Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

11 Mai 2022 - 7:14PM

Edgar (US Regulatory)

Filed pursuant to Rule 424(b)(3)

1933 Act File No. 333-237586

PROSPECTUS SUPPLEMENT dated May 11, 2022

(to Prospectus dated May 29, 2020, as supplemented from time to time)

EAGLE POINT CREDIT COMPANY INC.

$125,000,000 of Common Stock

Up to 1,900,000 Shares of 6.50% Series C

Term Preferred Stock due 2031

Liquidation Preference $25 per share

Up to 2,500,000 Shares of 6.75% Series D

Preferred Stock

Liquidation Preference $25 per share

This prospectus supplement

supplements the prospectus supplements dated March 11, 2022, or the “March Supplement,” and December 20, 2021, or the “December

Supplement,” and, together with the March Supplement, the “Supplements,” and the accompanying prospectus thereto dated

May 29, 2020, or the “Base Prospectus.” The Base Prospectus and Supplements, and all supplements to or documents incorporated

by reference into the Base Prospectus and Supplements, are collectively referred to as the “Prospectus.” The Prospectus relates

to the offering of (1) $125,000,000 aggregate amount of our common stock, par value $0.001 per share, or the “common stock,”

(2) up to 1,900,000 shares of our 6.50% Series C Term Preferred Stock due 2031, or the “Series C Term Preferred Stock,” with

an aggregate liquidation preference of $47,500,000, and (3) up to 2,500,000 shares of our 6.75% Series D Preferred Stock, or the “Series

D Preferred Stock” and, together with the Series C Term Preferred Stock, the “Preferred Stock,” with an aggregate liquidation

preference of $62,500,0000, pursuant to the second amended and restated at market issuance sales agreement, dated December 20, 2021, with

B. Riley Securities, Inc. This prospectus supplement provides certain updated financial information for the Company as of April 30, 2022.

Investing in our securities

involves a high degree of risk, including the risk of a substantial loss of investment. Before purchasing any shares of our common stock

or Preferred Stock, you should read the discussion of the principal risks of investing in our securities, which are summarized in “Risk

Factors” beginning on page S-26 of the December Supplement and page 20 of the Base Prospectus.

The terms “we,”

“us” and “our” refer to Eagle Point Credit Company Inc., a Delaware corporation, and its consolidated subsidiaries.

UPDATED FINANCIAL INFORMATION

Management’s unaudited estimate of the range

of the net asset value per share of our common stock as of April 30, 2022 was between $12.44 and $12.54.

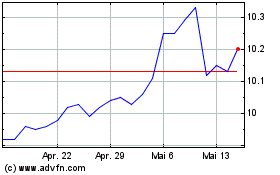

Eagle Point Credit (NYSE:ECC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

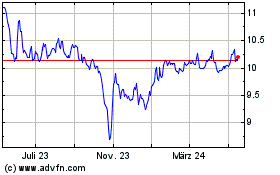

Eagle Point Credit (NYSE:ECC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024