false000164974900016497492024-01-162024-01-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 16, 2024

FB FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Tennessee | | 001-37875 | | 62-1216058 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer

Identification Number) |

| | | | |

| | | | |

1221 Broadway, Suite 1300

Nashville, Tennessee 37203

(Address of principal executive offices) (Zip Code)

(615) 564-1212

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions ( see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $1.00 par value | FBK | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 16, 2024, FB Financial Corporation (“FB Financial”) issued a press release announcing its financial results for the fourth quarter and year ended December 31, 2023 (the “Earnings Release”). A copy of the Earnings Release is furnished as Exhibit 99.1 to this current report on Form 8-K (this “Report”).

Item 7.01. Regulation FD Disclosure.

On January 16, 2024, FB Financial will host a conference call to discuss financial results for the quarter ended December 31, 2023.

On January 16, 2024, FB Financial made available on its website (investors.firstbankonline.com) supplemental financial information for the fourth quarter ended December 31, 2023 (the “Financial Supplement”) and an earnings release presentation (the “Earnings Presentation”) containing additional information about FB Financial’s financial results for the quarter ended December 31, 2023.

Copies of the Financial Supplement and the Earnings Presentation are furnished as Exhibit 99.2 and Exhibit 99.3, respectively, to this Report.

The information contained in this Report, including Exhibit 99.1, Exhibit 99.2 and Exhibit 99.3 furnished herewith, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference into any registration statement or other documents pursuant to the Securities Act of 1933, as amended, or into any filing or other document pursuant to the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit Number | | Description of Exhibit |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File (formatted as inline XBRL document) |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | FB FINANCIAL CORPORATION |

| | | |

| | | |

| | By: | /s/ Michael M. Mettee |

| | | Michael M. Mettee |

| | | Chief Financial Officer |

| | | (Principal Financial Officer) |

Date: January 16, 2024 | | |

FB Financial Corporation Reports Fourth Quarter 2023 Financial Results

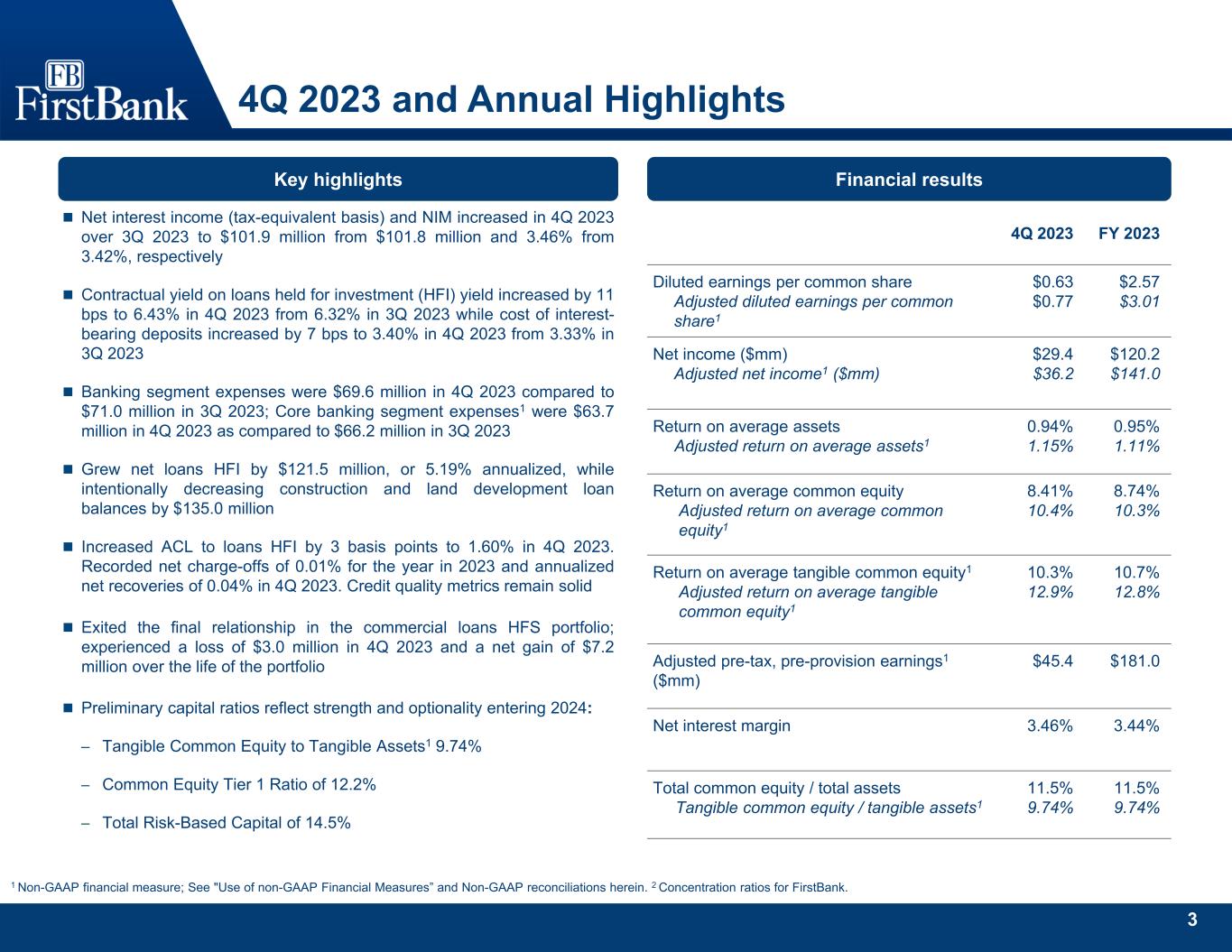

Reports Q4 Diluted EPS of $0.63, Adjusted Diluted EPS* of $0.77

NASHVILLE, TENNESSEE—January 16, 2024-- FB Financial Corporation (the “Company”) (NYSE: FBK), parent company of FirstBank, reported net income of $29.4 million, or $0.63 per diluted common share, for the fourth quarter of 2023, compared to $0.41 in the previous quarter and $0.81 in the fourth quarter of last year. Adjusted net income* was $36.2 million, or $0.77 per diluted common share, compared to $0.71 in the previous quarter and $0.85 in the fourth quarter of last year.

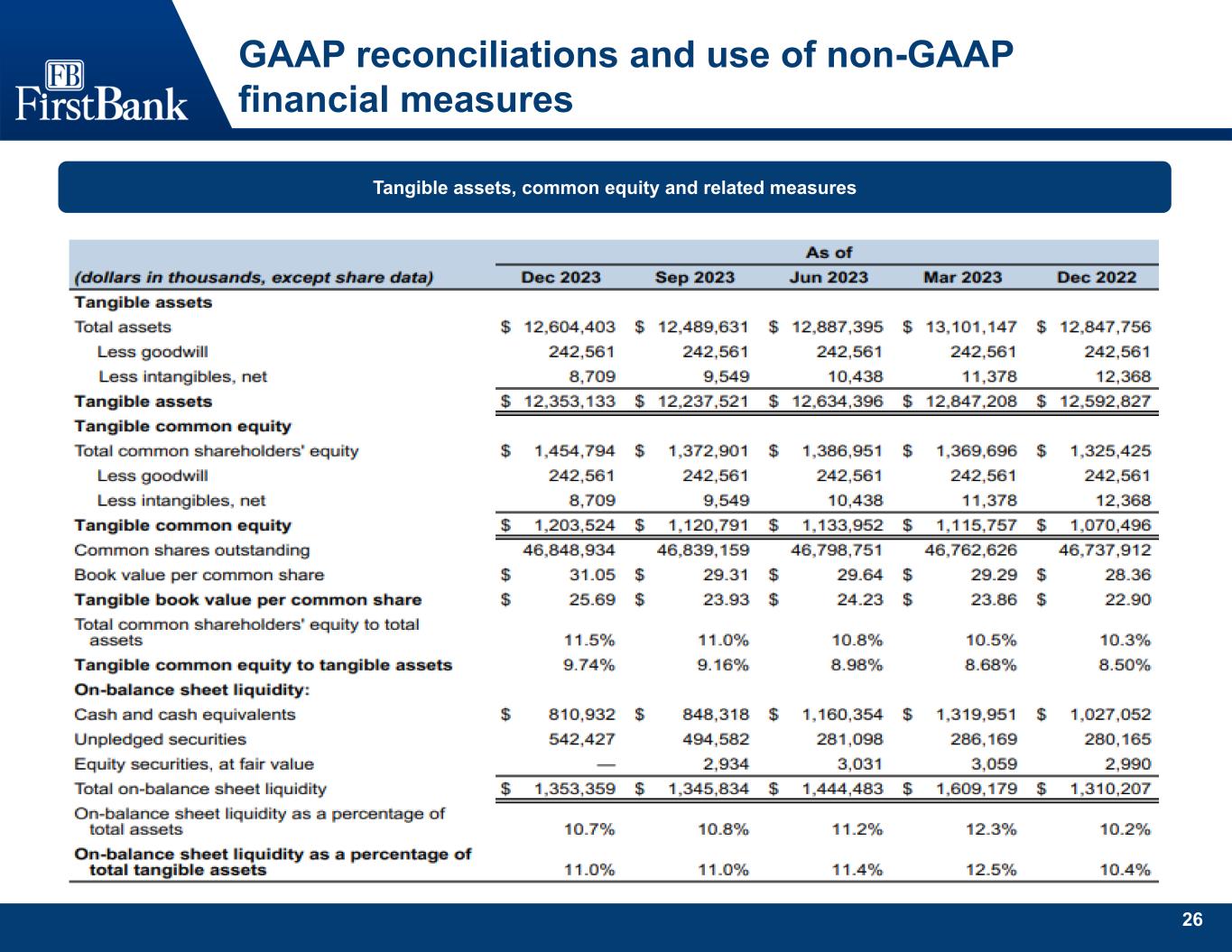

The Company’s loans held for investment (“HFI”) grew to $9.41 billion, or 5.19% annualized, as of the end of the fourth quarter compared to $9.29 billion as of the end of the previous quarter and $9.30 billion as of the end of the fourth quarter last year. Deposits were $10.55 billion as of December 31, 2023, compared to $10.64 billion as of September 30, 2023, and $10.86 billion as of December 31, 2022. Net interest margin (“NIM”) increased to 3.46% for the fourth quarter of 2023 compared to 3.42% in the prior quarter and 3.78% in the fourth quarter of 2022. The Company ended the quarter with book value per common share of $31.05 and tangible book value per common share* of $25.69, representing a 23.6% and 29.2% annualized increase respectively from the previous quarter.

President and Chief Executive Officer, Christopher T. Holmes stated, “The Company continues to execute well in key initiatives of limiting balance sheet risk, improving profitability, and enhancing operations. We have had success growing core banking relationships, improving net interest margin and reducing expenses while improving our risk profile by managing credit concentrations, all during what was a difficult banking year. Our success in 2023 has prepared us to deal with potential economic challenges, and at the same time, has positioned us to take advantage of opportunities.”

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Annualized | | | | | | | | | | | |

| (dollars in thousands, except share data) | | Dec 2023 | | Sep 2023 | | Dec 2022 | | | | Dec 23 / Sep 23

% Change | | Dec 23 / Dec 22

% Change | | | | | | | | | |

| Balance Sheet Highlights | | | | | | | | | | | | | | | | | | | | | |

| Investment securities, at fair value | | $ | 1,471,973 | | | $ | 1,351,153 | | | $ | 1,474,176 | | | | | 35.5 | % | | (0.15) | % | | | | | | | | | |

| Loans held for sale | | 67,847 | | | 103,858 | | | 139,451 | | | | | (137.6) | % | | (51.3) | % | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Loans HFI | | 9,408,783 | | | 9,287,225 | | | 9,298,212 | | | | | 5.19 | % | | 1.19 | % | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Allowance for credit losses on loans HFI | | 150,326 | | | 146,134 | | | 134,192 | | | | | 11.4 | % | | 12.0 | % | | | | | | | | | |

Allowance for credit losses on unfunded

commitments | | 8,770 | | | 11,600 | | | 22,969 | | | | | (96.8) | % | | (61.8) | % | | | | | | | | | |

| Total assets | | 12,604,403 | | | 12,489,631 | | | 12,847,756 | | | | | 3.65 | % | | (1.89) | % | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing deposits (non-brokered) | | 8,179,430 | | | 8,105,713 | | | 8,178,453 | | | | | 3.61 | % | | — | % | | | | | | | | | |

| Brokered deposits | | 150,475 | | | 174,920 | | | 750 | | | | | (55.4) | % | | NM | | | | | | | | | |

| Noninterest-bearing deposits | | 2,218,382 | | | 2,358,435 | | | 2,676,631 | | | | | (23.6) | % | | (17.1) | % | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Total deposits | | 10,548,287 | | | 10,639,068 | | | 10,855,834 | | | | | (3.39) | % | | (2.83) | % | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Borrowings | | 390,964 | | | 226,689 | | | 415,677 | | | | | 287.5 | % | | (5.95) | % | | | | | | | | | |

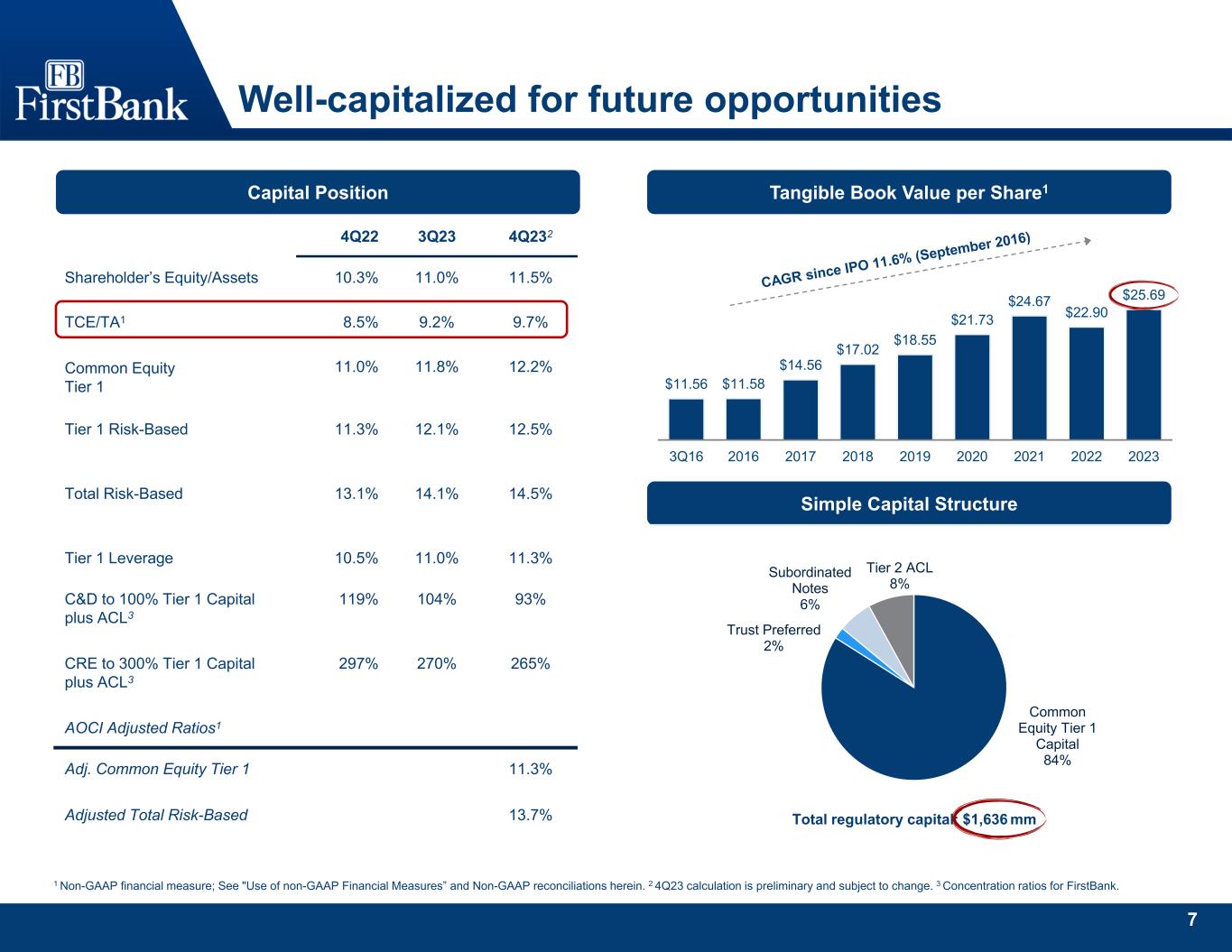

| Total common shareholders' equity | | 1,454,794 | | | 1,372,901 | | | 1,325,425 | | | | | 23.7 | % | | 9.76 | % | | | | | | | | | |

| Book value per common share | | $ | 31.05 | | | $ | 29.31 | | | $ | 28.36 | | | | | 23.6 | % | | 9.49 | % | | | | | | | | | |

| Tangible book value per common share* | | $ | 25.69 | | | $ | 23.93 | | | $ | 22.90 | | | | | 29.2 | % | | 12.2 | % | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Total common shareholders' equity to total assets | | 11.5 | % | | 11.0 | % | | 10.3 | % | | | | | | | | | | | | | | | |

| Tangible common equity to tangible assets* | | 9.74 | % | | 9.16 | % | | 8.50 | % | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

*Non-GAAP financial measure; A reconciliation of each of these non-GAAP measures to the most directly comparable GAAP measure is included in the Company's Fourth Quarter 2023 Financial Supplement. | | | | | | | | | |

| NM- Not meaningful | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

FB Financial Corporation

Fourth Quarter 2023 Results

Page 2

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | | | | |

| (dollars in thousands, except share data) | | Dec 2023 | | Sep 2023 | | Dec 2022 | | | | | | | |

| Statement of Income Highlights | | | | | | | | | | | | | |

| Net interest income | | $ | 101,088 | | | $ | 100,926 | | | $ | 110,498 | | | | | | | | |

| NIM | | 3.46 | % | | 3.42 | % | | 3.78 | % | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Noninterest income | | $ | 15,339 | | | $ | 8,042 | | | $ | 17,469 | | | | | | | | |

| | | | | | | | | | | | | |

| Gain (loss) from securities, net | | $ | 183 | | | $ | (14,197) | | | $ | 25 | | | | | | | | |

Loss from changes in fair value of commercial loans held for sale acquired in previous

business combinations | | $ | (3,009) | | | $ | (7) | | | $ | (2,562) | | | | | | | | |

| Total revenue | | $ | 116,427 | | | $ | 108,968 | | | $ | 127,967 | | | | | | | | |

| Noninterest expense | | $ | 80,200 | | | $ | 82,997 | | | $ | 80,230 | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Early retirement and severance costs | | $ | 2,214 | | | $ | 4,809 | | | $ | — | | | | | | | | |

| Loss on lease terminations | | $ | 1,843 | | | $ | — | | | $ | — | | | | | | | | |

| FDIC special assessment | | $ | 1,788 | | | $ | — | | | $ | — | | | | | | | | |

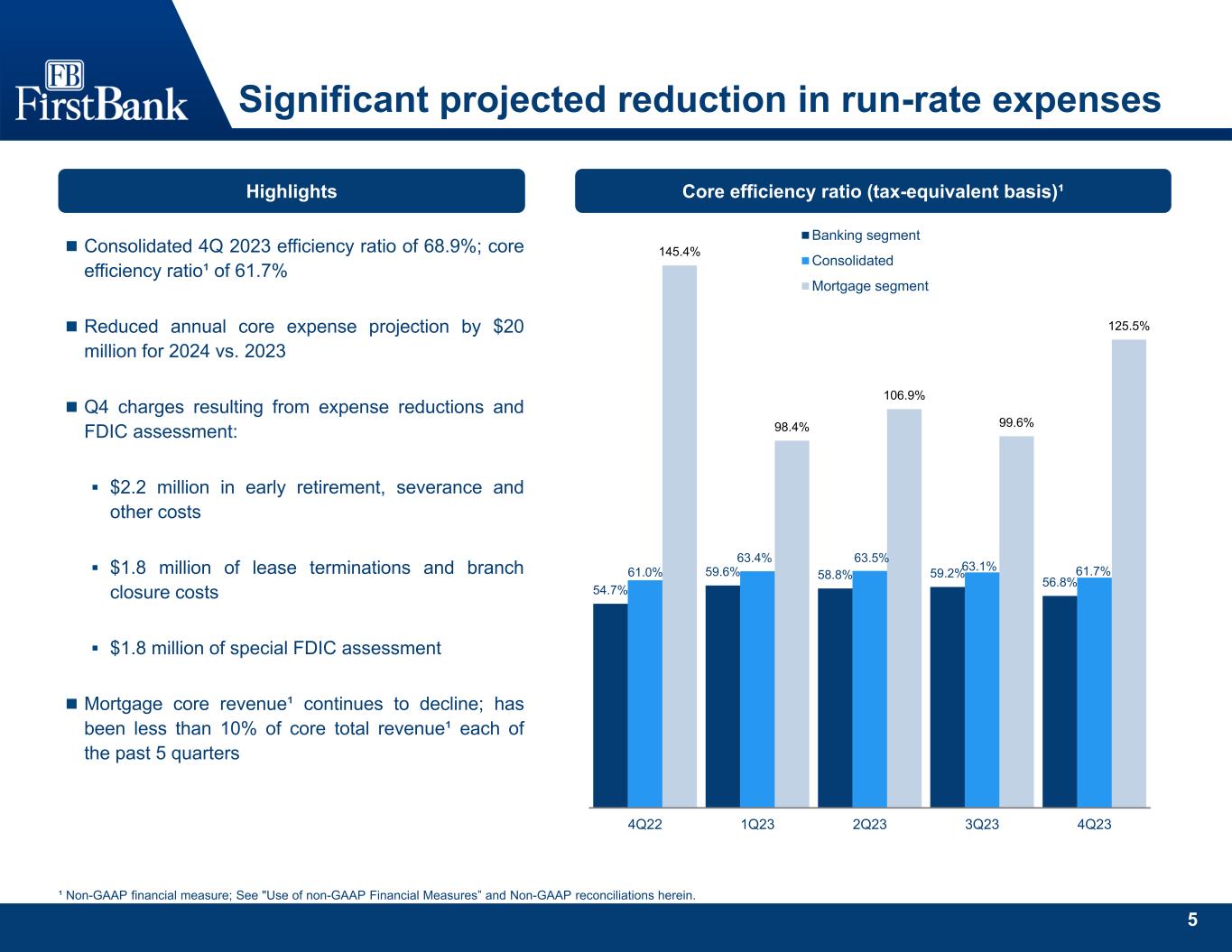

| Efficiency ratio | | 68.9 | % | | 76.2 | % | | 62.7 | % | | | | | | | |

| Core efficiency ratio* | | 61.7 | % | | 63.1 | % | | 61.0 | % | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Pre-tax, pre-provision earnings | | $ | 36,227 | | | $ | 25,971 | | | $ | 47,737 | | | | | | | | |

| Adjusted pre-tax, pre-provision earnings* | | $ | 45,390 | | | $ | 44,869 | | | $ | 50,526 | | | | | | | | |

| Provisions for credit losses | | $ | 305 | | | $ | 2,821 | | | $ | (456) | | | | | | | | |

| Net (recoveries) charge-off ratio | | (0.04) | % | | 0.02 | % | | 0.02 | % | | | | | | | |

| Net income applicable to FB Financial Corporation | | $ | 29,369 | | | $ | 19,175 | | | $ | 38,143 | | | | | | | | |

| Diluted earnings per common share | | $ | 0.63 | | | $ | 0.41 | | | $ | 0.81 | | | | | | | | |

| Effective tax rate | | 18.2 | % | | 17.2 | % | | 20.8 | % | | | | | | | |

| Adjusted net income* | | $ | 36,152 | | | $ | 33,148 | | | $ | 40,213 | | | | | | | | |

| Adjusted diluted earnings per common share* | | $ | 0.77 | | | $ | 0.71 | | | $ | 0.85 | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Weighted average number of shares outstanding - fully diluted | | 46,916,939 | | | 46,856,422 | | | 47,036,742 | | | | | | | | |

| | | | | | | | | | | | | |

| Returns on average: | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Return on average total assets | | 0.94 | % | | 0.61 | % | | 1.22 | % | | | | | | | |

Adjusted* | | 1.15 | % | | 1.05 | % | | 1.28 | % | | | | | | | |

| Return on average shareholders' equity | | 8.41 | % | | 5.46 | % | | 11.7 | % | | | | | | | |

Return on average tangible common equity* | | 10.3 | % | | 6.67 | % | | 14.6 | % | | | | | | | |

Adjusted* | | 12.9 | % | | 11.8 | % | | 15.6 | % | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

*Non-GAAP financial measure; A reconciliation of each of these non-GAAP measures to the most directly comparable GAAP measure is included in the Company's Fourth Quarter 2023 Financial Supplement. | | | | | |

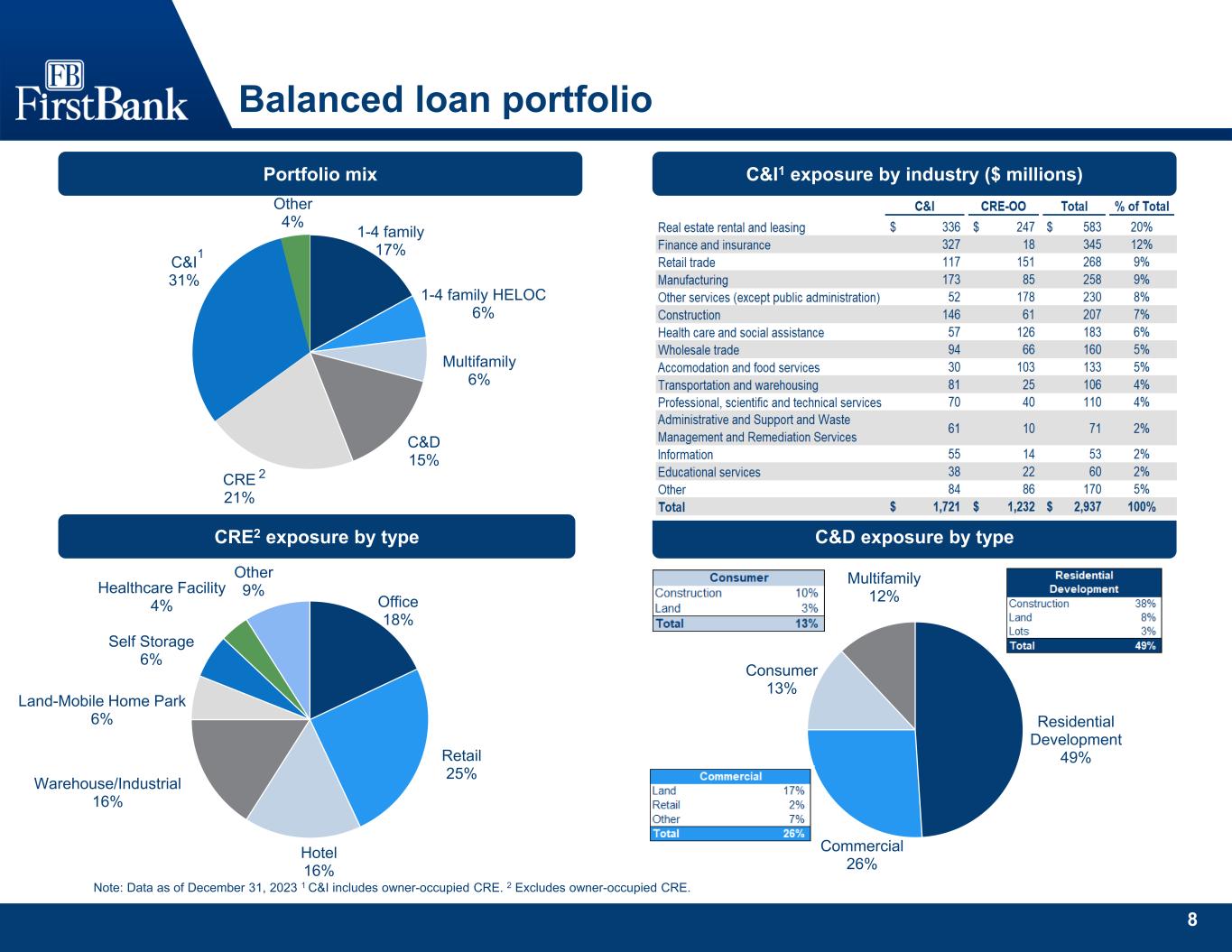

Balance Sheet and Net Interest Margin

The Company reported loans HFI of $9.41 billion at the end of the fourth quarter of 2023 compared to $9.29 billion from the end of the prior quarter. As construction projects transitioned to permanent financing, construction loans declined by $135.0 million which contributed to multifamily and non-owner occupied commercial real estate balance increases of $102.5 million and $31.6 million, respectively. The net loan growth primarily resulted from increases in commercial and industrial of $52.9 million and owner-occupied commercial real estate of $25.7 million. The contractual yield on loans HFI increased to 6.43% for the fourth quarter of 2023 from 6.32% for the previous quarter.

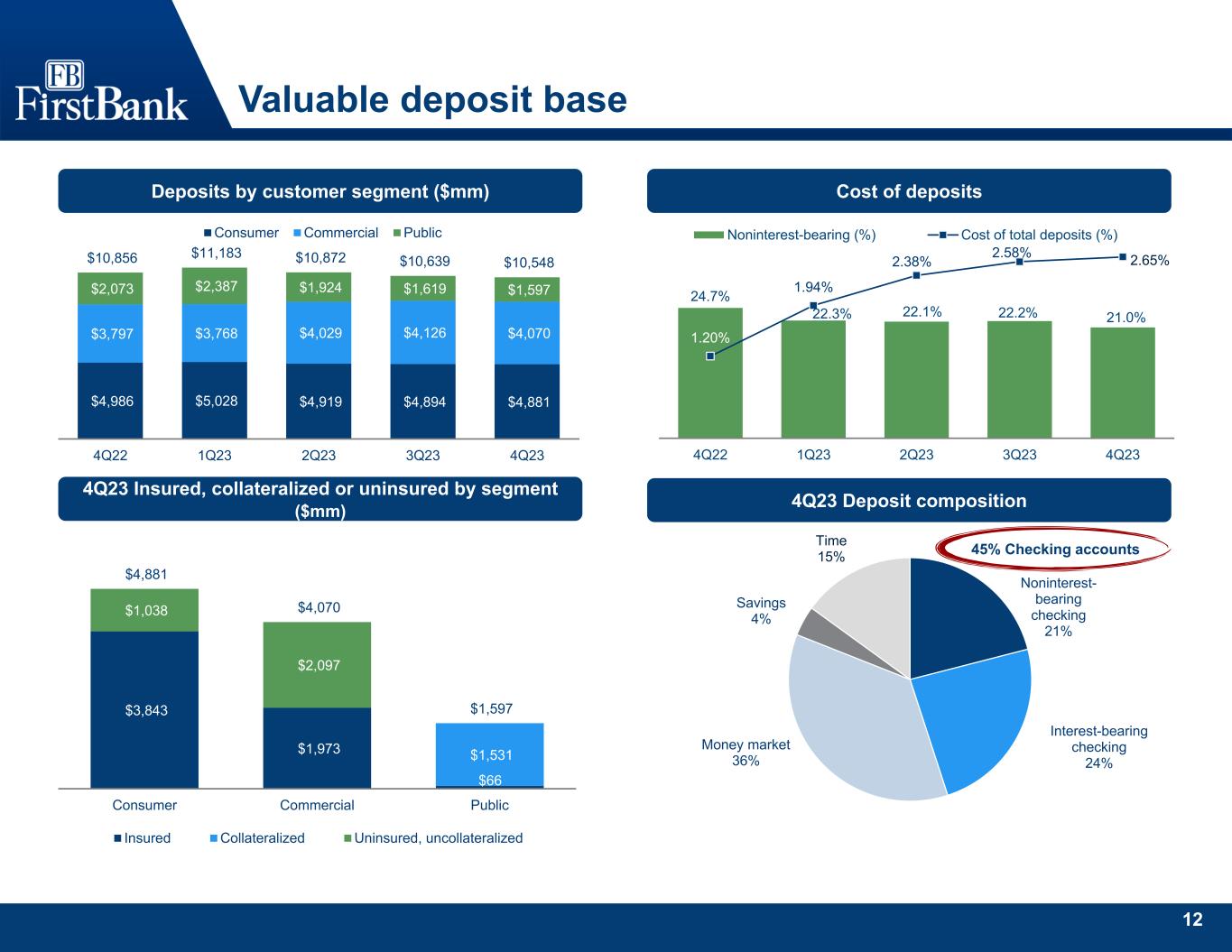

The Company reported total deposits of $10.55 billion at the end of the fourth quarter of 2023 compared to $10.64 billion at the end of the third quarter. The Company's total cost of deposits increased to 2.65% during the fourth quarter from 2.58% for the third quarter of 2023, and the cost of interest-bearing deposits increased to 3.40% from 3.33% for the same periods. Noninterest-bearing deposits were $2.22 billion at the end of the quarter compared to $2.36 billion at the end of third quarter of 2023. The decrease includes a reduction in mortgage escrow deposits of $59.1 million.

The Company’s net interest income on a tax equivalent basis increased slightly for the fourth quarter of 2023 to $101.9 million compared to $101.8 million in the prior quarter. NIM expanded to 3.46% for the fourth quarter of 2023 from 3.42% for the previous quarter as the increase in contractual yield on loans HFI outpaced the increase in the cost of interest-bearing deposits from the third quarter to the fourth quarter.

Holmes continued, “We were able to expand net interest margin during the quarter with prudent loan growth while continuing to reduce the risk profile of the balance sheet. We are encouraged by the increases that we achieved in both net interest income and net interest margin. Our team is focused on expanding existing relationships and developing new relationships in order to grow customer deposits at a reasonable customer value proposition.”

FB Financial Corporation

Fourth Quarter 2023 Results

Page 3

Noninterest Income

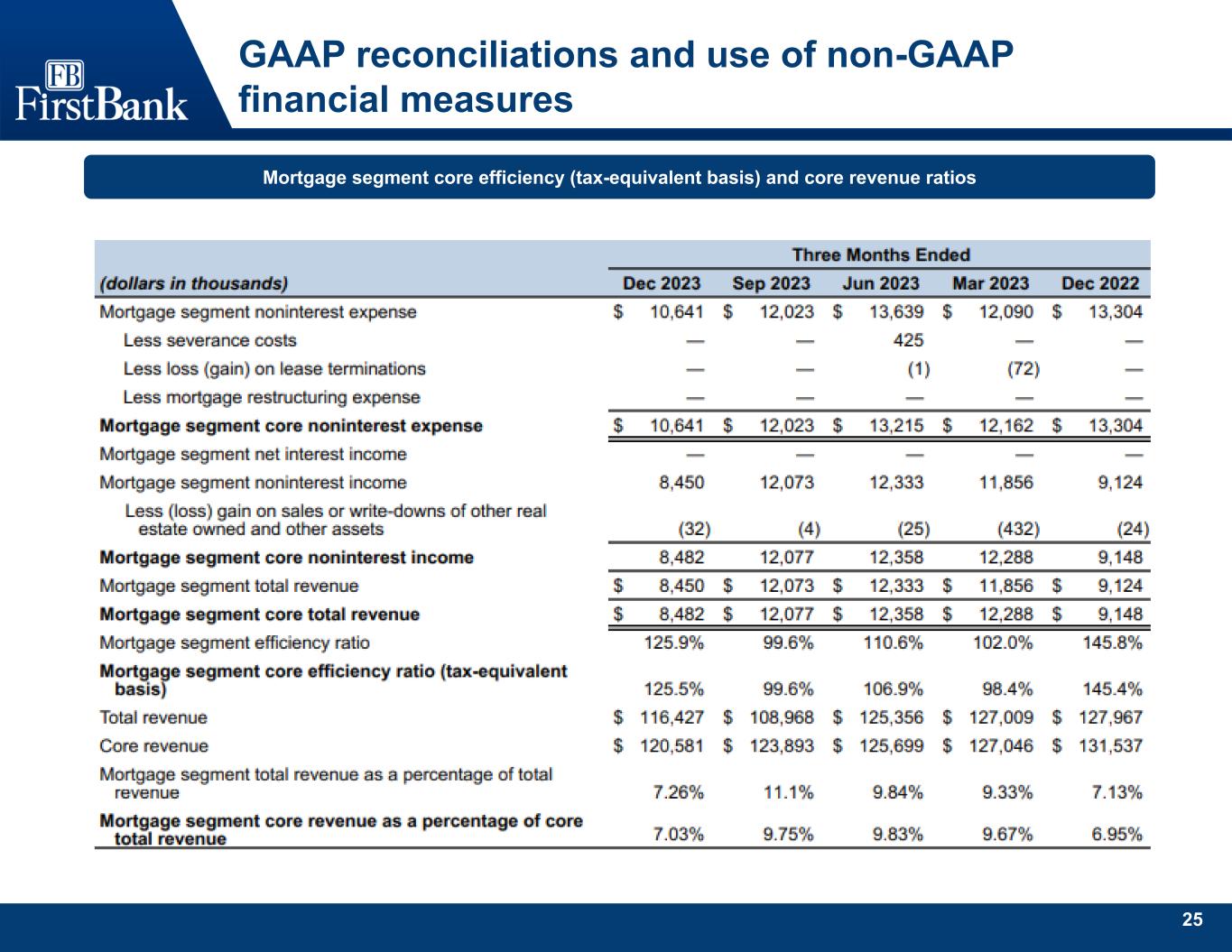

Core noninterest income* was $18.7 million for the fourth quarter of 2023, compared to $22.1 million and $20.3 million for the third quarter of 2023 and fourth quarter of 2022, respectively. These amounts reflect adjustments of a $3.0 million loss for changes in fair value on commercial loans held for sale, a $492 thousand loss on sales or write-downs of other real estate owned and other assets and a $183 thousand gain from securities in the fourth quarter 2023 compared to a $7 thousand loss for changes in fair value on commercial loans held for sale, a $115 thousand gain on sales or write-downs of other real estate owned and other assets and a $14.2 million loss from securities in the previous quarter.

The Company completed the exit of the commercial loans held for sale portfolio acquired in the Franklin Financial Network transaction after exiting the final relationship during the fourth quarter, resulting in a charge of $3.0 million in the quarter and a net gain of $7.2 million over the life of this portfolio.

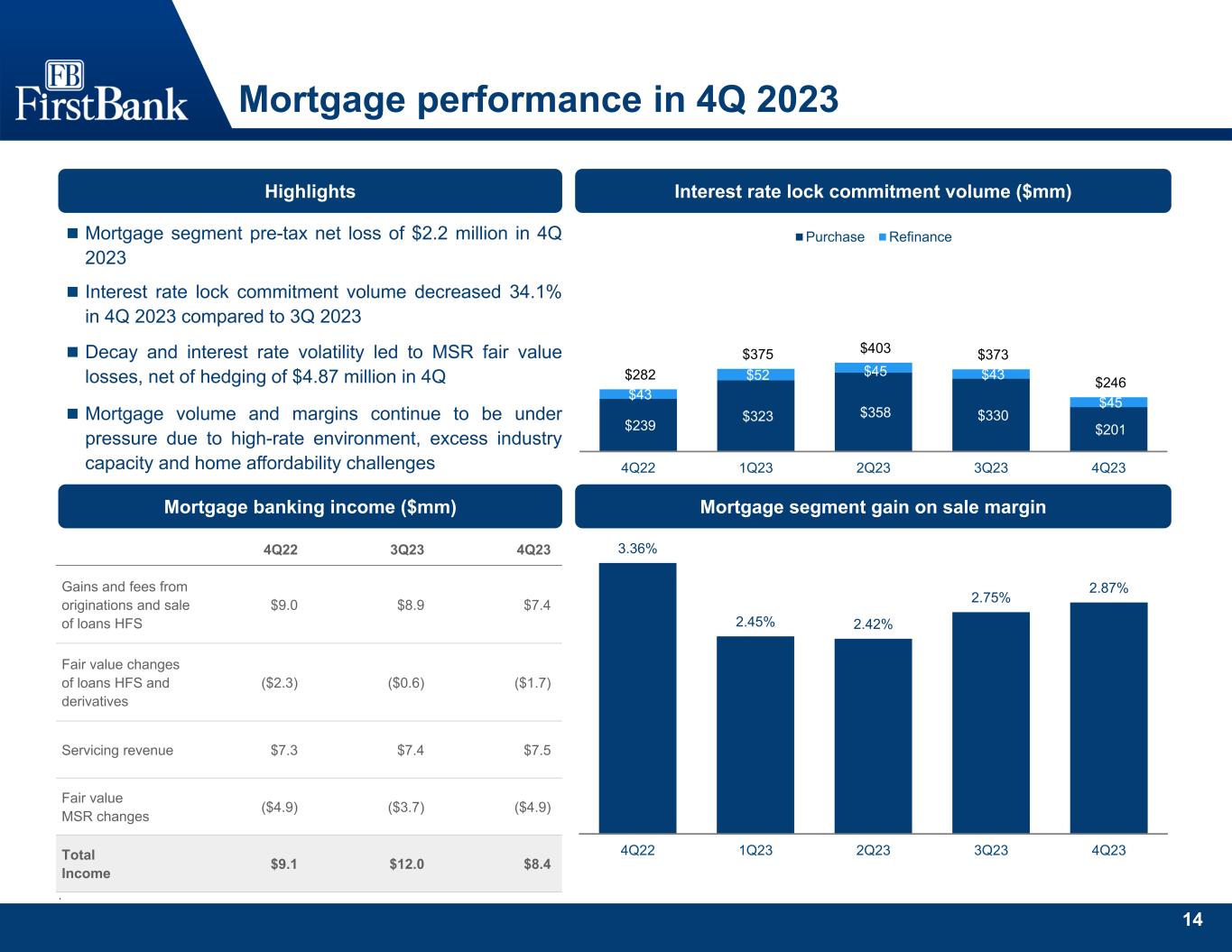

Mortgage banking income remains subdued in the higher interest rate environment as the Company recognized revenue of $8.4 million in the fourth quarter of 2023 compared with $12.0 million in the previous quarter and $9.1 million in the fourth quarter of 2022.

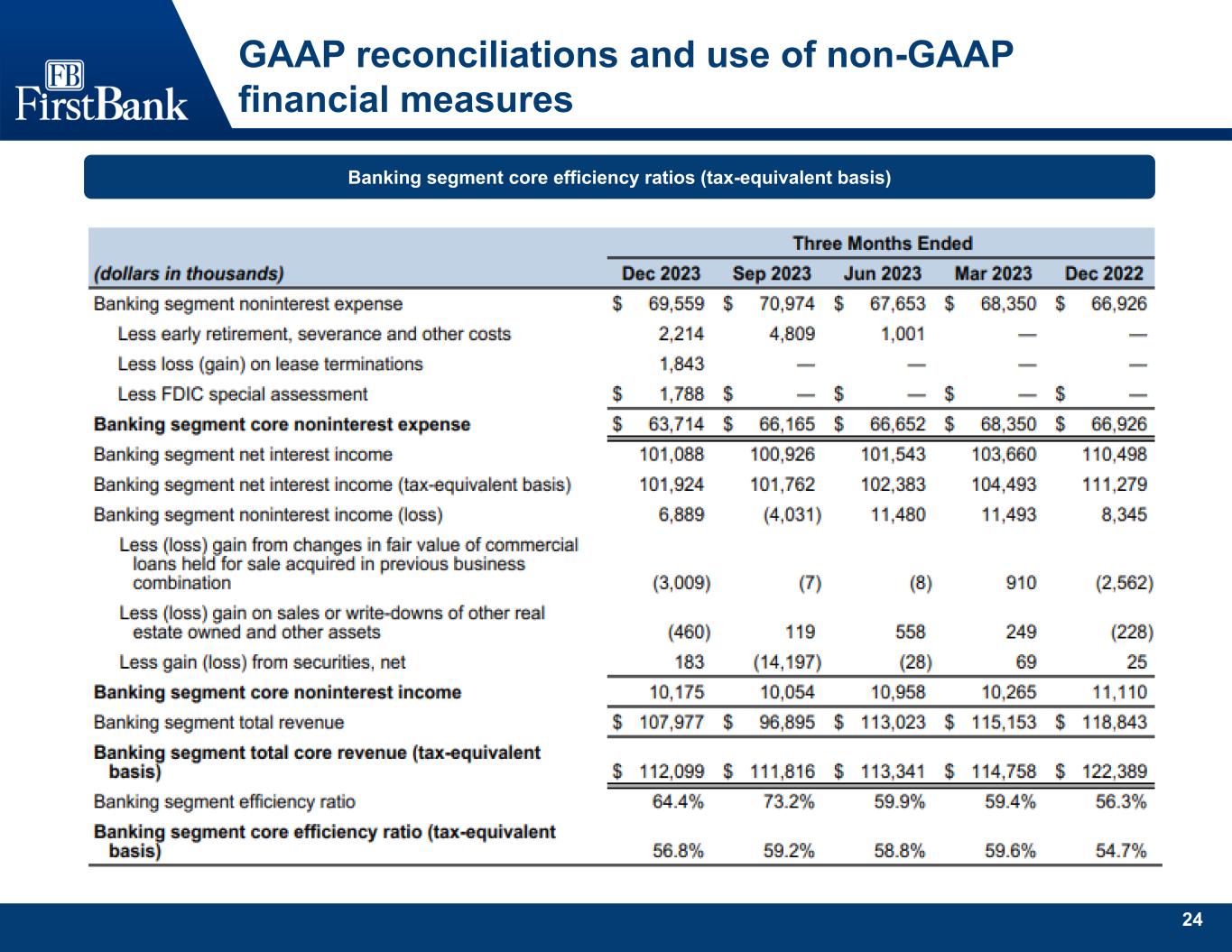

Expense Management

Core noninterest expense* during the fourth quarter of 2023 was $74.4 million compared to $78.2 million for the prior quarter and $80.2 million for the fourth quarter of 2022. These amounts reflect adjustments of $2.2 million for early retirement and severance costs, $1.8 million of loss on lease terminations and $1.8 million for the Federal Deposit Insurance Corporation ("FDIC") special assessment recognized in the fourth quarter of 2023 compared to $4.8 million for early retirement and severance costs in the prior quarter. During the fourth quarter of 2023, the Company's core efficiency ratio*1 was 61.7%, compared to 63.1% in the previous quarter and 61.0% in the fourth quarter of 2022. Core banking noninterest expense* was $63.7 million for the quarter, compared to $66.2 million in the prior quarter.

Chief Financial Officer, Michael Mettee noted, “The Company continued to lower our expense run rate during the quarter. Expense discipline continues to be a management focus even as we look to efficiently scale our operational platform.”

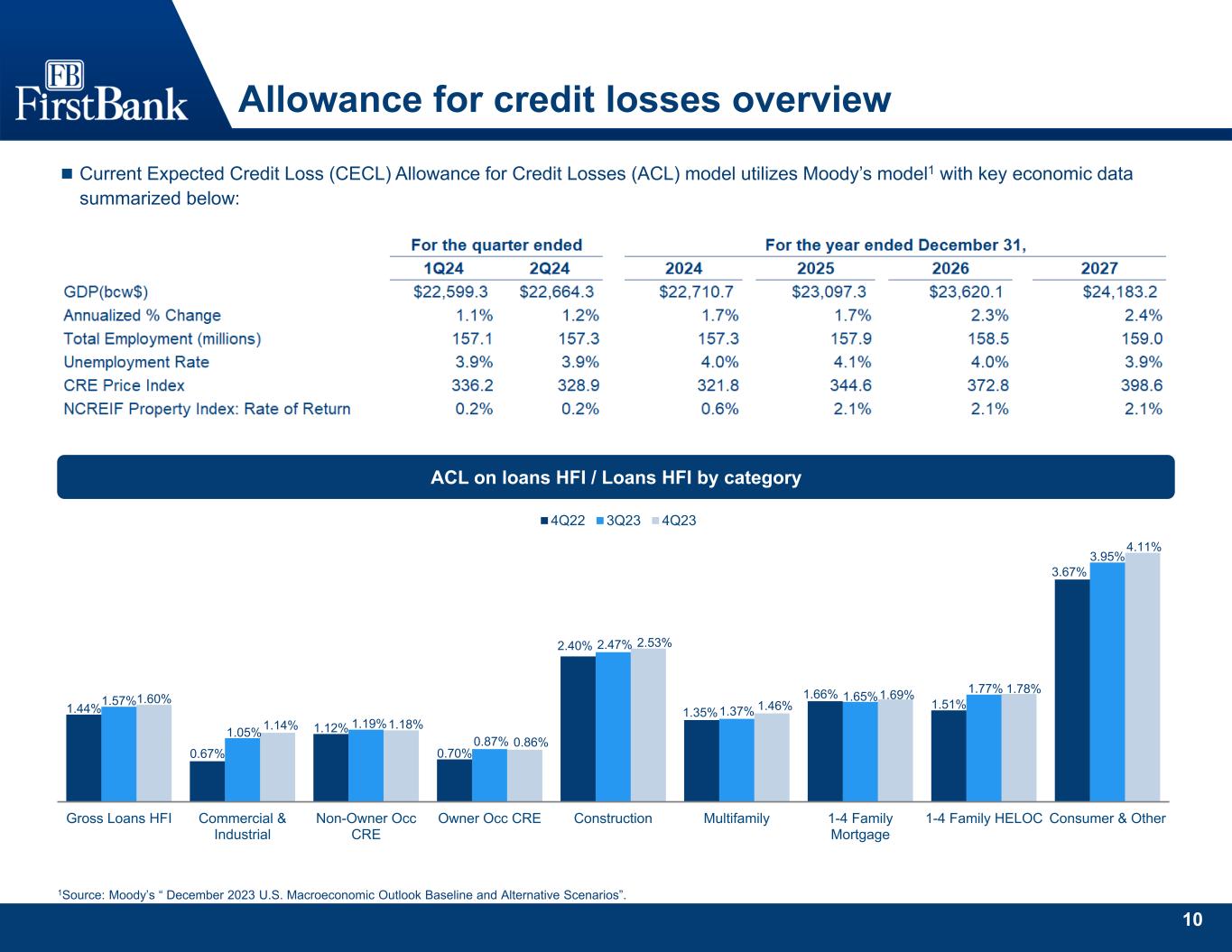

Credit Quality

The Company recorded a provision expense of $3.1 million during the fourth quarter related to loans HFI; it also recorded a provision reversal of $2.8 million on unfunded loan commitments, resulting in a net provision expense of $0.3 million. Given the range of economic forecasts for the coming quarters, the Company continued managing its exposure in unfunded commitments in construction and land development lower, ending the year with $725.9 million of exposure, which is a reduction from the previous quarter of $196.4 million and a reduction for the year of $913.2 million. The Company had an allowance for credit losses on loans HFI as of the end of the fourth quarter of 2023 of $150.3 million, representing 1.60% of loans HFI compared to $146.1 million, or 1.57% of loans HFI as of September 30, 2023.

The Company experienced net recoveries of $1.1 million in the fourth quarter of 2023, representing annualized net recoveries of 0.04% of average loans HFI for the quarter compared to annualized net charge-offs of 0.02% in both the third quarter of 2023 and fourth quarter of 2022. For the year ended December 31, 2023, the Company experienced annualized net charge-offs of $0.6 million representing net charge-offs of 0.01% of average loans HFI, compared to annualized net charge-offs of 0.02% for the year ended December 31, 2022.

The Company's nonperforming loans HFI as a percentage of total loans HFI increased to 0.65% as of the end of the fourth quarter of 2023 compared to 0.59% at the previous quarter-end and 0.49% at the end of the fourth quarter of 2022. The increase was primarily due to two commercial and industrial relationships moving to nonaccrual. Nonperforming assets as a percentage of total assets decreased to 0.69% as of the end of the fourth quarter of 2023 compared to 0.71% at the end of the prior quarter and 0.68% as of the end of the fourth quarter of 2022.

Holmes commented, “The Company had net recoveries for the quarter, demonstrating our resolve to work with customers for positive outcomes. We also modestly increased our allowance for credit losses, remaining cautious on our economic outlook. However, our local economies have continued performing well, migration into our markets continues at a healthy pace, and we are cautiously optimistic as we look forward into the coming year.”

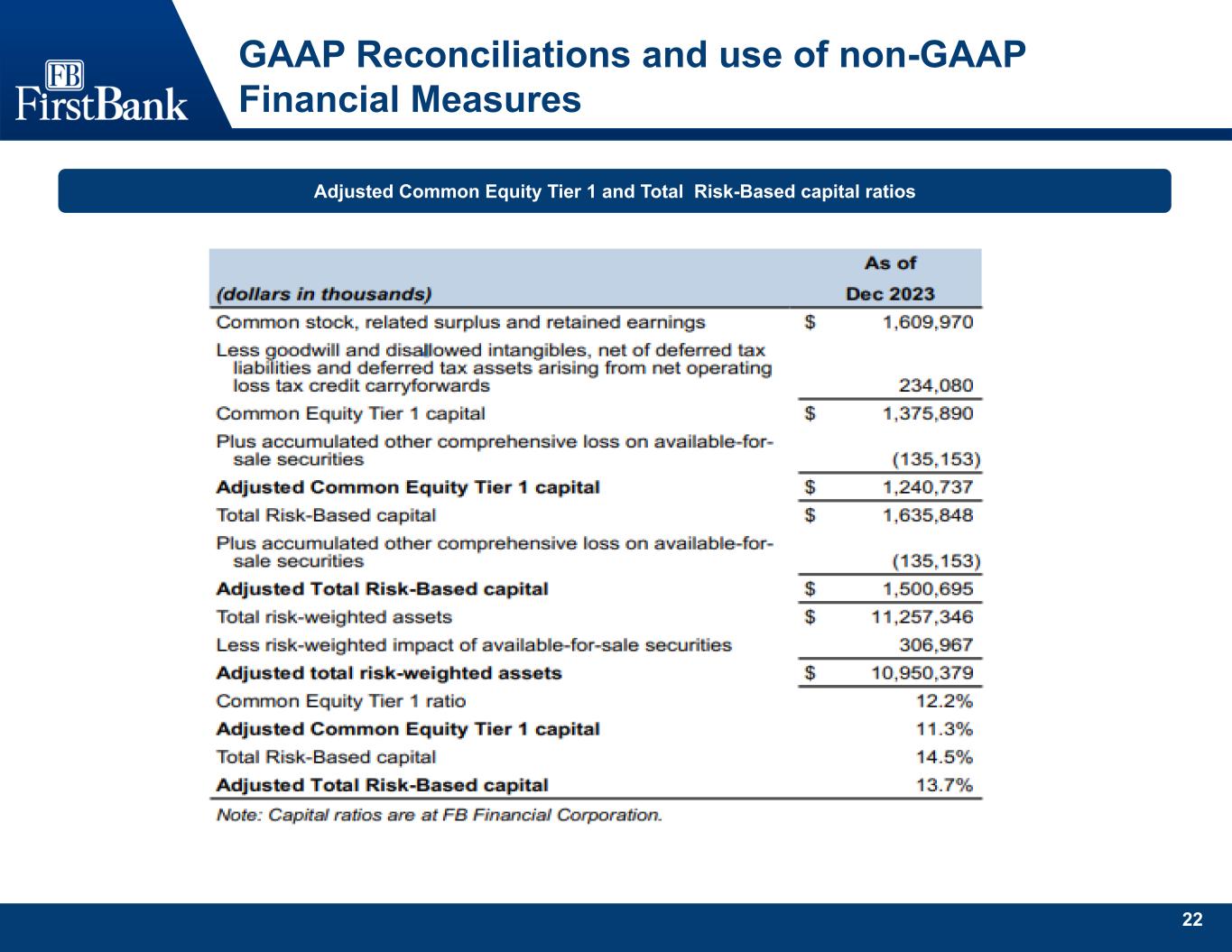

Capital Strength

Holmes continued, “We continue to build on our already strong capital position growing tangible common equity to tangible assets* to a solid 9.74% and Common Equity Tier 1 to 12.2%. Our capital levels provide flexibility as we enter 2024 in a position of strength.”

*Non-GAAP financial measure;1A reconciliation of each of these non-GAAP measures to the most directly comparable GAAP measure is included in the Company's Fourth Quarter 2023 Financial Supplement.

FB Financial Corporation

Fourth Quarter 2023 Results

Page 4

Summary

Holmes finalized, “While 2023 was a challenging year for the banking industry, I am proud of our team's management of credit, capital and liquidity while also taking care of our customers. We have executed in a difficult operating environment and positioned the Company to capitalize on future opportunities.”

WEBCAST AND CONFERENCE CALL INFORMATION

FB Financial Corporation will host a conference call to discuss the Company's financial results on January 16, 2024, at 8:00 a.m. (Central Time). To listen to the call, participants should dial 1-877-883-0383 (confirmation code 1010003) approximately 10 minutes prior to the call. A telephonic replay will be available approximately two hours after the call through January 23, 2024, by dialing 1-877-344-7529 and entering confirmation code 8306498.

A live online broadcast of the Company’s quarterly conference call will be available online at https://event.choruscall.com/mediaframe/webcast.html?webcastid=3uK1Ur6B. An online replay will be available on the Company’s website approximately two hours after the conclusion of the call and will remain available for 12 months.

ABOUT FB FINANCIAL CORPORATION

FB Financial Corporation (NYSE: FBK) is a financial holding company headquartered in Nashville, Tennessee. FB Financial Corporation operates through its wholly owned banking subsidiary, FirstBank with 81 full-service bank branches across Tennessee, Kentucky, Alabama and North Georgia, and mortgage offices across the Southeast. FB Financial Corporation has approximately $12.60 billion in total assets.

| | | | | | | | |

MEDIA CONTACT: | | FINANCIAL CONTACT: |

| | |

| Jeanie M. Rittenberry | | Michael Mettee |

| 615-313-8328 | | 615-564-1212 |

| jrittenberry@firstbankonline.com | | mmettee@firstbankonline.com |

www.firstbankonline.com | | investorrelations@firstbankonline.com |

SUPPLEMENTAL FINANCIAL INFORMATION AND EARNINGS PRESENTATION

Investors are encouraged to review this Earnings Release in conjunction with the Fourth Quarter 2023 Financial Supplement and Earnings Presentation posted on the Company’s website, which can be found at https://investors.firstbankonline.com. This Earnings Release, the Fourth Quarter 2023 Financial Supplement and the Earnings Presentation are also included with a Current Report on Form 8-K that the Company furnished to the U.S. Securities and Exchange Commission (“SEC”) on January 16, 2024.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this Earnings Release that are not historical in nature may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements regarding the Company’s future plans, results, strategies, and expectations, including expectations around changing economic markets. These statements can generally be identified by the use of the words and phrases “may,” “will,” “should,” “could,” “would,” “goal,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” “target,” “aim,” “predict,” “continue,” “seek,” and other variations of such words and phrases and similar expressions. These forward-looking statements are not historical facts, and are based upon management's current expectations, estimates, and projections, many of which, by their nature, are inherently uncertain and beyond the Company’s control. The inclusion of these forward-looking statements should not be regarded as a representation by the Company or any other person that such expectations, estimates, and projections will be achieved. Accordingly, the Company cautions shareholders and investors that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions, and uncertainties that are difficult to predict. Actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements including, without limitation, (1) current and future economic conditions, including the effects of inflation, interest rate fluctuations, changes in the economy or global supply chain, supply-demand imbalances affecting local real estate prices, and high unemployment rates in the local or regional economies in which the Company operates and/or the US economy generally, (2) changes in government interest rate policies and its impact on the Company’s business, net interest margin, and mortgage operations, (3) any continuation of the recent turmoil in the banking industry, including the associated impact to the Company and other financial institutions of any regulatory changes or other mitigation efforts taken by government agencies in response, (4) increased competition for deposits, (5) the Company’s ability to effectively manage problem credits, (6) any deterioration in commercial real estate market fundamentals, (7) the Company’s ability to identify potential candidates for, consummate, and achieve synergies from, potential future acquisitions, (8) the Company’s ability to successfully execute its various business strategies, (9) changes in state and federal legislation, regulations or policies applicable to banks and other

FB Financial Corporation

Fourth Quarter 2023 Results

Page 5

financial service providers, including legislative developments, (10) the effectiveness of the Company’s cybersecurity controls and procedures to prevent and mitigate attempted intrusions, (11) the Company's dependence on information technology systems of third party service providers and the risk of systems failures, interruptions, or breaches of security, and (12) the impact of natural disasters, pandemics, and/or acts of war or terrorism, (13) events giving rise to international or regional political instability, including the broader impacts of such events on financial markets and/or global macroeconomic environments, and (14) general competitive, economic, political, and market conditions. Further information regarding the Company and factors which could affect the forward-looking statements contained herein can be found in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and in any of the Company’s subsequent filings with the SEC. Many of these factors are beyond the Company’s ability to control or predict. If one or more events related to these or other risks or uncertainties materialize, or if the underlying assumptions prove to be incorrect, actual results may differ materially from the forward-looking statements. Accordingly, shareholders and investors should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date of this Earnings Release, and the Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how they will affect the Company.

The Company qualifies all forward-looking statements by these cautionary statements.

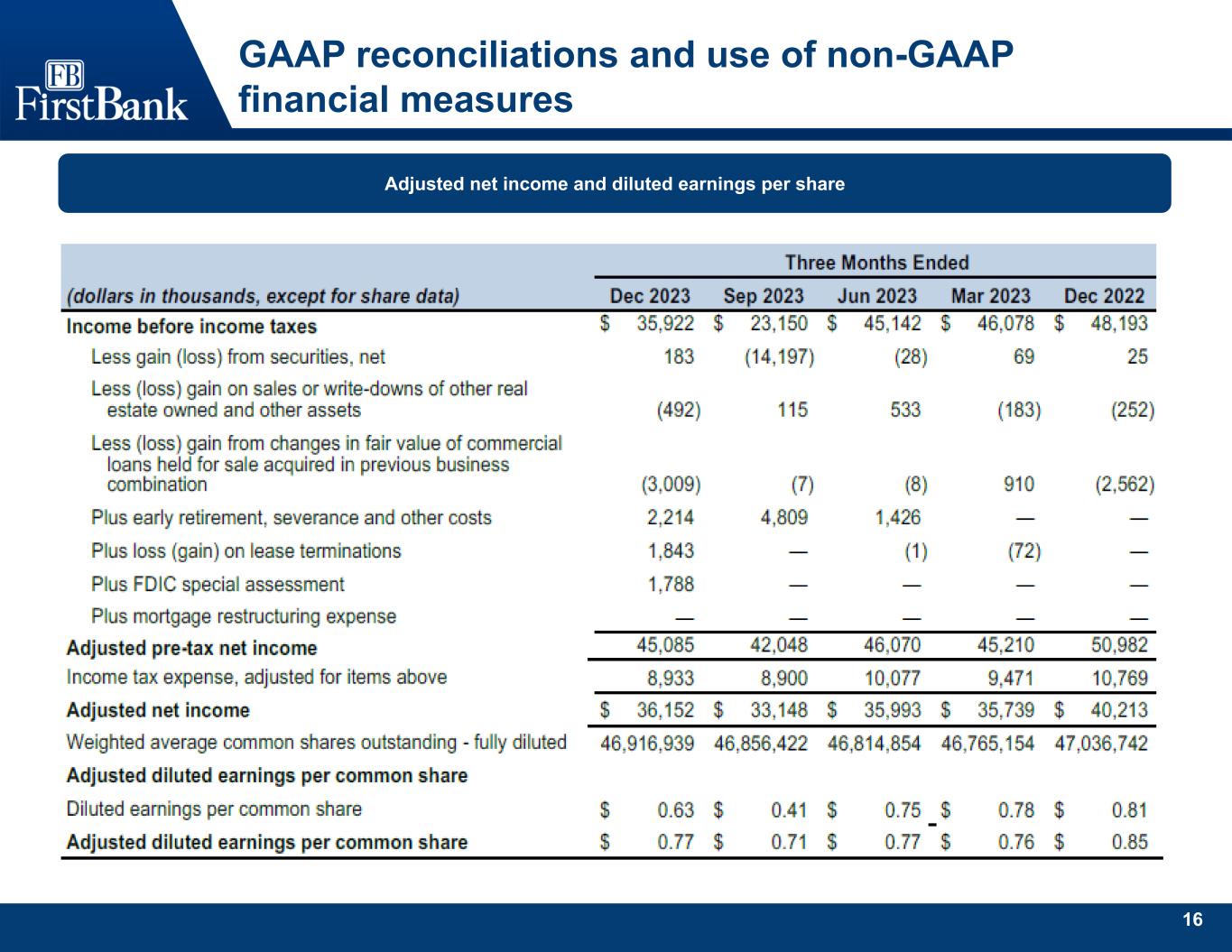

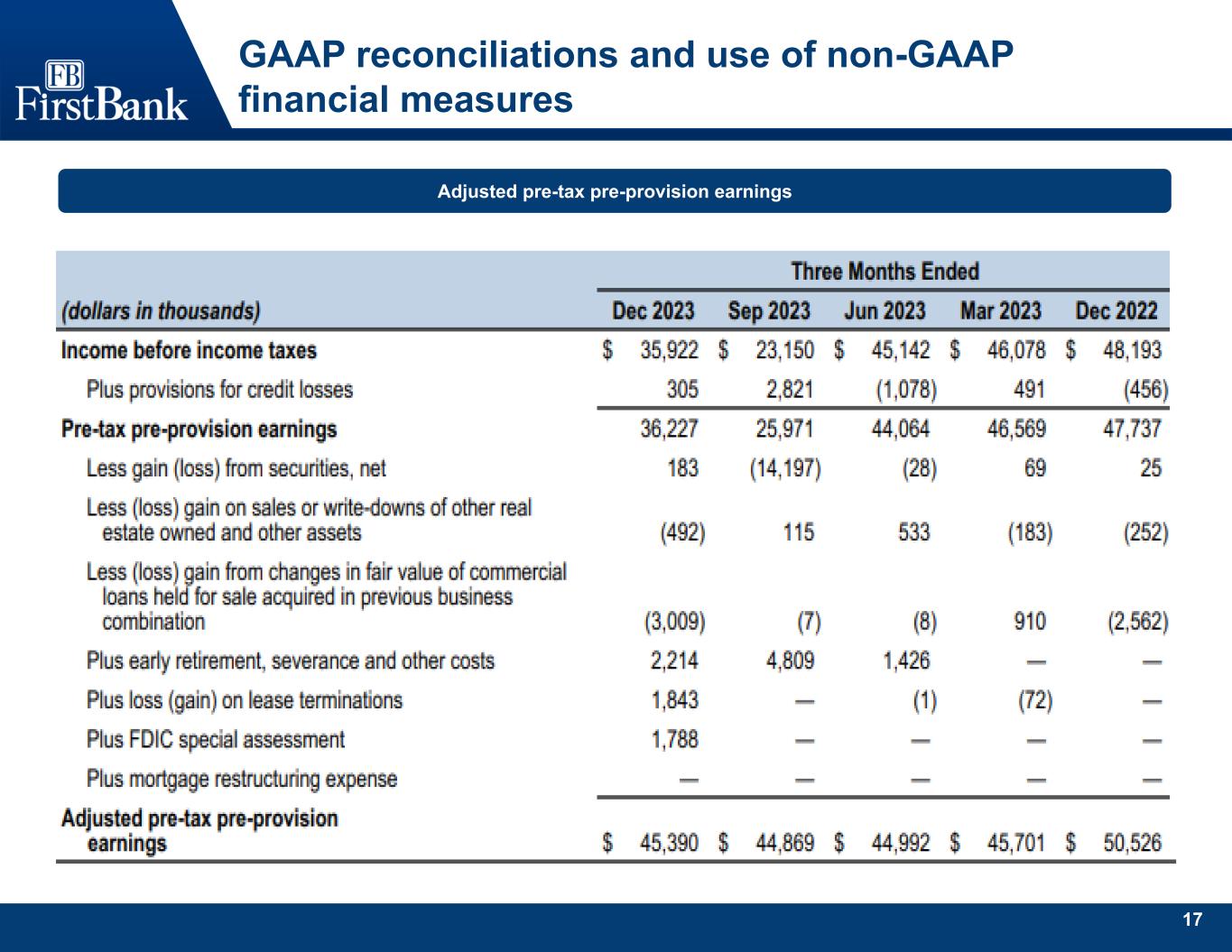

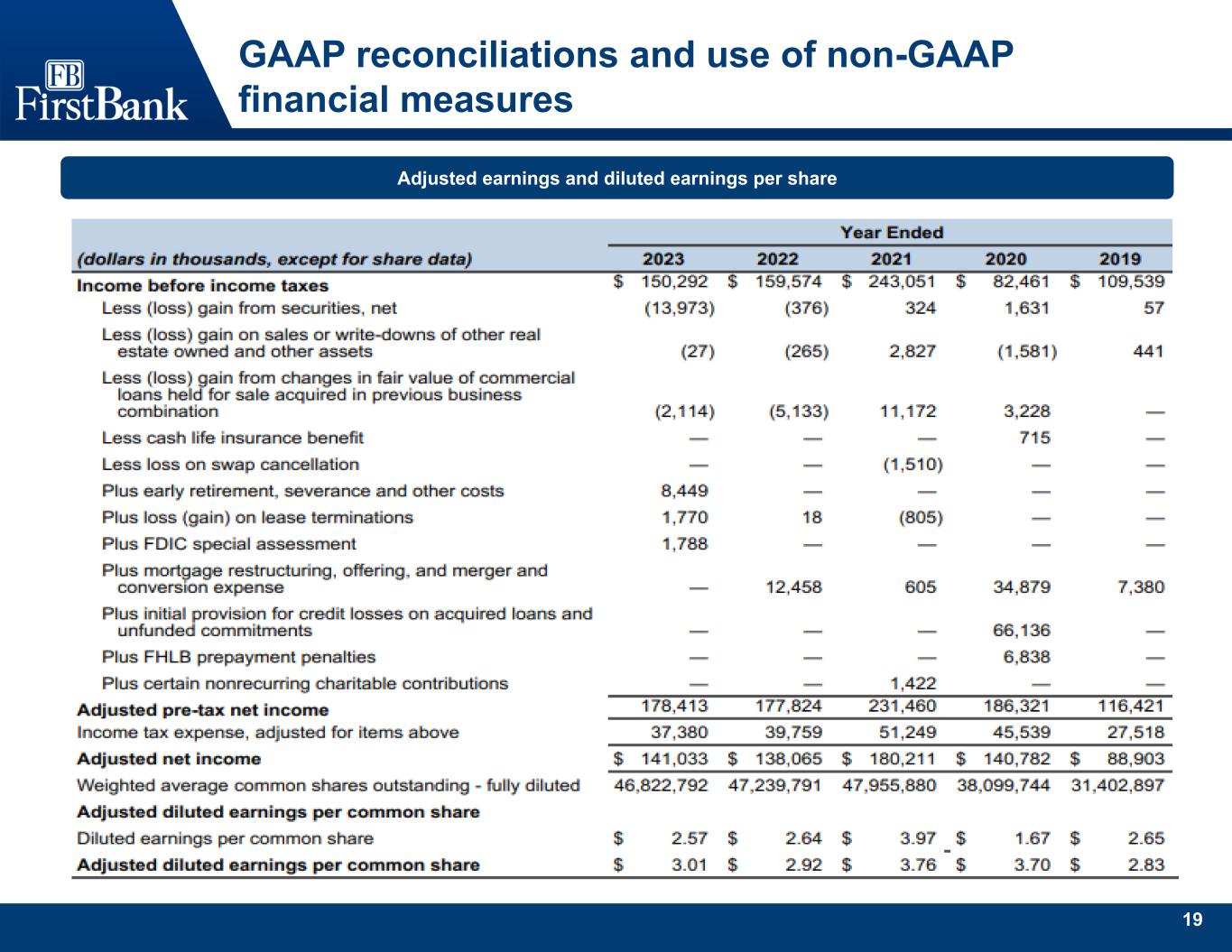

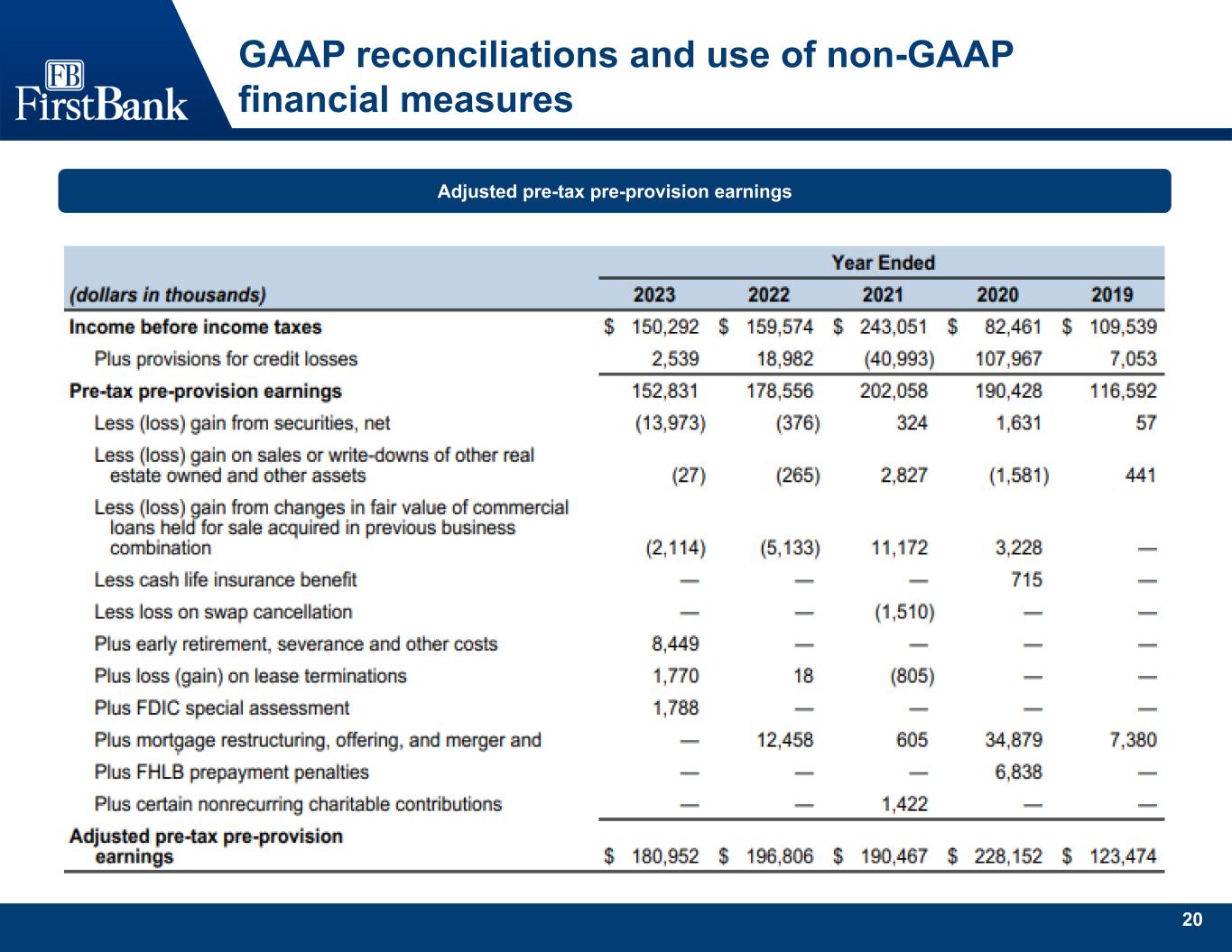

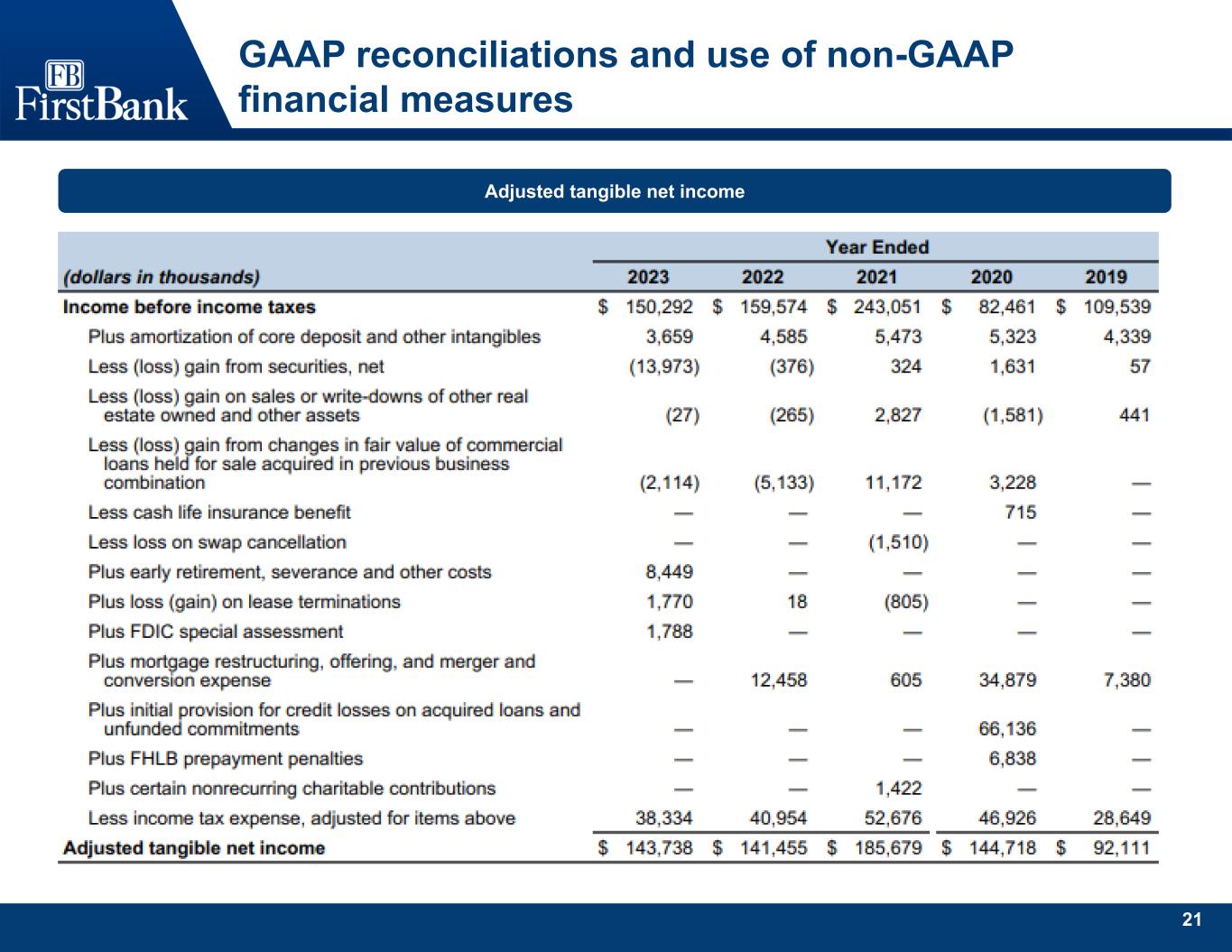

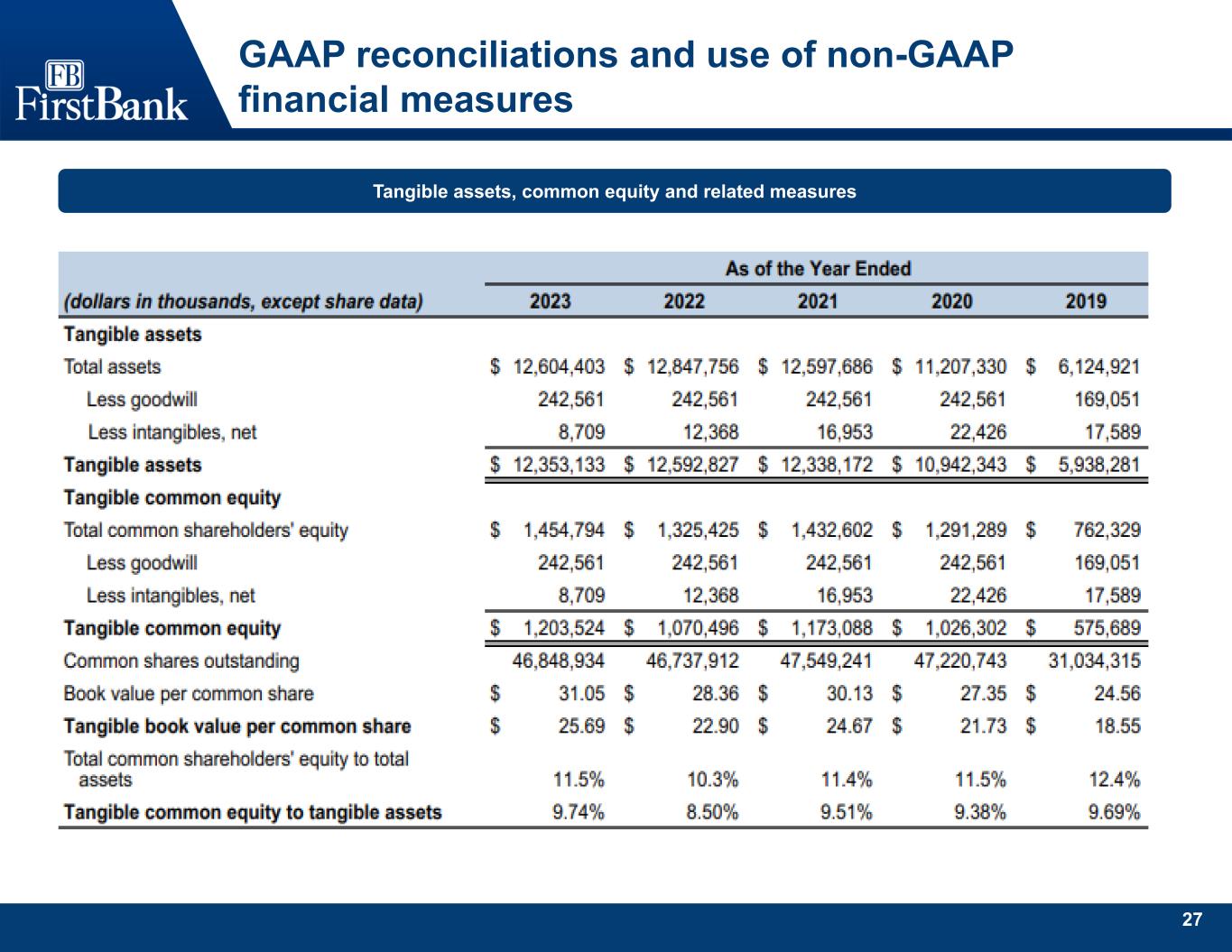

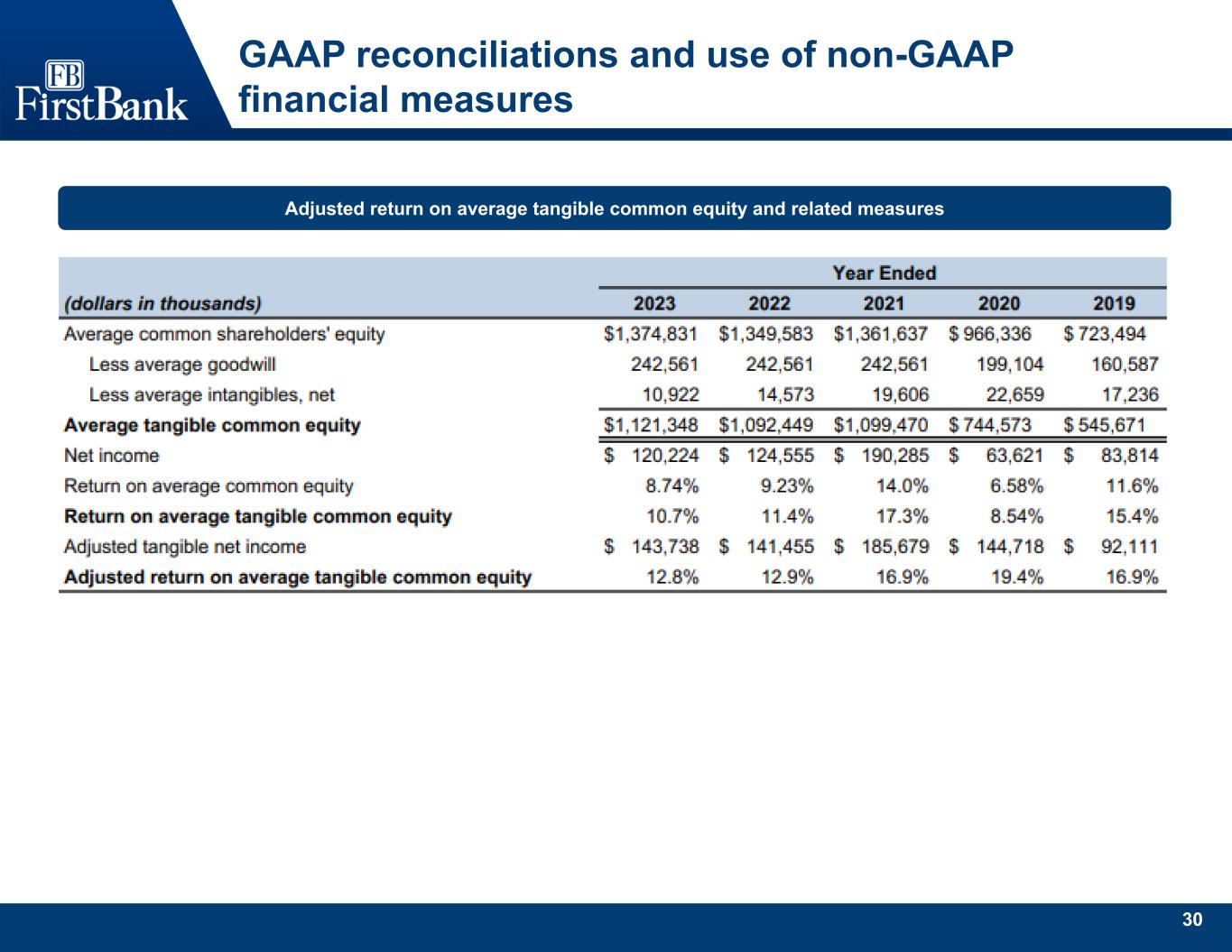

GAAP RECONCILIATION AND USE OF NON-GAAP FINANCIAL MEASURES

This Earnings Release contains certain financial measures that are not measures recognized under U.S. generally accepted accounting principles (“GAAP”) and therefore are considered non-GAAP financial measures. These non-GAAP financial measures may include, without limitation, adjusted net income, adjusted diluted earnings per common share, adjusted and unadjusted pre-tax pre-provision earnings, core revenue, core noninterest expense and core noninterest income, core efficiency ratio (tax equivalent basis), and adjusted return on average assets and equity. Each of these non-GAAP metrics excludes certain income and expense items that the Company’s management considers to be non-core/adjusted in nature. The Company refers to these non-GAAP measures as adjusted (or core) measures. Also, the Company presents tangible assets, tangible common equity, tangible book value per common share, tangible common equity to tangible assets, return on average tangible common equity, and adjusted return on average tangible common equity. Each of these non-GAAP metrics excludes the impact of goodwill and other intangibles.

The Company’s management uses these non-GAAP financial measures in their analysis of the Company’s performance, financial condition and the efficiency of its operations as management believes such measures facilitate period-to-period comparisons and provide meaningful indications of its operating performance as they eliminate both gains and charges that management views as non-recurring or not indicative of operating performance. Management believes that these non-GAAP financial measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods as well as demonstrate the effects of significant non-core gains and charges in the current and prior periods. The Company’s management also believes that investors find these non-GAAP financial measures useful as they assist investors in understanding the Company’s underlying operating performance and in the analysis of ongoing operating trends. In addition, because intangible assets such as goodwill and the other items excluded each vary extensively from company to company, the Company believes that the presentation of this information allows investors to more easily compare the Company’s results to the results of other companies. However, the non-GAAP financial measures discussed herein should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which the Company calculates the non-GAAP financial measures discussed herein may differ from that of other companies reporting measures with similar names. Investors should understand how such other banking organizations calculate their financial measures with names similar to the non-GAAP financial measures the Company has discussed herein when comparing such non-GAAP financial measures.

A reconciliation of these measures to the most directly comparable GAAP financial measures is included in the Company's Fourth Quarter 2023 Financial Supplement, which is available at https://investors.firstbankonline.com.

FB Financial Corporation

Fourth Quarter 2023 Results

Page 6

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Summary and Key Metrics | | | | | | |

| (Unaudited) | | | | | | |

| (dollars in thousands, except share data) | | | | | | |

| | | | | | | | | | | | |

| | As of or for the Three Months Ended | | | | | | |

| | Dec 2023 | | Sep 2023 | | Dec 2022 | | | | | | |

| Selected Statement of Income Data | | | | | | | | | | | | |

| Total interest income | | $ | 174,835 | | | $ | 173,912 | | | $ | 147,598 | | | | | | | |

| Total interest expense | | 73,747 | | | 72,986 | | | 37,100 | | | | | | | |

| Net interest income | | 101,088 | | | 100,926 | | | 110,498 | | | | | | | |

| Total noninterest income | | 15,339 | | | 8,042 | | | 17,469 | | | | | | | |

| Total noninterest expense | | 80,200 | | | 82,997 | | | 80,230 | | | | | | | |

| Earnings before income taxes and provisions for credit losses | | 36,227 | | | 25,971 | | | 47,737 | | | | | | | |

| Provisions for (reversals of) credit losses | | 305 | | | 2,821 | | | (456) | | | | | | | |

| Income tax expense | | 6,545 | | | 3,975 | | | 10,042 | | | | | | | |

| Net income applicable to noncontrolling interest | | 8 | | | — | | | 8 | | | | | | | |

| Net income applicable to FB Financial Corporation | | $ | 29,369 | | | $ | 19,175 | | | $ | 38,143 | | | | | | | |

| Net interest income (tax-equivalent basis) | | $ | 101,924 | | | $ | 101,762 | | | $ | 111,279 | | | | | | | |

| Adjusted net income* | | $ | 36,152 | | | $ | 33,148 | | | $ | 40,213 | | | | | | | |

| Adjusted pre-tax, pre-provision earnings* | | $ | 45,390 | | | $ | 44,869 | | | $ | 50,526 | | | | | | | |

| Per Common Share | | | | | | | | | | | | |

| Diluted net income | | $ | 0.63 | | | $ | 0.41 | | | $ | 0.81 | | | | | | | |

| Adjusted diluted net income* | | 0.77 | | | 0.71 | | | 0.85 | | | | | | | |

| | | | | | | | | | | | |

| Book value | | 31.05 | | | 29.31 | | | 28.36 | | | | | | | |

| Tangible book value* | | 25.69 | | | 23.93 | | | 22.90 | | | | | | | |

| | | | | | | | | | | | |

| Weighted average number of shares outstanding - fully diluted | | 46,916,939 | | | 46,856,422 | | | 47,036,742 | | | | | | | |

| Period-end number of shares | | 46,848,934 | | | 46,839,159 | | | 46,737,912 | | | | | | | |

| Selected Balance Sheet Data | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 810,932 | | | $ | 848,318 | | | $ | 1,027,052 | | | | | | | |

| Loans HFI | | 9,408,783 | | | 9,287,225 | | | 9,298,212 | | | | | | | |

| Allowance for credit losses on loans HFI | | (150,326) | | | (146,134) | | | (134,192) | | | | | | | |

| Allowance for credit losses on unfunded commitments | | (8,770) | | | (11,600) | | | (22,969) | | | | | | | |

| Mortgage loans held for sale | | 67,847 | | | 94,598 | | | 108,961 | | | | | | | |

| Commercial loans held for sale, at fair value | | — | | | 9,260 | | | 30,490 | | | | | | | |

| Investment securities, at fair value | | 1,471,973 | | | 1,351,153 | | | 1,474,176 | | | | | | | |

| | | | | | | | | | | | |

| Total assets | | 12,604,403 | | | 12,489,631 | | | 12,847,756 | | | | | | | |

| | | | | | | | | | | | |

| Interest-bearing deposits (non-brokered) | | 8,179,430 | | | 8,105,713 | | | 8,178,453 | | | | | | | |

| Brokered deposits | | 150,475 | | | 174,920 | | | 750 | | | | | | | |

| Noninterest-bearing deposits | | 2,218,382 | | | 2,358,435 | | | 2,676,631 | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total deposits | | 10,548,287 | | | 10,639,068 | | | 10,855,834 | | | | | | | |

| | | | | | | | | | | | |

| Borrowings | | 390,964 | | | 226,689 | | | 415,677 | | | | | | | |

| Total common shareholders' equity | | 1,454,794 | | | 1,372,901 | | | 1,325,425 | | | | | | | |

| Selected Ratios | | | | | | | | | | | | |

| Return on average: | | | | | | | | | | | | |

| Assets | | 0.94 | % | | 0.61 | % | | 1.22 | % | | | | | | |

| Shareholders' equity | | 8.41 | % | | 5.46 | % | | 11.7 | % | | | | | | |

| Tangible common equity* | | 10.3 | % | | 6.67 | % | | 14.6 | % | | | | | | |

| | | | | | | | | | | | |

| Net interest margin (tax-equivalent basis) | | 3.46 | % | | 3.42 | % | | 3.78 | % | | | | | | |

| Efficiency ratio | | 68.9 | % | | 76.2 | % | | 62.7 | % | | | | | | |

| Core efficiency ratio (tax-equivalent basis)* | | 61.7 | % | | 63.1 | % | | 61.0 | % | | | | | | |

| Loans HFI to deposit ratio | | 89.2 | % | | 87.3 | % | | 85.7 | % | | | | | | |

| | | | | | | | | | | | |

| Noninterest-bearing deposits to total deposits | | 21.0 | % | | 22.2 | % | | 24.7 | % | | | | | | |

| Yield on interest-earning assets | | 5.96 | % | | 5.87 | % | | 5.04 | % | | | | | | |

| Cost of interest-bearing liabilities | | 3.47 | % | | 3.41 | % | | 1.84 | % | | | | | | |

| Cost of total deposits | | 2.65 | % | | 2.58 | % | | 1.20 | % | | | | | | |

| | | | | | | | | | | | |

| Credit Quality Ratios | | | | | | | | | | | | |

| Allowance for credit losses on loans HFI as a percentage of loans HFI | | 1.60 | % | | 1.57 | % | | 1.44 | % | | | | | | |

| | | | | | | | | | | | |

| Net (recoveries) charge-offs as a percentage of average loans HFI | | (0.04) | % | | 0.02 | % | | 0.02 | % | | | | | | |

| Nonperforming loans HFI as a percentage of loans HFI | | 0.65 | % | | 0.59 | % | | 0.49 | % | | | | | | |

Nonperforming assets as a percentage of total assets | | 0.69 | % | | 0.71 | % | | 0.68 | % | | | | | | |

| Preliminary Capital Ratios (consolidated) | | | | | | | | | | | | |

| Total common shareholders' equity to assets | | 11.5 | % | | 11.0 | % | | 10.3 | % | | | | | | |

| Tangible common equity to tangible assets* | | 9.74 | % | | 9.16 | % | | 8.50 | % | | | | | | |

| | | | | | | | | | | | |

Tier 1 risk-based capital | | 12.5 | % | | 12.1 | % | | 11.3 | % | | | | | | |

| | | | | | | | | | | | |

Common equity Tier 1 | | 12.2 | % | | 11.8 | % | | 11.0 | % | | | | | | |

*Non-GAAP financial measure; A reconciliation of each of these non-GAAP measures to the most directly comparable GAAP measure is included in the Company's Fourth Quarter 2023 Financial Supplement.

Fourth Quarter 2023

Financial Supplement

TABLE OF CONTENTS

| | | | | | | | |

| | Page | |

| | | |

| Financial Summary and Key Metrics | | |

| | | |

| Consolidated Statements of Income | | |

| | | |

| Consolidated Balance Sheets | | |

| | |

| Average Balance and Interest Yield/Rate Analysis | | |

| | |

| | |

| | |

| Investments and Other Sources of Liquidity | | |

| | | |

| Loan Portfolio | | |

| | | |

| Asset Quality | | |

| | | |

| Selected Deposit Data | | |

| | |

| Preliminary Capital Ratios | | |

| | | |

| Segment Data | | |

| | | |

| Non-GAAP Reconciliations | | |

Use of non-GAAP Financial Measures

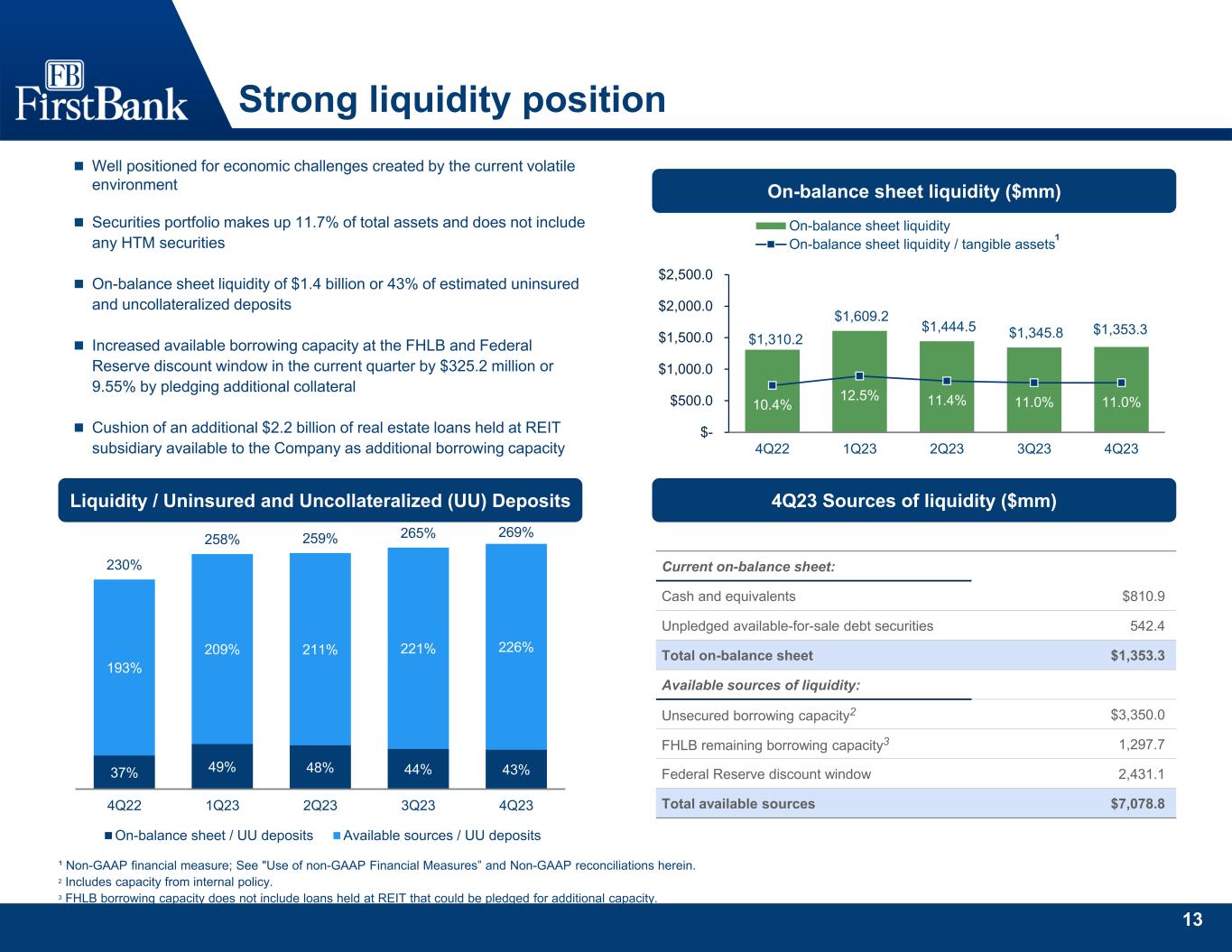

This Financial Supplement contains certain financial measures that are not measures recognized under U.S. generally accepted accounting principles (“GAAP”) and therefore are considered non-GAAP financial measures. These non-GAAP financial measures may include, without limitation, adjusted net income, adjusted diluted earnings per common share, adjusted and unadjusted pre-tax pre-provision earnings, consolidated and segment core revenue, consolidated and segment core noninterest expense and core noninterest income, consolidated and segment core efficiency ratio (tax equivalent basis), adjusted return on average assets and equity, and adjusted pre-tax pre-provision return on average assets. Each of these non-GAAP metrics excludes certain income and expense items that the Company’s management considers to be non-core/adjusted in nature. The Company refers to these non-GAAP measures as adjusted (or core) measures. Also, the Company presents tangible assets, tangible common equity, tangible book value per common share, tangible common equity to tangible assets, on-balance sheet liquidity to tangible assets, return on average tangible common equity, and adjusted return on average tangible common equity. Each of these non-GAAP metrics excludes the impact of goodwill and other intangibles.

The Company’s management uses these non-GAAP financial measures in their analysis of the Company’s performance, financial condition and the efficiency of its operations as management believes such measures facilitate period-to-period comparisons and provide meaningful indications of its operating performance as they eliminate both gains and charges that management views as non-recurring or not indicative of operating performance. Management believes that these non-GAAP financial measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods as well as demonstrate the effects of significant non-core gains and charges in the current and prior periods. The Company’s management also believes that investors find these non-GAAP financial measures useful as they assist investors in understanding the Company’s underlying operating performance and in the analysis of ongoing operating trends. In addition, because intangible assets such as goodwill and the other items excluded each vary extensively from company to company, the Company believes that the presentation of this information allows investors to more easily compare the Company’s results to the results of other companies. However, the non-GAAP financial measures discussed herein should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which the Company calculates the non-GAAP financial measures discussed herein may differ from that of other companies reporting measures with similar names. Investors should understand how such other banking organizations calculate their financial measures with names similar to the non-GAAP financial measures the Company has discussed herein when comparing such non-GAAP financial measures. See the corresponding non-GAAP reconciliation tables below in this Financial Supplement for additional discussion and reconciliation of these measures to the most directly comparable GAAP financial measures.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Summary and Key Metrics | | | | |

| (Unaudited) | | | | |

| (Dollars in Thousands, Except Share Data) | | | | |

| | | | | | | | | | | | | | | | | | |

| | | As of or for the Three Months Ended | | | | | | | |

| | | Dec 2023 | | Sep 2023 | | Jun 2023 | | Mar 2023 | | Dec 2022 | | | | | | | | |

| Selected Statement of Income Data | | | | | | | | | | | | | | | | | | |

| Total interest income | | $ | 174,835 | | | $ | 173,912 | | | $ | 170,183 | | | $ | 159,480 | | | $ | 147,598 | | | | | | | | | |

| Total interest expense | | 73,747 | | | 72,986 | | | 68,640 | | | 55,820 | | | 37,100 | | | | | | | | | |

| Net interest income | | 101,088 | | | 100,926 | | | 101,543 | | | 103,660 | | | 110,498 | | | | | | | | | |

| Total noninterest income | | 15,339 | | | 8,042 | | | 23,813 | | | 23,349 | | | 17,469 | | | | | | | | | |

| Total noninterest expense | | 80,200 | | | 82,997 | | | 81,292 | | | 80,440 | | | 80,230 | | | | | | | | | |

| Earnings before income taxes and provisions for credit losses | | 36,227 | | | 25,971 | | | 44,064 | | | 46,569 | | | 47,737 | | | | | | | | | |

| Provisions for (reversals of) credit losses | | 305 | | | 2,821 | | | (1,078) | | | 491 | | | (456) | | | | | | | | | |

| Income tax expense | | 6,545 | | | 3,975 | | | 9,835 | | | 9,697 | | | 10,042 | | | | | | | | | |

| Net income applicable to noncontrolling interest | | 8 | | | — | | | 8 | | | — | | | 8 | | | | | | | | | |

| Net income applicable to FB Financial Corporation | | $ | 29,369 | | | $ | 19,175 | | | $ | 35,299 | | | $ | 36,381 | | | $ | 38,143 | | | | | | | | | |

| Net interest income (tax-equivalent basis) | | $ | 101,924 | | | $ | 101,762 | | | $ | 102,383 | | | $ | 104,493 | | | $ | 111,279 | | | | | | | | | |

| Adjusted net income* | | $ | 36,152 | | | $ | 33,148 | | | $ | 35,993 | | | $ | 35,739 | | | $ | 40,213 | | | | | | | | | |

| Adjusted pre-tax, pre-provision earnings* | | $ | 45,390 | | | $ | 44,869 | | | $ | 44,992 | | | $ | 45,701 | | | $ | 50,526 | | | | | | | | | |

| Per Common Share | | | | | | | | | | | | | | | | | | |

| Diluted net income | | $ | 0.63 | | | $ | 0.41 | | | $ | 0.75 | | | $ | 0.78 | | | $ | 0.81 | | | | | | | | | |

| Adjusted diluted net income* | | 0.77 | | | 0.71 | | | 0.77 | | | 0.76 | | | 0.85 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Book value | | 31.05 | | | 29.31 | | | 29.64 | | | 29.29 | | | 28.36 | | | | | | | | | |

| Tangible book value* | | 25.69 | | | 23.93 | | | 24.23 | | | 23.86 | | | 22.90 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Weighted average number of shares outstanding - fully diluted | | 46,916,939 | | | 46,856,422 | | | 46,814,854 | | | 46,765,154 | | | 47,036,742 | | | | | | | | | |

| Period-end number of shares | | 46,848,934 | | | 46,839,159 | | | 46,798,751 | | | 46,762,626 | | | 46,737,912 | | | | | | | | | |

| Selected Balance Sheet Data | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 810,932 | | | $ | 848,318 | | | $ | 1,160,354 | | | $ | 1,319,951 | | | $ | 1,027,052 | | | | | | | | | |

| Loans HFI | | 9,408,783 | | | 9,287,225 | | | 9,326,024 | | | 9,365,996 | | | 9,298,212 | | | | | | | | | |

| Allowance for credit losses on loans HFI | | (150,326) | | | (146,134) | | | (140,664) | | | (138,809) | | | (134,192) | | | | | | | | | |

| Allowance for credit losses on unfunded commitments | | (8,770) | | | (11,600) | | | (14,810) | | | (18,463) | | | (22,969) | | | | | | | | | |

| Mortgage loans held for sale | | 67,847 | | | 94,598 | | | 89,864 | | | 73,005 | | | 108,961 | | | | | | | | | |

| Commercial loans held for sale, at fair value | | — | | | 9,260 | | | 9,267 | | | 9,510 | | | 30,490 | | | | | | | | | |

| Investment securities, at fair value | | 1,471,973 | | | 1,351,153 | | | 1,422,391 | | | 1,474,064 | | | 1,474,176 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Total assets | | 12,604,403 | | | 12,489,631 | | | 12,887,395 | | | 13,101,147 | | | 12,847,756 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Interest-bearing deposits (non-brokered) | | 8,179,430 | | | 8,105,713 | | | 8,233,082 | | | 8,693,515 | | | 8,178,453 | | | | | | | | | |

| Brokered deposits | | 150,475 | | | 174,920 | | | 238,885 | | | 251 | | | 750 | | | | | | | | | |

| Noninterest-bearing deposits | | 2,218,382 | | | 2,358,435 | | | 2,400,288 | | | 2,489,149 | | | 2,676,631 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Total deposits | | 10,548,287 | | | 10,639,068 | | | 10,872,255 | | | 11,182,915 | | | 10,855,834 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Borrowings | | 390,964 | | | 226,689 | | | 390,354 | | | 312,131 | | | 415,677 | | | | | | | | | |

| Total common shareholders' equity | | 1,454,794 | | | 1,372,901 | | | 1,386,951 | | | 1,369,696 | | | 1,325,425 | | | | | | | | | |

| Selected Ratios | | | | | | | | | | | | | | | | | | |

| Return on average: | | | | | | | | | | | | | | | | | | |

| Assets | | 0.94 | % | | 0.61 | % | | 1.10 | % | | 1.15 | % | | 1.22 | % | | | | | | | | |

| Shareholders' equity | | 8.41 | % | | 5.46 | % | | 10.3 | % | | 11.0 | % | | 11.7 | % | | | | | | | | |

| Tangible common equity* | | 10.3 | % | | 6.67 | % | | 12.6 | % | | 13.6 | % | | 14.6 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Net interest margin (NIM) (tax-equivalent basis) | | 3.46 | % | | 3.42 | % | | 3.40 | % | | 3.51 | % | | 3.78 | % | | | | | | | | |

| Efficiency ratio | | 68.9 | % | | 76.2 | % | | 64.8 | % | | 63.3 | % | | 62.7 | % | | | | | | | | |

| Core efficiency ratio (tax-equivalent basis)* | | 61.7 | % | | 63.1 | % | | 63.5 | % | | 63.3 | % | | 61.0 | % | | | | | | | | |

| Loans HFI to deposit ratio | | 89.2 | % | | 87.3 | % | | 85.8 | % | | 83.8 | % | | 85.7 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Noninterest-bearing deposits to total deposits | | 21.0 | % | | 22.2 | % | | 22.1 | % | | 22.3 | % | | 24.7 | % | | | | | | | | |

| Yield on interest-earning assets | | 5.96 | % | | 5.87 | % | | 5.67 | % | | 5.38 | % | | 5.04 | % | | | | | | | | |

| Cost of interest-bearing liabilities | | 3.47 | % | | 3.41 | % | | 3.14 | % | | 2.61 | % | | 1.84 | % | | | | | | | | |

| Cost of total deposits | | 2.65 | % | | 2.58 | % | | 2.38 | % | | 1.94 | % | | 1.20 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Credit Quality Ratios | | | | | | | | | | | | | | | | | | |

| Allowance for credit losses on loans HFI as a percentage of loans HFI | | 1.60 | % | | 1.57 | % | | 1.51 | % | | 1.48 | % | | 1.44 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Net (recoveries) charge-offs as a percentage of average loans HFI | | (0.04) | % | | 0.02 | % | | 0.03 | % | | 0.02 | % | | 0.02 | % | | | | | | | | |

| Nonperforming loans HFI as a percentage of loans HFI | | 0.65 | % | | 0.59 | % | | 0.47 | % | | 0.49 | % | | 0.49 | % | | | | | | | | |

| Nonperforming assets as a percentage of total assets | | 0.69 | % | | 0.71 | % | | 0.59 | % | | 0.61 | % | | 0.68 | % | | | | | | | | |

| Preliminary Capital Ratios (consolidated) | | | | | | | | | | | | | | | | | | |

| Total common shareholders' equity to assets | | 11.5 | % | | 11.0 | % | | 10.8 | % | | 10.5 | % | | 10.3 | % | | | | | | | | |

| Tangible common equity to tangible assets* | | 9.74 | % | | 9.16 | % | | 8.98 | % | | 8.68 | % | | 8.50 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Tier 1 risk-based capital | | 12.5 | % | | 12.1 | % | | 11.9 | % | | 11.6 | % | | 11.3 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Common equity Tier 1 | | 12.2 | % | | 11.8 | % | | 11.7 | % | | 11.3 | % | | 11.0 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

*Non-GAAP financial measure; See "Use of non-GAAP Financial Measures" and Non-GAAP reconciliations herein.

| | | | | | | | |

| FB Financial Corporation | | 4 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Statements of Income |

| (Unaudited) |

| (Dollars in Thousands, Except Share Data) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | Dec 2023 | | Dec 2023 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | vs. | | vs. |

| | | Three Months Ended | | | | | | | | | | | | Sep 2023 | | Dec 2022 |

| | Dec 2023 | | Sep 2023 | | Jun 2023 | | Mar 2023 | | Dec 2022 | | | | | | | | | | | | | | | | Percent variance | | Percent variance |

| Interest income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest and fees on loans | | $ | 155,737 | | | $ | 153,882 | | | $ | 149,220 | | | $ | 140,356 | | | $ | 133,180 | | | | | | | | | | | | | | | | | 1.21 | % | | 16.9 | % |

| Interest on securities | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Taxable | | 7,808 | | | 6,399 | | | 6,480 | | | 6,570 | | | 6,707 | | | | | | | | | | | | | | | | | 22.0 | % | | 16.4 | % |

| Tax-exempt | | 1,746 | | | 1,795 | | | 1,808 | | | 1,804 | | | 1,806 | | | | | | | | | | | | | | | | | (2.73) | % | | (3.32) | % |

| Other | | 9,544 | | | 11,836 | | | 12,675 | | | 10,750 | | | 5,905 | | | | | | | | | | | | | | | | | (19.4) | % | | 61.6 | % |

| Total interest income | | 174,835 | | | 173,912 | | | 170,183 | | | 159,480 | | | 147,598 | | | | | | | | | | | | | | | | | 0.53 | % | | 18.5 | % |

| Interest expense: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Deposits | | 70,873 | | | 69,826 | | | 65,257 | | | 52,863 | | | 31,456 | | | | | | | | | | | | | | | | | 1.50 | % | | 125.3 | % |

| Borrowings | | 2,874 | | | 3,160 | | | 3,383 | | | 2,957 | | | 5,644 | | | | | | | | | | | | | | | | | (9.05) | % | | (49.1) | % |

| Total interest expense | | 73,747 | | | 72,986 | | | 68,640 | | | 55,820 | | | 37,100 | | | | | | | | | | | | | | | | | 1.04 | % | | 98.8 | % |

| Net interest income | | 101,088 | | | 100,926 | | | 101,543 | | | 103,660 | | | 110,498 | | | | | | | | | | | | | | | | | 0.16 | % | | (8.52) | % |

| Provision for credit losses on loans HFI | | 3,135 | | | 6,031 | | | 2,575 | | | 4,997 | | | 152 | | | | | | | | | | | | | | | | | (48.0) | % | | NM |

| Reversal of credit losses on unfunded commitments | | (2,830) | | | (3,210) | | | (3,653) | | | (4,506) | | | (608) | | | | | | | | | | | | | | | | | (11.8) | % | | 365.5 | % |

Net interest income after provisions for credit

losses | | 100,783 | | | 98,105 | | | 102,621 | | | 103,169 | | | 110,954 | | | | | | | | | | | | | | | | | 2.73 | % | | (9.17) | % |

| Noninterest income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mortgage banking income | | 8,376 | | | 11,998 | | | 12,232 | | | 12,086 | | | 9,106 | | | | | | | | | | | | | | | | | (30.2) | % | | (8.02) | % |

| Service charges on deposit accounts | | 2,957 | | | 2,959 | | | 3,185 | | | 3,053 | | | 3,019 | | | | | | | | | | | | | | | | | (0.07) | % | | (2.05) | % |

| Investment services and trust income | | 3,093 | | | 3,072 | | | 2,777 | | | 2,378 | | | 2,232 | | | | | | | | | | | | | | | | | 0.68 | % | | 38.6 | % |

| ATM and interchange fees | | 2,618 | | | 2,639 | | | 2,629 | | | 2,396 | | | 2,546 | | | | | | | | | | | | | | | | | (0.80) | % | | 2.83 | % |

| Gain (loss) from securities, net | | 183 | | | (14,197) | | | (28) | | | 69 | | | 25 | | | | | | | | | | | | | | | | | (101.3) | % | | 632.0 | % |

| (Loss) gain on sales or write-downs of other real estate owned and other assets | | (492) | | | 115 | | | 533 | | | (183) | | | (252) | | | | | | | | | | | | | | | | | (527.8) | % | | 95.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other income | | (1,396) | | | 1,456 | | | 2,485 | | | 3,550 | | | 793 | | | | | | | | | | | | | | | | | (195.9) | % | | (276.0) | % |

| Total noninterest income | | 15,339 | | | 8,042 | | | 23,813 | | | 23,349 | | | 17,469 | | | | | | | | | | | | | | | | | 90.7 | % | | (12.2) | % |

| Total revenue | | 116,427 | | | 108,968 | | | 125,356 | | | 127,009 | | | 127,967 | | | | | | | | | | | | | | | | | 6.85 | % | | (9.02) | % |

| Noninterest expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Salaries, commissions and employee benefits | | 48,142 | | | 54,491 | | | 52,020 | | | 48,788 | | | 45,839 | | | | | | | | | | | | | | | | | (11.7) | % | | 5.02 | % |

| Occupancy and equipment expense | | 9,530 | | | 6,428 | | | 6,281 | | | 5,909 | | | 6,295 | | | | | | | | | | | | | | | | | 48.3 | % | | 51.4 | % |

| Legal and professional fees | | 1,823 | | | 1,760 | | | 2,199 | | | 3,108 | | | 4,857 | | | | | | | | | | | | | | | | | 3.58 | % | | (62.5) | % |

| Data processing | | 2,434 | | | 2,338 | | | 2,345 | | | 2,113 | | | 2,096 | | | | | | | | | | | | | | | | | 4.11 | % | | 16.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Advertising | | 2,009 | | | 2,124 | | | 2,001 | | | 2,133 | | | 3,094 | | | | | | | | | | | | | | | | | (5.41) | % | | (35.1) | % |

| Amortization of core deposits and other intangibles | | 840 | | | 889 | | | 940 | | | 990 | | | 1,039 | | | | | | | | | | | | | | | | | (5.51) | % | | (19.2) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other expense | | 15,422 | | | 14,967 | | | 15,506 | | | 17,399 | | | 17,010 | | | | | | | | | | | | | | | | | 3.04 | % | | (9.34) | % |

| Total noninterest expense | | 80,200 | | | 82,997 | | | 81,292 | | | 80,440 | | | 80,230 | | | | | | | | | | | | | | | | | (3.37) | % | | (0.04) | % |

| Income before income taxes | | 35,922 | | | 23,150 | | | 45,142 | | | 46,078 | | | 48,193 | | | | | | | | | | | | | | | | | 55.2 | % | | (25.5) | % |

| Income tax expense | | 6,545 | | | 3,975 | | | 9,835 | | | 9,697 | | | 10,042 | | | | | | | | | | | | | | | | | 64.7 | % | | (34.8) | % |

Net income applicable to FB Financial Corporation and noncontrolling interest | | 29,377 | | | 19,175 | | | 35,307 | | | 36,381 | | | 38,151 | | | | | | | | | | | | | | | | | 53.2 | % | | (23.0) | % |

| Net income applicable to noncontrolling interest | | 8 | | | — | | | 8 | | | — | | | 8 | | | | | | | | | | | | | | | | | 100.0 | % | | — | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income applicable to FB Financial Corporation | | $ | 29,369 | | | $ | 19,175 | | | $ | 35,299 | | | $ | 36,381 | | | $ | 38,143 | | | | | | | | | | | | | | | | | 53.2 | % | | (23.0) | % |

| Weighted average common shares outstanding: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | 46,845,055 | | | 46,818,612 | | | 46,779,388 | | | 46,679,618 | | | 46,909,389 | | | | | | | | | | | | | | | | | 0.06 | % | | (0.14) | % |

| Fully diluted | | 46,916,939 | | | 46,856,422 | | | 46,814,854 | | | 46,765,154 | | | 47,036,742 | | | | | | | | | | | | | | | | | 0.13 | % | | (0.25) | % |

| Earnings per common share: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.63 | | | $ | 0.41 | | | $ | 0.75 | | | $ | 0.78 | | | $ | 0.81 | | | | | | | | | | | | | | | | | 53.7 | % | | (22.2) | % |

| Fully diluted | | 0.63 | | | 0.41 | | | 0.75 | | | 0.78 | | | 0.81 | | | | | | | | | | | | | | | | | 53.7 | % | | (22.2) | % |

| Fully diluted - adjusted* | | 0.77 | | | 0.71 | | | 0.77 | | | 0.76 | | | 0.85 | | | | | | | | | | | | | | | | | 8.45 | % | | (9.41) | % |

*Non-GAAP financial measure; See "Use of non-GAAP Financial Measures" and Non-GAAP reconciliations herein.

NM- Not meaningful

| | | | | | | | |

| FB Financial Corporation | | 5 |

| | | | | | | | | | | | | | | | | | | | |

| Consolidated Statements of Income |

| (Unaudited) |

| (Dollars in Thousands, Except Share Data) |

| | | | | | |

| | | | | | | Dec 2023 |

| | | | | vs. |

| | | For the Year Ended | | Dec 2022 |

| | | Dec 2023 | | Dec 2022 | | Percent variance |

| Interest income: | | | | | | |

| Interest and fees on loans | | $ | 599,195 | | | $ | 436,363 | | | 37.3 | % |

| Interest on securities | | | | | | |

| Taxable | | 27,257 | | | 25,469 | | | 7.02 | % |

| Tax-exempt | | 7,153 | | | 7,332 | | | (2.44) | % |

| Other | | 44,805 | | | 12,258 | | | 265.5 | % |

| Total interest income | | 678,410 | | | 481,422 | | | 40.9 | % |

| Interest expense: | | | | | | |

| Deposits | | 258,819 | | | 56,642 | | | 356.9 | % |

| Borrowings | | 12,374 | | | 12,545 | | | (1.36) | % |

| Total interest expense | | 271,193 | | | 69,187 | | | 292.0 | % |

| Net interest income | | 407,217 | | | 412,235 | | | (1.22) | % |

| Provision for credit losses on loans HFI | | 16,738 | | | 10,393 | | | 61.1 | % |

| (Reversal of) provision for credit losses on unfunded commitments | | (14,199) | | | 8,589 | | | (265.3) | % |

| Net interest income after provisions for credit losses | | 404,678 | | | 393,253 | | | 2.91 | % |

| Noninterest income: | | | | | | |

| Mortgage banking income | | 44,692 | | | 73,580 | | | (39.3) | % |

| Service charges on deposit accounts | | 12,154 | | | 12,049 | | | 0.87 | % |

| Investment services and trust income | | 11,320 | | | 8,866 | | | 27.7 | % |

| ATM and interchange fees | | 10,282 | | | 15,600 | | | (34.1) | % |

| | | | | | |

| Loss from securities, net | | (13,973) | | | (376) | | | NM |

| Loss on sales or write-downs of other real estate owned and other assets | | (27) | | | (265) | | | (89.8) | % |

| | | | | | |

| Other income | | 6,095 | | | 5,213 | | | 16.9 | % |

| Total noninterest income | | 70,543 | | | 114,667 | | | (38.5) | % |

| Total revenue | | 477,760 | | | 526,902 | | | (9.33) | % |

| Noninterest expenses: | | | | | | |

| Salaries, commissions and employee benefits | | 203,441 | | | 211,491 | | | (3.81) | % |

| Occupancy and equipment expense | | 28,148 | | | 23,562 | | | 19.5 | % |

| Legal and professional fees | | 8,890 | | | 15,028 | | | (40.8) | % |

| Data processing | | 9,230 | | | 9,315 | | | (0.91) | % |

| | | | | | |

| Advertising | | 8,267 | | | 11,208 | | | (26.2) | % |

| Amortization of core deposit and other intangibles | | 3,659 | | | 4,585 | | | (20.2) | % |

| Mortgage restructuring expense | | — | | | 12,458 | | | (100.0) | % |

| Other expense | | 63,294 | | | 60,699 | | | 4.28 | % |

| Total noninterest expense | | 324,929 | | | 348,346 | | | (6.72) | % |

| Income before income taxes | | 150,292 | | | 159,574 | | | (5.82) | % |

| Income tax expense | | 30,052 | | | 35,003 | | | (14.1) | % |

| Net income applicable to noncontrolling interest and FB Financial Corporation | | 120,240 | | | 124,571 | | | (3.48) | % |

| Net income applicable to noncontrolling interests | | 16 | | | 16 | | | — | % |

| | | | | | |

| Net income applicable to FB Financial Corporation | | $ | 120,224 | | | $ | 124,555 | | | (3.48) | % |

| Weighted average common shares outstanding: | | | | | | |

| Basic | | 46,781,214 | | | 47,113,470 | | | (0.71) | % |

| Fully diluted | | 46,822,792 | | | 47,239,791 | | | (0.88) | % |

| Earnings per common share: | | | | | | |

| Basic | | $ | 2.57 | | | $ | 2.64 | | | (2.65) | % |

| Fully diluted | | 2.57 | | | 2.64 | | | (2.65) | % |

| Fully diluted - adjusted* | | 3.01 | | | 2.92 | | | 3.08 | % |

*Non-GAAP financial measure; See "Use of non-GAAP Financial Measures" and Non-GAAP reconciliations herein.

NM- Not meaningful

| | | | | | | | |

| FB Financial Corporation | | 6 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Balance Sheets |

| (Unaudited) |

| (Dollars in Thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | Annualized | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | Dec 2023 | | Dec 2023 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | vs. | | vs. |

| | As of | | | | | | | | | | | | Sep 2023 | | Dec 2022 |

| | Dec 2023 | | Sep 2023 | | Jun 2023 | | Mar 2023 | | Dec 2022 | | | | | | | | | | | | | | | | Percent variance | | Percent variance |

| ASSETS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash and due from banks | | $ | 146,542 | | | $ | 188,317 | | | $ | 147,646 | | | $ | 133,874 | | | $ | 259,872 | | | | | | | | | | | | | | | | | (88.0) | % | | (43.6) | % |

Federal funds sold and reverse repurchase agreements | | 83,324 | | | 129,885 | | | 48,346 | | | 63,994 | | | 210,536 | | | | | | | | | | | | | | | | | (142.2) | % | | (60.4) | % |

| Interest-bearing deposits in financial institutions | | 581,066 | | | 530,116 | | | 964,362 | | | 1,122,083 | | | 556,644 | | | | | | | | | | | | | | | | | 38.1 | % | | 4.39 | % |

| Cash and cash equivalents | | 810,932 | | | 848,318 | | | 1,160,354 | | | 1,319,951 | | | 1,027,052 | | | | | | | | | | | | | | | | | (17.5) | % | | (21.0) | % |

| Investments: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Available-for-sale debt securities, at fair value | | 1,471,973 | | | 1,348,219 | | | 1,419,360 | | | 1,471,005 | | | 1,471,186 | | | | | | | | | | | | | | | | | 36.4 | % | | 0.05 | % |

| Equity securities, at fair value | | — | | | 2,934 | | | 3,031 | | | 3,059 | | | 2,990 | | | | | | | | | | | | | | | | | (100.0) | % | | (100.00) | % |

| Federal Home Loan Bank stock, at cost | | 34,190 | | | 34,809 | | | 40,266 | | | 43,369 | | | 58,641 | | | | | | | | | | | | | | | | | (7.06) | % | | (41.7) | % |

| Mortgage loans held for sale | | 67,847 | | | 94,598 | | | 89,864 | | | 73,005 | | | 108,961 | | | | | | | | | | | | | | | | | (112.2) | % | | (37.7) | % |

| Commercial loans held for sale, at fair value | | — | | | 9,260 | | | 9,267 | | | 9,510 | | | 30,490 | | | | | | | | | | | | | | | | | (100.0) | % | | (100.0) | % |

| Loans held for investment | | 9,408,783 | | | 9,287,225 | | | 9,326,024 | | | 9,365,996 | | | 9,298,212 | | | | | | | | | | | | | | | | | 5.19 | % | | 1.19 | % |

| Less: allowance for credit losses on loans HFI | | 150,326 | | | 146,134 | | | 140,664 | | | 138,809 | | | 134,192 | | | | | | | | | | | | | | | | | 11.4 | % | | 12.0 | % |

| Net loans held for investment | | 9,258,457 | | | 9,141,091 | | | 9,185,360 | | | 9,227,187 | | | 9,164,020 | | | | | | | | | | | | | | | | | 5.09 | % | | 1.03 | % |

| Premises and equipment, net | | 155,731 | | | 156,081 | | | 154,526 | | | 153,397 | | | 146,316 | | | | | | | | | | | | | | | | | (0.89) | % | | 6.43 | % |

| Other real estate owned, net | | 3,192 | | | 1,504 | | | 1,974 | | | 4,085 | | | 5,794 | | | | | | | | | | | | | | | | | 445.3 | % | | (44.9) | % |

| Operating lease right-of-use assets | | 54,295 | | | 56,240 | | | 56,560 | | | 57,054 | | | 60,043 | | | | | | | | | | | | | | | | | (13.7) | % | | (9.57) | % |

| Interest receivable | | 52,715 | | | 49,205 | | | 44,973 | | | 44,737 | | | 45,684 | | | | | | | | | | | | | | | | | 28.3 | % | | 15.4 | % |

| Mortgage servicing rights, at fair value | | 164,249 | | | 172,710 | | | 166,433 | | | 164,879 | | | 168,365 | | | | | | | | | | | | | | | | | (19.4) | % | | (2.44) | % |

| Goodwill | | 242,561 | | | 242,561 | | | 242,561 | | | 242,561 | | | 242,561 | | | | | | | | | | | | | | | | | — | % | | — | % |

| Core deposit and other intangibles, net | | 8,709 | | | 9,549 | | | 10,438 | | | 11,378 | | | 12,368 | | | | | | | | | | | | | | | | | (34.9) | % | | (29.6) | % |

| Bank-owned life insurance | | 76,143 | | | 75,739 | | | 75,341 | | | 74,963 | | | 75,329 | | | | | | | | | | | | | | | | | 2.12 | % | | 1.08 | % |

| Other assets | | 203,409 | | | 246,813 | | | 227,087 | | | 201,007 | | | 227,956 | | | | | | | | | | | | | | | | | (69.8) | % | | (10.8) | % |

| Total assets | | $ | 12,604,403 | | | $ | 12,489,631 | | | $ | 12,887,395 | | | $ | 13,101,147 | | | $ | 12,847,756 | | | | | | | | | | | | | | | | | 3.65 | % | | (1.89) | % |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Deposits | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest-bearing | | $ | 2,218,382 | | | $ | 2,358,435 | | | $ | 2,400,288 | | | $ | 2,489,149 | | | $ | 2,676,631 | | | | | | | | | | | | | | | | | (23.6) | % | | (17.1) | % |

| Interest-bearing checking | | 2,504,421 | | | 2,554,641 | | | 2,879,336 | | | 3,292,883 | | | 3,059,984 | | | | | | | | | | | | | | | | | (7.80) | % | | (18.2) | % |

| Money market and savings | | 4,204,851 | | | 4,119,357 | | | 3,971,975 | | | 3,904,013 | | | 3,697,245 | | | | | | | | | | | | | | | | | 8.23 | % | | 13.7 | % |

| Customer time deposits | | 1,469,811 | | | 1,431,119 | | | 1,381,176 | | | 1,496,024 | | | 1,420,131 | | | | | | | | | | | | | | | | | 10.7 | % | | 3.50 | % |

| Brokered and internet time deposits | | 150,822 | | | 175,516 | | | 239,480 | | | 846 | | | 1,843 | | | | | | | | | | | | | | | | | (55.8) | % | | NM |

| Total deposits | | 10,548,287 | | | 10,639,068 | | | 10,872,255 | | | 11,182,915 | | | 10,855,834 | | | | | | | | | | | | | | | | | (3.39) | % | | (2.83) | % |

| Borrowings | | 390,964 | | | 226,689 | | | 390,354 | | | 312,131 | | | 415,677 | | | | | | | | | | | | | | | | | 287.5 | % | | (5.95) | % |

| Operating lease liabilities | | 67,643 | | | 67,542 | | | 67,304 | | | 67,345 | | | 69,754 | | | | | | | | | | | | | | | | | 0.59 | % | | (3.03) | % |

| Accrued expenses and other liabilities | | 142,622 | | | 183,338 | | | 170,438 | | | 168,967 | | | 180,973 | | | | | | | | | | | | | | | | | (88.1) | % | | (21.2) | % |

| Total liabilities | | 11,149,516 | | | 11,116,637 | | | 11,500,351 | | | 11,731,358 | | | 11,522,238 | | | | | | | | | | | | | | | | | 1.17 | % | | (3.23) | % |

| Shareholders' equity: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common stock, $1 par value | | 46,849 | | | 46,839 | | | 46,799 | | | 46,763 | | | 46,738 | | | | | | | | | | | | | | | | | 0.08 | % | | 0.24 | % |

| Additional paid-in capital | | 864,258 | | | 862,340 | | | 859,516 | | | 856,628 | | | 861,588 | | | | | | | | | | | | | | | | | 0.88 | % | | 0.31 | % |

| Retained earnings | | 678,412 | | | 656,120 | | | 644,043 | | | 615,871 | | | 586,532 | | | | | | | | | | | | | | | | | 13.5 | % | | 15.7 | % |

| Accumulated other comprehensive loss, net | | (134,725) | | | (192,398) | | | (163,407) | | | (149,566) | | | (169,433) | | | | | | | | | | | | | | | | | (118.9) | % | | (20.5) | % |

| Total common shareholders' equity | | 1,454,794 | | | 1,372,901 | | | 1,386,951 | | | 1,369,696 | | | 1,325,425 | | | | | | | | | | | | | | | | | 23.7 | % | | 9.76 | % |

| Noncontrolling interest | | 93 | | | 93 | | | 93 | | | 93 | | | 93 | | | | | | | | | | | | | | | | | — | % | | — | % |

| Total equity | | 1,454,887 | | | 1,372,994 | | | 1,387,044 | | | 1,369,789 | | | 1,325,518 | | | | | | | | | | | | | | | | | 23.7 | % | | 9.76 | % |

| Total liabilities and shareholders' equity | | $ | 12,604,403 | | | $ | 12,489,631 | | | $ | 12,887,395 | | | $ | 13,101,147 | | | $ | 12,847,756 | | | | | | | | | | | | | | | | | 3.65 | % | | (1.89) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

NM- Not meaningful

| | | | | | | | |

| FB Financial Corporation | | 7 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Balance and Interest Yield/Rate Analysis |

|

| (Unaudited) |

(Dollars in Thousands) |

| | | | | | | | | | | | |

| | | Three Months Ended |

| | | December 31, 2023 | | September 30, 2023 |

| | | Average

balances | | Interest

income/

expense | | Average

yield/

rate | | Average

balances | | Interest

income/

expense | | Average

yield/

rate |

| Interest-earning assets: | | | | | | | | | | | | |

Loans HFI(a)(b) | | $ | 9,330,176 | | | $ | 155,081 | | | 6.59 | % | | $ | 9,280,530 | | | $ | 153,038 | | | 6.54 | % |

| Mortgage loans held for sale | | 47,293 | | | 877 | | | 7.36 | % | | 60,291 | | | 1,047 | | | 6.89 | % |

| Commercial loans held for sale | | 7,281 | | | — | | | — | % | | 9,259 | | | — | | | — | % |

| Securities: | | | | | | | | | | | | |

| Taxable | | 1,361,987 | | | 7,808 | | | 2.27 | % | | 1,344,052 | | | 6,399 | | | 1.89 | % |

Tax-exempt(b) | | 283,395 | | | 2,361 | | | 3.31 | % | | 291,863 | | | 2,428 | | | 3.30 | % |

Total securities(b) | | 1,645,382 | | | 10,169 | | | 2.45 | % | | 1,635,915 | | | 8,827 | | | 2.14 | % |

| Federal funds sold and reverse repurchase agreements | | 107,276 | | | 1,518 | | | 5.61 | % | | 95,326 | | | 1,375 | | | 5.72 | % |

| Interest-bearing deposits with other financial institutions | | 525,763 | | | 7,195 | | | 5.43 | % | | 696,600 | | | 9,620 | | | 5.48 | % |

| FHLB stock | | 34,556 | | | 831 | | | 9.54 | % | | 36,624 | | | 841 | | | 9.11 | % |

Total interest-earning assets(b) | | 11,697,727 | | | 175,671 | | | 5.96 | % | | 11,814,545 | | | 174,748 | | | 5.87 | % |

| Noninterest-earning assets: | | | | | | | | | | | | |

| Cash and due from banks | | 127,715 | | | | | | | 128,780 | | | | | |

| Allowance for credit losses on loans HFI | | (147,035) | | | | | | | (140,033) | | | | | |

Other assets(c)(d) | | 756,168 | | | | | | | 753,866 | | | | | |

| Total noninterest-earning assets | | 736,848 | | | | | | | 742,613 | | | | | |

| Total assets | | $ | 12,434,575 | | | | | | | $ | 12,557,158 | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | |

| Interest-bearing deposits: | | | | | | | | | | | | |

| Interest-bearing checking | | $ | 2,500,139 | | | $ | 18,444 | | | 2.93 | % | | $ | 2,668,970 | | | $ | 20,506 | | | 3.05 | % |

| Money market | | 3,761,500 | | | 36,740 | | | 3.88 | % | | 3,661,262 | | | 34,902 | | | 3.78 | % |

| Savings deposits | | 388,296 | | | 67 | | | 0.07 | % | | 410,403 | | | 65 | | | 0.06 | % |

| Customer time deposits | | 1,447,094 | | | 13,463 | | | 3.69 | % | | 1,400,290 | | | 11,909 | | | 3.37 | % |

| Brokered and internet time deposits | | 162,317 | | | 2,159 | | | 5.28 | % | | 182,652 | | | 2,444 | | | 5.31 | % |

| Time deposits | | 1,609,411 | | | 15,622 | | | 3.85 | % | | 1,582,942 | | | 14,353 | | | 3.60 | % |

| Total interest-bearing deposits | | 8,259,346 | | | 70,873 | | | 3.40 | % | | 8,323,577 | | | 69,826 | | | 3.33 | % |

| Other interest-bearing liabilities: | | | | | | | | | | | | |

| Securities sold under agreements to repurchase and federal funds purchased | | 31,673 | | | 177 | | | 2.22 | % | | 30,520 | | | 349 | | | 4.54 | % |

| Federal Home Loan Bank advances | | — | | | — | | | — | % | | 13,859 | | | 204 | | | 5.84 | % |

| Subordinated debt | | 128,621 | | | 2,604 | | | 8.03 | % | | 127,605 | | | 2,600 | | | 8.08 | % |

| Other borrowings | | 8,407 | | | 93 | | | 4.39 | % | | 1,365 | | | 7 | | | 2.03 | % |

| Total other interest-bearing liabilities | | 168,701 | | | 2,874 | | | 6.76 | % | | 173,349 | | | 3,160 | | | 7.23 | % |

| Total interest-bearing liabilities | | 8,428,047 | | | 73,747 | | | 3.47 | % | | 8,496,926 | | | 72,986 | | | 3.41 | % |

| Noninterest-bearing liabilities: | | | | | | | | | | | | |

| Demand deposits | | 2,341,627 | | | | | | | 2,410,280 | | | | | |

Other liabilities(d) | | 279,435 | | | | | | | 256,606 | | | | | |

| Total noninterest-bearing liabilities | | 2,621,062 | | | | | | | 2,666,886 | | | | | |

| Total liabilities | | 11,049,109 | | | | | | | 11,163,812 | | | | | |

| Total common shareholders' equity | | 1,385,373 | | | | | | | 1,393,253 | | | | | |

| Noncontrolling interest | | 93 | | | | | | | 93 | | | | | |

| Total equity | | 1,385,466 | | | | | | | 1,393,346 | | | | | |

| Total liabilities and shareholders' equity | | $ | 12,434,575 | | | | | | | $ | 12,557,158 | | | | | |

Net interest income(b) | | | | $ | 101,924 | | | | | | | $ | 101,762 | | | |

Interest rate spread(b) | | | | | | 2.49 | % | | | | | | 2.46 | % |

Net interest margin(b)(e) | | | | | | 3.46 | % | | | | | | 3.42 | % |

| Cost of total deposits | | | | | | 2.65 | % | | | | | | 2.58 | % |

| Average interest-earning assets to average interest-bearing liabilities | | | | | | 138.8 | % | | | | | | 139.0 | % |

| Tax-equivalent adjustment | | | | $ | 836 | | | | | | | $ | 836 | | | |

| Loans HFI yield components: | | | | | | | | | | | | |

Contractual interest rate(b) | | | | $ | 151,193 | | | 6.43 | % | | | | $ | 147,806 | | | 6.32 | % |

| Origination and other loan fee income | | | | 3,322 | | | 0.14 | % | | | | 4,345 | | | 0.19 | % |

| Accretion on purchased loans | | | | 77 | | | — | % | | | | 312 | | | 0.01 | % |

| Nonaccrual interest | | | | 489 | | | 0.02 | % | | | | 575 | | | 0.02 | % |

| | | | | | | | | | | | |

| Total loans HFI yield | | | | $ | 155,081 | | | 6.59 | % | | | | $ | 153,038 | | | 6.54 | % |

(a) Average balances of nonaccrual loans and overdrafts are included in average loan balances.

(b) Includes tax-equivalent adjustment using combined marginal tax rate of 26.06%.

(c) Includes average net unrealized losses on investment securities available for sale of $258,265 and $232,613 for the three months ended December 31, 2023 and September 30, 2023, respectively.

(d) Includes average of optional rights to repurchase government guaranteed GNMA mortgage loans previously sold that have become past due greater than 90 days of $21,072 and $19,080 for the three months ended December 31, 2023 and September 30, 2023, respectively.

(e)The NIM is calculated by dividing annualized net interest income, on a tax-equivalent basis, by average total interest earning assets.

| | | | | | | | |

| FB Financial Corporation | | 8 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Balance and Interest Yield/Rate Analysis (continued) | | | | | | |

|

| (Unaudited) |

(Dollars in Thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | |

| | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 | | | |

| | | Average

balances | | Interest

income/

expense | | Average

yield/

rate | | Average

balances | | Interest

income/

expense | | Average

yield/

rate | | Average

balances | | Interest

income/

expense | | Average

yield/

rate | | | | | | | | | | | |

| Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loans HFI(a)(b) | | $ | 9,387,284 | | | $ | 148,415 | | | 6.34 | % | | $ | 9,346,708 | | | $ | 139,467 | | | 6.05 | % | | $ | 9,250,859 | | | $ | 132,171 | | | 5.67 | % | | | | | | | | | | | |