Current Report Filing (8-k)

19 April 2022 - 8:17PM

Edgar (US Regulatory)

FNB CORP/PA/ Depositary Shares each representing 1/40th interest in a share of Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series E One North Shore Center false 0000037808 0000037808 2022-04-18 2022-04-18 0000037808 us-gaap:CommonStockMember 2022-04-18 2022-04-18 0000037808 us-gaap:SeriesEPreferredStockMember 2022-04-18 2022-04-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 19, 2022 (April 18, 2022)

F.N.B. CORPORATION

(Exact name of registrant as specified in its charter)

Pennsylvania

(State or Other Jurisdiction

of Incorporation)

|

|

|

| 001-31940 |

|

25-1255406 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| One North Shore Center, 12 Federal Street, Pittsburgh, PA |

|

15212 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(800) 555-5455

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of Each Class |

|

Trading

Symbol(s) |

|

Name of Exchange on

which Registered |

| Common Stock, par value $0.01 per share |

|

FNB |

|

New York Stock Exchange |

| Depositary Shares each representing 1/40th interest in a share of Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series E |

|

FNBPrE |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| ITEM 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

(e) On April 18, 2022, F.N.B Corporation (the “Company”) implemented a new Deferred Compensation Plan (the “Plan”). The Plan is an unfunded, unsecured nonqualified deferred compensation plan that allows participants and the Company to defer receipt by participants of certain cash and stock compensation in a manner intended to comply with Section 409A of the Internal Revenue Code of 1986. Members of the Company’s Board of Directors, its officers and certain other highly compensated employees are eligible to participate in the Plan. The Plan administrator may modify, limit or expand the class of employees eligible to participate. Participation for elective deferrals is voluntary.

The Plan permits deferrals into various investment funds and deferrals into a Company common stock fund. The deferred compensation obligations incurred by the Company that are created by deferrals into the investment funds under the Plan will be unsecured general obligations of the Company, and will rank equally with other unsecured and unsubordinated indebtedness of the Company. All amounts credited to participant’s accounts will be credited with income, gains and losses as if they were invested in investment funds that are made available for participant direction under the Plan. Under the Plan, each investment fund is a hypothetical investment fund pursuant to which income, gains and losses are credited to a participant’s account as if such account, to the extent deemed invested in such investment fund, were invested in hypothetical shares of the mutual fund or other investment vehicle to which the investment fund is assigned or related. Deferrals into the Company common stock fund will be used to purchase the Company’s common stock to be held in the participant’s common stock fund under the Plan.

In general, if a participant terminates employment, the participant will receive distributions in accordance with the participant’s distribution election. Vested employer matching contributions, if any, will be paid to the participant in a lump sum. If the participant’s termination of employment occurs prior to retirement and the participant has previously elected installments, the distribution will instead be paid as a lump sum. Upon a participant’s termination of employment because of death or disability, the participant (or the participant’s beneficiaries, if applicable) will receive the participant’s remaining account balance as a lump sum or in installments as elected by the participant.

All deferred compensation obligations under the Plan will continue for all purposes to be a part of the general funds of the Company and, if the Company is insolvent and unable to pay the compensation deferred in accordance with the terms of the Plan, the participant’s account will at all times represent the general obligation of the Company. Each participant will be a general creditor of the Company with respect to all of the deferred compensation obligations to the participant under the Plan, and will not have a secured or preferred position with respect to the participant’s account.

The foregoing description of the Plan does not purport to be complete and is qualified in its entirety by reference to the Plan filed as Exhibit 10.1 to this Report and incorporated herein by reference.

| ITEM 9.01. |

FINANCIAL STATEMENTS AND EXHIBITS |

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| F.N.B. CORPORATION |

| (Registrant) |

|

|

| By: |

|

/s/ Vincent J. Calabrese, Jr. |

| Name: |

|

Vincent J. Calabrese, Jr. |

| Title: |

|

Chief Financial Officer |

Dated: April 19, 2022

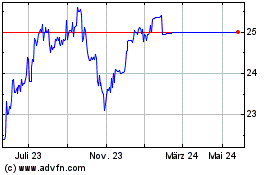

FNB (NYSE:FNB-E)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

FNB (NYSE:FNB-E)

Historical Stock Chart

Von Jul 2023 bis Jul 2024