Report of Foreign Issuer (6-k)

28 Juli 2020 - 12:49PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of July, 2020

Commission File Number: 1-16269

AMÉRICA MÓVIL, S.A.B. DE C.V.

(Exact name of registrant as specified in its charter)

America Mobile

(Translation of Registrant´s name into English)

Lago Zurich 245

Plaza Carso / Edificio Telcel

Colonia Ampliación Granada

Delegación Miguel Hidalgo,

11529, Mexico City, Mexico

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark if the Registrant is submitting this Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(1):

Yes _______ No ___X____

Indicate by check mark if the Registrant is submitting this Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No ___X____

Indicate by check mark whether the registrant by furnishing the information contained in this Form 6-K is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

“América Móvil informs

to the market”

Mexico City, July 27, 2020. América

Móvil, S.A.B. de C.V. ("AMX") [BMV: AMX] [NYSE: AMX | AMOV], informs that its Brazilian subsidiary,

Claro S.A. (“Claro”), agreed to extend and amend the binding offer submitted, jointly with Telefónica Brasil

S.A. (“Telefonica”) and TIM S.A. (“TIM”), for the acquisition of the mobile business owned

by Oi Group, in the amount of R$16,500 million. Such joint offer considers, aditionally, the possibility of entering into long

term agreements for the use of infrastructure with Oi Group.

The offer was submitted by the parties, and

is subject to certain conditions, including their right to make a higher bid than other offer potentially presented by a third

party (“right to top”) in the competitive process of Oi Group's mobile business sale.

Therefore, Claro believes that the joint offer

with TIM and Telefônica is the one that best serves the interests of current customers of Oi, as it provides long-term experience

in the Brazilian market, investment capacity and technical innovation to the sector as a whole; besides being in line with current

regulation.

This press release contains certain forward-looking

statements that reflect the current views and/or expectations of AMX and its management with respect to its performance, business

and future events. We use words such as “believe,” “anticipate,” “plan,” “expect,”

“intend,” “target,” “estimate,” “project,” “predict,” “forecast,”

“guideline,” “should” and other similar expressions to identify forward-looking statements, but they are

not the only way we identify such statements. Such statements are subject to a number of risks, uncertainties and assumptions.

We caution you that a number of important factors could cause actual results to differ materially from the plans, objectives, expectations,

estimates and intentions expressed in this release. AMX is under no obligation and expressly disclaims any intention or obligation

to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 28, 2020

|

AMÉRICA MÓVIL, S.A.B. DE C.V.

|

|

|

|

|

|

|

By:

|

/S/ Carlos José García Moreno Elizondo

|

|

|

Name:

Title:

|

Carlos José García Moreno Elizondo

Chief Financial Officer

|

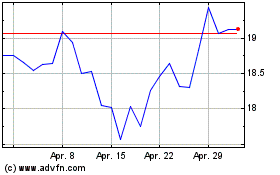

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

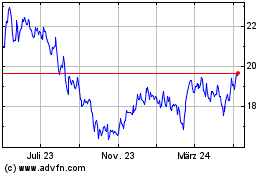

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

Von Mär 2024 bis Mär 2025