UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2023

Commission File Number: 001-31909

ASPEN INSURANCE HOLDINGS LIMITED

(Translation of registrant’s name into English)

141 Front Street

Hamilton HM 19

Bermuda

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ý Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Yes ¨ No ý

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Yes ¨ No ý

On August 22, 2023, Aspen Insurance Holdings Limited (the “Company”) issued a press release announcing results for the six months ended June 30, 2023. The press release, furnished as Exhibit 99.1 to this Form 6-K, is incorporated by reference as part of this Form 6-K.

The information included in this Form 6-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

EXHIBIT INDEX

Exhibit

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | ASPEN INSURANCE HOLDINGS LIMITED

|

| | | |

| Dated: August 22, 2023 | | | | By: | | /s/ Christopher Coleman |

| | | | Name: | | Christopher Coleman |

| | | | Title: | | Chief Financial Officer |

Aspen Reports Strong Financial Results for the First Six Months of 2023

•Net income increased by 352% to $219 million (June 30, 2022: $48 million)

•Operating income* increased by 47% to $191 million (June 30, 2022: $130 million)

•Annualized operating return on average equity* of 22% (June 30, 2022: 14%)

•Underwriting income increased by 33% to $208 million (June 30, 2022: $157 million), resulting in a combined ratio of 83.8% (June 30, 2022: 88.2%)

•Aspen Capital Markets’ total fee income increased by 28% to $61 million (June 30, 2022: $47 million)

•Net investment income increased by 46% to $129 million (June 30, 2022: $89 million)

Hamilton, Bermuda, August 22, 2023 - Aspen Insurance Holdings Limited (“Aspen”) today reported results for the six months ended June 30, 2023.

CEO statement

We are pleased to report a strong set of results for the first half of 2023, which saw our operating income* and net income continue to increase, by 47% to $191 million and by 352% to $219 million, respectively.

We are particularly encouraged to report another period of improved underwriting performance, with our reported combined ratio improving to 83.8% and underwriting income of $208 million. This result reflects the sustained impact of our highly disciplined approach and the benefits of the well-diversified portfolio we have deliberately constructed.

Our gross written premium was $2,125 million, which was slightly lower compared to the same period last year. This is the result of our continuing effort to use current favorable trading conditions to further reduce exposure and manage volatility, while holding our discipline in certain classes where pricing and terms do not meet our return objectives, as demonstrated by our improved underwriting income. While broadly trading conditions are strong, resulting in a 12% rate increase across our whole portfolio, our focus remains on rate adequacy, terms and conditions rather than just rate change. Growing and maintaining our profitability as conditions shift will always be our first priority.

Positive performance across Insurance, Reinsurance and Investments

Our diverse portfolio across our two underwriting segments, Insurance and Reinsurance, allows us to flexibly manage our business. Our underwriting income was well balanced across these two segments and their positive performance was further strengthened by continued expense discipline across the Group, with general and administrative expenses decreasing by 9% to $169 million, notwithstanding inflationary pressures on our cost base.

* Non-GAAP financial measures are used throughout this release, such as Operating Income. For additional information and reconciliation of non-GAAP financial measures, refer to the end of this press release. Refer to "Cautionary Statement Regarding Forward-Looking Statements" at the end of this press release.

Our net investment income of $129 million saw an increase of 46%, as a result of active repositioning of our investments to take advantage of higher interest rates, with limited increase in investment risk.

Continued growth in our capital markets franchise

Aspen Capital Markets continues to be an important differentiator, enabling us to offer a broader range of solutions while also generating attractive fee income. In the first half of the year, it generated total fee income of $61 million (June 30, 2022: $47 million), which is recorded within the underwriting result as a decrease to acquisition expenses, driven by further growth in assets under management to $1.3 billion (June 30, 2022: $1.0 billion).

Strengthening the team

We have made a number of hires across the different areas of the business. This is a reflection of our continuously improving business, as we strengthen our leadership teams shaping Aspen for the future. Notable hires in the period were: John Welch, appointed as Chief Underwriting Officer, Reinsurance, and a member of the Group Executive Committee; Yelena La Forgia who joined Aspen as Chief Financial Officer, Insurance and US; Robert Tartaglia who was appointed as Chief Operations Officer, Insurance; and Peter Grant who was appointed Chief Finance Transformation Officer.

Encouraging results for a strong 2023

In the first half of the year, we again saw significant rate increases across our portfolio, and the outlook remains favorable. Our relentless focus on underwriting discipline and managing volatility means we are well placed to continue to take advantage of current market conditions. We have an enviable international franchise: our leading Insurance, Reinsurance and Capital Market’s businesses and established platforms across the US, UK, Lloyd’s and Bermuda give us the tools to unlock further value and access new opportunities. We look to the future, confident we can deliver on our objective of being a top quartile specialty (re)insurer.

Mark Cloutier, Group Executive Chairman and Chief Executive Officer

Key financial highlights

•Gross written premiums of $2,125 million in the six months ended June 30, 2023, a decrease of 10% compared to $2,351 million in the six months ended June 30, 2022, consistent with management’s strategy to optimize portfolio, reduce exposure and manage volatility, partially offset by rate increases.

•Net written premiums of $1,351 million in the six months ended June 30, 2023, a decrease of 10% compared to $1,506 million in the six months ended June 30, 2022. Premiums ceded to reinsurers as a percentage of gross written premium in the six months ended June 30, 2023, was 37% compared with 36% in the six months ended June 30, 2022.

•Underwriting income of $208 million (adjusted underwriting income* of $196 million) in the six months ended June 30, 2023, compared to an underwriting income of $157 million (adjusted underwriting income of $131 million) in the six months ended June 30, 2022, resulting in a combined ratio of 83.8% (adjusted combined ratio of 84.8%) for the six months ended June 30, 2023, compared to 88.2% (adjusted combined ratio of 90.2%) for the six months ended June 30, 2022.

•Losses and loss adjustment expenses include:

◦Current accident year losses, excluding catastrophe losses, of $670 million, or 52.1 percentage points on the combined ratio, in the six months ended June 30, 2023, compared to $682 million, or 51.4 percentage points on the combined ratio in the six months ended June 30, 2022.

◦Catastrophe losses of $53 million, or 4.1 percentage points on the combined ratio, for the six months ended June 30, 2023, included losses associated with floods in New Zealand, Cyclone Gabrielle, wildfires in Chile and other weather-related events. Catastrophe losses of $93 million, or 7 percentage points on the combined ratio, for the six months ended June 30, 2022, included losses associated with floods in Australia and South Africa, the Russia/Ukraine war and other weather-related events.

◦Net favorable development on prior year loss reserves of $6 million, or 0.5 percentage points on the combined ratio, in the six months ended June 30, 2023, compared with net favorable development of $7 million, or 0.6 percentage points on the combined ratio in the six months ended June 30, 2022.

•Acquisition costs as a percentage of net earned premium improved from 16% in 2022 to 15% in 2023. This is primarily driven by an increase in fee income derived from Aspen Capital Markets, which increased to $61 million in the six months ended June 30, 2023, compared to $47 million in the six months ended June 30, 2022. Fee income from Aspen Capital Market’s activities is primarily allocated to the ceded line of business and serves to reduce acquisition expenses for that business.

•General and administrative expenses decreased to $169 million, representing 13 percentage points on the combined ratio, in the six months ended June 30, 2023, compared with $187 million, and 14 percentage points on the combined ratio, in the six months ended June 30, 2022. The reduction in general and administrative expenses was primarily driven by the favorable year over year foreign exchange rates, coupled with various cost saving initiatives.

•Net investment income of $129 million in the six months ended June 30, 2023, compared to $89 million in the six months ended June 30, 2022.

•Interest expense increased to $43 million in the six months ended June 30, 2023, compared with interest expense of $9 million in the six months ended June 30, 2022. This increase is primarily driven by $36 million of interest on the funds withheld related to the loss portfolio transfer (“LPT”) contract.

•Tax expense increased to $36 million in the six months ended June 30, 2023, compared with tax expense of $5 million in the six months ended June 30, 2022. The increase in tax expense was driven by higher pre-tax profits in our taxable jurisdictions compared to the prior year. The 2022 tax charge also benefited from the utilization of brought forward net operating losses that had a full valuation allowance recorded against U.S. profits.

•Net income includes net realized and unrealized investment gains of $18 million in the six months ended June 30, 2023, compared to losses of $126 million in the six months ended June 30, 2022. The change in net realized and unrealized investment gains and losses is a result of mark to market valuations, predominantly driven by credit spread reduction in our government, corporate bond and structured credit portfolio and lower allocations to rate sensitive asset classes.

•Book yield on the fixed income securities portfolio as at June 30, 2023, was 3.5% compared with 3.2% as at December 31, 2022.

•Annualized operating return on average equity of 22% in the six months ended June 30, 2023, compared to 14% in the six months ended June 30, 2022.

Segment highlights for six months ended June 30, 2023

•Insurance

◦Gross written premiums of $1,250 million in the six months ended June 30, 2023, a decrease of 4% compared to $1,306 million in the six months ended June 30, 2022. This is primarily due to our decision to reduce writing certain programs, which did not meet our profitability expectations, actively managing down premiums within financial and professional lines, offset by favorable market conditions in first party and specialty lines, evidenced with new business activity and a strong rate environment.

◦Net written premiums of $746 million, in the six months ended June 30, 2023, an increase of 3% compared with $722 million in the six months ended June 30, 2022, primarily due to changes to Aspen’s reinsurance programs. Premiums ceded to reinsurers as a percentage of gross written premium in the six months ended June 30, 2023, was 40% compared with 45% in the six months ended June 30, 2022. The lower cession percentage in 2023 is driven by business mix and the decision to restructure a portion of our outwards reinsurance renewals.

◦Underwriting income of $98 million (adjusted underwriting income of $85 million) in the six months ended June 30, 2023, compared to an underwriting income of $119 million (adjusted underwriting income of $106 million) in the six months ended June 30, 2022, resulting in a combined ratio of 86.4% (adjusted combined ratio of 88.2%) for the six months ended June 30, 2023, compared to 83.7% (adjusted combined ratio of 85.4%) for the six months ended June 30, 2022.

◦Losses and loss adjustment expenses include:

▪Current accident year losses, excluding catastrophe losses, of $411 million, or 57.4 percentage points on the combined ratio, in the six months ended June 30, 2023, compared to $395 million, or 54.4 percentage points on the combined ratio in the six months ended June 30, 2022. This is primarily due to an increase in the claims handling provision and proactive reserving actions to take account of potential impacts of social and economic inflationary trends, in comparison to the six months ended June 30, 2022.

▪Catastrophe losses of $18 million, or 2.5 percentage points on the combined ratio, in the six months ended June 30, 2023, compared with $20 million, or 2.7 percentage points on the combined ratio, in the six months ended June 30, 2022.

▪Prior year net favorable reserve development of $8 million or 1.2 percentage points on the combined ratio, in the six months ended June 30, 2023, compared with prior year net favorable development of $16 million, or 2 percentage points on the combined ratio, in the six months ended June 30, 2022. Prior year net favourable reserve development includes $5 million reserve strengthening on post-LPT accident years, in comparison to $4 million reserve release in prior period due to unfavorable underlying loss experience.

◦Acquisition costs decreased to $87 million representing 12.2 percentage points on the combined ratio, in the six months ended June 30, 2023, compared with $92 million, and 12.7 percentage points on the combined ratio, in the six months ended June 30, 2022. The decrease was primarily driven by an increase in fee income derived from Aspen Capital Markets, partially offset by an increase in acquisition costs in financial and professional lines.

◦General and administrative expenses decreased to $111 million, representing 15.5 percentage points on the combined ratio, in the six months ended June 30, 2023, compared with $117 million, and 16.1 percentage points on the combined ratio, in the six months ended June 30, 2022. The decrease was largely driven by favorable year over year foreign exchange rates and a reduction in IT related costs.

•Reinsurance

◦Gross written premiums of $876 million, in the six months ended June 30, 2023, a decrease of 16% compared to $1,046 million in the six months ended June 30, 2022. This is primarily driven by

management’s planned initiatives to reduce exposure to certain more volatile lines of business with inadequate terms as part of our continued portfolio optimization, partially offset by strong rate increases.

◦Net written premiums of $605 million, in the six months ended June 30, 2023, a decrease of 23% compared with $784 million in the six months ended June 30, 2022. Premiums ceded to reinsurers as a percentage of gross written premium in the six months ended June 30, 2023, increased to 31% compared with 25% in the six months ended June 30, 2022 primarily in property reinsurance to reduce net catastrophe exposure.

◦Underwriting income of $111 million (adjusted underwriting income of $112 million) in the six months ended June 30, 2023, compared to an underwriting income of $38 million (adjusted underwriting income of $24 million) in the six months ended June 30, 2022, resulting in a combined ratio of 80.7% (adjusted combined ratio of 80.5%) for the six months ended June 30, 2023, compared to 93.7% (adjusted combined ratio of 95.9%) for the six months ended June 30, 2022.

◦Losses and loss adjustment expenses include:

▪Current accident year losses, excluding catastrophe losses, of $260 million, or 45.4 percentage points on the combined ratio, for the six months ended June 30, 2023, compared to $287 million, or 47.8 percentage points on the combined ratio, for the six months ended June 30, 2022. This is primarily due to the impact of positive premium adjustments, improved pricing, as well as favorable underlying claim performance.

▪Catastrophe losses of $35 million, or 6.2 percentage points on the combined ratio, net of reinsurance recoveries, in the six months ended June 30, 2023, compared with $73 million, or 12.2 percentage points on the combined ratio, net of reinsurance recoveries, in the six months ended June 30, 2022.

▪Prior year net unfavorable reserve development of $2 million, or 0.4 percentage points on the combined ratio, in the six months ended June 30, 2023, compared to prior year net unfavorable reserve development of $9 million, or 1.5 percentage points on the combined ratio, in the six months ended June 30, 2022.

◦Acquisition costs decreased to $106 million, representing 18.5 percentage points on the combined ratio in the six months ended June 30, 2023, compared with $124 million and 20.7 percentage points on the combined ratio, in the six months ended June 30, 2022. The decrease was mainly attributable to reductions in net acquisition costs in specialty reinsurance and other property reinsurance lines of business.

◦General and administrative expenses decreased to $58 million, representing 10.2 percentage points on the combined ratio, in the six months ended June 30, 2023, compared with $70 million, and 11.6 percentage points on the combined ratio, in the six months ended June 30, 2022. The decrease was largely driven by favorable year over year foreign exchange rates, coupled with various cost saving initiatives.

Investment performance

•Investment income of $129 million for the six months ended June 30, 2023, compared with $89 million for the six months ended June 30, 2022, an increase of 46%, as a result of active repositioning of our investments to take advantage of higher interest rates, with limited increase in investment risk.

•Net realized and unrealized investment gains of $18 million in the six months ended June 30, 2023, includes unrealized gains of $16 million. This compares to $126 million net realized and unrealized investment losses in the six months ended June 30, 2022, which includes net unrealized losses of $81 million. In addition, $11 million of unrealized investment gains after tax were recognized through other comprehensive income in the six months ended June 30, 2023, compared to $287 million unrealized investment losses after tax in the six months ended June 30, 2022. The change in net realized and unrealized investment gains and losses is a

result of mark to market valuations, predominantly driven by credit spread reduction in our government, corporate bond and structured credit portfolio and lower allocations to rate sensitive asset classes.

•The total return, after tax, on Aspen’s managed investment portfolio was 2.2% for the six months ended June 30, 2023, compared to (4.5)% in the six months ended June 30, 2022, and reflects net investment income and net realized and unrealized gains and losses mainly in the fixed income portfolio.

•Aspen’s investment portfolio as at June 30, 2023, consisted primarily of high quality fixed income securities with an average credit rating of “AA-”. The average duration of the fixed income securities was 2.7 years as at June 30, 2023 compared with 3.0 years as at December 31, 2022.

•Book yield on these fixed income securities as at June 30, 2023, was 3.5% compared with 3.2% as at December 31, 2022.

Shareholders’ equity

•Total shareholders’ equity was $2,549 million as at June 30, 2023, an increase of $191 million, compared with $2,358 million as at December 31, 2022. This is primarily due to an increase in net income of $219 million during the six months ended June 30, 2023, partially offset by ordinary and preference dividends totalling $42 million.

•Annualized operating return on average equity of 22% in the six months ended June 30, 2023, compared to 14% in the six months ended June 30, 2022.

Earnings materials

The earnings press release for the six months ended June 30, 2023 will be published on Aspen’s website at www.aspen.co.

For further information please contact

Marc MacGillivray, Chief Accounting Officer

Marc.MacGillivray@Aspen.co

+44 20 7184 8455

Aspen Insurance Holdings Limited

Summary condensed consolidated balance sheet (unaudited)

$ in millions

| | | | | | | | | | | | | | |

| As at June 30, 2023 | | As at December 31, 2022 |

| | | |

| ASSETS | | | |

| Total investments | $ | 6,272.2 | | | $ | 6,085.8 | |

| Cash and cash equivalents | 1,061.5 | | | 959.2 | |

| Reinsurance recoverables | 5,495.3 | | | 5,635.0 | |

| Premiums receivable | 1,676.8 | | | 1,482.4 | |

| Other assets | 887.3 | | | 994.9 | |

| Total assets | $ | 15,393.1 | | | $ | 15,157.3 | |

| | | |

| LIABILITIES | | | |

| Losses and loss adjustment expenses | $ | 7,740.9 | | | $ | 7,710.9 | |

| Unearned premiums | 2,623.5 | | | 2,457.5 | |

| Other payables | 2,180.1 | | | 2,331.0 | |

| Short-term debt | 299.9 | | | 299.9 | |

| Total liabilities | $ | 12,844.4 | | | $ | 12,799.3 | |

| | | |

| SHAREHOLDERS’ EQUITY | | | |

Total shareholders’ equity (1) | 2,548.7 | | | 2,358.0 | |

| Total liabilities and shareholders’ equity | $ | 15,393.1 | | | $ | 15,157.3 | |

(1) Total shareholders’ equity includes preference shares with a total value as measured by their liquidation preferences of $775 million less issue expenses of $21.5 million as at both current and comparative periods shown above.

Aspen Insurance Holdings Limited

Summary consolidated statement of income (unaudited)

$ in millions, except ratios

| | | | | | | | | | | | | | |

| Six Months Ended June 30, |

| 2023 | | 2022 |

| UNDERWRITING REVENUES | | | |

| Gross written premiums | $ | 2,125.2 | | | $ | 2,351.3 | |

| Premiums ceded | (774.7) | | | (845.2) | |

| Net written premiums | 1,350.5 | | | 1,506.1 | |

| Change in unearned premiums | (63.1) | | | (178.9) | |

| Net earned premiums | 1,287.4 | | | 1,327.2 | |

| UNDERWRITING EXPENSES | | | |

| Losses and loss adjustment expenses | 717.1 | | | 767.7 | |

| Acquisition costs | 192.9 | | | 216.5 | |

| General and administrative expenses | 169.0 | | | 186.5 | |

| Total underwriting expenses | 1,079.0 | | | 1,170.7 | |

| | | |

| Underwriting income | 208.4 | | | 156.5 | |

| | | |

| Net investment income | 129.4 | | | 88.7 | |

Interest expense (1) | (42.9) | | | (9.1) | |

Corporate and other operating expenses (2) | (53.1) | | | (43.3) | |

| | | |

| | | |

| | | | |

Non-operating expenses (3) | (10.6) | | | (3.6) | |

Net realized and unrealized foreign exchange gains/(losses) (4) | 5.9 | | | (9.7) | |

| Net realized and unrealized investment gains/(losses) | 18.0 | | | (126.4) | |

| INCOME BEFORE TAX | 255.1 | | | 53.1 | |

| Income tax expense | (36.2) | | | (4.7) | |

| NET INCOME | 218.9 | | | 48.4 | |

| Dividends paid on preference shares | (22.2) | | | (22.2) | |

| Net income attributable to ordinary shareholders | $ | 196.7 | | | $ | 26.2 | |

| | | |

| Loss ratio | 55.7 | % | | 57.8 | % |

| Acquisition cost ratio | 15.0 | % | | 16.3 | % |

| General and administrative expense ratio | 13.1 | % | | 14.1 | % |

| Expense ratio | 28.1 | % | | 30.4 | % |

| Combined ratio | 83.8 | % | | 88.2 | % |

Adjusted combined ratio (5) | 84.8 | % | | 90.2 | % |

(1) Interest expense includes interest on deferred premium payments on funds withheld balances related to the LPT contract.

(2) Corporate and other operating expenses includes other income/expenses, which were previously presented separately.

(3) Non-operating expenses in the six months ended June 30, 2023 includes expenses in relation to consulting fees, non-recurring transformation activities, and other non-recurring costs.

(4) Includes the net realized and unrealized gains/(losses) from foreign exchange contracts.

(5) Adjusted combined ratio removes the impact of the change in deferred gain on retroactive reinsurance contracts in order to match the loss recoveries under the LPT contract with the underlying loss development of the subject business of 2019 and prior accident years. Adjusted combined ratio represents the performance of our business for accident years 2020 onwards, which we believe better reflects the underlying underwriting performance of the ongoing portfolio.

Aspen Insurance Holdings Limited

Summary consolidated segment information (unaudited)

$ in millions, except ratios

| | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2023 | | |

| Reinsurance | | Insurance | | Total | | | | |

| | | | | | | | | |

Gross written premiums | $ | 875.7 | | | $ | 1,249.5 | | | $ | 2,125.2 | | | | | |

Net written premiums | 605.0 | | | 745.5 | | | 1,350.5 | | | | | |

Gross earned premiums | 755.7 | | | 1,203.6 | | | 1,959.3 | | | | | |

Net earned premiums | 572.0 | | | 715.4 | | | 1,287.4 | | | | | |

Losses and loss adjustment expenses | 297.2 | | | 419.9 | | | 717.1 | | | | | |

Acquisition costs | 105.7 | | | 87.2 | | | 192.9 | | | | | |

General and administrative expenses | 58.4 | | | 110.6 | | | 169.0 | | | | | |

Underwriting income | $ | 110.7 | | | $ | 97.7 | | | $ | 208.4 | | | | | |

| | | | | | | | | |

| Net investment income | | | | | 129.4 | | | | | |

| Net realized and unrealized investment gains | | 18.0 | | | | | |

Corporate and other operating expenses (1) | | | | | (53.1) | | | | | |

Non-operating expenses (2) | | | | (10.6) | | | | | |

| | | | | | | | | |

Interest expense (3) | | | | | (42.9) | | | | | |

Net realized and unrealized foreign exchange gains (4) | | 5.9 | | | | | |

Income before tax | | | | | $ | 255.1 | | | | | |

| Income tax expense | | | | | (36.2) | | | | | |

Net income | | | | | $ | 218.9 | | | | | |

Ratios | | | | | | | | | |

Loss ratio | 52.0 | % | | 58.7 | % | | 55.7 | % | | | | |

| Acquisition cost ratio | 18.5 | % | | 12.2 | % | | 15.0 | % | | | | |

| General and administrative expense ratio | 10.2 | % | | 15.5 | % | | 13.1 | % | | | | |

Expense ratio | 28.7 | % | | 27.7 | % | | 28.1 | % | | | | |

Combined ratio | 80.7 | % | | 86.4 | % | | 83.8 | % | | | | |

Adjusted combined ratio (5) | 80.5 | % | | 88.2 | % | | 84.8 | % | | | | |

(1) Corporate and other operating expenses includes other income/expenses, which were previously presented separately.

(2) Non-operating expenses in the six months ended June 30, 2023 includes expenses in relation to consulting fees, non-recurring transformation activities, and other non-recurring costs.

(3) Interest expense includes interest on deferred premium payments for the LPT contract.

(4) Includes the net realized and unrealized gains/(losses) from foreign exchange contracts.

(5) Adjusted combined ratio removes the impact of the change in deferred gain on retroactive reinsurance contracts in order to match the loss recoveries under the LPT contracts with the underlying loss development of the subject business of 2019 and prior accident years. Adjusted combined ratio represents the performance of our business for accident years 2020 onwards, which we believe better reflects the underlying underwriting performance of the ongoing portfolio.

Aspen Insurance Holdings Limited

Summary consolidated segment information (unaudited)

$ in millions, except ratios

| | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2022 | | |

| Reinsurance | | Insurance | | Total | | | | |

| | | | | | | | | |

Gross written premiums | $ | 1,045.6 | | | $ | 1,305.7 | | | $ | 2,351.3 | | | | | |

Net written premiums | 783.7 | | | 722.4 | | | 1,506.1 | | | | | |

Gross earned premiums | 776.9 | | | 1,171.5 | | | 1,948.4 | | | | | |

Net earned premiums | 600.8 | | | 726.4 | | | 1,327.2 | | | | | |

Losses and loss adjustment expenses | 369.0 | | | 398.7 | | | 767.7 | | | | | |

Acquisition costs | 124.1 | | | 92.4 | | | 216.5 | | | | | |

General and administrative expenses | 69.7 | | | 116.8 | | | 186.5 | | | | | |

Underwriting income | $ | 38.0 | | | $ | 118.5 | | | $ | 156.5 | | | | | |

| | | | | | | | | |

| Net investment income | | | | | 88.7 | | | | | |

| Net realized and unrealized investment losses | | (126.4) | | | | | |

Corporate and other operating expenses (1) | | | | | (43.3) | | | | | |

Non-operating expenses (2) | | | | (3.6) | | | | | |

| | | | | | | | | |

Interest expense (3) | | | | | (9.1) | | | | | |

Net realized and unrealized foreign exchange losses (4) | | (9.7) | | | | | |

Income before tax | | | | | $ | 53.1 | | | | | |

| Income tax expense | | | | | (4.7) | | | | | |

Net income | | | | | $ | 48.4 | | | | | |

Ratios | | | | | | | | | |

Loss ratio | 61.4 | % | | 54.9 | % | | 57.8 | % | | | | |

| Acquisition cost ratio | 20.7 | % | | 12.7 | % | | 16.3 | % | | | | |

| General and administrative expense ratio | 11.6 | % | | 16.1 | % | | 14.1 | % | | | | |

Expense ratio | 32.3 | % | | 28.8 | % | | 30.4 | % | | | | |

Combined ratio | 93.7 | % | | 83.7 | % | | 88.2 | % | | | | |

Adjusted combined ratio (5) | 95.9 | % | | 85.4 | % | | 90.2 | % | | | | |

(1) Corporate and other operating expenses includes other income/expenses, which were previously presented separately.

(2) Non-operating expenses in the six months ended June 30, 2022 includes expenses in relation to amortization of intangible assets and other non-recurring costs.

(3) Interest expense includes interest on deferred premium payments for the LPT contract.

(4) Includes the net realized and unrealized gains/(losses) from foreign exchange contracts.

(5) Adjusted combined ratio removes the impact of the change in deferred gain on retroactive reinsurance contracts in order to match the loss recoveries under the LPT contracts with the underlying loss development of the subject business of 2019 and prior accident years. Adjusted combined ratio represents the performance of our business for accident years 2020 onwards, which we believe better reflects the underlying underwriting performance of the ongoing portfolio.

About Aspen Insurance Holdings Limited

Aspen provides insurance and reinsurance coverage to clients in various domestic and global markets through wholly-owned operating subsidiaries in Bermuda, the United States and the United Kingdom, as well as its branch operations in Canada, Singapore and Switzerland. For the year ended December 31, 2022, Aspen reported $15.2 billion in total assets, $7.7 billion in gross reserves, $2.4 billion in total shareholders’ equity and $4.3 billion in gross written premiums. Aspen's operating subsidiaries have been assigned a rating of “A-” by Standard & Poor’s Financial Services LLC and an “A” (“Excellent”) by A.M. Best Company Inc. For more information about Aspen, please visit www.aspen.co.

Please refer to the “Financials – Annual Reports” section of Aspen’s investor website for a copy of our Annual Report on Form 20-F.

(1) Cautionary Statement Regarding Forward-Looking Statements

This press release or any other written or oral statements made by or on behalf of the Company may contain written “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are made pursuant to the “safe harbor” provisions of The Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts. In particular, statements using the words such as “expect,” “intend,” “plan,” “believe,” “aim,” “project,” “anticipate,” “seek,” “will,” “likely,” “assume,” “estimate,” “may,” “continue,” “guidance,” “objective,” “outlook,” “trends,” “future,” “could,” “would,” “should,” “target,” “predict,” “potential,” “on track” or their negatives or variations and similar terminology and words of similar import generally involve forward-looking statements.

All forward-looking statements rely on a number of assumptions, estimates and data concerning future results and events and that are subject to a number of uncertainties, assumptions and other factors, many of which are outside Aspen’s control that could cause actual results to differ materially from such forward-looking statements. Accordingly, there are important factors that could cause our actual results to differ materially from those anticipated in the forward-looking statements, including, but not limited to, our exposure to weather-related natural disasters and other catastrophes, the direct and indirect impact of global climate change, our relationship with, and reliance upon, a limited number of brokers for both our insurance and reinsurance business, the impact of inflation, our exposure to credit, currency, interest and others risks within our investment portfolio, the cyclical nature of the insurance and reinsurance industry and many other factors. For a detailed description of these uncertainties and other factors that could impact the forward-looking statements in this press release and other communications issued by or on behalf of Aspen, please see the “Risk Factors” section in Aspen’s Annual Report on Form 20-F for the twelve months ended December 31, 2022, as filed with the SEC, which should be deemed incorporated herein.

The inclusion of forward-looking statements in this press release or any other communication should not be considered as a representation by Aspen that current plans or expectations will be achieved. Aspen undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Basis of Preparation

Aspen has prepared the financial information contained within this financial results press release in accordance with the principles of U.S. Generally Accepted Accounting Principles (“GAAP”).

Non-GAAP Financial Measures

In presenting Aspen’s results, management has included and discussed certain measurements that are considered “non-GAAP financial measures” under SEC rules and regulations. Management believes that these non-GAAP financial measures, which may be defined differently by other companies, help explain and enhance the understanding of Aspen’s results of operations. However, these measures should not be viewed as a substitute for those determined in accordance with GAAP.

Operating income is a non-GAAP financial measure. Operating income is an internal performance measure used by Aspen in the management of its operations and represents after-tax operating results. Operating income includes an adjustment for the change in deferred gain on retroactive reinsurance contracts in order to

economically match the loss recoveries under the loss portfolio transfer (“LPT”) contracts with the underlying loss development of the assumed net loss reserves for the subject business of 2019 and prior accident years. Operating income also excludes certain costs related to the LPT contract with Enstar that closed in the second quarter of 2022, net foreign exchange gains or losses, including net realized and unrealized gains and losses from foreign exchange contracts, net realized gains or losses on investments and non-operating expenses and income.

Aspen excludes the items above from its calculation of operating income because they are not reflective of underlying performance or the amount of these gains or losses is heavily influenced by, and fluctuates according to prevailing investment market and interest rate movements. Aspen believes these amounts are either largely independent of its business and underwriting process, not aligned with the economics of transactions undertaken, or including them, would distort the analysis of trends in its operations. In addition to presenting net income determined in accordance with GAAP, Aspen believes that showing operating income enables users of its financial information to more easily analyze Aspen’s results of operations in a manner similar to how management analyzes Aspen’s underlying business performance. Operating income should not be viewed as a substitute for GAAP net income.

| | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended |

| (in US$ millions) | | June 30, 2023 | | June 30, 2022 |

| | | | |

| | | | |

| | | | |

| | | | |

| Net income attributable to ordinary shareholders | | 196.7 | | | 26.2 | |

| Add (deduct) items before tax | | | | |

| Net foreign exchange (gains)/losses | | (5.9) | | | 9.7 | |

| Net realized and unrealized investment (gains)/losses | | (18.0) | | | 126.4 | |

| | | | | |

| Non-operating expenses | | 10.6 | | | 3.6 | |

| Change in deferred gain on retroactive reinsurance contracts, net of certain costs related to the LPT contract with Enstar | | 6.8 | | | (25.9) | |

| Tax expense/(benefit) related to non-operating income | | 0.9 | | | (10.0) | |

| Operating income | | $ | 191.1 | | | $ | 130.0 | |

Underwriting income or loss/gain or loss is a non-GAAP financial measure. Income or loss for each of the business segments is measured by underwriting income or loss. Underwriting income or loss is the excess of net earned premiums over the sum of losses and loss expenses, acquisition costs and general and administrative expenses. Underwriting income or loss provides a basis for management to evaluate the segment’s underwriting performance.

Adjusted underwriting income or loss is the underwriting profit or loss adjusted for the change in deferred gain on retroactive reinsurance contracts in order to economically match the loss recoveries under the loss portfolio transfer (“LPT”) contracts with the underlying loss development of the assumed net loss reserves for the subject business of 2019 and prior accident years. Adjusted underwriting income or loss also excludes certain costs related to the LPT contract with Enstar that closed in the second quarter of 2022. Adjusted underwriting income represents the performance of our business for accident years 2020 onwards, which we believe better reflects the underlying underwriting performance of the ongoing portfolio.

Book yield is a non-GAAP financial measure. Book yield is the interest rate earned, at the time of purchase of the fixed income instrument at market value, assuming the bond is held to maturity and all coupon and principal payments are made on schedule.

Loss ratio is a non-GAAP financial measure. Loss ratio is the sum of current year net losses, catastrophe losses and prior year reserve strengthening/(releases) together, loss and loss adjustment expenses, as a percentage of net earned premiums.

Combined ratio is the sum of the loss ratio and the expense ratio. The loss ratio is calculated by dividing losses and loss adjustment expenses by net earned premiums. The expense ratio is calculated by dividing the sum of acquisition costs and general and administrative expenses, by net earned premiums.

Adjusted Combined ratio is the sum of the adjusted loss ratio and the expense ratio. The adjusted loss ratio is calculated by dividing the adjusted losses and loss adjustment expenses by net earned premiums. The expense ratio is calculated by dividing the sum of acquisition costs and general and administrative expenses, by net earned premium.

| | | | | | | | | | | | | | | | | | | | |

| Adjusted Combined Ratio | | Six Months Ended June 30, 2023 |

| (in US$ millions except where stated) | | Reinsurance | | Insurance | | Total |

| | | | | | |

| Net earned premium | | $ | 572.0 | | | $ | 715.4 | | | $ | 1,287.4 | |

| | | | | | |

| Losses and loss adjustment expenses | | 297.2 | | | 419.9 | | | 717.1 | |

| Acquisition costs | | 105.7 | | | 87.2 | | | 192.9 | |

| General and administrative expenses | | 58.4 | | | 110.6 | | | 169.0 | |

| Underwriting expenses | | 461.3 | | | 617.7 | | | 1,079.0 | |

| | | | | | |

| Underwriting income | | 110.7 | | | 97.7 | | | 208.4 | |

| | | | | | |

| Combined ratio | | 80.7 | % | | 86.4 | % | | 83.8 | % |

| | | | | | |

| Adjustments to underwriting expenses | | | | | | |

| Add: change in deferred gain on retroactive contracts and exclude costs in relation to the LPT | | 0.8 | | | (13.2) | | | (12.4) | |

| Adjusted underwriting expenses | | 460.5 | | | 630.9 | | | 1,091.4 | |

| Adjusted underwriting income | | 111.5 | | | 84.5 | | | 196.0 | |

| Adjusted combined ratio | | 80.5 | % | | 88.2 | % | | 84.8 | % |

| | | | | | | | | | | | | | | | | | | | |

| Adjusted Combined Ratio | | Six Months Ended June 30, 2022 |

| (in US$ millions except where stated) | | Reinsurance | | Insurance | | Total |

| | | | | | |

| Net earned premium | | $ | 600.8 | | | $ | 726.4 | | | $ | 1,327.2 | |

| | | | | | |

| Losses and loss adjustment expenses | | 369.0 | | | 398.7 | | | 767.7 | |

| Acquisition costs | | 124.1 | | | 92.4 | | | 216.5 | |

| General and administrative expenses | | 69.7 | | | 116.8 | | | 186.5 | |

| Underwriting expenses | | 562.8 | | | 607.9 | | | 1,170.7 | |

| | | | | | |

| Underwriting income | | 38.0 | | | 118.5 | | | 156.5 | |

| | | | | | |

| Combined ratio | | 93.7 | % | | 83.7 | % | | 88.2 | % |

| | | | | | |

| Adjustments to underwriting expenses | | | | | | |

| Add: change in deferred gain on retroactive contracts and exclude costs in relation to the LPT | | (13.6) | | | (12.3) | | | (25.9) | |

| Adjusted underwriting expenses | | 576.4 | | | 620.2 | | | 1,196.6 | |

| Adjusted underwriting income | | 24.4 | | | 106.2 | | | 130.6 | |

| Adjusted combined ratio | | 95.9 | % | | 85.4 | % | | 90.2 | % |

Operating return on average equity is calculated by taking the operating income/(loss) after tax, less dividends paid on preference shares and divided by average equity attributable to ordinary shareholders.

| | | | | | | | | | | | | | |

| | | As at June 30, 2023 | | As at June 30, 2022 |

| | | ($ in millions) |

| Total shareholders’ equity | | $ | 2,548.7 | | | $ | 2,469.0 | |

| | | | |

| Preference shares less issue expenses | | (753.5) | | | (753.5) | |

| Average adjustment | | (76.1) | | | 141.9 | |

| Average equity | | $ | 1,719.1 | | | $ | 1,857.4 | |

| | | | |

| Operating Income | | $ | 191.1 | | | $ | 130.0 | |

| | | | |

| Annualized operating return on average equity | | 22.2 | % | | 14.0 | % |

Total return on Aspen’s managed investment portfolio is the cumulative of net investment income, net realized and unrealized investments losses in the trading and available for sale investment portfolio, divided by average total cash and investments, including receivables and payables for securities sold and purchased and accrued interest.

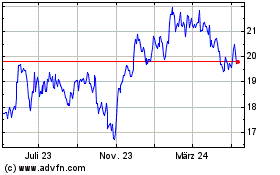

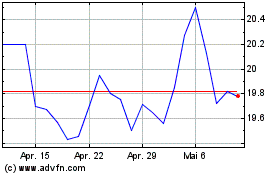

Aspen Insurance (NYSE:AHL-D)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Aspen Insurance (NYSE:AHL-D)

Historical Stock Chart

Von Feb 2024 bis Feb 2025