UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

under

the Securities Exchange Act of 1934

September

01, 2023

Commission

File Number: 001-37968

YATRA

ONLINE, INC.

Gulf

Adiba, Plot No. 272,

4th

Floor, Udyog Vihar, Phase-II,

Sector-20,

Gurugram-122008, Haryana

India

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Amendment to Material Agreements

Amendment to MAK Cooperation Agreement

On August 29, 2023, Yatra

Online, Inc. (the “Company,” “we” or “our”) entered into the First Amendment to the Cooperation Agreement

(“First Amendment to MAK Cooperation Agreement”) amending that certain Cooperation Agreement dated July

17, 2022 with MAK Capital One L.L.C. and MAK CAPITAL FUND LP (as amended, the “MAK Cooperation Agreement”). Pursuant to the

First Amendment to MAK Cooperation Agreement, Mr. Michael A. Kaufman will be nominated to serve as a Class I director of the Board of

Directors, for a term of office that expires at the 2026 Annual General Meeting of Shareholders. If at any time during the term of the

MAK Cooperation Agreement or any time during the tenure of Investor Group Designee’s (as defined in the MAK Cooperation Agreement)

directorship commencing from his appointment at the 2023 Annual General Meeting of Shareholders, whichever is longer, the MAK Investor

Group’s (as defined in the MAK Cooperation Agreement) Net Long Position (as defined in the MAK Cooperation Agreement) falls below

the lesser of 10.0% of the Company’s then outstanding Ordinary Shares and 6,085,150 Ordinary Shares, the Investor Group Designee

is obligated to immediately tender his resignation from the Board of Directors. In addition, the First Amendment to MAK Cooperation Agreement

extends the Standstill Period (as defined in the MAK Cooperation Agreement) to the period commencing on August 29, 2023 and ending on

the date that is the earlier to occur of (i) 30 calendar days prior to the date of the 2024 Annual General Meeting of Shareholders

or (ii) 60 calendar days following the resignation of the Investor Group Designee.

Amendment

to Maguire Cooperation Agreement

On August 29, 2023, the Company entered into

the First Amendment to the Cooperation Agreement (“First Amendment to Maguire Cooperation Agreement”) amending

that certain Cooperation Agreement dated January 17, 2022 with The 2020 Timothy J. Maguire Investment Trust (as amended,

the “Maguire Cooperation Agreement”). Pursuant to the First Amendment to Maguire Cooperation Agreement, Mr. Roshan

Mendis will be nominated to serve as a Class I director of the Board of Directors, for a term of office that expires at the

2026 Annual General Meeting of Shareholders. After a period of one year from the date of execution of the First Amendment

to Maguire Cooperation Agreement, either of the parties thereto may terminate the agreement by giving a 90 days prior written notice

to the other party. If the Maguire Cooperation Agreement is so terminated, Mr. Mendis is obligated to immediately tender his resignation

from the Board of Directors. In addition, the First Amendment to Maguire Cooperation Agreement extends the Standstill Period (as defined

in the Maguire Cooperation Agreement) to the period commencing on August 29, 2023 and ending on the date that is the earlier to occur

of (i) the date of the 2026 Annual General Meeting of Shareholders or (ii) 60 calendar days following the resignation of the New

Director (as defined in the Maguire Cooperation Agreement) (or Replacement Director (as defined in the Maguire Cooperation

Agreement)).

Second

Amendment to Note Purchase Agreement

Further, the Company and MAK Capital Fund, LP (“MAK”),

an affiliate of Michael A. Kaufman, entered into the Second Amendment (the “Second Amendment”) dated August 29, 2023 to the

Note Purchase Agreement dated October 5, 2022, by and between the Company and MAK to extend the timeline to obtain the Nasdaq Approval

(as defined in the Second Amendment) at the 2023 Annual General Meeting of Shareholders to be held by September 30, 2023.

The foregoing description of the First Amendment

to MAK Cooperation Agreement, the First Amendment to Maguire Cooperation Agreement and the Second Amendment is only a summary

and is qualified in its entirety by reference to the First Amendment to MAK Cooperation Agreement, the First Amendment to Maguire

Cooperation Agreement and the Second Amendment attached hereto as Exhibits 99.1, 99.2 and 99.3, respectively, which

are incorporated herein by reference.

Exhibit

Index

| Exhibit

No. |

|

Description |

| |

|

|

| 99.1 |

|

First Amendment to Cooperation Agreement, dated August 29, 2023, among Yatra Online, Inc. and MAK Capital One L.L.C. and MAK CAPITAL FUND LP

|

| 99.2 |

|

First Amendment to Cooperation Agreement, dated August 29, 2023, between Yatra Online, Inc. and The 2020 Timothy J. Maguire Investment Trust |

| 99.3 |

|

Second Amendment to Note Purchase Agreement, dated August 29, 2023, between Yatra Online, Inc. and MAK Capital Fund, LP |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

YATRA

ONLINE, INC. |

| |

|

|

| Date:

September [1], 2023 |

By: |

/s/

Dhruv Shringi |

| |

|

Dhruv

Shringi |

| |

|

Chief

Executive Officer |

Exhibit

99.1

FIRST

AMENDMENT TO COOPERATION AGREEMENT

This

First Amendment to the Cooperation Agreement (this “Amendment”), dated August 29, 2023, is by and among Yatra Online,

Inc., a Cayman Islands exempted company (the “Company”) and the entities and individuals set forth on the signatures

pages hereto (collectively with each of their respective affiliates, the “Investor Group”). The Cooperation Agreement,

dated July 17, 2022, was entered into by and among the Company and the Investor Group (the “Cooperation Agreement”).

Capitalized terms used and not otherwise defined in this Amendment shall have the meanings ascribed to them in the Cooperation Agreement.

Pursuant

to Section 17 of the Cooperation Agreement, the Cooperation Agreement may be amended, modified or waived only by an agreement in writing

signed by the Company and the Investor Group.

In

consideration of the foregoing and the mutual covenants and agreements contained herein, and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the Investor Group and the Company, intending to be legally bound hereby,

agree as follows:

1.

Amendment of Section 1(c) of the Cooperation Agreement. Section 1(c) of the Cooperation Agreement is amended and replaced

in its entirety by the following language.

(c)

The Company agrees that following the execution and delivery of this Agreement the Board and all applicable committees of the Board will

take all necessary action to nominate the Investor Group Designee, Michael A. Kaufman, as a Class I director for re-appointment to the

Board at the Company’s 2023 Annual General Meeting (“2023 Annual General Meeting”) to serve until the appointment

and qualification of his successor at the Company’s 2026 Annual General Meeting (“2026 Annual General Meeting”),

subject to his earlier death, resignation, disqualification or removal.

2.

Amendment of Section 1(g) of the Cooperation Agreement. Section 1(g) of the Cooperation Agreement is replaced with the following

language:

(g)

The Investor Group acknowledges and agrees that if at any time during the term of this Agreement or any time during the tenure of the

directorship of Investor Group Designee commencing from his appointment in the 2023 Annual General Meeting, whichever is longer, the

Investor Group’s aggregate Net Long Position falls below the lesser of 10.0% of the Company’s then outstanding ordinary shares,

par value $0.0001 per share (the “Ordinary Shares”) and 6,085,150 shares of Ordinary Shares (subject to adjustment for share

sub-divisions, reclassifications, consolidations and similar adjustments) (such lesser amount, the “Ownership Minimum”),

the Investor Group Designee shall be obligated to immediately tender his resignation pursuant to the Resignation Letter (it being understood

that the Board shall have the right to decline the resignation). The Investor Group shall provide written notice to the Company within

two days following the date on which the Investor Group’s Net Long Position falls below the Ownership Minimum. The Investor Group

shall provide written notice to the Company within two days following the end of each calendar quarter regarding the Investor Group’s

aggregate Net Long Position (it being understood that, notwithstanding anything to the contrary in this Agreement, the Company’s

sole remedy should the Investor Group fail to provide such notice will be the right to request that the Investor Group promptly provide

such notice), provided, however, that such notice shall be deemed provided so long as the Investor Group continues to have filed a statement

of beneficial ownership on Schedule 13D pursuant to the Exchange Act with respect to the Company.

3.

Amendment of Section 1(h) of the Cooperation Agreement. Section 1(h) of the Cooperation Agreement is amended with the addition

of the following language immediately after the existing paragraph in Section 1(h):

The

only matters to be considered at the 2023 Annual General Meeting will be (i) the election of Class I director nominees, to the Board,

(ii) the ratification of the appointment of Ernst & Young Associates LLP as the independent registered public accounting firm of

the Company for the fiscal year ending March 31, 2024, and (iii) approval of a special resolution for the issuance of Ordinary Shares

pursuant to the Note Purchase Agreement dated October 05, 2022, as amended, between Yatra Online, Inc. and MAK Capital Fund, LP. The

Company’s proxy statement for the 2023 Annual General Meeting to be filed as an exhibit to Form 6-K with the SEC will be substantially

the same as the draft proxy statement provided to the Investor Group before filing such proxy statement with the SEC.

4.

Amendment of Section 11(a) of the Cooperation Agreement. Section 11(a) of the Cooperation Agreement is amended and replaced

in its entirety by the following language and all references to the defined term “Standstill Period” in the Cooperation Agreement

shall take account of such amendment:

(a)

Except as otherwise provided in this Section 11, this Agreement shall remain in full force and effect for the period (the “Standstill

Period”) commencing on the date of this Agreement and ending on the date that is the earlier to occur of (i) 30 calendar days

prior to the date of the 2024 Annual General Meeting or (ii) 60 calendar days following the resignation of the Investor Group Designee;

provided, however, that, without affecting any other right or remedy available to it, a non-breaching party may terminate this Agreement

prior to the expiration of the Standstill Period where the other party commits a material breach of any term of this Agreement and (if

such breach is remediable) fails to remedy that breach within 15 days of receipt of written notice of such determination.

5.Amendment

of Exhibits to the Cooperation Agreement to add Exhibit B. The Exhibits to the Cooperation Agreement are amended and updated

as a new Exhibit B in the form attached to this Amendment.

6.

Resignation Letter. Notwithstanding anything contained in the Cooperation Agreement to the contrary, simultaneous with the

execution and delivery of this Amendment, the Investor Group Designee, Michael A. Kaufman, has executed and delivered to the Company

an irrevocable conditional letter of resignation from the Board in the form attached hereto as Exhibit B (Resignation Letter (Termination))

to this Amendment.

7.

No Other Modifications. Except as provided in Sections 1, 2, 3, 4, and 5 of this Amendment, no other modification of the Cooperation

Agreement is intended to be effected by this Amendment and the Cooperation Agreement, as amended by this Amendment, shall remain in full

force and effect.

8.

Voidness of this Amendment. This Amendment shall be void and of no effect if the Investor Group Designee is not appointed

to the Board at the 2023 Annual General Meeting.

9.

Representations and Warranties of the Company. The Company hereby represents and warrants that it has full power and authority

to execute, deliver and carry out the terms and provisions of this Amendment and to consummate the transactions contemplated hereby,

and that this Amendment has been duly and validly authorized, executed and delivered by the Company, constitutes a valid and binding

obligation and agreement of the Company and is enforceable against the Company in accordance with its terms. The Company represents and

warrants that the execution of this Amendment, the consummation of any of the transactions contemplated hereby, and the fulfillment of

the terms hereof, in each case in accordance with the terms hereof, will not conflict with, or result in a breach or violation of the

organizational documents of the Company as currently in effect, and that the execution, delivery and performance of this Amendment by

the Company does not and will not violate or conflict with (i) any law, rule, regulation, order, judgment or decree applicable to the

Company or (ii) result in any breach or violation of or constitute a default (or an event which with notice or lapse of time or both

could constitute such a breach, violation or default) under or pursuant to, or result in the loss of a material benefit under, or give

any right of termination, amendment, acceleration or cancellation of, any organizational document, agreement, contract, commitment, understanding

or arrangement to which the Company is a party or by which it is bound.

10.

Representations and Warranties of the Investor Group. Each member of the Investor Group represents and warrants that it has

full power and authority to execute, deliver and carry out the terms and provisions of this Amendment and to consummate the transactions

contemplated hereby, and that this Amendment has been duly and validly executed and delivered by it, constitutes a valid and binding

obligation and agreement of it and is enforceable against it in accordance with its terms. Each member of the Investor Group represents

and warrants that the execution of this Amendment, the consummation of any of the transactions contemplated hereby, and the fulfillment

of the terms hereof, in each case in accordance with the terms hereof, will not conflict with, or result in a breach or violation of

any organizational documents of it as currently in effect, and that the execution, delivery and performance of this Amendment by it does

not and will not violate or conflict with (i) any law, rule, regulation, order, judgment or decree applicable to it or (ii) result in

any breach or violation of or constitute a default (or an event which with notice or lapse of time or both could constitute such a breach,

violation or default) under or pursuant to, or result in the loss of a material benefit under, or give any right of termination, amendment,

acceleration or cancellation of, any organizational document, agreement, contract, commitment, understanding or arrangement to which

it is a party or by which it is bound.

11.

Governing Law; Jurisdiction. This Amendment and any dispute, claim, suit, action or proceeding of whatever nature arising

out of or in any way related to this Amendment (including any non-contractual disputes or claims) shall be governed by, and shall be

construed in accordance with, the laws of the Cayman Islands. The courts of the Cayman Islands shall have exclusive jurisdiction to hear

and determine any claim, suit, action or proceeding, and to settle any disputes, which may arise out of or are in any way related to

or in connection with this Amendment, and, for such purposes, each party submits to the non-exclusive jurisdiction of such courts.

12.

Representation by Counsel. Each of the parties acknowledges that it has been represented by counsel of its choice throughout

all negotiations that have preceded the execution of this Amendment, and that it has executed this Amendment with the advice of such

counsel. Each party and its counsel cooperated and participated in the drafting and preparation of this Amendment, and any and all drafts

relating thereto exchanged among the parties will be deemed the work product of all of the parties and may not be construed against any

party by reason of its drafting or preparation. Accordingly, any rule of law or any legal decision that would require interpretation

of any ambiguities in this Amendment against any party that drafted or prepared it is of no application and is hereby expressly waived

by each of the parties, and any controversy over interpretations of this Amendment will be decided without regard to events of drafting

or preparation.

13.

Counterparts. This Amendment may be executed in one or more textually identical counterparts, each of which shall be deemed

an original, but all of which together shall constitute one and the same agreement. Signatures to this Amendment transmitted by facsimile

transmission, by electronic mail in “portable document format” (“.pdf’) form, or by any other electronic means

intended to preserve the original graphic and pictorial appearance of a document, shall have the same effect as physical delivery of

the paper document bearing the original signature. Sections 8 and 19(3) of the Electronic Transactions Act (As Revised) of the Cayman

Islands shall not apply to this Amendment.

14.

No Third-Party Beneficiaries. A person who is not a party to this Amendment has no right under the Contracts (Rights of Third

Parties) Act (As Revised) of the Cayman Islands to enforce any term of this Amendment.

15.

Entire Understanding; Amendment. This Amendment, the Cooperation Agreement and the Confidentiality Agreement contain the entire

agreement between the parties with respect to the subject matter hereof and supersedes any and all prior and contemporaneous agreements,

memoranda, arrangements and understandings, both written and oral, between the parties, or any of them, with respect to the subject matter

of this Amendment. Any amendment or modification of the terms and conditions set forth herein or any waiver of such terms and conditions

must be agreed to in a writing signed by each party.

[Signature

page follows]

IN

WITNESS WHEREOF, each of the parties has executed and delivered this Amendment, or caused the same to be executed and delivered by its

duly authorized representative, as a deed on the date first above written.

| THE

COMPANY: |

|

| |

|

| YATRA

ONLINE, INC. |

|

| |

|

|

| By: |

/s/

Dhruv Shringi |

|

| |

Dhruv

Shringi |

|

| |

Chief

Executive Officer and Director |

|

SIGNATURE

PAGE TO AMENDMENT NO. 1 TO COOPERATION AGREEMENT

| INVESTOR

GROUP |

|

| |

|

| MAK

CAPITAL ONE L.L.C. |

|

| |

|

|

| By: |

/s/

Michael A. Kaufman |

|

| |

Michael

A. Kaufman |

|

| |

Managing

Member |

|

| |

|

|

| MAK

CAPITAL FUND LP |

|

| |

|

| By: |

MAK

GP L.L.C., General Partner |

|

| |

|

|

| By: |

/s/

Michael A. Kaufman |

|

| |

Michael

A. Kaufman |

|

| |

Managing

Member |

|

| |

|

| MICHAEL

A. KAUFMAN |

|

SIGNATURE

PAGE TO AMENDMENT NO. 1 TO COOPERATION AGREEMENT

EXHIBIT

B

Form

of Resignation Letter (Termination)

[●],

2023

Board

of Directors Yatra Online, Inc.

Gulf

Adiba, Plot No. 272

4th

Floor, Udyog Vihar, Phase-II

Sector-20,

Gurugram-122008, Haryana, India

Re:

Resignation

Ladies

and Gentlemen:

Reference

is made to that certain Cooperation Agreement (the “Agreement”), dated July 17, 2022, as amended by the First Amendment

to the Agreement (the “Amendment”), by and among Yatra Online, Inc., a Cayman Islands exempted company (the “Company”),

and the entities and individuals set forth on the signature pages thereto. Capitalized terms used herein but not defined shall have the

meaning set forth in the Agreement as amended.

I

hereby irrevocably offer to resign from my position as a director of the Company and from any and all committees of the Board on which

I serve, subject to acceptance of such resignation by the Board, if and as required pursuant to Section 1(g) of the Agreement.

| Very

truly yours, |

|

| |

|

|

| By: |

|

|

| Name: |

Michael

A. Kaufman |

|

Exhibit

99.2

FIRST

AMENDMENT TO COOPERATION AGREEMENT

This

First Amendment to the Cooperation Agreement (this “Amendment”), dated August 29, 2023, is by and among Yatra Online,

Inc., a Cayman Islands exempted company (the “Company”) and the entities and individuals set forth on the signatures

pages hereto (each, an “Investor” and collectively, the “Investors” or, with their respective affiliates

and associates, the “Investor Group”). The Cooperation Agreement, dated January 17, 2022, was entered into by and

among the Company and the Investor Group (the “Cooperation Agreement”). Capitalized terms used and not otherwise defined

in this Amendment shall have the meanings ascribed to them in the Cooperation Agreement.

Pursuant

to Section 23 of the Cooperation Agreement, the Cooperation Agreement may be modified, amended or otherwise changed only in writing signed

by the Company and the Investor Group.

In

consideration of the foregoing and the mutual covenants and agreements contained herein, and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the Investor Group and the Company, intending to be legally bound hereby,

agree as follows:

1.

Amendment of Section 1(a) of the Cooperation Agreement. Section 1(a) of the Cooperation Agreement is amended and replaced

in its entirety by the following language.

(a)

The Company agrees that it shall take all actions as are necessary to nominate the New Director, Roshan Mendis, as a Class I director

for re-appointment to the Board at the Company’s 2023 annual general meeting (“2023 Annual General Meeting”)

to serve until the appointment and qualification of his successor at the Company’s 2026 annual general meeting (“2026

Annual General Meeting”), subject to his earlier death, resignation, disqualification, removal or termination of this Agreement.

2.

Amendment of Section 3(f) of the Cooperation Agreement. Section 3(f) of the Cooperation Agreement is amended and replaced

in its entirety by the following language and all references to the defined term “Standstill Period” in the Cooperation Agreement

shall take account of such amendment:

(a)

For purposes of this Agreement, “Standstill Period” shall mean the period commencing on the date of this Agreement

and ending on the date that is the earlier to occur of (i) the date of the 2026 Annual General Meeting or (ii) 60 calendar days following

the resignation of the New Director (or Replacement Director). However, after a period of one year from the date of execution of this

Amendment, either of the parties hereto viz. the Company or the Investor Group may terminate the Agreement by giving a 90 days prior

written notice to the other party.

3. Amendment

of Section 3 of the Cooperation Agreement. Section 3 of the Cooperation Agreement is amended to add the following Section

3(g) in its entirety:

(g)

Notwithstanding anything contained in this Agreement to the contrary:

The

Investor Group acknowledges and agrees that if at any time during the term of this Agreement, the Agreement stands terminated, the New

Director (or Replacement Director as applicable) shall be obligated to immediately tender his or her resignation pursuant to the resignation

letter (the “Resignation Letter”) attached hereto as Exhibit C (it being understood that the Board shall have

the right to decline the resignation). The Company is authorized to take the requisite steps, if any, to complete any formalities related

to finalizing the Resignation Letter.

4.

Amendment of Exhibits to the Cooperation Agreement to add Exhibit C. The Exhibits to the Cooperation Agreement are amended

and updated to add a new Exhibit C in the form attached to this Amendment.

5.

Resignation Letter. Notwithstanding anything contained in the Cooperation Agreement to the contrary, simultaneous with the

execution and delivery of this Amendment, the New Director has executed and delivered to the Company an irrevocable conditional letter

of resignation from the Board in the form attached hereto as Exhibit C (the “Resignation Letter”) to this Amendment.

In addition, any Replacement Director will execute and deliver to the Company a Resignation Letter upon appointment.

6.

No Other Modifications. Except as provided in Sections 1, 2, 3 and 4 of this Amendment, no other modification of the Cooperation

Agreement is intended to be effected by this Amendment and the Cooperation Agreement, as amended by this Amendment, shall remain in full

force and effect.

7.

Voidness of this Amendment. This Amendment shall be void and of no effect if the New Director is not appointed to the Board

at the 2023 Annual General Meeting.

8.

Representations and Warranties of the Company. The Company represents and warrants to the Investors that (a) the Company has

the corporate power and authority to execute this Amendment and to bind it thereto, (b) this Amendment has been duly and validly authorized,

executed and delivered by the Company, constitutes a valid and binding obligation and agreement of the Company, and is enforceable against

the Company in accordance with its terms, except as enforcement thereof may be limited by applicable bankruptcy, insolvency, reorganization,

moratorium, fraudulent conveyance or similar laws generally affecting the rights of creditors and subject to general equity principles

and (c) the execution, delivery and performance of this Amendment by the Company does not and will not violate or conflict with (i) any

law, rule, regulation, order, judgment or decree applicable to it, or (ii) result in any breach or violation of or constitute a default

(or an event which with notice or lapse of time or both could become a default) under or pursuant to, or result in the loss of a material

benefit under, or give any right of termination, amendment, acceleration or cancellation of, any organizational document, or any material

agreement, contract, commitment, understanding or arrangement to which the Company is a party or by which it is bound.

9.

Representations and Warranties of the Investor Group. Each Investor, on behalf of itself, severally represents and warrants

to the Company that (a) this Amendment has been duly and validly authorized, executed and delivered by such Investor, and constitutes

a valid and binding obligation and agreement of such Investor, enforceable against such Investor in accordance with its terms, except

as enforcement thereof may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance or similar

laws generally affecting the rights of creditors and subject to general equity principles, (c) such Investor has the authority to execute

this Amendment on behalf of itself and the applicable Investor associated with that signatory’s name, and to bind such Investor

to the terms hereof, (d) each of the Investors shall use its commercially reasonable efforts to cause its respective Affiliates and Associates

to comply with the terms of this Amendment and (e) the execution, delivery and performance of this Amendment by such Investor does not

and will not violate or conflict with (i) any law, rule, regulation, order, judgment or decree applicable to it, or (ii) result in any

breach or violation of or constitute a default (or an event which with notice or lapse of time or both could become a default) under

or pursuant to, or result in the loss of a material benefit under, or give any right of termination, amendment, acceleration or cancellation

of, any organizational document, agreement, contract, commitment, understanding or arrangement to which such member is a party or by

which it is bound.

10.

Governing Law and Jurisdiction. This Amendment shall be governed in all respects, including validity, interpretation, and

effect, by, and construed in accordance with, the laws of the Cayman Islands executed and to be performed wholly within the Cayman Islands,

without giving effect to the choice of law or conflict of law principles thereof or of any other jurisdiction to the extent that such

principles would require or permit the application of the laws of another jurisdiction.

Each

of the parties hereto (a) consents to submit itself to the personal jurisdiction of the courts of the Cayman Islands in the event any

dispute arises out of this Amendment or the transactions contemplated by this Amendment, (b) agrees that it shall not bring any action

relating to this Amendment or the transactions contemplated by this Amendment in any court other than the courts of the Cayman Islands,

and each of the parties irrevocably waives the right to trial by jury, (c) agrees to waive any bonding requirement under any applicable

law, in the case any other party seeks to enforce the terms by way of equitable relief, and (d) irrevocably consents to service of process

by first class certified mail, return receipt requested, postage prepaid, to the address of such party’s principal place of business

or as otherwise provided by applicable law. Each of the parties hereto irrevocably waives, and agrees not to assert, by way of motion,

as a defense, counterclaim or otherwise, in any action, suit or other legal proceeding with respect to this Amendment, (a) any claim

that it is not personally subject to the jurisdiction of the above-named courts for any reason, (b) that it or its property is exempt

or immune from jurisdiction of any such court or from any legal process commenced in such courts (whether through service of notice,

attachment before judgment, attachment in aid of execution of judgment, execution of judgment or otherwise), and (c) to the fullest extent

permitted by applicable law, that (i) such action, suit or other legal proceeding in any such court is brought in an inconvenient forum,

(ii) the venue of such action, suit or other legal proceeding is improper or (iii) this Amendment, or the subject matter hereof, may

not be enforced in or by such court.

11.

Receipt of Adequate Information; No Reliance; Representation by Counsel. Each party acknowledges that it has received adequate

information to enter into this Amendment, that it has had adequate opportunity to make whatever investigation or inquiry it may deem

necessary or desirable in connection with the subject matter of this Amendment prior to the execution hereof, and that it has not relied

on any promise, representation or warranty, express or implied not contained in this Amendment. Each of the parties hereto acknowledges

that it has been represented by counsel of its choice throughout all negotiations that have preceded the execution of this Amendment,

and that it has executed the same with the advice of said independent counsel. Each party cooperated and participated in the drafting

and preparation of this Amendment and the documents referred to herein, and any and all drafts relating thereto exchanged among the parties

shall be deemed the work product of all of the parties and may not be construed against any party by reason of its drafting or preparation.

Accordingly, any rule of law or any legal decision that would require interpretation of any ambiguities in this Amendment against any

party that drafted or prepared it is of no application and is hereby expressly waived by each of the parties hereto, and any controversy

over interpretations of this Amendment shall be decided without regards to events of drafting or preparation. Further, any rule of law

or any legal decision that would provide any party with a defense to the enforcement of the terms of this Amendment against such party

shall have no application and is expressly waived. The provisions of this Amendment shall be interpreted in a reasonable manner to effect

the intent of the parties.

12.

Counterparts. This Amendment may be executed in one or more textually identical counterparts, each of which shall be deemed

an original, but all of which together shall constitute one and the same agreement. Signatures to this Amendment transmitted by facsimile

transmission, by electronic mail in “portable document format” (“.pdf’) form, or by any other electronic means

intended to preserve the original graphic and pictorial appearance of a document, shall have the same effect as physical delivery of

the paper document bearing the original signature. Sections 8 and 19(3) of the Electronic Transactions Act (As Revised) of the Cayman

Islands shall not apply to this Amendment.

13.

No Third-Party Beneficiaries. A person who is not a party to this Amendment has no right under the Contracts (Rights of Third

Parties) Act (As Revised) of the Cayman Islands to enforce any term of this Amendment.

14.

Entire Understanding; Amendment. This Amendment, the Cooperation Agreement and the Confidentiality Agreement contain the entire

agreement between the parties with respect to the subject matter hereof and supersedes any and all prior and contemporaneous agreements,

memoranda, arrangements and understandings, both written and oral, between the parties, or any of them, with respect to the subject matter

of this Amendment. Any amendment or modification of the terms and conditions set forth herein or any waiver of such terms and conditions

must be agreed to in a writing signed by each party.

[Signature

page follows]

IN

WITNESS WHEREOF, each of the parties has executed and delivered this Amendment, or caused the same to be executed and delivered by its

duly authorized representative, as a deed on the date first above written.

| THE

COMPANY: |

|

| |

|

| YATRA

ONLINE, INC. |

|

| |

|

|

| By: |

/s/

Dhruv Shringi |

|

| |

Dhruv

Shringi |

|

| |

Chief

Executive Officer and Director |

|

SIGNATURE

PAGE TO AMENDMENT NO. 1 TO COOPERATION AGREEMENT

| INVESTOR

GROUP |

|

| |

|

| THE

2020 TIMOTHY J. MAGUIRE INVESTMENT TRUST |

|

| |

|

|

| By: |

/s/

Timothy J. Maguire |

|

| |

Timothy

J. Maguire |

|

| |

Investment

Manager |

|

| |

|

| TIMOTHY

J. MAGUIRE |

|

SIGNATURE

PAGE TO AMENDMENT NO. 1 TO COOPERATION AGREEMENT

EXHIBIT

C

Form

of Resignation Letter

[●],

2023

Board

of Directors Yatra Online, Inc.

Gulf

Adiba, Plot No. 272

4th

Floor, Udyog Vihar, Phase-II

Sector-20,

Gurugram-122008, Haryana, India

Re:

Resignation

Ladies

and Gentlemen:

Reference

is made to that certain Cooperation Agreement (the “Agreement”), dated January 17, 2022 as amended by the First Amendment

to the Agreement (the “Amendment”), by and among Yatra Online, Inc., a Cayman Islands exempted company (the “Company”),

and the entities and individuals set forth on the signature pages thereto. Capitalized terms used herein but not defined shall have the

meaning set forth in the Agreement as amended.

I

hereby irrevocably offer to resign from my position as a director of the Company and from any and all committees of the Board on which

I serve, subject to acceptance of such resignation by the Board, if and as required pursuant to Section 3(g) of the Agreement.

It

is understood that this letter terminates automatically upon the expiration of the Standstill Period.

| Very

truly yours, |

|

| |

|

| By: |

|

|

| Name: |

Roshan

Mendis |

|

Exhibit 99.3

SECOND

AMENDMENT

TO

THE NOTE PURCHASE AGREEMENT

BETWEEN

YATRA

ONLINE, INC.

(“BORROWER”)

AND

MAK

CAPITAL FUND, LP (“HOLDER”)

This

Second Amendment to the Note Purchase Agreement dated October 05, 2022, as amended via the First Amendment dated June 28, 2023, (the

“Purchase Agreement”), is made as of August 29, 2023 (the “Effective Date”), between the Borrower

and Holder (the “Second Amendment”).

WHEREAS,

Section 5.2(a)(vi) of the Purchase Agreement requires the Borrower to use its best efforts to obtain the Nasdaq Approval at the 2023

Meeting, which must be held by August 31, 2023.

WHEREAS,

in view of the deferred filing of the Borrower’s 2023 Annual Report on Form 20-F (“2023 20-F”) and to allow

the Borrower’s shareholders the opportunity and sufficient time to review the disclosures in the 2023 20-F prior to the 2023 Meeting,

the Borrower proposes to hold the 2023 Meeting no later than September 30, 2023.

WHEREAS,

pursuant to section 9.9 of the Purchase Agreement, the Purchase Agreement may be amended by an agreement in writing signed by the Borrower

and Holder.

NOW,

THEREFORE, in consideration of the mutual covenants, conditions and agreements herein contained and other good and valuable consideration,

the receipt and sufficiency of which is hereby acknowledged, the parties hereby agree as follows:

| |

1. |

Capitalized

terms used but not defined in this Second Amendment shall have the meanings ascribed to them in the Purchase Agreement. |

| |

|

|

| |

2. |

Section

5.2(a)(vi) of the Purchase Agreement is hereby deleted in its entirety and replaced with the following text: |

| |

|

|

| |

|

“(vi)

Nasdaq Approval. The Company shall use its best efforts to obtain the Nasdaq Approval (as such term is defined in the

Certificate of Designation) which shall include a recommendation by the Board in favor of the approval of such proposal at the 2023

annual general meeting (“2023 Meeting”) which shall be held no later than September 30, 2023. In the event that

the Nasdaq Approval is not obtained at the 2023 Meeting, the Company shall be required to seek the Nasdaq Approval at each subsequent

annual general meeting which shall include a recommendation by the Board in favor of the approval of such proposal, until Nasdaq

Approval is obtained or the Holder no longer owns any Conversion Shares (as such term is defined in the Certificate of Designation).” |

| |

|

|

| |

3. |

After

the Effective Date, any reference to the Purchase Agreement shall mean the Purchase Agreement, as amended by this Second Amendment. |

| |

|

|

| |

4. |

The

Purchase Agreement is amended only to the extent specifically set forth herein. Except as specifically amended hereby, the Purchase

Agreement shall remain unaltered and in full force and effect in accordance with its terms. |

| |

|

|

| |

5. |

This

Second Amendment constitutes the sole agreement of the parties with respect to the transactions contemplated hereby and shall supersede

all oral negotiations and the terms of prior writings with respect thereto. |

| |

|

|

| |

6. |

No

determination by any court, governmental body or otherwise that any provision of this Second Amendment is invalid or unenforceable

in any instance shall affect the validity or enforceability of (a) any other such provision or (b) such provision in any circumstance

not controlled by such determination. Each such provision shall be valid and enforceable to the fullest extent allowed by, and shall

be construed wherever possible as being consistent with, Applicable Law. |

[Signature

Page Follows.]

IN

WITNESS WHEREOF, the undersigned have duly executed and delivered this Second Amendment as of the Effective Date.

| |

YATRA

ONLINE, INC., a Cayman Islands exempted company limited by shares, as Borrower |

| |

|

| |

By: |

/s/

Dhruv Shringi |

| |

Name: |

Dhruv

Shringi |

| |

Title: |

Chief

Executive Officer |

| |

|

|

| |

|

|

| |

MAK

CAPITAL FUND, LP, as Holder |

| |

|

|

| |

By: |

/s/

Michael A. Kaufman |

| |

Name: |

Michael

A. Kaufman |

| |

Title: |

Managing

Member |

[Signature

Page to Second Amendment to the Note Purchase Agreement]

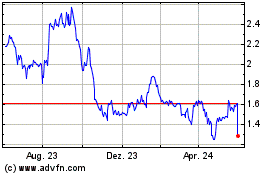

Yatra Online (NASDAQ:YTRA)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

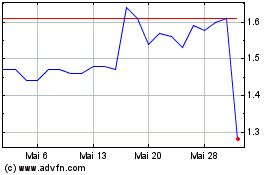

Yatra Online (NASDAQ:YTRA)

Historical Stock Chart

Von Mai 2023 bis Mai 2024