Cherry Hill Mortgage Investment Corporation (NYSE: CHMI)

(“Cherry Hill” or the “Company”) today reported results for the

fourth quarter and full year 2023.

Fourth Quarter 2023 Highlights

- GAAP net loss applicable to common stockholders of $35.5

million, or $1.29 per share.

- Earnings available for distribution (“EAD”) attributable to

common stockholders of $4.5 million, or $0.17 per diluted

share.

- Common book value per share of $4.53 at December 31, 2023.

- Declared regular common dividend of $0.15 per share, annualized

common dividend yield was 16.4% based on the closing sale price of

the Company’s common stock as reported by the NYSE on March 6,

2024.

- Board of Directors authorized a $50 million Preferred Stock

repurchase program. As of March 7, 2024, approximately 260 thousand

shares of 8.250% Series B Fixed-to-Floating Rate Cumulative

Redeemable Preferred Stock had been repurchased, totaling $6.1

million. There is $43.9 million of availability in the

program.

- Aggregate portfolio leverage stood at 4.2x at December 31,

2023.

- As of December 31, 2023, the Company had unrestricted cash of

$52.9 million.

“As macro volatility persists, we continue to align our

portfolio prudently to guard against risks that can have outsized

impact on our book value,” said Jay Lown, President and CEO of

Cherry Hill Mortgage Investment Corporation. “As we progress

through 2024, we are closely monitoring the rate environment as we

assess the optimal positioning for our portfolio, and will continue

to focus on creating a more stable equity profile for the benefit

of shareholders.”

Operating Results

Cherry Hill reported GAAP net loss applicable to common

stockholders for the fourth quarter of 2023 of $35.5 million, or

$1.29 per basic and diluted weighted average common share

outstanding. Reported GAAP net loss was determined based primarily

on the following: $0.4 million of net interest expense, $9.7

million of net servicing income, a net realized loss of $14.9

million on RMBS, a net realized gain of $7.1 million on

derivatives, a net unrealized gain of $36.3 million on RMBS

measured at fair value through earnings, a net unrealized loss of

$56.0 million on derivatives, a net unrealized loss of $12.8

million on investments in Servicing Related Assets, and general and

administrative expenses and management fees paid to Cherry Hill’s

external manager in the aggregate amount of $3.5 million.

Earnings available for distribution attributable to common

stockholders for the fourth quarter of 2023 were $4.5 million, or

$0.17 per basic and diluted weighted average common share

outstanding. For a reconciliation of GAAP net income to non-GAAP

earnings available for distribution, please refer to the

reconciliation table accompanying this release.

Three Months Ended

December 31, 2023

September 30, 2023

(unaudited)

(unaudited)

Income

Interest income

$

12,792

$

12,864

Interest expense

13,182

13,337

Net interest expense

(390)

(473)

Servicing fee income

12,892

13,225

Servicing costs

3,150

2,869

Net servicing income

9,742

10,356

Other income (loss)

Realized loss on RMBS, net

(14,851)

(10,209)

Realized gain on derivatives, net

7,106

20,675

Realized gain on acquired assets, net

11

12

Unrealized gain (loss) on RMBS, measured

at fair value through earnings, net

36,321

(19,755)

Unrealized gain (loss) on derivatives,

net

(55,995)

18,343

Unrealized gain (loss) on investments in

Servicing Related Assets

(12,837)

1,578

Total Income (Loss)

(30,893)

20,527

Expenses

General and administrative expense

1,756

1,626

Management fee to affiliate

1,716

1,740

Total Expenses

3,472

3,366

Income (Loss) Before Income

Taxes

(34,365)

17,161

Provision for (Benefit from) corporate

business taxes

(721)

1,276

Net Income (Loss)

(33,644)

15,885

Net (income) loss allocated to

noncontrolling interests in Operating Partnership

627

(306)

Dividends on preferred stock

2,463

2,462

Net Income (Loss) Applicable to Common

Stockholders

$

(35,480)

$

13,117

Net Income (Loss) Per Share of Common

Stock

Basic

$

(1.29)

$

0.49

Diluted

$

(1.29)

$

0.49

Weighted Average Number of Shares of

Common Stock Outstanding

Basic

27,398,266

26,936,242

Diluted

27,440,101

26,978,077

_______________ Dollar amounts in thousands, except per share

amounts.

Net unrealized gain on the Company’s RMBS portfolio classified

as available-for-sale that are reported in accumulated other

comprehensive income was approximately $29.5 million.

Three Months Ended

December 31, 2023

September 30, 2023

(unaudited)

(unaudited)

Net Income (Loss)

$

(33,644)

$

15,885

Other comprehensive income (loss):

Unrealized gain (loss) on RMBS,

available-for-sale, net

29,527

(14,485)

Net other comprehensive income (loss)

29,527

(14,485)

Comprehensive income (loss)

$

(4,117)

$

1,400

Comprehensive income (loss) attributable

to noncontrolling interests in Operating Partnership

(76)

29

Dividends on preferred stock

2,463

2,462

Comprehensive loss attributable to

common stockholders

$

(6,504)

$

(1,091)

_____________ Dollar amounts in thousands.

Portfolio Highlights for the Quarter Ended December 31,

2023

The Company realized net servicing fee income of $9.7 million,

net interest expense of $0.4 million and other loss of $40.2

million, primarily related to an unrealized loss on derivatives,

realized losses on RMBS and unrealized losses on investments in

servicing related assets, partially offset by unrealized gains on

the RMBS portfolio and realized gains on derivatives. The unpaid

principal balance for the MSR portfolio stood at $20.0 billion as

of December 31, 2023 and the carrying value of the MSR portfolio

ended the quarter at $253.6 million. Net interest spread for the

RMBS portfolio stood at 3.82% and the debt-to-equity ratio on the

aggregate portfolio ended the quarter at 4.2x.

The RMBS portfolio had a book value of approximately $1.0

billion and carrying value of approximately $1.0 billion at

quarter-end December 31, 2023. The portfolio had a weighted average

coupon of 4.64% and weighted average maturity of 28 years.

In order to mitigate duration risk and interest rate risk

associated with the Company’s RMBS and MSRs, Cherry Hill used

interest rate swaps, TBAs and Treasury futures. At quarter end

December 31, 2023, the Company held interest rate swaps with a

notional amount of $1.1 billion, TBAs with a notional amount of

($376.6) million, and Treasury futures with a notional amount of

$274.1 million.

As of December 31, 2023, Cherry Hill’s GAAP book value was $4.53

per diluted share, net of the fourth quarter dividend.

Dividends

On December 8, 2023, the Board of Directors declared a quarterly

dividend of $0.15 per share of common stock for the fourth quarter

of 2023. The dividend was paid in cash on January 31, 2024 to

common stockholders of record as of the close of business on

December 29, 2023. Additionally, the Board of Directors declared a

dividend of $0.5125 per share on the Company’s 8.20% Series A

Cumulative Redeemable Preferred Stock and a dividend of $0.515625

per share on the Company’s 8.250% Series B Fixed-to-Floating Rate

Cumulative Redeemable Preferred Stock for the fourth quarter 2023.

The dividends were paid in cash on January 16, 2024 to Series A and

B Preferred stockholders of record as of the close of business on

December 29, 2023.

Earnings Available for Distribution

Earnings available for distribution (“EAD”) is a non-GAAP

financial measure that we define as GAAP net income (loss),

excluding realized gain (loss) on RMBS, unrealized gain (loss) on

RMBS measured at fair value through earnings, realized and

unrealized gain (loss) on derivatives, realized gain (loss) on

acquired assets, realized and unrealized gain (loss) on investments

in MSRs (net of any estimated MSR amortization) and any tax expense

(benefit) on realized and unrealized gain (loss) on MSRs. MSR

amortization refers to the portion of the change in fair value of

the MSR that is primarily due to the realization of cashflows,

runoff resulting from prepayments and an adjustment for any gain or

loss on the capital used to purchase the MSR. EAD also includes

interest rate swap periodic interest income (expense) and drop

income on TBA dollar roll transactions, which are included in

“Realized gain (loss) on derivatives, net” on the consolidated

statements of income (loss). EAD is adjusted to exclude outstanding

LTIP-OP Units in our Operating Partnership and dividends paid on

our preferred stock.

EAD is provided for purposes of potential comparability to other

issuers that invest in residential mortgage-related assets. The

Company believes providing investors with EAD, in addition to

related GAAP financial measures, may provide investors some insight

into the Company’s ongoing operational performance. However, the

concept of EAD does have significant limitations, including the

exclusion of realized and unrealized gains (losses), and given the

apparent lack of a consistent methodology among issuers for

defining EAD, it may not be comparable to similarly titled measures

of other issuers, which define EAD differently from us and each

other. As a result, EAD should not be considered a substitute for

the Company’s GAAP net income (loss) or as a measure of the

Company’s liquidity. While EAD is one indicia of the Company’s

earnings capacity, it is not the only factor considered in setting

a dividend and is not the same as REIT taxable income which is

calculated in accordance with the rules of the IRS.

The following table provides a reconciliation of net income to

EAD for the three months ended December 31, 2023 and September 30,

2023:

Three Months Ended

December 31, 2023

September 30, 2023

(unaudited)

(unaudited)

Net Income (Loss)

$

(33,644)

$

15,885

Realized loss on RMBS, net

14,851

10,209

Realized loss (gain) on derivatives, net

¹

2,804

(10,565)

Realized gain on acquired assets, net

(11)

(12)

Unrealized loss (gain) on RMBS, measured

at fair value through earnings, net

(36,321)

19,755

Unrealized loss (gain) on derivatives,

net

55,995

(18,343)

Unrealized loss (gain) on investments in

MSRs, net of estimated MSR amortization

3,777

(11,588)

Tax (benefit) expense on realized and

unrealized (loss) gain on MSRs

(332)

1,684

Total EAD:

$

7,119

$

7,025

EAD attributable to noncontrolling

interests in Operating Partnership

(127)

(128)

Dividends on preferred stock

2,463

2,462

EAD Attributable to Common

Stockholders

$

4,529

$

4,435

EAD Attributable to Common

Stockholders, per Diluted Share

$

0.17

$

0.16

GAAP Net Income (Loss) Per Share of

Common Stock, per Diluted Share

$

(1.29)

$

0.49

_________ Dollar amounts in thousands, except per share

amounts.

- Excludes drop income on TBA dollar rolls of $924,000 and

$893,000 and interest rate swap periodic interest income of $9.0

million and $9.2 million for the three-month periods ended December

31, 2023 and September 30, 2023, respectively.

Additional Information

Additional information regarding Cherry Hill’s financial

condition and results of operations can be found in its Annual

Report on Form 10-K for the year ended December 31, 2023 filed with

the Securities and Exchange Commission on March 7, 2024. In

addition, an investor presentation with supplemental information

regarding Cherry Hill, its business and its financial condition as

of December 31, 2023 and its results of operations for the full

year 2023 has been posted to the Investor Relations section of

Cherry Hill’s website, www.chmireit.com. Cherry Hill will discuss

the investor presentation on the conference call referenced

below.

Webcast and Conference Call

The Company’s management will host a conference call today at

5:00 pm Eastern Time. A copy of this earnings release and the

investor presentation referenced above will be posted to the

Investor Relations section of Cherry Hill’s website,

www.chmireit.com. All interested parties are welcome to participate

on the live call.

A live webcast of the conference call will be available in the

investor relations section of the Company’s website at

www.chmireit.com. To listen to the live broadcast, go to the site

at least 15 minutes prior to the scheduled start time in order to

register, download and install any necessary audio software. An

online archive of the webcast will be available on the Company’s

website for one year following the call.

Participants may register for the conference call here. Once

registered, dial-in information for the call will be made

available.

About Cherry Hill Mortgage Investment Corporation

Cherry Hill Mortgage Investment Corporation is a real estate

finance company that acquires, invests in and manages residential

mortgage assets in the United States. For additional information,

visit www.chmireit.com.

Forward-Looking Statements

This press release contains forward looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

and other federal securities laws, including, among others,

statements relating to the Company’s long-term growth opportunities

and strategies, expand its market opportunities and create its own

Excess MSRs and its ability to generate sustainable and attractive

risk-adjusted returns for stockholders. These forward-looking

statements are based upon the Company’s present expectations, but

these statements are not guaranteed to occur. For a description of

factors that may cause the Company's actual results or performance

to differ from its forward-looking statements, please review the

information under the heading “Risk Factors” included in the

Company's Annual Report on Form 10-K for the year ended December

31, 2023, and other documents filed by the Company with the

Securities and Exchange Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240307417590/en/

Cherry Hill Mortgage Investment Corporation Investor Relations

(877) 870-7005 InvestorRelations@chmireit.com

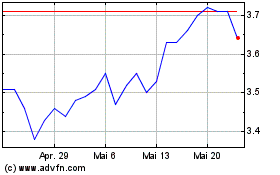

Cherry Hill Mortgage Inv... (NYSE:CHMI)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Cherry Hill Mortgage Inv... (NYSE:CHMI)

Historical Stock Chart

Von Jan 2024 bis Jan 2025