Judge Says Creditors Can Vote On TerreStar Bankruptcy Plan

22 Dezember 2010 - 7:11PM

Dow Jones News

A federal judge on Wednesday said creditors can vote on

TerreStar Networks Inc.'s bankruptcy plan, after the satellite

phone company and objecting creditors settled key disputes in the

case.

Judge Sean H. Lane of U.S. Bankruptcy Court in Manhattan

approved the company's disclosure statement, or plain-language

reading of a bankruptcy plan on which creditors must vote. Major

debtholders, including Philip Falcone's Harbinger Capital Partners

hedge-fund firm, had objected to both the speed of the case and

what they called favorable terms to would-be parent EchoStar Corp.

(SATS).

"All of these seem like excellent developments," Lane said in

approving both the disclosure statement and a plan between

TerreStar and EchoStar in which EchoStar would backstop a $125

million rights offering that would fund TerreStar's bankruptcy

exit.

An ad-hoc group that holds about $335 million in senior debt had

presented a competing backstop plan with lower fees and a

commitment to backstop the entire $125 million rights offering,

rather than the $100 million in the EchoStar plan. As part of the

settlement, EchoStar will now up its commitment to backstop the

entire $125 million.

"It has been a very productive 36 hours," Patrick J. Nash, Jr.,

of Kirkland & Ellis LLP, a lawyer for the ad-hoc creditors,

said of the settlement.

TerreStar is exploring a sale of the company concurrent with its

bankruptcy process, and creditors were worried that the fast pace

of the case would thwart any possible sale, which may fetch more

than the $1.215 billion value TerreStar's bankruptcy places on the

company. Part of the settlement is that the company will take more

time before asking the court to confirm the plan, pushing back any

hearing on confirmation to early March.

The Wall Street Journal reported that MetroPCS Communications

Inc. (PCS) is one of the parties interested in TerreStar's assets.

At Monday's contentious hearing, TerreStar lawyer Arik Preis of

Akin Gump Strauss Hauer & Feld confirmed the company is talking

to bidders. Just before adjourning that hearing, which was over the

EchoStar backstop agreement, Lane called the two sides into his

chambers and apparently urged the two sides to negotiate.

A lawyer for Sprint Nextel Corp. (S) still objected to the

disclosure statement over the timing of the case, saying the

company didn't think it left Sprint enough time to litigate claims

it has against TerreStar. Lane overruled that objection.

Reston, Va.-based TerreStar, which is trying to build the first

satellite smartphone, filed for Chapter 11 in Manhattan in October

with a plan calling for secured noteholders like EchoStar to swap

more than $850 million in debt for nearly all the equity in a

reorganized TerreStar. More junior creditors, however, will get

just pennies on the dollar and existing equity holders are set to

get nothing.

TerreStar launched its first satellite in July of last year and

is still planning to build a second. To fund the second satellite,

the telecommunications company tapped a $100 million credit line

from Harbinger and EchoStar.

Harbinger and EchoStar are also among the largest holders of

TerreStar's publicly traded parent company, which didn't file for

Chapter 11 protection.

(Dow Jones Daily Bankruptcy Review covers news about distressed

companies and those under bankruptcy protection.)

-By Joseph Checkler; Dow Jones Newswires; 212-416-2152;

joseph.checkler@dowjones.com

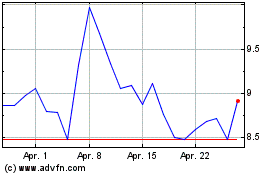

PlayAGS (NYSE:AGS)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

PlayAGS (NYSE:AGS)

Historical Stock Chart

Von Jul 2023 bis Jul 2024