CorEnergy to Sell MoGas and Omega Pipeline Systems to Spire

25 Mai 2023 - 2:00PM

Business Wire

All-Cash Transaction Expected to Repay Bank

Debt in Full and Generate Additional Cash

CorEnergy Infrastructure Trust, Inc. (NYSE: CORR, CORRPrA)

("CorEnergy" or the "Company") today announced entry into a

definitive agreement to sell its MoGas and Omega pipeline systems

(“MoGas System”) to Spire Inc. (NYSE: SR) for approximately $175

million in cash, subject to final working capital adjustments. The

MoGas System is an interstate natural gas transmission and

distribution system providing service to markets in Missouri and

Illinois.

Transaction Highlights

- All-cash transaction valued at approximately $175 million

- Expected to close in the third quarter 2023, subject only to

anti-trust clearance and customary closing conditions

- Estimated $165 million of net proceeds after taxes and

transaction-related costs

- Net proceeds will be used to repay all CorEnergy bank debt at

closing, approximately $100 million

Dave Schulte, Chairman and Chief Executive Officer of CorEnergy,

said: “The sale of our MoGas and Omega systems enables us to

significantly de-leverage our balance sheet and strengthen our

overall capital structure. This is one of several 2023 initiatives

we are undertaking to improve our balance sheet and operating

results, including proposed tariff increases and corporate cost

reductions.”

“The team at MoGas and Omega has produced reliably profitable

results and an excellent safety record as a part of CorEnergy, and

we wish to thank them for their dedicated service over the past

several years,” said Schulte. “Spire shares our commitment to

providing safe, reliable, and environmentally sustainable service

to the customers and communities that we serve, and we are pleased

they will retain our field operating personnel.”

The Company plans to provide an updated 2023 outlook, including

opportunities within its California energy transition and other

business initiatives, after the transaction has closed.

Evercore acted as the company’s financial advisor while K&L

Gates served as legal counsel.

About CorEnergy Infrastructure Trust, Inc.

CorEnergy Infrastructure Trust, Inc. (NYSE: CORR, CORRPrA) is a

real estate investment trust that owns and operates or leases

regulated natural gas transmission and distribution lines and crude

oil gathering, storage and transmission pipelines and associated

rights-of-way. For more information, please visit

corenergy.reit.

Forward-Looking Statements

With the exception of historical information, certain statements

contained in this press release may include "forward-looking

statements" within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934,

including those related to the potential sale of our MoGas and

Omega systems and use of proceeds therefrom, our ability to execute

on our business strategy of restoring our cost of services and the

expected results of tariff increase requests. Although CorEnergy

believes that the expectations reflected in these forward-looking

statements are reasonable, they do involve assumptions, risks and

uncertainties, such as the requirement to receive anti-trust

clearance for the sale of MoGas and Omega, and these expectations

may prove to be incorrect. Actual results could differ materially

from those anticipated in these forward-looking statements as a

result of a variety of factors, including that the sale of MoGas

and Omega might not be completed, we might not receive our

requested tariff increases, we might have further cost increases

and volume reductions beyond those projected in our tariff requests

and those additional factors discussed in CorEnergy’s reports that

are filed with the Securities and Exchange Commission. You should

not place undue reliance on these forward-looking statements, which

speak only as of the date of this press release. Other than as

required by law, CorEnergy does not assume a duty to update any

forward-looking statement. In particular, any dividends paid in the

future to our stockholders will depend on the actual performance of

CorEnergy, required distributions in order to maintain REIT status,

its costs of leverage and other operating expenses and will be

subject to the approval of CorEnergy’s Board of Directors and

compliance with leverage covenants and other applicable

requirements.

Source: CorEnergy Infrastructure Trust, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230525005310/en/

CorEnergy Infrastructure Trust, Inc. Investor Relations

Jeff Teeven or Matt Kreps info@corenergy.reit

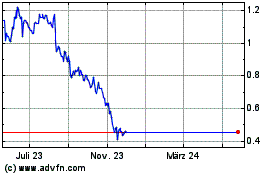

CorEnergy Infrastructure (NYSE:CORR)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

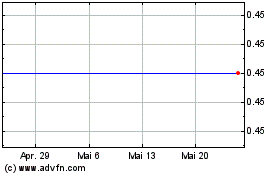

CorEnergy Infrastructure (NYSE:CORR)

Historical Stock Chart

Von Feb 2024 bis Feb 2025