UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

(Amendment

No. )

| Filed

by the Registrant ☒ |

| Filed

by a Party other than the Registrant ☐ |

| Check

the appropriate box: |

| |

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to §240.14a-12 |

| SAVE

FOODS, INC. |

| (Name

of Registrant as Specified In Its Charter) |

| |

| |

| (Name

of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment

of Filing Fee (Check the appropriate box): |

| |

| ☒ |

No

fee required. |

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| ☐ |

Fee

paid previously with preliminary materials. |

SAVE

FOODS, INC.

August

15, 2023

Dear

Stockholder:

You

are cordially invited to attend the annual meeting of stockholders of Save Foods, Inc. (the “Company”) to be held at 4:30

p.m., Israel time (9:30 a.m. EST), on October 2, 2023, at the offices of the Company’s legal counsel, Meitar | Law Offices, located

at 16 Abba Hillel Road, 10th floor, Ramat Gan 5250608, Israel.

In

order to facilitate your attendance at the annual meeting, we strongly encourage you to advise David Palach, our chief executive officer,

by email at david@savefoods.co or telephone at +972-54-721-5315 if you plan to attend the meeting prior to 11:59 p.m., Israel

time (4:59 p.m. EST), on September 29, 2023, so that we can timely provide your name to building security. In the event that you do not

advise us ahead of time that you will be attending the annual meeting, we encourage you to arrive at the meeting no later than 4:00 p.m.,

Israel time (9:00 a.m. EST), in order to ensure that you are able to pass through security prior to the start of the meeting.

Your

vote is very important, regardless of the number of shares of our voting securities that you own. I encourage you to vote by telephone,

over the Internet, or by marking, signing, dating and returning your proxy card so that your shares will be represented and voted at

the annual meeting, whether or not you plan to attend. If you attend the annual meeting, you will, of course, have the right to revoke

the proxy and vote your shares in person.

If

your shares are held in the name of a broker, trust, bank or other intermediary, and you receive notice of the annual meeting through

your broker or through another intermediary, please vote or return the materials in accordance with the instructions provided to you

by such broker or other intermediary, or contact your broker directly in order to obtain a proxy issued to you by your intermediary holder

to attend the meeting and vote in person. Failure to do so may result in your shares not being eligible to be voted by proxy at the meeting.

On

behalf of the board of directors, I urge you to submit your proxy as soon as possible, even if you currently plan to attend the meeting

in person.

Thank

you for your support of our company.

| |

Sincerely, |

| |

|

| |

/s/

Amitay Weiss |

| |

Amitay

Weiss |

| |

Chairman |

SAVE

FOODS, INC.

HaPardes

134 (Meshek Sander), Neve Yarak, 4994500 Israel (347) 468 9583

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

To

Be Held October 2, 2023

The

2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Save Foods, Inc., a Delaware corporation (the “Company”),

will be held at 4:30 p.m., Israel time (9:30 a.m. EST), on October 2, 2023, at the offices of the Company’s legal counsel, Meitar

| Law Offices, located at 16 Abba Hillel Road, 10th floor, Ramat Gan 5250608, Israel. We will consider and act on the following items

of business at the Annual Meeting:

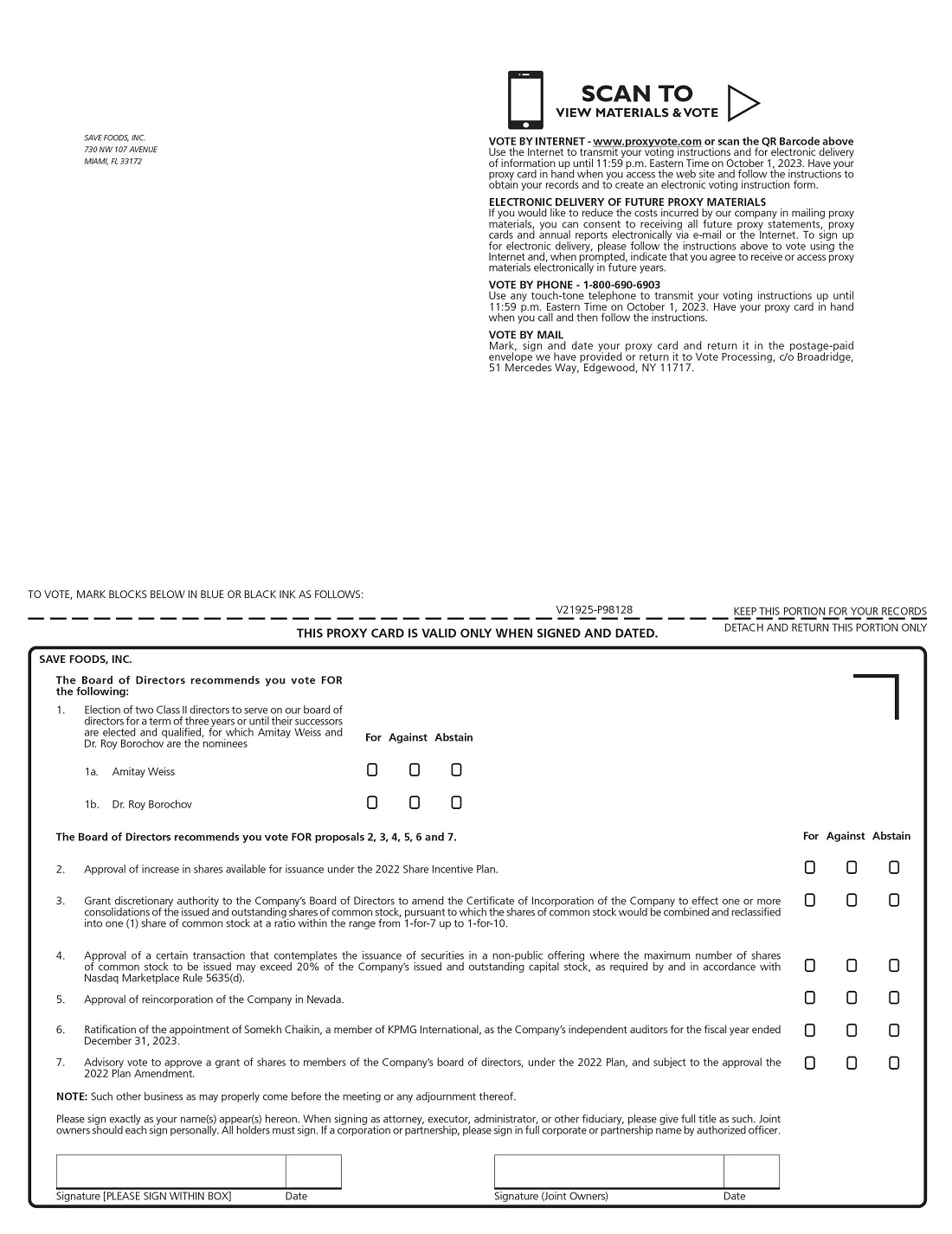

| |

(1) |

Election

of two Class II directors to serve on our board of directors for a term of three years or until their successors are elected and

qualified, for which Amitay Weiss and Dr. Roy Borochov are the nominees (the “Director Election Proposal”). |

| |

|

|

| |

(2) |

Approval

of increase in shares available for issuance under the Save Foods, Inc. 2022 Share Incentive Plan (the “2022 Plan Amendment”

and the “2022 Plan”, respectively). |

| |

|

|

| |

(3) |

Grant

discretionary authority to the Company’s board of directors to amend the Certificate of Incorporation of the Company

to effect one or more consolidations of the issued and outstanding shares of Common Stock, pursuant to which the shares of

Common Stock would be combined and reclassified into one (1) share of Common Stock, at a ratio within the range from

1-for-7 up to 1-for-10 (the “Reverse Stock Split”). |

| |

|

|

| |

(4) |

Approval

of a certain transaction that contemplates the issuance of securities in a non-public offering where the maximum number of shares

of Common Stock to be issued may exceed 20% of the Company’s issued and outstanding capital stock, as required by and

in accordance with Nasdaq Marketplace Rule 5635(d) (the “Nasdaq 20% Share Issuance Proposal”). |

| |

|

|

| |

(5) |

Approval

of the reincorporation of the Company in Nevada (the “Reincorporation Proposal”). |

| |

|

|

| |

(6) |

Ratification

of the appointment of Somekh Chaikin, a member of KPMG International, as the Company’s independent auditors for the fiscal

year ended December 31, 2023 (the “Auditor Appointment Proposal”). |

| |

|

|

| |

(7) |

Advisory

vote to approve a grant of shares to members of the Company’s board of directors, under the 2022 Plan, and subject to the approval

the 2022 Plan Amendment (the “Advisory Vote on Grant of Shares”). |

| |

|

|

| |

(8) |

Such

other business as may properly come before the Annual Meeting. |

Stockholders

are referred to the Proxy Statement accompanying this notice for more detailed information with respect to the matters to be considered

at the Annual Meeting. After careful consideration, our board of directors recommends a vote FOR the election of the nominees for

director named in the Director Election Proposal (Proposal 1); FOR the 2022 Plan Amendment (Proposal 2); FOR the grant of discretionary

approval to our board of directors to effect the Reverse Stock Split (Proposal 3); FOR the approval of the Nasdaq 20% Share Issuance

Proposal (Proposal 4); FOR the Reincorporation Proposal (Proposal 5); FOR the Auditor Appointment Proposal (Proposal 6); and FOR the

Advisory Vote on Grant of Shares (Proposal 7).

The

board of directors has fixed the close of business on August 11, 2023 as the record date (the “Record Date”). Only

holders of record of shares of our Common Stock as of the Record Date are entitled to receive notice of the Annual Meeting and to vote

at the Annual Meeting or at any postponement(s) or adjournment(s) of the Annual Meeting. A complete list of registered stockholders entitled

to vote at the Annual Meeting will be available for inspection at the office of the Company during regular business hours for the 10

calendar days prior to and during the Annual Meeting.

YOUR

VOTE AND PARTICIPATION IN THE COMPANY’S AFFAIRS ARE IMPORTANT.

If

your shares are registered in your name, even if you plan to attend the Annual Meeting or any postponement or adjournment of the

Annual Meeting in person, we request that you vote by telephone, over the Internet, or by completing, signing and mailing your proxy

card to ensure that your shares will be represented at the Annual Meeting.

If

your shares are held in the name of a broker, trust, bank or other intermediary, and you receive notice of the Annual Meeting through

your broker or through another intermediary, please vote online, by telephone or by completing and returning the voting instruction form

in accordance with the instructions provided to you by such broker or other intermediary, or contact your broker directly in order to

obtain a proxy issued to you by your intermediary holder to attend the Annual Meeting and vote in person. Failure to do any of the foregoing

may result in your shares not being eligible to be voted at the Annual Meeting.

| |

By

Order of the Board of Directors, |

| |

|

| |

/s/

Amitay Weiss |

| |

Amitay

Weiss |

| |

Chairman |

| |

|

| August

15, 2023 |

|

SAVE

FOODS, INC.

PROXY

STATEMENT

FOR

ANNUAL

MEETING OF STOCKHOLDERS

To

Be Held On October 2, 2023

Unless

the context otherwise requires, references in this Proxy Statement to “we,” “us,” “our,” the “Company,”

or “Save Foods” refer to Save Foods, Inc., a Delaware corporation, and its direct and indirect subsidiaries. In addition,

unless the context otherwise requires, references to “stockholders” are to the holders of our voting securities, which consist

of our common stock, par value $0.0001 per share, the “Common Stock”.

The

accompanying proxy is solicited by the board of directors on behalf of Save Foods, Inc., a Delaware corporation, to be voted at the 2023

annual meeting of stockholders of the Company (the “Annual Meeting”) to be held on October 2, 2023, at the time and place

and for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders (the “Notice”) and at any adjournment(s)

or postponement(s) of the Annual Meeting. This Proxy Statement and accompanying form of proxy are expected to be first sent or given

to stockholders on or about August 15, 2023.

The

executive office of the Company is located at, and the mailing address of the Company is, HaPardes 134 (Meshek Sander), Neve Yarak, 4994500

Israel.

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY

MATERIALS

FOR

THE

ANNUAL STOCKHOLDER MEETING TO BE HELD ON OCTOBER 2, 2023:

Our

official Notice of Annual Meeting of Stockholders, Proxy Statement, Proxy Card and

2022

Annual Report to Stockholders are available at:

www.proxyvote.com

Table

of Contents

ABOUT

THE ANNUAL MEETING

What

is a proxy?

A

proxy is another person whom you legally designate to vote your stock. If you designate someone as your proxy in a written document,

that document is also called a “proxy” or a “proxy card.” If you are a street name holder, you must obtain a

proxy from your broker or intermediary in order to vote your shares in person at the Annual Meeting.

What

is a proxy statement?

A

proxy statement is a document that regulations of the Securities and Exchange Commission (the “SEC”) require that we give

to you when we ask you to sign a proxy card to vote your stock at the Annual Meeting.

What

is the purpose of the Annual Meeting?

At

our Annual Meeting, stockholders will act upon the matters outlined in the Notice, including the following:

| |

(1) |

Election

of two Class II directors to serve on our board of directors for a term of three years or until their successors are elected and

qualified, for which Amitay Weiss and Dr. Roy Borochov are the nominees (the “Director Election Proposal”). |

| |

|

|

| |

(2) |

Approval

of increase in shares available for issuance under the Save Foods, Inc. 2022 Share Incentive Plan (the “2022 Plan Amendment”

and the “2022 Plan”, respectively). |

| |

|

|

| |

(3) |

Grant

discretionary authority to the Company’s board of directors to amend the Certificate of Incorporation of the Company

to effect one or more consolidations of the issued and outstanding shares of Common Stock, pursuant to which the shares of

Common Stock would be combined and reclassified into one (1) share of Common Stock, at a ratio within the range from

1-for-7 up to 1-for-10 (the “Reverse Stock Split”). |

| |

|

|

| |

(4) |

Approval

of a certain transaction that contemplates the issuance of securities in a non-public offering where the maximum number of shares

of Common Stock to be issued may exceed 20% of the Company’s issued and outstanding capital stock, as required by and

in accordance with Nasdaq Marketplace Rule 5635(d) (the “Nasdaq 20% Share Issuance Proposal”). |

| |

|

|

| |

(5) |

Approval

of the reincorporation of the Company in Nevada (the “Reincorporation Proposal”). |

| |

|

|

| |

(6) |

Ratification

of the appointment of Somekh Chaikin, a member of KPMG International, as the Company’s independent auditors for the fiscal

year ended December 31, 2023 (the “Auditor Appointment Proposal”). |

| |

|

|

| |

(7) |

Advisory

vote to approve a grant of shares to members of the Company’s board of directors, under the 2022 Plan, and subject to the approval

the 2022 Plan Amendment (the “Advisory Vote on Grant of Shares”). |

| |

|

|

| |

(8) |

Such

other business as may properly come before the Annual Meeting. |

What

is “householding” and how does it affect me?

With

respect to eligible stockholders who share a single address, we may send only one Proxy Statement to that address unless we receive instructions

to the contrary from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing

and postage costs. However, if a stockholder of record residing at such address wishes to receive a separate notice or proxy statement

in the future, he or she may contact Save Foods, Inc., HaPardes 134 (Meshek Sander), Neve Yarak, 4994500 Israel, Attn: David Palach,

chief executive officer, or via email to david@savefoods.co or telephone at +972-54-721-5315. Eligible stockholders of record

receiving multiple copies of our Notice and Proxy Statement can request householding by contacting us in the same manner. Stockholders

who own shares through a bank, broker or other intermediary can request householding by contacting the intermediary.

We

hereby undertake to deliver promptly, upon written or oral request, a copy of the Notice or Proxy Statement to a stockholder at a shared

address to which a single copy of the document was delivered. Requests should be directed to our Investor Relations at the address or

telephone number set forth above.

What

should I do if I receive more than one set of voting materials?

You

may receive more than one set of voting materials, including multiple proxy cards or voting instruction forms. For example, if you hold

your shares in more than one brokerage account, you may receive a separate voting instruction form for each brokerage account in which

you hold shares. Similarly, if you are a stockholder of record and also hold shares in a brokerage account, you will receive a proxy

card for shares held in your name and a voting instruction form for shares held in street name. Please follow the directions provided

in the Notice and in each proxy card or voting instruction form you receive to ensure that all your shares are voted.

What

is the record date and what does it mean?

The

record date to determine the stockholders entitled to notice of and to vote at the Annual Meeting is the close of business on August

11, 2023 (the “Record Date”). The Record Date is established by the board of directors as required by Delaware law. On

the Record Date, 9,689,211 shares of Common Stock were issued and outstanding.

Who

is entitled to vote at the Annual Meeting?

Holders

of Common Stock at the close of business on the Record Date may vote at the Annual Meeting.

What

are the voting rights of the stockholders?

On

each matter to be voted upon at the Annual Meeting, you have one vote for each share of Common Stock you own as of the Record

Date.

What

is the quorum requirement?

The

presence, in person or by proxy, of the holders of not less than 33.33% of the voting power of all of the shares of the stock entitled

to vote at the Annual Meeting is necessary to constitute a quorum to transact business. If a quorum is not present or represented

at the Annual Meeting, the stockholders representing a majority of the voting power present at the Annual Meeting, in person or by proxy,

may adjourn the Annual Meeting from time to time without notice or other announcement until a quorum is present or represented.

What

is the difference between a stockholder of record and a “street name” holder?

If

your shares are registered directly in your name with Securities Transfer Corporation, our stock transfer agent, you are considered the

stockholder of record with respect to those shares. The Notice has been sent directly to you by us.

If

your shares are held in a stock brokerage account or by a bank or other intermediary, the intermediary is considered the record holder

of those shares. You are considered the beneficial owner of those shares, and your shares are held in “street name.” A notice,

and Proxy Statement, along with a voting instruction form, have been forwarded to you by your intermediary. As the beneficial owner,

you have the right to direct your intermediary concerning how to vote your shares by using the voting instruction form they included

in the mailing or by following their instructions for voting.

What

is a broker non-vote?

Broker

non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee

holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial

owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares.

If

the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that

are considered to be “routine,” but not with respect to “non-routine” matters. In the event that a broker, bank,

or other agent indicates on a proxy that it does not have discretionary authority to vote certain shares on a non-routine proposal, then

those shares will be treated as broker non-votes.

Of

the proposals described in this Proxy Statement, Proposals 1, 2, 4, 5 and 7 are considered “non-routine” matters. Proposals

3 and 6 are considered “routine” matters. Accordingly, your broker does not have discretionary authority to vote your shares

with respect to the Director Election Proposal (Proposal 1), the 2022 Plan Amendment (Proposal 2), the Nasdaq 20% Share Issuance Proposal

(Proposal 4), the Reincorporation Proposal (Proposal 5), or the Advisory Vote on Grant of Shares (Proposal 7) in the absence of specific

instructions from you. With respect to the Reverse Stock Split (Proposal 3) and Auditor Appointment Proposal (Proposal 6), your broker

will have the discretion to vote your shares even if you do not provide your broker with specific instructions on that proposal.

How

do I vote my shares?

Your

vote is very important to us. Whether or not you plan to attend the Annual Meeting, please vote by proxy in accordance with the instructions

on your proxy card or voting instruction form (from your broker or other intermediary). There are three convenient ways of submitting

your vote:

| |

● |

By

Telephone or Internet – All record holders can vote by touchtone telephone from the United States using the toll free

telephone number on the proxy card, or over the Internet (at www.proxyvote.com), using the procedures and instructions described

on the proxy card. “Street name” holders may vote by telephone or Internet if their bank, broker or other intermediary

makes those methods available, in which case the bank, broker or other intermediary will enclose the instructions with the proxy

materials. The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders

to vote their shares, and to confirm that their instructions have been recorded properly. |

| |

|

|

| |

● |

In

Person – All record holders may vote in person at the Annual Meeting. “Street name” holders may vote in

person at the Annual Meeting if their bank, broker or other intermediary has furnished a legal proxy. If you are a “street

name” holder and would like to vote your shares by proxy, you will need to ask your bank, broker or other intermediary to furnish

you with an intermediary issued proxy. You will need to bring the intermediary issued proxy with you to the Annual Meeting and hand

it in with a signed ballot that will be provided to you at the Annual Meeting. You will not be able to vote your shares without an

intermediary issued proxy. Note that a broker letter that identifies you as a stockholder is not the same as an intermediary issued

proxy.

There

may be limitations on our ability to hold the Annual Meeting in person this year. See “Do you plan to hold the Annual Meeting

in person this year?” below. |

| |

|

|

| |

● |

By

Written Proxy or Voting Instruction Form – All record holders can vote by written proxy card, if they have requested

to receive printed proxy materials. If you are a “street name” holder and you request to receive printed proxy materials,

you will receive a voting instruction form from your bank, broker or other intermediary. |

The

board of directors has appointed David Palach, chief executive officer, to serve as proxy for the Annual Meeting.

If

you complete and sign the proxy card but do not provide instructions for one or more of the proposals, then the designated proxies will

or will not vote your shares as to those proposals, as described under “What if I do not specify how I want my shares voted?”

below. We do not anticipate that any other matters will come before the Annual Meeting, but if any other matters properly come before

the Annual Meeting, then the designated proxies will vote your shares in accordance with applicable law and their judgment.

If

you hold your shares in “street name,” and complete the voting instruction form provided by your broker or other intermediary

except with respect to one or more of the proposals, then, depending on the proposal(s), your broker may be unable to vote your shares

with respect to those proposal(s). See “What is a broker non-vote?” above.

Even

if you currently plan to attend the Annual Meeting, we recommend that you vote by telephone or Internet or return your proxy card or

voting instructions as described above so that your votes will be counted if you later decide not to attend the Annual Meeting or are

unable to attend.

Who

counts the votes?

A

representative of Broadridge Financial Solutions, Inc., our inspector of election, will tabulate and certify the votes.

What

are my choices when voting?

In

the Director Election Proposal (Proposal 1), stockholders may vote for all director nominees or may withhold their votes as to one or

both director nominees. With respect to the 2022 Plan Amendment (Proposal 2), the Reverse Stock Split (Proposal 3), the Nasdaq 20% Share

Issuance Proposal (Proposal 4), the Reincorporation Proposal (Proposal 5), the Auditor Appointment Proposal (Proposal 6) and the Advisory

Vote on Grant of Shares (Proposal 7) stockholders may vote for the proposal, against the proposal, or abstain from voting on the proposal.

What

are the board of directors’ recommendations on how I should vote my shares?

The

board of directors recommends that you vote your shares as follows:

Proposal

1—FOR the election of each of the nominees for director under the Director Election Proposal.

Proposal

2—FOR the 2022 Plan Amendment.

Proposal

3—FOR the Reverse Stock Split.

Proposal

4—FOR the Nasdaq 20% Share Issuance Proposal.

Proposal

5—FOR the Reincorporation Proposal.

Proposal

6—FOR the Auditor Appointment Proposal.

Proposal

7—FOR the Advisory Vote on Grant of Shares.

What

if I do not specify how I want my shares voted?

If

you are a record holder who returns a completed, executed proxy card that does not specify how you want to vote your shares on one or

more proposals, the proxies will vote your shares for each proposal as to which you provide no voting instructions, and such shares will

be voted in the following manner:

Proposal

1—FOR the election of each of the nominees for director under the Director Election Proposal.

Proposal

2—FOR the 2022 Plan Amendment.

Proposal

3—FOR the Reverse Stock Split.

Proposal

4—FOR the Nasdaq 20% Share Issuance Proposal.

Proposal

5—FOR the Reincorporation Proposal.

Proposal

6—FOR the Auditor Appointment Proposal.

Proposal

7—FOR the Advisory Vote on Grant of Shares.

If

you are a street name holder and do not provide voting instructions on one or more proposals, your bank, broker or other intermediary

may be unable to vote those shares. See “What is a broker non-vote?” above.

Can

I change my vote?

Yes.

If you are a record holder, you may revoke your proxy at any time by any of the following means:

| |

● |

Attending

the Annual Meeting and voting in person. Your attendance at the Annual Meeting will not by itself revoke a proxy. You must vote your

shares by ballot at the Annual Meeting to revoke your proxy. |

| |

|

|

| |

● |

Voting

again by telephone or over the Internet (only your latest telephone or Internet vote submitted prior to the Annual Meeting will be

counted). |

| |

|

|

| |

● |

If

you requested and received written proxy materials, completing and submitting a new valid proxy bearing a later date. |

| |

|

|

| |

● |

Giving

written notice of revocation to the Company addressed to David Palach, chief executive officer, at the Company’s address

above, which notice must be received before noon, Eastern Standard time on September 29, 2023. |

If

you are a street name holder, your bank, broker or other intermediary should provide instructions explaining how you may change or revoke

your voting instructions.

What

percentage of the vote is required to approve each proposal?

Assuming

the presence of a quorum:

| |

● |

Proposal

1 - the plurality of the votes cast. This means that the two nominees receiving the highest number of affirmative “FOR”

votes will be elected as Class II Directors under the Director Election Proposal (Proposal 1). |

| |

|

|

| |

● |

Proposal

2 - pursuant to Section 5635 of The Nasdaq Stock Market LLC (the “Nasdaq Rules”), the 2022 Plan Amendment (Proposal

2) will require approval by a majority of votes cast. Abstentions and broker non-votes, which are not considered “votes cast,”

will have no effect on the outcome of the 2022 Plan Amendment (Proposal 2). |

| |

|

|

| |

● |

Proposal

3 - the Reverse Stock Split (Proposal 3) will require the affirmative vote of the holders of a majority of the shares of our

issued and outstanding Common Stock entitled to vote on such proposal at the Annual Meeting. Failures to vote, abstentions

and broker “non-votes”, if any, will be the equivalent of a vote AGAINST the Reverse Stock Split (Proposal 3). Because

this proposal is a routine matter, brokers will have discretionary voting on this matter if they do not receive instructions. |

| |

● |

Proposal

4 - pursuant to Section 5635 of the Nasdaq Rules, the Nasdaq 20% Share Issuance Proposal (Proposal 4) will require approval by

a majority of votes cast. Abstentions and broker non-votes, which are not considered “votes cast,” will have no effect

on the outcome of the Nasdaq 20% Share Issuance Proposal (Proposal 4). |

| |

|

|

| |

● |

Proposal

5 - the affirmative vote of a majority of the outstanding shares of Common Stock of the Company is required to approve

the Reincorporation Proposal (Proposal 5). Abstentions will only be counted toward the tabulations of voting power present and

entitled to vote on the Reincorporation Proposal (Proposal 5) and will have the same effect as votes AGAINST the proposal. Brokers

do not have discretion to vote on the proposal to approve the Reincorporation Proposal (Proposal 5) and broker non-votes will have

the same effect as votes AGAINST the proposal. |

| |

|

|

| |

● |

Proposal

6 - the Auditor Appointment Proposal (Proposal 6) will require the affirmative vote of the holders of a majority of the shares

of our Common Stock represented in person or by proxy at the Annual Meeting entitled to vote on such proposal that are voted

for or against such proposal. Abstentions and broker non-votes will have no effect on the outcome of the Auditor Appointment Proposal

(Proposal 6). Because this proposal is a routine matter, brokers will have discretionary voting on this matter if they do not receive

instructions. |

| |

|

|

| |

● |

Proposal

7 - the Advisory Vote on Grant of Shares (Proposal 7) is a non-binding advisory vote that is (1) subject to the approval of

Proposal 2 and (2) will require the affirmative vote of the holders of a majority of the shares of our Common Stock represented

in person or by proxy at the Annual Meeting entitled to vote on such proposal that are voted for or against such proposal. Abstentions

and broker non-votes will have no effect on the outcome of the Vote on Grant of Shares (Proposal 7). For the avoidance of any

doubt, Proposal 7 will not be treated as approved if Proposal 2 fails even if the requisite majority of our shares of our Common

Stock vote in favor of this non-binding advisory vote. |

Do

I have any dissenters’ or appraisal rights with respect to any of the matters to be voted on at the Annual Meeting?

No.

Under Delaware General Corporation Law stockholders are not entitled to any appraisal rights or similar rights of dissenters

with respect to the matters to be voted on at the Annual Meeting.

What

are the solicitation expenses and who pays the cost of this proxy solicitation?

Our

board of directors is asking for your proxy and we will pay all of the costs of asking for stockholder proxies. We will reimburse brokerage

houses and other custodians, intermediaries and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation material

to the beneficial owners of Common Stock and collecting voting instructions. We may use officers and employees of the Company

to ask for proxies.

Are

there any other matters to be acted upon at the Annual Meeting?

Management

does not intend to present any business at the Annual Meeting for a vote other than the matters set forth in the Notice and has no information

that others will do so. If other matters requiring a vote of the stockholders properly come before the Annual Meeting, it is the intention

of the persons named in the accompanying form of proxy to vote the shares represented by the proxies held by them in accordance with

applicable law and their judgment on such matters.

Where

can I find voting results?

The

Company expects to publish the voting results in a Current Report on Form 8-K, which it expects to file with the SEC within four business

days following the Annual Meeting.

Who

can help answer my questions?

The

information provided above in this “Question and Answer” format is for your convenience only and is merely a summary of the

information contained in this Proxy Statement. We urge you to carefully read this entire proxy statement, including the documents we

refer to in this Proxy Statement. If you have any questions, or need additional material, please feel free to contact David Palach, our

chief executive officer, by email at david@savefoods.co or telephone at +972-54-721-5315.

CORPORATE

GOVERNANCE AND BOARD OF DIRECTORS MATTERS

Director

Independence

Our

board of directors has determined that Ronen Rosenbloom, Israel Berenshtein, Amitay Weiss, Eliahou Arbib, Udi Kalifi and Dr. Roy Borochov

do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director

and that each of these directors is “independent” as that term is defined under the rules of the Nasdaq.

Board

Committees

Our

board of directors has established an audit committee, a nominating and corporate governance committee and a compensation committee,

each of which has the composition and responsibilities described below.

Audit

Committee. Our audit committee consists of Udi Kalifi, Eliahou Arbib and Ronen Rosenbloom, with Udi Kalifi serving as chair. Our

board of directors has affirmatively determined that Udi Kalifi, Eliahou Arbib and Ronen Rosenbloom each meet the definition of “independent

director” for purposes of serving on the audit committee under Rule 10A-3 under the Exchange Act of 1934, as amended (“Exchange

Act”) and Nasdaq rules. Each member of our audit committee also meets the financial literacy requirements of Nasdaq listing

standards. In addition, our board of directors has determined that Udi Kalifi qualifies as an “audit committee financial expert,”

as such term is defined in Item 407(d)(5) of Regulation S-K. The audit committee held a total of five meetings and acted five times

by unanimous written consent during the year ended December 31, 2022. Our board of directors adopted a written charter for

the audit committee, which is available on our corporate website at www.savefoods.co. The audit committee is responsible for, among other

things:

| |

● |

appointing,

compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm; |

| |

|

|

| |

● |

discussing

with our independent registered public accounting firm their independence from management; |

| |

● |

reviewing

with our independent registered public accounting firm the scope and results of their audit; |

| |

|

|

| |

● |

approving

all audit and permissible non-audit services to be performed by our independent registered public accounting firm; |

| |

|

|

| |

● |

overseeing

the financial reporting process and discussing with management and our independent registered public accounting firm the quarterly

and annual consolidated financial statements that we file with the SEC; |

| |

|

|

| |

● |

overseeing

our financial and accounting controls and compliance with legal and regulatory requirements; |

| |

|

|

| |

● |

reviewing

our policies on risk assessment and risk management; |

| |

|

|

| |

● |

reviewing

related person transactions; and |

| |

|

|

| |

● |

establishing

procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing

matters. |

Nominating

and Corporate Governance Committee. Our nominating and corporate governance committee consists of Ronen Rosenbloom, Israel Berenshtein

and Eliahou Arbib, with Ronen Rosenbloom serving as chair. Our board of directors adopted a written charter for the nominating and corporate

governance committee, which is available on our corporate website at www.savefoods.co. The nominating and corporate governance committee

held one meeting and acted one time by unanimous written consent during the year ended December 31, 2022. The nominating

and corporate governance committee is responsible for, among other things:

| |

● |

identifying

individuals qualified to become members of our board of directors, consistent with criteria approved by our board of directors; |

| |

|

|

| |

● |

overseeing

our succession plan for the CEO and other executive officers; |

| |

|

|

| |

● |

overseeing

the evaluation of the effectiveness of our board of directors and its committees; and |

| |

|

|

| |

● |

developing

and recommending to our board of directors a set of corporate governance guidelines. |

Compensation

Committee. Our compensation committee consists of Ronen Rosenbloom, Israel Berenshtein and Eliahou Arbib, with Israel Berenshtein

serving as chair. Our board has determined that each of Ronen Rosenbloom, Israel Berenshtein and Eliahou Arbib meet the definition of

“independent director” for purposes of serving on the compensation committee under Nasdaq rules, including the heightened

independence standards for members of a compensation committee, and are “non-employee directors” as defined in Rule 16b-3

of the Exchange Act. Our board of directors adopted a written charter for the compensation committee, which is available on our corporate

website at www.savefoods.co. The compensation committee held two meetings and acted two times by unanimous written consent during

the year ended December 31, 2022. The compensation committee is responsible for, among other things:

| |

● |

reviewing

and approving the compensation of our chief executive officer and other executive officers; |

| |

|

|

| |

● |

reviewing

and making recommendations to the board of directors regarding director compensation; and |

| |

|

|

| |

● |

appointing

and overseeing any compensation consultants. |

Meetings

and Attendance

The

board of directors held a total of twenty-seven (27) meetings and acted twenty-seven (27) times by unanimous written

consent during the year ended December 31, 2022, and each director attended at least 100% percent of the aggregate number of

all (i) board meetings held during the period for which he was a director and (ii) committee meetings held during the period for

which he was a committee member. We do not have a policy requiring director attendance at stockholder meetings, but members of our

board of directors are encouraged to attend.

Board

Leadership Structure

The

board of directors is committed to promoting effective, independent governance of the Company. Our board believes it is in the best interests

of the stockholders and the Company for the board to have the flexibility to select the best director to serve as chairman at any given

time, regardless of whether that director is an independent director or the chief executive officer. Consequently, we do not have a policy

governing whether the roles of chairman of the board and chief executive officer should be separate or combined. This decision is made

by our board of directors, based on the best interests of the Company considering the circumstances at the time.

Currently,

the offices of the chairman of the board and the chief executive officer are held by two different people. Amitay Weiss is our independent,

non-executive chairman of the board of directors and David Palach is our chief executive officer. The chief executive officer is

responsible for the day to day leadership and performance of the Company, while the chairman of the board of directors provides guidance

to the chief executive officer and sets the agenda for board meetings and presides over meetings of the board. We believe that separation

of the positions reinforces the independence of the board in its oversight of the business and affairs of the Company, and creates an

environment that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability

and improving the ability of the board to monitor whether management’s actions are in the best interests of the Company and its

stockholders.

Under

our certificate of incorporation, as amended on November 24, 2020, our board of directors is divided into three classes with staggered

three-year terms. Each class of directors consists, as nearly as possible, of one-third of the total number of directors constituting

the entire board of directors. At each annual general meeting of our stockholders, the election or re-election of directors following

the expiration of the term of office of the directors of that class of directors will be for a term of office that expires on the third

annual general meeting following such election or re-election, such that from the Annual Meeting and thereafter, each year the term of

office of only one class of directors will expire.

Our

directors are divided among the three classes as follows:

| |

● |

the

Class I directors are Ronen Rosenbloom and Israel Berenshtein, and their terms will expire at our annual meeting of our stockholders

to be held in 2025; |

| |

|

|

| |

● |

the

Class II directors are Amitay Weiss and Dr. Roy Borochov and their terms will expire at the Annual Meeting; and |

| |

|

|

| |

● |

the

Class III directors are Eliahou Arbib and Udi Kalifi, and their terms will expire at our annual meeting of our stockholders

to be held in 2024. |

Role

in Risk Oversight

Our

board of directors is responsible for overseeing our risk management process. Our board of directors focuses on our general risk management

strategy, the most significant risks facing us, and oversees the implementation of risk mitigation strategies by management. Our audit

committee is also responsible for discussing our policies with respect to risk assessment and risk management. Our board of directors

believes its administration of its risk oversight function has not negatively affected our board of directors’ leadership structure.

Code

of Business Conduct and Ethics

We

adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal

executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

A copy of the code is posted on our website, www.savefoods.co. In addition, we post on our website all disclosures that are required

by law or Nasdaq listing standards concerning any amendments to, or waivers from, any provision of the code. In addition, a copy of

the Code of Ethics will be provided without charge upon written request to the Company’s Secretary, c/o Save Foods, Inc.,

HaPardes 134 (Meshek Sander), Neve Yarak, 4994500 Israel.

Communications

with the Board of Directors

A

stockholder who wishes to communicate with our board of directors, any committee of our board of directors, the non-management directors

or any particular director, may do so by writing to such director or directors in care of the Secretary, c/o Save Foods, Inc., HaPardes

134 (Meshek Sander), Neve Yarak, 4994500 Israel. Our chief executive officer will forward such communication to the full board of directors,

to the appropriate committee or to any individual director or directors to whom the communication is addressed, unless the communication

is unrelated to the duties and responsibilities of our board of directors (such as spam, junk mail and mass mailings, ordinary course

disputes over fees or services, personal employee complaints, business inquiries, new product or service suggestions, resumes and other

forms of job inquiries, surveys, business solicitations or advertisements) or is unduly hostile, threatening, illegal, or harassing,

in which case our secretary has the authority to discard the communication or take appropriate legal action regarding the communication.

Anti-Hedging

Policy

Pursuant

to our Insider Trading Policy, our directors, officers and employees, consultants and contractors, are prevented from engaging in hedging

or monetization transactions, as such transactions allow individuals to continue to own our securities without the full risks and rewards

of ownership and as a result, not have the same objectives as other stockholders.

Director

Nomination Policies

We

have a standing nominating and corporate governance committee consisting entirely of independent directors. The director nominees for

reelection at the Annual Meeting were recommended to the board by the nominating and corporate governance committee for selection.

The

nominating and corporate governance committee will consider all proposed nominees for the board of directors, including those properly

put forward by stockholders. Stockholder nominations should be addressed to the nominating and corporate governance committee in care

of the Secretary, c/o Save Foods, Inc., HaPardes 134 (Meshek Sander), Neve Yarak, 4994500 Israel, in accordance with the provisions of

the Company’s amended and restated bylaws. The nominating and corporate governance committee annually reviews with the board the

applicable skills and characteristics required of board nominees in the context of current board composition and our circumstances. In

making its recommendations to the board, the nominating and corporate governance committee considers all factors it considers appropriate,

which may include experience, accomplishments, education, understanding of the business and the industry in which we operate, specific

skills, general business acumen and the highest personal and professional integrity. Generally, the nominating and corporate governance

committee will first consider current board members because they meet the criteria listed above and possess an in-depth knowledge of

us, our history, strengths, weaknesses, goals and objectives. This level of knowledge has proven very valuable to us. In determining

whether to recommend a director for re-election, the nominating and corporate governance committee also considers the director’s

past attendance at meetings and participation in and contributions to the activities of the board.

The

board and the nominating and corporate governance committee aim to assemble a diverse group of board members and believe that no single

criterion such as gender or minority status is determinative in obtaining diversity on the board. The board defines diversity as differences

of viewpoint, professional experience, education and skills such as a candidate’s range of experience serving on other public company

boards, the balance of the business interest and experience of the candidate as compared to the incumbent or other nominated directors,

and the need for any particular expertise on the board or one of its committees.

Board

Diversity

The

table below provides certain information regarding the diversity of our board of directors as of the date of this Proxy Statement.

| | |

Female | | |

Male | | |

Non-Binary | | |

Did

Not Disclose Gender | |

| Part I: Gender Identity | |

| | | |

| | | |

| | | |

| | |

| Directors | |

| 0 | | |

| 6 | | |

| 0 | | |

| 0 | |

| | |

| | | |

| | | |

| | | |

| | |

| Part II: Demographic Background | |

| | | |

| | | |

| | | |

| | |

| African American or Black | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Alaskan Native or Native American | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Asian | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Hispanic or Latinx | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Native Hawaiian or Pacific Islander | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| White | |

| 0 | | |

| 4 | | |

| 0 | | |

| 0 | |

| Two or More Races or Ethnicities | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| LGBTQ+ | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Did Not Disclose Demographic Background | |

| 0 | | |

| 2 | | |

| 0 | | |

| 0 | |

Certain

Related Transactions and Relationships

The

following is a description of transactions since January 1, 2021, to which we were a party or will be a party, in which the amount

involved exceeded or will exceed the lesser of $120,000 or 1% of the average of our total assets at year-end for the last two completed

fiscal years, and any of our directors, executive officers or holders of more than 5% of our outstanding capital stock, or any immediate

family member of, or person sharing the household with, any of these individuals or entities, had or will have a direct or indirect material

interest.

Plantify

Transaction

On

March 31, 2023, we entered into a securities exchange agreement (the “Exchange Agreement”), with Plantify Foods, Inc., a

British Columbia company (“Plantify”), pursuant to which each of the respective parties agreed to issue to the opposite party

19.99% of its issued and outstanding capital stock. We closed the Exchange Agreement on April 5, 2023 (the “Closing”). Upon

the Closing, we issued 1,164,374 shares of our Common Stock to Plantify, which amount represented 19.99% of our outstanding capital

stock as of immediately prior to the Closing (and 16.66% of our outstanding capital stock as of immediately following the Closing), and

Plantify issued 30,004,349 common shares of Plantify to us in exchange thereof.

In

connection with, and contingent upon, the execution of the Exchange Agreement, we executed a debenture (the “Debenture”),

whereby we agreed to lend C$1,500,000 to Plantify (the “Principal”), which Principal will accrue interest at a rate of 8%

annually and will be repayable by Plantify over approximately 18 months. The Debenture has a maturity date of October 4, 2024. The Principal

may be converted, at our sole discretion, into common shares of Plantify at a price of C$0.05 per share until the first anniversary of

the Debenture issuance date and C$0.10 per share thereafter. The accrued interest may be converted at the market price of Plantify’s

common shares, subject to TSXV approval at the time of conversion. Plantify executed a general security agreement in our favor and specifically

pledged to us the shares of Plantify’s subsidiary, Peas of Bean Ltd.

If

the Principal under the Debenture is converted in the first year into 30,000,000 Plantify common shares, and assuming no further Plantify

common shares are issued following the Exchange Agreement, we will hold approximately 28.56% of Plantify’s outstanding common shares.

Accordingly, closing of the Debenture is subject to the approval of Plantify’s shareholders.

In

connection with the Closing, Dr. Roy Borochov, chief executive officer of Plantify, was appointed as a Class II director of the Company.

Dr. Borochov is up for re-election at the Annual Meeting, which is further described in Proposal 1 herein.

Employment

Agreements

Certain

of our executive officers have employment and service agreements with us. We have entered into written employment and service agreement

with each of our executive officers. Such employment and service agreement will contain customary provisions and representations, including

confidentiality, non-competition and inventions assignment undertakings by the executive officers. However, the enforceability of the

noncompetition provisions may be limited under applicable law. For additional information about such employment and service agreements,

please refer to “Executive Compensation” in this proxy statement.

Indemnification

Agreements

We

entered into indemnification agreements with each of our directors and executive officers, which, among other things, require

us to indemnify each director and executive officer to the fullest extent permitted by Delaware law, including indemnification of expenses

such as attorneys’ fees, judgments, fines and settlement amounts incurred by such director or executive officer, arising

out of such person’s services to the Company as a director or executive officer. For further information, see “Executive

and Director Compensation—Limitations of Liability and Indemnification” in the Company’s Annual Report on Form 10-K.

REPORT

OF THE AUDIT COMMITTEE

The

audit committee has reviewed and discussed the Company’s audited financial statements and related footnotes for the year ended

December 31, 2022, and the independent auditor’s report on those financial statements, with management and with our independent

auditor, Somekh Chaikin, member firm of KPMG International (“Somekh”). The audit committee has also discussed with Somekh’s

the matters required to be discussed by the Statement on Auditing Standards No. 61, as amended, as adopted by the Public Company Accounting

Oversight Board in Rule 3200T. The audit committee has also received the written disclosures and the letter from Somekh required by applicable

requirements of the Public Company Accounting Oversight Board regarding Somekh’s communications with the audit committee concerning

independence, and has discussed with Somekh that firm’s independence.

Based

on the review and the discussions referred to in the preceding paragraph, the audit committee determined that the Company’s audited

financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, which was filed

with the SEC.

| |

The

Audit Committee: |

| |

|

| |

Udi

Kalifi |

| |

Eliahou

Arbib |

| |

Ronen

Rosenbloom |

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

table below provides information regarding the beneficial ownership of our Common Stock as of August 11, 2023 of (i) each of our

current directors, (ii) each of the Named Executive Officers, (iii) all of our current directors and executive officers as a group, and

(iv) each person (or group of affiliated persons) known to us who owns more than 5% of our outstanding Common Stock.

The

beneficial ownership of our Common Stock is determined in accordance with the rules of the SEC. Under these rules, a person is

deemed to be a beneficial owner of a security if that person directly or indirectly has or shares voting power, which includes

the power to vote or to direct the voting of the security, or investment power, which includes the power to dispose of or to direct the

disposition of the security. The person is also deemed to be a beneficial owner of any security of which that person has a right to

acquire beneficial ownership within 60 days. Under the SEC rules, more than one person may be deemed to be a beneficial owner of the

same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary interest.

The

percentage of shares of Common Stock beneficially owned is based on 9,689,211 shares of Common Stock outstanding as of August

11, 2023.

Unless

otherwise indicated below, each person has sole voting and investment power with respect to the shares beneficially owned and

the address for each beneficial owner listed in the table below is c/o Save Foods, Inc., HaPardes 134 (Meshek Sander), Neve Yarak, 4994500

Israel.

| Owner | |

Number of

Shares Beneficially Owned | | |

Percentage

Beneficially Owned | |

| 5% or more stockholders: | |

| | | |

| | |

| Yaaran Investments Ltd.(1) | |

| 1,561,051 | | |

| 16.1 | % |

| Plantify Foods, Inc.(2) | |

| 1,164,374 | | |

| 12.0 | % |

| Directors: | |

| | | |

| | |

| Amitay Weiss | |

| - | | |

| * | |

| Eliahou Arbib | |

| - | | |

| * | |

| Udi Kalifi | |

| 27,692 | | |

| * | |

| Israel Berenshtein | |

| - | | |

| * | |

| Ronen Rosenbloom | |

| - | | |

| * | |

| Roy Borochov | |

| - | | |

| * | |

| Executive Officers: | |

| | | |

| | |

| David Palach | |

| 300,000 | | |

| 3.1 | % |

| Lital Barda | |

| 100,000 | | |

| 1.0 | % |

| Dan Sztybel(3) | |

| 124,605 | | |

| 1.3 | % |

| All directors and executive officers as a group (9 persons) | |

| 552,297 | | |

| 5.7

| % |

| * |

Less

than 1%. |

| |

|

| (1) |

The

address of Yaaran Investments Ltd. is Harsit 7 St., Sheary-Tikva, Israel. |

| (2) |

Based

on a Schedule 13G filed by Plantify Foods, Inc. with the SEC on April 10, 2023. The address of Plantify Foods, Inc. is 2264 East

11th Ave., Vancouver, V5N1Z6, British Columbia, Canada. |

| (3) |

Includes options to purchase 71,430 shares of Common Stock, which are currently exercisable or will become exercisable within 60

days of August 11, 2023. |

DELINQUENT

SECTION 16(a) REPORTS

Section

16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than 10% of our equity securities (“Reporting

Persons”), to file with the SEC reports of ownership and changes in ownership. Officers, directors and greater than

10% stockholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. Based solely upon a

review of such filings and representations from Reporting Persons we believe that during 2022, the Reporting Persons timely

filed all such reports, except that Udi Kalifi, failed to timely file a Form 4 reporting the acquisition of 9,270 shares of our

Common Stock on June 15, 2022 and 18,422 shares of our Common Stock on June 16, 2022.

PROPOSAL

1: RE-ELECTION OF CLASS II DIRECTORS

The

board of directors currently consists of six (6) members and is classified into three classes of similar size. The members of each class

are elected in different years, so that only approximately one-third of the board is elected in any single year. As indicated below,

we currently have two directors in Class I (with a term of office expiring in 2025), two directors in Class II (with a term of office

expiring at the Annual Meeting), and two directors in Class III (with a term of office expiring in 2024). This year, the board of directors

have nominated Amitay Weiss and Dr. Roy Borochov, for re-election as Class II directors.

Each

of Mr. Weiss and Dr. Borochov has been nominated to serve for a term of office to expire at the annual meeting of the stockholders

to be convened in 2026 or until his successor has been duly elected and qualified. Stockholders will be unable to vote for more than

two persons. Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the

Annual Meeting. Assuming the presence of a quorum, the two director nominees who receive the most votes cast in the election of directors

will be elected as Class II directors. Should any of the director nominees become unable or unwilling to accept nomination or election,

the proxy holders may vote the proxies for the election, in his stead, of any other person the board of directors may nominate or designate.

Each of the director nominees has expressed his intention to serve the entire term for which election is sought.

Directors

and Nominees

The

following table sets forth the name, age and positions of the director nominees and each director currently serving on

our board of directors:

| Name |

|

Age |

|

Director

Class |

|

Position |

|

Term

Expiration |

| Ronen

Rosenbloom |

|

51 |

|

Class

I |

|

Director |

|

2025

Annual Meeting |

| Israel

Berenshtein |

|

52 |

|

Class

I |

|

Director |

|

2025

Annual Meeting |

| Amitay

Weiss |

|

71 |

|

Class

II |

|

Chairman

of the Board of Directors |

|

2023

Annual Meeting |

| Roy

Borochov |

|

48 |

|

Class

II |

|

Director |

|

2023

Annual Meeting |

| Eliahou

Arbib |

|

56 |

|

Class

III |

|

Director |

|

2024

Annual Meeting |

| Udi

Kalifi |

|

44 |

|

Class

III |

|

Director |

|

2024

Annual Meeting |

Biographies

Biographies

of Class I and Class III Directors Whose Current Terms Extend Beyond the Annual Meeting

Ronen

Rosenbloom has served as a member of our board of directors since August 2020. Mr. Rosenbloom is an independent lawyer and has been

working out of a self-owned law firm specializing in white collar offences since 2004. Mr. Rosenbloom has served on the board of directors

of Medigus Ltd. (Nasdaq and TASE: MDGS) since September 2018 and ScoutCam Inc. (OTC: SCTC) since December 2019. Prior to that, Mr. Rosenbloom

served as chairman of the Israeli Money Laundering Prohibition committee and the Prohibition of Money Laundering Committee of the Tel

Aviv District, both of the Israel Bar Association from November 2015 to December 2019. Mr. Rosenbloom holds an LL.B. from the Ono Academic

College, an Israeli branch of University of Manchester. We believe that Mr. Rosenbloom is qualified to serve on our board of directors

because of his business experience and legal expertise and background.

Israel

Berenshtein has served as a member of our board of directors since August 2020. Mr. Berenshtein has also served on the board of directors

of Chrion Refineries Ltd. (TASE: CHR) since May 2019 and recently started working as a lawyer in Ben Yakov, Shvimer, Dolv – Law

Office. He previously served in the legal department of Sonol Israel Ltd. since April 2010 to December 2020. Before that, Mr. Berenshtein

worked as a commercial lawyer and litigator for a leading Israeli law firm from July 2000 to April 2010. Mr. Berenshtein earned an LL.B.

in law and an M.A. in political science from Bar Ilan University, Israel. Mr. Berenshtein was admitted to the Israel Bar Association

in 2000. We believe that Mr. Berenshtein is qualified to serve on our board of directors due to his extensive legal experience.

Eliahou

Arbib has served as a member of our board of directors since January 2021. Mr. Arbib has also served as chairman of the board of

directors of Chiron Refineries Ltd. (TASE: CHR) since September 2016. He has also the current owner and manager of Eliahou Arbib Law

Offices, since May 2013. Prior to that, from 1993 until 2000, Mr. Arbib was the managing director of AA Arbib Agriculture Supply Ltd.

Mr. Arbib holds an LLB from the Law and Business Academic Center of Ramat Gan, Israel. Mr. Arbib has been an active member of the Israeli

Bar Association since 2013, and served as deputy chairman of the Security and Defense Committee of the Israeli Bar Association since

2014. We believe that Mr. Arbib is qualified to serve on our board of directors because of his legal experience as well as experience

in the field of agriculture.

Udi

Kalifi has served as a member of our board of directors since May 18, 2021. Mr. Kalifi is the owner and manager of Udi Kalifi Law

Offices since 2006. He has also served as a member of the board of directors of Matomi Media Group Ltd. (TASE: MTMY) since May 2020.

Mr. Kalifi holds an LLB, BSc in Accounting and LLM from the Tel Aviv University, Israel and a master’s degree in law and economics

from the University of Bologna, Humbourg and Roterdam. Mr. Kalifi has been an active member of the Israeli Bar Association since 2006.

Mr. Kalifi was selected to serve as a member of our board of directors due to his legal and finance experience.

Biographies

of Class II Directors Subject to Reelection at the Annual Meeting

Amitay

Weiss has served as a member of our board of directors since August 2020 and as our chairman of the board of directors since May

24, 2021. Mr. Weiss also serves as a director in other public companies, including Gix Internet Ltd., Arazim Investments Ltd., Maris-Tech

Ltd. and Upsellon Brands Holdings Ltd. Mr. Weiss also serves as Chairman of the Board of Automax Motors Ltd., Clearmind Medicine

Inc., SciSparc Ltd. and Internet Golden Lines Ltd. In April 2016, Mr. Weiss founded Amitay Weiss Management Ltd., an economic consulting

company located in Israel and now serves as its chief executive officer. Mr. Weiss holds a B.A in economics from New England College,

a M.B.A. in business administration and LLB from Ono Academic College in Israel, an Israeli branch of University of Manchester.

We believe that Mr. Weiss is qualified to serve on our board of directors because of his diverse business, management and leadership

experience.

Dr.

Roy Borochov has served as a Class II director of the Company since April 5, 2023 and is the current chief executive officer of

Plantify Foods, Inc., a minority subsidiary of the Company. Since December 2020, Dr. Borochov has also served as the chief executive

officer of Mercury Investment Fund and the founder and owner of OLEA since 2000. Dr. Borochov has also served as chairman of ParaZone

Drone Safety Systems since February 2022 and as a member of the board of directors of Peas of Bean since March 2021. Prior to that, from

September 2018 to September 2020, Dr. Borochov was the Head of Agriculture at Prospera Technologies Ltd., and from November 2016 to September

2017, he served as chief technology officer and project co-lead of Forrest Innovations Ltd. Prior to that, from January 2015 to September

2017, Dr. Borochov served as the president of Forrest Innovations USA Inc., and from 2009 to 2015, he served in various roles at the

Israeli Bio Organic Agriculture Association, including as its chief executive officer and chief orchard instructor. Dr. Borochov holds

a Ph.D, M.Sc. and B.Sc. in Plant Science from the Hebrew University of Jerusalem. We believe that Dr. Borochov is qualified to serve

on our board of directors given his extensive experience in and expertise with agri-tech companies and his leadership position with Plantify

Foods, Inc., which is a key subsidiary of the Company.

Family

Relationships

There

are no family relationships between our directors and executive officers.

Vote

Required

The

Class II directors will be elected by a plurality of the votes cast by the holders of our Common Stock voting in person or by

proxy at the Annual Meeting. The two director nominees who receive the most votes cast in the election of directors will be elected as

Class II directors.

| |

Board

Recommendation

The

board of directors recommends a vote FOR each of the Class II director nominees under the Director Election Proposal. |

| |

EXECUTIVE

OFFICERS

Below

is certain information with respect to our other executive officers.

| Name |

|

Age |

|

Position |

| David

Palach |

|

57 |

|

Chief

Executive Officer |

| Lital

Barda |

|

36 |

|

Chief

Financial Officer |

| Dan

Sztybel |

|

46 |

|

Chief

Executive Officer of Save Foods Ltd. |

The

Company’s officers are appointed by the board of directors and

serve at its discretion.

David

Palach has served as our chief executive officer since January 2021 and served as our interim chief financial officer from April

1, 2023 until July 15, 2023 while Lital Barda was on maternity leave. Mr. Palach has owned and served as chief executive officer of S.T.

Sporting Ltd. and Sun Light Lightning Solutions Ltd., companies operating in the environmental industry since 2009 and

2015, respectively. Mr. Palach holds a BBA in Accounting from Baruch College/City University of New York and completed a Directors Course

at Bar Ilan University in Israel. Mr. Palach previously maintained a certified public accounting license in the State of Maryland.

Lital

Barda has served as the Company’s chief financial officer since April 2022. In addition to her role as the Company’s

chief financial officer, Ms. Barda currently serves as an accountant and financial controller for Shlomo Zakai, CPA, a position she has

held since November 2017, and provided a wide range of accounting and controlling services for publicly traded and private companies. Ms. Barda holds a B.A. in accounting from the Ono Academic College in Kiryat Ono, Israel. Ms. Barda is also a

certified public accountant in Israel.

Dan

Sztybel has served as the chief executive officer of Save Foods Ltd. since April 2019. Mr. Sztybel previously served as the chief

executive officer of the Company from April 2019 to January 2021, and vice president of business development from October 2018

to March 2019. Prior to joining the Company, Mr. Sztybel served as principal at Goldmed Ltd., a consulting firm from September

2016 to September 2018. Mr. Sztybel is the founder of Dan Sztybel Consulting Group, a boutique firm advising global leaders and emerging

startups in the healthcare field on strategy, partnerships, and investments and has served as its managing director since November 2014.

Mr. Sztybel is also the co-founder of MyndYou, a digital health-tech company. Mr. Sztybel led the life sciences and healthcare advisory

team at Kost, Forer, Gabbay & Kasierer, a member firm of Ernst & Young Global from July 2007 to November 2014. Mr. Sztybel received

his B.Sc. and M.Sc. in molecular biology and biotechnology from Bar-Ilan University. Mr. Sztybel also completed a special EY-Kellogg-Recanati

business program for employee excellence.

EXECUTIVE

COMPENSATION

Summary

Compensation Table

The

following table sets forth certain information concerning the compensation awarded to, earned by or paid to of our Chief Executive

Officer and our other executive officers receiving annual remuneration in excess of $100,000 during 2022 (each, a “Named

Executive Officer”).

| Name and principal position | |

Fiscal Year | | |

Salary ($) | | |

Bonus ($) | | |

Stock awards ($) | | |

Option awards ($) | | |

All other compensation ($) | | |

Total ($) | |

| David Palach | |

| 2022 | | |

| 134,844 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 134,844 | |

| Chief Executive Officer (1) | |

| 2021 | | |

| 164,017 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 164,017 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Dan Sztybel | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Former co-Chief Executive Officer, Chief Executive Officer of Save Foods Ltd. (2) | |

| 2021 | | |

| 289,087 | | |

| 65,000 | | |

| - | | |

| 73,974 | | |

| - | | |

| 428,061 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shlomo Zakai | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Former

Chief Financial Officer (3) | |

| 2021 | | |

| 210,470 | | |

| 30,000 | | |

| - | | |

| 3,049 | | |

| - | | |

| 243,519 | |

| (1) |

Mr.

Palach was appointed as our co-Chief Executive Officer on November 5, 2020, and as our Chief Executive Officer on January

11, 2021, upon the resignation of Mr. Sztybel. |

| |

|

| (2) |

Mr.

Sztybel resigned from his position as our co-Chief Executive Officer, effective January 11, 2021, and thereafter continued

serving as the Chief Executive Officer of Save Foods Ltd. |

| |

|

| (3) |

Mr.

Zakai resigned from his position as our Chief Financial Officer, effective May 18, 2021. |

Outstanding

Equity Awards at Fiscal Year-End

The

following table provides information about the number of outstanding equity awards held by each of our named executive officers as of

December 31, 2022:

| | |

Option Awards | | |

| | |

Stock Awards | |

| Name | |

Number of Securities Underlying Unexercised Options (Exercisable) | | |

Number of Securities Underlying Unexercised Options (Unexercisable) | | |

Option Exercise Price | | |

Option Expiration Date | | |

Equity Incentive Plan Awards: Number of Unearned Shares That Have Not Vested | | |

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares That Have Not Vested | |

| David Palach | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Chief Executive Officer | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Dan Sztybel | |

| 14,286 | | |

| - | | |

| 3.15 | | |

| 1/3/2029 | | |

| - | | |

| - | |

| Former co-Chief Executive Officer, Chief Executive Officer of Save Foods Ltd. | |

| 28,572 | | |

| - | | |

| 3.15 | | |

| 4/2/2029 | | |

| | | |

| | |

| | |

| 28,572 | | |

| - | | |

| 3.78 | | |

| 7/1/2030 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shlomo Zakai | |

| 9,524 | | |

| - | | |

| 3.15 | | |

| 1/3/2029 | | |

| - | | |

| - | |

| Former Chief Financial Officer | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

Employment

Agreements with Executive Officers

We,

and through our Israeli subsidiary, have entered into written employment agreements with certain of our executive officers.

Consulting

Agreement with David Palach

On

November 6, 2020, we entered into a consulting agreement with S.T Sporting (1996) Ltd., for the services of David Palach (the “CEO

Consulting Agreement”). Pursuant to the terms of the CEO Consulting Agreement, Mr. Palach provides us services as chief executive

officer. Pursuant to the terms of the CEO Consulting Agreement, Mr. Palach was entitled to a monthly fee in the amount of $8,000 plus

value added tax per month and a grant of options to purchase shares of our Common Stock, which amount shall be determined by good