0001703644false00017036442023-08-042023-08-040001703644exch:XNYSus-gaap:CommonStockMember2023-08-042023-08-040001703644us-gaap:SeriesAPreferredStockMemberexch:XNYS2023-08-042023-08-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 3, 2023

Granite Point Mortgage Trust Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-38124 | | 61-1843143 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

| 3 Bryant Park, Suite 2400A |

| New York, | NY | 10036 |

(Address of principal executive offices)

(Zip Code) |

Registrant’s telephone number, including area code: (212) 364-5500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class: | | Trading Symbol(s) | | Name of each exchange on which registered: |

| Common Stock, par value $0.01 per share | | GPMT | | NYSE |

7.00% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock, par value $0.01 per share | | GPMTPrA | | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Previously, certain indirect subsidiaries of Granite Point Mortgage Trust Inc. (the “Company”) entered into master repurchase agreements, as the same have been or may be further amended, modified and/or restated from time to time, with each of Morgan Stanley Bank, N.A., JPMorgan Chase Bank, National Association, Goldman Sachs Bank USA and Citibank, N.A. (collectively, the “Repurchase Facilities”). In connection with each Repurchase Facility, the Company entered into a limited guaranty pursuant to which the Company guarantees certain payment and performance obligations of its indirect subsidiaries under the applicable Repurchase Facility (collectively, the “Limited Guaranties”).

On August 3, 2023, the Company entered into an amendment to each Limited Guaranty (collectively, the “Amendments”) to, among other things, modify the “Minimum Tangible Net Worth” and “Minimum Interest Expense Coverage Ratio” (each as defined in such Limited Guaranty) financial covenants in such Limited Guaranty.

The foregoing summary of the Amendments does not purport to be complete and is qualified in its entirety by reference to the full and complete text thereof, copies of which are attached hereto as Exhibits 10.1, 10.2, 10.3 and 10.4 are incorporated by

reference herein.

Item 2.03 Creating of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 10.1 | | |

| 10.2 | | |

| 10.3 | | |

| 10.4 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | GRANITE POINT MORTGAGE TRUST INC. |

| | | |

| | | |

| | By: | /s/ MICHAEL J. KARBER |

| | | Michael J. Karber |

| | | General Counsel and Secretary |

| | | |

| Date: August 4, 2023 | | |

FOURTH AMENDMENT TO GUARANTY

THIS FOURTH AMENDMENT TO GUARANTY (this “Amendment”), dated as of August 3, 2023, is entered into by and between MORGAN STANLEY BANK, N.A., a national banking association, as Buyer (together with its successors and assigns “Buyer”) and GRANITE POINT MORTGAGE TRUST INC., a Maryland corporation (“Guarantor”). Capitalized terms used but not otherwise defined herein shall have the meanings given to them in the Guaranty (as defined below).

WITNESSETH:

WHEREAS, GP Commercial MS LLC (f/k/a TH Commercial MS II, LLC) (“Seller”) and Buyer are parties to that certain Master Repurchase and Securities Contract Agreement, dated as of February 18, 2016, as amended by that certain First Amendment to Master Repurchase and Securities Contract Agreement, dated as of June 30, 2016, as further amended by that certain Second Amendment to Master Repurchase and Securities Contract Agreement, dated as of February 21, 2017, as further amended by that certain Third Amendment to Master Repurchase and Securities Contract Agreement, dated as of June 28, 2017, as further amended by that certain Fourth Amendment to Master Repurchase and Securities Contract Agreement, dated as of October 27, 2017, as further amended by that certain Fifth Amendment to Master Repurchase and Securities Contract Agreement, dated as of May 9, 2018, and as further amended by that certain Sixth Amendment to Master Repurchase and Securities Contract Agreement, dated as of August 21, 2019, as further amended by that certain Seventh Amendment to Master Repurchase and Securities Contract Agreement and Second Amendment to Guaranty, dated as of September 25, 2020, as further amended by that certain Eighth Amendment to Master Repurchase and Securities Contract Agreement, dated as of June 25, 2021, as further amended by that certain Ninth Amendment to Master Repurchase and Securities Contract Agreement, dated as of July 14, 2021, as further amended by that certain Tenth Amendment to Master Repurchase and Securities Contract Agreement, dated as of March 22, 2022, as further amended by that certain Eleventh Amendment to Master Repurchase and Securities Contract Agreement, dated as of April 20, 2022, as further amended by that certain Twelfth Amendment to Master Repurchase and Securities Contract Agreement, dated as of April 24, 2023 (as the same has been or may be further amended, modified and/or restated from time to time, the “ Master Repurchase Agreement”); and

WHEREAS, Guarantor has executed and delivered that certain Guaranty, dated as of June 28, 2017, as amended by that certain First Amendment to Guaranty, dated as of December 17, 2019, as further amended by that certain Seventh Amendment to Master Repurchase and Securities Contract Agreement and Second Amendment to Guaranty, dated as of September 25, 2020, and as further amended by that certain Third Amendment to Guaranty, dated as of March 22, 2022 (as the same may be further amended, modified and/or restated from time to time, the “Guaranty”); and

WHEREAS, Guarantor and Buyer wish to modify certain terms and provisions of the Guaranty, as set forth herein.

NOW, THEREFORE, in consideration of the premises and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Amendment to Guaranty. The Guaranty is hereby amended as follows:

(a) Section 9(a) of the Guaranty is hereby deleted in its entirety and replaced with the following:

(a) Guarantor shall not, with respect to itself and its consolidated Subsidiaries, directly or indirectly, permit any of the following to be breached, as determined quarterly on a consolidated basis in conformity with GAAP, as adjusted pursuant to the last sentence of this Section 9(a):

(i) Unrestricted Cash. Guarantor shall not, with respect to itself and its consolidated Subsidiaries, directly or indirectly, permit its Unrestricted Cash to be less than the greater of: (i) Thirty Million and No/100 Dollars ($30,000,000.00), and (ii) five percent (5.0%) of Guarantor’s Recourse Indebtedness;

(ii) Minimum Tangible Net Worth. Guarantor shall not, with respect to itself and its consolidated Subsidiaries, directly or indirectly, permit its Tangible Net Worth to be less than the sum of (x) $816,913,000, plus (y) seventy-five percent (75%) of the aggregate net cash proceeds of any equity issuances made by Guarantor after August 3, 2023 (net of underwriting discounts and commissions and other out-of-pocket costs and expenses incurred by Guarantor and its Affiliates in connection with such equity issuance)

(iii) Total Debt to Total Assets Ratio. Guarantor shall not, with respect to itself and its Subsidiaries, directly or indirectly, permit the ratio, expressed as a percentage, (i) the numerator of which shall equal the Indebtedness of Guarantor and its consolidated Subsidiaries associated with its Target Investments (net of restricted cash associated with any consolidated variable interest entities) and (ii) the denominator of which shall equal the Total Assets of Guarantor and its consolidated Subsidiaries associated with its Target Investments, to at any time be greater than seventy-seven and one half percent (77.5%); provided, that notwithstanding the foregoing, Guarantor and its consolidated Subsidiaries may from time to time acquire Highly Rated CMBS and enter into secured Indebtedness in connection therewith pursuant to which the ratio, expressed as a percentage, (i) the numerator of which equals the Indebtedness of Guarantor and its consolidated Subsidiaries associated with its Highly Rated CMBS (net of restricted cash associated with any consolidated variable interest entities) and (ii) the denominator of which equals the Total Assets of Guarantor and its consolidated Subsidiaries associated with its Highly Rated CMBS exceeds seventy-seven and one half percent (77.5%) but is not greater than ninety percent (90.00%), subject to the condition that at any such time, Guarantor shall not, with respect to itself and its Subsidiaries, directly or indirectly, permit the ratio, expressed as a percentage, (i) the numerator of which shall equal the Indebtedness of Guarantor and its consolidated Subsidiaries and (ii) the denominator of which shall equal the Total Assets of Guarantor and its consolidated Subsidiaries to be greater than eighty percent (80.00%); and

(iv) Minimum Interest Expense Coverage Ratio. Guarantor shall not, with respect to itself and its consolidated Subsidiaries, directly or indirectly, permit the ratio of (i) all amounts set forth on an income statement of Guarantor and its consolidated Subsidiaries prepared in accordance with GAAP for interest income for the period of four (4) consecutive fiscal quarters ended on or most recently prior to such date of determination to (ii) the Interest Expense of Guarantor and its consolidated Subsidiaries for such period, to be (x) from June 28, 2017 through the calendar quarter ending June 30, 2023, less than 1.50 to 1.00; (y) from the calendar quarter ending September 30, 2023 through the calendar quarter ending December 31, 2024, less than 1.30 to 1.00; and (z) at all times after the calendar quarter ending December 31, 2024, less than 1.40 to 1.00.

Notwithstanding anything to the contrary herein, all calculations of the financial covenants in this Section 9(a) shall be adjusted to remove the impact of (i) CECL Reserves and (ii) consolidating any variable interest entities under the requirements of Accounting Standards Codification ("ASC") Section 810 and/or transfers of financial assets accounted for as secured borrowings under ASC Section 860, as both of such ASC sections are amended, modified and/or supplemented from time to time.

2. Conditions Precedent to Amendment. The effectiveness of this Amendment is subject to the following:

(a) This Amendment shall be duly executed and delivered by the Guarantor and Buyer and acknowledged by Seller;

(b) Payment by the Seller of the actual costs and expenses, including, without limitation, the reasonable fees and expenses of counsel to Buyer, incurred by Buyer in connection with this Amendment and the transactions contemplated hereby;

(c) Buyer shall have received such other documents as Buyer may reasonably request.

3. Representations and Warranties of the Guarantor. Guarantor hereby represents and warrants to Buyer, on and as of the date hereof, after giving effect to this Amendment:

(a) that no Default, Event of Default or Margin Deficit exists, and no Default, Event of Default or Margin Deficit will occur as a result of the execution, delivery and performance by such party of this Amendment;

(b) all representations and warranties contained in the Guaranty are true, correct, complete and accurate in all respects (except such representations which by their terms speak as of a specified date);

(c) no amendments have been made to the organizational documents of Guarantor, Seller or Pledgor since June 28, 2017, other than those certain Certificates of Amendment filed September 3, 2019 changing the names of Seller and Pledgor and the supplemental articles filed with respect to the issuance of authorized (but previously unissued)preferred stock in the Guarantor, copies of which have been provided to Buyer;

(d) Guarantor is duly authorized to execute and deliver this Amendment.

4. Continuing Effect; Reaffirmation of Guaranty. As amended by this Amendment, all terms, covenants and provisions of the Guaranty are ratified and confirmed and shall remain in full force and effect. In addition, any and all guaranties and indemnities for the benefit of Buyer and agreements subordinating rights and liens to the rights and liens of Buyer, are hereby ratified and confirmed and shall not be released, diminished, impaired, reduced or adversely affected by this Amendment, and each party indemnifying Buyer, and each party subordinating any right or lien to the rights and liens of Buyer, hereby consents, acknowledges and agrees to the modifications set forth in this Amendment and waives any common law, equitable, statutory or other rights which such party might otherwise have as a result of or in connection with this Amendment.

5. Binding Effect; No Partnership. The provisions of the Guaranty, as amended hereby, shall be binding upon and inure to the benefit of the respective parties thereto and their respective successors and permitted assigns. Nothing herein contained shall be deemed or construed to create a partnership or joint venture between any of the parties hereto.

6. Counterparts. This Amendment may be executed in counterparts, each of which when so executed shall be deemed to be an original and all of which when taken together shall constitute one and the same instrument. This Amendment may be delivered by facsimile transmission, by electronic mail, or by other electronic transmission, in portable document format (.pdf) or otherwise, and each such executed facsimile, .pdf, or other electronic record shall be considered an original executed counterpart for purposes of this Amendment. Each party to this Amendment (a) agrees that it will be bound by its own electronic signature, (b) accepts the electronic signature of each other party to this Amendment, and (c) agrees that such electronic signatures shall be the legal equivalent of manual signatures. The words “execution,” “executed”, “signed,” “signature,” and words of like import in this paragraph shall, for the avoidance of doubt, be deemed to include electronic signatures and the use and keeping of records in electronic form, each of which shall have the same legal effect, validity and enforceability as manually executed signatures and the use of paper records and paper-based recordkeeping systems, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, state laws based on the Uniform Electronic Transactions Act, or any other state law.

7. Further Agreements. The Guarantor agrees to execute and deliver such additional documents, instruments or agreements as may be reasonably requested by Buyer and as may be necessary or appropriate from time to time to effectuate the purposes of this Amendment.

8. Governing Law; Submission to Jurisdiction, Etc. The provisions of Sections 15 and 17 of the Guaranty are hereby incorporated herein by reference and shall apply to this Amendment, mutatis mutandis, as if more fully set forth herein.

9. Headings. The headings of the sections and subsections of this Amendment are for convenience of reference only and shall not be considered a part hereof nor shall they be deemed to limit or otherwise affect any of the terms or provisions hereof.

10. References to Transaction Documents. All references to the Guaranty in any Transaction Document or in any other document executed or delivered in connection therewith shall, from and after the execution and delivery of this Amendment, be deemed a reference to the Guaranty, as amended hereby, unless the context expressly requires otherwise.

[NO FURTHER TEXT ON THIS PAGE]

IN WITNESS WHEREOF, the parties have executed this Amendment as of the day first written above.

Buyer:

MORGAN STANLEY BANK, N.A., a national banking association

By: /s/ WILLIAM P. BOWMAN

Name: William P. Bowman

Title: Authorized Signatory

GUARANTOR:

GRANITE POINT MORTGAGE TRUST INC.,

a Maryland corporation

By: /s/ MARCIN URBASZEK

Name: Marcin Urbaszek

Title: Chief Financial Officer

ACKNOWLEDGED AND AGREED TO BY:

SELLER:

GP COMMERCIAL MS LLC, a Delaware limited liability company

By: /s/ MARCIN URBASZEK

Name: Marcin Urbaszek

Title: Chief Financial Officer

FOURTH AMENDMENT TO AMENDED AND RESTATED GUARANTEE AGREEMENT

THIS FOURTH AMENDMENT TO AMENDED AND RESTATED GUARANTEE AGREEMENT (this “Amendment”), dated as of August 3, 2023, is entered into by and between JPMORGAN CHASE BANK, NATIONAL ASSOCIATION, a national banking association, as Buyer (together with its successors and assigns “Buyer”) and GRANITE POINT MORTGAGE TRUST INC., a Maryland corporation (“Guarantor”). Capitalized terms used but not otherwise defined herein shall have the meanings given to them in the Master Repurchase Agreement (as defined below).

WITNESSETH:

WHEREAS, GP Commercial JPM LLC (“Seller”) and Buyer are parties to that certain Uncommitted Master Repurchase Agreement, dated as of December 3, 2015 (as amended by that certain Amendment No. 1 to Master Repurchase Agreement, dated as of June 28, 2017, as further amended by that certain Amendment No. 2 to Master Repurchase Agreement, dated as of June 28, 2019, as further amended by that certain Amendment No. 3 to Master Repurchase Agreement, dated as of August 23, 2019, as further amended by that certain Amendment No. 4 to Master Repurchase Agreement, dated as of December 13, 2019, as further amended by that certain Amendment No. 5 to Master Repurchase Agreement and Amendment No. 2 to Amended and Restated Guarantee Agreement, dated as of July 2, 2020, as further amended by that certain Amendment No. 6 to Master Repurchase Agreement and Amendment No. 3 to Amended and Restated Guarantee Agreement, dated as of September 25, 2020, as further amended by that certain Amendment No. 7 to Master Repurchase Agreement, dated as of September 27, 2021, as further amended by that certain Term SOFR Conforming Changes Amendment, dated as of December 31, 2021, as amended further by that certain Amendment No. 8 to Master Repurchase Agreement and Amendment No. 4 to Fee and Pricing Letter, dated as of June 28, 2022, as further amended by that certain Amendment No. 9 to Master Repurchase Agreement and Amendment No, 5 to Fee and Pricing Letter, dated as of March 16, 2023, as amended further by that certain Amendment No. 10 to Master Repurchase Agreement and Amendment No. 6 to Fee and Pricing Letter, dated as of July 28, 2023 (as further amended, restated, supplemented or otherwise modified and in effect from time to time, the “Master Repurchase Agreement”); and

WHEREAS, Guarantor has executed and delivered that certain Amended and Restated Guarantee Agreement, dated as of June 28, 2017, as amended by that certain First Amendment to Amended and Restated Guarantee Agreement, dated as of December 17, 2019, and as further amended by Amendment No. 5 to Master Repurchase Agreement and Amendment No. 2 to Amended and Restated Guarantee Agreement, dated as of July 2, 2020, as further amended by Amendment No. 6 to Master Repurchase Agreement and Amendment No. 3 to Amended and Restated Guarantee Agreement, dated as of September 25, 2020, (as amended hereby and as further amended, restated, supplemented or otherwise modified and in effect from time to time, the “Guarantee”); and

WHEREAS, Guarantor and Buyer wish to modify certain terms and provisions of the Guarantee, as set forth herein.

NOW, THEREFORE, in consideration of the premises and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1.Amendment to Guarantee. The Guarantee is hereby amended as follows:

(a)Section 9(b) of the Guarantee is hereby deleted in its entirety and replaced with the following:

(i)(b) Minimum Tangible Net Worth. Guarantor shall not, with respect to itself and its consolidated Subsidiaries, directly or indirectly, permit its Tangible Net Worth to be less than, from and after the Tenth Amendment Effective Date, the sum of (x) $816,913,000, plus (y) seventy-five percent (75%) of the aggregate net cash proceeds of any equity issuances made by Guarantor from and after the Tenth Amendment Effective Date (net of underwriting discounts and commissions and other out-of-pocket costs and expenses incurred by Guarantor and its Affiliates in connection with such equity issuance).

(b)Section 9(d) of the Guarantee is hereby deleted in its entirety and replaced with the following:

(i)(d) Minimum Interest Expense Coverage Ratio. Guarantor shall not, with respect to itself and its consolidated Subsidiaries, directly or indirectly, permit the ratio of (i) all amounts set forth on an income statement of Guarantor and its consolidated Subsidiaries prepared in accordance with GAAP for interest income for the period of four (4) consecutive fiscal quarters ended on or most recently prior to such date of determination to (ii) the Interest Expense of Guarantor and its consolidated Subsidiaries for such period, to be (x) at all times before the start of the calendar quarter ending September 30, 2023, less than 1.50 to 1.00, (y) from the calendar quarter ending September 30, 2023 through the calendar quarter ending June 30, 2024, less than 1.30 to 1.00; and (z) at all times after the calendar quarter ending June 30, 2024, less than 1.50 to 1.00.

2.Conditions Precedent to Amendment. The effectiveness of this Amendment is subject to the following:

(a)This Amendment shall be duly executed and delivered by the Guarantor and Buyer and acknowledged by Seller;

(b)Payment by the Seller of the actual costs and expenses, including, without limitation, the reasonable fees and expenses of counsel to Buyer, incurred by Buyer in connection with this Amendment and the transactions contemplated hereby;

(c)Buyer shall have received such other documents as Buyer may reasonably request.

3.Representations and Warranties of the Guarantor. On and as of the date hereof, after giving effect to this Amendment:

(a)the Guarantor hereby represents and warrants to Buyer that no Default, Event of Default or Margin Deficit exists, and no Default, Event of Default or Margin Deficit will occur as a result of the execution, delivery and performance by such party of this Amendment;

(b)all representations and warranties contained in the Guarantee are true, correct, complete and accurate in all respects (except such representations which by their terms speak as of a specified date); and

(c)Guarantor is duly authorized to execute and deliver this Amendment.

4.Continuing Effect; Reaffirmation of Guarantee. As amended by this Amendment, all terms, covenants and provisions of the Guarantee are ratified and confirmed and shall remain in full force and effect. In addition, any and all guaranties and indemnities for the benefit of Buyer and agreements subordinating rights and liens to the rights and liens of Buyer, are hereby ratified and confirmed and shall not be released, diminished, impaired, reduced or adversely affected by this Amendment, and each party indemnifying Buyer, and each party subordinating any right or lien to the rights and liens of Buyer, hereby consents, acknowledges and agrees to the modifications set forth in this Amendment and waives any common law, equitable, statutory or other rights which such party might otherwise have as a result of or in connection with this Amendment.

5.Binding Effect; No Partnership. The provisions of the Guarantee, as amended hereby, shall be binding upon and inure to the benefit of the respective parties thereto and their respective successors and permitted assigns. Nothing herein contained shall be deemed or construed to create a partnership or joint venture between any of the parties hereto.

6.Counterparts. This Amendment may be executed in counterparts, each of which when so executed shall be deemed to be an original and all of which when taken together shall constitute one and the same instrument, and the words “executed,” “signed,” “signature,” and words of like import as used above and elsewhere in this Amendment or in any other certificate, agreement or document related to this transaction shall include, in addition to manually executed signatures, images of manually executed signatures transmitted by facsimile or other electronic format (including, without limitation, “pdf”, “tif” or “jpg”) and other electronic signatures (including, without limitation, any electronic sound, symbol, or process, attached to or logically associated with a contract or other record and executed or adopted by a person with the intent to sign the record). The use of electronic signatures and electronic records (including, without limitation, any contract or other record created, generated, sent, communicated, received, or stored by electronic means) shall be of the same legal effect, validity and enforceability as a manually executed signature or use of a paper-based record-keeping system to the fullest extent permitted by applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act and any other applicable law, including, without limitation, any state law based on the Uniform Electronic Transactions Act or the Uniform Commercial Code.

7.Further Agreements. The Guarantor agrees to execute and deliver such additional documents, instruments or agreements as may be reasonably requested by Buyer and as may be necessary or appropriate from time to time to effectuate the purposes of this Amendment.

8.Governing Law; Submission to Jurisdiction, Etc. The provisions of Sections 15 and 17 of the Guarantee are hereby incorporated herein by reference and shall apply to this Amendment, mutatis mutandis, as if more fully set forth herein.

9.Headings. The headings of the sections and subsections of this Amendment are for convenience of reference only and shall not be considered a part hereof nor shall they be deemed to limit or otherwise affect any of the terms or provisions hereof.

10.References to Transaction Documents. All references to the Guarantee in any Transaction Document or in any other document executed or delivered in connection therewith shall, from and after the execution and delivery of this Amendment, be deemed a reference to the Guarantee, as amended hereby, unless the context expressly requires otherwise.

[NO FURTHER TEXT ON THIS PAGE]

IN WITNESS WHEREOF, the parties have executed this Amendment as of the day first written above.

Buyer:

JPMORGAN CHASE BANK, NATIONAL ASSOCIATION, a national banking association

By: /s/ THOMAS CASSINO

Name: Thomas N. Cassino

Title: Managing Director

GUARANTOR:

GRANITE POINT MORTGAGE TRUST INC.,

a Maryland corporation

By: /s/ MARCIN URBASZEK

Name: Marcin Urbaszek

Title: Chief Financial Officer

ACKNOWLEDGED AND AGREED TO BY:

SELLER:

GP COMMERCIAL JPM LLC, a Delaware limited liability company

By: /s/ MARCIN URBASZEK

Name: Marcin Urbaszek

Title: Chief Financial Officer

FOURTH AMENDMENT TO GUARANTEE AGREEMENT

THIS FOURTH AMENDMENT TO GUARANTEE AGREEMENT (this “Amendment”), dated as of August 3, 2023, is entered into by and between GOLDMAN SACHS BANK USA, a New York state-chartered bank, as Buyer (together with its successors and assigns “Buyer”) and GRANITE POINT MORTGAGE TRUST INC., a Maryland corporation (“Guarantor”). Capitalized terms used but not otherwise defined herein shall have the meanings given to them in the Guarantee Agreement (as defined below).

WITNESSETH:

WHEREAS, GP Commercial GS, LLC (f/k/a TH Commercial GS LLC) (“Seller”) and Buyer have entered into that certain Master Repurchase and Securities Contract Agreement, dated as of May 2, 2017, as amended by that certain First Amendment to Master Repurchase and Securities Contract Agreement, dated as of June 28, 2017, as further amended by that certain Second Amendment to Master Repurchase and Securities Contract Agreement, dated as of November 16, 2017, as further amended by that certain Third Amendment to Master Repurchase and Securities Contract Agreement, dated as of May 9, 2018, as further amended by that certain Fourth Amendment to Master Repurchase and Securities Contract Agreement, dated as of July 16, 2019, as further amended by that certain Fifth Amendment to Master Repurchase and Securities Contract Agreement, dated as of May 1, 2020, as further amended by that certain Sixth Amendment to Master Repurchase and Securities Contract Agreement and Second Amendment to Guarantee Agreement, dated as of September 25, 2020, as further amended by that certain Seventh Amendment to Master Repurchase and Securities Contract Agreement, dated as of July 13, 2021, and as further amended by that certain Eighth Amendment to Master Repurchase and Securities Contract Agreement, dated as of March 17, 2023 (as the same has been or may be further amended, modified and/or restated from time to time, the “Master Repurchase Agreement”); and

WHEREAS, Guarantor has executed and delivered that certain Guarantee Agreement, dated as of June 28, 2017, as amended by that certain First Amendment to Guarantee Agreement, dated as of December 17, 2019, as further amended by that certain Sixth Amendment to Master Repurchase and Securities Contract Agreement and Second Amendment to Guarantee Agreement, dated as of September 25, 2020, and as further amended by that certain Third Amendment to Guarantee Agreement, dated as of March 22, 2022 (as the same may be further amended, modified and/or restated from time to time, the “Guarantee Agreement”); and

WHEREAS, Guarantor and Buyer wish to modify certain terms and provisions of the Guarantee Agreement, as set forth herein.

NOW, THEREFORE, in consideration of the premises and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1.Amendment to Guarantee Agreement. The Guarantee Agreement is hereby amended as follows:

(a)Section 9(a)(ii) of the Guarantee Agreement is hereby deleted in its entirety and replaced with the following:

(ii) Minimum Tangible Net Worth. Guarantor shall not, with respect to itself and its consolidated Subsidiaries, directly or indirectly, permit its Tangible Net Worth to be less than the sum of (x) $816,913,000, plus (y) seventy-five percent (75%) of the aggregate net cash proceeds of any equity issuances made by Guarantor after August 3, 2023 (net of underwriting discounts and commissions and other out-of-pocket costs and expenses incurred by Guarantor and its Affiliates in connection with such equity issuance).

(b)Section 9(a)(iv) of the Guarantee Agreement is hereby deleted in its entirety and replaced with the following:

(iv) Minimum Interest Expense Coverage Ratio. Guarantor shall not, with respect to itself and its consolidated Subsidiaries, directly or indirectly, permit the ratio of (i) all amounts set forth on an income statement of Guarantor and its consolidated Subsidiaries prepared in accordance with GAAP for interest income for the period of four (4) consecutive fiscal quarters ended on or most recently prior to such date of determination to (ii) the Interest Expense of Guarantor and its consolidated Subsidiaries for such period, to be (x) from the calendar quarter ending September 30, 2023 through the calendar quarter ending June 30, 2024, less than 1.30 to 1.00; and (y) at all times after the calendar quarter ending June 30, 2024, less than 1.40 to 1.00.

2.Conditions Precedent to Amendment. The effectiveness of this Amendment is subject to the following:

(a)This Amendment duly executed and delivered by the Guarantor and Buyer and acknowledged by Seller;

(b)Payment by the Seller of the actual costs and expenses, including, without limitation, the reasonable fees and expenses of counsel to Buyer, incurred by Buyer in connection with this Amendment and the transactions contemplated hereby; and

(c)Buyer shall have received such other documents as Buyer may reasonably request.

3.Representations and Warranties of the Guarantor. Guarantor hereby represents and warrants to Buyer, on and as of the date hereof, after giving effect to this Amendment:

(a)that no Default or Event of Default exists, and no Default or Event of Default will occur as a result of the execution, delivery and performance by such party of this Amendment;

(b)all representations and warranties contained in the Guarantee Agreement are true, correct, complete and accurate in all respects (except such representations which by their terms speak as of a specified date); and

(c)Guarantor is duly authorized to execute and deliver this Amendment.

4.Continuing Effect; Reaffirmation of Guarantee Agreement. As amended by this Amendment, all terms, covenants and provisions of the Guarantee Agreement are ratified and confirmed and shall remain in full force and effect. In addition, any and all guaranties and indemnities for the benefit of Buyer and agreements subordinating rights and liens to the rights and liens of Buyer, are hereby ratified and confirmed and shall not be released, diminished, impaired, reduced or adversely affected by this Amendment, and each party indemnifying Buyer, and each party subordinating any right or lien to the rights and liens of Buyer, hereby consents, acknowledges and agrees to the modifications set forth in this Amendment and waives any common law, equitable, statutory or other rights which such party might otherwise have as a result of or in connection with this Amendment.

5.Binding Effect; No Partnership. The provisions of the Guarantee Agreement, as amended hereby, shall be binding upon and inure to the benefit of the respective parties thereto and their respective successors and permitted assigns. Nothing herein contained shall be deemed or construed to create a partnership or joint venture between any of the parties hereto.

6.Counterparts. This Amendment may be executed in counterparts, each of which when so executed shall be deemed to be an original and all of which when taken together shall constitute one and the same instrument. This Amendment may be delivered by facsimile transmission, by electronic mail, or by other electronic transmission, in portable document format (.pdf) or otherwise, and each such executed facsimile, .pdf, or other electronic record shall be considered an original executed counterpart for purposes of this Amendment. Each party to this Amendment (a) agrees that it will be bound by its own electronic signature, (b) accepts the electronic signature of each other party to this Amendment, and (c) agrees that such electronic signatures shall be the legal equivalent of manual signatures. The words “execution,” “executed”, “signed,” “signature,” and words of like import in this paragraph shall, for the avoidance of doubt, be deemed to include electronic signatures and the use and keeping of records in electronic form, each of which shall have the same legal effect, validity and enforceability as manually executed signatures and the use of paper records and paper-based recordkeeping systems, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, state laws based on the Uniform Electronic Transactions Act, or any other state law.

7.Further Agreements. The Guarantor agrees to execute and deliver such additional documents, instruments or agreements as may be reasonably requested by Buyer and as may be necessary or appropriate from time to time to effectuate the purposes of this Amendment.

8.Governing Law; Submission to Jurisdiction, Etc. The provisions of Sections 15 and 17 of the Guarantee Agreement are hereby incorporated herein by reference and shall apply to this Amendment, mutatis mutandis, as if more fully set forth herein.

9.Headings. The headings of the sections and subsections of this Amendment are for convenience of reference only and shall not be considered a part hereof nor shall they be deemed to limit or otherwise affect any of the terms or provisions hereof.

10.References to Transaction Documents. All references to the Guarantee Agreement in any Transaction Document or in any other document executed or delivered in connection therewith shall, from and after the execution and delivery of this Amendment, be deemed a reference to the Guarantee Agreement, as amended hereby, unless the context expressly requires otherwise.

11.No Waiver. The execution, delivery and effectiveness of this Amendment shall not (i) limit, impair, constitute a waiver by, or otherwise affect any right, power or remedy of Buyer under the Guarantee Agreement or any other Transaction Document, (ii) constitute a waiver of any provision in the Guarantee Agreement or in any of the other Transaction Documents or of any Default or Event of Default that may have occurred and be continuing, (iii) limit, impair, constitute a waiver by, or otherwise affect any right or power of Buyer to determine that a Material Adverse Effect, Margin Deficit, Default or Event of Default has occurred or (iv) alter, modify, amend or in any way affect any of the terms, conditions, obligations, covenants or agreements contained in the Guarantee Agreement or in any of the other Transaction Document, all of which are ratified and affirmed in all respects and shall continue in full force and effect.

[NO FURTHER TEXT ON THIS PAGE]

IN WITNESS WHEREOF, the parties have executed this Amendment as of the day first written above.

Buyer:

GOLDMAN SACHS BANK USA, a New York state-chartered bank

By: /s/ PRACHI BANSAL

Name: Prachi Bansal

Title: Authorized Person

GUARANTOR:

GRANITE POINT MORTGAGE TRUST INC.,

a Maryland corporation

By: /s/ MARCIN URBASZEK

Name: Marcin Urbaszek

Title: Chief Financial Officer

ACKNOWLEDGED AND AGREED TO BY:

SELLER:

GP COMMERCIAL GS LLC, a Delaware limited liability company

By: /s/ MARCIN URBASZEK

Name: Marcin Urbaszek

Title: Chief Financial Officer

FIRST AMENDMENT TO AMENDED AND RESTATED GUARANTY

THIS FIRST AMENDMENT TO AMENDED AND RESTATED GUARANTY (this “Amendment”), dated as of August 3, 2023, is entered into by and between CITIBANK, N.A., a national banking association, as purchaser (together with its successors and assigns “Purchaser”) and GRANITE POINT MORTGAGE TRUST INC., a Maryland corporation (“Guarantor”). Capitalized terms used but not otherwise defined herein shall have the meanings given to them in the Guaranty (as defined below).

WITNESSETH:

WHEREAS, GP COMMERCIAL CB LLC, a Delaware limited liability company, as seller (“Seller”), and GP COMMERCIAL CB SL SUB LLC, a Delaware limited liability company (“Swingline Subsidiary,” and together with Seller, collectively the “Seller Counterparties,” and individually the “Seller Counterparty”) and Purchaser are parties to that certain Amended and Restated Master Repurchase Agreement, dated as of May 25, 2022;

WHEREAS, the Guarantor and Purchaser are parties to that certain Amended and Restated Guaranty, dated as of May 25, 2022 (as the same has been or may be further amended, modified and/or restated from time to time, the “Guaranty”);

WHEREAS, the Guarantor and Purchaser have agreed, subject to the terms and conditions hereof, that the Guaranty shall be amended as set forth in this Amendment.

NOW, THEREFORE, in consideration of the premises and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1.Amendment to Guaranty. The Guaranty is hereby amended as follows:

(a)Article V(l) of the Guaranty is hereby deleted in its entirety and replaced with the following:

(l) Financial Covenants. Guarantor shall not, with respect to itself and its consolidated Subsidiaries, directly or indirectly, permit any of the following to be breached, as determined quarterly on a consolidated basis in conformity with GAAP, as adjusted pursuant to the last sentence of this Article V(l):

(i) Unrestricted Cash. Guarantor shall not, with respect to itself and its consolidated Subsidiaries, directly or indirectly, permit its Unrestricted Cash to be less than the greater of: (i) Thirty Million and No/100 Dollars ($30,000,000.00), and (ii) five percent (5.0%) of Guarantor’s Recourse Indebtedness .

(ii) Minimum Tangible Net Worth. Guarantor shall not, with respect to itself and its consolidated Subsidiaries, directly or indirectly, permit its Tangible Net Worth to be less than the sum of (x) $816,913,000, plus (y) seventy-five percent (75%) of the aggregate net cash proceeds of any equity issuances made by Guarantor after August 3, 2023 (net of underwriting discounts and commissions and other out-of-pocket costs and expenses incurred by Guarantor and its Affiliates in connection with such equity issuance).

(iii) Total Debt to Total Assets Ratio. Guarantor shall not, with respect to itself and its Subsidiaries, directly or indirectly, permit the ratio, expressed as a percentage, (i) the numerator of which shall equal the Indebtedness of Guarantor and its consolidated Subsidiaries associated with its Target Investments (net of restricted cash associated with any consolidated variable interest entities) and (ii) the denominator of which shall equal the Total Assets of Guarantor and its consolidated Subsidiaries associated with its Target Investments, to at any time be greater than seventy-seven and one half percent (77.5%); provided, that notwithstanding the foregoing, Guarantor and its consolidated Subsidiaries may from time to time acquire Highly Rated CMBS and enter into secured Indebtedness in connection therewith pursuant to which the ratio, expressed as a percentage, (i) the numerator of which equals the Indebtedness of Guarantor and its consolidated Subsidiaries associated with its Highly Rated CMBS (net of restricted cash associated with any consolidated variable interest entities) and (ii) the denominator of which equals the Total Assets of Guarantor and its consolidated Subsidiaries associated with its Highly Rated CMBS exceeds seventy-seven and one half percent (77.5%) but is not greater than ninety percent (90.00%), subject to the condition that at any such time, Guarantor shall not, with respect to itself and its Subsidiaries, directly or indirectly, permit the ratio, expressed as a percentage, (i) the numerator of which shall equal the Indebtedness of Guarantor and its consolidated Subsidiaries and (ii) the denominator of which shall equal the Total Assets of Guarantor and its consolidated Subsidiaries to be greater than eighty percent (80.00%).

(iv) Minimum Interest Expense Coverage Ratio. Guarantor shall not, with respect to itself and its consolidated Subsidiaries, directly or indirectly, permit the ratio of (i) all amounts set forth on an income statement of Guarantor and its consolidated Subsidiaries prepared in accordance with GAAP for interest income for the period of four (4) consecutive fiscal quarters ended on or most recently prior to such date of determination to (ii) the Interest Expense of Guarantor and its consolidated Subsidiaries for such period, to be (x) from June 28, 2017, through the calendar quarter ending June 30, 2023, less than 1.50 to 1.00; (y) from the calendar quarter ending September 30, 2023, through the calendar quarter ending December 31, 2024, less than 1.30 to 1.00; and (z) at all times after the calendar quarter ending December 31, 2024, less than 1.40 to 1.00.

Notwithstanding anything to the contrary herein, all calculations of the financial covenants in this Article V(l) shall be adjusted to remove the impact of (i) CECL Reserves and (ii) consolidating any variable interest entities under the requirements of Accounting Standards Codification ("ASC") Section 810 and/or transfers of financial assets accounted for as secured borrowings under ASC Section 860, as both of such ASC sections are amended, modified and/or supplemented from time to time.

2.Conditions Precedent to Amendment. The effectiveness of this Amendment is subject to the following:

(a)This Amendment duly executed and delivered by the Guarantor and Purchaser and acknowledged by each Seller Counterparty;

(b)Payment by the Seller of the actual costs and expenses, including, without limitation, the reasonable fees and expenses of counsel to Purchaser, incurred by Purchaser in connection with this Amendment and the transactions contemplated hereby;

(c)Purchaser shall have received such other documents as Purchaser may reasonably request.

3.Representations and Warranties of the Guarantor. On and as of the date hereof, after giving effect to this Amendment:

(a)the Guarantor hereby represents and warrants to Purchaser that no Default, Event of Default or Margin Deficit exists, and no Default, Event of Default or Margin Deficit will occur as a result of the execution, delivery and performance by such party of this Amendment;

(b)no amendments have been made to the organizational documents of Guarantor or Seller Counterparties since May 25, 2022; and

(c)Guarantor hereby represents and warrants to Purchaser that all representations and warranties of Guarantor contained in the Guaranty are true and correct in all material respects (except for any such representation or warranty that by its terms refers to a specific date, in which case such representation or warranty was true and correct in all material respects as of such other date).

4.Continuing Effect; Reaffirmation of Guaranty. As amended by this Amendment, all terms, covenants and provisions of the Guaranty are ratified and confirmed and shall remain in full force and effect. In addition, any and all guaranties and indemnities for the benefit of Purchaser and agreements subordinating rights and liens to the rights and liens of Purchaser, are hereby ratified and confirmed and shall not be released, diminished, impaired, reduced or adversely affected by this Amendment, and each party indemnifying Purchaser, and each party subordinating any right or lien to the rights and liens of Purchaser, hereby consents, acknowledges and agrees to the modifications set forth in this Amendment and waives any common law, equitable, statutory or other rights which such party might otherwise have as a result of or in connection with this Amendment.

5.Binding Effect; No Partnership. The provisions of the Guaranty, as amended hereby, shall be binding upon and inure to the benefit of the respective parties thereto and their respective successors and permitted assigns. Nothing herein contained shall be deemed or construed to create a partnership or joint venture between any of the parties hereto.

6.Counterparts. This Amendment may be executed in counterparts, each of which when so executed shall be deemed to be an original and all of which when taken together shall constitute one and the same instrument. This Amendment may be delivered by facsimile transmission, by electronic mail, or by other electronic transmission, in portable document format (.pdf) or otherwise, and each such executed facsimile, .pdf, or other electronic record shall be considered an original executed counterpart for purposes of this Amendment. Each party to this Amendment (a) agrees that it will be bound by its own electronic signature, (b) accepts the electronic signature of each other party to this Amendment, and (c) agrees that such electronic signatures shall be the legal equivalent of manual signatures. The words “execution,” “executed”, “signed,” “signature,” and words of like import in this paragraph shall, for the avoidance of doubt, be deemed to include electronic signatures and the use and keeping of records in electronic form, each of which shall have the same legal effect, validity and enforceability as manually executed signatures and the use of paper records and paper-based recordkeeping systems, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, state laws based on the Uniform Electronic Transactions Act, or any other state law.

7.Further Agreements. The Guarantor agrees to execute and deliver such additional documents, instruments or agreements as may be reasonably requested by Purchaser and as may be necessary or appropriate from time to time to effectuate the purposes of this Amendment.

8.Governing Law; Submission to Jurisdiction, Etc. The provisions of Articles VII(c) and VII(d) of the Guaranty are hereby incorporated herein by reference and shall apply to this Amendment, mutatis mutandis, as if more fully set forth herein.

9.Headings. The headings of the sections and subsections of this Amendment are for convenience of reference only and shall not be considered a part hereof nor shall they be deemed to limit or otherwise affect any of the terms or provisions hereof.

10.References to Transaction Documents. All references to the Guaranty in any Transaction Document or in any other document executed or delivered in connection therewith shall, from and after the execution and delivery of this Amendment, be deemed a reference to the Guaranty, as amended hereby, unless the context expressly requires otherwise.

[NO FURTHER TEXT ON THIS PAGE]

IN WITNESS WHEREOF, the parties have executed this Amendment as of the day first written above.

Purchaser:

CITIBANK, N.A., a national banking association

By: /s/ LINDSAY DECHIARO

Name: Lindsay DiChiaro

Title: Authorized Signatory

GUARANTOR:

GRANITE POINT MORTGAGE TRUST INC.,

a Maryland corporation

By: /s/ MARCIN URBASZEK

Name: Marcin Urbaszek

Title: Chief Financial Officer

ACKNOWLEDGED AND AGREED TO BY:

SELLER COUNTERPARTIES:

GP COMMERCIAL CB LLC, a Delaware limited liability company

By: /s/ MARCIN URBASZEK

Name: Marcin Urbaszek

Title: Chief Financial Officer

GP COMMERCIAL CB SL SUB LLC, a Delaware limited liability company

By: /s/ MARCIN URBASZEK

Name: Marcin Urbaszek

Title: Chief Financial Officer

v3.23.2

Document and Entity Information Document

|

Aug. 04, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 03, 2023

|

| Entity Registrant Name |

Granite Point Mortgage Trust Inc.

|

| Entity Central Index Key |

0001703644

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-38124

|

| Entity Tax Identification Number |

61-1843143

|

| Entity Address, Address Line One |

3 Bryant Park, Suite 2400A

|

| Entity Address, City or Town |

New York,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10036

|

| City Area Code |

212

|

| Local Phone Number |

364-5500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| NEW YORK STOCK EXCHANGE, INC. [Member] | Series A Preferred Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

7.00% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock, par value $0.01 per share

|

| Trading Symbol |

GPMTPrA

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. [Member] | Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

GPMT

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

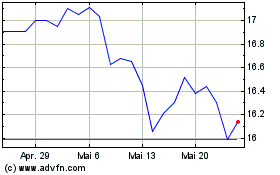

Granite Point Mortgage (NYSE:GPMT-A)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Granite Point Mortgage (NYSE:GPMT-A)

Historical Stock Chart

Von Mai 2023 bis Mai 2024