UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 1, 2022 (May 31, 2022)

F.N.B. CORPORATION

(Exact name of registrant as specified in its charter)

Pennsylvania

(State or Other Jurisdiction of Incorporation)

|

|

|

| 001-31940 |

|

25-1255406 |

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

| One North Shore Center, 12 Federal Street, Pittsburgh, PA |

|

15212 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(800) 555-5455

(Registrant’s telephone number, including area code)

N/A

(Former name or

former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| |

☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of Each Class |

|

Trading

Symbol(s) |

|

Name of Exchange

on which Registered |

| Common Stock, par value $0.01 per share |

|

FNB |

|

New York Stock Exchange |

| Depositary Shares each representing 1/40th interest in a share of Fixed-to-Floating Rate

Non-Cumulative Perpetual Preferred Stock, Series E |

|

FNBPrE |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

On June 1, 2022, F.N.B. Corporation and UB Bancorp issued a joint press release announcing the execution of an Agreement and Plan of Merger, dated as of

May 31, 2022. A copy of the joint press release is attached hereto as Exhibit 99.1. In addition, F.N.B. is providing supplemental information regarding the proposed transaction in the form of an investor presentation, which is attached hereto

as Exhibit 99.2, and which is also available through the “About Us” section of F.N.B.’s website at www.fnbcorporation.com by clicking on “Investor Relations” and then “Investor & Analyst Presentations.”

Additional Information and Where to Find It

F.N.B.

plans to file with the SEC, and the parties plan to furnish to the security holders of UB Bancorp, a Registration Statement on Form S-4, which will constitute a proxy statement of UB Bancorp and a prospectus

of F.N.B. in connection with the proposed Merger, referred to as a proxy statement/prospectus, as well as other relevant documents related to the proposed transaction. The proxy statement/prospectus described above will contain important information

about F.N.B., UB Bancorp, the proposed Merger and related matters.

BEFORE MAKING ANY VOTING DECISIONS, INVESTORS ARE URGED TO READ THE REGISTRATION

STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION.

Investors and security holders will be able to obtain free copies of these documents, and other documents filed with the SEC by F.N.B.

through the website maintained by the SEC at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents F.N.B. has filed with the SEC by contacting James Orie, Chief Legal Officer, F.N.B. Corporation, One North

Shore Center, 12 Federal Street, Pittsburgh, PA, 15212, telephone: (724) 983-3317; and may obtain free copies of the proxy statement/prospectus (when available) by contacting UB Bancorp, 1011 Red Banks Road,

Greenville, NC 27858, telephone: (866) 638-0552.

Participants in the Solicitation

F.N.B. and UB Bancorp and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from UB

Bancorp’s stockholders in connection with the proposed merger. Information regarding F.N.B.’s directors and executive officers is contained in F.N.B.’s Proxy Statement on Schedule 14A, dated March 25, 2022, as amended, and in

certain of its Current Reports on Form 8-K, which are filed with the SEC. Additional information regarding the interests of those participants and other persons who may be deemed participants in the

transaction may be obtained by reading the proxy statement/prospectus regarding the proposed merger when it becomes available. Free copies of these documents may be obtained as described in the preceding paragraph.

No Offer or Solicitation

This Current Report on Form 8-K and related communications are not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any

vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of

securities shall be made except by means of a prospectus that meets the requirements of Section 10 of the Securities Act of 1933, as amended.

Cautionary Statement Regarding Forward-Looking Information

This Current Report on Form 8-K may contain “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act. These forward-looking statements include, but are not limited to, statements regarding the outlook and expectations of F.N.B. and UB Bancorp with respect to their planned merger, the strategic benefits and

financial benefits of the merger, including the expected impact of the transaction on the combined company’s future financial performance (including anticipated accretion to earnings per share and other metrics) and the timing of the closing of

the transaction.

Forward-looking statements are typically identified by words such as “believe,” “plan,”

“expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “will,” “should,” “project,” “goal” and other similar words and expressions.

Forward-looking statements are subject to risks, uncertainties and assumptions which may change over time or as a result of unforeseen circumstances. Future events or circumstances may change expectations or outlook and may affect the nature of the

assumptions, risks and uncertainties to which forward-looking statements are subject. The forward-looking statements in this Current Report on Form 8-K pertain only to the date hereof, and F.N.B. and UB

Bancorp disclaim any obligation to update or revise any forward-looking statements, except as required by law. Actual results or future events may differ, possibly materially, from those that are anticipated in these

forward-looking statements. Accordingly, we caution against placing undue reliance on any forward-looking statements.

Forward-looking statements contained in this Form 8-K are subject to, among others, the following risks, uncertainties

and assumptions:

| |

• |

|

The possibility that the anticipated benefits of the transaction, including anticipated cost savings and

strategic gains, are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy, competitive factors in the areas where

F.N.B. and UB Bancorp do business, or as a result of other unexpected factors or events; |

| |

• |

|

Completion of the transaction is dependent on the satisfaction of customary closing conditions, including

approval by UB Bancorp stockholders, which cannot be assured, and the timing and completion of the transaction is dependent on various factors that cannot be predicted with precision at this point; |

| |

• |

|

The occurrence of any event, change or other circumstances that could give rise to the right of one or both of

the parties to terminate the merger agreement; |

| |

• |

|

Completion of the transaction is subject to bank regulatory approvals and such approvals may not be obtained in a

timely manner or at all or may be subject to conditions which may cause additional significant expense or delay the consummation of the merger transaction; |

| |

• |

|

Potential adverse reactions or changes to business or employee relationships, including those resulting from the

announcement or completion of the transaction; |

| |

• |

|

The outcome of any legal proceedings that may be instituted against F.N.B. or UB Bancorp;

|

| |

• |

|

Subsequent federal legislative and regulatory actions and reforms affecting the financial institutions’

industry may substantially impact the economic benefits of the proposed merger; |

| |

• |

|

Unanticipated challenges or delays in the integration of UB Bancorp’s business into F.N.B.’s and or the

conversion of UB Bancorp’s technology systems and customer data may significantly increase the expense associated with the transaction; and |

| |

• |

|

Other factors that may affect future results of F.N.B. and UB Bancorp, including changes in asset quality and

credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes;

capital management activities; and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. |

These

forward-looking statements are also subject to the principal risks and uncertainties applicable to F.N.B.’s and UB Bancorp’s respective businesses and activities generally that are disclosed in F.N.B.’s 2021 Annual Report on Form 10-K and other documents F.N.B. files with the SEC, and on UB Bancorp’s Investor Relations website. F.N.B.’s SEC filings are accessible on the SEC website at www.sec.gov.

| ITEM 9.01. |

FINANCIAL STATEMENTS AND EXHIBITS |

(d) Exhibits:

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press release dated June 1, 2022. |

|

|

| 99.2 |

|

Investor Presentation dated June 1, 2022. |

|

|

| 104 |

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

| F.N.B. CORPORATION |

| (Registrant) |

|

|

| By: |

|

/s/ Vincent J. Calabrese, Jr. |

| Name: |

|

Vincent J. Calabrese, Jr. |

| Title: |

|

Chief Financial Officer |

Dated: June 1, 2022

Exhibit 99.1

F.N.B. Corporation Strengthens North Carolina Presence With

Pending Acquisition of UB Bancorp

Joint Press Release

PITTSBURGH, PA, and GREENVILLE,

NC – June 1, 2022 — F.N.B. Corporation (“FNB”) (NYSE: FNB) and UB Bancorp (OTCQX: UBNC) today announced the signing of a definitive merger agreement for FNB to acquire UB Bancorp, including its

wholly-owned banking subsidiary, Union Bank, in an all-stock transaction valued at $19.56 per share, or a fully diluted market value of approximately $117 million, based upon the closing stock price of FNB as

of Tuesday, May 31, 2022.

Union Bank, based in Greenville, North Carolina, has approximately $1.2 billion in total assets, $1.0 billion in

total deposits of which approximately 40% are non-interest bearing, and $0.7 billion in total loans and leases as of March 31, 2022. Union Bank operates 15 full-service banking offices in 12 counties

located throughout Eastern and Central North Carolina. This merger further increases FNB’s presence in North Carolina, moving its proforma deposit market share to eighth in the state1, while

also adding low-cost granular deposits, which will continue to be value accretive in a rising rate environment.

Following the proposed merger with UB Bancorp on a proforma basis, FNB will have approximately $43 billion in total assets, $35 billion in deposits

and $28 billion in total loans. Under the terms of the merger agreement, which has been unanimously approved by the Boards of Directors of both companies, stockholders of UB Bancorp will be entitled to receive 1.61 shares of FNB common stock

for each share of UB Bancorp common stock they own. The exchange ratio is fixed, and the transaction is expected to qualify as a tax-free exchange for UB Bancorp stockholders.

Vincent J. Delie, Jr., Chairman, President and Chief Executive Officer of F.N.B. Corporation stated, “FNB and Union Bank share a deep cultural commitment

to the clients and communities we serve. Our partnership with Union Bank represents another step in our continued investment in North Carolina with proforma deposits growing to over $7 billion since we entered the market in 2017. North

Carolina has proven to be a growth engine for our Company, and this new partnership with Union Bank will further leverage our investments in the market and accelerate our organic growth potential.”

“Union Bank’s guiding principal is that of a local bank delivering personalized customer service to our clients. In FNB, we’ve found a

like-minded partner committed to building meaningful relationships with its clients and communities, and we look forward to working together as FNB continues to expand in the Carolinas,” said Lee Burrows, Chairman of Union Bank. “Our

partnership will add meaningful scale and access to a comprehensive product offering and broader in-market expertise that we believe will result in an enhanced customer experience for our clients.”

| 1 |

Excluding PacWest Bancorp |

FNB expects the merger to be approximately 2% accretive to earnings per share with fully phased-in cost savings on a GAAP basis in addition to enhancing FNB’s profitability metrics. FNB anticipates the tangible book value per common share impact to be de minimis at less than 1% and expects the CET1

ratio to remain unchanged on a proforma basis at closing.

FNB and UB Bancorp expect to complete the transaction in late 2022 after satisfaction of

customary closing conditions, including regulatory approvals and the approval of Union Bank’s stockholders. Union Bank will merge with and into FNB’s subsidiary, First National Bank of Pennsylvania.

BofA Securities, Inc. is serving as financial advisor and Reed Smith LLP is serving as legal counsel to FNB. Piper Sandler & Co. is serving as

financial advisor and Fenimore Kay Harrison LLP is serving as legal counsel to UB Bancorp.

An investor presentation will be available through the

“About Us” section of FNB’s website at www.fnbcorporation.com by clicking on “Investor Relations” then “Investor & Analyst Presentations,” or in the filings of FNB on the SEC’s website at

www.sec.gov.

ADDITIONAL INFORMATION ABOUT THE MERGER AND WHERE TO FIND IT

This communication is being made in respect of the proposed merger transaction between FNB and UB Bancorp. In connection with the proposed merger, FNB will

file a registration statement on Form S-4 with the SEC to register FNB’s shares that will be issued to UB Bancorp’s stockholders in connection with the merger. The registration statement will include

a proxy statement of UB Bancorp and a prospectus of FNB as well as other relevant documents concerning the proposed transaction.

INVESTORS ARE URGED TO

READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION.

The proxy statement/prospectus, other relevant materials (when they become available) and any other documents FNB has

filed with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents FNB has filed with the SEC by contacting James Orie, Chief Legal Officer,

F.N.B. Corporation, One North Shore Center, Pittsburgh, PA 15212, telephone: (724) 983-3317. The proxy statement/prospectus, when it becomes available, may also be obtained free of charge from F.N.B.

Corporation, One North Shore Center, Pittsburgh, PA 15212, telephone: (724) 983-3317, or UB Bancorp, 1011 Red Banks Road, Greenville, NC 27858, telephone: (866)

638-0552.

Participants in the Solicitation

FNB and UB Bancorp and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from UB Bancorp’s

stockholders in connection with the proposed merger. Information regarding FNB’s directors and executive officers is contained in FNB’s Proxy Statement on Schedule 14A, dated March 25, 2022, as amended, and in certain of its Current

Reports on Form 8-K, which are filed with the SEC. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by

reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of these documents may be obtained as described in the preceding paragraph.

No Offer or Solicitation

This communication does not

constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of such jurisdiction.

Cautionary Statement Regarding Forward-Looking Information

This joint press release of FNB and UB Bancorp contains “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act. These forward-looking statements include, but are not limited to, statements regarding the outlook and expectations of FNB and UB Bancorp with respect to their planned merger, the strategic benefits and financial benefits of the merger,

including the expected impact of the transaction on the combined company’s future financial performance (including anticipated accretion to earnings per share and other metrics) and the timing of the closing of the transaction.

Forward-looking statements are typically identified by words such as “believe,” “plan,” “expect,” “anticipate,”

“intend,” “outlook,” “estimate,” “forecast,” “will,” “should,” “project,” “goal,” and other similar words and expressions. Forward-looking statements are subject to

risks, uncertainties and assumptions which may change over time or as a result of unforeseen circumstances. Future events or circumstances may change expectations or outlook and may affect the nature of the assumptions, risks and uncertainties to

which forward-looking statements are subject. The forward-looking statements in this press release pertain only to the date of this press release, and FNB and UB Bancorp disclaim any obligation to update or revise any forward-looking statements,

except as required by law. Actual results or future events may differ, possibly materially, from those that are anticipated in these forward-looking statements. Accordingly, we caution against placing undue reliance on any forward-looking

statements.

Forward-looking statements contained in this press release are subject to, among others, the following risks, uncertainties and assumptions:

| |

• |

|

The possibility that the anticipated benefits of the transaction, including anticipated cost savings and

strategic gains, are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy, competitive factors in the areas where

FNB and UB Bancorp do business, or as a result of other unexpected factors or events; |

| |

• |

|

Completion of the transaction is dependent on the satisfaction of customary closing conditions, including

approval by UB Bancorp stockholders, which cannot be assured, and the timing and completion of the transaction is dependent on various factors that cannot be predicted with precision at this point; |

| |

• |

|

The occurrence of any event, change or other circumstances that could give rise to the right of one or both of

the parties to terminate the merger agreement; |

| |

• |

|

Completion of the transaction is subject to bank regulatory approvals and such approvals may not be obtained in a

timely manner or at all or may be subject to conditions which may cause additional significant expense or delay the consummation of the merger transaction; |

| |

• |

|

Potential adverse reactions or changes to business or employee relationships, including those resulting from the

announcement or completion of the transaction; |

| |

• |

|

The outcome of any legal proceedings that may be instituted against FNB or UB Bancorp; |

| |

• |

|

Subsequent federal legislative and regulatory actions and reforms affecting the financial institutions’

industry may substantially impact the economic benefits of the proposed merger; |

| |

• |

|

Unanticipated challenges or delays in the integration of UB Bancorp’s business into FNB’s and the

conversion of UB Bancorp’s technology systems and customer data may significantly increase the expense associated with the transaction; and |

| |

• |

|

Other factors that may affect future results of FNB and UB Bancorp, including changes in asset quality and credit

risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; capital

management activities; and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. |

These

forward-looking statements are also subject to the principal risks and uncertainties applicable to FNB’s business and activities generally that are disclosed in FNB’s 2021 Annual Report on Form 10-K

and other documents FNB files with the SEC and UB Bancorp’s Investor Relations website. FNB’s SEC filings are accessible on the SEC website at www.sec.gov.

###

Media Contact:

Jennifer Reel, 724-983-4856, 724-699-6389 (cell)

reel@fnb-corp.com

Analyst/Institutional Investor Contact:

Lisa Constantine, 412-385-4773

constantinel@fnb-corp.com

Acquisition of UB Bancorp Further

Strengthening Our Presence in North Carolina June 1, 2022 Exhibit 99.2

Adding Scale in Strategically Important

North Carolina Low Risk, In-Market Transaction Disciplined Pricing; Attractive Financial Impact In-market acquisition that adds ~$1.0bn of deposits to FNB’s franchise in attractive North Carolina markets Further strengthens FNB’s

position in North Carolina with Top 10 share overall and Top 10 share in 7 of North Carolina’s 10 largest MSAs Granular deposit franchise with 40% non-interest bearing and 11bps cost of deposits Opportunity for significant cross-sell of FNB

product suite into UB Bancorp’s customers In-Market Transaction with Low Execution Risk and Attractive Financial Impact Successful history of operating in North Carolina with 101 branches, over 150 ATMs, and $7.4bn of deposits pro forma for

the transaction In-market transaction with identified cost savings opportunities 33% of UB Bancorp branches within 3 miles of an FNB branch Transaction represents only ~3% of combined asset size Proven acquisition history having successfully

integrated 8 acquisitions over the last 10 years Disciplined pricing with a P/TBV of 1.54x (1.32x ex. AOCI) and Price / Fwd. Earnings with Fully Phased-In Cost Savings of 5.3x ~2% EPS accretion with fully phased-in cost savings Limited TBV dilution

of <1% with ~2 year Earnback Attractive use of capital with IRR >30%; neutral to CET1 capital ratio

UB Bancorp (“UBNC”) was

founded in 1998 as the little bank Inc. and headquartered in Greenville, NC Acquired Union Banc Corp in 2017; combined company re-branded to Union Bank 6th largest community bank headquartered in NC(1) Experienced and long-tenured management team

that has grown the bank since inception Loan Yield: 4.63% Cost of Deposits: 0.11% $1,043mm NIB MMDA & Savings Retail Time Franchise & Market Data: Profitability: Balance Sheet, Capital and Asset Quality: Interest Bearing DDA Loans Breakdown

Deposits Breakdown Commercially Focused Bank with Attractive Presence in North Carolina Overview of UB Bancorp Key Franchise / Financial Highlights C&I OO CRE NOO CRE Multifamily C&D(3) Resi. RE Consumer & Other $668mm

____________________ Sources: S&P Capital IQ and Company materials. Includes banks with assets under $5bn. Reflects bank-level CET1 ratio. 1-4 Family Construction Loans account for 55% of C&D portfolio. 97% Core 76% Commercial Jumbo Time

(2)

____________________ Sources: S&P

Capital IQ and Company materials. Raleigh MSA Greenville MSA Durham MSA Key Businesses HHI Growth (‘22-‘27E) Pop. Growth (‘22-‘27E) Presence in Attractive Markets Across Eastern and Central North Carolina Adding In-Market

Scale in Key North Carolina Markets 3 Branches $143mm Deposits 3 Branches $185mm Deposits 1 Branch $187mm Deposits Key Businesses HHI Growth (‘22-‘27E) Pop. Growth (‘22-‘27E) Key Businesses HHI Growth (‘22-‘27E)

Pop. Growth (‘22-‘27E) Charleston Wilmington Charlotte Winston-Salem Pittsburgh Harrisburg Cleveland UBNC FNB Baltimore Asheville 95 40 40 26 77 85 Greensboro Durham Greenville Raleigh UBNC FNB Charlotte Winston-Salem

Wilmington

~$2,000 Median Account Balance(2) 5

____________________ Sources: S&P Capital IQ and Company materials. Defines as Total Deposits excluding Jumbo Time Deposits. Reflects median account size of non-time deposits. Balance weighted tenure of non-time deposits accounts. UB

Bancorp’s Low-Cost Granular Deposit Base Opportunity to Leverage Core Deposit Funding with Loan/Deposit Ratio of 64% Review of Last Hike Cycle: Valuable Lower Beta Deposits Q3’15-Q2’19 Beta UBNC: 23% FNB: 29% Significant Growth of

Core Deposits(1) 17% Deposit CAGR 18% Core Deposit CAGR ($ in millions) 0.64% 0.87% 0.47% 0.16% 0.11% Cost: 40% Non-Interest Bearing 7 Year Avg. Deposit Relationship(3) Granular, Long Standing, Low Cost Deposit Franchise

6 Loan Growth by Region (‘18

-‘21) NC Other 12% Deposit Organic CAGR 1.3x FNB Pro Forma Top 10 Ranking in 7 of 10 Largest North Carolina MSAs Complementing FNB’s Strong Organic Growth in North Carolina Improved Deposit Ranking Across the State and Key MSAs Top 10

Share in Attractive North Carolina Markets ($ in millions) Complementary to FNB’s Continued Investment in North Carolina ~800 FTE’s in North Carolina 1.2x North Carolina Has Provided a Strong Engine for Growth 8% Loan Organic CAGR(1) ($

in billions) 9 New Branches / LPOs Since 2018 ~$10mm Investment in Raleigh and Charlotte HQs 2.0x 1.5x 2.5x #12 #10 #9 #8 #10 #5 #9 #7 #10 #8 (2)

Key Merger Assumptions Cost Savings

& Earnings Adjustments Consideration Mix: 100% Stock Exchange Ratio: 1.61 shares of FNB common stock for each share of UB Bancorp common stock Transaction Value: $117mm deal value, or $19.56 per share Price / TBV: 1.54x (1.32x ex. AOCI) Price /

Forward Earnings with Fully Phased-In Cost Savings: 5.3x Consideration & Deal Value 7 Cost Savings: >45% cost savings on UB Bancorp’s non-interest expense Phase-In Period: 75% in year one and 100% thereafter Durbin Impact: ~$0.4mm

reduction in interchange income per year One-Time Merger Expenses: ~$17mm pre-tax Impact of one-time merger expenses fully included in pro forma closing impact for TBV and capital Loan Credit Mark: 1.60% of loans 23% PCD loan mark composition and

77% non-PCD composition Day 2 CECL reserve of 1.65% of non-PCD loans Core Deposit Intangible: 1.50% of non-time deposits Amortized using 10-year sum-of-year digits Closing: Estimated in late 2022 Key Transaction Assumptions Conservative Assumptions

Utilized for Pro Forma Merger Analysis

8 ____________________ Sources: S&P

Capital IQ and Company materials. Includes bank M&A transactions between $150 - $500mm since 2017 where target is headquartered in FL, NC, GA, and SC. Includes Carolinas transactions above $100mm in deal value. Core deposits defined as total

deposits less jumbo time deposits. Attractive Financial Impact Financially-Compelling Transaction for FNB, While Preserving Tangible Book Value and Capital Disciplined Pricing Resulting in… Southeast Precedents(1) P / TBV Core Deposit

Premium(2) Fully-Phased EPS Accretion TBVPS Accr. / (Dil.) TBV Earnback (Yrs) IRR GAAP Excluding AOCI 1.54x 4.1% ~2.0% <(1.0%) ~2 +30% 1.32x 2.8% ~1.6% ~(0.5%) <2 +30% 1.85x 12.2% 3.3% (1.9%) ~2.5 ~20% …Attractive Financials Despite

Relative Size Target as % Combined Assets 3% 3% 15%

9 Key Items Assessment FNB & UB

Bancorp Partnership Minimal tangible book value dilution (<1%) with a 2 year earnback period Neutral to regulatory capital metrics Does not impact FNB’s previously announced buyback program ~2% EPS accretive to FNB Increases ROATCE by

>40bps Improves efficiency ratio by >60bps Qualitative Quantitative Low-Risk UB Bancorp is additive to FNB’s NC strategy, increasing market deposits by ~$1.0bn Improves competitive position in key markets; pro forma company has top 10

share in 7 out of North Carolina’s 10 largest markets In-market with identified cost savings opportunities In-Market UB Bancorp represents ~3% of combined asset size FNB already operates in a number of UB Bancorp markets FNB has an experienced

dedicated project management and integration office FNB has acquired and successfully integrated 8 acquisitions over the last 10 years Experienced Acquirer Limited TBV Dilution Capital Improved Profitability ✔ ✔ ✔ ✔

✔ ✔ Transaction In Line With Our Stated M&A Strategy ____________________ Sources: S&P Capital IQ and Company materials.

10 Key Takeaways Adding Scale in

Strategically Important North Carolina Disciplined Pricing; Attractive Financial Impact Low Risk, In-Market Transaction

Disclaimer ADDITIONAL INFORMATION

ABOUT THE MERGER AND WHERE TO FIND IT This document is being made available in respect of the proposed merger transaction between FNB and UB Bancorp. In connection with the proposed merger, FNB will file a registration statement on Form S-4 with the

SEC to register FNB’s shares that will be issued to UB Bancorp’s stockholders in connection with the merger. The registration statement will include a proxy statement of UB Bancorp and a prospectus of FNB as well as other relevant

documents concerning the proposed transaction. INVESTORS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC AS WELL AS

ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The proxy statement/prospectus, other relevant materials (when they become available) and any other documents FNB has filed with the SEC may be

obtained free of charge at the SEC's website at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents FNB has filed with the SEC by contacting James Orie, Chief Legal Officer, F.N.B. Corporation, One North

Shore Center, Pittsburgh, PA 15212, telephone: (724) 983-3317. The proxy statement/prospectus, when it becomes available, may also be obtained free of charge from F.N.B. Corporation, One North Shore Center, Pittsburgh, PA 15212, telephone: (724)

983-3317, or UB Bancorp, 1011 Red Banks Road, Greenville, NC 27858, telephone: (866) 638-0552. Participants in the Solicitation FNB and UB Bancorp and certain of their directors and executive officers may be deemed to be participants in the

solicitation of proxies from UB Bancorp’s stockholders in connection with the proposed merger. Information regarding FNB’s directors and executive officers is contained in FNB’s Proxy Statement on Schedule 14A, dated March 25,

2022, as amended, and in certain of its Current Reports on Form 8-K, which are filed with the SEC. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be

obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of these documents may be obtained as described in the preceding paragraph. No Offer or Solicitation This document does

not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the securities laws of such jurisdiction. Cautionary Statement Regarding Forward-Looking Information This document contains "forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act. These forward-looking statements include, but are not limited to, statements regarding the outlook and expectations of FNB and UB Bancorp with respect to their planned merger, the strategic benefits and financial

benefits of the merger, including the expected impact of the transaction on the combined company’s future financial performance (including anticipated accretion to earnings per share and other metrics) and the timing of the closing of the

transaction. Forward-looking statements are typically identified by words such as "believe," "plan," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "will," "should," "project," "goal," and other similar words and expressions.

Forward-looking statements are subject to risks, uncertainties and assumptions which may change over time or as a result of unforeseen circumstances. Future events or circumstances may change expectations or outlook and may affect the nature of the

assumptions, risks and uncertainties to which forward-looking statements are subject. The forward-looking statements in this document pertain only to the date of this document, and FNB and UB Bancorp disclaim any obligation to update or revise any

forward-looking statements, except as required by law. Actual results or future events may differ, possibly materially, from those that are anticipated in these forward-looking statements. Accordingly, we caution against placing undue reliance on

any forward-looking statements. Forward-looking statements contained in this document are subject to, among others, the following risks, uncertainties and assumptions: The possibility that the anticipated benefits of the transaction, including

anticipated cost savings and strategic gains, are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy, competitive

factors in the areas where FNB and UB Bancorp do business, or as a result of other unexpected factors or events; Completion of the transaction is dependent on the satisfaction of customary closing conditions, including approval by UB Bancorp

stockholders, which cannot be assured, and the timing and completion of the transaction is dependent on various factors that cannot be predicted with precision at this point; The occurrence of any event, change or other circumstances that could give

rise to the right of one or both of the parties to terminate the merger agreement; Completion of the transaction is subject to bank regulatory approvals and such approvals may not be obtained in a timely manner or at all or may be subject to

conditions which may cause additional significant expense or delay the consummation of the merger transaction; Potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or

completion of the transaction; The outcome of any legal proceedings that may be instituted against FNB or UB Bancorp; Subsequent federal legislative and regulatory actions and reforms affecting the financial institutions’ industry may

substantially impact the economic benefits of the proposed merger; Unanticipated challenges or delays in the integration of UB Bancorp’s business into FNB’s and the conversion of UB Bancorp’s technology systems and customer data

may significantly increase the expense associated with the transaction; and Other factors that may affect future results of FNB and UB Bancorp, including changes in asset quality and credit risk; the inability to sustain revenue and earnings growth;

changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; capital management activities; and other actions of the Federal

Reserve Board and legislative and regulatory actions and reforms. These forward-looking statements are also subject to the principal risks and uncertainties applicable to FNB’s business and activities generally that are disclosed in

FNB’s 2021 Annual Report on Form 10-K and other FNB files with the SEC and UB Bancorp’s Investor Relations website. FNB’s SEC filings are accessible on the SEC website at www.sec.gov. Use of Projections and Financial Information

This document contains financial forecasts relating to the anticipated future financial performance of the proposed combination of FNB and UB Bancorp and is subject to risks and uncertainties that could cause actual results to differ materially from

those forecasts and should be read with caution. They are subjective in many respects and thus susceptible to interpretations and periodic revisions based on actual experience and recent developments. While presented with numerical specificity, the

projections were not prepared in the ordinary course and are based upon a variety of estimates and hypothetical assumptions made by management of FNB and UB Bancorp with respect to, among other things, general economic, market, interest rate and

financial conditions, the availability and cost of capital for future investment, and competition within applicable markets. The projections were not prepared with a view toward compliance with published guidelines of the SEC, the guidelines

established by the American Institute of Certified Public Accountants for prospective financial information or generally accepted accounting principles in the United States of America (“GAAP”). None of the assumptions underlying the

projections may be realized, and they are inherently subject to significant business, economic and competitive uncertainties and contingencies, all of which are difficult to predict and many of which are beyond the control of FNB and UB Bancorp.

Accordingly, there can be no assurance that the assumptions made in preparing the projections will prove accurate, and actual results may materially differ. For these reasons, as well as the bases and assumptions on which the projections were

compiled, the inclusion of the information set forth below should not be regarded as an indication that the projections will be an accurate prediction of future events, and they should not be relied on as such. None of FNB and UB Bancorp or any of

their respective affiliates, advisors or other representatives has made, or makes, any representation to any stockholder regarding the information contained in the projections and, except as required by applicable securities laws, neither FNB and UB

Bancorp intends to update or otherwise revise the projections to reflect circumstances existing after the date when made or to reflect the occurrences of future events even in the event that any or all of the assumptions are shown to be in error.

Market and Industry Data Market and industry data used throughout this presentation is based on information derived from third party sources, the knowledge of the management teams of FNB and UB Bancorp regarding their respective industries and

businesses and respective management teams’ good faith estimates. While management of FNB and UB Bancorp believe that the third party sources from which market and industry data has been derived are reputable, FNB and UB Bancorp have not

independently verified such market and industry data, and you are cautioned not to give undue weight to such market and industry data. Non-GAAP Financial Measures Financial measures included in the forecasts provided to a board of directors or

financial advisor in connection with a business combination transaction are excluded from the definition of “non-GAAP financial measures” under the rules of the SEC, and therefore the UB Bancorp projections, the FNB and UB Bancorp

combined company projections, and estimated synergies included in this presentation are not subject to SEC rules regarding disclosures of non-GAAP financial measures, which would otherwise require a reconciliation of a non-GAAP financial measure to

a GAAP financial measure. Reconciliations of non-GAAP financial measures were not provided to or relied upon by the FNB board of directors, UB Bancorp, or the FNB and UB Bancorp respective financial advisors in connection with the merger.

Accordingly, no reconciliation of such measures is provided in this presentation.

FNB (NYSE:FNB-E)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

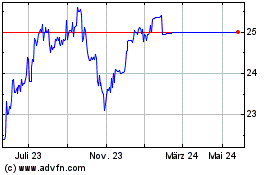

FNB (NYSE:FNB-E)

Historical Stock Chart

Von Jul 2023 bis Jul 2024