Additional Proxy Soliciting Materials (definitive) (defa14a)

23 November 2022 - 7:48PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington,

D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT

TO SECTION 14(a) OF

THE SECURITIES EXCHANGE

ACT OF 1934

| Filed by the registrant x |

Filed by a party other than the registrant ¨ |

Check the appropriate box:

| ¨ | Preliminary proxy statement |

| ¨ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive proxy statement. |

| x | Definitive additional materials. |

| ¨ | Soliciting material pursuant to Section 240.14a-12 |

ARGO GROUP INTERNATIONAL HOLDINGS, LTD.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than

the Registrant)

Payment of filing fee (check the appropriate box):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

| https://pipeline.thedeal.com/article/00000184-a510-d64c-a7ef-e53c7c530000/deal-news/activism/argo-units-sale-simplified-insurer-for-auction?cmpid=

…

1

/

5

Argo Unit's Sale Simplified Insurer for

Auction

Argo Group

The activist-targeted specialty insurer’s September sale of its

Lloyd's Syndicate for $125 million simplified the company’s

structure and made it more attractive to buyers, according to its

CEO and an activist on its board.

By

Ronald Orol

November 23, 2022 1157 AM

|

| https://pipeline.thedeal.com/article/00000184-a510-d64c-a7ef-e53c7c530000/deal-news/activism/argo-units-sale-simplified-insurer-for-auction?cmpid=

…

2

/

5

Argo Group International Holdings Inc.’s (ARGO) September sale of its Lloyd's

Syndicate U.K. unit to Westfield Specialty Insurance for about $125 million helped

simplify the insurer’s structure and make the activist-targeted company potentially

more attractive for buyers as a strategic review continues, two top company officials

told The Deal.

Argo CEO

Tom Bradley

and activist investor J. Daniel Plants of

Voce Capital

Management LLC

, who joined the insurer’s board

in August

to lead a strategic review

committee, defended the company's actions in response to another activist investor in

the stock, Ron Bobman’s

Capital Returns Management LLC

, which is seeking two

board seats at a meeting next month.

Argo had

launched a strategic review

in April, with

Goldman, Sachs & Co.

as an

adviser, with the primary goal of seeking to sell the whole business. Argo, however,

during the process received a proposal from Westfield, a U.S. property and casualty

insurer, to buy a smaller unit, Lloyd's Syndicate 1200 of the U.K, which focuses on

specialty insurance.

“We met with [Westfield] and ascertained their interest and decided to pause the

greater process in the early summer to concentrate on the sale of the syndicate,”

Bradley said. “We had received feedback early in the process that Argo’s ownership

of the Lloyd’s Syndicate was complicating potential buyer interest in the company, as

it has a complicated regulatory structure and the expense burden of maintaining it in

the U.K. vs. just being in the U.S. was high.”

Plants, who owns 9.5% of Argo, said the unit was acting as a "poison pill" on the

overall strategic review, and he said he even would have been willing to see the U.K.

unit closed down at no value to help simplify the company’s story for potential

bidders.

Other recent deals also helped simplify Argo for potential buyers to consider, Bradley

and Plants added. The company on Nov. 9 completed a Loss Portfolio Transfer, or

LPT, transaction with

Enstar Group Ltd.

(ESGR) for about $746 million of U.S.

|

| https://pipeline.thedeal.com/article/00000184-a510-d64c-a7ef-e53c7c530000/deal-news/activism/argo-units-sale-simplified-insurer-for-auction?cmpid=

…

3

/

5

casualty reserves, which Bradley and Plants argued also helped clean up Argo’s

balance sheet by removing uncertainty about prior years.

Argo also closed insurance businesses in Brazil, Malta and Italy and a reinsurance

business in Bermuda over the past two years, also with the goal of simplifying the

Argo story for the auction, which was re-started in September.

“There are people who are in the process now who weren’t involved before,” Plants

said. “They had passed on considering a purchase of Argo previously but are

interested now because we eliminated the U.K. syndicate and the uncertainty related

to the prior reserves.”

Meanwhile, the other activist investor, Bobman’s Capital Return, earlier this year

launched a director contest set for a Dec. 15 meeting, raising concerns about Argo’s

performance, its review process and Plants' role as chief of the strategic review

committee. In a November release, Bobman said he doesn’t believe Plants is the best

person to lead the strategic review committee because his cost basis, estimated by

FactSet Research Systems Inc.

at $56 a share, would deter him from accepting a deal.

A sale of Argo even at a 50% premium to its current trading level of around $26

would result in substantial losses and “significantly” affect Plants' investment

partners, fund and business, Bobman argued.

Voce reported Nov. 14 owning about 3.3 million Argo shares as of Sept. 30, the fund’s

largest position of 10 holdings. Voce bought part of its position when Argo’s shares

were trading in the $60s and $70s in 2018 and 2019, though it purchased additional

shares in the $30s in the first half of 2020.

Argo, which traded Wednesday a.m. at $26.37 a share, respectively has produced total

returns of -54%, -23%, and -11% over the past year, three years and five years,

according to FactSet.

Plants, however, pushed back on Bobman's concerns. He said the stock price doesn’t

reflect Argo’s value, but he rejected Bobman’s assertion that he would oppose a

potential sale of the company if it did not come at a premium to his cost basis.

|

| https://pipeline.thedeal.com/article/00000184-a510-d64c-a7ef-e53c7c530000/deal-news/activism/argo-units-sale-simplified-insurer-for-auction?cmpid=

…

4

/

5

“I don’t make investment decisions that way,” he said. “What you paid a year ago or

five years ago for an asset doesn’t mean a damn thing. When I joined the board, all

the directors asked me if I was open-minded about the outcome and would my

historical cost basis play any role in the strategic review, and I assured them it didn’t. I

asked them the same question and got the same answer in return. Bobman clearly

knows nothing about how I make investment decisions."

Plants also rejected Bobman’s comments that the company has made “disastrous

strategic decisions” and that the review has failed to drive value. “The two

transactions that already emanated from the review are extraordinarily beneficial to

shareholders,” Plants said.

He added that the auction process was restarted in September after the U.K. syndicate

sale and that Goldman Sachs has reached out to more than 80 parties, both strategic

and financial buyers, to gauge their interest.

“We received preliminary indications of interest from a subset of those people, and we

are now in the second round of the review, with management meetings ongoing,"

Plants said. “We will follow the process to its conclusion; we are in the later stages,

but we also don't want to rush it."

The strategic review and Bobman contest come after Plants

reached a 2020 settlement

with Argo that installed three directors and drove out Argo’s then CEO, Mark Watson

III, after the company, also under pressure from Voce, removed five long-tenured

incumbent directors. Watson’s ouster came after the company's confirmation that it

had received a subpoena from the Securities and Exchange Commission

regarding the

disclosure

of “certain compensation-related" C-suite perquisites issued to the then-

CEO.

Plants noted Tuesday that at the time of his 2019 campaign, he had already urged

Argo to exit its Lloyd's Syndicate business. “The biggest opportunity we saw for the

company to create value was to exit the U.K. business and become a pure-play U.S.

specialty insurer,” Plants said. “Many buyers who were interested in Argo’s U.S.

operations didn’t have any appetite for the U.K. asset, as they either had their own

scaled U.K. platform or they previously had a U.K. presence but had chosen to exit

it."

|

| https://pipeline.thedeal.com/article/00000184-a510-d64c-a7ef-e53c7c530000/deal-news/activism/argo-units-sale-simplified-insurer-for-auction?cmpid=

…

5

/

5

He added that after receiving that feedback, the board correctly decided to "pull the

car over to the side of the road" and focus on divesting that asset before proceeding.

TAGS

ACTIVISM

AUCTIONS

M&A

FINANCIAL SERVICES

INSURANCE

INSTITUTIONAL INVESTORS, ASSET MANAGERS AND CUSTODIANS

BERMUDA

$ 1-10 BILLION

EXCLUSIVE INTERVIEW

EDITOR'S PICK

COMPANIES MENTIONED

Lloyd's Syndicate 1301

Voce Capital Management LLC

Goldman, Sachs & Co.

FactSet Research Systems Inc.

U.S. Securities And Exchange Commission

Argo Group International Holdings Ltd.

Enstar Group Ltd.

Capital Returns Management LLC

PEOPLE MENTIONED

Tom Bradley

Ronald David Bobman

Mark E. Watson III

|

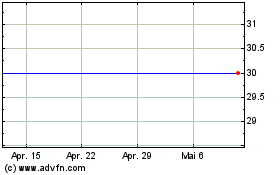

Argo (NYSE:ARGO)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

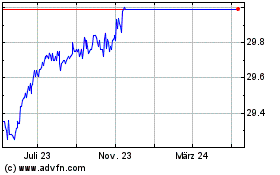

Argo (NYSE:ARGO)

Historical Stock Chart

Von Feb 2024 bis Feb 2025