Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

11 März 2022 - 10:19PM

Edgar (US Regulatory)

Filed pursuant to Rule 424(b)(3)

1933 Act File No. 333-237586

PROSPECTUS SUPPLEMENT dated March 11, 2022

(to Prospectus dated May 29, 2020, as supplemented from time to time)

EAGLE POINT CREDIT COMPANY INC.

$125,000,000 of Common Stock

Up to 1,900,000 Shares of 6.50% Series C Term Preferred Stock due 2031

Liquidation Preference $25 per share

Up to 2,500,000 Shares of 6.75% Series D Preferred Stock

Liquidation Preference $25 per share

This prospectus supplement

supplements the prospectus supplement dated December 20, 2021, or the “December Supplement,” and the accompanying prospectus

thereto dated May 29, 2020, or the “Base Prospectus.” The Base Prospectus and December Supplement, and all supplements to

or documents incorporated by reference into the Base Prospectus and December Supplement, are collectively referred to as the “Prospectus.”

The Prospectus relates to the offering of (1) $125,000,000 aggregate amount of our common stock, par value $0.001 per share, or the “common

stock,” (2) up to 1,900,000 shares of our 6.50% Series C Term Preferred Stock due 2031, or the “Series C Term Preferred Stock,”

with an aggregate liquidation preference of $47,500,000, and (3) up to 2,500,000 shares of our 6.75% Series D Preferred Stock, or the

“Series D Preferred Stock” and, together with the Series C Term Preferred Stock, the “Preferred Stock,” with an

aggregate liquidation preference of $62,500,0000, pursuant to the second amended and restated at market issuance sales agreement, dated

December 20, 2021, with B. Riley Securities, Inc. This prospectus supplement provides certain updated financial information for the Company

as of February 28, 2022.

Investing in our securities

involves a high degree of risk, including the risk of a substantial loss of investment. Before purchasing any shares of our common stock

or Preferred Stock, you should read the discussion of the principal risks of investing in our securities, which are summarized in “Risk

Factors” beginning on page S-26 of the December Supplement and page 20 of the Base Prospectus.

The terms “we,”

“us” and “our” refer to Eagle Point Credit Company Inc., a Delaware corporation, and its consolidated subsidiaries.

UPDATED FINANCIAL INFORMATION

Management’s unaudited estimate of the range

of the net asset value per share of our common stock as of February 28, 2022 was between $12.43 and $12.53.

ADDITIONAL RISK FACTOR

Risks Related to Russia’s Invasion

of Ukraine. Russia’s recent military incursion into Ukraine, the response of the United States and other countries, and

the potential for wider conflict, has increased volatility and uncertainty in the financial markets and may adversely affect the Company.

Immediately following Russia’s invasion, the United States and other countries imposed wide-ranging economic sanctions on Russia,

individual Russian citizens, and Russian banking entities and other businesses, including those in the energy sector. These unprecedented

sanctions have been highly disruptive to the Russian economy and, given the interconnectedness of today’s global economy, could

have broad and unforeseen macroeconomic implications. The ultimate nature, extent and duration of Russia’s military actions (including

the potential for cyberattacks and espionage), and the response of state governments and businesses, cannot be predicted at this time.

However, further escalation of the conflict could result in significant market disruptions, and negatively affect global supply chains,

inflation and global growth. These and any related events could negatively impact the performance of the Company’s underlying

obligors and/or the market value of our common shares or preferred stock.

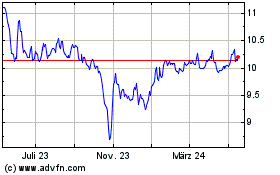

Eagle Point Credit (NYSE:ECC)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

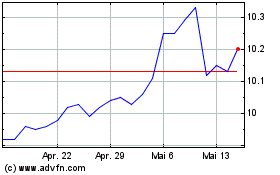

Eagle Point Credit (NYSE:ECC)

Historical Stock Chart

Von Jan 2024 bis Jan 2025