Filed Pursuant to Rule 424(b)(2)

File No. 333-270080

Supplement No. 1 dated August 10, 2023

to PROSPECTUS SUPPLEMENT Dated February 28, 2023

(To Prospectus dated February 28, 2023)

$300,000,000

Common Stock

6.75% Series A Cumulative Redeemable Perpetual

Preferred Stock (Liquidation Preference $25.00 Per Share)

This supplement, which we refer to as this supplement, relates to

and supplements certain information in the prospectus supplement, dated February 28, 2023, or the prospectus supplement,

relating to the issuance and sale of shares of our common stock, $0.01 par value per share, or our common stock, and our 6.75%

Series A Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share, or our Series A Preferred Stock,

offered by the prospectus supplement and the base prospectus (as defined below) pursuant to an “at-the-market” equity

offering program. We refer to the shares of our common stock and shares of our Series A Preferred Stock offered under the

prospectus supplement, collectively, as the “offered shares.” This supplement should be read in conjunction with the

prospectus supplement and the accompanying base prospectus, dated February 28, 2023, to which the prospectus supplement

relates, or the base prospectus. We refer to the base prospectus, as supplemented by the prospectus supplement and this supplement, as the prospectus. Defined terms used in this supplement and not defined herein have the respective meanings given to such terms in the

prospectus supplement. This supplement amends only those sections of the prospectus supplement contained in this supplement; all

other sections of the prospectus supplement remain unchanged except as otherwise set forth in this supplement.

This supplement is being filed to reflect Amendment No. 2 to

the sales agreement, dated August 10, 2023, among the Company, our operating partnership, Jefferies LLC, Barclays Capital Inc.,

Barclays Bank PLC, Robert W. Baird & Co. Incorporated, Regions Securities LLC and Stifel, Nicolaus &

Company, Incorporated, or Amendment No. 2, to include (i) Barclays Capital Inc. and Stifel, Nicolaus &

Company, Incorporated as additional agents and Forward Sellers, as the case may be, (ii) Barclays Bank PLC and Stifel,

Nicolaus & Company, Incorporated as additional Forward Purchasers and (iii) Robert W. Baird & Co.

Incorporated and Regions Securities LLC as additional Forward Purchasers and Forward Sellers, as the case may be. Each reference to

the term “sales agreement” in the prospectus supplement is hereby amended to refer to the sales agreement as so further

amended by Amendment No. 2. Each reference to the term “agents” in the prospectus supplement is hereby amended to

include Barclays Capital Inc. and Stifel, Nicolaus & Company, Incorporated (and each of them referred to individually,

an “agent”). Each reference to the term “the Forward Purchaser” in the prospectus supplement is hereby

amended to refer to “a Forward Purchaser,” “the applicable Forward Purchaser” or “the Forward

Purchasers,” as applicable, and to include Barclays Bank PLC, Robert W. Baird & Co. Incorporated, Regions

Securities LLC and Stifel, Nicolaus & Company, Incorporated (or an affiliate of any of them). Each reference to the term “the Forward

Seller” is hereby amended to refer to “a Forward Seller,” “the applicable Forward Seller” or

“the Forward Sellers,” as applicable, and to include Barclays Capital Inc., Robert W. Baird & Co. Incorporated,

Regions Securities LLC, and Stifel, Nicolaus & Company, Incorporated (or an affiliate of any of them).

The sales agreement contemplates that, in addition to the issuance

and sale by us of the offered shares to or through the agents, we may enter into one or more forward sale agreements with Jefferies LLC,

Barclays Bank PLC, Robert W. Baird & Co. Incorporated, Regions Securities LLC or Stifel, Nicolaus & Company, Incorporated

(or an affiliate of any of them). If we enter into a forward sale agreement with a Forward Purchaser relating to shares of our common

stock, such Forward Purchaser (or its affiliate) will attempt to borrow from third parties and sell, through Jefferies LLC, Barclays Capital

Inc., Robert W. Baird & Co. Incorporated, Regions Securities LLC or Stifel, Nicolaus & Company, Incorporated, as

applicable, acting as Forward Seller for such Forward Purchaser, a number of shares of our common stock underlying such forward sale agreement

to hedge such Forward Purchaser’s exposure under such forward sale agreement. We will not initially receive any proceeds from any

sale of borrowed shares of our common stock sold through a Forward Seller.

As of the date of this supplement, offered shares having an aggregate

gross sales price of up to approximately $205 million remain to be sold under the sales agreement.

Our common stock is listed on the NYSE under the symbol “AHH.”

Our Series A Preferred Stock is listed on the NYSE under the symbol “AHHPrA.”

Investing in shares of our common stock and our Series A Preferred

Stock involves substantial risks. See “Risk Factors” beginning on page S-8 of the prospectus supplement and the risks

set forth under the caption “Item 1A. Risk Factors” in our most recent Annual Report on Form 10-K, as well as additional

risks that may be described in future reports or information that we file with the Securities and Exchange Commission, or the SEC, including

our Quarterly Reports on Form 10-Q, which are incorporated by reference in this supplement, the prospectus supplement and the accompanying

prospectus.

Neither the SEC nor any state securities commission has

approved or disapproved of these securities or determined if this supplement, the prospectus supplement and the accompanying base

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Jefferies |

Baird |

Regions Securities

LLC |

The date of this supplement is August 10,

2023.

The following section of the prospectus supplement is hereby amended

and restated as follows:

PLAN OF DISTRIBUTION

We have entered into a sales agreement, as amended, with the agents

and the Forward Purchasers, relating to the issuance and sale of the offered shares. The offered shares sold in connection with the forward

sale agreements, if any, will include only shares of our common stock and will not include any shares of our Series A Preferred Stock.

In accordance with the terms of the sales agreement, offered shares having an aggregate gross sales price of up to $300 million, including

$95 million of offered shares previously sold under our expired registration statement on Form S-3 (File No. 333-236982), may

be offered and sold from time to time through the agents, as our sales agents or, if applicable, the Forward Sellers, or directly to the

agents, as principals. Sales of the offered shares under the prospectus may be made in transactions

that are deemed to be “at-the-market” offerings, as defined in Rule 415 of the Securities Act, including, without limitation,

sales made by means of ordinary brokers’ transactions on the NYSE, to or through a market maker at market prices prevailing at time

of sale, at prices relating to prevailing market prices or at negotiated prices.

The sales agreement contemplates that, in addition to the

issuance and sale by us of the offered shares to or through the agents, we may enter into one or more forward sale agreements with

any of the Forward Purchasers. If we enter into a forward sale agreement with a Forward Purchaser, such Forward Purchaser (or its

affiliate) will attempt to borrow from third parties and sell, through the applicable Forward Seller, acting as sales agent for such

Forward Purchaser, a number of shares of our common stock underlying such forward sale agreement to hedge such Forward

Purchaser’s exposure under such forward sale agreement. We will not initially receive any proceeds from any sale of borrowed

shares of our common stock sold through any of the Forward Sellers.

The expenses of this offering are estimated at approximately $200,000

and are payable by us.

In connection with the sale of the offered shares, the agents and the

Forward Purchasers may be deemed to be “underwriters” within the meaning of the Securities Act and the compensation of the

agents may be deemed to be underwriting commissions or discounts. We have agreed to indemnify the agents and the Forward Purchasers against

specified liabilities, including liabilities under the Securities Act, or to contribute to payments that the agents may be required to

make because of those liabilities.

Our common stock is an “actively-traded security” excepted

from the requirements of Rule 101 of Regulation M under the Exchange Act by Rule 101(c)(1) of Regulation M. If either we

or an agent has reason to believe that the exemptive provisions set forth in Rule 101(c)(1) of Regulation M are not satisfied,

that party will promptly notify the other and sales of our common stock under the sales agreement will be suspended until Rule 101(c)(1) or

other exemptive provisions have been satisfied in our and such agent’s judgment.

Sales of the offered shares as contemplated by the prospectus supplement, as supplemented by this supplement,

will be settled through the facilities of The Depository Trust Company or by such other means as we and the relevant agent may agree.

We will report at least quarterly the aggregate number of the

offered shares sold through the agents, as our sales agents, and/or through the Forward Sellers, the net proceeds to us from such

sales and the compensation paid by us to the agents and/or Forward Sellers in connection with such sales.

The offering of the offered shares pursuant to the sales agreement

will terminate upon the earlier of (1) the sale of the maximum aggregate amount of the offered shares subject to the sales

agreement and (2) the termination of the sales agreement by us or the agents and the Forward Purchasers (as to themselves) at any

time in each of our sole discretion.

Sales Through or To Our Sales Agents

From time to time during the term of the sales agreement, we may deliver

an issuance notice to one of the agents with the maximum amount of the offered shares to be sold and the minimum per share price below

which sales may not be made. Upon receipt of an issuance notice from us, and subject to the terms and conditions of the sales agreement

each agent agrees to use its commercially reasonable efforts consistent with its normal trading and sales practices and applicable law

and regulations to sell such shares of our common stock on such terms. Offers and sales, if any, will be made by only one agent on any

given day. We or an agent may suspend the offering of the offered shares at any time upon proper notice to the other, upon which the selling

period will immediately terminate. Settlement for sales of the offered shares will occur on the second business day following the date

on which any sales are made, unless we agree otherwise in writing with the applicable agent. The obligation of each agent under the sales

agreement to sell the offered shares pursuant to an issuance notice is subject to certain conditions, which such agent reserves the right

to waive in its sole discretion.

We may also sell some or all of the offered shares to an agent as principal

for its own account at a price agreed upon at the time of sale. If we sell the offered shares to an agent as principal, we will enter

into a separate terms agreement setting forth the terms of such transaction and we will describe such agreement in a separate prospectus

supplement or pricing supplement.

We will pay each agent commissions for its services in acting as our

sales agent and/or principal in the sale of the offered shares. Each agent will be entitled to compensation that will not exceed, but

may be lower than, 2.0% of the gross sales price of all the offered shares sold through it from time to time, as our sales agent, under

the applicable sales agreement.

Sales Through Forward Sellers

If we enter into a forward sale agreement with a Forward Purchaser,

such Forward Purchaser (or its affiliate) will attempt to borrow from third parties and sell, through the related agent, acting as sales

agent for such Forward Purchaser, a number of shares of our common stock underlying such forward sale agreement to hedge such Forward

Purchaser’s exposure under such forward sale agreement. The offered shares sold in connection with the forward sale agreements,

if any, will include only shares of our common stock and will not include any shares of our Series A Preferred Stock.

In connection with any forward sale agreement, we will deliver an instruction

to the applicable Forward Seller to sell such shares on behalf of the applicable Forward Purchaser. Upon its acceptance of such instruction,

such agents have agreed to use their commercially reasonable efforts consistent with their normal trading and sales practices to sell

such shares of our common stock, on the terms and subject to the conditions set forth in the sales agreement. We may instruct such Forward

Seller as to the amount of shares of our common stock to be sold and may also instruct such agent not to sell such shares of our common

stock if the sales cannot be effected at or above a price designated by us. We or the applicable agent may at any time immediately suspend

the offering of shares of our common stock through the applicable Forward Seller, upon notice to the other parties.

In connection with each forward sale agreement, we will pay the applicable

agent a commission, in the form of a reduction to the initial forward price payable under the related forward sale agreement, at a mutually

agreed rate that will not exceed, but may be less than, 2.0% of the volume weighted average sales price per share of all borrowed shares

of our common stock sold through the applicable Forward Seller, during the applicable forward selling period for such shares. We refer

to this commission as the “forward selling commission.”

We expect that settlement between the applicable Forward Purchaser

and the applicable Forward Seller, for sales of borrowed shares of our common stock, as well as settlement between such agent and buyers

of such shares in the market, will occur on the second business day (or such other date as may be agreed upon by the relevant parties)

following the respective dates on which any such sales are made in return for the payment of the net proceeds to the applicable Forward

Purchaser. There is no arrangement for funds to be received in escrow, trust or similar arrangement. The obligations of the Forward Sellers

under the sales agreement are subject to a number of conditions, which the Forward Sellers may waive in their sole discretion.

Pursuant to each forward sale agreement, if any, we will have the right

to issue and sell to the applicable Forward Purchaser a specified number of shares of our common stock on the terms and subject to the

conditions set forth therein, or, alternatively, elect cash settlement or net share settlement, as described below. The initial forward

price per share under each forward sale agreement will equal the product of (1) an amount equal to one minus the applicable

forward selling commission and (2) the volume weighted average price per share at which the borrowed shares of our common stock were

sold pursuant to the sales agreement through the applicable Forward Seller to hedge the applicable Forward Purchaser’s exposure

under such forward sale agreement.

Thereafter, the forward price will be subject to the price adjustment

provisions of the applicable forward sale agreement. We will not initially receive any proceeds from any sale of borrowed shares of our

common stock sold through any of the Forward Sellers.

We currently expect to fully physically settle each forward sale agreement

with the Forward Purchasers on one or more dates specified by us on or prior to the maturity date of such forward sale agreement, although,

as discussed below, we generally have the right, subject to certain exceptions, to elect cash settlement or net share settlement instead

of physical settlement for any of the shares of our common stock we have agreed to sell under such forward sale agreements. If we elect

to or are deemed to have elected to physically settle any forward sale agreement by delivering shares of our common stock, we will receive

an amount of cash from the applicable Forward Purchaser equal to the product of (1) the forward price per share, adjusted

in accordance with the forward price adjustment provisions of such forward sale agreement and (2) the number of shares of our common

stock underlying such forward sale agreement as to which we have elected or are deemed to have elected physical settlement, subject to

the price adjustment and other provisions of such forward sale agreement. Each forward sale agreement will provide that the forward price

will be subject to adjustment on a daily basis based on a floating interest rate factor equal to a specified daily rate less a spread.

In addition, the forward price will be subject to decrease on certain dates specified in the relevant forward sale agreement by the amount

per share of quarterly dividends we expect to declare on our shares of common stock during the term of such forward sale agreement. If

the specified daily rate is less than the applicable spread on any day, the interest rate factor will result in a daily reduction of the

forward price and if the specified daily rate is greater than the applicable spread on any day, the interest rate factor will result in

a daily increase of the forward price.

We expect that, before any issuance of shares of our common stock upon

physical settlement or net share settlement of any forward sale agreement, the shares issuable upon settlement of such forward sale agreement

will be reflected in our diluted earnings per share calculations using the treasury stock method. Under this method, the number of shares

of our common stock used in calculating diluted earnings per share will be deemed to be increased by the excess, if any, of the number

of shares that would be issued upon physical settlement of such forward sale agreement over the number of shares that could be purchased

by us in the market (based on the average market price during the relevant forward selling period specified in such forward sale agreement)

using the proceeds receivable upon settlement (based on the adjusted forward price at the end of the relevant reporting period). Consequently,

prior to physical or net share settlement of the forward sale agreement and subject to the occurrence of certain events, we anticipate

there will be no dilutive effect on our earnings per share except during periods when the average market price of our common stock is

above the per share adjusted forward price of such forward sale agreement, subject to increase or decrease based on the specified daily

rate less a spread, and subject to decrease by amounts related to expected dividends on our common shares during the term of that particular

forward sale agreement. However, if we decide to physically or net share settle any forward sale agreement, delivery of shares of our

common stock by us will result in dilution to our earnings per share, FFO per share and return on equity.

Except under the circumstances described below, we generally have the

right, in lieu of physical settlement of any forward sale agreement, to elect cash or net share settlement in respect of any of the shares

of our common stock underlying such forward sale agreement. If we elect cash or net share settlement of any part of any forward sale agreement,

we would expect the applicable Forward Purchaser or one of its affiliates to purchase shares of our common stock in secondary market transactions

over an unwind period to:

| § | return shares of our common stock to securities lenders to unwind such Forward Purchaser’s hedge (after taking into consideration

any shares of our common stock to be delivered by us to such Forward Purchaser, in the case of net share settlement); and, if applicable, |

| § | in the case of net share settlement, deliver shares of our common stock to us to the extent required upon settlement of such forward

sale agreement. |

If the price of shares of our common stock at which these purchases

by the applicable Forward Purchaser are made is below the relevant forward price, such Forward Purchaser will pay us such difference in

cash (if we cash settle) or deliver to us a number of shares of our common stock having a market value equal to such difference (if we

net share settle). If the price of our common stock at which these purchases are made exceeds the applicable forward price, we will pay

the applicable Forward Purchaser an amount in cash equal to such difference (if we elect to cash settle) or we will deliver to such Forward

Purchaser a number of shares of our common stock having a market value equal to such difference (if we elect to net share settle). Any

such difference could be significant and could result in our receipt of a significant amount of cash or number of shares of our common

stock from the applicable Forward Purchaser, or require us to pay a significant amount of cash or deliver a significant number of shares

of our common stock to the applicable Forward Purchaser.

In addition, the purchase of shares of our common stock by the applicable

Forward Purchaser or its affiliate to unwind such Forward Purchaser’s hedge position could cause the price of our common stock to

increase above the price that would have prevailed in the absence of those purchases, thereby increasing the amount of cash (in the case

of cash settlement) or the number of shares (in the case of net share settlement) that we would owe such Forward Purchaser upon settlement

of the applicable forward sale agreement or decrease the amount of cash (in the case of cash settlement) or the number of shares (in the

case of net share settlement) that such Forward Purchaser would owe us upon settlement of the applicable forward sale agreement.

A Forward Purchaser will have the right to accelerate its forward sale

agreement (with respect to all or, in certain cases, the portion of the transaction under such forward sale agreement that such Forward

Purchaser determines is affected by an event described below) and to require us to settle on a date specified by such Forward Purchaser

if:

| § | it or its affiliate (a) is unable to hedge its exposure under such forward sale agreement in a commercially reasonable manner

because insufficient shares of our common stock have been made available for borrowing by securities lenders or (b) would incur a

stock loan fee to borrow shares of common stock in excess of a threshold specified in the forward sale agreement; |

| § | we declare any dividend, issue or distribution on shares of our common stock that is payable in (a) cash that exceeds specified

amounts (unless it is an extraordinary dividend), (b) securities of another company that we acquire or own (directly or indirectly)

as a result of a spin-off or similar transaction, or (c) any other type of securities (other than on shares of our common stock),

rights, warrants or other assets for payment at less than the prevailing market price; |

| § | certain equity ownership thresholds applicable to such Forward Purchaser and its affiliates are or would be exceeded; |

| § | an event (a) is announced that if consummated would result in a specified extraordinary event (including certain mergers or tender

offers, as well as certain events involving our nationalization, our insolvency or a delisting of our common stock) or (b) occurs

that would constitute a delisting of our common stock or change in law; or |

| § | certain other events of default, termination events or other specified events occur, including, among others, any material misrepresentation

made in connection with the particular forward sale agreement (each as more fully described in the particular forward sale agreement). |

A Forward Purchaser’s decision to exercise its right to accelerate

any forward sale agreement and to require us to physically settle any such forward sale agreement will be made irrespective of our interests,

including our need for capital. In such cases, we could be required to issue and deliver shares of our common stock under the terms of

the physical settlement provisions of the applicable forward sale agreement irrespective of our capital needs, which would result in dilution

to our earnings per share, FFO per share and return on equity.

In addition, upon certain events of bankruptcy or insolvency relating

to us, the forward sale agreements will terminate without further liability of the parties thereto. Following any such termination, we

would not issue any shares of our common stock pursuant to such forward sale agreement agreements, and we would not receive any proceeds

pursuant to the forward sale agreements.

Other Activities and Relationships

Affiliates of Regions Securities LLC (an agent, a Forward Purchaser

and a Forward Seller in this offering) act as a syndicate agent and a joint lead arranger under our credit facility. As described above,

our operating partnership may use a portion of the net proceeds from this offering to repay outstanding indebtedness, including amounts

outstanding under our credit facility. As a result, the affiliate serving as a syndicate agent and/or lender will receive its proportionate

share of any amount of our credit facility that is repaid with the net proceeds from this offering. If any other affiliates of the agents,

Forward Purchasers or Forward Sellers become a lender under our credit facility or otherwise lend money to the Company, such affiliates

would be entitled to their proportionate share of any amount of our credit facility or other debt that is repaid with the net proceeds

from this offering.

The sales agents, Forward Sellers, Forward Purchasers and their respective

affiliates are full service financial institutions engaged in various activities, which may include sales and trading, commercial and

investment banking, advisory, investment management, investment research, principal investment, hedging, market making, brokerage and

other financial and nonfinancial activities and services for which they have received customary fees and reimbursement of expenses. The

sales agents, Forward Sellers, Forward Purchasers and their respective affiliates may, from time to time, engage in transactions with

and perform services for us in the ordinary course of their business, including with respect to commercial real estate transactions, for

which they may receive customary fees and reimbursement of expenses.

In addition, in the ordinary course of their business activities, the

sales agents, Forward Sellers, Forward Purchasers and their respective affiliates may make or hold a broad array of investments and actively

trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account

and for the accounts of their customers. Such investments and securities activities may involve securities and/or instruments of ours

or our affiliates. The sales agents, Forward Sellers, Forward Purchasers and their respective affiliates may also make investment recommendations

and/or publish or express independent research views in respect of such securities or financial instruments and may hold, or recommend

to clients that they acquire, long and/or short positions in such securities and instruments.

If we enter into a forward sale agreement with a Forward Purchaser,

such a Forward Purchaser (or its affiliate) will attempt to borrow from third parties and sell, through the applicable Forward Seller,

acting as sales agent for such Forward Purchaser, a number of shares of our common stock underlying such forward sale agreement to hedge

such Forward Purchaser’s exposure under such forward sale agreement. All of the net proceeds from the sale of any such borrowed

shares will be paid to the applicable Forward Purchaser (or one or more of its affiliates). Such entity will be either an agent or its

affiliate. As a result, an agent or one of its affiliates will receive the net proceeds from any sale of borrowed shares of our common

stock made in connection with any forward sale agreement.

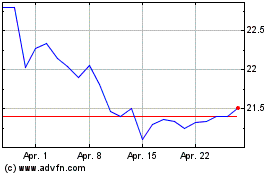

Armada Hoffler Properties (NYSE:AHH-A)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

Armada Hoffler Properties (NYSE:AHH-A)

Historical Stock Chart

Von Mär 2024 bis Mär 2025