Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

24 Juni 2022 - 2:01PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of June 2022

Commission

File Number: 001-39803

Meiwu

Technology Co. Ltd.

(Translation

of registrant’s name into English)

B401,

4th Floor Building 12, Hangcheng Street,

Hourui

No. 2 Industrial District,

Shenzhen,

People’s Republic of China

Telephone:

+86-755-85255139

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report

to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on

which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

Entry

into a Material Definitive Agreement

On

June 23, 2022, Meiwu Technology Co., Ltd. (the “Company”) entered into a Share Purchase Agreement (“SPA”)

with Mahaotiaodong Information Technology Company Limited, a British Virgin Islands business company (the “Mahao BVI”),

and all the shareholders of Mahao BVI, who collectively hold 100% issued and outstanding shares of Mahao BVI (the “Sellers”).

Mahao BVI indirectly owns 100% of Mahaotiaodong (Xiamen) Technology Company Limited, a company organized under the laws of the PRC (“Mahao”),

via Mahao BVI’s wholly-owned subsidiary in Hong Kong, DELIMOND Limited. Mahao is a company engaging in providing Internet access

and related services based in Xiamen, China.

Pursuant

to the SPA, the Company is going to acquire 100% of the issued and outstanding shares of Mahao BVI. Upon the closing, the Company shall

deliver to the Sellers total consideration of US$6 million to be paid in ordinary shares, no par value (“Ordinary Shares”),

of the Company, at a price of US$0.6 per share, for a total of 10,000,000 Ordinary Shares (“Share Consideration”)

provided, however, if the audit of the Mahao BVI’s financial statements for the years ended December 31, 2021 and 2020 is not completed

by the sixty-fifth (65th) day following the closing date of the transaction contemplated in the SPA, all the Share Consideration paid

to each Seller shall be forfeited and returned to the Company for cancellation. The parties also agreed that in the event that Maohao

BVI has not reached certain amount for its net income for the year ended December 31, 2022 and for the six months ended June 30, 2023

as set forth in the SPA, the Sellers should repurchase the 100% of equity interest of Mahao BVI and return the Share Consideration for

cancellation.

The

SPA contains customary representations and warranties of Mahao BVI and Sellers, including, among other things, (a) the good standing

of the parties under the laws of the jurisdiction under which they are organized, (b) the individual authority for each of the parties

to execute and deliver the SPA, (c) the accuracy of Mahao BVI’s and its subsidiaries’ financial records, (d) the absence

of any undisclosed material adverse changes, and (e) the absence of legal proceedings that relate to the completion of the transaction

contemplated by the SPA.

The

SPA is subject to various conditions to closing, including, among other things Nasdaq approval of the listing of the Share Consideration.

The

foregoing description of the SPA does not purport to be complete and is qualified in its entirety by reference to the complete text of

the SPA, which is filed hereto as Exhibit 10.1

Financial

Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Meiwu Technology Co. Ltd. |

| |

|

|

| |

By: |

/s/

Xinliang Zhang |

| |

|

Xinliang Zhang |

| |

|

Chief Executive Officer |

Date:

June 24, 2022

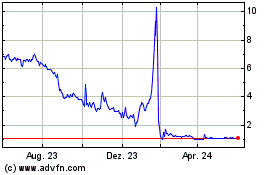

Meiwu Technology (NASDAQ:WNW)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

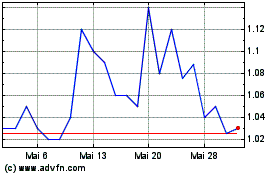

Meiwu Technology (NASDAQ:WNW)

Historical Stock Chart

Von Dez 2023 bis Dez 2024