UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________________

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

November 6, 2024

___________________________

Commission File Number: 001-39007

____________________________________________

Borr Drilling Limited

____________________________________________

S.E. Pearman Building

2nd Floor 9 Par-la-Ville Road

Hamilton HM11 Bermuda

+1 (441) 542-9234

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F Yes ☒ No ☐

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Included in this Report on Form 6-K is our Unaudited Interim Financial Report for the nine months ended September 30, 2024.

The information contained in this Report on Form 6-K is hereby incorporated by reference into the Company's registration statement on Form F-3 Registration Number 333-266328) which was filed with the U.S. Securities and Exchange Commission (the "Commission") on July 26, 2022, and into each prospectus outstanding under the foregoing registration statement, to the extent not superseded by documents or reports subsequently filed or furnished by the Company under the Securities Act of 1933, or the Securities Exchange Act of 1934.

Exhibits

99.1 Unaudited Interim Financial Report as of and for the nine months ended September 30, 2024

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| Borr Drilling Limited |

| (Registrant) |

| | |

| By: | /s/ Magnus Vaaler |

| Name: | Magnus Vaaler |

November 6, 2024 | Title: | Principal Financial Officer |

UNAUDITED INTERIM FINANCIAL REPORT

Forward-Looking Statements

This document and any other written or oral statements made by us in connection with this document include forward-looking statements that involve risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995.

You can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “estimate,” “intend,” “plan,” “believe,” “likely to” “should,” “continue” or other similar expressions. These forward-looking statements include statements about plans, objectives, goals, strategies, future events or performance, outlook, prospects and trends, market outlook, contract backlog, expected contracting and operation of our jack-up rigs, drilling contracts, options, expected trends in dayrates, market conditions, statements about dividends and share buybacks, statements with respect to newbuilds, including expected delivery dates, activity levels in the jack-up rig and oil industry, expected demand for and utilization of rigs, expected Adjusted EBITDA and other non-historical statements.

These forward-looking statements are not statements of historical facts and are based upon current estimates, expectations, beliefs and various assumptions, many of which are based, in turn, upon further assumptions. These statements involve significant known and unknown risks, uncertainties, contingencies and factors that are difficult or impossible to predict and are beyond our control, and that may cause our actual results, performance, financial results, position or achievements to be materially different from those expressed or implied by the forward-looking statements. Numerous factors could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by these forward-looking statements including: risks relating to our industry and business, risks relating to industry conditions and tendering activity, risks relating to customer demand and contracting activity and the risk of suspension and or termination of operations, the risk of delays in payments to our joint ventures and consequent payments to us, the risk that our customers do not comply with their contractual obligations, risks relating to our liquidity, including the risk that we may not be able to meet our liquidity requirements from cash flows from operations or through issuance of additional debt or equity or sale of assets, risks relating to our debt agreements, including our super senior revolving credit facility and other debt instruments, including our senior secured bonds due in 2028 and 2030, our convertible notes due in 2028, including risks relating to our ability to comply with covenants under our super senior revolving credit facility and other debt instruments and obtain any necessary waivers and the risk of cross defaults, risks relating to our ability to meet repayment obligations under senior secured notes due in 2028 and 2030, our convertible bonds and our other obligations as they fall due, including amortization payments, excess cash repayment offers and payments due at maturity, risks relating to future financings including the risk that future financings may not be completed when required and future equity and convertible debt financings will dilute shareholders and the risk that the foregoing would result in insufficient liquidity to continue our operations, risks relating to contracting our newly acquired rigs, risks related to climate change, including climate-change or greenhouse gas related legislation or regulations and the impact on our business from climate-change related physical changes or changes in weather patterns, and the potential impact of new regulations relating to climate change and the potential impact on the demand for oil and gas, risks relating to military actions including in Ukraine and the Middle East and their impact on our business and industry, and other risks described in Part. I of "Item 3.D. Risk Factors" of our most recent Annual Report on Form 20-F and other filings with the Commission.

The foregoing factors that could cause our actual results to differ materially from those contemplated in any forward-looking statement included in this report should not be construed as exhaustive. Any forward-looking statements that we make in this report speak only as of the date of such statements and we caution readers of this report not to place undue reliance on these forward-looking statements. Except as required by law, we undertake no (and expressly disclaim any) obligation to update or revise any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made.

Exhibit 99.1

Management Discussion and Analysis of Financial Condition and Results of Operation

The following is a discussion of our financial condition and results of operations for the nine months ended September 30, 2024 and 2023. Unless the context indicates otherwise, the "Company," "we," "us," "our," and words of similar nature, all refer to Borr Drilling Limited and its consolidated subsidiaries. Unless otherwise indicated, all references to "USD" and "$" in this report are to U.S. dollars. You should read the following discussion and analysis together with the financial statements and related notes included elsewhere in this report. For additional information, including definitions of certain terms used herein, please see Item 5 of our annual report on Form 20-F for the year ended December 31, 2023, which was filed with the Commission on March 27, 2024.

Overview

We are an offshore shallow-water drilling contractor providing worldwide offshore drilling services to the oil and gas industry. Our primary business is the ownership, contracting and operation of jack-up rigs for operation in shallow-water areas (i.e., in water depths up to approximately 400 feet), including the provision of related equipment and work crews to conduct oil and gas drilling and workover operations for exploration and production customers. As of September 30, 2024, we had 23 premium jack-up rigs and had agreed to purchase one additional premium jack-up rig under construction.

Recent Developments

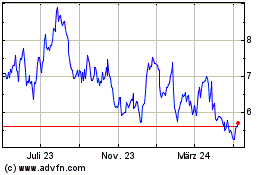

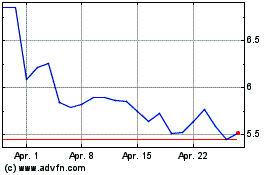

Delisting from the Oslo Stock Exchange

In October 2024, at a Special General Meeting of the Company, a resolution was passed to approve the delisting of the Company's common shares from the Oslo Stock Exchange ("OSE"), and to authorize the Board of Directors to take the necessary steps to implement the delisting, including filing an application with the OSE. The Company filed the delisting application with the OSE on October 2, 2024 which was approved by the OSE on November 1, 2024. The last day of trading for the Company on the OSE will be December 30, 2024.

Issuance of Additional Senior Secured Notes Due 2030

In October 2024, the Company priced an offering of additional 10.375% Senior Secured Notes due in 2030 ("Additional 2030 Notes" and, together with the existing 2028 Notes and the 2030 Notes, the "Notes") for gross proceeds of approximately $175.0 million, under the same terms and conditions as the $515.0 million 2023 Notes issued in November 2023. Settlement of the notes offering is expected on or about November 8, 2024 and is subject to customary closing conditions.

Issuance of Additional Senior Secured Notes Due 2028

In March 2024 and August 2024, the Company issued $200.0 million and $150.0 million principal amount of additional 10% Senior Secured Notes due in 2028, respectively, (together, "the Additional 2028 Notes and the Further Additional 2028 Notes") under the same indenture and with the same terms and conditions as the $1,025.0 million 2028 Notes issued in November 2023.

Amendment to the Super Senior Revolving Credit Facility

In November 2023, the Company entered into a $180 million Super Senior Revolving Credit Facility, comprised of a $150 million Revolving Credit Facility and a $30.0 million Guarantee Facility. In August 2024, the Company increased the $30.0 million Guarantee Facility to $45.0 million, bringing the total Super Senior Revolving Credit Facility to $195.0 million.

Grant of Restricted Share Units, Performance Share Units and Share Options

In May 2024, the Company granted the Chief Executive Officer ("CEO") 750,000 restricted share units ("RSUs") and 250,000 performance share units ("PSUs"). 500,000 RSUs vest on December 31, 2025 and 250,000 RSUs and 250,000 PSUs vest on December 31, 2026. The awards are conditional upon the CEO remaining an executive of the Company at the date of vesting with the PSUs being subject to an additional performance criteria linked to the Company's total shareholder return performance in comparison to a certain set of industry peers.

In September 2024, the Board of Directors resolved to grant 2,990,000 share options under the Company's approved share options scheme to certain of employees. Each share option gives the awardee the right to subscribe to one share in the Company. The options have a strike price of $6.68 and vest over a three-year period commencing on August 15, 2025 and expire after five years.

Operational and Contract Updates

In April 2024, we received a notice of temporary suspension of operations for the rig “Arabia I”, operating in Saudi Arabia. In June 2024, we terminated the contract for the rig, allowing us to secure a new contract for the rig in Brazil, which is expected to commence in 2025.

In August 2024, the Company accepted delivery of newbuild rig "Vali".

Operating and Financial Review

Set forth below is selected financial information for the nine months ended September 30, 2024 and 2023.

| | | | | | | | | | | | | | |

| Nine months ended September 30, | | |

| In $ millions | 2024 | 2023 | Change | % Change |

| | | | |

| | | | |

| Total operating revenues | 747.5 | 551.0 | 196.5 | | 36 | % |

| Gain on disposal | 0.6 | | 0.4 | | 0.2 | | 50 | % |

| Rig operating and maintenance expenses | (342.4) | | (260.8) | | (81.6) | | 31 | % |

| Depreciation of non-current assets | (95.5) | | (86.6) | | (8.9) | | 10 | % |

| | | | |

| General and administrative expenses | (37.0) | | (34.3) | | (2.7) | | 8 | % |

| Total operating expenses | (474.9) | | (381.7) | | (93.2) | | 24 | % |

| Operating income | 273.2 | | 169.7 | | 103.5 | | 61 | % |

| | | | |

| | | | |

| Income from equity method investments | 1.3 | | 7.4 | | (6.1) | | (82) | % |

| Total financial expenses, net | (170.1) | | (140.1) | | (30.0) | | 21 | % |

| Income before income taxes | 104.4 | | 37.0 | | 67.4 | | 182 | % |

| Income tax expense | (48.6) | | (43.3) | | (5.3) | | 12 | % |

| Net income / (loss) | 55.8 | | (6.3) | | 62.1 | | 986 | % |

Nine months ended September 30, 2024 compared with the nine months ended September 30, 2023

Net income / (loss): Net income increased by $62.1 million to net income of $55.8 million for the nine months ended September 30, 2024 compared to net loss of $6.3 million in the same period in 2023. The increase in net income is primarily a result of an increase in total operating revenue, offset in part by an increase in rig operating and maintenance expenses, depreciation of non-current assets, total financial expenses, net and income tax expense, as discussed below.

Total operating revenues: Total operating revenues increased by $196.5 million to $747.5 million for the nine months ended September 30, 2024 compared to $551.0 million for the same period in 2023. The increase is a result of an increase in dayrate revenue of $166.2 million, of which $76.1 million is attributable to an increase in the number of rigs in operation, $85.9 million is attributable to an increase in average dayrates and $15.6 million is attributable to other revenue, which is primarily comprised of amortization of deferred mobilization and demobilization revenue and reimbursable revenue. These increases were offset by a decrease of $11.4 million related to a decrease in the number of operating days for the rigs that were already in operation during the nine months ended September 30, 2023.

The increase in total operating revenues includes an increase in bareboat charter revenue of $65.3 million which is attributable to the execution of new fixed bareboat charter agreements for five of our rigs with an external party during the nine months ended September 30, 2024 and an increase in management contract revenue of $23.8 million which is attributable to the execution of new contract management agreements during the three months ended June 30, 2024, pursuant to which we provide rig operational and maintenance support services for three of our rigs which are on bareboat contracts with an external party. These increases were offset by a decrease in related party revenue of $58.8 million which is driven by the fact that the five rigs earning bareboat charter revenue during the nine months ended September 30, 2024 were previously earning related party revenue for the same period in 2023.

Gain on disposal: Gain on disposal was $0.6 million for the nine months ended September 30, 2024 compared to $0.4 million for the same period in 2023. The gain on disposal for the nine months ended September 30, 2024 and 2023 relate to the sale of scrap assets.

Rig operating and maintenance expenses: Rig operating and maintenance expenses increased by $81.6 million to $342.4 million for the nine months ended September 30, 2024 compared to $260.8 million for the same period in 2023. The increase is primarily a result of an increase in the number of rigs in operation as well as a result of the execution of new rig management contracts during the three months ended June 30, 2024 pursuant to which we provide rig operational and maintenance support services for three of our rigs which are on bareboat contracts with an external party. The expenses associated with these three rigs were previously recognized in our equity method investment, Perfomex.

Depreciation of non-current assets: Depreciation of non-current assets increased by $8.9 million to $95.5 million for the nine months ended September 30, 2024, compared to $86.6 million for the same period in 2023. The increase is primarily a result of an increase of $4.7 million associated with the increase in the asset base primarily due to additions for the jack-up rigs Arabia III and Hild and fleet spares and an increase of $4.2 million related to long-term maintenance projects primarily due to additions for the jack-up rigs Prospector 1, Idun, Natt and Ran and fleet spares.

General and administrative expenses: General and administrative expenses increased by $2.7 million to $37.0 million for the nine months ended September 30, 2024 compared to $34.3 million for the same period in 2023. The increase is primarily comprised of a $2.8 million increase in personnel and associated personnel tax expense as well as various individually insignificant movements associated with general corporate activities, offset in part by a $0.4 million decrease in share base compensation expense and social security expense associated with our employee share option plan.

Income from equity method investments: Income from equity method investments decreased by $6.1 million to $1.3 million for the nine months ended September 30, 2024 compared to $7.4 million for the same period in 2023. The decrease is primarily a result of an increase of $10.6 million in net foreign exchange losses, partially offset by a decrease of $6.2 million in income tax expense.

Total financial expenses, net: Total financial expenses, net, increased by $30.0 million to $170.1 million for the nine months ended September 30, 2024 compared to $140.1 million for the same period in 2023. The increase is principally due to an increase of $32.6 million in interest expense, primarily related to an increase in the principal amount of debt outstanding. In addition, the increase includes a $2.3 million increase in relation to the premium paid on Convertible Bonds which the Company repurchased in March 2024, partially offset by a $2.4 million decrease in net foreign exchange losses, $1.4 million decrease in yard cost cover expense, a $1.2 million increase in interest income as well as various individually insignificant movements associated with financing activities.

Income tax expense: Income tax expense increased by $5.3 million to $48.6 million for the nine months ended September 30, 2024, compared to $43.3 million for the same period in 2023. The overall increase is principally due to a $6.7 million utilization of deferred tax assets offset by a decrease of $1.4 million in corporate income tax expense.

Adjusted EBITDA: Adjusted EBITDA increased by $112.4 million to $368.7 million for the nine months ended September 30, 2024 compared to $256.3 million for the same period in 2023. Adjusted EBITDA is a non-GAAP measure. We present Adjusted EBITDA because we believe this measure increases comparability of underlying business performance from period to period and may be used to more easily compare our performance to other companies. Set forth below is how we calculate Adjusted EBITDA and a reconciliation of Adjusted EBITDA to net income / (loss) for the periods presented. Adjusted EBITDA for the nine months ended September 30, 2023 has been recast as per the updated definition of Adjusted EBITDA. See "Non-GAAP Financial Measures".

| | | | | | | | | | | | | | | | | | |

| Nine months ended September 30, | | | | | | |

| In $ millions | 2024 | 2023 | Change | % Change | | | | |

| Net income / (loss) | 55.8 | | (6.3) | | 62.1 | | 986 | % | | | | |

| Depreciation of non-current assets | 95.5 | | 86.6 | | 8.9 | | 10 | % | | | | |

| | | | | | | | |

| | | | | | | | |

| Income from equity method investments | (1.3) | | (7.4) | | 6.1 | | (82) | % | | | | |

| Total financial expenses, net | 170.1 | 140.1 | 30.0 | | 21 | % | | | | |

| Income tax | 48.6 | | 43.3 | | 5.3 | | 12 | % | | | | |

| | | | | | | | |

| | | | | | | | |

| Adjusted EBITDA | 368.7 | | 256.3 | | 112.4 | | 44 | % | | | | |

Liquidity and Capital Resources

Historically, we have met our liquidity needs principally from cash generated from operations, offerings of equity, convertible bonds, secured bonds, secured loan facilities, including shipyard delivery financing arrangements, revolving credit facilities and sale of non-core assets.

As of September 30, 2024, we had $185.7 million in cash and cash equivalents and $0.9 million in restricted cash.

During the year ended December 31, 2023, in connection with our Convertible Bonds, the Company entered into a share lending agreement with the intention of making up to 25.0 million common shares available to lend to DNB for the purposes of allowing the holders of the Convertible Bonds to perform hedging activities on the Oslo Stock Exchange. As of September 30, 2024, 12,331,900 shares have been issued to DNB Markets by the Company under the share lending agreement. For more information see Note 23 - Common Shares.

Cash Distributions

In December 2023, our Board of Directors approved a cash distribution of $0.05 per share for the third quarter of 2023, which was paid on January 22, 2024.

In February 2024, our Board of Directors approved a cash distribution of $0.05 per share for the fourth quarter of 2023, which was paid on March 18, 2024.

In May 2024, our Board of Directors approved a cash distribution of $0.10 per share for the first quarter of 2024, which was paid on June 17, 2024.

In August 2024, our Board of Directors approved a cash distribution of $0.10 per share for the second quarter of 2024, which was paid on September 6, 2024.

Borrowing Activities

As of September 30, 2024, we had total principal amount of debt outstanding of $2,072.1 million, of which $126.0 million matures within the next twelve months.

Repurchase of $10.6 million Unsecured Convertible Bonds due 2028

In February 2023 we issued $250.0 million unsecured convertible bonds due in February 2028. The Convertible Bonds have a coupon of 5.0% per annum payable semi-annually in arrears in equal installments. In March 2024, we repurchased $10.6 million principal amount of Convertible Bonds.

Following the payment of a $0.05 per share cash distribution in each of January and March 2024, as well as the payment of a $0.10 per share cash distribution in each of June and August 2024, the adjusted conversion price for the convertible bonds is $7.0249 per share, with the current outstanding principal amount of the Convertible Bonds convertible into 34,078,777 shares.

The Company and its subsidiaries may from time to time further repurchase or otherwise trade in its own debt in open market or privately negotiated transactions or otherwise.

Issuance of Additional 10% Senior Secured Notes Due 2028 and 10.375% Senior Secured Notes Due 2030

In March 2024 and August 2024, we issued $200.0 million and $150.0 million principal amount of additional 10% Senior Secured Notes due in 2028, respectively, under the same terms and conditions as the $1,025.0 million Senior Secured Note due 2028 issued in November 2023. In October 2024, we issued $175.0 million principal amount of additional 10.375% Senior Secured Notes due in 2030 under the same indenture and with the same terms and conditions as the $515.0 million Senior Secured Notes due in 2030 issued in November 2023.

Cash Flows

The table below sets forth cash flow information for the periods presented.

| | | | | | | | | | | | | | |

| Nine months ended September 30, | | |

| In $ millions | 2024 | 2023 | Change | % Change |

| Net cash provided by operating activities | 81.4 | | 28.7 | | 52.7 | | 184 | % |

| Net cash used in investing activities | (219.5) | | (68.7) | | (150.8) | | 220 | % |

| Net cash provided by financing activities | 222.1 | | 16.0 | | 206.1 | | 1,288 | % |

| Net increase / (decrease) in cash and cash equivalents and restricted cash | 84.0 | | (24.0) | | 108.0 | | (450) | % |

| Cash and cash equivalents and restricted cash at beginning of period | 102.6 | | 118.5 | | (15.9) | | (13) | % |

| Cash and cash equivalents and restricted cash at end of period | 186.6 | | 94.5 | | 92.1 | | 97 | % |

Net cash provided by operating activities increased by $52.7 million to $81.4 million for the nine months ended September 30, 2024, compared to net cash provided by operating activities of $28.7 million for the same period in 2023, primarily due to the increase in the number of operating rigs, increase in average dayrates and associated cash receipts from contract drilling services, partially offset by cash expenditures for contract drilling services and the timing of working capital movements.

Net cash used in investing activities of $219.5 million for the nine months ended September 30, 2024 is comprised of $36.1 million in additions to jack-up rigs, primarily as a result of special periodic survey and long term maintenance costs and $183.0 million in additions to newbuildings, primarily as a result the $159.9 million final installment payment for the "Vali" as well as $23.1 million in activation costs relating to the "Vali" and the "Var" and $0.4 million in purchases of property, plant and equipment.

Net cash used in investing activities of $68.7 million for the nine months ended September 30, 2023 is comprised of $77.2 million in additions to jack-up rigs, primarily as a result of activation and reactivation costs and $1.3 million in purchases of property, plant and equipment. These were offset by $9.8 million of distributions from equity method investments as a result of the return of previous shareholder funding.

Net cash provided by financing activities of $222.1 million for the nine months ended September 30, 2024 is comprised of:

•$208.3 million net proceeds from our additional Senior Secured Notes due in 2028 issued in March 2024;

•$154.4 million net proceeds from our additional Senior Secured Notes due in 2028 issued in August 2024;

•$85.0 million net proceeds from the temporary drawdown of our RCF due to the timing between the delivery of the jack-up rig '"Vali" and the receipt of the proceeds from our Further Additional 2028 Notes issued in August 2024;

•$1.9 million proceeds from the exercise of share options; offset by

•$155.9 million repayments of debt including $85.0 million related to our RCF, $47.2 million related to our Senior Secured Notes due in 2028, $13.1 million related to our Senior Secured Notes due in 2030 and $10.6 million associated with the repurchase of our Convertible Bonds in March 2024; and

•$71.6 million in cash distributions to shareholders.

Net cash provided by financing activities of $16.0 million for the nine months ended September 30, 2023 is comprised of:

•$391.3 million net proceeds from our Convertible Bonds and Senior Secured Bonds issued in February 2023;

• $25.0 million proceeds from the drawdown in April 2023 on our upsized DNB Facility;

• $9.6 million net proceeds from the sale of shares under our ATM program;

• $0.7 million proceeds from the exercise of share options; offset by

• $410.6 million of repayments of debt including $329.0 million related to our Convertible Bonds due in May 2023.

Cash interest paid was $104.2 million for the nine months ended September 30, 2024 and $118.2 million for the same period in 2023 and is included in net cash used in operating activities.

Non-GAAP Financial Measures

In addition to disclosing financial results in accordance with U.S. GAAP, this report includes the non-GAAP financial measure, Adjusted EBITDA. We believe that this non-GAAP financial measure provides useful supplemental information about the financial performance of our business, enables comparison of financial results between periods where certain items may vary independent of business performance, and allows for greater transparency with respect to key metrics used by management in operating our business and measuring our performance.

The non-GAAP financial measure should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP. Non-GAAP measures are not uniformly defined by all companies and may not be comparable with similarly titled measures and disclosures used by other companies.

During the nine months ended September 30, 2024, the Company changed its definition of Adjusted EBITDA to exclude the adjustment for amortization of deferred mobilization and contract preparations costs as well as the adjustment for amortization of deferred mobilization, demobilization and other revenue. We believe that this change enables us to be more closely aligned with the calculation methodology used by many of our industry peers. Adjusted EBITDA for all periods presented has been updated as per the definition below.

| | | | | | | | | | | |

| Non-GAAP Measure | Closest Equivalent to GAAP Measure | Definition | Rationale for Presentation of this non-GAAP Measure |

| Adjusted EBITDA | Net income / (loss) attributable to shareholders of Borr Drilling Limited | Net income / (loss) adjusted for: depreciation of non-current assets; (loss) / income from equity method investments; total financial expenses, net; and income tax expense. | Increases the comparability of total business performance from period to period and against the performance of other companies by excluding the results of our equity investments and removing the impact of depreciation, financing and tax items. |

| | | |

We believe that Adjusted EBITDA improves the comparability of period-to-period results and is representative of our underlying performance, although Adjusted EBITDA has significant limitations, including not reflecting our cash requirements for capital or deferred costs, rig reactivation costs, newbuild rig activation costs, contractual commitments, taxes, working capital or debt service. Non-GAAP financial measures may not be comparable to similarly titled measures of other companies and have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our operating results as reported under U.S. GAAP.

Borr Drilling Limited

Index to the Unaudited Condensed Consolidated Financial Statements

| | | | | | | | | | | | | | |

| | | | Page |

| Unaudited Condensed Consolidated Statements of Operations for the three and nine months ended September 30, 2024 and 2023 | |

| | | | |

| Unaudited Condensed Consolidated Balance Sheets as of September 30, 2024 and December 31, 2023 | |

| | | | |

| Unaudited Condensed Consolidated Statements of Cash Flows for the three and nine months ended September 30, 2024 and 2023 | |

| | | | |

| Unaudited Condensed Consolidated Statements of Changes in Shareholders' Equity for the three and nine months ended September 30, 2024 and 2023 | |

| | | | |

| Notes to the Unaudited Condensed Consolidated Financial Statements | |

Borr Drilling Limited

Unaudited Condensed Consolidated Statements of Operations

(In $ millions except share and per share data)

| | | | | | | | | | | | | | | | | |

| Notes | Three months ended September 30, 2024 | Three months ended September 30, 2023 | Nine months ended September 30, 2024 | Nine months ended September 30, 2023 |

| Operating revenues |

|

|

|

| |

| Dayrate revenue | 4 | 202.1 | | 160.4 | | 623.4 | | 457.2 | |

| Bareboat charter revenue | 4, 14 | 27.4 | | — | | 65.3 | | — | |

| Management contract revenue | 4 | 12.1 | | — | | 23.8 | | — | |

| Related party revenue | 4, 21 | — | | 31.1 | | 35.0 | | 93.8 | |

| Total operating revenues | | 241.6 | | 191.5 | | 747.5 | | 551.0 | |

| | | | | |

| Gain on disposals | | 0.2 | | 0.1 | | 0.6 | | 0.4 | |

| | | | | |

| Operating expenses | | | | | |

| Rig operating and maintenance expenses | | (114.3) | | (85.8) | | (342.4) | | (260.8) | |

| Depreciation of non-current assets | 13 | (31.8) | | (30.4) | | (95.5) | | (86.6) | |

| | | | | |

| General and administrative expenses | | (12.0) | | (11.6) | | (37.0) | | (34.3) | |

| | | | | |

| Total operating expenses | | (158.1) | | (127.8) | | (474.9) | | (381.7) | |

| | | | | |

| Operating income | | 83.7 | | 63.8 | | 273.2 | | 169.7 | |

| | | | | |

| | | | | |

| (Loss) / income from equity method investments | 6 | (1.6) | | 1.1 | | 1.3 | | 7.4 | |

| | | | | |

| Financial income (expenses), net | | | | | |

| Interest income | | 1.6 | | 0.1 | | 5.4 | | 4.2 | |

| Interest expense | 7 | (53.5) | | (41.7) | | (154.5) | | (121.9) | |

| Other financial expenses, net | 8 | (5.0) | | (8.4) | | (21.0) | | (22.4) | |

| Total financial expenses, net | | (56.9) | | (50.0) | | (170.1) | | (140.1) | |

| | | | | |

| Income before income taxes | | 25.2 | | 14.9 | | 104.4 | | 37.0 | |

| Income tax expense | 9 | (15.5) | | (14.6) | | (48.6) | | (43.3) | |

| Net income / (loss) attributable to shareholders of Borr Drilling Limited | | 9.7 | | 0.3 | | 55.8 | | (6.3) | |

| | | | | |

Total comprehensive income / (loss) attributable to shareholders of Borr Drilling Limited | | 9.7 | | 0.3 | | 55.8 | | (6.3) | |

| | | | | |

| | | | | |

| Basic income / (loss) per share | 10 | 0.04 | — | | 0.22 | | (0.03) | |

| Diluted income / (loss) per share | 10 | 0.04 | — | | 0.22 | | (0.03) | |

| Weighted-average shares outstanding - basic | 10 | 250,974,773 | | 245,754,679 | | 251,625,161 | | 241,811,304 | |

| Weighted-average shares outstanding - diluted | 10 | 254,890,897 | | 250,171,209 | | 255,576,088 | | 241,811,304 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Borr Drilling Limited

Unaudited Condensed Consolidated Balance Sheets

(In $ millions)

| | | | | | | | | | | |

| Notes | September 30, 2024 | December 31, 2023 |

| ASSETS |

| Unaudited | Audited |

| Current assets |

|

|

|

| Cash and cash equivalents | | 185.7 | | 102.5 | |

| Restricted cash | | 0.9 | | 0.1 | |

| Trade receivables, net | | 152.4 | | 56.2 | |

| | | |

| Prepaid expenses | | 7.2 | | 11.0 | |

| | | |

| Deferred mobilization and contract preparation costs | 5 | 33.6 | | 39.4 | |

| Accrued revenue | 5 | 94.7 | | 73.7 | |

| | | |

| Due from related parties | 21 | 78.3 | | 95.0 | |

| | | |

| Other current assets | 11 | 29.8 | | 32.0 | |

| Total current assets | | 582.6 | | 409.9 | |

| | | |

| Non-current assets | | | |

| | | |

| Property, plant and equipment | | 3.0 | | 3.5 | |

| Newbuildings | 12 | 169.2 | | 5.4 | |

| Jack-up drilling rigs, net | 13 | 2,526.2 | | 2,578.3 | |

| | | |

| | | |

| Equity method investments | 6 | 17.0 | | 15.7 | |

| Other non-current assets | 15 | 45.3 | | 67.3 | |

| Total non-current assets | | 2,760.7 | | 2,670.2 | |

| Total assets | | 3,343.3 | | 3,080.1 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities | | | |

| Trade payables | | 59.0 | | 35.5 | |

| | | |

| | | |

| Accrued expenses | 16 | 75.3 | | 77.0 | |

| Short-term accrued interest and other items | | 80.7 | | 42.3 | |

| Short-term debt | 18 | 109.4 | | 82.9 | |

| Short-term deferred mobilization, demobilization and other revenue | 5 | 29.6 | | 59.5 | |

| | | |

| Other current liabilities | 17 | 59.0 | | 63.2 | |

| Total current liabilities | | 413.0 | | 360.4 | |

| | | |

| Non-current liabilities | | | |

| | | |

| Long-term debt | 18 | 1,889.1 | | 1,618.8 | |

| Long-term deferred mobilization, demobilization and other revenue | 5 | 20.8 | | 56.6 | |

| Other non-current liabilities | | 4.6 | | 5.8 | |

| Onerous contracts | 19 | 27.6 | | 54.5 | |

| Total non-current liabilities | | 1,942.1 | | 1,735.7 | |

| Total liabilities | | 2,355.1 | | 2,096.1 | |

| | | |

| | | | | | | | | | | | |

| Shareholders’ Equity | | | | |

Common shares of par value $0.10 per share: authorized 315,000,000 (2023:315,000,000) shares, issued 264,080,391 (2023: 264,080,391) shares and outstanding 251,175,371 (2023: 252,582,036) shares | 23 | 26.5 | | 26.5 | | |

| Treasury shares | | (9.0) | | (8.9) | | |

| Additional paid in capital | | 345.4 | | 337.2 | | |

| Contributed surplus | | 1,928.4 | | 1,988.1 | | |

| | | | |

| Accumulated deficit | | (1,303.1) | | (1,358.9) | | |

| | | | |

| | | | |

| Total equity | | 988.2 | | 984.0 | | |

| | | | |

| Total liabilities and equity | | 3,343.3 | | 3,080.1 | | |

| | | | |

| | | | |

| | | | |

| | | | |

Borr Drilling Limited

Unaudited Condensed Consolidated Statements of Cash Flows

(In $ millions)

| | | | | | | | | | | | | | | | | |

| Notes | Three months ended September 30, 2024 | Three months ended September 30, 2023 | Nine months ended September 30, 2024 | Nine months ended September 30, 2023 |

| Cash flows from operating activities |

| | | | |

| Net income / (loss) | | 9.7 | | 0.3 | | 55.8 | | (6.3) | |

| Adjustments to reconcile net income / (loss) to net cash provided by operating activities: | | | | | |

| Non-cash compensation expense related to share based employee and directors' compensation | | 2.5 | | 1.3 | | 6.1 | | 3.9 | |

| Depreciation of non-current assets | 13 | 31.8 | | 30.4 | | 95.5 | | 86.6 | |

| | | | | |

| | | | | |

| Amortization of deferred mobilization and contract preparation costs | | 13.3 | | 8.0 | | 45.1 | | 32.8 | |

| Amortization of deferred mobilization, demobilization and other revenue | | (10.4) | | (14.0) | | (79.1) | | (44.5) | |

| Gain on disposal of assets | | (0.2) | | (0.1) | | (0.6) | | (0.4) | |

| Amortization of debt discount | 7 | 1.7 | | — | | 5.1 | | — | |

| Amortization of debt premium | 7 | (0.4) | | — | | (0.7) | | — | |

| Amortization of deferred finance charges | 7 | 3.1 | | 2.6 | | 8.6 | | 7.6 | |

| Bank commitment, guarantee and other fees | | — | | — | | — | | 0.3 | |

| Effective interest rate adjustments | | — | | 0.5 | | — | | (2.7) | |

| Change in fair value of financial instruments | 8 | 0.3 | | — | | — | | — | |

| Loss / (income) from equity method investments | 6 | 1.6 | | (1.1) | | (1.3) | | (7.4) | |

| | | | | |

| | | | | |

| Deferred income tax | 9 | (3.0) | | (1.2) | | (7.4) | | (0.4) | |

| Change in assets and liabilities: | | | | | |

| Amounts due from related parties | | 0.1 | | (8.5) | | 10.8 | | (24.7) | |

| Accrued expenses | | 2.1 | | (16.4) | | (9.9) | | (18.0) | |

| Accrued interest | | 39.7 | | 7.0 | | 30.6 | | (0.5) | |

| Other current and non-current assets | | (49.8) | | (43.9) | | (121.6) | | (75.7) | |

| Other current and non-current liabilities | | 6.3 | | 69.6 | | 44.4 | | 78.1 | |

| Net cash provided by operating activities | | 48.4 | | 34.5 | | 81.4 | | 28.7 | |

|

| | | | |

| Cash flows from investing activities |

|

|

|

|

|

| Purchase of property, plant and equipment | | — | | (0.4) | | (0.4) | | (1.3) | |

| | | | | |

| | | | | |

| Repayment of loan from equity method investments | 6 | — | | — | | — | | 9.8 | |

| | | | | |

| | | | | |

| Additions to newbuildings | | (173.3) | | — | | (183.0) | | — | |

| Additions to jack-up drilling rigs | | (14.1) | | (23.4) | | (36.1) | | (77.2) | |

| Net cash used in investing activities |

| (187.4) | | (23.8) | | (219.5) | | (68.7) | |

|

| | | | |

| Cash flows from financing activities |

|

|

|

|

|

| Proceeds from share issuance, net of issuance cost | | — | | 9.6 | | — | | 9.6 | |

| | | | | |

Repayment of debt (1) | 18 | (85.0) | | (10.3) | | (155.9) | | (410.6) | |

| | | | | |

| Cash dividends paid | | (23.9) | | — | | (71.6) | | — | |

| Debt proceeds, gross of premium / (net of discount) and issuance costs | 18 | 239.4 | | — | | 447.7 | | 416.3 | |

| | | | | |

| | | | | |

| Proceeds from exercise of share options | | 0.6 | | 0.7 | | 1.9 | | 0.7 | |

| Net cash provided by financing activities | | 131.1 | | — | | 222.1 | | 16.0 | |

|

| | | — | | — | |

Net (decrease) / increase in cash, cash equivalents and restricted cash | | (7.9) | | 10.7 | | 84.0 | | (24.0) | |

| Cash, cash equivalents and restricted cash at the beginning of the period | | 194.5 | | 83.8 | | 102.6 | | 118.5 | |

| Cash, cash equivalents and restricted cash at the end of the period | | 186.6 | | 94.5 | | 186.6 | | 94.5 | |

| | | | | |

| Supplementary disclosure of cash flow information | | | | | |

| Interest paid | | (6.0) | | (21.6) | | (104.2) | | (118.2) | |

| Income taxes paid | | (9.7) | | (10.4) | | (39.7) | | (28.3) | |

(1) Included in repayment of debt is the redemption premium on our Senior Secured Notes due in 2028 and 2030

Borr Drilling Limited

Unaudited Condensed Consolidated Statements of Cash Flows

(In $ millions)

| | | | | | | | | | | |

| (In $ millions) | | September 30, 2024 | December 31, 2023 | | |

| | | | | |

| Cash and cash equivalents | | 185.7 | | 102.5 | | | |

| Restricted cash | | 0.9 | | 0.1 | | | |

| | | | | |

| Total cash and cash equivalents and restricted cash | | 186.6 | | 102.6 | | | |

Borr Drilling Limited

Unaudited Condensed Consolidated Statements of Changes in Shareholders’ Equity

(In $ millions except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Number of outstanding shares | Common shares | Treasury shares | Additional paid in capital | | Contributed Surplus | Accumulated deficit | | Total equity | |

| Balance as at December 31, 2022 | 228,948,087 | | 23.0 | | (9.8) | | 2,265.6 | | | — | | (1,381.0) | | | 897.8 | | |

| Issue of common shares | 15,000,000 | | 2.5 | | (1.0) | | — | | | — | | — | | | 1.5 | | |

| Convertible debt issuance cost | — | | — | | — | | 10.9 | | | | — | | | 10.9 | | |

| | | | | | | | | | |

| Share-based compensation | — | | — | | — | | 1.3 | | | — | | — | | | 1.3 | | |

| Total comprehensive loss | — | | — | | — | | — | | | — | | (7.4) | | | (7.4) | | |

| Balance as at March 31, 2023 | 243,948,087 | | 25.5 | | (10.8) | | 2,277.8 | | | — | | (1,388.4) | | | 904.1 | | |

| Issue of common shares | 1,154,645 | | — | | 0.1 | | (0.1) | | | — | | — | | | — | | |

| Equity issuance costs | — | | — | | — | | — | | | — | | — | | | — | | |

| Share-based compensation | — | | — | | — | | 1.3 | | | — | | — | | | 1.3 | | |

| Total comprehensive income | — | | — | | — | | — | | | — | | 0.8 | | | 0.8 | | |

| Balance as at June 30, 2023 | 245,102,732 | | 25.5 | | (10.7) | | 2,279.0 | | | — | | (1,387.6) | | | 906.2 | | |

| Issue of common shares | 430,437 | | 0.2 | | (0.2) | | 9.6 | | | — | | — | | | 9.6 | | |

| | | | | | | | | | |

| Share-based compensation | 380,302 | | — | | — | | 2.0 | | | — | | — | | | 2.0 | | |

| Total comprehensive income | — | | — | | — | | — | | | — | | 0.3 | | | 0.3 | | |

| Balance as at September 30, 2023 | 245,913,471 | | 25.7 | | (10.9) | | 2,290.6 | | | — | | (1,387.3) | | | 918.1 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Number of outstanding shares | Common shares | Treasury shares | Additional paid in capital | | Contributed Surplus | Accumulated deficit | | Total equity | |

| Balance as at December 31, 2023 | 252,582,036 | | 26.5 | | (8.9) | | 337.2 | | | 1,988.1 | | (1,358.9) | | | 984.0 | | |

| Issue of common shares | 3,067 | | — | | — | | — | | | — | | — | | | — | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Share based compensation | 411,336 | | — | | 0.1 | | 3.0 | | | — | | — | | | 3.1 | | |

| Distribution to shareholders | — | | — | | — | | — | | | (11.9) | | — | | | (11.9) | | |

| Total comprehensive income | — | | — | | — | | — | | | — | | 14.4 | | | 14.4 | | |

| | | | | | | | | | |

| Balance as at March 31, 2024 | 252,996,439 | | 26.5 | | (8.8) | | 340.2 | | | 1,976.2 | | (1,344.5) | | | 989.6 | | |

| Movement in treasury shares | (2,364,437) | | — | | (0.3) | | 0.3 | | | — | | — | | | — | | |

| | | | | | | | | | |

| Share based compensation | — | | — | | — | | 1.8 | | | — | | — | | | 1.8 | | |

| Distribution to shareholders | — | | — | | — | | — | | | (23.9) | | — | | | (23.9) | | |

| Total comprehensive income | — | | — | | — | | — | | | — | | 31.7 | | | 31.7 | | |

| Balance as at June 30, 2024 | 250,632,002 | | 26.5 | | (9.1) | | 342.3 | | | 1,952.3 | | (1,312.8) | | | 999.2 | | |

| Movement in treasury shares | 250,000 | | — | | — | | — | | | — | | — | | | — | | |

| Share based compensation | 293,369 | | — | | 0.1 | | 3.1 | | | — | | — | | | 3.2 | | |

| Distribution to shareholders | — | | — | | — | | — | | | (23.9) | | — | | | (23.9) | | |

| Total comprehensive income | — | | — | | — | | — | | | — | | 9.7 | | | 9.7 | | |

| Balance as at September 30, 2024 | 251,175,371 | | 26.5 | | (9.0) | | 345.4 | | | 1,928.4 | | (1,303.1) | | | 988.2 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Borr Drilling Limited

Notes to the Unaudited Condensed Consolidated Financial Statements

Note 1 - General Information

Borr Drilling Limited was incorporated in Bermuda on August 8, 2016. We are listed on the Oslo Stock Exchange ("OSE") and on the New York Stock Exchange ("NYSE") under the ticker "BORR". We have applied to delist our shares from the OSE and the OSE has approved such application on November 1, 2024. The last day of trading for the Company on the OSE will be on December 30, 2024. Borr Drilling Limited is an international offshore drilling contractor providing services to the oil and gas industry. Our primary business is the ownership, contracting and operation of modern jack-up drilling rigs for operations in shallow-water areas (i.e., in water depths up to approximately 400 feet), including the provision of related equipment and work crews to conduct drilling of oil and gas wells and workover operations for exploration and production customers. As of September 30, 2024, we had 23 premium jack-up rigs and had agreed to purchase one additional premium jack-up rig under construction which is scheduled for delivery in the fourth quarter of 2024.

As used herein, and unless otherwise required by the context, the terms “Company,” “Borr”, “we,” “Group,” “our” and words of similar nature refer to Borr Drilling Limited and its consolidated companies. The use herein of such terms as “group”, “organization”, “we”, “us”, “our” and “its”, or references to specific entities, is not intended to be a precise description of corporate relationships.

Note 2 - Basis of Preparation and Accounting Policies

Basis of preparation

The unaudited condensed consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”). The unaudited condensed consolidated financial statements do not include all of the disclosures required under U.S. GAAP in the annual consolidated financial statements, and should be read in conjunction with our audited annual financial statements for the year ended December 31, 2023, which are included in our annual report on Form 20-F for the fiscal year ended December 31, 2023, filed with the Securities and Exchange Commission on March 27, 2024. The Consolidated Balance Sheet data as of December 31, 2023 was derived from our audited annual financial statements. The amounts are presented in millions of United States dollars ("U.S. dollar" or "$"), unless otherwise stated. The financial statements have been prepared on a going concern basis and in management's opinion, all adjustments necessary for a fair presentation of the financial statements are reflected in the interim periods presented.

Significant accounting policies

The accounting policies adopted in the preparation of the unaudited condensed consolidated financial statements for the nine months ended September 30, 2024 are consistent with those followed in preparation of our annual audited consolidated financial statements for the year ended December 31, 2023, except for the revenue and marketable equity securities accounting policies. During the nine months ended September 30, 2024, the revenue accounting policy was updated as a result of the execution of bareboat charter agreements and operating and maintenance agreements with third-parties and the marketable equity securities accounting policy was included as a result of the Company's investment in equity securities.

Revenue

The Company performs services that represent a single performance obligation under its drilling contracts. This performance obligation is satisfied over time. The Company earns revenues primarily by performing the following activities: (i) providing the drilling rig, work crews, related equipment and services necessary to operate the rig (ii) delivering the drilling rig by mobilizing to and demobilizing from the drilling location, and (iii) performing certain pre-operating activities, including rig preparation activities or equipment modifications required for the contract.

The Company recognizes revenues earned under drilling contracts based on variable dayrates, which range from full operating dayrates to lower rates or zero rates for periods when drilling operations are interrupted or restricted, based on the specific activities performed during the contract. The total transaction price is determined for each individual contract by estimating both fixed and variable consideration expected to be earned over the firm term of the contract and may include the blending of rates when a contract has operating dayrates that change over the firm term of the contract. Such dayrate consideration is attributed to the distinct time period to which it relates within the contract term, and therefore is recognized as the Company performs the services.

The Company recognizes revenues earned in relation to contract management agreements where we provide rig operational and maintenance support services to third parties based either on a cost-plus or dayrate basis. Such consideration is attributed to the distinct time period to which it relates within the contract term, and therefore is recognized as the Company performs the services.

The Company recognizes revenues earned in relation to certain bareboat charter agreements where we lease our owned rigs to third parties based on fixed daily rates, which range from operating rates to stand-by rates or zero rates for periods when drilling operations are interrupted or restricted, based on the specific activities performed during the contract. The total transaction price is determined for each individual contract by estimating both fixed and variable consideration expected to be earned over the firm term of the contract and may include the blending of rates when a contract has fixed daily rates that change over the firm term of the contract. Such fixed daily rate consideration is attributed to the distinct time period to which it relates within the contract term, and therefore is recognized as the Company performs the services.

The Company recognizes reimbursement revenues and the corresponding costs, gross, at a point in time, as the Company provides the customer-requested goods and services, when such reimbursable costs are incurred while performing drilling operations. Reimbursable revenues are recognized in 'Dayrate revenue' in the Unaudited Condensed Consolidated Statements of Operations.

Prior to performing drilling operations, the Company may receive pre-operating revenues, on either a fixed lump-sum or variable dayrate basis, for mobilization, contract preparation, customer-requested goods and services or capital upgrades or other upfront payments, which the Company recognizes over time in line with the satisfaction of the performance obligation. These activities are not considered to be distinct within the context of the contract and therefore, the associated revenue is allocated to the overall performance obligation and recognized ratably over the expected term of the related drilling contract. We record a contract liability for mobilization fees received, which is amortized ratably to dayrate revenue as services are rendered over the initial term of the related drilling contract.

We may receive fees (on either a fixed lump-sum or variable dayrate basis) for the demobilization of our rigs. Demobilization revenue expected to be received upon contract completion is estimated as part of the overall transaction price at contract inception and recognized over the term of the contract. In most of our contracts, there is uncertainty as to the likelihood and amount of expected demobilization revenue to be received as the amount may vary dependent upon whether or not the rig has additional contracted work following the contract. Therefore, the estimate for such revenue may be constrained, depending on the facts and circumstances pertaining to the specific contract. We assess the likelihood of receiving such revenue based on past experience and knowledge of the market conditions.

Investment in marketable equity securities

Investment in marketable equity securities with readily determinable fair values are measured at fair value each reporting period with the related gains and losses, including unrealized, recognized in “Other financial expenses, net” in the Unaudited Condensed Consolidated Statements of Operations.

We classify our investment in marketable equity securities as current assets because the securities are available to be sold to meet liquidity needs if necessary, even if it is not the intention to dispose of the securities in the next twelve months.

Use of estimates

The preparation of financial statements in accordance with U.S. GAAP requires that management make estimates and assumptions affecting the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Note 3 - Recently Issued Accounting Standards

Adoption of new accounting standards

In June 2022, the Financial Accounting Standards Board ("FASB") issued ASU 2022-03 Fair Value Measurement (Topic 820): Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions. The amendments clarify that a contractual restriction on the sale of an equity security is not considered part of the unit of account of the equity security and, therefore, is not considered in measuring fair value. The amendments also clarify that an entity cannot, as a separate unit of account, recognize and measure a contractual sale restriction and require the following disclosures for equity securities subject to contractual sale restrictions: 1) The fair value of equity securities subject to contractual sale restrictions reflected in the balance sheet; 2) The nature and remaining duration of the restriction(s) and 3) The circumstances that could cause a lapse in the restriction(s). These amendments are effective for the Company from January 1, 2024. There was no impact resulting from these amendments on our unaudited consolidated financial statements or related disclosures as presented in this interim set of accounts for the nine months ended September 30, 2024.

In March 2023, the FASB issued ASU 2023-01 Leases (Topic 842): Common Control Arrangements. The amendments provide a practical expedient for private companies and not-for-profit entities that are not conduit bond obligors to use the written terms and conditions of a common control arrangement to determine whether a lease exists and, if so, the classification of and accounting for that lease. If no written terms and conditions exist (including in situations in which an entity does not document existing unwritten terms and conditions in writing upon transition to the practical expedient), an entity is prohibited from applying the practical expedient and must evaluate the enforceable terms and conditions to apply Topic 842. Also, the amendments require that leasehold improvements associated with common control leases be: 1) Amortized by the lessee over the useful life of the leasehold improvements to the common control group (regardless of the lease term) as long as the lessee controls the use of the underlying asset (the leased asset) through a lease. However, if the lessor obtained the right to control the use of the underlying asset through a lease with another entity not within the same common control group, the amortization period may not exceed the amortization period of the common control group; 2) Accounted for as a transfer between entities under common control through an adjustment to equity (or net assets for not-for-profit entities) if, and when, the lessee no longer controls the use of the underlying asset. Additionally, those leasehold improvements are subject to the impairment guidance in Topic 360, Property, Plant, and Equipment. These amendments are effective for the Company from January 1, 2024. There was no impact resulting from these amendments on our unaudited consolidated financial statements or related disclosures as presented in this interim set of accounts for the nine months ended September 30, 2024.

In March 2023, the FASB issued ASU 2023-02 Investments—Equity Method and Joint Ventures (Topic 323): Accounting for Investments in Tax Credit Structures Using the Proportional Amortization Method (a consensus of the Emerging Issues Task Force). The amendments permit reporting entities to elect to account for their tax equity investments, regardless of the tax credit program from which the income tax credits are received, using the proportional amortization method if certain conditions are met. Under the proportional amortization method, an entity amortizes the initial cost of the investment in proportion to the income tax credits and other income tax benefits received and recognizes the net amortization and income tax credits and other income tax benefits in the income statement as a component of income tax expense (benefit). These amendments are effective for the Company from January 1, 2024. There was no impact resulting from these amendments on our unaudited consolidated financial statements or related disclosures as presented in this interim set of accounts for the nine months ended September 30, 2024.

In November 2023, the FASB issued ASU 2023-07 Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures. The amendments in this Update improve reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. The amendments in this Update: 1) Require that a public entity disclose, on an annual and interim basis, significant segment

expenses that are regularly provided to the Chief Operating Decision Maker ("CODM") and included within each reported measure of segment profit or loss; 2) Require that a public entity disclose, on an annual and interim basis, an amount for other segment items by reportable segment and a description of its composition; 3) Require that a public entity provide all annual disclosures about a reportable segment’s profit or loss and assets currently required by Topic 280 in interim periods; 4) Clarify that if the CODM uses more than one measure of a segment’s profit or loss in assessing segment performance and deciding how to allocate resources, a public entity may report one or more of those additional measures of segment profit. However, at least one of the reported segment profit or loss measures (or the single reported measure, if only one is disclosed) should be the measure that is most consistent with the measurement principles used in measuring the corresponding amounts in the public entity’s consolidated financial statements; 5) Require that a public entity disclose the title and position of the CODM and an explanation of how the CODM uses the reported measure(s) of segment profit or loss in assessing segment performance and deciding how to allocate resources; 6) Require that a public entity that has a single reportable segment provide all the disclosures required by the amendments in this Update and all existing segment disclosures in Topic 280. These amendments are effective for the Company for annual periods beginning from January 1, 2024 and interim periods beginning January 1, 2025. There was no impact resulting from these amendments on our unaudited consolidated financial statements and no material impact on our related disclosures as presented in this interim set of accounts for the nine months ended September 30, 2024.

Accounting pronouncements that have been issued but not yet adopted

| | | | | | | | | | | |

| Standard | Description | Date of Adoption | Effect on our Consolidated Financial Statements or Other Significant Matters |

| ASU 2023-05 Business Combinations—Joint Venture Formations (Subtopic 805-60): Recognition and Initial Measurement | The amendments in this Update address the accounting for contributions made to a joint venture, upon formation, in a joint venture’s separate financial statements. The objectives of the amendments are to:

(1) provide decision-useful information to investors and other allocators of capital (collectively, investors) in a joint venture’s financial statements; and

(2) reduce diversity in practice.

To reduce diversity in practice and provide decision-useful information to a joint venture’s investors, the Board decided to require that a joint venture apply a new basis of accounting upon formation, resulting in a joint venture, upon formation, being required to recognize and initially measure its assets and liabilities at fair value (with exceptions to fair value measurement that are consistent with the business combinations guidance). | January 1, 2025 | Under evaluation |

| ASU 2023-09 Income Taxes (Topic 740): Improvements to Income Tax Disclosures | The amendments in this Update require that public business entities on an annual basis (1) disclose specific categories in the rate reconciliation and (2) provide additional information for reconciling items that meet a quantitative threshold (if the effect of those reconciling items is equal to or greater than 5 percent of the amount computed by multiplying pretax income (or loss) by the applicable statutory income tax rate). A public business entity is required to provide an explanation, if not otherwise evident, of the individual reconciling items disclosed, such as the nature, effect, and underlying causes of the reconciling items and the judgment used in categorizing the reconciling items.

The other amendments in this Update improve the effectiveness and comparability of disclosures by (1) adding disclosures of pretax income (or loss) and income tax expense (or benefit) to be consistent with U.S. Securities and Exchange Commission (SEC) Regulation S-X 210.4-08(h), Rules of General Application—General Notes to Financial Statements: Income Tax Expense, and (2) removing disclosures that no longer are considered cost beneficial or relevant. | January 1, 2025 | Under evaluation |

| ASU 2024-01: Compensation—Stock Compensation (Topic 718) | The amendments in this Update improve GAAP by adding an illustrative example to demonstrate how an entity should apply the scope guidance in paragraph 718-10-15-3 to determine whether a profits interest award should be accounted for in accordance with Topic 718, Compensation—Stock Compensation. The fact patterns in the illustrative example focus on the scope conditions in paragraph 718-10-15-3. The illustrative example is intended to reduce (1) complexity in determining whether a profits interest award is subject to the guidance in Topic 718 and (2) existing diversity in practice. | January 1, 2025 | Under evaluation |

As of November 6, 2024, the FASB have issued further updates not included above. We do not currently expect any of these updates to have a material impact on our consolidated financial statements and related disclosures either on transition or in future periods.

Note 4 - Segment Information

During the three months ended September 30, 2024 and September 30, 2023, we had a single reportable segment: our operations performed under our dayrate model (which includes rig charters and ancillary services). Our CODM, our Board of Directors, reviews financial information provided as an aggregate sum of assets, liabilities and activities that exist to generate cash flows, by our single operating segment. Given that we only have a single reportable segment, allocation of resources by our CODM is not determined by segment profit or loss.

The following presents financial information by segment for the three months ended September 30, 2024:

| | | | | | | | | | | | |

| Dayrate | | Reconciling Items (2) | Consolidated total |

| Dayrate revenue | 206.1 | | (4.0) | 202.1 |

| Bareboat charter revenue | 27.4 | | — | 27.4 |

| Management contract revenue | 32.6 | | (20.5) | 12.1 |

| | | | |

| Gain on disposal | — | | 0.2 | 0.2 |

| Rig operating and maintenance expenses | (137.9) | | 23.6 | (114.3) |

Depreciation of non-current assets (1) | (31.7) | | (0.1) | (31.8) |

| | | | |

General and administrative expenses (1) | — | | (12.0) | (12.0) |

| Loss from equity method investments | — | | (1.6) | (1.6) |

| Operating income including equity method investments | 96.5 | | (14.4) | 82.1 |

| | | | |

| Total assets | 3,569.0 | | (225.7) | 3,343.3 |

| | | | |

The following presents financial information by segment for the three months ended September 30, 2023: |

| | | | |

| (in $ millions) | Dayrate | | Reconciling Items (2) | Consolidated total |

| Dayrate revenue | 237.5 | | (77.1) | 160.4 |

| Related party revenue | — | | 31.1 | 31.1 |

| Gain on disposal | — | | 0.1 | 0.1 |

| Rig operating and maintenance expenses | (161.7) | | 75.9 | (85.8) |

Depreciation of non-current assets (1) | (29.6) | | (0.8) | (30.4) |

| | | | |

General and administrative expenses (1) | — | | (11.6) | (11.6) |

| Income from equity method investments | — | | 1.1 | 1.1 |

| Operating income including equity method investments | 46.2 | | 18.7 | 64.9 |

| | | | |

| Total assets | 3,312.2 | | (268.4) | 3,043.8 |

| | | | |

The following presents financial information by segment for the nine months ended September 30, 2024: |

| | | | |

| (In $ millions) | Dayrate | | Reconciling Items (2) | Consolidated total |

| Dayrate revenue | 667.0 | | (43.6) | 623.4 |

| Bareboat charter revenue | 65.3 | | — | 65.3 |

| Management contract revenue | 87.1 | | (63.3) | 23.8 |

| Related party revenue | — | | 35.0 | 35.0 |

| Gain on disposal | — | | 0.6 | 0.6 |

| Rig operating and maintenance expenses | (447.2) | | 104.8 | (342.4) |

Depreciation of non-current assets (1) | (94.7) | | (0.8) | (95.5) |

General and administrative expenses(1) | — | | (37.0) | (37.0) |

| Income from equity method investments | — | | 1.3 | 1.3 |

| Operating income including equity method investments | 277.5 | | (3.0) | 274.5 |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | | | | | | | | |

| | | | |

| | | | |

The following presents financial information by segment for the nine months ended September 30, 2023: |

| | | | |

| (In $ millions) | Dayrate | | Reconciling Items (2) | Consolidated total |

| Dayrate revenue | 692.2 | | (235.0) | 457.2 |

| Related party revenue | — | | 93.8 | 93.8 |

| Gain on disposal | — | | 0.4 | 0.4 |

| Rig operating and maintenance expenses | (491.4) | | 230.6 | (260.8) |

Depreciation of non-current assets (1) | (85.0) | | (1.6) | (86.6) |

General and administrative expenses(1) | — | | (34.3) | (34.3) |

| Income from equity method investments | — | | 7.4 | 7.4 |

| Operating income including equity method investments | 115.8 | | 61.3 | 177.1 |

(1) General and administrative expenses and depreciation expense incurred by our corporate office are not allocated to our operating segment for purposes of measuring segment operating income / (loss) and are included in "Reconciling items."

(2) The full operating results included above for our equity method investments are not included within our consolidated results and thus are deducted under "Reconciling items" and replaced with our income / (loss) from equity method investments (see Note 6 - Equity Method Investments).

Geographic data

Revenues are attributed to geographical location based on the country of operations for drilling activities, and thus the country where the revenues are generated.

The following presents our revenues by geographic area:

| | | | | | | | | | | | | | |

| Three months ended September 30, 2024 | Three months ended September 30, 2023 | Nine months ended September 30, 2024 | Nine months ended September 30, 2023 |

| South East Asia | 73.0 | | 61.9 | | 211.5 | | 172.3 | |

| Mexico | 71.0 | | 44.6 | | 217.5 | | 127.1 | |

| West Africa | 46.6 | | 41.2 | | 123.3 | | 130.5 | |

| Middle East | 43.8 | | 35.6 | | 173.1 | | 97.8 | |

| Europe | 7.2 | | 8.2 | | 22.1 | | 23.3 | |

| Total | 241.6 | | 191.5 | | 747.5 | | 551.0 | |

| | | | |

| | | | |

| | | | |

Major customers

The following customers accounted for more than 10% of our dayrate and related party revenues:

| | | | | | | | | | | | | | |

| Three months ended September 30, 2024 | Three months ended September 30, 2023 | Nine months ended September 30, 2024 | Nine months ended September 30, 2023 |

| (In % of operating revenues) | | | | |

| PTT Exploration and Production Public Company Limited | 13 | % | 3 | % | 11 | % | 6 | % |

| ENI Congo S.A. | 12 | % | 14 | % | 11 | % | 14 | % |

| Irish Energy Drilling Assets, DAC | 12 | % | — | % | 9 | % | — | % |

| Saudi Arabian Oil Company | 11 | % | 15 | % | 15 | % | 14 | % |

| Perfomex | — | % | 16 | % | 5 | % | 17 | % |

| Total | 48 | % | 48 | % | 51 | % | 51 | % |

Fixed Assets — Jack-up rigs (1)

The following presents the net book value of our jack-up rigs by geographic area:

| | | | | | | | |

| September 30, 2024 | December 31, 2023 |

| (In $ millions) | | |

| Mexico | 798.8 | | 815.4 | |

| South East Asia | 661.9 | | 673.4 | |

| Middle East | 537.5 | | 553.0 | |

| West Africa | 435.9 | | 444.8 | |

| Europe | 92.1 | | 91.7 | |

| Total | 2,526.2 | | 2,578.3 | |

| | |

| | |

(1) The fixed assets referred to in the table above exclude assets under construction. Asset locations at the end of a period are not necessarily indicative of the geographical distribution of the revenues or operating profits generated by such assets during the associated periods.

Note 5 - Contracts with Customers

Contract Assets and Liabilities

When the right to consideration becomes unconditional based on the contractual billing schedule, accrued revenue is recognized. At the point that accrued revenue is billed, trade accounts receivable are recognized. Payment terms on invoice amounts are typically 30 days.

Deferred mobilization, demobilization and contract preparation revenue includes revenues received for rig mobilization as well as preparation and upgrade activities, in addition to demobilization revenues expected to be received upon contract commencement and other lump-sum revenues relating to the firm periods of our contracts. These revenues are allocated to the overall performance obligation and recognized on a straight-line basis over the initial firm term of the contracts.

The following presents our contract assets and liabilities from our contracts with customers:

| | | | | | | | |

| September 30, 2024 | December 31, 2023 |

| (In $ millions) | | |

| | |

Accrued revenue (1) | 94.7 | | 73.7 | |

| Current contract assets | 94.7 | | 73.7 | |

| | |

| | |

| | |

Non-current accrued revenue (2) | 2.5 | | 2.3 | |

Non-current contract asset | 2.5 | | 2.3 | |

Total contract asset | 97.2 | | 76.0 | |

| | |

| | |

Current deferred mobilization, demobilization and other revenue | (29.6) | | (59.5) | |

| Current contract liability | (29.6) | | (59.5) | |

| | |

| Non-current deferred mobilization, demobilization and other revenue | (20.8) | | (56.6) | |

| Non-current contract liability | (20.8) | | (56.6) | |

| Total contract liability | (50.4) | | (116.1) | |

| | |

| | |

| | |

| | |

(1) Accrued revenue includes $16.6 million ($7.3 million as of December 31, 2023) related to the current portion of deferred variable rate revenue, $0.6 million ($1.2 million as of December 31, 2023) related to the current portion of liquidated damages associated with a known delay in the operational start date of one of our contracts (two of our contracts as at December 31, 2023) and nil ($1.1 million as of December 31, 2023) pertaining to the current portion of deferred demobilization revenue.

(2) Non-current accrued revenue includes $2.5 million ($1.5 million as of December 31, 2023) pertaining to the non-current portion of deferred demobilization revenue, and nil ($0.8 million as of December 31, 2023) related to the non-current portion of liquidated damages associated with a known delay in the operational start date of one of our contracts (two of our contracts as at December 31, 2023). Non-current accrued revenue is included in "Other non-current assets" in our Unaudited Condensed Consolidated Balance Sheets (see Note 15 - Other Non-Current Assets).

Total movement in our contract assets and contract liabilities balances during the nine months ended September 30, 2024 are as follows:

| | | | | | | | | | |

(In $ millions) | | | Contract assets | Contract liabilities |

| Balance as of December 31, 2023 | | | 76.0 | | 116.1 | |

Performance obligations satisfied during the reporting period | | | 85.7 | | — | |

Amortization of revenue | | | — | | (79.1) | |

| | | | |

| Unbilled variable rate revenue | | | 9.4 | | — | |

| | | | |

| Unbilled mobilization revenue | | | 0.6 | | — | |

| Cash received, excluding amounts recognized as revenue | | | — | | 13.4 | |

Cash received against the contract asset balance | | | (74.5) | | — | |

Balance as of September 30, 2024 | | | 97.2 | | 50.4 | |

Timing of Revenue

The Company derives its revenue from contracts with customers for the transfer of goods and services, from various activities performed both at a point in time and over time, under the output method.

| | | | | | | | | | | | | | |

| Three months ended September 30, 2024 | Three months ended September 30, 2023 | Nine months ended September 30, 2024 | Nine months ended September 30, 2023 |

| (In $ millions) | | | | |

| Over time | 236.0 | | 186.3 | | 728.7 | | 533.4 | |

| Point in time | 5.6 | | 5.2 | | 18.8 | | 17.6 | |

| Total | 241.6 | | 191.5 | | 747.5 | | 551.0 | |

Revenue on existing contracts, where performance obligations are unsatisfied or partially unsatisfied at the balance sheet date, is expected to be recognized as follows as at September 30, 2024:

| | | | | | | | | | | | | | |

| For the periods ending September 30, |

(In $ millions) | 2025 | 2026 | 2027 | 2028 onwards |

Dayrate revenue | 910.2 | | 314.3 | | 116.4 | | 127.0 | |

Other revenue (1) | 51.1 | | 32.5 | | 15.0 | | 17.1 | |

| Total | 961.3 | | 346.8 | | 131.4 | | 144.1 | |

(1) Other revenue represents lump sum revenue associated with contract preparation and mobilization and is recognized ratably over the initial firm term of the associated contract in "Dayrate revenue" in the Unaudited Condensed Consolidated Statements of Operations.

Contract Costs

Deferred mobilization and contract preparation costs relate to costs incurred to prepare a rig for contract and delivery or to mobilize a rig to the drilling location. We defer pre‑operating costs, such as contract preparation and mobilization costs, and recognize such costs on a straight‑line basis, over the estimated firm period of the drilling contract. Costs incurred for the demobilization of rigs at contract completion are recognized as incurred during the demobilization period.

| | | | | | | | | |

| September 30, 2024 | December 31, 2023 | |

| (In $ millions) | | | |

| Current deferred mobilization and contract preparation costs | 33.6 | | 39.4 | | |

Non-current deferred mobilization and contract preparation costs (1) | 28.6 | | 42.6 | | |

| Total deferred mobilization and contract preparation asset | 62.2 | | 82.0 | | |