Current Report Filing (8-k)

04 September 2019 - 3:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

September 4, 2019, (August 30, 2019)

Date of Report (Date of earliest event reported)

PLAYAGS, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

001-38357

|

46-3698600

|

|

(State of

Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification Number)

|

5475 S. Decatur Blvd., Suite #100

Las Vegas, Nevada 89118

(Address of principal executive offices) (Zip Code)

(702) 722-6700

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock, $0.01 par value

|

|

AGS

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 1.01 Entry into Material Definitive Agreement.

On August 30, 2019 (the “Closing Date”), AP Gaming I, LLC (the “Borrower”), a Delaware limited liability company and wholly owned indirect subsidiary of PlayAGS, Inc. (the “Company”), as borrower, and AP Gaming Holdings, LLC, a Delaware limited liability company and wholly owned indirect subsidiary of the Company (“Holdings”), as holdings, entered into an Amendment Agreement No. 3 (the “Repricing Amendment”) to that certain First Lien Credit Agreement, dated as of June 6, 2017, as amended on December 6, 2017, as amended and restated on February 7, 2018, as amended and restated on October 5, 2018 and as further amended, restated, supplemented, waived or otherwise modified from time to time prior to the date hereof (the “Credit Agreement”), among the Borrower, Holdings, the lenders party thereto from time to time and Jefferies Finance LLC, as administrative agent.

The Repricing Amendment reduced the interest rate margin applicable to the revolving credit facility under the Credit Agreement by 200 basis points, from LIBOR plus 550 basis points to LIBOR plus 350 basis points. The Repricing Amendment also provides that the interest rate margin applicable to the revolving credit facility will be further reduced by an additional 25 basis points if at any time the Company receives a corporate credit rating of at least B1 from Moody’s. As a result, following the Repricing Amendment, the revolving credit facility has the same interest rate margin with the term loans issued under the Credit Agreement.

Other than as described above, the revolving credit facility continues to have the same terms as provided under the Credit Agreement. Additionally, the parties to the Repricing Amendment continue to have the same obligations set forth in the Credit Agreement. Other than as described above, the provisions of the revolving credit facility and the obligations under the Credit Agreement are described in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Indebtedness – First Lien Credit Facilities” in the Company’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission on March 5, 2019, which description is hereby incorporated by reference into this Form 8-K.

The foregoing description of the Repricing Amendment does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Repricing Amendment, a copy of which is filed as Exhibit 10.1 hereto.

Item 7.01 Regulation FD Disclosure

On September 4, 2019, the Company issued a press release announcing the consummation of the Repricing Amendment, a copy of which is filed as Exhibit 99.1 hereto and incorporated by reference herein.

The information in this Item 7.01, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Item 7.01, including Exhibit 99.1 hereto, shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

The information in this Current Report on Form 8-K contains forward-looking statements based on management’s current expectations and projections, which are intended to qualify for the safe harbor of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding the public offering and other statements identified by words such as “believe,” “will,” “may,” “might,” “likely,” “expect,” “anticipates,” “intends,” “plans,” “seeks,” “estimates,” “believes,” “continues,” “projects” and similar references to future periods, or by the inclusion of forecasts or projections. All forward-looking statements are based on current expectations and projections of future events. These forward-looking statements reflect the current views, models, and assumptions of the Company, and are subject to various risks and uncertainties that cannot be predicted or qualified and could cause actual results in the Company’s performance to differ materially from those expressed or implied by such forward looking statements. These risks and uncertainties include, but are not limited to, the ability of the Company to maintain strategic alliances, unit placements or installations, grow revenue, garner new market share, secure new licenses in new jurisdictions, successfully develop or place proprietary product, comply with regulations, have its games approved by relevant jurisdictions and other factors set forth under “Item 1A. Risk Factors” in the Company’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission on March 5, 2019. All forward-looking statements made herein are expressly qualified in their entirety by these cautionary statements and there can be no assurance that the actual results, events or developments referenced herein will occur or be realized. Readers are cautioned that all forward-looking statements speak only to the facts and circumstances present as of the date of this Current Report on Form 8-K. The Company expressly disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

Exhibit No.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

PLAYAGS, INC.

|

|

|

|

|

|

Date: September 4, 2019

|

|

By: /s/ Kimo Akiona

|

|

|

|

Name: Kimo Akiona

Title: Chief Financial Officer,

Chief Accounting Officer and

Treasurer

(Principal Financial and Accounting

Officer)

|

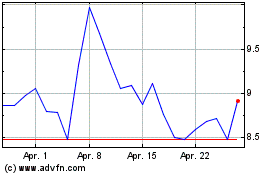

PlayAGS (NYSE:AGS)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

PlayAGS (NYSE:AGS)

Historical Stock Chart

Von Jul 2023 bis Jul 2024