Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

30 Oktober 2013 - 5:11PM

Edgar (US Regulatory)

Filed pursuant to Rule 433

Registration Statement No. 333-180300-03

October 23, 2013

Email not displaying correctly? View as

webpage

.

Investors have long sought access to hedge fund strategies, but with the high cost of and barriers to entry, not many investors were able to access these investment vehicles. However, recent advancements have allowed product providers to repackage some

of these strategies in a rules-based, transparent wrapper that has made this once exclusive investment opportunity more widely available. How are exchange-traded product providers able to do this and is now the time to consider these strategies as part

of your clients’ portfolios?

Join IndexUniverse and Credit Suisse as we take a deep dive into the world of index-based alternative investment strategies. This 60-minute webinar will focus on various alternative beta strategies and how they are packaged as ETPs. Topics to be covered

include how these products are constructed and why they might make sense for today’s investor. Additional topics to be covered include:

|

•

|

|

Alternative beta strategies: how and why they work and how they may be effective tools

in a portfolio

|

|

•

|

|

The various types of replication strategies

|

|

•

|

|

ETN vs. ETF: why the wrapper matters

|

Credit Suisse AG (“Credit Suisse”) has filed a registration statement (including prospectus supplement and prospectus) with the Securities and Exchange Commission, or SEC, for the offering of securities.

Before you invest, you should read the applicable pricing supplement, the Prospectus Supplement dated March 23, 2012, and Prospectus dated March 23, 2012, to understand fully the terms of the ETNs and other considerations that are important in making a

decision about investing in the ETNs. You may get these documents without cost by visiting EDGAR on the SEC website at

www.sec.gov

. Alternatively, Credit Suisse, any agent or dealer participating in an offering will

arrange to send you the pricing supplement, prospectus supplement and prospectus if you so request by calling toll-free

1 (800) 221-1037

.

You may access the prospectus supplement and prospectus on the SEC website at

www.sec.gov

or by clicking on the hyperlinks to each of the respective documents incorporated by reference in the pricing supplement.

To change your email preferences or unsubscribe, please

click here.

Copyright © 2013 IndexUniverse, LLC, 201 Mission Street, Suite 720, San Francisco, CA, 94105, USA

To globally opt out click here.

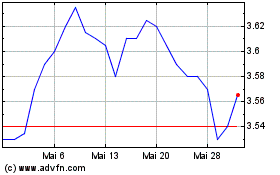

MFS High Income Municipal (NYSE:CXE)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

MFS High Income Municipal (NYSE:CXE)

Historical Stock Chart

Von Jul 2023 bis Jul 2024