UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington,

D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT

TO SECTION 14(a) OF

THE SECURITIES EXCHANGE

ACT OF 1934

| Filed by the registrant x |

Filed by a party other than the registrant ¨ |

Check the appropriate box:

| ¨ | Preliminary proxy statement |

| ¨ | Confidential, for

use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive proxy statement. |

| x | Definitive

additional materials. |

| ¨ | Soliciting

material pursuant to Section 240.14a-12 |

ARGO

GROUP INTERNATIONAL HOLDINGS, LTD.

(Name of Registrant as

Specified in Its Charter)

(Name of Person(s) Filing

Proxy Statement if Other Than the Registrant)

Payment of

filing fee (check the appropriate box):

| ¨ | Fee paid previously

with preliminary materials. |

| ¨ | Fee computed on table

in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

Leading Independent Proxy Advisory Firms ISS

and Glass Lewis Recommend that Argo Shareholders Vote “FOR” All Seven of Argo’s Highly Qualified Director Nominees

Argo’s Largest Shareholder, Voce Capital

Management, Votes All its Shares in Support of Argo’s Director Nominees

The Argo Board of Directors Urges Shareholders

to Vote “FOR” Argo’s Highly Qualified Director Nominees on the BLUE Proxy Card TODAY

HAMILTON,

BERMUDA — December 5, 2022 – Argo Group International Holdings, Ltd. (NYSE: ARGO) today announced that

leading independent proxy advisory firms, Institutional Shareholder Services (ISS) and Glass Lewis & Co, have recommended

that shareholders vote “FOR” all seven of Argo’s highly qualified director nominees at the Company’s upcoming

Annual Meeting of Shareholders to be held on December 15, 2022.

In addition, Voce Capital Management LLC, the owner of approximately

9.5% of the Company’s common shares, has informed the Company that it has voted all of its shares on the BLUE proxy

card in support of the seven Argo nominees at the Company’s upcoming 2022 annual meeting.

In making its recommendations, ISS stated in its December 2,

2022 report1:

| · | “The dissident has not made a compelling case for change. The highest priority for ARGO is the ongoing strategic review. There

is no reason to believe that the process is not being conducted to advance the best interests of shareholders, and there is no indication

that a key competency or perspective is absent from the strategic review committee.” |

| · | “The addition of Dan Plants in early August only bolstered the board's credibility, particularly because he was appointed

to chair the strategic review committee.” |

| · | “ARGO appears to have emerged from the tumult of 2019 with a more focused strategy. The company began closing and selling international

and non-core units, and now draws over 95 percent of its revenue from the United States. This transition may have contributed to improved

operations, as the revenue CAGR since the end of 2019 is almost double the claims and loss growth rate, even when the impact of the increase

in loss reserves is taken into account.” |

In

making its recommendations, Glass Lewis stated in its December 2, 2022 report1:

| · | “Overall, we recognize that steps taken by the incumbent board and management have significantly transformed Argo into a focused

U.S. specialty commercial insurance business and the resulting company appears stronger, more efficient and better positioned to generate

value for shareholders than the legacy structure, in our view.” |

| · | “Shareholders should note that Capital Returns has not offered alternative suggestions to improve the business beyond pursuing

a sale of the whole Company. Given that the board is already considering a sale and has solicited a large range of potential counterparties

as part of the strategic review, we do not believe the Dissident Nominees would be clearly additive to the strategic review process or

likely to improve the outcome for all shareholders, if appointed to the board.” |

1

Permission to use quotes neither sought nor obtained

| · | “Furthermore, given the level of operational as well as board and management change that has already taken place at Argo over

the last several years, we do not believe a further shakeup of the board would be a favorable development at this time.” |

Argo issued the following statement:

We are pleased that

ISS and Glass Lewis support the election of all seven of Argo’s director nominees. Both of these recommendations further validate

our belief that Argo’s seven highly qualified nominees with relevant expertise and proven track records continue to move with speed

to best position the Company.

The seven directors up for election at the annual general

meeting – Bernard Bailey, Thomas Bradley, Dymphna Lehane, Samuel Liss, Carol McFate, J. Daniel Plants and Al-Noor Ramji –

are integral to continuing Argo’s momentum, advancing our strategy and driving enhanced shareholder value.

This is a critical moment in Argo’s history. It

is imperative that we continue the process we have underway to maximize value for shareholders.

To follow ISS’s and Glass Lewis’s recommendations, shareholders

should vote “FOR” all seven of Argo’s highly qualified director nominees on the BLUE proxy card prior

to the deadline of 9:00 a.m. local Bermuda time (8:00 a.m. Eastern Time) on December 13, 2022. Argo shareholders are advised

to discard any white proxy cards they receive from Capital Returns. Argo shareholders can vote today by telephone, by internet or by signing,

dating and returning the BLUE proxy card in the postage-paid envelope provided.

| YOUR VOTE IS IMPORTANT! |

| |

| If you have any questions, or need assistance in voting |

| your shares on the BLUE proxy card, |

| please call our proxy solicitor: |

| |

| INNISFREE M&A INCORPORATED |

| Shareholders in the U.S. and Canada Call Toll-Free at +1 (877) 750-9496 |

| Banks and Brokers Call Collect at +1 (212) 750-5833 |

| |

About Argo Group International Holdings, Ltd.

Argo Group International Holdings, Ltd. (NYSE: ARGO) is an underwriter

of specialty insurance products in the property and casualty market. Argo offers a full line of products and services designed to meet

the unique coverage and claims-handling needs of businesses in two primary segments: U.S. Operations and International Operations. Argo

Group and its insurance subsidiaries are rated ‛A-’ by Standard & Poor’s. Argo’s insurance subsidiaries

are rated ‛A-’ by A.M. Best. More information on Argo and its subsidiaries is available at argogroup.com.

Forward-Looking Statements

This press release and any related oral statements may include forward-looking

statements that reflect our current views with respect to future events and financial and operational performance. Forward-looking statements

include all statements that do not relate solely to historical or current facts, and can be identified by the use of words such as “positioning,”

“expect,” “intend,” “plan,” “believe,” “do not believe,” “aim,”

“project,” “anticipate,” “confident,” “seek,” “will,” “likely,”

“assume,” “estimate,” “may,” “continue,” “create,” “maximize,”

“guidance,” “objective,” “outcome,” remain optimistic,” “outlook,” “trends,”

“future,” “could,” “would,” “should,” “target,” “on track,” “simplifies”

and similar expressions of a future or forward-looking nature. Such statements are subject to certain risks and uncertainties that could

cause actual events or results to differ materially. For a more detailed discussion of such risks and uncertainties, see Item 1A, “Risk

Factors” in Argo’s Annual Report on Form 10-K and Form 10-K/A for the fiscal year ended December 31, 2021,

as supplemented in Argo’s subsequent Quarterly Reports on Form 10-Q, and in other filings with the U.S. Securities and Exchange

Commission. The inclusion of a forward-looking statement herein should not be regarded as a representation by Argo that Argo’s objectives

will be achieved. Argo undertakes no obligation to publicly update forward-looking statements, whether as a result of new information,

future events or otherwise. You should not place undue reliance on any such statements. Each of the transactions referenced in this press

release is subject to risks and uncertainties, including, but not limited to, that the transactions may be unable to be completed because

of the failure to obtain required regulatory approvals or satisfy (or obtain waivers of) the closing conditions and uncertainty as to

the timing of completion of the transactions.

Contacts

Investors:

Andrew Hersom

Head of Investor Relations

860-970-5845

andrew.hersom@argogroupus.com

Gregory Charpentier

AVP, Investor Relations and Corporate Finance

978-387-4150

gregory.charpentier@argogroupus.com

Media:

David Snowden

Senior Vice President, Group Communications

210-321-2104

david.snowden@argogroupus.com

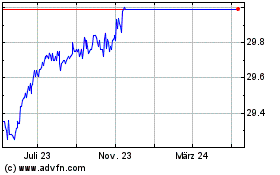

Argo (NYSE:ARGO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

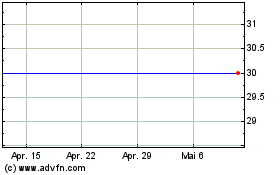

Argo (NYSE:ARGO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025