Customers Bank bolsters executive team with new C-suite appointments, sets stage for continued deposit growth, momentum

09 September 2024 - 2:30PM

Business Wire

Customers Bank, the $21 billion asset

subsidiary of Customers Bancorp (NYSE:CUBI), is laying the

groundwork for continued deposit growth in commercial and specialty

banking divisions, enhancing its C-suite to incorporate

significant, top-level expertise and capabilities. A new role of

Chief Banking Officer will be filled by Lyle Cunningham, a

long-standing member of the company who most recently served as

Executive Vice President, Chief Lending Officer & Head of

Corporate and Specialized Banking. Additionally, the Bank has named

Nick Robinson as Chief Risk Officer, who hails from a top 10 bank

in the U.S. Robinson will collaborate closely with Joan Cheney, who

is transitioning to the Deputy Chief Risk Officer role.

“Customers Bank has grown into one of the nation’s

top-performing banks, and as we position ourselves for the next

stage of our journey, we must remain cognizant of the rapidly

evolving environment around us and all its associated risks and

opportunities,” said Sam Sidhu, President and CEO. “We are

fortunate to count some of the most talented professionals in the

financial services industry among our ranks, and their dedication

to delivering exceptional customer service and forward-thinking

technological solutions, all with an eye toward prudent risk

management, will be key to our continued success.”

Customers Bank has instituted a new role of Chief Banking

Officer, promoting Lyle Cunningham to fill it. With the company for

more than 10 years, Cunningham most recently served as Chief

Lending Officer and Head of Corporate and Specialized Banking,

overseeing corporate lending and deposits including in Lender

Finance, Fund Finance, Financial Institutions, Technology and

Venture, and Healthcare groups. As Chief Banking Officer, he will

gain comprehensive responsibility for the Bank’s lending and

deposits functions. A member of the Executive Committee, Cunningham

works with Bank leaders to drive long- and short-term strategies

that promote market and deposit growth. With nearly 40 years of

experience in banking and finance, he is well-equipped to provide

strategic consultation on the Bank’s next stage of growth.

The company is also growing its risk management team,

reinforcing its risk management efforts through a collaborative

Chief Risk Officer and Deputy Chief Risk Officer partnership.

Robinson brings a wealth of experience to the position of Chief

Risk Officer, having led risk management, compliance and operations

initiatives for some of the world’s most admired companies in a

career spanning over 25 years. Most recently, he served as Chief

Risk Officer for Capital One’s commercial division and spearheaded

the design and execution of its compliance risk policies and

procedures. At Customers Bank, he will be responsible for

identifying and mitigating current and future risks, monitoring and

testing risk controls, and continuing to promote risk management as

a key pillar of the Bank’s workplace culture. Robinson assumed his

role with Customers Bank on September 3.

Robinson’s addition was a joint effort between the Executive

Committee and Joan Cheney, who will continue with Customers Bank as

Deputy Chief Risk Officer. His inclusion augments the Bank’s strong

bench of risk management experts. Robinson and Cheney will partner

to position Customers Bank to meet the future with confidence no

matter the regulatory or risk environment.

Institutional Background Customers Bancorp, Inc.

(NYSE:CUBI) is one of the nation’s top-performing banking companies

with nearly $21 billion in assets, making it one of the 80 largest

bank holding companies in the U.S. Customers Bank’s commercial and

consumer clients benefit from a full suite of technology-enabled

tailored product experiences delivered by best-in-class customer

service distinguished by a Single Point of Contact approach. In

addition to traditional lines such as C&I lending, commercial

real estate lending and multifamily lending, Customers Bank also

provides a number of national corporate banking services to

specialized lending clients. Major accolades include:

- No. 1 on American Banker 2024 list of top-performing banks with

$10B to $50B in assets

- No. 29 out of the 100 largest publicly traded banks in 2024

Forbes Best Banks list

- No. 52 on Investor’s Business Daily 100 Best Stocks for

2023

A member of the Federal Reserve System with deposits insured by

the Federal Deposit Insurance Corporation, Customers Bank is an

equal opportunity lender. Learn more: www.customersbank.com .

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240903311867/en/

Media Jordan Baucum Media Relations

jbaucum@customersbank.com (951) 608-8314

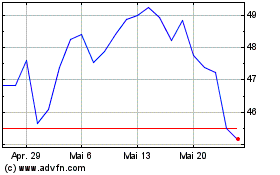

Customers Bancorp (NYSE:CUBI)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

Customers Bancorp (NYSE:CUBI)

Historical Stock Chart

Von Mär 2024 bis Mär 2025