Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

30 September 2021 - 12:04PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of September, 2021

Commission File Number: 1-16269

AMÉRICA MÓVIL, S.A.B. DE C.V.

(Exact name of registrant as specified in its charter)

America Mobile

(Translation of Registrant´s name into English)

Lago Zurich 245

Plaza Carso / Edificio Telcel

Colonia Ampliación Granada

Delegación Miguel Hidalgo,

11529, Mexico City, Mexico

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark if the Registrant is submitting this Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(1):

Yes _______ No ___X____

Indicate by check mark if the Registrant is submitting this Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No ___X____

Indicate by check mark whether the registrant by furnishing the information contained in this Form 6-K is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

“América Móvil’s shareholders

approve Latam tower spin-off”

Mexico City, September 29, 2021. América

Móvil, S.A.B. de C.V. ("AMX") [BMV: AMX] [NYSE: AMX | AMOV], announced that shareholders representing approximately

98% of its capital stock approved the spin-off (escisión) of all telecommunications towers and other associated passive

infrastructure deployed in certain Latin American countries where it operates.

By virtue of the spin-off, AMX will contribute

to Sitios Latinoamérica, S.A.B. de C.V. (“Sitios Latam”) a portion of its capital stock, assets

and liabilities, mainly consisting in the shares of AMX’s subsidiaries holding telecommunications towers and other associated infrastructure.

The spin-off is subject to customary conditions

and adjustments for corporate reorganizations and shall comply with applicable requirements under the laws of Mexico and of the jurisdictions

where the telecommunications towers are located.

Once the split-up becomes effective, Sitios

Latam is expected to own approximately 36,000 telecommunications towers located in Argentina, Brazil, Chile, Costa Rica, Ecuador,

El Salvador, Guatemala, Honduras, Nicaragua, Panama, Paraguay, Peru, Puerto Rico, Dominican Republic and Uruguay.

This press release contains certain forward-looking

statements that reflect the current views and/or expectations of AMX and its management with respect to its performance, business and

future events. We use words such as “believe,” “anticipate,” “plan,” “expect,” “intend,”

“target,” “estimate,” “project,” “predict,” “forecast,” “guideline,”

“should” and other similar expressions to identify forward-looking statements, but they are not the only way we identify such

statements. Such statements are subject to a number of risks, uncertainties and assumptions. We caution you that a number of important

factors could cause actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in

this release. AMX is under no obligation and expressly disclaims any intention or obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: September 29, 2021

|

AMÉRICA MÓVIL, S.A.B. DE C.V.

|

|

|

|

|

|

|

By:

|

/S/ Alejandro Cantú Jiménez

|

|

|

Name:

Title:

|

Alejandro Cantú Jiménez

Attorney-in-fact

|

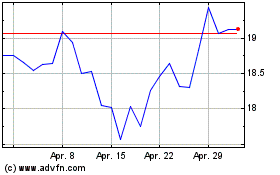

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

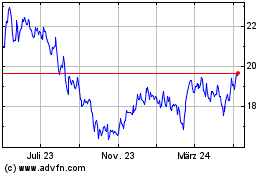

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

Von Jan 2024 bis Jan 2025