0000714310false00007143102023-07-272023-07-270000714310exch:XNASvly:CommonStockNoParValueMember2023-07-272023-07-270000714310exch:XNASvly:NonCumulativePerpetualPreferredStockSeriesANoParValueMember2023-07-272023-07-270000714310exch:XNASvly:NonCumulativePerpetualPreferredStockSeriesBNoParValueMember2023-07-272023-07-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) July 27, 2023

Valley National Bancorp

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| New Jersey | | 1-11277 | | 22-2477875 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | | | | | | | | | | | | | |

| One Penn Plaza, | New York, | New York | | 10119 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code (973) 305-8800

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbols | Name of exchange on which registered |

| Common Stock, no par value | VLY | The Nasdaq Stock Market LLC |

| Non-Cumulative Perpetual Preferred Stock, Series A, no par value | VLYPP | The Nasdaq Stock Market LLC |

| Non-Cumulative Perpetual Preferred Stock, Series B, no par value | VLYPO | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On July 27, 2023, Valley National Bancorp (“Valley”) issued a press release reporting second quarter 2023 results of operations.

A copy of the press release is attached to this Current Report Form 8-K as Exhibit 99.1.

The information disclosed in this Item 2.02 shall be considered “furnished” but not “filed” for purposes of the Securities Exchange Act of 1934, as amended.

Valley’s second quarter 2023 press release contains certain supplemental financial information, described in the Notes to Selected Financial Data included in Exhibit 99.1, which has been determined by methods other than U.S. Generally Accepted Accounting Principles (“GAAP”). Management internally reviews each of these non-GAAP financial measures to evaluate performance on a comparative period to period basis. Management believes that the non-GAAP financial measures provide useful supplemental information to both management and investors in understanding Valley’s underlying operational performance, business and performance trends, and may facilitate comparisons of our current and prior performance with the performance of others in the financial services industry. These non-GAAP financial measures should not be considered in isolation or as a substitute for or superior to financial measures calculated in accordance with U.S. GAAP.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

Valley is furnishing presentation materials included as Exhibit 99.2 to this report pursuant to Item 7.01 of Form 8-K. Valley is not undertaking to update this presentation. The information in this report (including Exhibit 99.2) is being furnished pursuant to Item 7.01 and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. This report will not be deemed an admission as to the materiality of any information herein (including Exhibit 99.2).

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| Exhibit No. | Description |

| (d) | Exhibits. |

| 99.1 | |

| The Press Release disclosed in this Item 9.01 as Exhibit 99.1 shall be considered “furnished” but not “filed” for purposes of the Securities Exchange Act of 1934, as amended. |

| 99.2 | |

| The presentation materials disclosed in this Item 9.01 as Exhibit 99.2 shall be considered “furnished” but not “filed” for purposes of the Securities Exchange Act of 1934, as amended. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

Dated: July 27, 2023 | | VALLEY NATIONAL BANCORP |

| | By: | /s/ Michael D. Hagedorn |

| | | Michael D. Hagedorn |

| | | Senior Executive Vice President and |

| | | Chief Financial Officer (Principal Financial Officer) |

| | | | | | | | | | | |

| FOR IMMEDIATE RELEASE | Contact: | | Michael D. Hagedorn |

| | | Senior Executive Vice President and |

| | | Chief Financial Officer |

| | | 973-872-4885 |

VALLEY NATIONAL BANCORP ANNOUNCES SECOND QUARTER 2023 RESULTS

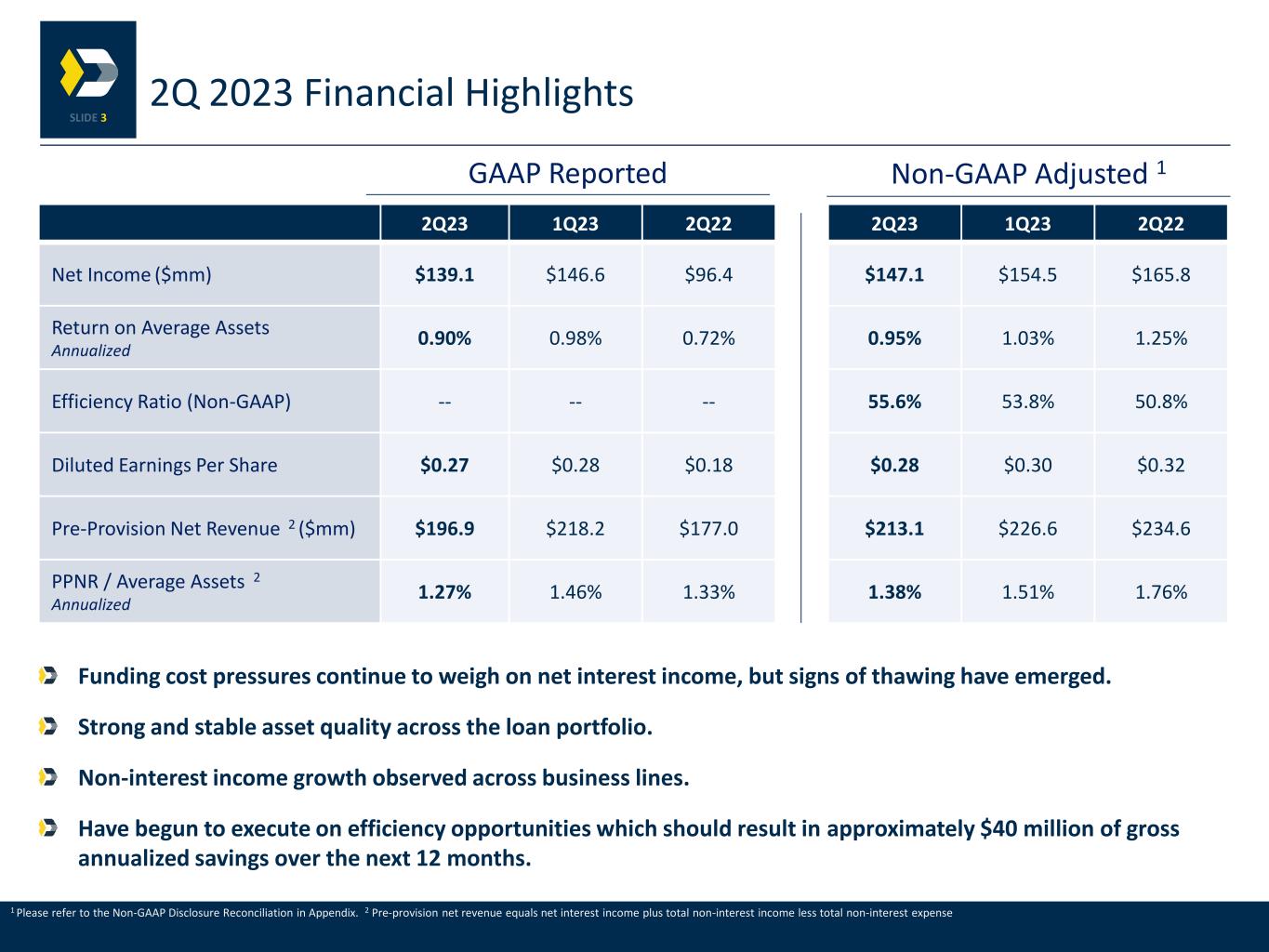

NEW YORK, NY – July 27, 2023 -- Valley National Bancorp (NASDAQ:VLY), the holding company for Valley National Bank, today reported net income for the second quarter 2023 of $139.1 million, or $0.27 per diluted common share, as compared to the second quarter 2022 net income of $96.4 million, or $0.18 per diluted common share, and net income of $146.6 million, or $0.28 per diluted common share, for the first quarter 2023. Excluding all non-core charges, our adjusted net income (a non-GAAP measure) was $147.1 million, or $0.28 per diluted common share, for the second quarter 2023, $165.8 million, or $0.32 per diluted common share, for second quarter 2022, and $154.5 million, or $0.30 per diluted common share, for the first quarter 2023. See further details below, including a reconciliation of our non-GAAP adjusted net income, in the "Consolidated Financial Highlights" tables.

Key financial highlights for the second quarter:

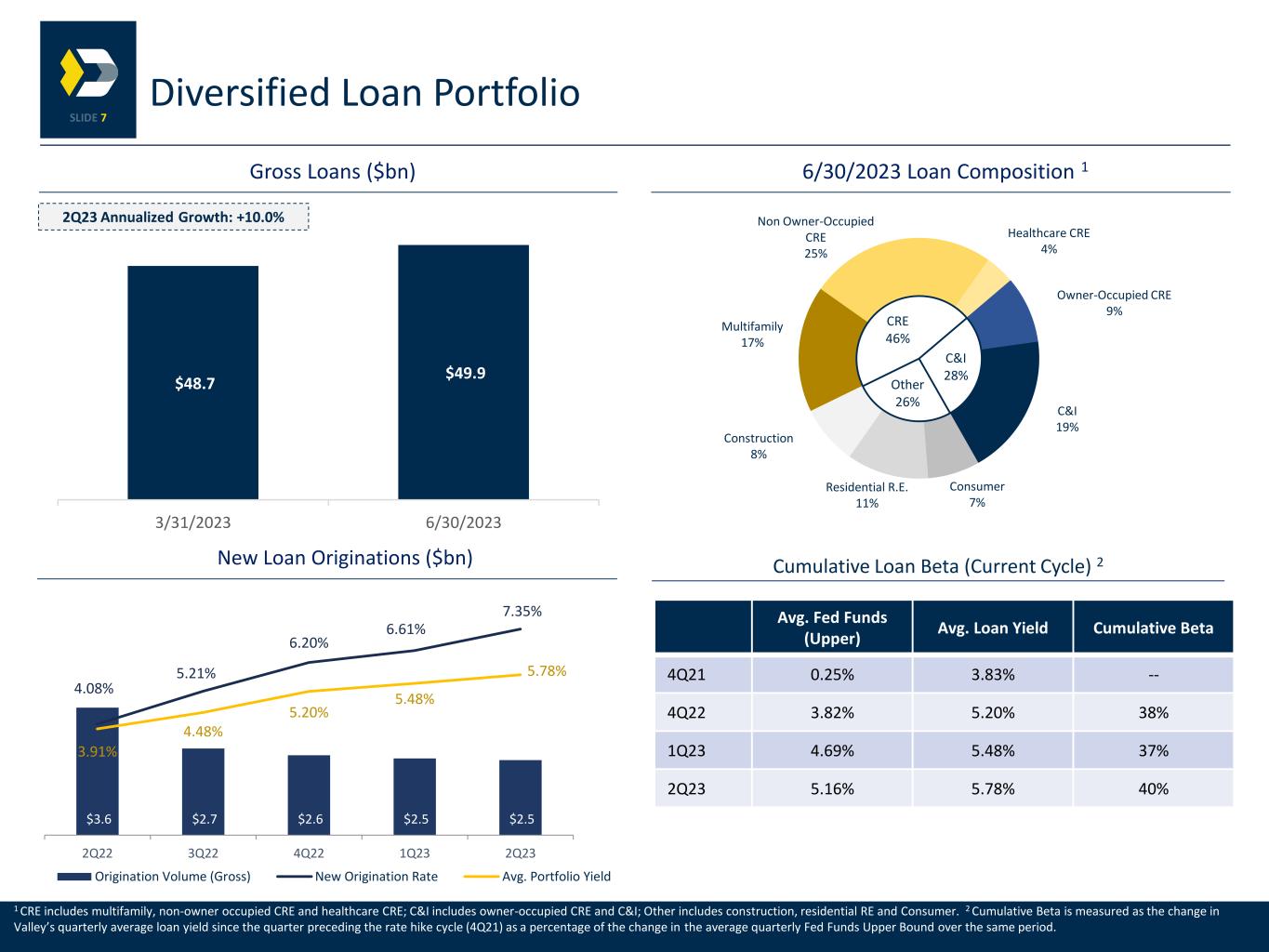

•Loan Portfolio: Total loans increased $1.2 billion, or 10.0 percent on an annualized basis, to $49.9 billion at June 30, 2023 from March 31, 2023 mainly as a result of new commercial loan production from mostly seasoned customer relationships and the continuation of slower prepayment activity within the loan portfolio. See the "Loans" section below for more details.

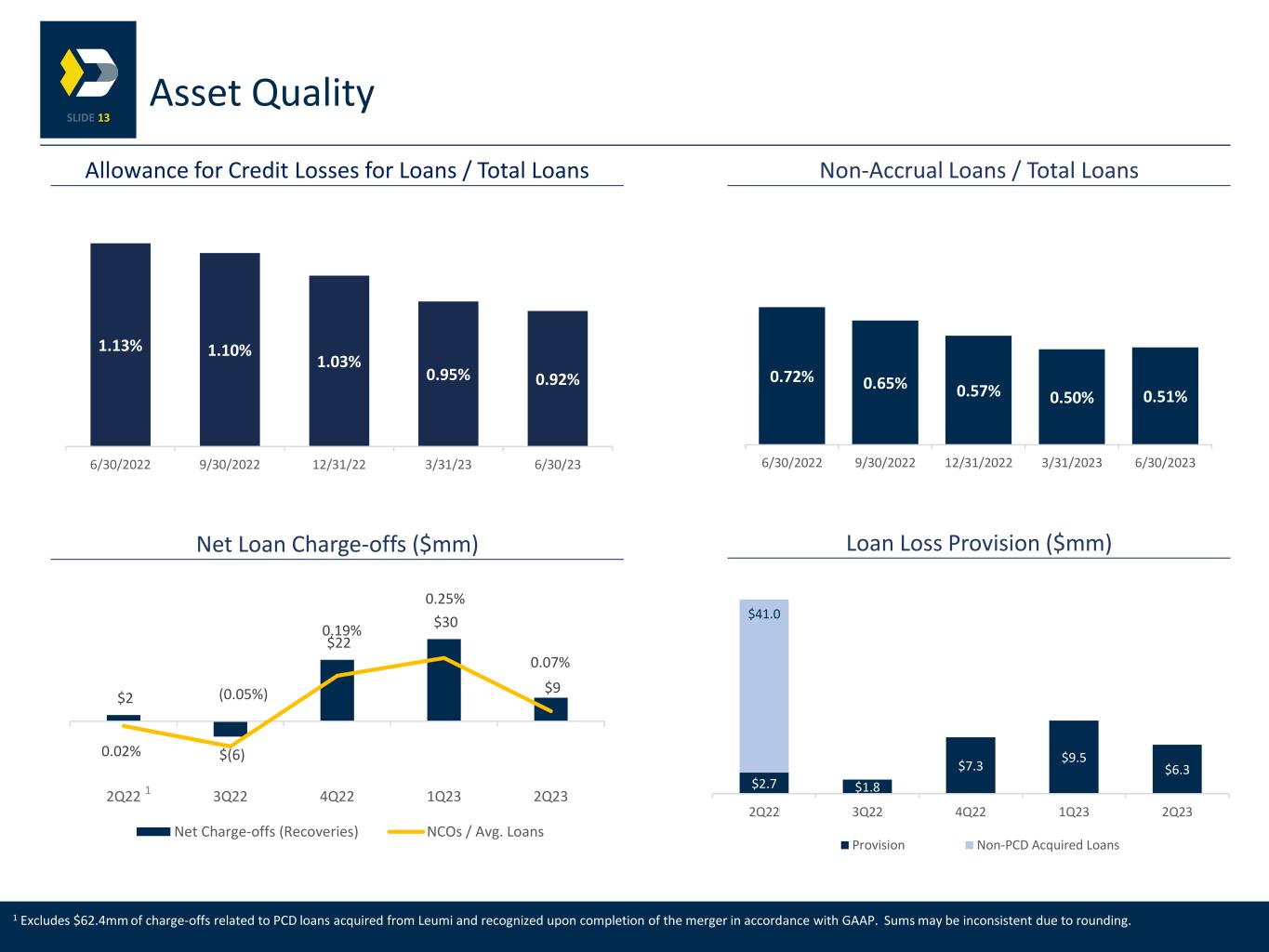

•Allowance and Provision for Credit Losses for Loans: The allowance for credit losses for loans totaled $458.7 million and $461.0 million at June 30, 2023 and March 31, 2023, respectively, representing 0.92 percent and 0.95 percent of total loans at each respective date. During the second quarter 2023, the provision for credit losses for loans totaled $6.3 million as compared to $9.5 million and $43.7 million for the first quarter 2023 and second quarter 2022, respectively.

•Credit Quality: Total accruing past due loans decreased $38.5 million to $61.8 million, or 0.12 percent of total loans, at June 30, 2023 as compared to $100.3 million, or 0.21 percent of total loans, at March 31, 2023. Non-accrual loans represented 0.51 percent and 0.50 percent of total loans at June 30, 2023 and March 31, 2023, respectively. Net loan charge-offs totaled $8.6 million for the second quarter 2023 as compared to $30.4 million and $2.3 million for the first quarter 2023 and second quarter 2022, respectively. See the "Credit Quality" section below for more details.

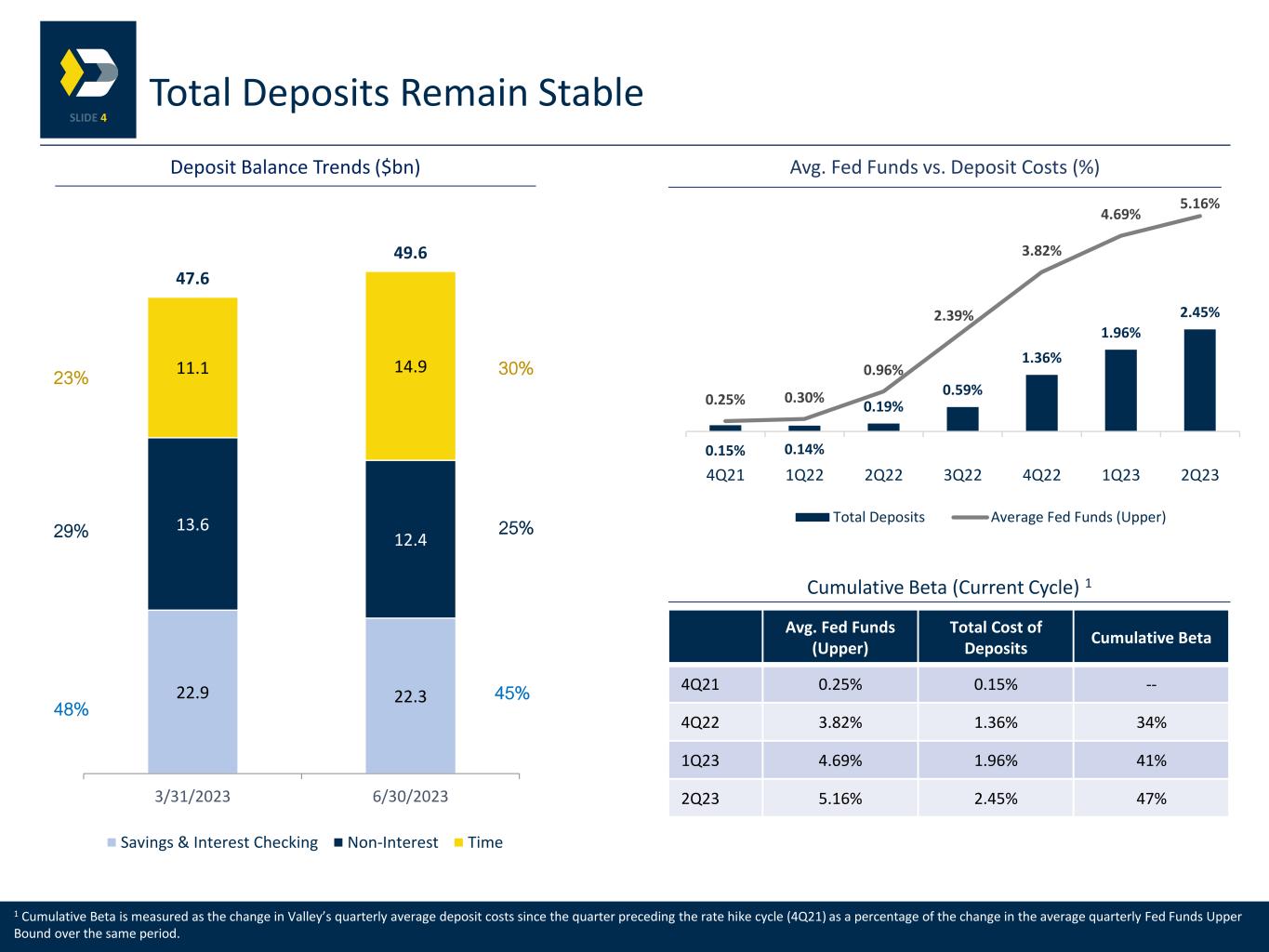

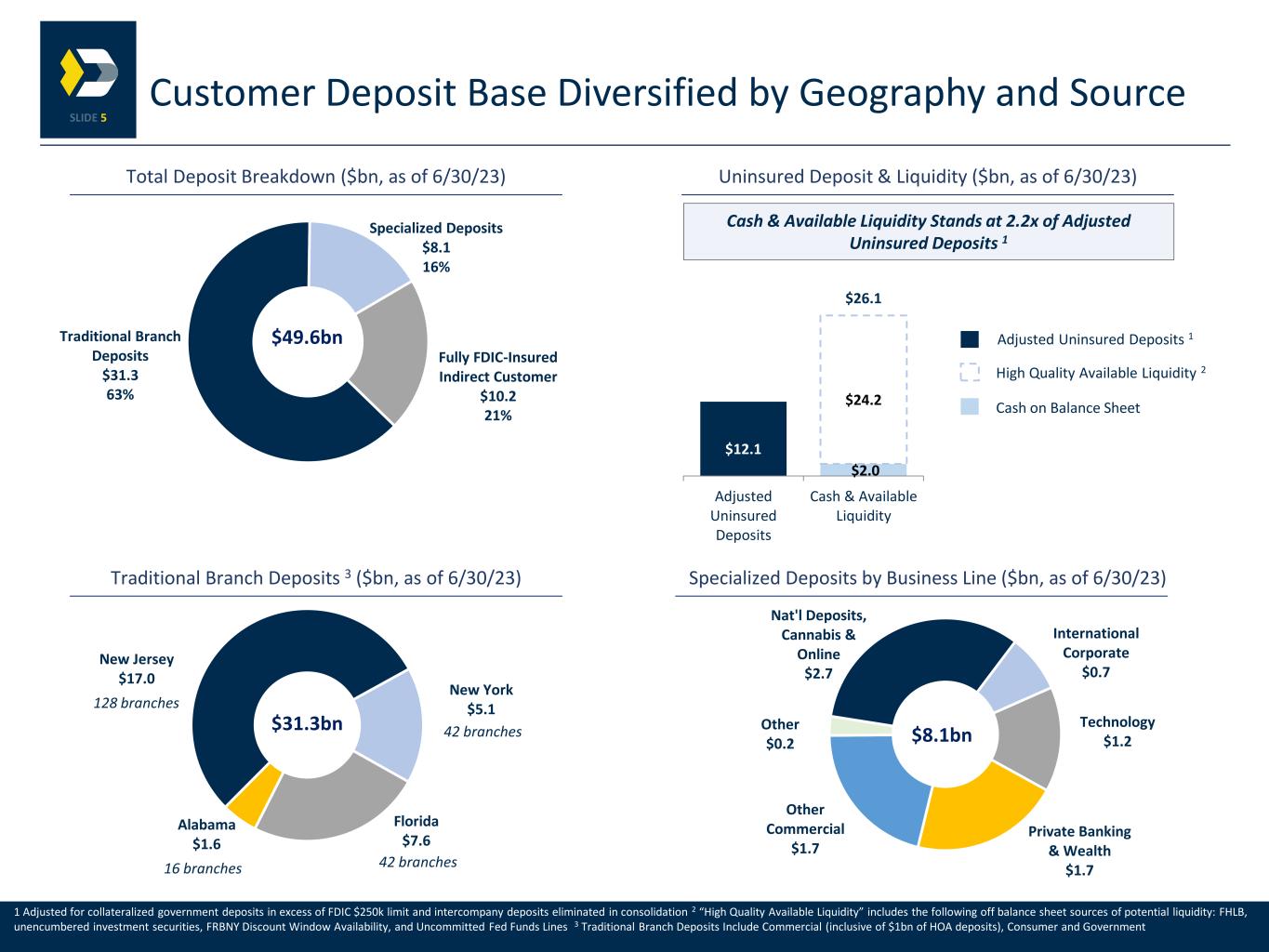

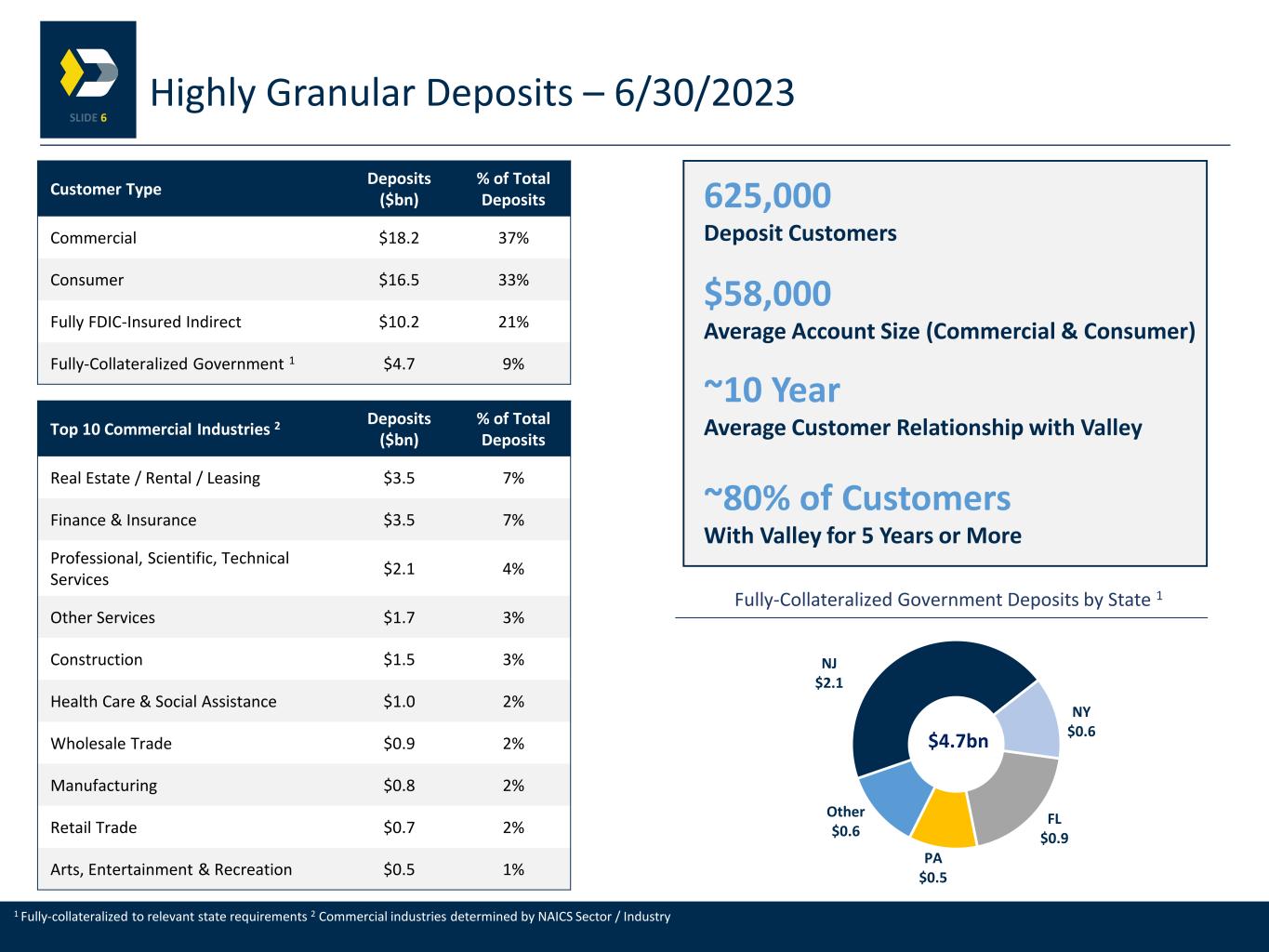

•Deposits: Total deposits increased $2.0 billion to $49.6 billion at June 30, 2023 as compared to $47.6 billion at March 31, 2023 largely due to increases in indirect customer deposits and retail CDs. See the "Deposits" section below for more details.

•Net Interest Income and Margin: Net interest income on a tax equivalent basis of $421.3 million for the second quarter 2023 decreased $16.2 million compared to the first quarter 2023 and increased $1.7 million as compared to the second quarter 2022. Our net interest margin on

Valley National Bancorp (NASDAQ: VLY)

Second Quarter 2023 Earnings

July 27, 2023

a tax equivalent basis decreased by 22 basis points to 2.94 percent in the second quarter 2023 as compared to 3.16 percent for the first quarter 2023. The decline in both net interest income and margin as compared to the linked first quarter reflects the impact of rising market interest rates on interest bearing deposits and incremental short-term borrowings held during the second quarter 2023. While our cash position declined compared to the linked quarter, elevated liquidity on an average basis continued to weigh on our net interest margin during the quarter. See the "Net Interest Income and Margin" section below for more details.

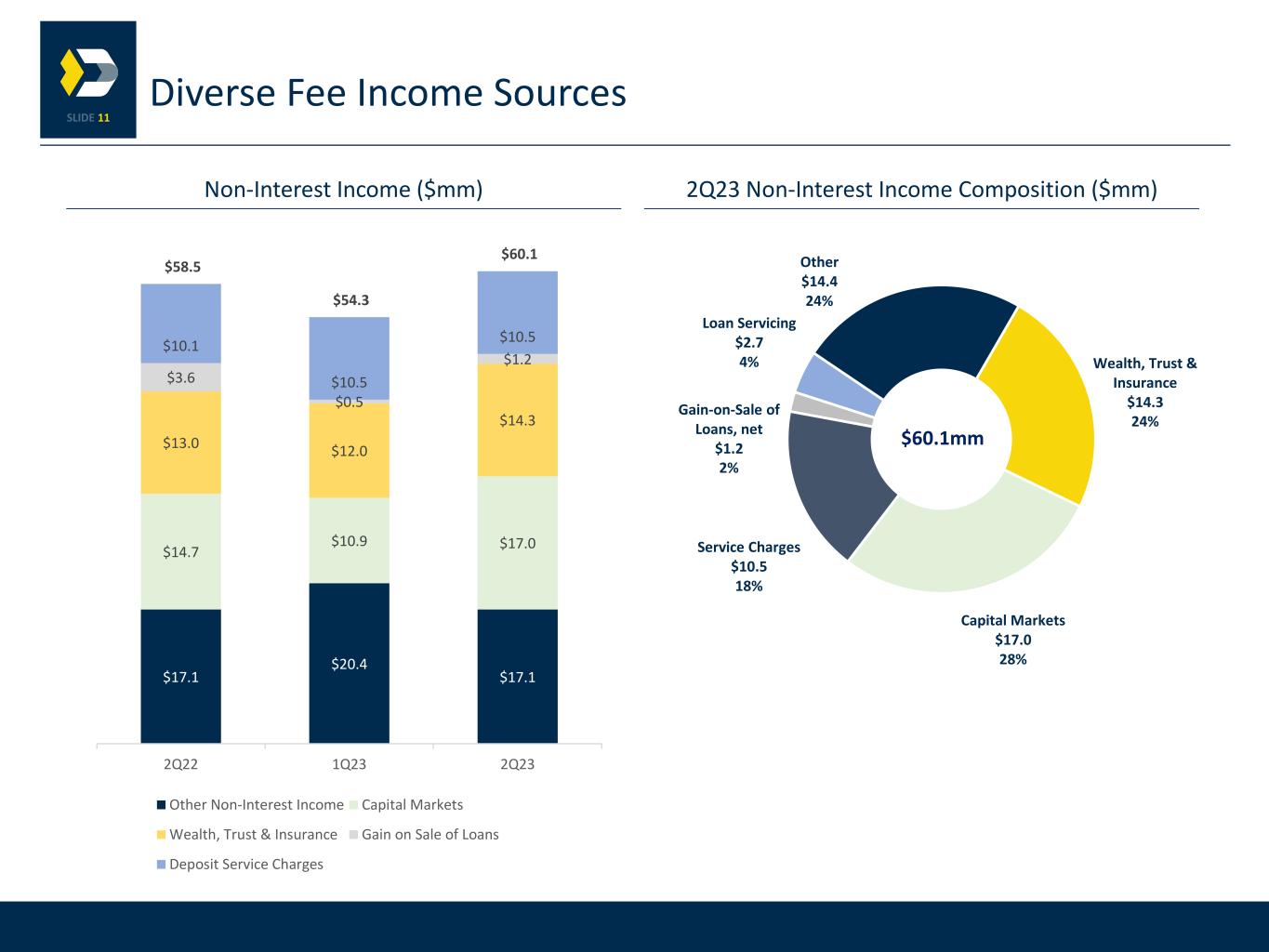

•Non-Interest Income: Non-interest income increased $5.8 million to $60.1 million for the second quarter 2023 as compared to the first quarter 2023 mainly due to a $6.1 million increase in capital market fees. The increase in capital market fees was largely driven by additional fee income from a higher volume of interest rate swap transactions executed for commercial loan customers during the second quarter 2023.

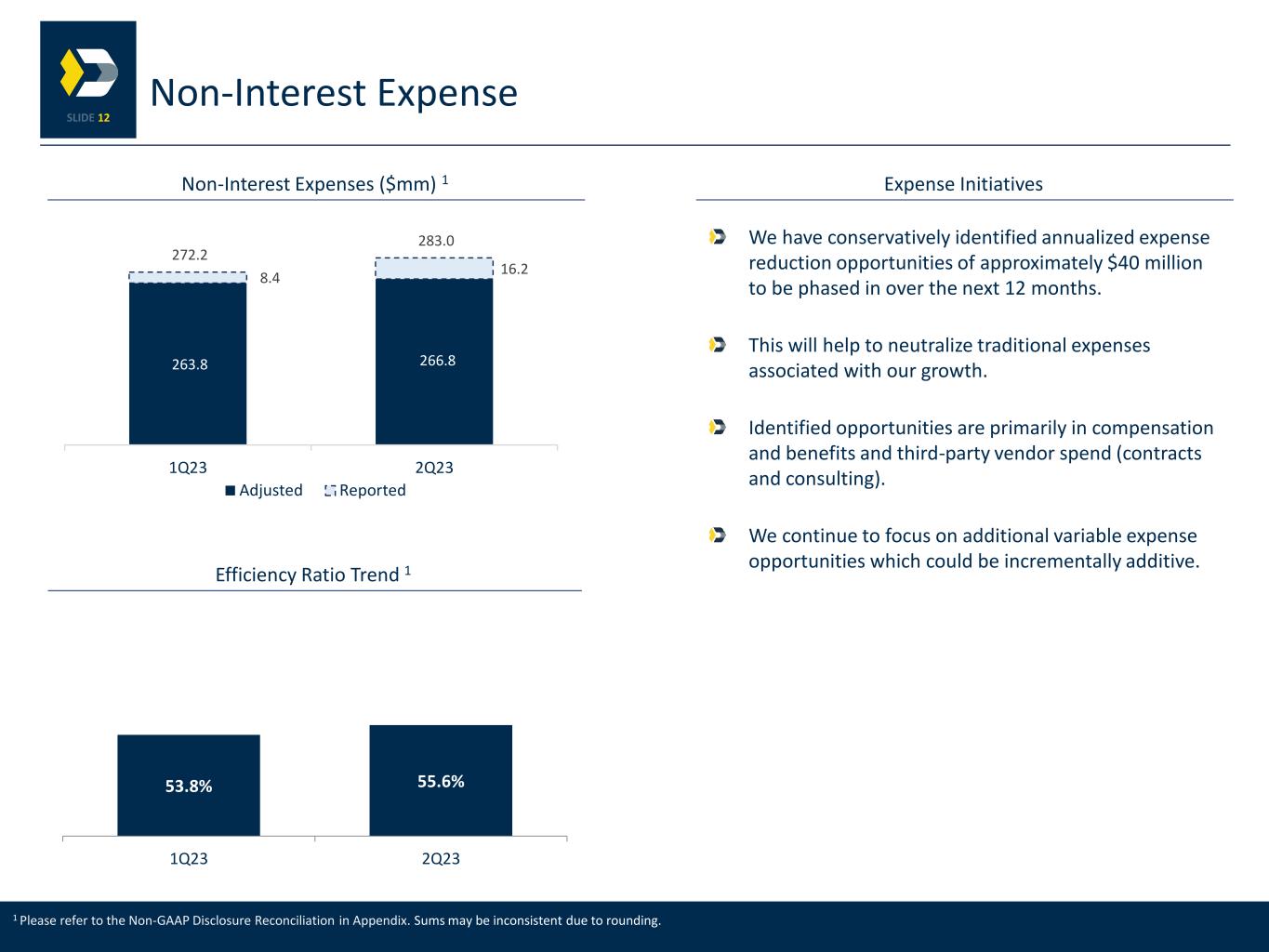

•Non-Interest Expense: Non-interest expense increased $10.8 million to $283.0 million for the second quarter 2023 as compared to the first quarter 2023 primarily due to a non-core charge of $11.2 million recorded within salary and employee benefits expense largely related to recent workforce reductions. Salary and employee benefits expense increased $4.6 million from first quarter 2023 mainly due to the non-core charge, partially offset by lower cash incentive compensation expense and payroll taxes. Additionally, professional and legal fees increased $4.6 million from first quarter 2023 mostly due to higher technology consulting and managed services, while technology, furniture and equipment expense decreased $4.0 million during the second quarter 2023 due, in part, to lower depreciation expense.

•Efficiency Ratio: Our efficiency ratio was 55.59 percent for the second quarter 2023 as compared to 53.79 percent and 50.78 percent for the first quarter 2023 and second quarter 2022, respectively. See the "Consolidated Financial Highlights" tables below for additional information regarding our non-GAAP measures.

•Performance Ratios: Annualized return on average assets (ROA), shareholders’ equity (ROE) and tangible ROE were 0.90 percent, 8.50 percent and 12.37 percent for the second quarter 2023, respectively. Annualized ROA, ROE, and tangible ROE, adjusted for non-core charges, were 0.95 percent, 8.99 percent and 13.09 percent for the second quarter 2023, respectively. See the "Consolidated Financial Highlights" tables below for additional information regarding our non-GAAP measures.

Ira Robbins, CEO commented, "In a challenging and competitive operating environment, Valley continues to exhibit strong and stable asset quality which has set us apart throughout our history. This strength is the product of significant granularity and diversity on both sides of the balance sheet. Further, our ability to service and support our premier clientele will drive our ongoing success in a volatile market."

Mr. Robbins continued, "We will continue to navigate the current impact of an inverted yield curve through a combination of thoughtful and methodical growth and diligent expense management. Our commitment to our local communities remains paramount, and we believe that a brighter future lies ahead for both Valley and the banking industry as a whole."

Valley National Bancorp (NASDAQ: VLY)

Second Quarter 2023 Earnings

July 27, 2023

Net Interest Income and Margin

Net interest income on a tax equivalent basis totaling $421.3 million for the second quarter 2023 decreased $16.2 million as compared to the first quarter 2023 and increased $1.7 million as compared to the second quarter 2022. The decrease as compared to the first quarter 2023 was mainly due to a $3.3 billion increase in average interest bearing liabilities and higher interest rates on most interest bearing deposit products and short-term borrowings, partially offset by higher loan yields. As a result, interest expense increased $83.5 million to $367.7 million for the second quarter 2023 as compared to the first quarter 2023. Interest income on a tax equivalent basis increased $67.3 million to $789.0 million in the second quarter 2023 as compared to the first quarter 2023. The increase was mostly due to higher yields on both new originations and adjustable rate loans in our portfolio and a $1.6 billion increase in average loan balances driven by organic new loan volumes and a continuation of slower loan prepayments.

Net interest margin on a tax equivalent basis of 2.94 percent for the second quarter 2023 decreased by 22 basis points and 49 basis points from 3.16 percent and 3.43 percent for the first quarter 2023 and the second quarter 2022, respectively. The decrease as compared to the first quarter 2023 was largely driven by higher interest rates on interest bearing deposits and short-term borrowings, partially offset by a 29 basis point increase in the yield on average interest earning assets. The yield on average loans increased by 30 basis points to 5.78 percent for the second quarter 2023 as compared to the first quarter 2023 largely due to higher interest rates on new originations and adjustable rate loans. The yields on average taxable and non-taxable investments also increased 13 basis points and 16 basis points, respectively, from the first quarter 2023 mostly due to investment maturities and prepayments redeployed into new higher yielding securities during the first half of 2023. Our cost of total average deposits increased to 2.45 percent for the second quarter 2023 from 1.96 percent and 0.19 percent for the first quarter 2023 and the second quarter 2022, respectively. The overall cost of average interest bearing liabilities also increased 57 basis points to 3.59 percent for the second quarter 2023 as compared to the first quarter 2023 primarily driven by the rising market interest rates on deposits during the first half of 2023.

Loans, Deposits and Other Borrowings

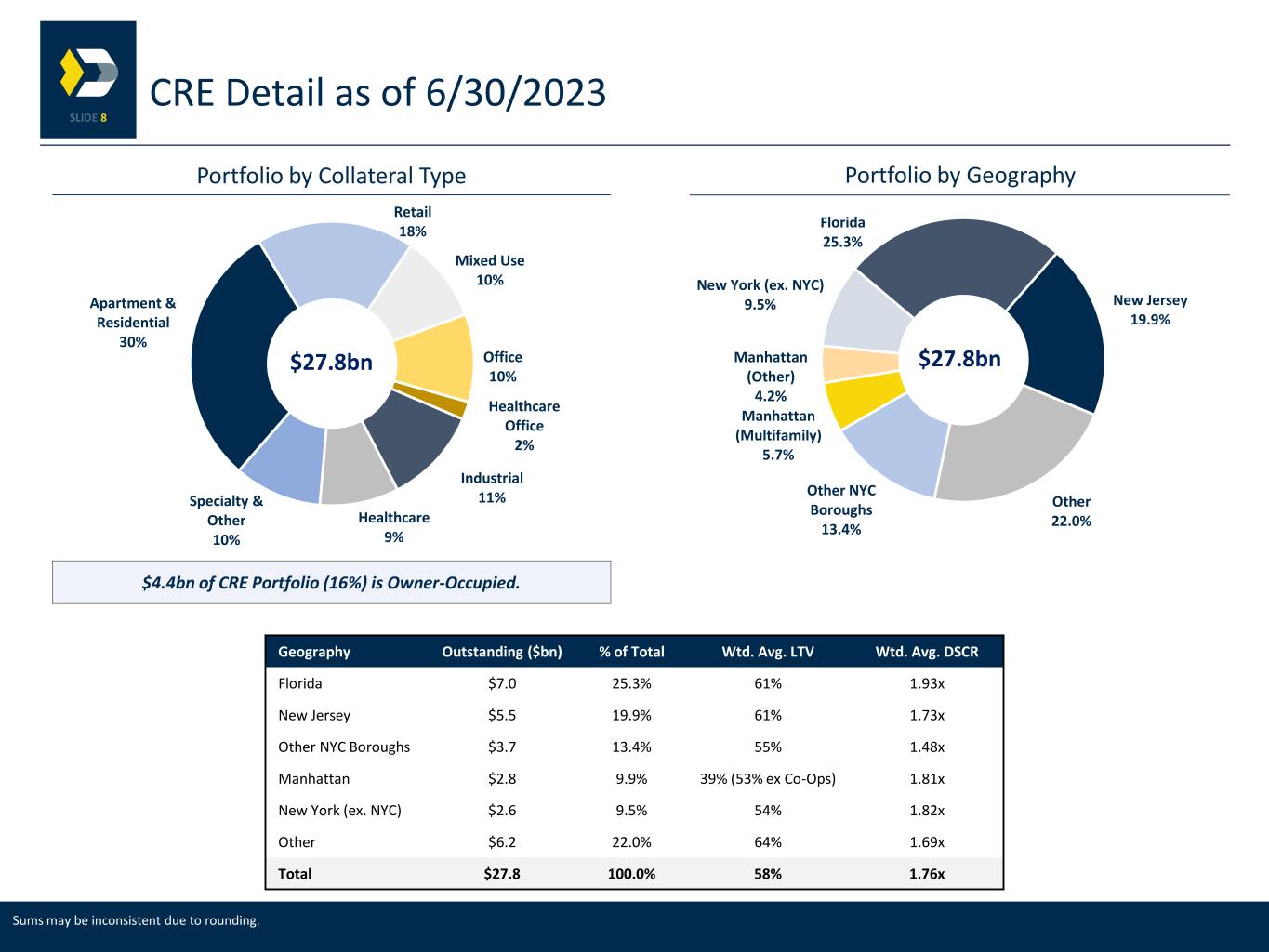

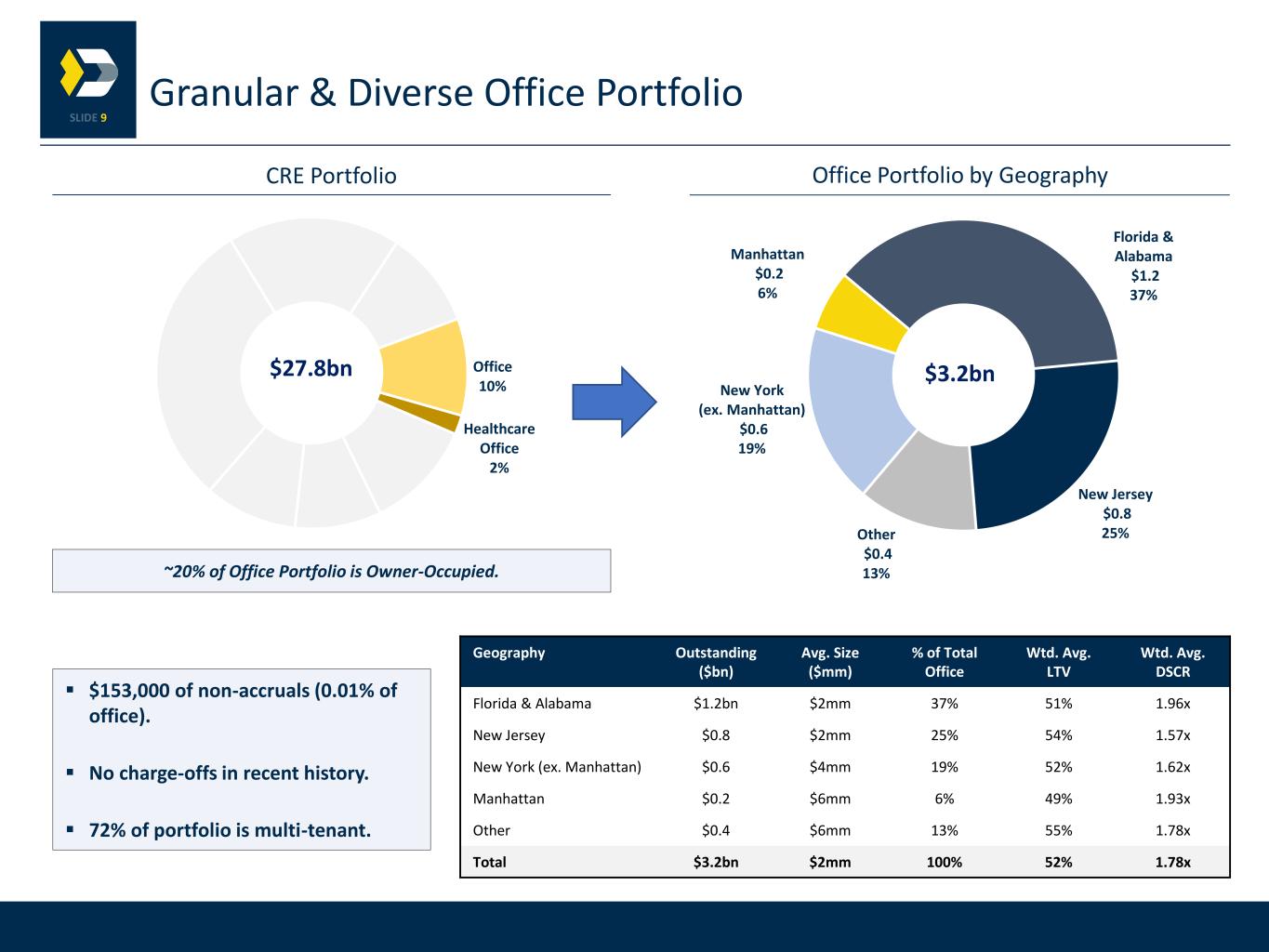

Loans. Loans increased $1.2 billion to approximately $49.9 billion at June 30, 2023 from March 31, 2023 mainly due to continued organic loan growth in commercial loan categories and low levels of prepayment activity during the second quarter 2023. Total commercial real estate (including construction) and commercial and industrial loans increased $831.8 million, or 10.8 percent, and $243.4 million, or 10.8 percent, respectively, on an annualized basis during the second quarter 2023. Residential mortgage loans increased $74.1 million during the second quarter 2023 as we largely originated new portfolio loans held for investment. During the second quarter 2023, we sold $44.5 million of residential mortgage loans as compared to $27.3 million in the first quarter 2023. Residential mortgage loans held for sale at fair value totaled $23.0 million and $17.2 million at June 30, 2023 and March 31, 2023, respectively. At June 30, 2023, loans held for sale also included one non-performing construction loan totaling $10.0 million, net of charge-offs, transferred from the loan portfolio during the second quarter 2023.

Valley National Bancorp (NASDAQ: VLY)

Second Quarter 2023 Earnings

July 27, 2023

Deposits. Total deposits increased $2.0 billion to $49.6 billion at June 30, 2023 from March 31, 2023 mainly due to a $3.8 billion increase in time deposits, partially offset by decreases in non-interest bearing deposits, and savings, NOW and money market deposits totaling $1.1 billion and $626.1 million, respectively. The increase in time deposits from March 31, 2023 was partially attributable to higher fully-insured indirect customer CD balances at June 30, 2023. Non-interest bearing deposits; savings, NOW and money market deposits; and time deposits represented approximately 25 percent, 45 percent and 30 percent of total deposits as of June 30, 2023, respectively, as compared to 29 percent, 48 percent and 23 percent of total deposits as of March 31, 2023, respectively.

Other Borrowings. Short-term borrowings decreased $5.3 billion to $1.1 billion at June 30, 2023 as compared to March 31, 2023 mainly due to maturities and repayment of FHLB advances. In March 2023, we increased our short-term borrowings to bolster our liquidity position out of an abundance of caution in the wake of the two bank failures and subsequently managed these balances to a lower level during the second quarter 2023, partially through the greater use of time deposits. We continue to closely monitor changes in the current banking environment and have substantial access to additional liquidity. Long-term borrowings totaled $2.4 billion at June 30, 2023 and remained relatively unchanged as compared to March 31, 2023.

Credit Quality

Non-Performing Assets (NPAs). Total NPAs, consisting of non-accrual loans, other real estate owned (OREO) and other repossessed assets, increased $11.2 million to $256.1 million at June 30, 2023 as compared to March 31, 2023 mostly driven by an increase in non-accrual loans. Non-accrual commercial real estate loans increased $14.8 million to $82.7 million at June 30, 2023 due, in part, to the migration of two loans totaling $10.2 million from the 30 to 59 days past due delinquency category at March 31, 2023 and one new $4.5 million non-performing loan at June 30, 2023. Non-accrual construction loans decreased $5.6 million to $63.0 million at June 30, 2023 from March 31, 2023 primarily due to the $4.2 million partial charge-off of one loan, which was transferred to loans held for sale at June 30, 2023. Non-accrual loans represented 0.51 percent of total loans at June 30, 2023 compared to 0.50 percent at March 31, 2023.

Accruing Past Due Loans. Total accruing past due loans (i.e., loans past due 30 days or more and still accruing interest) decreased $38.5 million to $61.8 million, or 0.12 percent of total loans, at June 30, 2023 as compared to $100.3 million, or 0.21 percent of total loans at March 31, 2023.

Loans 30 to 59 days past due decreased $20.9 million at June 30, 2023 as compared to March 31, 2023 due, in part, to the aforementioned commercial real estate loans totaling $10.2 million included in this delinquency category at March 31, 2023 that moved to non-accrual loans at June 30, 2023. Commercial and industrial loans 30 to 59 days past due decreased $14.5 million mainly due to improved performance during the second quarter 2023. Loans 60 to 89 days past due decreased $14.8 million to $12.9 million at June 30, 2023 as compared to March 31, 2023 largely due to a commercial and industrial loan relationship totaling $21.2 million included in this delinquency category at March 31, 2023 that became current with respect to its contractual payments at June 30, 2023. Loans 90 days or more past due and still accruing interest decreased $2.8 million to $15.0 million at June 30, 2023 as compared to March 31, 2023. All loans 90 days or more past due and still accruing interest are well-secured and in the process of collection.

Valley National Bancorp (NASDAQ: VLY)

Second Quarter 2023 Earnings

July 27, 2023

Allowance for Credit Losses for Loans and Unfunded Commitments. The following table summarizes the allocation of the allowance for credit losses to loan categories and the allocation as a percentage of each loan category at June 30, 2023, March 31, 2023 and June 30, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

| | | | Allocation | | | | Allocation | | | | Allocation |

| | | | as a % of | | | | as a % of | | | | as a % of |

| | Allowance | | Loan | | Allowance | | Loan | | Allowance | | Loan |

| Allocation | | Category | | Allocation | | Category | | Allocation | | Category |

| ($ in thousands) |

| Loan Category: | | | | | | | | | | | |

| Commercial and industrial loans | $ | 128,245 | | | 1.38 | % | | $ | 127,992 | | | 1.42 | % | | $ | 144,539 | | | 1.70 | % |

| Commercial real estate loans: | | | | | | | | | | | |

| Commercial real estate | 194,177 | | | 0.70 | | | 190,420 | | | 0.70 | | | 227,457 | | | 0.97 | |

| Construction | 45,518 | | | 1.19 | | | 52,912 | | | 1.42 | | | 49,770 | | | 1.47 | |

| Total commercial real estate loans | 239,695 | | | 0.76 | | | 243,332 | | | 0.79 | | | 277,227 | | | 1.03 | |

| Residential mortgage loans | 44,153 | | | 0.79 | | | 41,708 | | | 0.76 | | | 29,889 | | | 0.60 | |

| Consumer loans: | | | | | | | | | | | |

| Home equity | 4,020 | | | 0.75 | | | 4,417 | | | 0.86 | | | 3,907 | | | 0.91 | |

| Auto and other consumer | 20,319 | | | 0.70 | | | 19,449 | | | 0.69 | | | 13,257 | | | 0.49 | |

| Total consumer loans | 24,339 | | | 0.71 | | | 23,866 | | | 0.71 | | | 17,164 | | | 0.55 | |

| | | | | | | | | | | |

| Allowance for loan losses | 436,432 | | | 0.88 | | | 436,898 | | | 0.90 | | | 468,819 | | | 1.08 | |

| Allowance for unfunded credit commitments | 22,244 | | | | | 24,071 | | | | | 22,144 | | | |

| Total allowance for credit losses for loans | $ | 458,676 | | | | | $ | 460,969 | | | | | $ | 490,963 | | | |

| Allowance for credit losses for loans as a % total loans | | | 0.92 | % | | | | 0.95 | % | | | | 1.13 | % |

Our loan portfolio, totaling $49.9 billion at June 30, 2023, had net loan charge-offs totaling $8.6 million for the second quarter 2023 as compared to $30.4 million and $2.3 million for the first quarter 2023 and the second quarter 2022, respectively. Gross charge-offs totaled $11.3 million for the second quarter 2023 and included the $4.2 million partial charge-off related to the valuation of a non-performing construction loan transferred from the held for investment loan portfolio to loans held for sale at June 30, 2023. This construction loan had specific reserves of $5.2 million within the allowance for loan losses at March 31, 2023 and, as a result, the partial charge-off was fully reserved for prior to the second quarter 2023.

The allowance for credit losses for loans, comprised of our allowance for loan losses and unfunded credit commitments, as a percentage of total loans was 0.92 percent at June 30, 2023 as compared to 0.95 percent and 1.13 percent at March 31, 2023 and June 30, 2022, respectively. During the second quarter 2023, the provision for credit losses for loans totaled $6.3 million as compared to $9.5 million and $43.7 million for the first quarter 2023 and second quarter 2022, respectively. At June 30, 2023, our allowance for credit losses for loans as a percentage of total loans decreased as compared to March 31, 2023 as higher economic forecast reserves driven by a more pessimistic Moody's Baseline

Valley National Bancorp (NASDAQ: VLY)

Second Quarter 2023 Earnings

July 27, 2023

outlook was more than offset by lower non-economic qualitative reserves for commercial loans. The net impact of other changes in quantitative reserves for each loan category was not significant to the total allowance for loan losses at June 30, 2023.

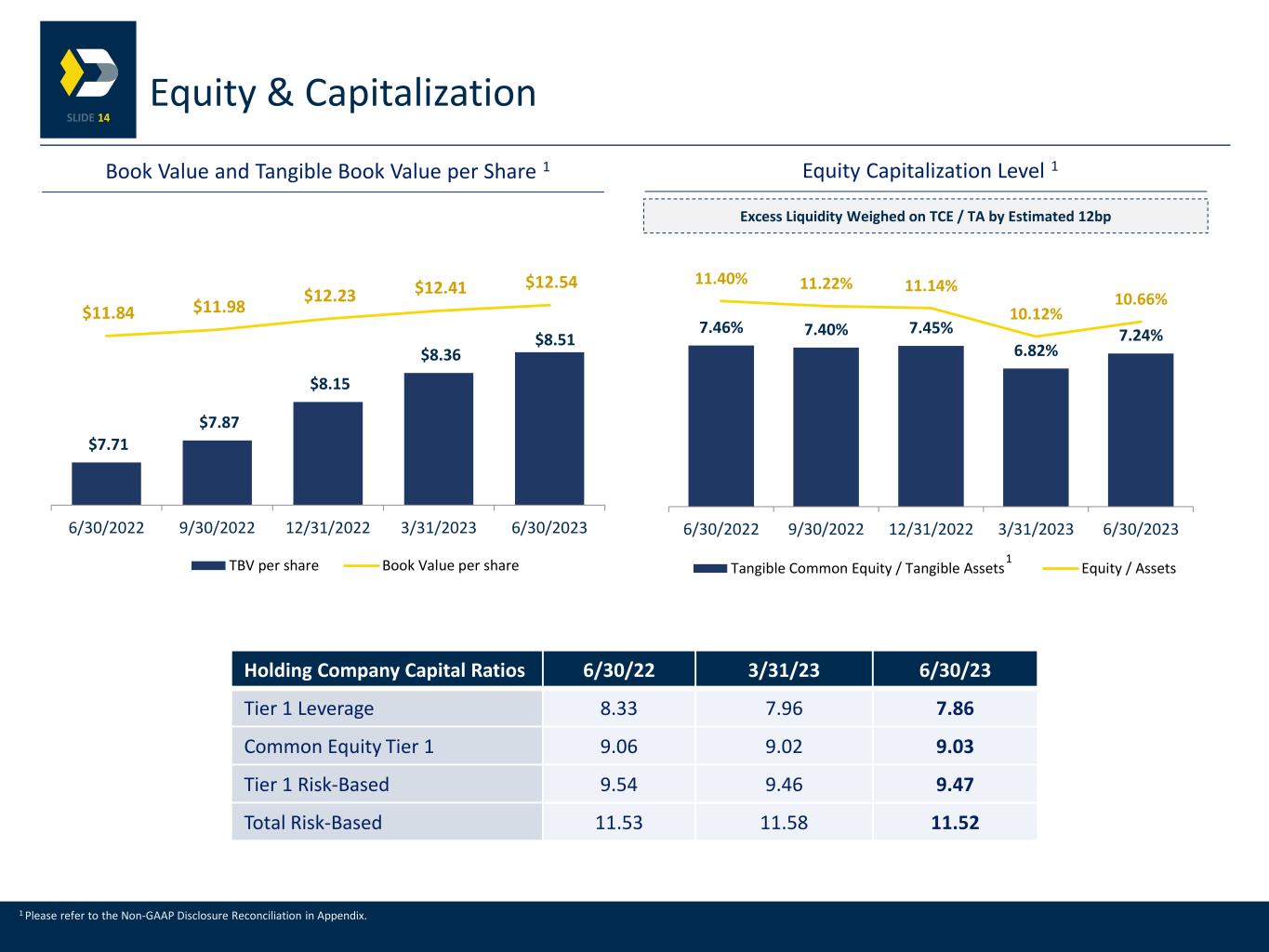

Capital Adequacy

Valley's total risk-based capital, common equity Tier 1 capital, Tier 1 capital and Tier 1 leverage capital ratios were 11.52 percent, 9.03 percent, 9.47 percent and 7.86 percent, respectively, at June 30, 2023.

Investor Conference Call

Valley will host a conference call with investors and the financial community at 11:00 AM Eastern Daylight Savings Time, today to discuss the second quarter 2023 earnings and related matters. Interested parties should preregister using this link: https://register.vevent.com to receive the dial-in number and a personal PIN, which are required to access the conference call. The teleconference will also be webcast live: https://edge.media-server.com and archived on Valley’s website through Monday, August 28, 2023.

About Valley

As the principal subsidiary of Valley National Bancorp, Valley National Bank is a regional bank with nearly $62 billion in assets. Valley is committed to giving people and businesses the power to succeed. Valley operates many convenient branch locations and commercial banking offices across New Jersey, New York, Florida, Alabama, California, and Illinois, and is committed to providing the most convenient service, the latest innovations and an experienced and knowledgeable team dedicated to meeting customer needs. Helping communities grow and prosper is the heart of Valley’s corporate citizenship philosophy. To learn more about Valley, go to www.valley.com or call our Customer Care Center at 800-522-4100.

Forward Looking Statements

The foregoing contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not historical facts and include expressions about management’s confidence and strategies and management’s expectations about our business, new and existing programs and products, acquisitions, relationships, opportunities, taxation, technology, market conditions and economic expectations. These statements may be identified by such forward-looking terminology as “intend,” “should,” “expect,” “believe,” “view,” “opportunity,” “allow,” “continues,” “reflects,” “would,” “could,” “typically,” “usually,” “anticipate,” “may,” “estimate,” “outlook,” “project,” or similar statements or variations of such terms. Such forward-looking statements involve certain risks and uncertainties. Actual results may differ materially from such forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, but are not limited to:

•the impact of Federal Reserve actions affecting the level of market interest rates and increases in business failures, specifically among our clients, as well as on our business, our employees and our ability to provide services to our customers;

Valley National Bancorp (NASDAQ: VLY)

Second Quarter 2023 Earnings

July 27, 2023

•the impact of recent and possible future bank failures on the business environment in which we operate and resulting market volatility and reduced confidence in depository institutions, including impact on stock price, customer deposit withdrawals from Valley National Bank, or business disruptions or liquidity issues that have or may affect our customers;

•the impact of unfavorable macroeconomic conditions or downturns, instability or volatility in financial markets, unanticipated loan delinquencies, loss of collateral, decreased service revenues, and other potential negative effects on our business caused by and factors outside of our control, such as geopolitical instabilities or events; natural and other disasters (including severe weather events) and health emergencies, acts of terrorism or other external events;

•risks associated with our acquisition of Bank Leumi Le-Israel Corporation (Bank Leumi USA), including (i) the inability to realize expected cost savings and synergies from the acquisition in the amounts or timeframe anticipated and (ii) greater than expected costs or difficulties relating to integration matters;

•the loss of or decrease in lower-cost funding sources within our deposit base;

•the need to supplement debt or equity capital to maintain or exceed internal capital thresholds;

•the inability to attract new customer deposits to keep pace with loan growth strategies;

•a material change in our allowance for credit losses under CECL due to forecasted economic conditions and/or unexpected credit deterioration in our loan and investment portfolios;

•greater than expected technology related costs due to, among other factors, prolonged or failed implementations, additional project staffing and obsolescence caused by continuous and rapid market innovations;

•the risks related to the replacement of the London Interbank Offered Rate with Secured Overnight Financing Rate and other reference rates, including increased expenses, risk of litigation and the effectiveness of hedging strategies;

•cyber-attacks, ransomware attacks, computer viruses or other malware that may breach the security of our websites or other systems to obtain unauthorized access to confidential information, destroy data, disable or degrade service, or sabotage our systems;

•damage verdicts or settlements or restrictions related to existing or potential class action litigation or individual litigation arising from claims of violations of laws or regulations, contractual claims, breach of fiduciary responsibility, negligence, fraud, environmental laws, patent or trademark infringement, employment related claims, and other matters;

•changes to laws and regulations, including changes affecting oversight of the financial services industry; changes in the enforcement and interpretation of such laws and regulations; and changes in accounting and reporting standards;

•higher or lower than expected income tax expense or tax rates, including increases or decreases resulting from changes in uncertain tax position liabilities, tax laws, regulations and case law;

•results of examinations by the Office of the Comptroller of the Currency (OCC), the Federal Reserve Bank (FRB), the Consumer Financial Protection Bureau (CFPB) and other regulatory authorities, including the possibility that any such regulatory authority may, among other things, require us to increase our allowance for credit losses, write-down assets, reimburse customers, change the way we do business, or limit or eliminate certain other banking activities;

Valley National Bancorp (NASDAQ: VLY)

Second Quarter 2023 Earnings

July 27, 2023

•our inability or determination not to pay dividends at current levels, or at all, because of inadequate earnings, regulatory restrictions or limitations, changes in our capital requirements or a decision to increase capital by retaining more earnings;

•a prolonged downturn in the economy, mainly in New Jersey, New York, Florida, Alabama, California, and Illinois, as well as an unexpected decline in commercial real estate values within our market areas; and

•unexpected significant declines in the loan portfolio due to the lack of economic expansion, increased competition, large prepayments, changes in regulatory lending guidance or other factors.

A detailed discussion of factors that could affect our results is included in our SEC filings, including the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2022 and in Item 1A of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023.

We undertake no duty to update any forward-looking statement to conform the statement to actual results or changes in our expectations. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

# # #

-Tables to Follow-

VALLEY NATIONAL BANCORP

CONSOLIDATED FINANCIAL HIGHLIGHTS

SELECTED FINANCIAL DATA

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | March 31, | | June 30, | | June 30, |

| ($ in thousands, except for share data and stock price) | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| FINANCIAL DATA: | | | | | | | | | |

Net interest income - FTE (1) | $ | 421,275 | | | $ | 437,458 | | | $ | 419,565 | | | $ | 858,733 | | | $ | 737,927 | |

| Net interest income | $ | 419,765 | | | $ | 436,020 | | | $ | 418,160 | | | $ | 855,785 | | | $ | 735,829 | |

| Non-interest income | 60,075 | | | 54,299 | | | 58,533 | | | 114,374 | | | 97,803 | |

| Total revenue | 479,840 | | | 490,319 | | | 476,693 | | | 970,159 | | | 833,632 | |

| Non-interest expense | 282,971 | | | 272,166 | | | 299,730 | | | 555,137 | | | 497,070 | |

| Pre-provision net revenue | 196,869 | | | 218,153 | | | 176,963 | | | 415,022 | | | 336,562 | |

| Provision for credit losses | 6,050 | | | 14,437 | | | 43,998 | | | 20,487 | | | 47,555 | |

| Income tax expense | 51,759 | | | 57,165 | | | 36,552 | | | 108,924 | | | 75,866 | |

| Net income | 139,060 | | | 146,551 | | | 96,413 | | | 285,611 | | | 213,141 | |

| Dividends on preferred stock | 4,030 | | | 3,874 | | | 3,172 | | | 7,904 | | | 6,344 | |

| Net income available to common shareholders | $ | 135,030 | | | $ | 142,677 | | | $ | 93,241 | | | $ | 277,707 | | | $ | 206,797 | |

| Weighted average number of common shares outstanding: | | | | | | | | | |

| Basic | 507,690,043 | | | 507,111,295 | | | 506,302,464 | | | 507,402,268 | | | 464,172,210 | |

| Diluted | 508,643,025 | | | 509,656,430 | | | 508,479,206 | | | 509,076,303 | | | 466,320,683 | |

| Per common share data: | | | | | | | | | |

| Basic earnings | $ | 0.27 | | | $ | 0.28 | | | $ | 0.18 | | | $ | 0.55 | | | $ | 0.45 | |

| Diluted earnings | 0.27 | | | 0.28 | | | 0.18 | | | 0.55 | | | 0.44 | |

| Cash dividends declared | 0.11 | | | 0.11 | | | 0.11 | | | 0.22 | | | 0.22 | |

| Closing stock price - high | 9.38 | | | 12.59 | | | 13.04 | | | 12.59 | | | 15.02 | |

| Closing stock price - low | 6.59 | | | 9.06 | | | 10.34 | | | 6.59 | | | 10.34 | |

| FINANCIAL RATIOS: | | | | | | | | | |

| Net interest margin | 2.93 | % | | 3.15 | % | | 3.42 | % | | 3.04 | % | | 3.30 | % |

Net interest margin - FTE (1) | 2.94 | | | 3.16 | | | 3.43 | | | 3.05 | | | 3.31 | |

| Annualized return on average assets | 0.90 | | | 0.98 | | | 0.72 | | | 0.94 | | | 0.88 | |

| Annualized return on avg. shareholders' equity | 8.50 | | | 9.10 | | | 6.18 | | | 8.80 | | | 7.51 | |

NON-GAAP FINANCIAL DATA AND RATIOS: (3) | | | | | | | | | |

| Basic earnings per share, as adjusted | $ | 0.28 | | | $ | 0.30 | | | $ | 0.32 | | | $ | 0.58 | | | $ | 0.60 | |

| Diluted earnings per share, as adjusted | 0.28 | | | 0.30 | | | 0.32 | | | 0.58 | | | 0.60 | |

| Annualized return on average assets, as adjusted | 0.95 | % | | 1.03 | % | | 1.25 | % | | 0.99 | % | | 1.18 | % |

| Annualized return on average shareholders' equity, as adjusted | 8.99 | | | 9.60 | | | 10.63 | | | 9.29 | | | 10.09 | |

| Annualized return on avg. tangible shareholders' equity | 12.37 | % | | 13.39 | % | | 9.33 | % | | 12.87 | % | | 11.07 | % |

| Annualized return on average tangible shareholders' equity, as adjusted | 13.09 | | | 14.12 | | | 16.05 | | | 13.59 | | | 14.87 | |

| Efficiency ratio | 55.59 | | | 53.79 | | | 50.78 | | | 54.69 | | | 51.81 | |

| | | |

| | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| AVERAGE BALANCE SHEET ITEMS: | | | | | | | | | |

| Assets | $ | 61,877,464 | | $ | 59,867,002 | | $ | 53,211,422 | | $ | 60,877,792 | | $ | 48,417,469 |

| Interest earning assets | 57,351,808 | | 55,362,790 | | 48,891,230 | | 56,362,794 | | 44,609,968 |

| Loans | 49,457,937 | | 47,859,371 | | 42,517,287 | | 48,663,070 | | 38,592,151 |

| Interest bearing liabilities | 40,925,791 | | 37,618,750 | | 29,694,271 | | 39,281,405 | | 27,930,890 |

| Deposits | 47,464,469 | | 47,152,919 | | 42,896,381 | | 47,309,554 | | 39,349,737 |

| Shareholders' equity | 6,546,452 | | 6,440,215 | | 6,238,985 | | 6,493,627 | | 5,673,014 |

VALLEY NATIONAL BANCORP

CONSOLIDATED FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As Of |

| BALANCE SHEET ITEMS: | June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| (In thousands) | 2023 | | 2023 | | 2022 | | 2022 | | 2022 |

| Assets | $ | 61,703,693 | | $ | 64,309,573 | | $ | 57,462,749 | | $ | 55,927,501 | | $ | 54,438,807 |

| Total loans | 49,877,248 | | 48,659,966 | | 46,917,200 | | 45,185,764 | | 43,560,777 |

| Deposits | 49,619,815 | | 47,590,916 | | 47,636,914 | | 45,308,843 | | 43,881,051 |

| Shareholders' equity | 6,575,184 | | 6,511,581 | | 6,400,802 | | 6,273,829 | | 6,204,913 |

| | | | | | | | | |

| LOANS: | | | | | | | | | |

| (In thousands) | | | | | | | | | |

| Commercial and industrial loans: | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Commercial and industrial | $ | 9,287,309 | | $ | 9,043,946 | | $ | 8,804,830 | | $ | 8,701,377 | | $ | 8,514,458 |

| Commercial real estate: | | | | | | | | | |

| Commercial real estate | 27,793,072 | | 27,051,111 | | 25,732,033 | | 24,493,445 | | 23,535,086 |

| Construction | 3,815,761 | | 3,725,967 | | 3,700,835 | | 3,571,818 | | 3,374,373 |

| Total commercial real estate | 31,608,833 | | 30,777,078 | | 29,432,868 | | 28,065,263 | | 26,909,459 |

| Residential mortgage | 5,560,356 | | 5,486,280 | | 5,364,550 | | 5,177,128 | | 5,005,069 |

| Consumer: | | | | | | | | | |

| Home equity | 535,493 | | 516,592 | | 503,884 | | 467,135 | | 431,455 |

| Automobile | 1,632,875 | | 1,717,141 | | 1,746,225 | | 1,711,086 | | 1,673,482 |

| Other consumer | 1,252,382 | | 1,118,929 | | 1,064,843 | | 1,063,775 | | 1,026,854 |

| Total consumer loans | 3,420,750 | | 3,352,662 | | 3,314,952 | | 3,241,996 | | 3,131,791 |

| Total loans | $ | 49,877,248 | | $ | 48,659,966 | | $ | 46,917,200 | | $ | 45,185,764 | | $ | 43,560,777 |

| | | | | | | | | |

| CAPITAL RATIOS: | | | | | | | | | |

| Book value per common share | $ | 12.54 | | | $ | 12.41 | | | $ | 12.23 | | | $ | 11.98 | | | $ | 11.84 | |

Tangible book value per common share (3) | 8.51 | | | 8.36 | | | 8.15 | | | 7.87 | | | 7.71 | |

Tangible common equity to tangible assets (3) | 7.24 | % | | 6.82 | % | | 7.45 | % | | 7.40 | % | | 7.46 | % |

| Tier 1 leverage capital | 7.86 | | | 7.96 | | | 8.23 | | | 8.31 | | | 8.33 | |

| Common equity tier 1 capital | 9.03 | | | 9.02 | | | 9.01 | | | 9.09 | | | 9.06 | |

| Tier 1 risk-based capital | 9.47 | | | 9.46 | | | 9.46 | | | 9.56 | | | 9.54 | |

| Total risk-based capital | 11.52 | | | 11.58 | | | 11.63 | | | 11.84 | | | 11.53 | |

VALLEY NATIONAL BANCORP

CONSOLIDATED FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

ALLOWANCE FOR CREDIT LOSSES: | June 30, | | March 31, | | June 30, | | June 30, |

| ($ in thousands) | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| Allowance for credit losses for loans | | | | | | | | | |

| Beginning balance | $ | 460,969 | | $ | 483,255 | | $ | 379,252 | | $ | 483,255 | | $ | 375,702 |

| Impact of the adoption of ASU No. 2022-02 | — | | (1,368) | | — | | (1,368) | | — |

Allowance for purchased credit deteriorated (PCD) loans, net (2) | — | | — | | 70,319 | | — | | 70,319 |

| Beginning balance, adjusted | 460,969 | | 481,887 | | 449,571 | | 481,887 | | 446,021 |

| Loans charged-off: | | | | | | | | | |

| Commercial and industrial | (3,865) | | (26,047) | | (4,540) | | (29,912) | | (6,111) |

| Commercial real estate | (2,065) | | — | | — | | (2,065) | | (173) |

| Construction | (4,208) | | (5,698) | | — | | (9,906) | | — |

| Residential mortgage | (149) | | — | | (1) | | (149) | | (27) |

| Total consumer | (1,040) | | (828) | | (726) | | (1,868) | | (1,551) |

| Total loans charged-off | (11,327) | | (32,573) | | (5,267) | | (43,900) | | (7,862) |

| Charged-off loans recovered: | | | | | | | | | |

| Commercial and industrial | 2,173 | | 1,399 | | 1,952 | | 3,572 | | 2,776 |

| Commercial real estate | 4 | | 24 | | 224 | | 28 | | 331 |

| | | | | | | | | |

| Residential mortgage | 135 | | 21 | | 74 | | 156 | | 531 |

| Total consumer | 390 | | 761 | | 697 | | 1,151 | | 1,954 |

| Total loans recovered | 2,702 | | 2,205 | | 2,947 | | 4,907 | | 5,592 |

| Total net charge-offs | (8,625) | | (30,368) | | (2,320) | | (38,993) | | (2,270) |

| Provision for credit losses for loans | 6,332 | | 9,450 | | 43,712 | | 15,782 | | 47,212 |

| Ending balance | $ | 458,676 | | $ | 460,969 | | $ | 490,963 | | $ | 458,676 | | $ | 490,963 |

Components of allowance for credit losses for loans: | | | | | | | | | |

| Allowance for loan losses | $ | 436,432 | | $ | 436,898 | | $ | 468,819 | | $ | 436,432 | | $ | 468,819 |

| Allowance for unfunded credit commitments | 22,244 | | 24,071 | | 22,144 | | 22,244 | | 22,144 |

| Allowance for credit losses for loans | $ | 458,676 | | $ | 460,969 | | $ | 490,963 | | $ | 458,676 | | $ | 490,963 |

Components of provision for credit losses for loans: | | | | | | | | | |

| Provision for credit losses for loans | $ | 8,159 | | $ | 9,979 | | $ | 38,310 | | $ | 18,138 | | $ | 41,568 |

| (Credit) provision for unfunded credit commitments | (1,827) | | (529) | | 5,402 | | (2,356) | | 5,644 |

| Total provision for credit losses for loans | $ | 6,332 | | $ | 9,450 | | $ | 43,712 | | $ | 15,782 | | $ | 47,212 |

| Annualized ratio of total net charge-offs to total average loans | 0.07 | % | | 0.25 | % | | 0.02 | % | | 0.16 | % | | 0.01 | % |

Allowance for credit losses for loans as a % of total loans | 0.92 | % | | 0.95 | % | | 1.13 | % | | 0.92 | | | 1.13 | |

VALLEY NATIONAL BANCORP

CONSOLIDATED FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of |

| ASSET QUALITY: | June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| ($ in thousands) | 2023 | | 2023 | | 2022 | | 2022 | | 2022 |

| Accruing past due loans: | | | | | | | | | |

| 30 to 59 days past due: | | | | | | | | | |

| Commercial and industrial | $ | 6,229 | | | $ | 20,716 | | | $ | 11,664 | | | $ | 19,526 | | | $ | 7,143 | |

| Commercial real estate | 3,612 | | | 13,580 | | | 6,638 | | | 6,196 | | | 10,516 | |

| Construction | — | | | — | | | — | | | — | | | 9,108 | |

| Residential mortgage | 15,565 | | | 12,599 | | | 16,146 | | | 13,045 | | | 12,326 | |

| Total consumer | 8,431 | | | 7,845 | | | 9,087 | | | 6,196 | | | 6,009 | |

| Total 30 to 59 days past due | 33,837 | | | 54,740 | | | 43,535 | | | 44,963 | | | 45,102 | |

| 60 to 89 days past due: | | | | | | | | | |

| Commercial and industrial | 7,468 | | | 24,118 | | | 12,705 | | | 2,188 | | | 3,870 | |

| Commercial real estate | — | | | — | | | 3,167 | | | 383 | | | 630 | |

| Construction | — | | | — | | | — | | | 12,969 | | | 3,862 | |

| Residential mortgage | 1,348 | | | 2,133 | | | 3,315 | | | 5,947 | | | 2,410 | |

| Total consumer | 4,126 | | | 1,519 | | | 1,579 | | | 1,174 | | | 702 | |

| Total 60 to 89 days past due | 12,942 | | | 27,770 | | | 20,766 | | | 22,661 | | | 11,474 | |

| 90 or more days past due: | | | | | | | | | |

| Commercial and industrial | 6,599 | | | 8,927 | | | 18,392 | | | 15,072 | | | 15,470 | |

| Commercial real estate | 2,242 | | | — | | | 2,292 | | | 15,082 | | | — | |

| Construction | 3,990 | | | 6,450 | | | 3,990 | | | — | | | — | |

| Residential mortgage | 1,165 | | | 1,668 | | | 1,866 | | | 550 | | | 1,188 | |

| Total consumer | 1,006 | | | 747 | | | 47 | | | 421 | | | 267 | |

| Total 90 or more days past due | 15,002 | | | 17,792 | | | 26,587 | | | 31,125 | | | 16,925 | |

| Total accruing past due loans | $ | 61,781 | | | $ | 100,302 | | | $ | 90,888 | | | $ | 98,749 | | | $ | 73,501 | |

| Non-accrual loans: | | | | | | | | | |

| Commercial and industrial | $ | 84,449 | | | $ | 78,606 | | | $ | 98,881 | | | $ | 135,187 | | | $ | 148,404 | |

| Commercial real estate | 82,712 | | | 67,938 | | | 68,316 | | | 67,319 | | | 85,807 | |

| Construction | 63,043 | | | 68,649 | | | 74,230 | | | 61,098 | | | 49,780 | |

| Residential mortgage | 20,819 | | | 23,483 | | | 25,160 | | | 26,564 | | | 25,847 | |

| Total consumer | 3,068 | | | 3,318 | | | 3,174 | | | 3,227 | | | 3,279 | |

| Total non-accrual loans | 254,091 | | | 241,994 | | | 269,761 | | | 293,395 | | | 313,117 | |

| Other real estate owned (OREO) | 824 | | | 1,189 | | | 286 | | | 286 | | | 422 | |

| Other repossessed assets | 1,230 | | | 1,752 | | | 1,937 | | | 1,122 | | | 1,200 | |

| | | | | | | | | |

| Total non-performing assets | $ | 256,145 | | | $ | 244,935 | | | $ | 271,984 | | | $ | 294,803 | | | $ | 314,739 | |

| Total non-accrual loans as a % of loans | 0.51 | % | | 0.50 | % | | 0.57 | % | | 0.65 | % | | 0.72 | % |

Total accruing past due and non-accrual loans as a % of loans | 0.63 | | | 0.70 | | | 0.77 | | | 0.87 | | | 0.89 | |

Allowance for losses on loans as a % of non-accrual loans | 171.76 | | | 180.54 | | | 170.02 | | | 162.15 | | | 149.73 | |

VALLEY NATIONAL BANCORP

CONSOLIDATED FINANCIAL HIGHLIGHTS

NOTES TO SELECTED FINANCIAL DATA

| | | | | |

(1) | Net interest income and net interest margin are presented on a tax equivalent basis using a 21 percent federal tax rate. Valley believes that this presentation provides comparability of net interest income and net interest margin arising from both taxable and tax-exempt sources and is consistent with industry practice and SEC rules. |

| (2) | Represents the allowance for acquired PCD loans, net of PCD loan charge-offs totaling $62.4 million in the second quarter 2022. |

| (3) | Non-GAAP Reconciliations. This press release contains certain supplemental financial information, described in the Notes below, which has been determined by methods other than U.S. Generally Accepted Accounting Principles ("GAAP") that management uses in its analysis of Valley's performance. The Company believes that the non-GAAP financial measures provide useful supplemental information to both management and investors in understanding Valley’s underlying operational performance, business and performance trends, and may facilitate comparisons of our current and prior performance with the performance of others in the financial services industry. Management utilizes these measures for internal planning, forecasting and analysis purposes. Management believes that Valley’s presentation and discussion of this supplemental information, together with the accompanying reconciliations to the GAAP financial measures, also allows investors to view performance in a manner similar to management. These non-GAAP financial measures should not be considered in isolation or as a substitute for or superior to financial measures calculated in accordance with U.S. GAAP. These non-GAAP financial measures may also be calculated differently from similar measures disclosed by other companies. |

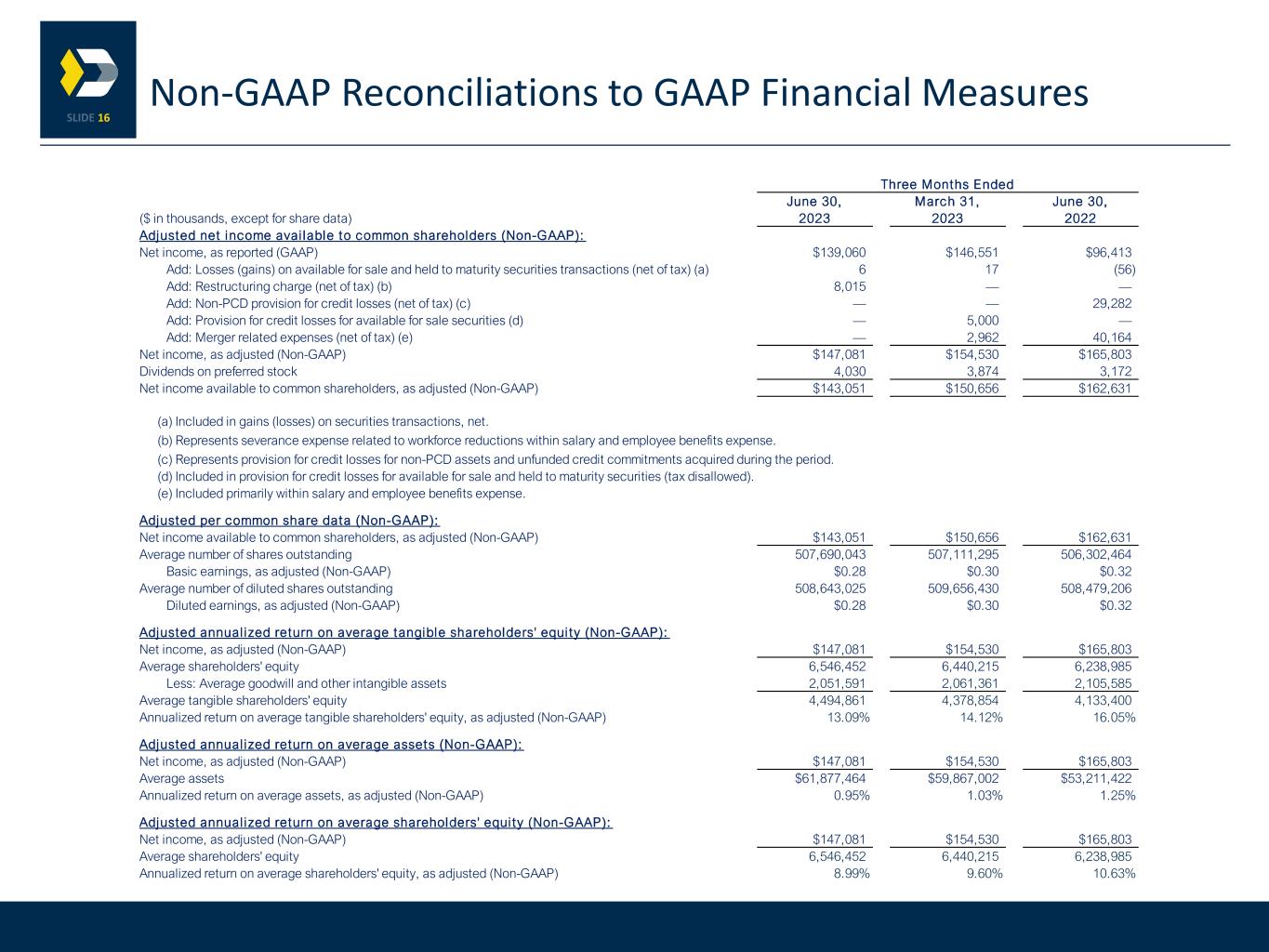

Non-GAAP Reconciliations to GAAP Financial Measures | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | March 31, | | June 30, | | June 30, |

| ($ in thousands, except for share data) | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| Adjusted net income available to common shareholders (non-GAAP): | | | | | | | | | |

| Net income, as reported (GAAP) | $ | 139,060 | | | $ | 146,551 | | | $ | 96,413 | | | $ | 285,611 | | | $ | 213,141 | |

| | | | | | | | | |

Add: Losses (gains) on available for sale and held to maturity securities transactions (net of tax)(a) | 6 | | | 17 | | | (56) | | | 23 | | | (50) | |

Add: Restructuring charge (net of tax)(b) | 8,015 | | | — | | | — | | | 8,015 | | | — | |

Add: Provision for credit losses for available for sale securities (c) | — | | | 5,000 | | | — | | | 5,000 | | | — | |

Add: Non-PCD provision for credit losses (net of tax)(d) | — | | | — | | | 29,282 | | | — | | | 29,282 | |

Add: Merger related expenses (net of tax)(e) | — | | | 2,962 | | | 40,164 | | | 2,962 | | | 43,743 | |

| | | | | | | | | |

| | | | | | | | | |

| Net income, as adjusted (non-GAAP) | $ | 147,081 | | | $ | 154,530 | | | $ | 165,803 | | | $ | 301,611 | | | $ | 286,116 | |

| Dividends on preferred stock | 4,030 | | | 3,874 | | | 3,172 | | | 7,904 | | | 6,344 | |

| Net income available to common shareholders, as adjusted (non-GAAP) | $ | 143,051 | | | $ | 150,656 | | | $ | 162,631 | | | $ | 293,707 | | | $ | 279,772 | |

| __________ | | | | | | | | | |

| (a) Included in gains (losses) on securities transactions, net. |

| (b) Represents severance expense related to workforce reductions within salary and employee benefits expense. |

| (c) Included in provision for credit losses for available for sale and held to maturity securities (tax disallowed). |

(d) Represents provision for credit losses for non-PCD assets and unfunded credit commitments acquired during the period. |

| (e) Included primarily within salary and employee benefits expense. |

|

| | | | | | | | | |

| Adjusted per common share data (non-GAAP): | | | | | | | | | |

| Net income available to common shareholders, as adjusted (non-GAAP) | $ | 143,051 | | | $ | 150,656 | | | $ | 162,631 | | | $ | 293,707 | | | $ | 279,772 | |

| Average number of shares outstanding | 507,690,043 | | | 507,111,295 | | | 506,302,464 | | | 507,402,268 | | | 464,172,210 | |

| Basic earnings, as adjusted (non-GAAP) | $ | 0.28 | | | $ | 0.30 | | | $ | 0.32 | | | $ | 0.58 | | | $ | 0.60 | |

| Average number of diluted shares outstanding | 508,643,025 | | | 509,656,430 | | | 508,479,206 | | | 509,076,303 | | | 466,320,683 | |

| Diluted earnings, as adjusted (non-GAAP) | $ | 0.28 | | | $ | 0.30 | | | $ | 0.32 | | | $ | 0.58 | | | $ | 0.60 | |

| Adjusted annualized return on average tangible shareholders' equity (non-GAAP): | | | | | | | | | |

| Net income, as adjusted (non-GAAP) | $ | 147,081 | | | $ | 154,530 | | | $ | 165,803 | | | $ | 301,611 | | | $ | 286,116 | |

| Average shareholders' equity | $ | 6,546,452 | | | $ | 6,440,215 | | | $ | 6,238,985 | | | 6,493,627 | | | 5,673,014 | |

| Less: Average goodwill and other intangible assets | 2,051,591 | | | 2,061,361 | | | 2,105,585 | | | 2,056,487 | | | 1,823,538 | |

| Average tangible shareholders' equity | $ | 4,494,861 | | | $ | 4,378,854 | | | $ | 4,133,400 | | | $ | 4,437,140 | | | $ | 3,849,476 | |

| Annualized return on average tangible shareholders' equity, as adjusted (non-GAAP) | 13.09 | % | | 14.12 | % | | 16.05 | % | | 13.59 | % | | 14.87 | % |

| Adjusted annualized return on average assets (non-GAAP): | | | | | | | | | |

| Net income, as adjusted (non-GAAP) | $ | 147,081 | | | $ | 154,530 | | | $ | 165,803 | | | $ | 301,611 | | | $ | 286,116 | |

| Average assets | $ | 61,877,464 | | | $ | 59,867,002 | | | $ | 53,211,422 | | | $ | 60,877,792 | | | $ | 48,417,469 | |

| Annualized return on average assets, as adjusted (non-GAAP) | 0.95 | % | | 1.03 | % | | 1.25 | % | | 0.99 | % | | 1.18 | % |

VALLEY NATIONAL BANCORP

CONSOLIDATED FINANCIAL HIGHLIGHTS

Non-GAAP Reconciliations to GAAP Financial Measures (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | March 31, | | June 30, | | June 30, |

| ($ in thousands) | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

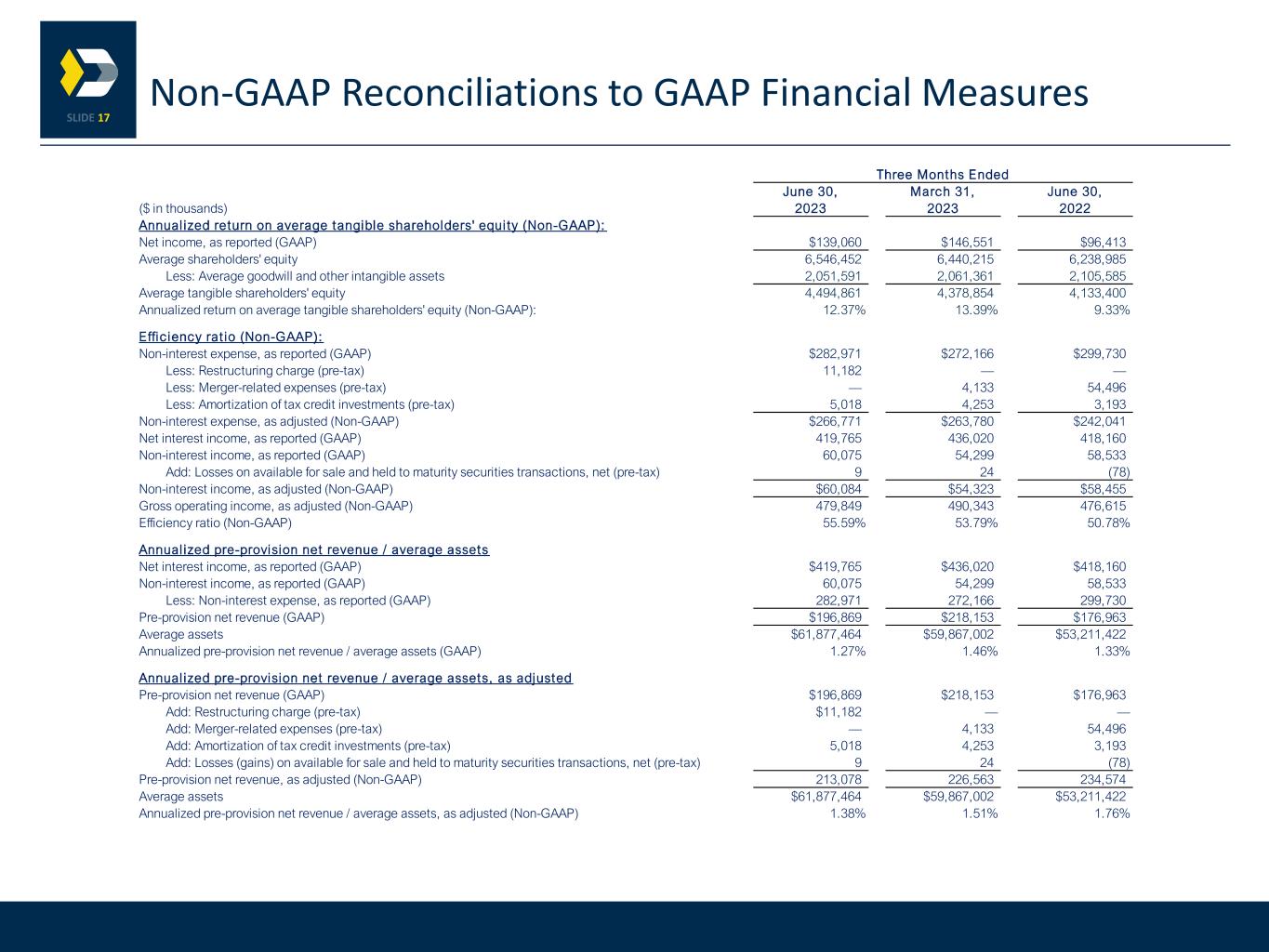

| Adjusted annualized return on average shareholders' equity (non-GAAP): | | | | | | | | | |

| Net income, as adjusted (non-GAAP) | $ | 147,081 | | | $ | 154,530 | | | $ | 165,803 | | | $ | 301,611 | | | $ | 286,116 | |

| Average shareholders' equity | $ | 6,546,452 | | | $ | 6,440,215 | | | $ | 6,238,985 | | | $ | 6,493,627 | | | $ | 5,673,014 | |

| Annualized return on average shareholders' equity, as adjusted (non-GAAP) | 8.99 | % | | 9.60 | % | | 10.63 | % | | 9.29 | % | | 10.09 | % |

| Annualized return on average tangible shareholders' equity (non-GAAP): | | | | | | | | | |

| Net income, as reported (GAAP) | $ | 139,060 | | | $ | 146,551 | | | $ | 96,413 | | | $ | 285,611 | | | $ | 213,141 | |

| Average shareholders' equity | $ | 6,546,452 | | | $ | 6,440,215 | | | $ | 6,238,985 | | | 6,493,627 | | | 5,673,014 | |

| Less: Average goodwill and other intangible assets | 2,051,591 | | | 2,061,361 | | | 2,105,585 | | | 2,056,487 | | | 1,823,538 | |

| Average tangible shareholders' equity | $ | 4,494,861 | | | $ | 4,378,854 | | | $ | 4,133,400 | | | $ | 4,437,140 | | | $ | 3,849,476 | |

| Annualized return on average tangible shareholders' equity (non-GAAP) | 12.37 | % | | 13.39 | % | | 9.33 | % | | 12.87 | % | | 11.07 | % |

| Efficiency ratio (non-GAAP): | | | | | | | | | |

| Non-interest expense, as reported (GAAP) | $ | 282,971 | | | $ | 272,166 | | | $ | 299,730 | | | $ | 555,137 | | | $ | 497,070 | |

| | | | | | | | | |

| Less: Restructuring charge (pre-tax) | 11,182 | | | — | | | — | | | 11,182 | | | — | |

| Less: Merger-related expenses (pre-tax) | — | | | 4,133 | | | 54,496 | | | 4,133 | | | 59,124 | |

| Less: Amortization of tax credit investments (pre-tax) | 5,018 | | | 4,253 | | | 3,193 | | | 9,271 | | | 6,089 | |

| | | | | | | | | |

| Non-interest expense, as adjusted (non-GAAP) | $ | 266,771 | | | $ | 263,780 | | | $ | 242,041 | | | $ | 530,551 | | | $ | 431,857 | |

| Net interest income, as reported (GAAP) | 419,765 | | | 436,020 | | | 418,160 | | | 855,785 | | | 735,829 | |

| Non-interest income, as reported (GAAP) | 60,075 | | | 54,299 | | | 58,533 | | | 114,374 | | | 97,803 | |

| Add: Losses (gains) on available for sale and held to maturity securities transactions, net (pre-tax) | 9 | | | 24 | | | (78) | | | 33 | | | (69) | |

| Non-interest income, as adjusted (non-GAAP) | $ | 60,084 | | | $ | 54,323 | | | $ | 58,455 | | | $ | 114,407 | | | $ | 97,734 | |

| Gross operating income, as adjusted (non-GAAP) | $ | 479,849 | | | $ | 490,343 | | | $ | 476,615 | | | $ | 970,192 | | | $ | 833,563 | |

| Efficiency ratio (non-GAAP) | 55.59 | % | | 53.79 | % | | 50.78 | % | | 54.69 | % | | 51.81 | % |

| | | | | | | | | |

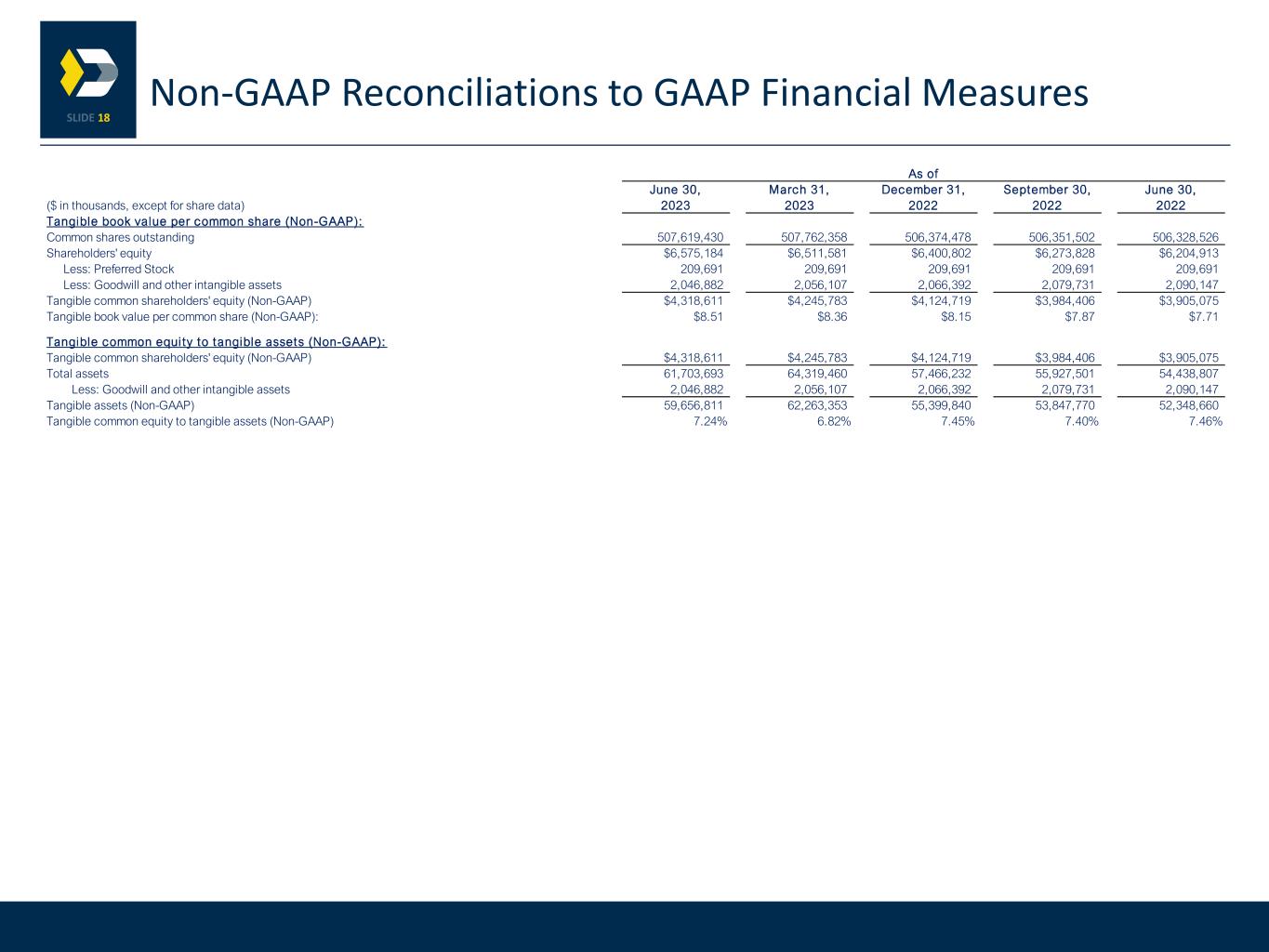

| As of |

| June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| ($ in thousands, except for share data) | 2023 | | 2023 | | 2022 | | 2022 | | 2022 |

| Tangible book value per common share (non-GAAP): | | | | | | | | | |

| Common shares outstanding | 507,619,430 | | | 507,762,358 | | | 506,374,478 | | | 506,351,502 | | | 506,328,526 | |

| Shareholders' equity (GAAP) | $ | 6,575,184 | | | $ | 6,511,581 | | | $ | 6,400,802 | | | $ | 6,273,829 | | | $ | 6,204,913 | |

| Less: Preferred stock | 209,691 | | | 209,691 | | | 209,691 | | | 209,691 | | | 209,691 | |

| Less: Goodwill and other intangible assets | 2,046,882 | | | 2,056,107 | | | 2,066,392 | | | 2,079,731 | | | 2,090,147 | |

| Tangible common shareholders' equity (non-GAAP) | $ | 4,318,611 | | | $ | 4,245,783 | | | $ | 4,124,719 | | | $ | 3,984,407 | | | $ | 3,905,075 | |

| Tangible book value per common share (non-GAAP) | $ | 8.51 | | | $ | 8.36 | | | $ | 8.15 | | | $ | 7.87 | | | $ | 7.71 | |

| Tangible common equity to tangible assets (non-GAAP): | | | | | | | | | |

| Tangible common shareholders' equity (non-GAAP) | $ | 4,318,611 | | | $ | 4,245,783 | | | $ | 4,124,719 | | | $ | 3,984,407 | | | $ | 3,905,075 | |

| Total assets (GAAP) | $ | 61,703,693 | | | $ | 64,309,573 | | | $ | 57,462,749 | | | $ | 55,927,501 | | | $ | 54,438,807 | |

| Less: Goodwill and other intangible assets | 2,046,882 | | | 2,056,107 | | | 2,066,392 | | | 2,079,731 | | | 2,090,147 | |

| Tangible assets (non-GAAP) | $ | 59,656,811 | | | $ | 62,253,466 | | | $ | 55,396,357 | | | $ | 53,847,770 | | | $ | 52,348,660 | |

| Tangible common equity to tangible assets (non-GAAP) | 7.24 | % | | 6.82 | % | | 7.45 | % | | 7.40 | % | | 7.46 | % |

VALLEY NATIONAL BANCORP

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

(in thousands, except for share data)

| | | | | | | | | | | |

| June 30, | | December 31, |

| 2023 | | 2022 |

| (Unaudited) | | |

| Assets | | | |

| Cash and due from banks | $ | 463,318 | | | $ | 444,325 | |

| Interest bearing deposits with banks | 1,491,091 | | | 503,622 | |

| Investment securities: | | | |

| Equity securities | 61,010 | | | 48,731 | |

| Trading debt securities | 3,409 | | | 13,438 | |

| Available for sale debt securities | 1,236,946 | | | 1,261,397 | |

Held to maturity debt securities (net of allowance for credit losses of $1,351 at June 30, 2023 and $1,646 at December 31, 2022) | 3,765,487 | | | 3,827,338 | |

| Total investment securities | 5,066,852 | | | 5,150,904 | |

| Loans held for sale, at fair value | 33,044 | | | 18,118 | |

| Loans | 49,877,248 | | | 46,917,200 | |

| Less: Allowance for loan losses | (436,432) | | | (458,655) | |

| Net loans | 49,440,816 | | | 46,458,545 | |

| Premises and equipment, net | 386,584 | | | 358,556 | |

| Lease right of use assets | 359,751 | | | 306,352 | |

| Bank owned life insurance | 717,681 | | | 717,177 | |

| Accrued interest receivable | 225,918 | | | 196,606 | |

| Goodwill | 1,868,936 | | | 1,868,936 | |

| Other intangible assets, net | 177,946 | | | 197,456 | |

| Other assets | 1,471,756 | | | 1,242,152 | |

| Total Assets | $ | 61,703,693 | | | $ | 57,462,749 | |

| Liabilities | | | |

| Deposits: | | | |

| Non-interest bearing | $ | 12,434,307 | | | $ | 14,463,645 | |

| Interest bearing: | | | |

| Savings, NOW and money market | 22,277,326 | | | 23,616,812 | |

| Time | 14,908,182 | | | 9,556,457 | |

| Total deposits | 49,619,815 | | | 47,636,914 | |

| Short-term borrowings | 1,088,899 | | | 138,729 | |

| Long-term borrowings | 2,443,533 | | | 1,543,058 | |

| Junior subordinated debentures issued to capital trusts | 56,934 | | | 56,760 | |

| Lease liabilities | 420,972 | | | 358,884 | |

| Accrued expenses and other liabilities | 1,498,356 | | | 1,327,602 | |

| Total Liabilities | 55,128,509 | | | 51,061,947 | |

| Shareholders’ Equity | | | |

| Preferred stock, no par value; 50,000,000 authorized shares: | | | |

| Series A (4,600,000 shares issued at June 30, 2023 and December 31, 2022) | 111,590 | | | 111,590 | |

| Series B (4,000,000 shares issued at June 30, 2023 and December 31, 2022) | 98,101 | | | 98,101 | |

| Common stock (no par value, authorized 650,000,000 shares; issued 507,896,910 shares at June 30, 2023 and December 31, 2022) | 178,187 | | | 178,185 | |

| Surplus | 4,974,507 | | | 4,980,231 | |

| Retained earnings | 1,379,534 | | | 1,218,445 | |

| Accumulated other comprehensive loss | (164,747) | | | (164,002) | |

Treasury stock, at cost (277,480 common shares at June 30, 2023 and 1,522,432 common shares at December 31, 2022) | (1,988) | | | (21,748) | |

| Total Shareholders’ Equity | 6,575,184 | | | 6,400,802 | |

| Total Liabilities and Shareholders’ Equity | $ | 61,703,693 | | | $ | 57,462,749 | |

VALLEY NATIONAL BANCORP

CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

(in thousands, except for share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | March 31, | | June 30, | | June 30, |

| 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| Interest Income | | | | | | | | | |

| Interest and fees on loans | $ | 715,172 | | | $ | 655,226 | | | $ | 415,577 | | | $ | 1,370,398 | | | $ | 732,942 | |

| Interest and dividends on investment securities: | | | | | | | | | |

| Taxable | 31,919 | | | 32,289 | | | 27,534 | | | 64,208 | | | 45,973 | |

| Tax-exempt | 5,575 | | | 5,325 | | | 5,191 | | | 10,900 | | | 7,708 | |

| Dividends | 7,517 | | | 5,185 | | | 3,076 | | | 12,702 | | | 4,752 | |

| Interest on federal funds sold and other short-term investments | 27,276 | | | 22,205 | | | 1,569 | | | 49,481 | | | 2,030 | |

| | | | | | | | | |

| Total interest income | 787,459 | | | 720,230 | | | 452,947 | | | 1,507,689 | | | 793,405 | |

| Interest Expense | | | | | | | | | |

| Interest on deposits: | | | | | | | | | |

| Savings, NOW and money market | 164,842 | | | 150,766 | | | 17,122 | | | 315,608 | | | 26,749 | |

| Time | 125,764 | | | 80,298 | | | 3,269 | | | 206,062 | | | 6,100 | |

| Interest on short-term borrowings | 50,208 | | | 33,948 | | | 4,083 | | | 84,156 | | | 4,889 | |

| Interest on long-term borrowings and junior subordinated debentures | 26,880 | | | 19,198 | | | 10,313 | | | 46,078 | | | 19,838 | |

| Total interest expense | 367,694 | | | 284,210 | | | 34,787 | | | 651,904 | | | 57,576 | |

| Net Interest Income | 419,765 | | | 436,020 | | | 418,160 | | | 855,785 | | | 735,829 | |

| | | | | | | | | |

| (Credit) provision for credit losses for available for sale and held to maturity securities | (282) | | | 4,987 | | | 286 | | | 4,705 | | | 343 | |

| Provision for credit losses for loans | 6,332 | | | 9,450 | | | 43,712 | | | 15,782 | | | 47,212 | |

| Net Interest Income After Provision for Credit Losses | 413,715 | | | 421,583 | | | 374,162 | | | 835,298 | | | 688,274 | |

| Non-Interest Income | | | | | | | | | |

| Wealth management and trust fees | 11,176 | | | 9,587 | | | 9,577 | | | 20,763 | | | 14,708 | |

| Insurance commissions | 3,139 | | | 2,420 | | | 3,463 | | | 5,559 | | | 5,322 | |

| Capital markets | 16,967 | | | 10,892 | | | 14,711 | | | 27,859 | | | 29,071 | |

| Service charges on deposit accounts | 10,542 | | | 10,476 | | | 10,067 | | | 21,018 | | | 16,279 | |

| Gains (losses) on securities transactions, net | 217 | | | 378 | | | (309) | | | 595 | | | (1,381) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Fees from loan servicing | 2,702 | | | 2,671 | | | 2,717 | | | 5,373 | | | 5,498 | |

| Gains on sales of loans, net | 1,240 | | | 489 | | | 3,602 | | | 1,729 | | | 4,588 | |

| | | | | | | | | |

| Bank owned life insurance | 2,443 | | | 2,584 | | | 2,113 | | | 5,027 | | | 4,159 | |

| Other | 11,649 | | | 14,802 | | | 12,592 | | | 26,451 | | | 19,559 | |

| Total non-interest income | 60,075 | | | 54,299 | | | 58,533 | | | 114,374 | | | 97,803 | |

| Non-Interest Expense | | | | | | | | | |

| Salary and employee benefits expense | 149,594 | | | 144,986 | | | 154,798 | | | 294,580 | | | 262,531 | |

| Net occupancy expense | 25,949 | | | 23,256 | | | 22,429 | | | 49,205 | | | 44,420 | |

| Technology, furniture and equipment expense | 32,476 | | | 36,508 | | | 49,866 | | | 68,984 | | | 75,880 | |

| FDIC insurance assessment | 10,426 | | | 9,155 | | | 5,351 | | | 19,581 | | | 9,509 | |

| Amortization of other intangible assets | 9,812 | | | 10,519 | | | 11,400 | | | 20,331 | | | 15,837 | |

| Professional and legal fees | 21,406 | | | 16,814 | | | 30,409 | | | 38,220 | | | 45,158 | |

| | | | | | | | | |

| Amortization of tax credit investments | 5,018 | | | 4,253 | | | 3,193 | | | 9,271 | | | 6,089 | |

| Other | 28,290 | | | 26,675 | | | 22,284 | | | 54,965 | | | 37,646 | |

| Total non-interest expense | 282,971 | | | 272,166 | | | 299,730 | | | 555,137 | | | 497,070 | |

| Income Before Income Taxes | 190,819 | | | 203,716 | | | 132,965 | | | 394,535 | | | 289,007 | |

| Income tax expense | 51,759 | | | 57,165 | | | 36,552 | | | 108,924 | | | 75,866 | |

| Net Income | 139,060 | | | 146,551 | | | 96,413 | | | 285,611 | | | 213,141 | |

| Dividends on preferred stock | 4,030 | | | 3,874 | | | 3,172 | | | 7,904 | | | 6,344 | |

| Net Income Available to Common Shareholders | $ | 135,030 | | | $ | 142,677 | | | $ | 93,241 | | | $ | 277,707 | | | $ | 206,797 | |

VALLEY NATIONAL BANCORP

Quarterly Analysis of Average Assets, Liabilities and Shareholders' Equity and

Net Interest Income on a Tax Equivalent Basis

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

| Average | | | | Avg. | | Average | | | | Avg. | | Average | | | | Avg. |

| ($ in thousands) | Balance | | Interest | | Rate | | Balance | | Interest | | Rate | | Balance | | Interest | | Rate |

| Assets | | | | | | | | | | | | | | | | | |

| Interest earning assets: | | | | | | | | | | | | | | | |

Loans (1)(2) | $ | 49,457,937 | | | $ | 715,195 | | | 5.78 | % | | $ | 47,859,371 | | | $ | 655,250 | | | 5.48 | % | | $ | 42,517,287 | | | $ | 415,602 | | | 3.91 | % |

Taxable investments (3) | 5,065,812 | | | 39,436 | | | 3.11 | | | 5,033,134 | | | 37,474 | | | 2.98 | | | 4,912,994 | | | 30,610 | | | 2.49 | |

Tax-exempt investments (1)(3) | 629,342 | | | 7,062 | | | 4.49 | | | 623,145 | | | 6,739 | | | 4.33 | | | 684,471 | | | 6,571 | | | 3.84 | |

| Interest bearing deposits with banks | 2,198,717 | | | 27,276 | | | 4.96 | | | 1,847,140 | | | 22,205 | | | 4.81 | | | 776,478 | | | 1,569 | | | 0.81 | |

| Total interest earning assets | 57,351,808 | | | 788,969 | | | 5.50 | | | 55,362,790 | | | 721,668 | | | 5.21 | | | 48,891,230 | | | 454,352 | | | 3.72 | |

| Other assets | 4,525,656 | | | | | | | 4,504,212 | | | | | | | 4,320,192 | | | | | |

| Total assets | $ | 61,877,464 | | | | | | | $ | 59,867,002 | | | | | | | $ | 53,211,422 | | | | | |

| Liabilities and shareholders' equity | | | | | | | | | | | | | | | | | |

| Interest bearing liabilities: | | | | | | | | | | | | | | | | | |

Savings, NOW and money market deposits | $ | 22,512,128 | | | $ | 164,843 | | | 2.93 | % | | $ | 23,389,569 | | | $ | 150,766 | | | 2.58 | % | | $ | 23,027,347 | | | $ | 17,122 | | | 0.30 | % |

| Time deposits | 12,195,479 | | | 125,764 | | | 4.12 | | | 9,738,608 | | | 80,298 | | | 3.30 | | | 3,601,088 | | | 3,269 | | | 0.36 | |

| Short-term borrowings | 3,878,457 | | | 50,207 | | | 5.18 | | | 2,803,743 | | | 33,948 | | | 4.84 | | | 1,603,198 | | | 4,083 | | | 1.02 | |

Long-term borrowings (4) | 2,339,727 | | | 26,880 | | | 4.60 | | | 1,686,830 | | | 19,198 | | | 4.55 | | | 1,462,638 | | | 10,313 | | | 2.82 | |

| Total interest bearing liabilities | 40,925,791 | | | 367,694 | | | 3.59 | | | 37,618,750 | | | 284,210 | | | 3.02 | | | 29,694,271 | | | 34,787 | | | 0.47 | |

| Non-interest bearing deposits | 12,756,862 | | | | | | | 14,024,742 | | | | | | | 16,267,946 | | | | | |

| Other liabilities | 1,648,359 | | | | | | | 1,783,295 | | | | | | | 1,010,220 | | | | | |

| Shareholders' equity | 6,546,452 | | | | | | | 6,440,215 | | | | | | | 6,238,985 | | | | | |

| Total liabilities and shareholders' equity | $ | 61,877,464 | | | | | | | $ | 59,867,002 | | | | | | | $ | 53,211,422 | | | | | |

| | | | | | | | | | | | | | | | | |

Net interest income/interest rate spread (5) | | | $ | 421,275 | | | 1.91 | % | | | | $ | 437,458 | | | 2.19 | % | | | | $ | 419,565 | | | 3.25 | % |

| Tax equivalent adjustment | | | (1,510) | | | | | | | (1,438) | | | | | | | (1,405) | | | |

| Net interest income, as reported | | | $ | 419,765 | | | | | | | $ | 436,020 | | | | | | | $ | 418,160 | | | |

Net interest margin (6) | | | | | 2.93 | | | | | | | 3.15 | | | | | | | 3.42 | |

| Tax equivalent effect | | | | | 0.01 | | | | | | | 0.01 | | | | | | | 0.01 | |

Net interest margin on a fully tax equivalent basis (6) | | | | | 2.94 | % | | | | | | 3.16 | % | | | | | | 3.43 | % |

(1) Interest income is presented on a tax equivalent basis using a 21 percent federal tax rate.

(2) Loans are stated net of unearned income and include non-accrual loans.

(3) The yield for securities that are classified as available for sale is based on the average historical amortized cost.

(4) Includes junior subordinated debentures issued to capital trusts which are presented separately on the consolidated statements of condition.

(5) Interest rate spread represents the difference between the average yield on interest earning assets and the average cost of interest bearing liabilities and is presented on a fully tax equivalent basis.

(6) Net interest income as a percentage of total average interest earning assets.

| | | | | |

| |

| |

| |

| |

| |

| SHAREHOLDERS RELATIONS

Requests for copies of reports and/or other inquiries should be directed to Tina Zarkadas, Assistant Vice President, Shareholder Relations Specialist, Valley National Bancorp, 1455 Valley Road, Wayne, New Jersey, 07470, by telephone at (973) 305-3380, by fax at (973) 305-1364 or by e-mail at tzarkadas@valley.com. |

2 Q 2 3 E a r n i n g s P r e s e n t a t i o n J u l y 2 7 , 2 0 2 3 Exhibit 99.2

Forward Looking Statements The foregoing contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not historical facts and include expressions about management’s confidence and strategies and management’s expectations about our business, new and existing programs and products, acquisitions, relationships, opportunities, taxation, technology, market conditions and economic expectations. These statements may be identified by such forward-looking terminology as “intend,” “should,” “expect,” “believe,” “view,” “opportunity,” “allow,” “continues,” “reflects,” “would,” “could,” “typically,” “usually,” “anticipate,” “may,” “estimate,” “outlook,” “project,” or similar statements or variations of such terms. Such forward-looking statements involve certain risks and uncertainties. Actual results may differ materially from such forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, but are not limited to: the impact of Federal Reserve actions affecting the level of market interest rates and increases in business failures, specifically among our clients, as well as on our business, our employees and our ability to provide services to our customers; the impact of recent and possible future bank failures on the business environment in which we operate and resulting market volatility and reduced confidence in depository institutions, including impact on stock price, customer deposit withdrawals from Valley National Bank, or business disruptions or liquidity issues that have or may affect our customers; the impact of unfavorable macroeconomic conditions or downturns, instability or volatility in financial markets, unanticipated loan delinquencies, loss of collateral, decreased service revenues, and other potential negative effects on our business caused by and factors outside of our control, such as geopolitical instabilities or events; natural and other disasters (including severe weather events) and health emergencies, acts of terrorism or other external events; risks associated with our acquisition of Bank Leumi Le-Israel Corporation (Bank Leumi USA), including (i) the inability to realize expected cost savings and synergies from the acquisition in the amounts or timeframe anticipated and (ii) greater than expected costs or difficulties relating to integration matters; the loss of or decrease in lower-cost funding sources within our deposit base; the need to supplement debt or equity capital to maintain or exceed internal capital thresholds; the inability to attract new customer deposits to keep pace with loan growth strategies; a material change in our allowance for credit losses under CECL due to forecasted economic conditions and/or unexpected credit deterioration in our loan and investment portfolios; greater than expected technology related costs due to, among other factors, prolonged or failed implementations, additional project staffing and obsolescence caused by continuous and rapid market innovations; the risks related to the replacement of the London Interbank Offered Rate with Secured Overnight Financing Rate and other reference rates, including increased expenses, risk of litigation and the effectiveness of hedging strategies; cyber-attacks, ransomware attacks, computer viruses or other malware that may breach the security of our websites or other systems to obtain unauthorized access to confidential information, destroy data, disable or degrade service, or sabotage our systems; damage verdicts or settlements or restrictions related to existing or potential class action litigation or individual litigation arising from claims of violations of laws or regulations, contractual claims, breach of fiduciary responsibility, negligence, fraud, environmental laws, patent or trademark infringement, employment related claims, and other matters; changes to laws and regulations, including changes affecting oversight of the financial services industry; changes in the enforcement and interpretation of such laws and regulations; and changes in accounting and reporting standards; higher or lower than expected income tax expense or tax rates, including increases or decreases resulting from changes in uncertain tax position liabilities, tax laws, regulations and case law; results of examinations by the Office of the Comptroller of the Currency (OCC), the Federal Reserve Bank (FRB), the Consumer Financial Protection Bureau (CFPB) and other regulatory authorities, including the possibility that any such regulatory authority may, among other things, require us to increase our allowance for credit losses, write-down assets, reimburse customers, change the way we do business, or limit or eliminate certain other banking activities; our inability or determination not to pay dividends at current levels, or at all, because of inadequate earnings, regulatory restrictions or limitations, changes in our capital requirements or a decision to increase capital by retaining more earnings; a prolonged downturn in the economy, mainly in New Jersey, New York, Florida, Alabama, California, and Illinois, as well as an unexpected decline in commercial real estate values within our market areas; and unexpected significant declines in the loan portfolio due to the lack of economic expansion, increased competition, large prepayments, changes in regulatory lending guidance or other factors. A detailed discussion of factors that could affect our results is included in our SEC filings, including the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2022 and in Item 1A of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023. We undertake no duty to update any forward-looking statement to conform the statement to actual results or changes in our expectations. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

3 2Q23 1Q23 2Q22 2Q23 1Q23 2Q22 Net Income ($mm) $139.1 $146.6 $96.4 $147.1 $154.5 $165.8 Return on Average Assets Annualized 0.90% 0.98% 0.72% 0.95% 1.03% 1.25% Efficiency Ratio (Non-GAAP) -- -- -- 55.6% 53.8% 50.8% Diluted Earnings Per Share $0.27 $0.28 $0.18 $0.28 $0.30 $0.32 Pre-Provision Net Revenue 2 ($mm) $196.9 $218.2 $177.0 $213.1 $226.6 $234.6 PPNR / Average Assets 2 Annualized 1.27% 1.46% 1.33% 1.38% 1.51% 1.76% GAAP Reported Non-GAAP Adjusted 1 1 Please refer to the Non-GAAP Disclosure Reconciliation in Appendix. 2 Pre-provision net revenue equals net interest income plus total non-interest income less total non-interest expense 2Q 2023 Financial Highlights Funding cost pressures continue to weigh on net interest income, but signs of thawing have emerged. Strong and stable asset quality across the loan portfolio. Non-interest income growth observed across business lines. Have begun to execute on efficiency opportunities which should result in approximately $40 million of gross annualized savings over the next 12 months.

4 22.9 22.3 13.6 12.4 11.1 14.9 47.6 49.6 3/31/2023 6/30/2023 Savings & Interest Checking Non-Interest Time 25% 48% 29% 23% 0.15% 0.14% 0.19% 0.59% 1.36% 1.96% 2.45% 0.25% 0.30% 0.96% 2.39% 3.82% 4.69% 5.16% 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 Total Deposits Average Fed Funds (Upper) Total Deposits Remain Stable Deposit Balance Trends ($bn) 30% 45% Avg. Fed Funds vs. Deposit Costs (%) Cumulative Beta (Current Cycle) 1 1 Cumulative Beta is measured as the change in Valley’s quarterly average deposit costs since the quarter preceding the rate hike cycle (4Q21) as a percentage of the change in the average quarterly Fed Funds Upper Bound over the same period. Avg. Fed Funds (Upper) Total Cost of Deposits Cumulative Beta 4Q21 0.25% 0.15% -- 4Q22 3.82% 1.36% 34% 1Q23 4.69% 1.96% 41% 2Q23 5.16% 2.45% 47%