0001064728false00010647282024-10-112024-10-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 11, 2024

PEABODY ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Delaware | | 1-16463 | | 13-4004153 |

(State or other jurisdiction of

incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

| 701 Market Street, | St. Louis, | Missouri | | | | 63101-1826 |

| (Address of principal executive offices) | | | | (Zip Code) |

| |

| Registrant's telephone number, including area code: | (314) | 342-3400 |

| |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | BTU | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On October 11, 2024, Peabody Energy Corporation (the “Company”) issued a press release and slide presentation regarding its Centurion Mine. Copies of the press release and slides are attached as Exhibits 99.1 and 99.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference. These materials should be read together with the information included in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and Quarterly Report on Form 10-Q for the quarter ended June 30, 2024.

The information contained herein, including Exhibits 99.1 and 99.2, respectively, is being furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such a filing. The furnishing of this information will not be deemed an admission as to the materiality of any information contained herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description of Exhibit |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| PEABODY ENERGY CORPORATION |

| |

| October 11, 2024 | By: /s/ Scott T. Jarboe |

| Name: Scott T. Jarboe |

| Title: Chief Administrative Officer and Corporate Secretary |

|

Peabody Provides Update on Centurion Metallurgical Coal Mine Development

Integrated Mine Plan Complete with Estimated Net Present Value of $1.6 billion

Average Annual Production of 4.7 Million Tons at First Quartile Cost and Mine Life of 25+ years

ST. LOUIS October 11, 2024/PR Newswire/-- Peabody (NYSE: BTU) today provided an investor presentation on project development and the related integrated mine plan at Centurion, the Company’s premium low volatile hard coking coal project located in Australia’s Bowen Basin. The Company will hold a conference call on Monday, October 14, 2024, at 3:00 p.m. CST to share a comprehensive update on Peabody’s development of Centurion. To watch the event live or access a replay, please visit www.peabodyenergy.com.

Centurion is quickly becoming the cornerstone metallurgical coal asset in Peabody’s global coal portfolio, unlocking substantial, untapped reserves and repositioning Peabody as primarily a metallurgical coal producer. “The development of Centurion is a key strategic priority to maximize shareholder value and reweight our portfolio and long-term cashflows to metallurgical coal,” Jim Grech, Peabody’s President and Chief Executive Officer, said. “Combined with Peabody’s diversified portfolio, resilient balance sheet, fully funded reclamation obligations and robust shareholder return program, Peabody is uniquely positioned as a leading global coal producer.”

Thus far, two continuous miner units have been commissioned and the mine successfully produced its first development coal in June. The prep plant successfully washed its first coal and moved it to stockpile via the overhead belts in September. Peabody expects to commission a third continuous miner and ship the first cargo of coal in the fourth quarter.

Centurion is set to significantly enhance Peabody’s metallurgical coal production with average volume of 4.7 million tons per year at expected costs of $105 per ton over the twenty-five plus year life of the mine. Centurion will also reposition the metallurgical coal portfolio toward higher quality premium met coals.

“We anticipate demand for premium hard coking coals to grow significantly,” Malcolm Roberts, Peabody’s Chief Marketing Officer, said. “While demand for this product continues to grow, new projects are increasingly rare, making Centurion’s product highly sought after.”

At September 30, 2024, Peabody has completed approximately $250 million of the anticipated $489 million of initial development capital to achieve longwall production in March 2026. With a $210 per metric ton benchmark price assumption, Centurion has an estimated net present value of $1.6 billion and a 25 percent internal rate of return.

“Peabody is committed to increasing shareholder value through a balanced approach of maximizing shareholder returns and developing Centurion,” Mark Spurbeck, Peabody’s Chief Financial Officer, said. “Centurion provides increased optionality to tightening metallurgical coal markets and will be a strategic asset in Peabody’s global coal portfolio for decades.”

Concurrent with this release, Peabody has issued a presentation on the Centurion project that can be found on the investor section of www.peabodyenergy.com.

Peabody (NYSE: BTU) is a leading coal producer, providing essential products for the production of affordable, reliable energy and steel. Our commitment to sustainability underpins everything we do and shapes our strategy for the future. For further information, visit www.PeabodyEnergy.com.

Contact:

Karla Kimrey

ir@peabodyenergy.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the securities laws. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words or variation of words such as "expects,” "anticipates," "intends," "plans," "believes," "seeks," "estimates," "projects," "forecasts," "targets," "would," "will," "should," "goal," "could" or "may" or other similar expressions. Forward-looking statements provide management's or the Board’s current expectations or predictions of future conditions, events or results. All statements that address operating performance, events, or developments that may occur in the future are forward-looking statements, including statements regarding the shareholder return framework, execution of Peabody's operating plans, market conditions, reclamation obligations, financial outlook, potential acquisitions and strategic investments, and liquidity requirements. They may include estimates of sales and other operating performance targets, cost savings, capital expenditures, other expense items, actions relating to strategic initiatives, demand for the company’s products, liquidity, capital structure, market share, industry volume, other financial items, descriptions of management’s plans or objectives for future operations and descriptions of assumptions underlying any of the above. All forward-looking statements speak only as of the date they are made and reflect Peabody’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance or events. Furthermore, Peabody disclaims any obligation to publicly update or revise any forward-looking statement, except as required by law. By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, a variety of economic, competitive, and regulatory factors, many of which are beyond Peabody's control, that are described in Peabody's periodic reports filed with the SEC including its Annual Report on Form 10-K for the fiscal year ended Dec. 31, 2023 and Quarterly Report on Form 10-Q for the quarter ended Jun. 30, 2024 and other factors that Peabody may describe from time to time in other filings with the SEC. You may get such filings for free at Peabody's website at www.peabodyenergy.com. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

B U I L D I N G B R I G H T E R F U T U R E S Centurion Peabody’s Cornerstone Metallurgical Coal Asset October 14, 2024

2 Disclosure Regarding Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the securities laws. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words or variation of words such as "expects,” "anticipates," "intends," "plans," "believes," "seeks," "estimates," "projects," "forecasts," "targets," "would," "will," "should," "goal," "could" or "may" or other similar expressions. Forward-looking statements provide management's or the Board’s current expectations or predictions of future conditions, events or results. All statements that address operating performance, events, or developments that may occur in the future are forward-looking statements, including statements regarding the shareholder return framework, execution of Peabody's operating plans, market conditions, reclamation obligations, financial outlook, potential acquisitions and strategic investments, and liquidity requirements. They may include estimates of sales and other operating performance targets, cost savings, capital expenditures, other expense items, actions relating to strategic initiatives, demand for the company’s products, liquidity, capital structure, market share, industry volume, other financial items, descriptions of management’s plans or objectives for future operations and descriptions of assumptions underlying any of the above. All forward-looking statements speak only as of the date they are made and reflect Peabody’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance or events. Furthermore, Peabody disclaims any obligation to publicly update or revise any forward-looking statement, except as required by law. By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, a variety of economic, competitive, and regulatory factors, many of which are beyond Peabody's control, that are described in Peabody's periodic reports filed with the SEC including its Annual Report on Form 10-K for the fiscal year ended Dec. 31, 2023 and Quarterly Report on Form 10-Q for the quarter ended Jun. 30, 2024 and other factors that Peabody may describe from time to time in other filings with the SEC. You may get such filings for free at Peabody's website at www.peabodyenergy.com. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

3 Peabody – The Investment Thesis • Proven commitment to shareholder returns - Allocated nearly $600 million primarily through buybacks since restarting the shareholder return program in Q2 2023 - Continuing commitment to return 65-100% of available free cash flow (2) • Unique diversified portfolio offers unmatched option value in all three segments - 2022/2023 Segment Adjusted EBITDA(1) contributions weighted: • ~40% Seaborne Thermal; • ~40% Seaborne Metallurgical; • ~20% U.S. Thermal • Developing Centurion, a hard coking coal growth project with average annual production of 4.7 million tons, 1st quartile cost production and mine life of 25+ years - Reweights Seaborne Metallurgical Segment Adjusted EBITDA(1) to 56% • Seaborne Thermal segment serves demand in Asia for expanding power generation • U.S. Thermal segments generate substantial free cash flow and are some of the lowest-cost, most competitive coal assets in the U.S. • Strong and resilient balance sheet - No secured debt and 100% funded global reclamation obligations (1) Adjusted EBITDA is a non-GAAP financial measure. Refer to the definitions and reconciliations to the nearest GAAP measures in the appendix (2) Available Free Cash Flow is a non-GAAP financial measure defined as operating cash flow less investing cash flow and distributions to noncontrolling interests; plus/minus changes to restricted cash and collateral and other anticipated expenditures. Peabody is committed to increasing shareholder value through a balanced approach of maximizing shareholder returns and investing in the development of the Centurion metallurgical coal project

4 Centurion - Peabody’s Cornerstone Metallurgical Coal Asset • Tier one premium hard coking coal mine complex utilizing $1.0+ billion of existing infrastructure and equipment • Mine life of 25+ years with ~140 million tons integrated mine plan • Further weights Peabody’s long-term cash flows toward premium hard coking coal when longwall production begins in 2026 • Premium grade hard coking coal, mined from the Goonyella Middle Seam, an established cornerstone of coking coal blends • Enables Peabody to meet the increasing demand in the market for premium low vol coking coal NPV $1.6B NPV/Share $12.80/share IRR ~25% Adj. EBITDA Margin ~45% Capex $489M FOB Cost ~$105/Short ton At 08/2024 excludes $375M of previous capex ~125.9 million shares Total project return LOM average to 1st Longwall production LOM average (1) Adjusted EBITDA is a non-GAAP financial measure. Refer to the definitions and reconciliations to the nearest GAAP measures in the appendix (1)

2 5 Steelmaking Coal – Market Overview

6 The World Requires Steel and Centurion Steelmaking Coal • Metallurgical coal is an essential ingredient in the production of steel, making it one of the most widely used industrial materials on Earth • It takes around 770 kilograms of coal to make one ton of steel, with approximately 70 percent of global steel produced in basic oxygen blast furnaces • Centurion Coal enables highly efficient coke and steel production. Centurion high-quality hard coking (HCC) coal when processed into coke has very low impurities and excellent strength both in low and high temperatures, resulting in high reduction efficiency in the blast furnace • Centurion expected to achieve a high FOB price point relative to other metallurgical coals

7 Blast Furnace Steel Production Shifting to India & Southeast Asia, Fueling Seaborne Metallurgical Coal Demand Seaborne Metallurgical Coal Demand (Million Tonnes) +132% Proportionate Location of BOF Steel Production (% of Global Production) 74 94 135 172 94 89 73 60 17 23 26 28 58 43 36 30 10 17 24 31 13 14 15 14 49 48 35 25 316 328 344 360 2024 2030 2040 2050 India Japan/Korea/Taiwan Asia (Other) China Vietnam Brazil Other Source: Data obtained from Wood Mackenzie Data Service; Peabody Data Analysis. 5% 9% 16% 25% 2% 2% 4% 5% 10% 10% 10% 9% 67% 62% 53% 44% 6% 7% 7% 5% 5% 5% 5% 6% 5% 5% 5% 6% 2024 2030 2040 2050 India South East Asia Asia (Other) China Europe Americas Other

8 New Supply of HCC Required to Meet Demand Source: Data obtained from Wood Mackenzie Data Service; Peabody Data Analysis. (Million Tonnes) Seaborne Demand By Grade 208 212 214 235 70 70 74 76 38 46 56 49316 328 344 360 2024 2030 2040 2050 Hard Coking Coal (HCC) Pulverised Coal Injection (PCI) Semi Soft Coking Coal (SSCC) (Million Tonnes) 0 10 20 30 40 50 60 70 80 90 100 110 2035 2040 2045 2050 New Supply of HCC Required New Supply of HCC Required

9 Queensland Coal Shipments, Advantaged by Proximity to the Center of Demand Growth – India Source: Platts Freight Assessments (CDBFAIO, CDWCI04,CDBUI00) and Peabody Analysis; * Each year represents Q1 Additional Ocean Freight Cost vs. Queensland $0 $2 $4 $6 $8 $10 $12 2019 2020 2021 2022 2023 2024 (U S D /M t) West Coast - Canada to India $0 $10 $20 $30 $40 2019 2020 2021 2022 2023 2024 (U S D /M t) East Coast - USA to India Avg. $21 Avg. $8 Port of Hay Point

10 Australian PLV – The Cornerstone of Customer Blends and Widely considered the Highest-grade Coal in the Market 10% 20% 30% 40% 50% 60% 70% 80% 15% 20% 25% 30% 35% 40% C o k e S tr e n g th m e a s u re d b y C S R % Volatile Matter % Coal Blending for Coke Optimization Framework USA High Vol A Hunter Valley Semi Soft Queensland Semi soft U S A L o w V o l. H C C Premium LV Centurion Australian Lol vol . HCC Blend Target P re m iu m H C C S e m i H a rd / H C C S e m i S o ft Low Volatile Medium Volatile High Volatile Illustrative Source: Peabody analysis • The framework diagram on the right demonstrates why Centurion will be the cornerstone of customer blends • Centurion product fits well within the Premium Low Volatile Hard Coking Coal (PLV HCC) Category • PLV HCC is high yielding when converted to coke compared to USA high volatile coals • Centurion coal produces high strength coke and is essential for a high productivity blast furnace • High productivity coke, enables lower CO₂ emissions per ton of hot metal produced • PLV HCC primarily exported from Australia and Canada

11 Centurion Expected to Price Favorably Amongst the Highest-grade Coals in the Market Centurion quality is perfect balance of high coal reactivity and coke strength Source: Peabody analysis Illustrative ✓ Very high coke strength - +68 CSR means highly productive coke ✓ Very low ash for premium coking coal - Less than 10% ash, increasingly rare ✓ Low phosphorus - Improves steel quality, lowers steel cost ✓ Low sulphur - Assists steel mills to meet environmental standards while reducing treatment costs ✓ Very high fluidity for premium coking coal - Enabler for blending and lowering coke cost

12 Centurion - Tier One Asset Within World’s Premier HCC Corridor • The majority of the world’s Premium HCC comes from Australia’s Bowen Basin, specifically the Moranbah Coal Measures • Moranbah Coal Measures are the widely assumed “Benchmark” of HCC qualities • Ownership of mines in this premium corridor is concentrated with BHP/Mitsubishi Alliance (BMA), Anglo American and Peabody • Centurion the new mine in this corridor, includes the Wards Well deposit

2 13 Project Overview

14 Major Project Stages & Milestones Major Project Stages & Milestones Completed/Estimated First Development Coal June 2024 Second Continuous Miner & ~140 Employees July 2024 CHPP Refurbishment September 2024 First Coal Shipment Q4 2024 Third Continuous Miner Q4 2024 ~300 Employees 2025 ~400 Employees 2026 First Longwall Coal March 2026 First Production Development Coal June 2024

15 Centurion South Development Meters to LW Coal Production (Km) 2024: 4.1 2025: 18.1 2026: 3.5 Reserves 20 million tons LOM Production ~3.8 million saleable tons average per year Centurion Project Summary – Development KPI’s Project Map Centurion North Development Meters to LW Coal Production (Km) 2025: 5.1 2026: 7.2 2027: 11.1 2028: 18.9 Reserves 121 million tons LOM Production ~4.8 million saleable tons average per year Centurion South Centurion North

16 Centurion Mine Complex - World-Class Infrastructure in Place Coal Handling Prep Plant (CHPP) with successful history Dedicated accommodation village for over 400 workers New CAT longwall system on the surface Dedicated rail loop connected to Goonyella rail system Brownfield redevelopment benefits from utilizing $1.0+ billion of existing infrastructure and equipment

17 Mining Equipment Type Manufacturer/Model Description # of Units Development Komatsu 12CM30 Continuous Miner 3 Komatsu BF-14 Feeder Breaker 2 Komatsu 10SC32 Shuttle Car 4 Sandvik LS190 Loader 5 Torque Titan Loader 5 AME Mine Cruisers MK8 Personnel Transporter 10 AMP Control Power Center 2 Howdens 24m3 Ancillary Fan 4 Longwall CAT EL3000 Shearer 1 CAT 2m 1501t Shields 153 CAT PF6 1242mm AFC 1 CAT BSL Stageloader & Crusher 1 Kamat Hydraulic System 1 AMP Control Power Center 1

18 Established Logistics Arrangements in the Coking Coal Heartland – The Goonyella Rail System and Port of Hay Point • All surface logistics infrastructure in place • The port and rail are also used by our existing operations Coppabella, Moorvale, and Middlemount • Trains will travel 217km to the Port of Hay Point and load into stockpiles at Dalrymple Bay Coal Terminal (DBCT) • Shipping of coal to customers will take place on an ocean-going vessel, often shared with other coal suppliers

19 Safety – A Core Value • We have taken the lessons from past incidents and incorporated them into our management plans for longwall operations • At Centurion, the approach will be multifaceted with advanced gas drainage and active inertization • Peabody has spent considerable time, effort and funds to mitigate future risks. Some of these implemented and improved plans include: • Best-in-class monitoring • Sealing & Spontaneous Combustion management plans • Development of trigger points for convening the Site Incident Management Team, along with clearly defined responsibilities for mine site personnel

2 20 Project Economics

21 Centurion - Our Cornerstone Metallurgical Coal Asset NPV $1.6B NPV/Share $12.80/share IRR ~25% Adj. EBITDA Margin ~45% Capex $489M FOB Cost ~$105/Short ton At 08/2024 excludes $375M of previous capex to 1st Longwall production LOM average ~125.9 million shares LOM average Total project return (1) Adjusted EBITDA is a non-GAAP financial measure. Refer to the definitions and reconciliations to the nearest GAAP measures in the appendix (1)

22 Centurion Project Summary – Financial KPI’s Description Centurion South & North Reserves GM Seam: ~140 million tons Product Premium Low Vol Hard Coking Coal (PLV HCC) LOM Production ~4.7 million saleable tons average per year Costs ~$105/ton (includes royalties) LOM average Project Returns ~25 percent at ~$210/metric tonne PLV HCC price Saleable Production 0.1 0.5 3.5 3.3 4.7 4.8 2024 2025 2026 2027 2028 2029 + (Million Tons) All values in real US$ and short tons, unless otherwise noted. An allowance for the Australian Safeguard Mechanism has been included in costs.

23 Capital Expenditures $123 $216 $243 $92 $99 $146 2023 2024 2025 2026 2027 2028 Centurion South • $489M to 1st Longwall in 2026 • ~$250M Spent to Date (through 9/30/2024) Centurion North • $430M to 1st Longwall in 2029 • ~$20M Spent to Date (through 9/30/2024) Total Project Development Capex (US$ Millions)

24 Centurion Transforms Peabody’s Seaborne Metallurgical Coal Segment Metallurgical Sales By GradeMetallurgical Coal Sales 2023 2026E 30% 34% 16% 13% 7% PCI Premium LV HCC High Vol A AUS Low Vol HCC Other 6.9 11.6 2023 2023 Pro Forma LOM Average (Million Tons) (1) 2023 Pro forma with LOM average of 4.7 million tons +68% (1) 60% 6% 24% 10% PCI Premium LV HCC High Vol A AUS Low Vol HCC Other

25 Consistent Free Cash Flow Generator Illustrative Impact to Seaborne Met Adj. EBITDA (1) Illustrative Centurion Adj. EBITDA(1) Across Various PLV HCC Prices (1) Adjusted EBITDA is a non-GAAP financial measure. Refer to the definitions and reconciliations to the nearest GAAP measures in the appendix. (2) Illustrative - 2023 average benchmark HCC price $296 (US$/tonne) HCC Price (US$/tonne) $438 $950 2023 2023 Pro Forma (US$ In Millions) Centurion increases Peabody’s metallurgical coal optionality 117% 89% $79 $98 $115 $148 $271 $337 $398 $512 $180 $210 $240 $296 Margin Per Tonne Adj. EBITDA (US$ in Millions) 89% (2)

26 KEY TAKEAWAYS Peabody’s organic investment plan is to maximize shareholder value with Centurion growth project Provides Peabody’s shareholders exposure to increasing demand for hard coking coal Premier large-scale hard coking coal asset with Australia geographical proximity to Asian demand ~$1.6B NPV / ~25% IRR ~4.7M Saleable tons per year beginning in 2026 at cost of ~$105 per ton Mine life 25+ years Centurion - Organic Growth with a Cornerstone Asset

2 27 Q&A

2 28 Appendix

29 Centurion Royalties • Centurion is subject to the Queensland Government Royalty charged on total revenue. Queensland Government royalties are based on coal prices per tonne (in $A). • Centurion South is subject to a special private royalty agreement established in relation to the sale of the property by a prior owner. This special royalty is limited to production from the Goonyella Middle Seam (GMS) within a defined area. The royalty, paid annually, amounts to 20% of the nominal before-tax cashflow attributable to sales from the defined area less capex, and any accumulated losses (since the original sale process was completed in CY2000). • Centurion North (Wards Well) tenements, is subject to a price- linked royalty payable to the prior owner on the first 120Mt of product coal mined from the area, capped at US$200M. Peabody will only commence making payments once it has recovered its upfront investment in the development of Centurion North. • All royalties have been considered in the financial analysis. Average price per tonne for period Rate Up to and including $100 7% Over $100 and up to and including $150 First $100: Balance: 7% 12.5% More than $150 and up to and including $175 First $100: Next $50: Balance: 7% 12.5% 15% More than $175 and up to and including $225 First $100: Next $50: Next $25: Balance: 7% 12.5% 15% 20% More than $225 and up to and including $300 First $100: Next $50: Next $25: Next $50: Balance: 7% 12.5% 15% 20% 30% More than $300 First $100: Next $50: Next $25: Next $50: Next $75: Balance: 7% 12.5% 15% 20% 30% 40% Queensland Government Royalty Rates

30 Australian Safeguard Mechanism • Centurion Mine is subject to the Australian Safeguard Mechanism, which requires • Determination and assurance of a site-specific emission intensity • Annual reductions in emissions, aligned with Australian greenhouse gas emission reduction targets • Retirement of offsets, in the form of Australian Carbon Credit Units, for emissions exceeding annual baseline • Multiple mitigation measures are being considered, from concept to operationalization, including • Capture of goaf gas for flaring / power generation • Gas drainage and enhanced flaring, power generation, and sale into pipeline • Regenerative thermal oxidation

31 Reconciliation of Non-GAAP Measures Note: Refer to definitions and footnotes on slides 32. Year Ended Year Ended Dec. 31, 2022 Dec. 31, 2023 Adjusted EBITDA (In Millions) (1) Seaborne Thermal $ 647.6 $ 576.8 Seaborne Metallurgical 781.7 438.1 Powder River Basin 68.2 153.7 Other U.S. Thermal 242.4 207.5 Total U.S. Thermal 310.6 361.2 Middlemount 132.8 13.2 Resource Management Results (2) 29.3 21.0 Selling and Administrative Expenses (88.8) (90.7) Other Operating Costs, Net (3) 31.5 44.3 Adjusted EBITDA (2) $ 1,844.7 $ 1,363.9 Reconciliation of Non-GAAP Financial Measures (In Millions) Income from Continuing Operations, Net of Income Taxes $ 1,317.4 $ 816.0 Depreciation, Depletion and Amortization 317.6 321.4 Asset Retirement Obligation Expenses 49.4 50.5 Restructuring Charges 2.9 3.3 Asset Impairment 11.2 2.0 Provision for NARM and Shoal Creek Losses - 40.9 Changes in Amortization of Basis Difference Related to Equity Affiliates (2.3) (1.6) Interest Expense 140.3 59.8 Net Loss on Early Debt Extinguishment 57.9 8.8 Interest Income (18.4) (76.8) Net Mark-to-Market Adjustment on Actuarially Determined Liabilities (27.8) (0.3) Unrealized Losses (Gains) on Derivative Contracts Related to Forecasted Sales 35.8 (159.0) Unrealized Losses (Gains) on Foreign Currency Option Contracts 2.3 (7.4) Take-or-Pay Contract-Based Intangible Recognition (2.8) (2.5) Income Tax (Benefit) Provision (38.8) 308.8 Adjusted EBITDA (1) $ 1,844.7 $ 1,363.9

32 Reconciliation of Non-GAAP Measures Note: Management believes that non-GAAP performance measures are used by investors to measure our operating performance. These measures are not intended to serve as alternatives to U.S. GAAP measures of performance and may not be comparable to similarly-titled measures presented by other companies. Note: Certain forward-looking measures and metrics presented are non-GAAP financial and operating/statistical measures. Due to the volatility and variability of certain items needed to reconcile these measures to their nearest GAAP measure, no reconciliation can be provided without unreasonable cost or effort. (1) Adjusted EBITDA is defined as income from continuing operations before deducting net interest expense, income taxes, asset retirement obligation expenses and depreciation, depletion and amortization. Adjusted EBITDA is also adjusted for the discrete items that management excluded in analyzing each of our segment's operating performance as displayed in the reconciliation above. Adjusted EBITDA is used by management as the primary metric to measure each of our segment's operating performance and allocate resources. (2) Includes gains (losses) on certain surplus coal reserve and surface land sales and property management costs and revenue. (3) Includes trading and brokerage activities; costs associated with post-mining activities; gains (losses) on certain asset disposals; minimum charges on certain transportation-related contracts; costs associated with suspended operations including the Centurion Mine; and revenue of $25.9 million related to the assignment of port and rail capacity during 2023.

v3.24.3

Cover Page

|

Oct. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 11, 2024

|

| Entity Registrant Name |

PEABODY ENERGY CORPORATION

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-16463

|

| Entity Tax Identification Number |

13-4004153

|

| Entity Address, Address Line One |

701 Market Street,

|

| Entity Address, City or Town |

St. Louis,

|

| Entity Address, State or Province |

MO

|

| Entity Address, Postal Zip Code |

63101-1826

|

| City Area Code |

(314)

|

| Local Phone Number |

342-3400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

BTU

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001064728

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

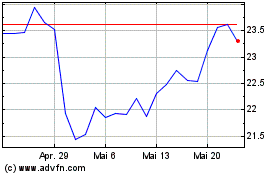

Peabody Energy (NYSE:BTU)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Peabody Energy (NYSE:BTU)

Historical Stock Chart

Von Nov 2023 bis Nov 2024