Filed Pursuant to Rule 424(b)(3)

Registration File No.: 333-262469

BLACKROCK CORPORATE HIGH YIELD FUND, INC.

Supplement dated January 26, 2024 to the

Prospectus dated February 22, 2022, as supplemented on July 18, 2022, January 3, 2023 and May 10, 2023

and Statement of Additional Information (“SAI”) dated February 22, 2022, as supplemented on July 18, 2022 and

May 30, 2023

This supplement amends certain information in the Prospectus dated February 22, 2022, as supplemented on July 18, 2022,

January 3, 2023 and May 10, 2023, and SAI dated February 22, 2022, as supplemented on July 18, 2022 and May 30, 2023, of BlackRock Corporate High Yield Fund, Inc. (the “Fund”). Unless otherwise indicated, all other

information included in the Prospectus and SAI that is not inconsistent with the information set forth in this supplement remains unchanged. Capitalized terms not otherwise defined in this supplement have the same meanings as in the Prospectus and

SAI, as applicable.

Effective January 26, 2024, the following changes are made to the Fund’s Prospectus:

The section of the Prospectus entitled “Management of the Fund — Portfolio Managers” is deleted in its entirety and replaced with the

following:

Portfolio Managers

The members of

the portfolio management team who are primarily responsible for the day-to-day management of the Fund’s portfolio are as follows:

Mitchell Garfin, CFA, Managing Director of BlackRock, Inc., since 2009. Mr. Garfin also served as Director of BlackRock from 2005 to 2008.

Mr. Garfin is jointly and primarily responsible for the day-to-day

management of the Fund’s portfolio, which includes setting the Fund’s overall investment strategy, overseeing the management of the Fund and/or selection of its investments. Mr. Garfin has been a member of the Fund’s portfolio

management team since 2009.

David Delbos, Managing Director of BlackRock, Inc., since 2012. Mr. Delbos also served as Director of BlackRock,

Inc. from 2007 to 2011, and served as Vice President of BlackRock, Inc. from 2005 to 2006.

Mr. Delbos is jointly and primarily responsible for the day-to-day management of the Fund’s portfolio, including setting the Fund’s overall investment strategy and overseeing the management of the Fund. Mr. Delbos

has been a member of the Fund’s portfolio management team since 2023.

The SAI provides additional information about each portfolio manager’s

compensation, other accounts managed by the portfolio management team and the ownership of the Fund’s securities by each portfolio manager.

Effective January 26, 2024, the following changes are made to the Fund’s SAI:

The section of the SAI entitled “Management of the Fund — Portfolio Managers” is deleted in its entirety and replaced with the

following:

Portfolio Management

Portfolio

Manager Assets Under Management

The following table sets forth information about funds and accounts other than the Fund for which the portfolio

managers are primarily responsible for the day-to-day portfolio management as of December 31, 2021:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(ii) Number of Other Accounts

Managed and Assets by Account Type |

|

(iii) Number of Other Accounts and

Assets for Which Advisory Fee is

Performance-Based |

(i) Name of Portfolio

Manager |

|

Other

Registered

Investment

Companies |

|

Other

Pooled

Investment

Vehicles |

|

Other

Accounts |

|

Other

Registered

Investment

Companies |

|

Other

Pooled

Investment

Vehicles |

|

Other

Accounts |

| Mitchell Garfin, CFA |

|

27

$44.76 Billion |

|

27

$15.54 Billion |

|

61

$16.87 Billion |

|

0

$0 |

|

0

$0 |

|

5

$1.03 Billion |

| David Delbos* |

|

29

$33.58 Billion |

|

25

$11.02 Billion |

|

116

$16.41 Billion |

|

0

$0 |

|

0

$0 |

|

5

$782.2 Million |

| * |

Information provided as of April 30, 2023. |

Portfolio Manager Compensation Overview

The discussion

below describes the portfolio managers’ compensation as of December 31, 2021.

The Advisor’s financial arrangements with its portfolio

managers, its competitive compensation and its career path emphasis at all levels reflect the value senior management places on key resources. Compensation may include a variety of components and may vary from year to year based on a number of

factors. The principal components of compensation include a base salary, a performance-based discretionary bonus, participation in various benefits programs and one or more of the incentive compensation programs established by the Advisor.

Base Compensation. Generally, portfolio managers receive base compensation based on their position with the firm.

Discretionary Incentive Compensation. Discretionary incentive compensation is a function of several components: the performance of BlackRock, Inc., the

performance of the portfolio manager’s group within BlackRock, the investment performance, including risk-adjusted returns, of the firm’s assets under management or supervision by that portfolio manager relative to predetermined

benchmarks, and the individual’s performance and contribution to the overall performance of these portfolios and BlackRock. In most cases, these benchmarks are the same as the benchmark or benchmarks against which the performance of the Fund or

other accounts managed by the portfolio managers are measured. Among other things, BlackRock’s Chief Investment Officers make a subjective determination with respect to each portfolio manager’s compensation based on the performance of the

Fund and other accounts managed by each portfolio manager relative to the various benchmarks. Performance of fixed-income funds is measured on

a pre-tax and/or after-tax basis over various time periods

including 1-, 3- and 5- year periods, as applicable. With respect to these portfolio managers, such benchmarks for

the Fund and other accounts are: A combination of market-based indices (e.g., The Bloomberg U.S. Corporate High Yield 2% Issuer Cap Index), certain customized indices and certain fund industry peer groups.

- 2 -

Distribution of Discretionary Incentive Compensation. Discretionary incentive compensation is

distributed to portfolio managers in a combination of cash, deferred BlackRock, Inc. stock awards, and/or deferred cash awards that notionally track the return of certain BlackRock investment products.

Portfolio managers receive their annual discretionary incentive compensation in the form of cash. Portfolio managers whose total compensation is above a

specified threshold also receive deferred BlackRock, Inc. stock awards annually as part of their discretionary incentive compensation. Paying a portion of discretionary incentive compensation in the form of deferred BlackRock, Inc. stock puts

compensation earned by a portfolio manager for a given year “at risk” based on BlackRock’s ability to sustain and improve its performance over future periods. In some cases, additional deferred BlackRock, Inc. stock may be granted to

certain key employees as part of a long-term incentive award to aid in retention, align interests with long-term shareholders and motivate performance. Deferred BlackRock, Inc. stock awards are generally granted in the form of BlackRock, Inc.

restricted stock units that vest pursuant to the terms of the applicable plan and, once vested, settle in BlackRock, Inc. common stock. The portfolio managers of this Fund have deferred BlackRock, Inc. stock awards.

For certain portfolio managers, a portion of the discretionary incentive compensation is also distributed in the form of deferred cash awards that notionally

track the returns of select BlackRock investment products they manage, which provides direct alignment of portfolio manager discretionary incentive compensation with investment product results. Deferred cash awards vest ratably over a number of

years and, once vested, settle in the form of cash. Only portfolio managers who manage specified products and whose total compensation is above a specified threshold are eligible to participate in the deferred cash award program.

Other Compensation Benefits. In addition to base salary and discretionary incentive compensation, portfolio managers may be eligible to receive or

participate in one or more of the following:

Incentive Savings Plans — BlackRock, Inc. has created a variety of incentive savings

plans in which BlackRock, Inc. employees are eligible to participate, including a 401(k) plan, the BlackRock Retirement Savings Plan (RSP), and the BlackRock Employee Stock Purchase Plan (ESPP). The employer contribution components of the RSP

include a company match equal to 50% of the first 8% of eligible pay contributed to the plan capped at $5,000 per year, and a company retirement contribution equal to 3-5% of eligible

compensation up to the Internal Revenue Service limit ($290,000 for 2021). The RSP offers a range of investment options, including registered investment companies and collective investment funds managed by the firm. BlackRock, Inc. contributions

follow the investment direction set by participants for their own contributions or, absent participant investment direction, are invested into a target date fund that corresponds to, or is closest to, the year in which the participant attains age

65. The ESPP allows for investment in BlackRock, Inc. common stock at a 5% discount on the fair market value of the stock on the purchase date. Annual participation in the ESPP is limited to the purchase of 1,000 shares of common stock or

a dollar value of $25,000 based on its fair market value on the purchase date. All of the eligible portfolio managers are eligible to participate in these plans.

Securities Ownership of Portfolio Managers

As of

December 31, 2021, the end of the Fund’s most recently completed fiscal year end, the dollar range of securities beneficially owned by each portfolio manager in the Fund is shown below:

|

|

|

|

|

|

| Portfolio Manager |

|

Dollar Range of Equity Securities of

the Fund Beneficially Owned |

| Mitchell Garfin, CFA |

|

$100,001-$500,000 |

| David Delbos* |

|

$500,001-$1,000,000 |

| * |

Information provided as of April 30, 2023. |

- 3 -

Potential Material Conflicts of Interest

The Advisor has built a professional working environment, firm-wide compliance culture and compliance procedures and systems designed to protect against

potential incentives that may favor one account over another. The Advisor has adopted policies and procedures that address the allocation of investment opportunities, execution of portfolio transactions, personal trading by employees and other

potential conflicts of interest that are designed to ensure that all client accounts are treated equitably over time. Nevertheless, the Advisor furnishes investment management and advisory services to numerous clients in addition to the Fund, and

the Advisor may, consistent with applicable law, make investment recommendations to other clients or accounts (including accounts which are hedge funds or have performance or higher fees paid to the Advisor, or in which portfolio managers have a

personal interest in the receipt of such fees), which may be the same as or different from those made to the Fund. In addition, BlackRock, Inc., its affiliates and significant shareholders and any officer, director, shareholder or employee may or

may not have an interest in the securities whose purchase and sale the Advisor recommends to the Fund. BlackRock, Inc. or any of its affiliates or significant shareholders, or any officer, director, shareholder, employee or any member of their

families may take different actions than those recommended to the Fund by the Advisor with respect to the same securities. Moreover, the Advisor may refrain from rendering any advice or services concerning securities of companies of which any of

BlackRock, Inc.’s (or its affiliates’ or significant shareholders’) officers, directors or employees are directors or officers, or companies as to which BlackRock, Inc. or any of its affiliates or significant shareholders or the

officers, directors and employees of any of them has any substantial economic interest or possesses material non-public information. Certain portfolio managers also may manage accounts whose

investment strategies may at times be opposed to the strategy utilized for a fund. It should also be noted that Messrs. Garfin and Delbos may be managing hedge fund and/or long only accounts, or may be part of a team managing certain hedge fund

and/or long only accounts, subject to incentive fees. Messrs. Garfin and Delbos may therefore be entitled to receive a portion of any incentive fees earned on such accounts.

As a fiduciary, the Advisor owes a duty of loyalty to its clients and must treat each client fairly. When the Advisor purchases or sells securities for more

than one account, the trades must be allocated in a manner consistent with its fiduciary duties. The Advisor attempts to allocate investments in a fair and equitable manner among client accounts, with no account receiving preferential treatment. To

this end, BlackRock, Inc. has adopted policies that are intended to ensure reasonable efficiency in client transactions and provide the Advisor with sufficient flexibility to allocate investments in a manner that is consistent with the particular

investment discipline and client base, as appropriate.

Investors should retain this supplement for future reference.

PRSAI-HYT-0124SUP

- 4 -

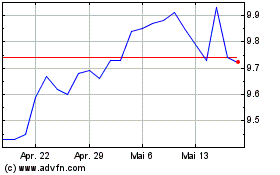

BlackRock Corporate High... (NYSE:HYT)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

BlackRock Corporate High... (NYSE:HYT)

Historical Stock Chart

Von Jan 2024 bis Jan 2025