

financial technology company from North America, Asia, Latin

America, Europe and Israel to the U.S. public market. As a result

of the pandemic, the world is changing rapidly, and in unique,

unexpected ways. Thanks to growth and investment in the global

digital infrastructure, legal, healthcare, automotive, financial,

and other fields are evolving at a faster rate than ever before.

INFINT believes the greatest opportunities in the near future lie

in the global fintech space and are looking forward to merging with

an exceptional international fintech company.

Cautionary Statement Regarding Forward-Looking

Statements

This release includes "forward-looking statements" within the

meaning of the "safe harbor" provisions of the Private Securities

Litigation Reform Act of 1995. The Company's actual results may

differ from its expectations, estimates and projections and

consequently, you should not rely on these forward looking

statements as predictions of future events. Words such as "expect,"

"estimate," "project," "budget," "forecast," "anticipate,"

"intend," "plan," "may," "will," "could," "should," "believes,"

"predicts," "potential," "continue," and similar expressions (or

the negative versions of such words or expressions) are intended to

identify such forward-looking statements. These forward-looking

statements include, without limitation, the timing of the Company’s

consent to redemption reversals. These forward-looking statements

involve significant risks and uncertainties that could cause the

actual results to differ materially from the expected results. Most

of these factors are outside the Company's control and are

difficult to predict. The Company cautions investors not to place

undue reliance upon any forward-looking statements, which speak

only as of the date made. The Company does not undertake or accept

any obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements to reflect any change

in its expectations or any change in events, conditions or

circumstances on which any such statement is based.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221121005309/en/

Investor Contacts Shannon Devine/ Mark Schwalenberg MZ Group

North America 203-741-8811 shannon.devine@mzgroup.us PR Contacts

Joe McGurk MZ Group North America joe.mcgurk@mzgroup.us

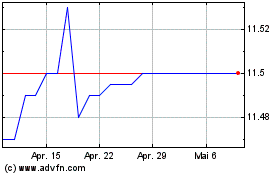

InFinT Acquisition (NYSE:IFIN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

InFinT Acquisition (NYSE:IFIN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024