false

--12-31

0001091748

0001091748

2023-11-16

2023-11-16

0001091748

us-gaap:CommonStockMember

2023-11-16

2023-11-16

0001091748

argo:Sec6.500SeniorNotesDue2042IssuedByArgoGroupU.s.Inc.AndGuaranteeWithRespectTheretoMember

2023-11-16

2023-11-16

0001091748

argo:DepositarySharesEachRepresenting11000thInterestIn7.00ResettableFixedRatePreferenceShareSeriesParValue1.00PerShareMember

2023-11-16

2023-11-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 16, 2023

ARGO GROUP INTERNATIONAL HOLDINGS, LTD.

(Exact Name of Registrant

as Specified in its Charter)

| Bermuda |

|

001-15259 |

|

98-0214719 |

(State or Other Jurisdiction of

Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| |

|

|

|

|

|

90 Pitts Bay Road

Pembroke HM 08

Bermuda |

|

|

|

P.O. Box HM 1282

Hamilton HM FX

Bermuda |

(Address, Including Zip Code,

of Principal

Executive Offices) |

|

|

|

(Mailing Address) |

Registrant’s

telephone number, including area code: (441) 296-5858

Not Applicable

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common

Stock, par value $1.00 per share |

|

ARGO |

|

New York Stock Exchange |

| 6.500% Senior Notes due 2042 issued by Argo Group U.S., Inc. and the Guarantee with respect thereto |

|

ARGD |

|

New York Stock Exchange |

| Depositary Shares, Each Representing a 1/1,000th Interest in a 7.00% Resettable Fixed Rate Preference Share, Series A, Par Value $1.00 Per Share |

|

ARGOPrA |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

On November 16, 2023, Argo Group International

Holdings, Ltd., a Bermuda exempted company limited by shares (the “Company”), completed its previously announced

merger with BNRE Bermuda Merger Sub Ltd. (“Merger Sub”), a wholly owned subsidiary of Brookfield Reinsurance Ltd. (“Brookfield

Reinsurance”). Pursuant to the Agreement and Plan of Merger, dated as of February 8, 2023, by and among the Company, Merger

Sub and Brookfield Reinsurance (the “Merger Agreement”), and the statutory merger agreement required in accordance

with Section 105 of the Bermuda Companies Act 1981, as amended (the “Companies Act”), by and among the Company,

Merger Sub and Brookfield Reinsurance, dated as of November 16, 2023, Merger Sub merged with and into the Company in accordance with

the Companies Act (the “Merger”), with the Company surviving the Merger as a wholly owned subsidiary of Brookfield

Reinsurance (such entity, the “Surviving Company”).

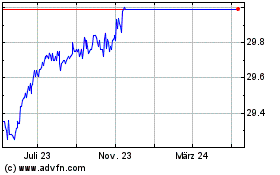

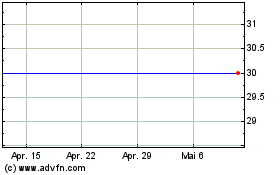

Pursuant to the Merger Agreement, at the effective

time of the Merger (the “Effective Time”), each common share, par value $1.00 per share, of the Company (each, a “Company

Share”), issued and outstanding immediately prior to the Effective Time (other than any Company Share (i) granted under

the Company’s 2014 Long-Term Incentive Plan or 2019 Omnibus Incentive Plan (each, a “Company Share Plan”) that

is subject to (a) vesting restrictions (each, a “Company Restricted Share”), or (b) a share appreciation

right (each, a “Company SAR”), or (ii) owned by the Company, Brookfield Reinsurance, Merger Sub or any other direct

or indirect wholly owned subsidiary of the Company or Brookfield Reinsurance), was automatically canceled and converted into the right

to receive an amount in cash equal to $30.00, without interest (the “Merger Consideration”).

At the Effective Time, each issued and outstanding

depositary share, each representing a 1/1,000th interest in a 7.00% Resettable Fixed Rate Preference Share, Series A,

par value $1.00 per share, of the Company (each, a “Series A Preferred Share”), remains issued and outstanding

as a depositary share of the Surviving Company. Each issued and outstanding Series A Preferred Share remains issued and outstanding

as a preferred share of the Surviving Company and is entitled to the same dividend and all other preferences and privileges, voting rights,

relative, participating, optional and other special rights, and qualifications, limitations and restrictions set forth in the certificate

of designations applicable to the Series A Preferred Shares, which certificate of designations remains at and following the Effective

Time in full force and effect as an obligation of the Surviving Company in accordance with Section 109(2) of the Companies Act,

as described further in the Merger Agreement.

At the Effective Time, each Company Restricted

Share outstanding immediately prior to the Effective Time (i) (a) became fully vested, in the case of a time-based vesting Company

Restricted Share, or (b) became vested at the assumed level of performance determined in accordance with the Merger Agreement and

the applicable Company Share Plan, in the case of a performance-based vesting Company Restricted Share, and (ii) was canceled and

converted into the right to receive an amount in cash equal to the sum of (x) the Merger Consideration and (y) the value of

any dividends accrued in respect of such Company Restricted Share that remained unpaid as of immediately prior to the Effective Time.

At the Effective Time, each Company SAR award outstanding

immediately prior to the Effective Time, whether vested or unvested, was deemed to be fully vested and was canceled and converted into

solely the right to receive a lump-sum amount in cash equal to the product of (i) the excess, if any of (a) the Merger Consideration,

over (b) the per share exercise price of such Company SAR, multiplied by (ii) the total number of Company Shares subject to

such Company SAR immediately prior to the Effective Time.

The foregoing description of the Merger Agreement

and the Merger does not purport to be complete and is subject to and qualified in its entirety by reference to the Merger Agreement, a

copy of which was filed as Exhibit 2.1 to the Current Report on Form 8-K filed by the Company on February 8, 2023, and

is incorporated herein by reference.

| Item 3.01 | Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

The information set forth under Item 2.01 of this

Current Report on Form 8-K is incorporated in this Item 3.01 by reference.

In

connection with the consummation of the Merger, trading of the Company Shares on the New York Stock Exchange (the “NYSE”)

was suspended prior to the opening of trading on November 16, 2023, and the Company

Shares became eligible for delisting from the NYSE and termination of registration under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). The Company has requested that the NYSE file with the Securities and Exchange Commission (the

“SEC”) a notification of removal from listing on Form 25 with respect to the Company Shares to report the

delisting of the Company Shares from the NYSE and to deregister the Company Shares under Section 12(b) of the Exchange Act.

After

the Form 25 becomes effective, the Company intends to file with the SEC a certificate of notice of termination on Form 15

with respect to the Company Shares, requesting that the Company Shares be deregistered under Section 12(g) of the Exchange Act,

and that the reporting obligations of the Company with respect to the Company Shares under Sections 13 and 15(d) of the Exchange

Act be suspended.

| Item 3.03 | Material Modification to Rights of Security Holders. |

The information set forth under Item 2.01 and 3.01

of this Current Report on Form 8-K is incorporated in this Item 3.03 by reference.

In connection with the completion of the Merger

and at the Effective Time, holders of the Company Shares immediately prior to such time ceased to have any rights as shareholders in the

Company (other than their right to receive the Merger Consideration) and accordingly, no longer have any interest in the Company’s

future earnings or growth.

| Item 5.01 | Changes in Control of Registrant. |

The information set forth under Item 2.01 of this

Current Report on Form 8-K is incorporated in this Item 5.01 by reference.

As

a result of the Merger, a change in control of the Company occurred, and the Company is now a wholly owned subsidiary of Brookfield Reinsurance.

The aggregate Merger Consideration payable by Brookfield Reinsurance in connection with the

Merger is approximately $1.1 billion, funded by existing cash on hand and available liquidity.

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The information set forth under Item 2.01 of this

Current Report on Form 8-K is incorporated in this Item 5.02 by reference.

Director Changes and Arrangements

In accordance with the terms of the Merger Agreement,

at the Effective Time, each of the six directors of the Company prior to consummation of the Merger (Bernard C. Bailey, Thomas A. Bradley,

Dymphna A. Lehane, Samuel G. Liss, Carol A. McFate and Al-Noor Ramji) ceased to be directors of the Company. In accordance with the terms

of the Merger Agreement, the directors of Merger Sub in office immediately prior to consummation of the Merger (Seamus M. MacLoughlin,

Gregory N. McConnie and Gregory E. Morrison) became the directors of the Company at the Effective Time and will be the directors of the

Company until the earlier of their death, resignation or removal or until their respective successors are duly elected and qualified,

as the case may be.

There are no arrangements or understandings between

any of Seamus M. MacLoughlin, Gregory N. McConnie or Gregory E. Morrison and any other persons pursuant to which Seamus M. MacLoughlin,

Gregory N. McConnie or Gregory E. Morrison, as applicable, was selected as a director of the Company. None of Seamus M. MacLoughlin, Gregory

N. McConnie or Gregory E. Morrison has any direct or indirect material interest in any transaction required to be disclosed pursuant to

Item 404(a) of Regulation S-K.

Officer Changes and Arrangements

In connection with the completion of the Merger

and effective as of immediately following the Effective Time, Thomas A. Bradley retired from his position as Chief Executive Officer of

the Company, and ceased to be an officer and employee of the Company. As previously reported by the Company in its Annual Report on Form 10-K

filed with the SEC on March 6, 2023, the Company entered into a letter agreement with Mr. Bradley, dated March 3, 2023,

pursuant to which Mr. Bradley is entitled to receive a one-time cash bonus in the amount of $1,200,000 in recognition of his continued

services with the Company through the consummation of the Merger. Mr. Bradley is not entitled to any severance benefits or other

compensation following his retirement as an officer and employee of the Company.

Jessica Snyder has been appointed to serve as Chief

Executive Officer of the Company effective as of November 16, 2023 (the “Commencement Date”). Ms. Snyder,

52, previously served as the Company’s President, U.S. Insurance since August 2022. She joined the Company from GuideOne Insurance

where she served as its President and Chief Executive Officer from 2017 through 2022. Prior to GuideOne, Ms. Snyder served as Senior

Vice President of commercial and specialty lines at State Auto Insurance from 2015 to 2017. She also served as Senior Vice President,

Chief Operating Officer and Chief Financial Officer at Rockhill Insurance Group, a member of the State AutoGroup from 2005-2009. She also

was the Chief Financial Officer at Citizens Property Insurance from 1998 to 2005. Ms. Snyder also serves on the Board of Directors

of Open Lending Corporation, a NASDAQ company, since August 2020, where she serves as Chair, Chair of the Audit Committee and a member

of the Nominating and Corporate Governance Committee. Ms. Snyder received a Bachelor of Science in accounting from the University

of Wisconsin and a Master of Business Administration degree in finance from the University of Florida. Ms. Snyder does not have any

family relationships with any of the Company’s directors or executive officers.

In connection with Ms. Snyder’s new

role, the Company has entered into an offer letter with Ms. Snyder, dated as of November 16, 2023 (the “CEO Offer Letter”).

Under the CEO Offer Letter, Ms. Snyder is entitled to receive an annual base salary of $700,000 and a target annual bonus opportunity

of 100% of her base salary. In addition, the CEO Offer Letter provides that, as soon as practicable after the Commencement Date, the Company

will recommend to the Board of Directors of the Company (the “Board”) that Ms. Snyder receive a one-time long-term

incentive award with a target grant date value of $7,500,000 under a new long-term incentive compensation plan of the Company expected

to be adopted by the Board following the Commencement Date. Ms. Snyder will continue to be eligible for severance benefits under

the ESP (as defined below) through December 31, 2024, and, subject to her relocation to New York, New York within six (6) months

after the Commencement Date, will be eligible for relocation benefits under the applicable Company policies (subject to repayment if Ms. Snyder

resigns from her employment with the Company for any reason within twenty-four (24) months after the Commencement Date).

The Company has also entered into a Retention Award

Agreement with Ms. Snyder, dated as of November 16, 2023 (the “Retention Award Agreement”), pursuant to which

she was also granted a one-time, special cash retention bonus in the amount of $700,000 (the “Retention Bonus”) as

of the Commencement Date. The Retention Bonus will vest in three equal annual installments on each of March 15, 2024, March 15,

2025 and March 15, 2026, subject to Ms. Snyder’s continued employment through each applicable vesting date. If Ms. Snyder’s

employment is terminated without Cause or if Ms. Snyder resigns for Good Reason (each as defined in the Executive Severance Plan

of the Company (the “ESP”)), in each case, prior to November 16, 2025, then any then-unvested portion of the Retention

Bonus will vest. The Retention Bonus replaces in its entirety, and Ms. Snyder has forfeited her rights with respect to, the cash-based annual long-term

incentive award having a value of $700,000 granted to Ms. Snyder under the Company’s 2019 Omnibus Incentive Plan on March 15, 2023.

There are no arrangements or understandings between

Ms. Snyder and any other persons pursuant to which Ms. Snyder was selected as an officer of the Company and Ms. Snyder

does not have any direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation

S-K.

In addition, in connection with the completion

of the Merger, Susan B. Comparato resigned from her position as Chief Administrative Officer of the Company, and ceased to be an officer

and employee of the Company, in each case, as of the Effective Time. Effective as of November 17, 2023, Ms. Comparato will commence

employment with Brookfield Reinsurance as Managing Director, Portfolio Management. In connection with Ms. Comparato’s resignation,

the Company entered into a letter agreement with Ms. Comparato, dated as of November 16, 2023 (the “Resignation Letter”),

pursuant to which Ms. Comparato is entitled to receive a pro-rated 2023 annual bonus in the amount of $257,753, subject to a general

release of claims (the “Discretionary Bonus”). The Discretionary Bonus will be paid no later than the second payroll

date following Ms. Comparato’s delivery of the general release of claims, subject to any applicable taxes. The Resignation

Letter also contains an acknowledgement by Ms. Comparato that neither the termination of her employment with the Company nor commencement

of employment with Brookfield Reinsurance will entitle Ms. Comparato to any severance benefits under the ESP.

Scott Kirk, the Chief Financial Officer of the

Company, also announced his intention to resign from his position with the Company effective as of December 1, 2023 (the “Transition

Date”). From the Effective Time through the Transition Date, Mr. Kirk will continue to serve in his current position as

Chief Financial Officer and Principal Accounting Officer of the Company, subject to the terms and conditions of his employment with the

Company as in effect as of the Effective Time. Effective as of the Transition Date, Mr. Kirk will step down from his position as

Chief Financial Officer and Principal Accounting Officer of the Company and will continue with the Company in an advisory role through

February 29, 2024, or such earlier date following the Transition Date as elected by Mr. Kirk or the Company upon thirty days’

advance written notice to the other party (the “Separation Date”).

On the Transition Date, Mr. Kirk’s responsibilities

as Chief Financial Officer and Principal Accounting Officer will be assumed by Christopher Donahue, who has been appointed to serve as

Senior Vice President, Finance of the Company effective as of November 16, 2023. Mr. Donahue, 36, first joined Brookfield Reinsurance

as a Vice President in September 2021 and held the position of Senior Vice President since February 2023. Prior to joining Brookfield

Reinsurance, Mr. Donahue was Vice President in the Financial Institutions Group of Lazard, from April 2018 to September 2021,

and an Investment Banking Associate in the Financial Institutions Group of Morgan Stanley, from August 2015 to March 2018. In

connection with Mr. Donahue’s new role, the Company has entered into an offer letter with Mr. Donahue, dated as of November 16,

2023 (the “CFO Offer Letter”), pursuant to which Mr. Donahue is entitled to receive an annual base salary of $425,000

and a target annual bonus opportunity of 70% of his base salary. There are no arrangements or understandings between Mr. Donahue

and any other persons pursuant to which Mr. Donahue was selected as an officer of the Company. Mr. Donahue does not have any

family relationships with any of the Company’s directors or executive officers. Mr. Donahue does not have any direct or indirect

material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

In connection with Mr. Kirk’s transition,

the Company entered into a letter agreement with Mr. Kirk, dated as of November 16, 2023 (the “Transition Letter”).

Under the Transition Letter, from the Transition Date through the Separation Date (the “Transition Period”), Mr. Kirk

will provide transition-related services to the Company on a part-time basis, and will be paid (i) a base salary at an annual rate

of $350,000 and (ii) an annual bonus for the 2023 calendar year based on his target bonus in effect as of the date of the Transition

Letter. Effective as of the Separation Date, Mr. Kirk will cease to be an employee of the Company, and will be eligible to receive

severance benefits under the ESP for a Qualifying Termination following a Change in Control (as defined in the ESP), with Mr. Kirk’s

Severance Amount (as defined in the ESP) determined based on Mr. Kirk’s annual base salary and target bonus in effect as of

the date of the Transition Letter. If Mr. Kirk’s qualifying employment termination occurs in calendar year 2023, Mr. Kirk

will receive a CIC Pro-Rata Bonus (as defined in the ESP), and if Mr. Kirk’s qualifying employment termination occurs in calendar

year 2024, Mr. Kirk will not receive a CIC Pro Rata Bonus, and his annual bonus for the 2023 calendar year will equal Mr. Kirk’s

target bonus (or if greater, the amount of the 2023 annual bonus based on actual achievement of applicable performance goals). Mr. Kirk’s

receipt of the foregoing severance benefits is subject to the terms of the ESP, including a general release of claims upon the Separation

Date, and continued compliance with certain restrictive covenants following his separation from the Company (including confidentiality,

non-disparagement, non-competition and non-solicitation covenants).

Further, in connection with the completion of the

Merger, Allison D. Kiene, General Counsel and Secretary of the Company, announced her intention to resign from her position with the Company

effective as of December 1, 2023 (the “Resignation Date”). From the Effective Time through the Resignation Date,

Ms. Kiene will continue to serve in her current position as General Counsel and Secretary of the Company, subject to the terms and

conditions of her employment with the Company as in effect as of the Effective Time. Effective as of the Resignation Date, Ms. Kiene

will cease to be an officer and employee of the Company, and will be eligible to receive severance benefits under the ESP for a Qualifying

Termination following a Change in Control (as defined in the ESP), subject to the terms of the ESP, including a general release of claims

upon the Resignation Date, and continued compliance with certain restrictive covenants following Ms. Kiene’s separation from

the Company (including confidentiality, non-disparagement, non-competition and non-solicitation covenants).

The foregoing descriptions of the CEO Offer Letter,

Retention Award Agreement, Resignation Letter, CFO Offer Letter and Transition Letter do not purport to be complete and are subject to,

and qualified in their entirety by, the full text of the CEO Offer Letter, Retention Award Agreement, Resignation Letter, CFO Offer Letter

and Transition Letter, respectively, a copy of each of which is attached as Exhibits 10.1, 10.2, 10.3, 10.4 and 10.5, respectively, hereto

and incorporated by reference herein. The ESP was previously filed as Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q

filed with the SEC on May 6, 2022.

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

The information set forth under Item 2.01 of this

Current Report on Form 8-K is incorporated in this Item 5.03 by reference.

Pursuant to the terms of the Merger Agreement,

at the Effective Time, the memorandum of association and bye-laws of Merger Sub immediately prior to the Effective Time became the memorandum

of association and bye-laws, respectively, of the Surviving Company and will remain the memorandum of association (the “Altered

Memorandum of Association”) and bye-laws (the “Amended and Restated Bye-laws”), respectively, of the Surviving

Company, except that the name of the Surviving Company shall remain as Argo Group International Holdings, Ltd., until changed or

amended as provided therein or pursuant to applicable law.

Copies of the Altered Memorandum of Association

and the Amended and Restated Bye-laws of the Surviving Company are attached as Exhibits 3.1 and 3.2 to this Current Report on Form 8-K,

respectively, and are incorporated herein by reference.

Press Release

On November 16, 2023, the Company issued a

press release announcing the completion of the Merger. A copy of the press release is attached as Exhibit 99.1 to this Current Report

on Form 8-K and is incorporated herein by reference.

Redomestication

After the Effective Time, the Surviving Company

intends to discontinue its existence as a Bermuda exempted company limited by shares as provided under Section 132G of the Companies

Act and, pursuant to Section 388 of the General Corporation Law of the State of Delaware (the “DGCL”), continue

its existence under the DGCL as a corporation incorporated in the State of Delaware (the “Redomestication”). Effective

at the time of the Redomestication, the Surviving Company intends to (i) file a certificate of incorporation and a certificate of

corporate domestication with the Secretary of State of the State of Delaware and (ii) adopt new bylaws of the Surviving Company to

govern its existence as a Delaware corporation.

No shareholder action is required in connection

with the Redomestication. Following the Redomestication, the CUSIP for the Series A Preferred Stock will change to 040128 407 and

the CUSIP for the 6.500% Senior Notes due 2042 issued by Argo Group U.S., Inc. and the Guarantee with respect thereto will change

to 040130 AA4.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| 2.1 |

Agreement and Plan of Merger, dated as of February 8, 2023, by and among Argo Group International Holdings, Ltd., Brookfield Reinsurance Ltd. and BNRE Bermuda Merger Sub Ltd. (incorporated herein by reference to Exhibit 2.1 to Argo Group International Holdings, Ltd.’s Current Report on Form 8-K filed with the SEC on February 8, 2023). |

| 3.1 |

Altered Memorandum of Association of Argo Group International Holdings, Ltd. |

| 3.2 |

Amended and Restated Bye-laws of Argo Group International Holdings, Ltd. |

| 10.1 |

Offer Letter, by and between Argo Group International Holdings, Ltd. and Jessica Snyder, dated November 16, 2023. |

| 10.2 |

Retention Award Agreement, by and between Argo Group International Holdings, Ltd. and Jessica Snyder, dated November 16, 2023. |

| 10.3 |

Resignation Letter, by and between Argo Group International Holdings, Ltd. and Susan Comparato, dated November 16, 2023. |

| 10.4 |

Offer Letter, by and between Argo Group International Holdings, Ltd. and Christopher Donahue, dated November 16, 2023. |

| 10.5 |

Letter Agreement, by and between Argo Group International Holdings, Ltd. and Scott Kirk, dated November 16, 2023. |

| 99.1 |

Press Release issued by Argo Group International Holdings, Ltd., dated November 16, 2023. |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 16, 2023

| |

ARGO GROUP INTERNATIONAL HOLDINGS, LTD. |

| |

|

| |

By: |

/s/ Scott Kirk |

| |

|

Name: Scott Kirk |

| |

|

Title: Chief Financial Officer |

Exhibit 3.1

| Amended November, 2023

______________ Argo Group International Holdings, Ltd.

Amended November, 2023 |

| US$2,030,000,000 Amended November, 2023

A

mended October, 2023 |

Exhibit

3.2

BYE-LAWS

of

Argo

Group International Holdings, Ltd.

The

undersigned HEREBY CERTIFIES that the attached Bye-Laws are a true copy of the Bye-Laws of Argo Group International Holdings, Ltd.

(Company) adopted by the Shareholder of the Company on 16 November 2023.

| /s/ Allison Kiene |

|

| Secretary |

|

BYE-LAWS

Of

Argo

Group International Holdings, Ltd.

| Bye-Law |

Subject |

Page |

| |

|

|

| 1. |

Definitions and Interpretation |

1 |

| |

|

|

| 2. |

Registered Office |

3 |

| |

|

|

| 3. |

Share Rights |

3 |

| |

|

|

| 4. |

Modification of Rights |

4 |

| |

|

|

| 5. |

Shares |

4 |

| |

|

|

| 6. |

Certificates |

5 |

| |

|

|

| 7. |

Lien |

5 |

| |

|

|

| 8. |

Calls on Shares |

6 |

| |

|

|

| 9. |

Forfeiture of Shares |

7 |

| |

|

|

| 10. |

Register of Shareholders |

8 |

| |

|

|

| 11. |

Register of Directors and Officers |

8 |

| |

|

|

| 12. |

Transfer of Shares |

8 |

| |

|

|

| 13. |

Transmission of Shares |

9 |

| |

|

|

| 14. |

Increase of Capital |

10 |

| |

|

|

| 15. |

Alteration of Capital |

10 |

| |

|

|

| 16. |

Reduction of Capital |

11 |

| |

|

|

| 17. |

General Meetings and Resolutions in Writing |

11 |

| |

|

|

| 18. |

Notice of General Meetings |

12 |

| |

|

|

| 19. |

Proceedings at General Meetings |

13 |

| |

|

|

| 20. |

Voting |

14 |

| |

|

|

| 21. |

Proxies and Corporate Representatives |

16 |

| |

|

|

| 22. |

Appointment and Removal of Directors |

18 |

| |

|

|

| 23. |

Resignation and Disqualification of Directors |

19 |

| |

|

|

| 24. |

Alternate Directors |

19 |

| |

|

|

| 25. |

Directors’ Fees and Additional Remuneration and Expenses |

20 |

| |

|

|

| 26. |

Directors’ Interests |

20 |

| |

|

|

| 27. |

Powers and Duties of the Board |

21 |

| |

|

|

| 28. |

Delegation of the Board’s Powers |

22 |

| |

|

|

| 29. |

Proceedings of the Board |

22 |

| |

|

|

| 30. |

Officers |

24 |

| |

|

|

| 31. |

Minutes |

24 |

| |

|

|

| 32. |

Secretary and Resident Representative |

25 |

| 33. |

The Seal |

25 |

| |

|

|

| 34. |

Dividends and Other Payments |

26 |

| |

|

|

| 35. |

Reserves |

27 |

| |

|

|

| 36. |

Capitalisation of Profits |

27 |

| |

|

|

| 37. |

Record Dates |

28 |

| |

|

|

| 38. |

Accounting Records |

28 |

| |

|

|

| 39. |

Audit |

29 |

| |

|

|

| 40. |

Service of Notices and Other Documents |

29 |

| |

|

|

| 41. |

Winding Up |

30 |

| |

|

|

| 42. |

Indemnity |

31 |

| |

|

|

| 43. |

Amalgamation and Merger |

32 |

| |

|

|

| 44. |

Continuation |

32 |

| |

|

|

| 45. |

Alteration of Bye-Laws |

32 |

BYE-LAWS

of

Argo

Group International Holdings, Ltd.

INTERPRETATION

| 1. | DEFINITIONS

AND INTERPRETATION |

| 1.1 | In

these Bye-Laws, unless the context otherwise requires: |

Alternate

Director: means an alternate Director appointed to the Board as provided for in these Bye-Laws;

Auditor:

means the person or firm for the time being appointed as auditor of the Company;

Bermuda:

means the Islands of Bermuda;

Board:

means the Directors of the Company appointed or elected pursuant to these Bye-Laws and acting by resolution as provided for in the Companies

Acts and in these Bye-Laws or the Directors present at a meeting of Directors at which there is a quorum;

Companies

Acts: means every Bermuda statute from time to time in force concerning companies insofar as the

same applies to the Company;

Company:

means Argo Group International Holdings, Ltd. a company incorporated in Bermuda on 4 June 1999;

Director:

means such person or persons appointed or elected to the Board from time to time pursuant to these Bye-Laws and includes an Alternate

Director;

Indemnified

Person: means any Director, Officer, Resident Representative, member of a committee duly constituted under these Bye-Laws and any

liquidator, manager or trustee for the time being acting in relation to the affairs of the Company, and his heirs, executors and administrators;

Officer:

means a person appointed by the Board pursuant to these Bye-Laws but shall not include the Auditor;

paid

up: means paid up or credited as paid up;

Register:

means the Register of Shareholders of the Company maintained by the Company in Bermuda;

Bye-Laws of Argo Group International Holdings, Ltd. 1 of 32 |

Registered

Office: means the registered office of the Company which shall be at such place in Bermuda as the Board shall from time to time determine;

Resident

Representative: means (if any) the individual or the company appointed to perform the duties of resident representative set out in

the Companies Acts and includes any assistant or deputy Resident Representative appointed by the Board to perform any of the duties of

the Resident Representative;

Resolution:

means a resolution of the Shareholders passed in a general meeting or, where required, of a separate class or separate classes of

shareholders passed in a separate general meeting or in either case adopted by resolution in writing, in accordance with the provisions

of these Bye-Laws;

Seal:

means the common seal of the Company and includes any authorised duplicate thereof;

Secretary:

means the individual or the company appointed by the Board to perform any of the duties of the Secretary and includes a temporary

or assistant or deputy Secretary;

share:

means share in the capital of the Company and includes a fraction of a share;

Shareholder:

means a shareholder or member of the Company provided that for the purposes of Bye-Law 42 it shall also include any holder of notes,

debentures or bonds issued by the Company;

these

Bye-Laws: means these Bye-Laws in their present form.

| 1.2 | For

the purposes of these Bye-Laws, a corporation which is a shareholder shall be deemed to be

present in person at a general meeting if, in accordance with the Companies Acts, its authorised

representative is present. |

| 1.3 | For

the purposes of these Bye-Laws, a corporation which is a Director shall be deemed to be present

in person at a Board meeting if an officer, attorney or other person authorised to attend

on its behalf is present, and shall be deemed to discharge its duties and carry out any actions

required under these Bye-Laws and the Companies Acts, including the signing and execution

of documents, deeds and other instruments, if an officer, attorney or other person authorised

to act on its behalf so acts. |

| 1.4 | Words

importing only the singular number include the plural number and vice versa. |

| 1.5 | Words

importing only the masculine gender include the feminine and neuter genders respectively. |

| 1.6 | Words

importing persons include companies, associations, bodies of persons, whether corporate or

not. |

Bye-Laws of Argo Group International Holdings, Ltd. 2 of 32 |

| 1.7 | Words

importing a Director as an individual shall include companies, associations and bodies of

persons, whether corporate or not. |

| 1.8 | A

reference to writing shall include typewriting, printing, lithography, photography and electronic

record. |

| 1.9 | Any

words or expressions defined in the Companies Acts in force at the date when these Bye- Laws

or any part thereof are adopted shall bear the same meaning in these Bye-Laws or such part

(as the case may be). |

REGISTERED

OFFICE

The

Registered Office shall be at such place in Bermuda as the Board shall from time to time appoint.

SHARES

AND SHARE RIGHTS

| 3.1 | Subject

to any special rights conferred on the holders of any share or class of shares, any share

in the Company may be issued with or have attached thereto such preferred, deferred, qualified

or other special rights or such restrictions, whether in regard to dividend, voting, return

of capital or otherwise, as the Company may by Resolution determine or, if there has not

been any such determination or so far as the same shall not make specific provision, as the

Board may determine. |

| 3.2 | Subject

to the Companies Acts, any preference shares may, with the sanction of a resolution of the

Board, be issued on terms: |

| (a) | that

they are to be redeemed on the happening of a specified event or on a given date; and/or, |

| (b) | that

they are liable to be redeemed at the option of the Company; and/or, |

| (c) | if

authorised by the memorandum of association of the Company, that they are liable to be redeemed

at the option of the holder. |

The

terms and manner of redemption shall be provided for in such resolution of the Board and shall be attached to but shall not form part

of these Bye-Laws.

| 3.3 | The

Board may, at its discretion and without the sanction of a Resolution, authorise the purchase

by the Company of its own shares upon such terms as the Board may in its discretion determine,

provided always that such purchase is effected in accordance with the provisions of the Companies

Acts. |

Bye-Laws of Argo Group International Holdings, Ltd. 3 of 32 |

| 3.4 | The

Board may, at its discretion and without the sanction of a Resolution, authorise the acquisition

by the Company of its own shares, to be held as treasury shares, upon such terms as the Board

may in its discretion determine, provided always that such acquisition is effected in accordance

with the provisions of the Companies Acts. The Company shall be entered in the Register as

a Shareholder in respect of the shares held by the Company as treasury shares and shall be

a Shareholder of the Company but subject always to the provisions of the Companies Acts and

for the avoidance of doubt the Company shall not exercise any rights and shall not enjoy

or participate in any of the rights attaching to those shares save as expressly provided

for in the Companies Acts. |

| 4.1 | Subject

to the Companies Acts, all or any of the special rights for the time being attached to any

class of shares for the time being issued may from time to time (whether or not the Company

is being wound up) be altered or abrogated with the consent in writing of the holders of

not less than seventy-five per cent (75%) of the issued shares of that class or with the

sanction of a resolution passed at a separate general meeting of the holders of such shares

voting in person or by proxy. To any such separate general meeting, all the provisions of

these Bye-Laws as to general meetings of the Company shall mutatis mutandis apply,

but so that the necessary quorum shall be one or more persons holding or representing by

proxy any of the shares of the relevant class, that every holder of shares of the relevant

class shall be entitled on a poll to one vote for every such share held by him and that any

holder of shares of the relevant class present in person or by proxy may demand a poll. |

| 4.2 | The

special rights conferred upon the holders of any shares or class of shares shall not, unless

otherwise expressly provided in the rights attaching to or the terms of issue of such shares,

be deemed to be altered by the creation or issue of further shares ranking pari passu

therewith. |

| 5.1 | Subject

to the provisions of these Bye-Laws, the unissued shares of the Company (whether forming

part of the original capital or any increased capital) shall be at the disposal of the Board,

which may offer, allot, grant options over or otherwise dispose of them to such persons,

at such times and for such consideration and upon such terms and conditions as the Board

may determine. |

| 5.2 | Subject

to the provisions of these Bye-Laws, any shares of the Company held by the Company as treasury

shares shall be at the disposal of the Board, which may hold all or any of the shares, dispose

of or transfer all or any of the shares for cash or other consideration, or cancel all or

any of the shares. |

| 5.3 | The

Board may in connection with the issue of any shares exercise all powers of paying commission

and brokerage conferred or permitted by law. |

Bye-Laws of Argo Group International Holdings, Ltd. 4 of 32 |

| 5.4 | Except

as ordered by a court of competent jurisdiction or as required by law, no person shall be

recognised by the Company as holding any share upon trust and the Company shall not be bound

by or required in any way to recognise (even when having notice thereof) any equitable, contingent,

future or partial interest in any share or in any fractional part of a share or (except only

as otherwise provided in these Bye-Laws or by law) any other right in respect of any share

except an absolute right to the entirety thereof in the registered holder. |

| 6.1 | The

Company shall be under no obligation to complete and deliver a share certificate unless specifically

called upon to do so by the person to whom the shares have been issued. In the case of a

share held jointly by several persons, delivery of a certificate to one of several joint

holders shall be sufficient delivery to all. |

| 6.2 | If

a share certificate is defaced, lost or destroyed, it may be replaced without fee but on

such terms (if any) as to evidence and indemnity and to payment of the costs and out of pocket

expenses of the Company in investigating such evidence and preparing such indemnity as the

Board may think fit and, in case of defacement, on delivery of the old certificate to the

Company. |

| 6.3 | All

certificates for share or loan capital or other securities of the Company (other than letters

of allotment, scrip certificates and other like documents) shall, except to the extent that

the terms and conditions for the time being relating thereto otherwise provide, be issued

under the Seal or signed by a Director, the Secretary or any person authorised by the Board

for that purpose. The Board may by resolution determine, either generally or in any particular

case, that any signatures on any such certificates need not be autographic but may be affixed

to such certificates by some mechanical means or may be printed thereon or that such certificates

need not be signed by any persons. |

| 7.1 | The

Company shall have a first and paramount lien on every share (not being a fully paid share)

for all monies, whether presently payable or not, called or payable, at a date fixed by or

in accordance with the terms of issue of such share in respect of such share, and the Company

shall also have a first and paramount lien on every share (other than a fully paid share)

standing registered in the name of a Shareholder, whether singly or jointly with any other

person, for all the debts and liabilities of such Shareholder or his estate to the Company,

whether the same shall have been incurred before or after notice to the Company of any interest

of any person other than such Shareholder, and whether the time for the payment or discharge

of the same shall have actually arrived or not, and notwithstanding that the same are joint

debts or liabilities of such Shareholder or his estate and any other person, whether a Shareholder

or not. The Company's lien on a share shall extend to all dividends payable thereon. The

Board may at any time, either generally or in any particular case, waive any lien that has

arisen or declare any share to be wholly or in part exempt from the provisions of this Bye-Law. |

Bye-Laws of Argo Group International Holdings, Ltd. 5 of 32 |

| 7.2 | The

Company may sell, in such manner as the Board may think fit, any share on which the Company

has a lien but no sale shall be made unless some sum in respect of which the lien exists

is presently payable nor until the expiration of fourteen (14) days after a notice in writing,

stating and demanding payment of the sum presently payable and giving notice of the intention

to sell in default of such payment, has been served on the holder for the time being of the

share. |

| 7.3 | The

net proceeds of sale by the Company of any shares on which it has a lien shall be applied

in or towards payment or discharge of the debt or liability in respect of which the lien

exists so far as the same is presently payable, and any residue shall (subject to a like

lien for debts or liabilities not presently payable as existed upon the share prior to the

sale) be paid to the person who was the holder of the share immediately before such sale.

For giving effect to any such sale, the Board may authorise some person to transfer the share

sold to the purchaser thereof. The purchaser shall be registered as the holder of the share

and he shall not be bound to see to the application of the purchase money, nor shall his

title to the share be affected by any irregularity or invalidity in the proceedings relating

to the sale. |

| 8.1 | The

Board may from time to time make calls upon the Shareholders (for the avoidance of doubt

excluding the Company in respect of any nil or partly paid shares held by the Company as

treasury shares) in respect of any monies unpaid on their shares (whether on account of the

par value of the shares or by way of premium) and not by the terms of issue thereof made

payable at a date fixed by or in accordance with such terms of issue, and each Shareholder

shall (subject to the Company serving upon him at least fourteen (14) days’ notice

specifying the time or times and place of payment) pay to the Company at the time or times

and place so specified the amount called on his shares. A call may be revoked or postponed

as the Board may determine. |

| 8.2 | A

call may be made payable by instalments and shall be deemed to have been made at the time

when the resolution of the Board authorising the call was passed. |

| 8.3 | The

joint holders of a share shall be jointly and severally liable to pay all calls in respect

thereof. |

| 8.4 | If

a sum called in respect of the share shall not be paid before or on the day appointed for

payment thereof the person from whom the sum is due shall pay interest on the sum from the

day appointed for the payment thereof to the time of actual payment at such rate as the Board

may determine, but the Board shall be at liberty to waive payment of such interest wholly

or in part. |

| 8.5 | Any

sum which, by the terms of issue of a share, becomes payable on allotment or at any date

fixed by or in accordance with such terms of issue, whether on account of the nominal amount

of the share or by way of premium, shall for all the purposes of these Bye-Laws be deemed

to be a call duly made, notified and payable on the date on which, by the terms of issue,

the same becomes payable and, in case of non-payment, all the relevant provisions of these

Bye-Laws as to

payment of interest, forfeiture or otherwise shall apply as if such sum had become payable by virtue of a call duly made and notified. |

Bye-Laws of Argo Group International Holdings, Ltd. 6 of 32 |

| 8.6 | The

Board may on the issue of shares differentiate between the allottees or holders as to the

amount of calls to be paid and the times of payment. |

| 9.1 | If

a Shareholder fails to pay any call or instalment of a call on the day appointed for payment

thereof, the Board may at any time thereafter during such time as any part of such call or

instalment remains unpaid serve a notice on him requiring payment of so much of the call

or instalment as is unpaid, together with any interest which may have accrued. |

| 9.2 | The

notice shall name a further day (not being less than fourteen (14) days from the date of

the notice) on or before which, and the place where, the payment required by the notice is

to be made and shall state that, in the event of non-payment on or before the day and at

the place appointed, the shares in respect of which such call is made or instalment is payable

will be liable to be forfeited. The Board may accept the surrender of any share liable to

be forfeited hereunder and, in such case, references in these Bye-Laws to forfeiture shall

include surrender. |

| 9.3 | If

the requirements of any such notice as aforesaid are not complied with, any share in respect

of which such notice has been given may at any time thereafter, before payment of all calls

or instalments and interest due in respect thereof has been made, be forfeited by a resolution

of the Board to that effect. Such forfeiture shall include all dividends declared in respect

of the forfeited shares and not actually paid before the forfeiture. |

| 9.4 | When

any share has been forfeited, notice of the forfeiture shall be served upon the person who

was before forfeiture the holder of the share but no forfeiture shall be in any manner invalidated

by any omission or neglect to give such notice as aforesaid. |

| 9.5 | A

forfeited share shall be deemed to be the property of the Company and may be sold, re-offered

or otherwise disposed of either to the person who was, before forfeiture, the holder thereof

or entitled thereto or to any other person upon such terms and in such manner as the Board

shall think fit, and at any time before a sale, re-allotment or disposition the forfeiture

may be cancelled on such terms as the Board may think fit. |

| 9.6 | A

person whose shares have been forfeited shall thereupon cease to be a Shareholder in respect

of the forfeited shares but shall, notwithstanding the forfeiture, remain liable to pay to

the Company all monies which at the date of forfeiture were presently payable by him to the

Company in respect of the shares with interest thereon at such rate as the Board may determine

from the date of forfeiture until payment, and the Company may enforce payment without being

under any obligation to make any allowance for the value of the shares forfeited. |

| 9.7 | An

affidavit in writing that the deponent is a Director of the Company or the Secretary and

that a share has been duly forfeited on the date stated in the affidavit shall be conclusive

evidence of the

facts therein stated as against all persons claiming to be entitled to the share. The Company may receive the consideration (if any)

given for the share on the sale, re-allotment or disposition thereof and the Board may authorise some person to transfer the share to

the person to whom the same is sold, re-allotted or disposed of, and he shall thereupon be registered as the holder of the share and

shall not be bound to see to the application of the purchase money (if any) nor shall his title to the share be affected by any irregularity

or invalidity in the proceedings relating to the forfeiture, sale, re-allotment or disposal of the share. |

Bye-Laws of Argo Group International Holdings, Ltd. 7 of 32 |

REGISTER

OF SHAREHOLDERS

| 10. | REGISTER

OF SHAREHOLDERS |

The

Secretary shall establish and maintain the Register at the Registered Office in the manner prescribed by the Companies Acts. Unless the

Board otherwise determines, the Register shall be open to inspection in the manner prescribed by the Companies Acts between 10:00 am

and 12:00 noon on every working day. Unless the Board so determines, no Shareholder or intending Shareholder shall be entitled to have

entered in the Register any indication of any trust or any equitable, contingent, future or partial interest in any share or any fractional

part of a share and if any such entry exists or is permitted by the Board it shall not be deemed to abrogate any of the provisions of

Bye-Law 5.4.

REGISTER

OF DIRECTORS AND OFFICERS

| 11. | REGISTER

OF DIRECTORS AND OFFICERS |

The

Secretary shall establish and maintain a register of the Directors and Officers of the Company as required by the Companies Acts. The

register of Directors and Officers shall be open to inspection in the manner prescribed by the Companies Acts between 10:00 am and 12:00

noon on every working day.

TRANSFER

OF SHARES

| 12.1 | Subject

to the Companies Acts and to such of the restrictions contained in these Bye-Laws as may

be applicable, any Shareholder may transfer all or any of his shares by an instrument of

transfer in the usual common form or in any other form which the Board may approve. No such

instrument shall be required on the redemption of a share or on the purchase by the Company

of a share. |

| 12.2 | The

instrument of transfer of a share shall be signed by or on behalf of the transferor and where

any share is not fully-paid, the transferee. The transferor shall be deemed to remain the

holder of the share until the name of the transferee is entered in the Register in respect

thereof. All instruments of transfer when registered may be retained by the Company. The

Board may, in its absolute discretion and without assigning any reason therefor, decline

to register any transfer of

any share which is not a fully-paid share. The Board may also decline to register any transfer unless: |

Bye-Laws of Argo Group International Holdings, Ltd. 8 of 32 |

| (a) | the

instrument of transfer is duly stamped (if required by law) and lodged with the Company,

accompanied by the certificate for the shares to which it relates, and such other evidence

as the Board may reasonably require to show the right of the transferor to make the transfer, |

| (b) | the

instrument of transfer is in respect of only one class of share, and |

| (c) | where

applicable, the permission of the Bermuda Monetary Authority with respect thereto has been

obtained. |

| 12.3 | Subject

to any directions of the Board from time to time in force, the Secretary may exercise the

powers and discretions of the Board under this Bye-Law. |

| 12.4 | If

the Board declines to register a transfer it shall, within three (3) months after the

date on which the instrument of transfer was lodged, send to the transferee notice of such

refusal. |

| 12.5 | No

fee shall be charged by the Company for registering any transfer, probate, letters of administration,

certificate of death or marriage, power of attorney, stop notice, order of court or other

instrument relating to or affecting the title to any share, or otherwise making an entry

in the Register relating to any share. |

TRANSMISSION

OF SHARES

| 13. | TRANSMISSION

OF SHARES |

| 13.1 | In

the case of the death of a Shareholder, the survivor or survivors, where the deceased was

a joint holder, and the estate representative, where he was sole holder, shall be the only

person recognised by the Company as having any title to his shares; but nothing herein contained

shall release the estate of a deceased holder (whether the sole or joint) from any liability

in respect of any share held by him solely or jointly with other persons. For the purpose

of this Bye-Law, estate representative means the person to whom probate or letters

of administration has or have been granted in Bermuda or, failing any such person, such other

person as the Board may in its absolute discretion determine to be the person recognised

by the Company for the purpose of this Bye-Law. |

| 13.2 | Any

person becoming entitled to a share in consequence of the death of a Shareholder or otherwise

by operation of applicable law may, subject as hereafter provided and upon such evidence

being produced as may from time to time be required by the Board as to his entitlement, either

be registered himself as the holder of the share or elect to have some person nominated by

him registered as the transferee thereof. If the person so becoming entitled elects to be

registered himself, he shall deliver or send to the Company a notice in writing signed by

him stating that he so elects. If he shall elect to have his nominee registered, he shall

signify his election

by signing an instrument of transfer of such share in favour of his nominee. All the limitations, restrictions and provisions of these

Bye-Laws relating to the right to transfer and the registration of transfer of shares shall be applicable to any such notice or instrument

of transfer as aforesaid as if the death of the Shareholder or other event giving rise to the transmission had not occurred and the notice

or instrument of transfer was an instrument of transfer signed by such Shareholder. |

Bye-Laws of Argo Group International Holdings, Ltd. 9 of 32 |

| 13.3 | A

person becoming entitled to a share in consequence of the death of a Shareholder or otherwise

by operation of applicable law shall (upon such evidence being produced as may from time

to time be required by the Board as to his entitlement) be entitled to receive and may give

a discharge for any dividends or other monies payable in respect of the share, but he shall

not be entitled in respect of the share to receive notices of or to attend or vote at general

meetings of the Company or, save as aforesaid, to exercise in respect of the share any of

the rights or privileges of a Shareholder until he shall have become registered as the holder

thereof. The Board may at any time give notice requiring such person to elect either to be

registered himself or to transfer the share and, if the notice is not complied with within

sixty (60) days, the Board may thereafter withhold payment of all dividends and other monies

payable in respect of the shares until the requirements of the notice have been complied

with. |

| 13.4 | Subject

to any directions of the Board from time to time in force, the Secretary may exercise the

powers and discretions of the Board under this Bye-Law. |

SHARE

CAPITAL

| 14.1 | The

Company may from time to time increase its capital by such sum to be divided into shares

of such par value as the Company by Resolution shall prescribe. |

| 14.2 | The

Company may, by the Resolution increasing the capital, direct that the new shares or any

of them shall be offered in the first instance either at par or at a premium or (subject

to the provisions of the Companies Acts) at a discount to all the holders for the time being

of shares of any class or classes in proportion to the number of such shares held by them

respectively or make any other provision as to the issue of the new shares. |

| 14.3 | The

new shares shall be subject to all the provisions of these Bye-Laws with reference to lien,

the payment of calls, forfeiture, transfer, transmission and otherwise. |

| 15.1 | The

Company may from time to time by Resolution: |

| (a) | divide

its shares into several classes and attach thereto respectively any preferential, deferred,

qualified or special rights, privileges or conditions; |

Bye-Laws of Argo Group International Holdings, Ltd. 10 of 32 |

| (b) | consolidate

and divide all or any of its share capital into shares of larger par value than its existing

shares; |

| (c) | sub-divide

its shares or any of them into shares of smaller par value than is fixed by its memorandum,

so, however, that in the sub-division the proportion between the amount paid and the amount,

if any, unpaid on each reduced share shall be the same as it was in the case of the share

from which the reduced share is derived; |

| (d) | make

provision for the issue and allotment of shares which do not carry any voting rights; |

| (e) | cancel

shares which, at the date of the passing of the Resolution in that behalf, have not been

taken or agreed to be taken by any person, and diminish the amount of its share capital by

the amount of the shares so cancelled; and |

| (f) | change

the currency denomination of its share capital. |

| 15.2 | Where

any difficulty arises in regard to any division, consolidation, or sub-division under this

Bye-Law, the Board may settle the same as it thinks expedient and, in particular, may arrange

for the sale of the shares representing fractions and the distribution of the net proceeds

of sale in due proportion amongst the Shareholders who would have been entitled to the fractions,

and for this purpose the Board may authorise some person to transfer the shares representing

fractions to the purchaser thereof, who shall not be bound to see to the application of the

purchase money nor shall his title to the shares be affected by any irregularity or invalidity

in the proceedings relating to the sale. |

| 15.3 | Subject

to the Companies Acts and to any confirmation or consent required by law or these Bye- Laws,

the Company may by Resolution from time to time convert any preference shares into redeemable

preference shares. |

| 16.1 | Subject

to the Companies Acts, its memorandum and any confirmation or consent required by law or

these Bye-Laws, the Company may from time to time by Resolution authorise the reduction of

its issued share capital or any share premium account in any manner. |

| 16.2 | In

relation to any such reduction, the Company may by Resolution determine the terms upon which

such reduction is to be effected including, in the case of a reduction of part only of a

class of shares, those shares to be affected. |

GENERAL

MEETINGS AND RESOLUTIONS IN WRITING

| 17. | GENERAL

MEETINGS AND RESOLUTIONS IN WRITING |

| 17.1 | Save

and to the extent that the Company elects to dispense with the holding of one or more of

its annual general meetings in the manner permitted by the Companies Acts, the Board shall convene

and the Company shall hold general meetings as annual general meetings in accordance with the requirements of the Companies Acts at such

times and places as the Board shall appoint. The Board may, whenever it thinks fit, and shall, when required by the Companies Acts, convene

general meetings other than annual general meetings which shall be called special general meetings. |

Bye-Laws of Argo Group International Holdings, Ltd. 11 of 32 |

| 17.2 | Except

in the case of the removal of Auditors or Directors, anything which may be done by resolution

of the Shareholders in general meeting or by resolution of any class of Shareholders in a

separate general meeting may be done by resolution in writing, signed by the Shareholders

(or the holders of such class of shares) who at the date of the notice of the resolution

in writing represent the majority of votes that would be required if the resolution had been

voted on at a meeting of the Shareholders. Such resolution in writing may be signed by the

Shareholder or its proxy, or in the case of a Shareholder that is a corporation (whether

or not a company within the meaning of the Companies Acts) by its representative on behalf

of such Shareholder, in as many counterparts as may be necessary. |

| 17.3 | Notice

of any resolution in writing to be made under this Bye-Law shall be given to all the Shareholders

who would be entitled to attend a meeting and vote on the resolution. The requirement to

give notice of any resolution in writing to be made under this Bye-Law to such Shareholders

shall be satisfied by giving to those Shareholders a copy of that resolution in writing in

the same manner that is required for a notice of a general meeting of the Company at which

the resolution could have been considered, except that the length of the period of notice

shall not apply. The date of the notice shall be set out in the copy of the resolution in

writing. |

| 17.4 | The

accidental omission to give notice, in accordance with this Bye-Law, of a resolution in writing

to, or the non-receipt of such notice by, any person entitled to receive such notice shall

not invalidate the passing of the resolution in writing. |

| 17.5 | For

the purposes of this Bye-Law, the date of the resolution in writing is the date when the

resolution in writing is signed by, or on behalf of, the Shareholder who establishes the

majority of votes required for the passing of the resolution in writing and any reference

in any enactment to the date of passing of a resolution is, in relation to a resolution in

writing made in accordance with this Bye-Law, a reference to such date. |

| 17.6 | A

resolution in writing made in accordance with this Bye-Law is as valid as if it had been

passed by the Company in general meeting or, if applicable, by a meeting of the relevant

class of Shareholders of the Company, as the case may be. A resolution in writing made in

accordance with this Bye-Law shall constitute minutes for the purposes of the Companies Acts

and these Bye-Laws. |

| 18. | NOTICE

OF GENERAL MEETINGS |

| 18.1 | An

annual general meeting shall be called by not less than five (5) days’ notice

in writing and a special

general meeting shall be called by not less than five (5) days’ notice in writing. The notice

shall be exclusive of the day on which it is served or deemed to be served and of the day for which it is given, and shall specify the

place, day and time of the meeting, and, the nature of the business to be considered. Notice of every general meeting shall be given

in any manner permitted by these Bye-Laws to all Shareholders other than such as, under the provisions of these Bye-Laws or the terms

of issue of the shares they hold, are not entitled to receive such notice from the Company and every Director and to any Resident Representative

who or which has delivered a written notice upon the Registered Office requiring that such notice be sent to him or it. |

Bye-Laws of Argo Group International Holdings, Ltd. 12 of 32 |

Notwithstanding

that a meeting of the Company is called by shorter notice than that specified in this Bye-Law, it shall be deemed to have been duly called

if it is so agreed:

| (a) | in

the case of a meeting called as an annual general meeting, by all the Shareholders entitled

to attend and vote thereat; |

| (b) | in

the case of any other meeting, by a majority in number of the Shareholders having the right

to attend and vote at the meeting, being a majority together holding not less than ninety-five

per cent (95%) in nominal value of the shares giving that right. |

| 18.2 | The

accidental omission to give notice of a meeting or (in cases where instruments of proxy are

sent out with the notice) the accidental omission to send such instrument of proxy to, or

the non-receipt of notice of a meeting or such instrument of proxy by, any person entitled

to receive such notice shall not invalidate the proceedings at that meeting. |

| 18.3 | The

Board may cancel or postpone a meeting of the Shareholders after it has been convened and

notice of such cancellation or postponement shall be served in accordance with these Bye-Laws

upon all Shareholders entitled to notice of the meeting so cancelled or postponed setting

out, where the meeting is postponed to a specific date, notice of the new meeting in accordance

with this Bye-Law. |

| 19. | PROCEEDINGS

AT GENERAL MEETINGS |

| 19.1 | In

accordance with the Companies Acts, a general meeting may be held with only one individual

present provided that the requirement for a quorum is satisfied. No business shall be transacted

at any general meeting unless a quorum is present when the meeting proceeds to business,

but the absence of a quorum shall not preclude the appointment, choice or election of a chairman,

which shall not be treated as part of the business of the meeting. Save as otherwise provided

by these Bye-Laws, at least one Shareholder present in person or by proxy and entitled to

vote shall be a quorum for all purposes. |

| 19.2 | If

within five (5) minutes (or such longer time as the chairman of the meeting may determine

to wait) after the time appointed for the meeting, a quorum is not present, the meeting,

if convened on the requisition of Shareholders, shall be dissolved. In any other case, it

shall stand adjourned to such other day and such other time and place as the chairman of

the meeting may determine and at such adjourned meeting one Shareholder present in person

or by proxy (whatever the number

of shares held by him) and entitled to vote shall be a quorum. The Company shall give not less than five (5) days’ notice

of any meeting adjourned through want of a quorum and such notice shall state that the one Shareholder present in person or by proxy

(whatever the number of shares held by them) and entitled to vote shall be a quorum. |

Bye-Laws of Argo Group International Holdings, Ltd. 13 of 32 |

| 19.3 | A

meeting of the Shareholders or any class thereof may be held by means of such telephone,

electronic or other communication facilities (including, without limiting the generality

of the foregoing, by telephone, or by video conferencing) as to permit all persons participating

in the meeting to communicate with each other simultaneously and instantaneously, and participation

in such a meeting shall constitute presence in person at such meeting. |

| 19.4 | Each

Director, and upon giving the notice referred to in Bye-Law 18.1 above, the Resident Representative,

if any, shall be entitled to attend and speak at any general meeting of the Company. |

| 19.5 | The

Board may choose one of their number to preside as chairman at every general meeting. If

there is no such chairman, or if at any meeting the chairman is not present within five (5) minutes

after the time appointed for holding the meeting, or is not willing to act as chairman, the

Directors present shall choose one of their number to act or if only one Director is present

he shall preside as chairman if willing to act. If no Director is present, or if each of

the Directors present declines to take the chair, the persons present and entitled to vote

on a poll shall elect one of their number to be chairman. |

| 19.6 | The

chairman of the meeting may, with the consent by resolution of any meeting at which a quorum

is present (and shall if so directed by the meeting), adjourn the meeting from time to time

and from place to place but no business shall be transacted at any adjourned meeting except

business which might lawfully have been transacted at the meeting from which the adjournment

took place. When a meeting is adjourned for three (3) months or more, notice of the

adjourned meeting shall be given as in the case of an original meeting. Save as expressly

provided by these Bye-Laws, it shall not be necessary to give any notice of an adjournment

or of the business to be transacted at an adjourned meeting. |

| 20.1 | Save

where a greater majority is required by the Companies Acts or these Bye-Laws, any question

proposed for consideration at any general meeting shall be decided on by a simple majority

of votes cast. |

| 20.2 | At

any general meeting, a resolution put to the vote of the meeting shall be decided on a show

of hands or by a count of votes received in the form of electronic records, unless (before

or on the declaration of the result of the show of hands or count of votes received as electronic

records or on the withdrawal of any other demand for a poll) a poll is demanded by: |

| (a) | the

chairman of the meeting; or |

Bye-Laws of Argo Group International Holdings, Ltd. 14 of 32 |

| (b) | at

least three (3) Shareholders present in person or represented by proxy; or |

| (c) | any

Shareholder or Shareholders present in person or represented by proxy and holding between

them not less than one tenth (1/10) of the total voting rights of all the Shareholders having

the right to vote at such meeting; or |

| (d) | a

Shareholder or Shareholders present in person or represented by proxy holding shares conferring

the right to vote at such meeting, being shares on which an aggregate sum has been paid up

equal to not less than one tenth (1/10) of the total sum paid up on all such shares conferring

such right. |

The

demand for a poll may be withdrawn by the person or any of the persons making it at any time prior to the declaration of the result.

Unless a poll is so demanded and the demand is not withdrawn, a declaration by the chairman that a resolution has, on a show of hands

or count of votes received as electronic records, been carried or carried unanimously or by a particular majority or not carried by a

particular majority or lost shall be final and conclusive, and an entry to that effect in the minute book of the Company shall be conclusive

evidence of the fact without proof of the number or proportion of votes recorded for or against such resolution.

| 20.3 | If

a poll is duly demanded, the result of the poll shall be deemed to be the resolution of the

meeting at which the poll is demanded. |

| 20.4 | A

poll demanded on the election of a chairman, or on a question of adjournment, shall be taken

forthwith. A poll demanded on any other question shall be taken in such manner and either

forthwith or at such time (being not later than three (3) months after the date of the

demand) and place as the chairman shall direct. It shall not be necessary (unless the chairman

otherwise directs) for notice to be given of a poll. |

| 20.5 | The

demand for a poll shall not prevent the continuance of a meeting for the transaction of any

business other than the question on which the poll has been demanded and it may be withdrawn

at any time before the close of the meeting or the taking of the poll, whichever is the earlier. |

| 20.6 | On

a poll, votes may be cast either personally or by proxy. |

| 20.7 | A

person entitled to more than one vote on a poll need not use all his votes or cast all the

votes he uses in the same way. |

| 20.8 | In

the case of an equality of votes at a general meeting, whether on a show of hands or count

of votes received as electronic records or on a poll, the chairman of such meeting shall