0001588972false00015889722023-11-082023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 08, 2023 |

Societal CDMO, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Pennsylvania |

001-36329 |

26-1523233 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1 E. Uwchlan Ave, Suite 112 |

|

Exton, Pennsylvania |

|

19341 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 770 534-8239 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, par value $0.01 |

|

SCTL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 8, 2023, Societal CDMO, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended September 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The Company has scheduled a conference call and webcast for 4:30 p.m. Eastern time on November 8, 2023 to discuss these financial results and business updates.

The information disclosed under this Item 2.02, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

Attached as Exhibit 99.2 is a presentation that the Company will post on its website on November 8, 2023 and may use from time to time in presentations or discussions with investors, analysts, and other parties.

The information in this Item 7.01, including Exhibit 99.2 hereto, is being furnished solely to satisfy the requirements of Regulation FD and shall not be deemed to be “filed” for the purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are being furnished herewith:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Societal CDMO, Inc. |

|

|

|

|

Date: |

November 8, 2023 |

By: |

/s/ J. David Enloe, Jr. |

|

|

|

J. David Enloe, Jr.

President and Chief Executive Officer |

Exhibit 99.1

Societal CDMO Reports Third Quarter 2023 Financial Results

Recorded Q3 Revenue of $23.6 Million

Signed Multiple New Business Agreements with New and Existing Customers

Closed Public Offering Raising Gross Proceeds of Approximately $8.3 Million

Initiated Corporate Restructuring; Expected to Result in Annualized Savings of Approximately $5.5 Million

Company to Host Webcast Today at 4:30 p.m. ET

SAN DIEGO, CA, and GAINESVILLE, GA – November 8, 2023 — Societal CDMO, Inc. (“Societal”; NASDAQ: SCTL), a contract development and manufacturing organization (CDMO) dedicated to solving complex formulation and manufacturing challenges primarily in small molecule therapeutic development, today reported financial results for the third quarter and nine months ended September 30, 2023.

“During the third quarter, the company’s operational performance was strong, with our team adding multiple new and existing customer projects to our pipeline. These projects span a range of Societal’s capabilities and we believe speak to the growing strength of our reputation within the industry, and track record of success with our existing customers,” said David Enloe, chief executive officer of Societal.

“The company also opened a new revenue channel by securing a license to manufacture in support of psychedelic drug development. Given our years of experience handling controlled substances, we believe we are uniquely qualified to support the emerging psychedelic therapy sector as well as the growing number of ongoing and planned clinical trials in this area. We are very excited to be working in this innovative area of drug development.

“Over the last few months, we also had a number of notable corporate achievements. During the third quarter, we initiated a strategic reorganization of the company that we believe will generate millions in annual savings, favorably restructured our debt, and raised funds in a very challenging market. While undertaking these efforts in a single quarter presented challenges, we believe that our successful execution of each has placed us on a path to long-term growth and financial stability.

“Given the achievements of the quarter combined with our leaner and highly focused operation, I wish to emphasize the optimism we have for the future of Societal CDMO. We have high conviction that the current market valuation of our company is not at all reflective of, nor indicative of, the real value of the company we have built and continue to grow every day. When we view the company’s 2023 achievements to-date in the context of expectations for 2024 and beyond, we are bullish on our prospects for financial growth in the near future, and believe we are well positioned to reach positive cash flow in 2025.”

Third Quarter 2023 and Other Recent Developments and Events

New and Expanded Customer Projects. During the quarter, the company added two new customers, including Societal’s first government contract with the National Institutes of Health (NIH) for a project to be conducted at the Georgia facility. In addition, Societal expanded project agreements across multiple existing programs. The new business includes formulation and analytical method development, cGMP manufacturing, stability studies, packaging and logistics services.

Secured Schedule 1 Controlled Substance Manufacturing License from Drug Enforcement Agency; Allows Expansion into Manufacture of Psychedelic Drug Products. During the quarter, the company completed key regulatory requirements, and received U.S. Drug Enforcement Agency (DEA) approval to add certain Schedule 1 psychedelic compounds to its controlled substance manufacturing registration. These compounds expand upon the Schedule 2 manufacturing registration that the company has held with the DEA for over 20 years. Importantly, Societal is now able to expand its capabilities into the psychedelic drug development market without committing any additional capital investment. The company is excited to support this emerging and growing market and is currently in discussions with drug manufacturers engaged in the psychedelic area.

Renegotiated Debt Terms. Today’s unfavorable financing environment has impacted the manufacturing decisions of many of Societal’s customers. In an effort to mitigate the effects of these conditions to Societal, the company has taken proactive steps to improve its financial position. During this quarter, the company renegotiated its debt structure and certain covenants with its creditors to provide the company with additional financial optionality. Specifically, among other benefits, the new terms defer previous mandatory payments, reduce certain payments, and lower certain minimum liquidity and fixed charge coverage ratios. The company is very pleased with the outcome of this effort and the additional financial flexibility secured.

Successfully Closed Public Offering. During the third quarter, the company also closed an underwritten public offering of 20,750,000 shares of its common stock (or common stock equivalents). The gross proceeds from the offering were approximately $8.3 million, before underwriting discounts and commissions and offering expenses. These funds provide added operational flexibility and will be used to further support Societal’s growth objectives.

New Board Appointments. Concurrent with the closing of the financing, which was largely supported by many of the company’s existing investors, the company’s board of directors appointed Wayne Weisman, Societal’s previous board chairman, to the position of executive chairman, and Matt Arens joined the board as a new director. Mr. Arens serves as the chief executive officer and senior portfolio manager at First Light Asset Management, one of Societal’s largest investors and a long-time supporter of the company. He has a track record of success supporting micro-cap, small-cap, and mid-cap health care companies, and Societal is thrilled to have expanded access to his experience in guiding companies toward growth and sustainable profitability.

“I am pleased to join the Societal board of directors,” stated Mr. Arens. “I continue to see substantial value in Societal and am encouraged by the tangible steps the company has taken over the last few months to improve both its near-term and longer-term business outlook. It is clear to me that the board and management team are aligned and focused on creating shareholder value, and I am encouraged by the strategic actions the company is undertaking to maximize its optionality in a difficult operating environment.”

Initiated Corporate Restructuring. During the quarter, the company initiated a strategic restructuring designed to right-size the organization and optimize cost efficiencies. Following the completion of a comprehensive review of its operations, Societal reduced its workforce by 26 positions (9%), and eliminated nine open positions across all aspects of the business, effective September 20, 2023. These moves are expected to result in annualized savings of approximately $5.5 million.

Concurrent with the reduction in workforce, the company also decided to scale back or discontinue aspects of its operations which will impact the company’s manufacturing capacity and accordingly, its revenue generating capability. A significant majority of these cuts will impact the portion of the business supporting earlier-stage services, which are most acutely affected by the current financing environment. While the company believes these actions will drive improved cash flows, they will also reduce Societal’s overall revenue-generating capacity in the near-term by approximately 5% - 10%. While Societal continues to prioritize achieving profitability in the future, it is a first priority to establish a healthy cash flow today to sustain the company in the current challenging market. As a result of the restructuring and strategic refocusing of assets, the company is resetting its 2023 revenue guidance to account for the discontinuation of certain programs and services, to between $92 million - $94 million.

Financial Results for the Three Months Ended September 30, 2023

Revenues for the quarter ended September 30, 2023, were $23.6 million, compared to $21.6 million for the comparable 2022 period. The increase of $2.0 million was primarily driven by an increase in revenue from the company’s largest commercial customer, Teva, due to the continued pull through in demand during the quarter resulting from market share gains against the sole competitor for the Verapamil SR products as well as a catch-up in shipments to Teva from the second quarter of 2023, during which the company saw a decrease in shipments due to the company’s scheduled shutdown of the company’s packaging line to implement upgrades required to comply with new serialization aggregation compliance standards. In addition, there was an increase in shipments to Lannett for Verapamil PM due to timing of customer orders during the year. Further, the company had its first shipment of Otsuka commercial batches during the quarter. Offsetting these increases were a decrease in Novartis and InfectoPharm shipments due to timing of customer orders as well as prior year inventory-build for InfectoPharm as a then new customer.

Cost of sales for the quarter ended September 30, 2023, was $19.9 million compared to $16.1 million for the comparable period of 2022. The increase of $3.8 million was primarily due to higher commercial manufacturing revenue and higher fixed costs to support the newly installed aseptic fill/finish line that has expanded the company’s capabilities. In addition, there were $0.7 million of restructuring costs recorded during the current year period.

Selling, general and administrative expenses for the third quarter of 2023 of $5.3 million were relatively consistent with the comparable prior year period of $5.1 million. Included within the current year period was $0.4 million of restructuring costs.

Interest expense was $3.0 million for the three months ended September 30, 2023, a decrease compared to $3.6 million for the comparable period of 2022. The decrease of $0.6 million was primarily due to a significantly reduced amount of aggregate principal and lower interest rates under the company’s refinanced debt as compared to the borrowings outstanding during the period ended September 30, 2022.

For the quarter ended September 30, 2023, the company recorded a net loss of $4.6 million or $0.05 per diluted share, as compared to a net loss of $3.3 million or $0.06 per diluted share, for the comparable period of 2022. EBITDA, as adjusted* for the period was $2.8 million compared to $3.8 million in the prior year period. The $1.0 million decrease in EBITDA, as adjusted, is primarily due to higher expense during the period.

Financial Results for the Nine Months Ended September 30, 2023

Revenue for the nine months ended September 30, 2023, was $66.9 million, compared to $65.9 million for 2022. The increase of $1.0 million in revenue was primarily driven by increases in revenues from Teva and Lannett as well as an increase in pre-commercial development revenues, which were partially offset by a decrease in Novartis and InfectoPharm revenues, as described above.

Cost of sales for the nine months ended September 30, 2023, was $56.5 million, compared to $49.6 million in 2022. The cost of sales increase of $6.9 million was primarily due to mix of revenue and related fixed cost absorption, including increased costs associated with the new aseptic fill/finish line that has expanded the company’s capabilities and increased material costs. In addition, there were $0.7 million of restructuring costs recorded during the current year period.

Selling, general and administrative expenses for the nine months ended September 30, 2023, were $15.2 million, compared to $15.9 million in 2022. The decrease of $0.7 million was primarily related to lower public company costs and administrative costs than the prior year offset by $0.4 million of restructuring costs recorded in the current year period.

Interest expense was $7.4 million and $10.5 million for the first nine months of 2023 and 2022, respectively. The decrease of $3.1 million was primarily due to a significantly reduced amount of aggregate principal and lower interest rates under the company’s refinanced debt as compared to the borrowings outstanding during the period ended September 30, 2022.

For the nine months ended September 30, 2023, Societal reported a net loss of $12.5 million, or $0.14 per diluted share, compared to a net loss of $10.7 million, or $0.19 per diluted share, for 2022. EBITDA, as adjusted* for the first nine months was $6.3 million compared to $10.6 million in the prior year period. The $4.3 million decrease in EBITDA, as adjusted is primarily due to mix of revenue and related fixed cost absorption offset by reduced selling, general and administrative costs.

2023 Guidance

The company is resetting revenue guidance for the full year 2023 to account for the discontinuation of certain programs and services, to between $92 million - $94 million, with expected net loss of $12.1 million - $13.6 million.

The company is resetting EBITDA, as adjusted* guidance for the full year to between $11.5 million - $13 million.

* EBITDA, as adjusted is non-GAAP financial measure (see reconciliation of non-GAAP financial measures at the end of this release).

Non-GAAP Financial Measures

To supplement Societal’s financial results determined by U.S. generally accepted accounting principles (“GAAP”), the company monitors certain non-GAAP information for the business, including EBITDA, as adjusted. The company believes that these non-GAAP financial measures are helpful in understanding the business as they are useful to investors in allowing for greater transparency of supplemental information used by management. These measures are used by investors, as well as management in assessing the company’s performance. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, reported GAAP results. Further, non-GAAP financial measures, even if similarly titled, may not be calculated in the same manner by all companies, and therefore should not be compared. Please see the section of this press release titled “Reconciliation of GAAP to Non-GAAP Financial Measures” for a reconciliation of any non-GAAP financial measures to their most directly comparable GAAP measures.

Webcast

Societal management will be hosting a webcast today, November 8, 2023, beginning at 4:30 p.m. ET. The webcast may be accessed via "Investor Events" in the Investor section of the company’s website, https://ir.societalcdmo.com/events. An archived webcast will be available on the company’s website approximately two hours after the event and will be available for 30 days.

About Societal CDMO

Societal CDMO (NASDAQ: SCTL) is a bi-coastal contract development and manufacturing organization (CDMO) with capabilities spanning pre-Investigational New Drug (IND) development to commercial manufacturing and packaging for a wide range of therapeutic dosage forms with a primary focus in the area of small molecules. With an expertise in solving complex manufacturing problems, Societal CDMO is a leading CDMO providing therapeutic development, end-to-end regulatory support, clinical and commercial manufacturing, aseptic fill/finish, lyophilization, packaging and logistics services to the global pharmaceutical market.

In addition to our experience in handling DEA controlled substances and developing and manufacturing modified-release dosage forms, Societal CDMO has the expertise to deliver on our clients’ pharmaceutical development and manufacturing projects, regardless of complexity level. We do all of this in our best-in-class facilities, which total 145,000 square feet, in Gainesville, Georgia and San Diego, California.

Societal CDMO: Bringing Science to Society. For more information about Societal’s customer solutions, visit societalcdmo.com.

Cautionary Statement Regarding Forward Looking Statements

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements, among other things, relate to the company’s financial guidance; expectations regarding use of proceeds from recent financings; expectations regarding customer ordering patterns; ability to manage costs and to achieve its financial goals; to operate under lending covenants; and to maintain relationships with CDMO commercial partners and develop additional commercial partnerships. The words "anticipate", "believe", "correlate", "could", "estimate", “upcoming”, "expect", "intend", "may", "plan", "predict", "project", "will" and similar terms and phrases may be used to identify forward-looking statements in this press release. Our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. Factors that could cause the company’s actual outcomes to differ materially from those expressed in or underlying these forward-looking statements include, but are not limited to, unstable market and macroeconomic conditions, including any adverse impact on the customer ordering patterns or inventory rebalancing or disruption in raw materials or supply chain; demand for the company’s services, which depends in part on customers’ research and development funding, their clinical plans and the market success of their products; customers’ changing inventory requirements and manufacturing plans; customers and prospective customers decisions to move forward with the company’s manufacturing services; the average profitability, or mix, of the products the company manufactures; the company’s ability to enhance existing or introduce new services in a timely manner; the company’s ability to close its previously announced land sale transaction on the anticipated timeline; fluctuations in the costs, availability, and suitability of the components of the products the company manufactures, including active pharmaceutical ingredients, excipients, purchased components and raw materials, or the company’s customers facing increasing or new competition; the company’s ability to collect on customers’ receivable balances; the extent to which health epidemics and other outbreaks of communicable diseases could disrupt our operations; and other risks and uncertainties discussed in our filings with the Securities and Exchange Commission at www.sec.gov. These forward-looking statements are based on information currently available to us, and we assume no obligation to update any forward-looking statements except as required by applicable law.

Contacts

Stephanie Diaz (Investors)

Vida Strategic Partners

(415) 675-7401

sdiaz@vidasp.com

Tim Brons (Media)

Vida Strategic Partners

(415) 675-7402

tbrons@vidasp.com

Ryan D. Lake (CFO)

Societal CDMO

(770) 531-8365

ryan.lake@societalcdmo.com

SOCIETAL CDMO, INC. AND SUBSIDIARIES

Summary of Operating Results

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

|

|

|

|

|

|

(dollars in thousands, except per share amounts) |

2023 |

|

|

2022 |

|

|

Change |

|

|

% |

|

Revenue |

$ |

23,590 |

|

|

$ |

21,589 |

|

|

$ |

2,001 |

|

|

|

9 |

% |

Cost of sales |

|

19,870 |

|

|

|

16,055 |

|

|

|

3,815 |

|

|

|

24 |

% |

Gross margin |

|

16 |

% |

|

|

26 |

% |

|

|

|

Selling, general and administrative expenses |

|

5,309 |

|

|

|

5,075 |

|

|

|

234 |

|

|

|

5 |

% |

Amortization of intangible assets |

|

168 |

|

|

|

244 |

|

|

|

(76 |

) |

|

|

-31 |

% |

Total operating expenses |

|

25,347 |

|

|

|

21,374 |

|

|

|

3,973 |

|

|

|

19 |

% |

Operating (loss) income |

|

(1,757 |

) |

|

|

215 |

|

|

|

(1,972 |

) |

|

|

-917 |

% |

Interest expense |

|

(2,911 |

) |

|

|

(3,586 |

) |

|

|

675 |

|

|

|

-19 |

% |

Interest income |

|

79 |

|

|

|

42 |

|

|

|

37 |

|

|

|

88 |

% |

Loss before income taxes |

|

(4,589 |

) |

|

|

(3,329 |

) |

|

|

(1,260 |

) |

|

|

38 |

% |

Income tax expense |

|

3 |

|

|

|

— |

|

|

|

3 |

|

|

n/a |

|

Net loss |

$ |

(4,592 |

) |

|

$ |

(3,329 |

) |

|

$ |

(1,263 |

) |

|

|

38 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share, diluted |

$ |

(0.05 |

) |

|

$ |

(0.06 |

) |

|

$ |

0.01 |

|

|

|

-17 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA, as adjusted* |

$ |

2,836 |

|

|

$ |

3,816 |

|

|

$ |

(980 |

) |

|

|

-26 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended September 30, |

|

|

|

|

|

|

|

(dollars in thousands, except per share amounts) |

2023 |

|

|

2022 |

|

|

Change |

|

|

% |

|

Revenue |

$ |

66,916 |

|

|

$ |

65,935 |

|

|

$ |

981 |

|

|

|

1 |

% |

Cost of sales |

|

56,476 |

|

|

|

49,639 |

|

|

|

6,837 |

|

|

|

14 |

% |

Gross margin |

|

16 |

% |

|

|

25 |

% |

|

|

|

Selling, general and administrative expenses |

|

15,243 |

|

|

|

15,945 |

|

|

|

(702 |

) |

|

|

-4 |

% |

Amortization of intangible assets |

|

520 |

|

|

|

685 |

|

|

|

(165 |

) |

|

|

-24 |

% |

Total operating expenses |

|

72,239 |

|

|

|

66,269 |

|

|

|

5,970 |

|

|

|

9 |

% |

Operating loss |

|

(5,323 |

) |

|

|

(334 |

) |

|

|

(4,989 |

) |

|

|

1494 |

% |

Interest expense |

|

(7,370 |

) |

|

|

(10,434 |

) |

|

|

3,064 |

|

|

|

-29 |

% |

Interest income |

|

319 |

|

|

|

56 |

|

|

|

263 |

|

|

|

470 |

% |

Loss before income taxes |

|

(12,374 |

) |

|

|

(10,712 |

) |

|

|

(1,662 |

) |

|

|

16 |

% |

Income tax expense |

|

114 |

|

|

|

— |

|

|

|

114 |

|

|

n/a |

|

Net loss |

$ |

(12,488 |

) |

|

$ |

(10,712 |

) |

|

|

(1,776 |

) |

|

|

17 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share, diluted |

$ |

(0.14 |

) |

|

$ |

(0.19 |

) |

|

$ |

0.05 |

|

|

|

-26 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA, as adjusted* |

$ |

6,271 |

|

|

$ |

10,571 |

|

|

$ |

(4,300 |

) |

|

|

-41 |

% |

* EBITDA, as adjusted, is a non-GAAP financial measure (see reconciliation of non-GAAP financial measures at the end of this release).

SOCIETAL CDMO, INC. AND SUBSIDIARIES

Reconciliation of GAAP to Non-GAAP Measures

(Unaudited)

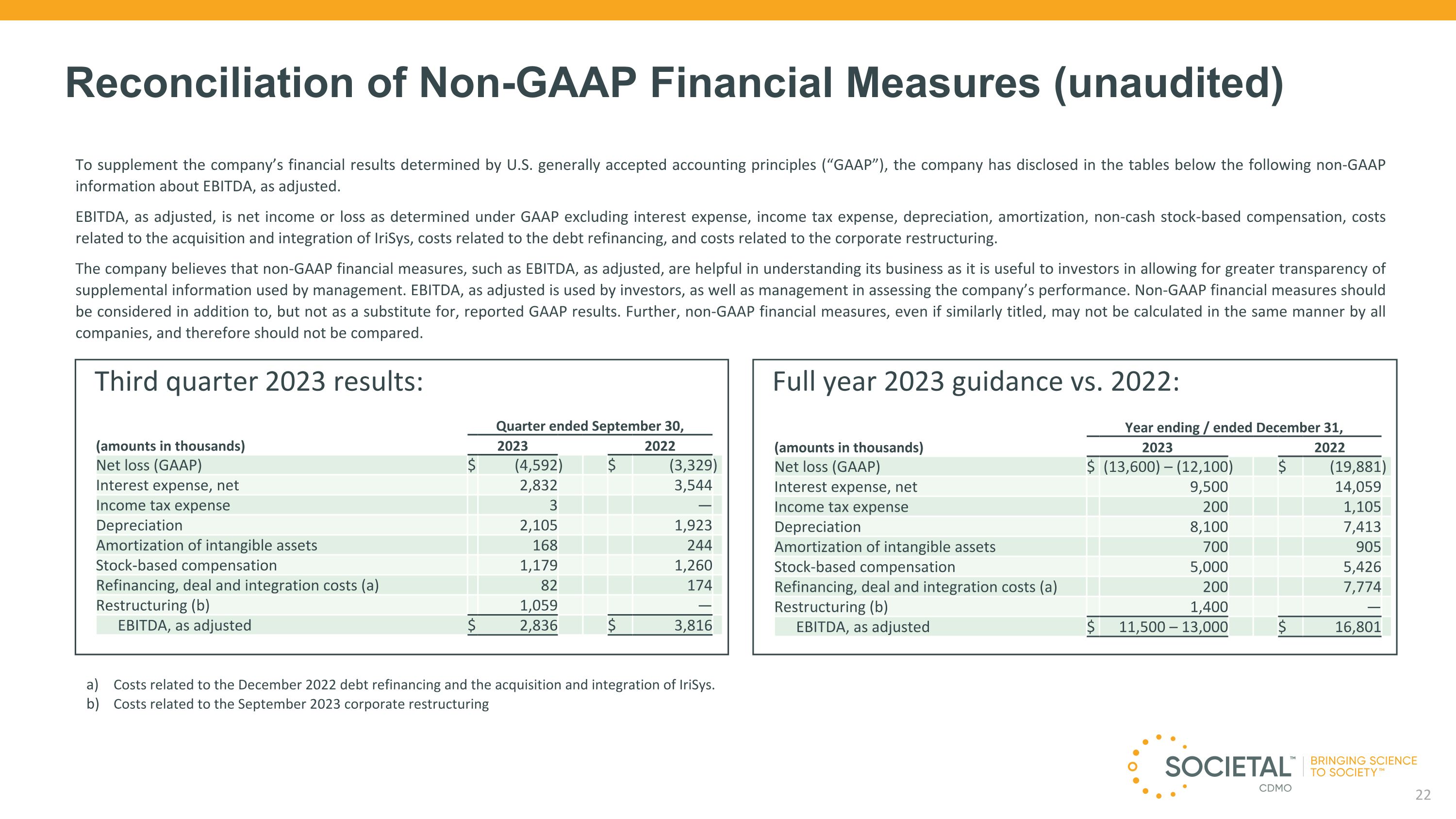

To supplement the company’s financial results determined by U.S. generally accepted accounting principles (“GAAP”), the company has disclosed in the tables below the following non-GAAP information about EBITDA, as adjusted.

EBITDA, as adjusted, is net income or loss as determined under GAAP excluding interest expense, income tax expense, depreciation, amortization, non-cash stock-based compensation, costs related to the acquisition and integration of IriSys, costs related to the debt refinancing, and costs related to the corporate restructuring.

The company believes that non-GAAP financial measures, such as EBITDA, as adjusted, are helpful in understanding its business as it is useful to investors in allowing for greater transparency of supplemental information used by management. EBITDA, as adjusted is used by investors, as well as management in assessing the company’s performance. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, reported GAAP results. Further, non-GAAP financial measures, even if similarly titled, may not be calculated in the same manner by all companies, and therefore should not be compared.

Third quarter and year to date results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

(amounts in thousands) |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net loss (GAAP) |

$ |

(4,592 |

) |

|

$ |

(3,329 |

) |

|

$ |

(12,488 |

) |

|

$ |

(10,712 |

) |

Interest expense, net |

|

2,832 |

|

|

|

3,544 |

|

|

|

7,051 |

|

|

|

10,378 |

|

Income tax expense |

|

3 |

|

|

|

— |

|

|

|

114 |

|

|

|

— |

|

Depreciation |

|

2,105 |

|

|

|

1,923 |

|

|

|

6,043 |

|

|

|

5,516 |

|

Amortization of intangible assets |

|

168 |

|

|

|

244 |

|

|

|

520 |

|

|

|

685 |

|

Stock-based compensation |

|

1,179 |

|

|

|

1,260 |

|

|

|

3,816 |

|

|

|

4,147 |

|

Refinancing, deal and integration costs (a) |

|

82 |

|

|

|

174 |

|

|

|

156 |

|

|

|

557 |

|

Restructuring (b) |

|

1,059 |

|

|

|

— |

|

|

|

1,059 |

|

|

|

— |

|

EBITDA, as adjusted |

$ |

2,836 |

|

|

$ |

3,816 |

|

|

$ |

6,271 |

|

|

$ |

10,571 |

|

2023 guidance compared to 2022 full year results

|

|

|

|

|

|

|

|

|

Year ending / ended December 31, |

|

(amounts in thousands) |

2023 |

|

|

2022 |

|

|

(estimate) |

|

|

|

|

Net loss (GAAP) |

$(13,600) - (12,100) |

|

|

$ |

(19,881 |

) |

Interest expense, net |

|

9,500 |

|

|

|

14,059 |

|

Income tax expense |

|

200 |

|

|

|

1,105 |

|

Depreciation |

|

8,100 |

|

|

|

7,413 |

|

Amortization of intangible assets |

|

700 |

|

|

|

905 |

|

Stock-based compensation |

|

5,000 |

|

|

|

5,426 |

|

Refinancing, deal and integration costs (a) |

|

200 |

|

|

|

7,774 |

|

Restructuring (b) |

|

1,400 |

|

|

|

— |

|

EBITDA, as adjusted |

$11,500 - 13,000 |

|

|

$ |

16,801 |

|

a)Costs related to the December 2022 debt refinancing and the acquisition and integration of IriSys.

b)Costs related to the September 2023 corporate restructuring.

Corporate Presentation November 2023

We anticipate raising funds from real estate asset sales to reduce our outstanding debt principal. There are a number of risks and uncertainties that could impact real estate values and or our ability, if any, to successfully monetize the sale of any non-core real-estate assets including, but not limited to, market forces, economic conditions, revenue concentration, debt levels, geographic location, interest rates, results of engineering plans, geotechnical surveys, coverage density, physical characteristics of the land (e.g. rock, wetlands delineation, streams, powerlines, topography, zoning), ability to reach acceptable contractual terms and obtaining the required approvals and release(s) from our senior secured lender. Any historical or projected financial information contained in this presentation are not intended to be indicative of future financial results. The events and circumstances reflected in these forward-looking statements, may not be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements. Undue reliance should not be placed on the forward-looking statements. Moreover, we operate in a dynamic industry and economy. New risk factors could emerge from time to time, and it is not possible for our management to predict all uncertainties that the Company may face. Non-GAAP Measures To supplement our financial results determined by U.S. generally accepted accounting principles (“GAAP”), we have included certain non-GAAP information for our business. We believe that non-GAAP financial measures are helpful in understanding our business as it is useful to investors in allowing for greater transparency of supplemental information used by management. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, reported GAAP results. Please see the “Reconciliation of GAAP to Non-GAAP Financial Measures” at the end of this presentation for a reconciliation of non-GAAP financial measures to their most directly comparable GAAP measures. This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements, among other things, relate to the Company’s growth drivers and expected levels of our organic growth; the impact of our investment in development and commercial initiatives; the anticipated impact of real estate transactions, debt repayment and contract renegotiations; financial guidance, including timing of revenues and EBITDA; our ability to manage costs and to achieve our financial goals; our ability to operate under lending covenants; our ability to maintain sufficient liquidity to operate the business; our ability to pay our debt under our credit agreement and to maintain relationships with CDMO commercial partners and develop additional commercial and development partnerships. The words "anticipate", "believe", "could", "estimate", “upcoming”, "expect", "intend", "may", "plan", "predict", "project", "will" and similar terms and phrases may be used to identify forward-looking statements in this presentation. The forward-looking statements in this presentation are only predictions. Our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. Factors that could cause the company’s actual outcomes to differ materially from those expressed in or underlying these forward-looking statements include, but are not limited to, unstable market and macroeconomic conditions, including any adverse impact on the customer ordering patterns or inventory rebalancing or disruption in raw materials or supply chain; demand for the company’s services, which depends in part on customers’ research and development funding, their clinical plans and the market success of their products; customers' changing inventory requirements and manufacturing plans; customers and prospective customers decisions to move forward with the company’s manufacturing services; the average profitability, or mix, of the products the company manufactures; the company’s ability to enhance existing or introduce new services in a timely manner; the Company’s ability to close its previously announced land sale transaction on the anticipated timeline; fluctuations in the costs, availability, and suitability of the components of the products the company manufactures, including active pharmaceutical ingredients, excipients, purchased components and raw materials, or the company’s customers facing increasing or new competition; the Company’s ability to collect on customers’ receivable balances; the extent to which health epidemics and other outbreaks of communicable diseases could disrupt our operations; and other risks and uncertainties discussed in our filings with the Securities and Exchange Commission at www.sec.gov. These forward-looking statements are based on information currently available to us, and we assume no obligation to update any forward-looking statements except as required by applicable law. Forward Looking Statements

Investment Highlights Re-Organized, Rebranded Company Poised for Growth and Diversification Success State-of-the-Art, Newly Upgraded Facilities, Available Capacity in U.S. 30+ Years of Successful Commercial Manufacturing for Multiple Global Customers Solid Base of Development and Commercial Customers Highly Experienced Management Team and Talented Workforce to Drive Future Growth Strong Regulatory Track Record Spanning Multiple Countries and Agencies NDA Ownership and Profit-Sharing Structure for Certain Drug Assets End-to-End Capabilities with Unique Expertise Solving a Wide Array of Complex Dosage Formulation & Development Challenges 3

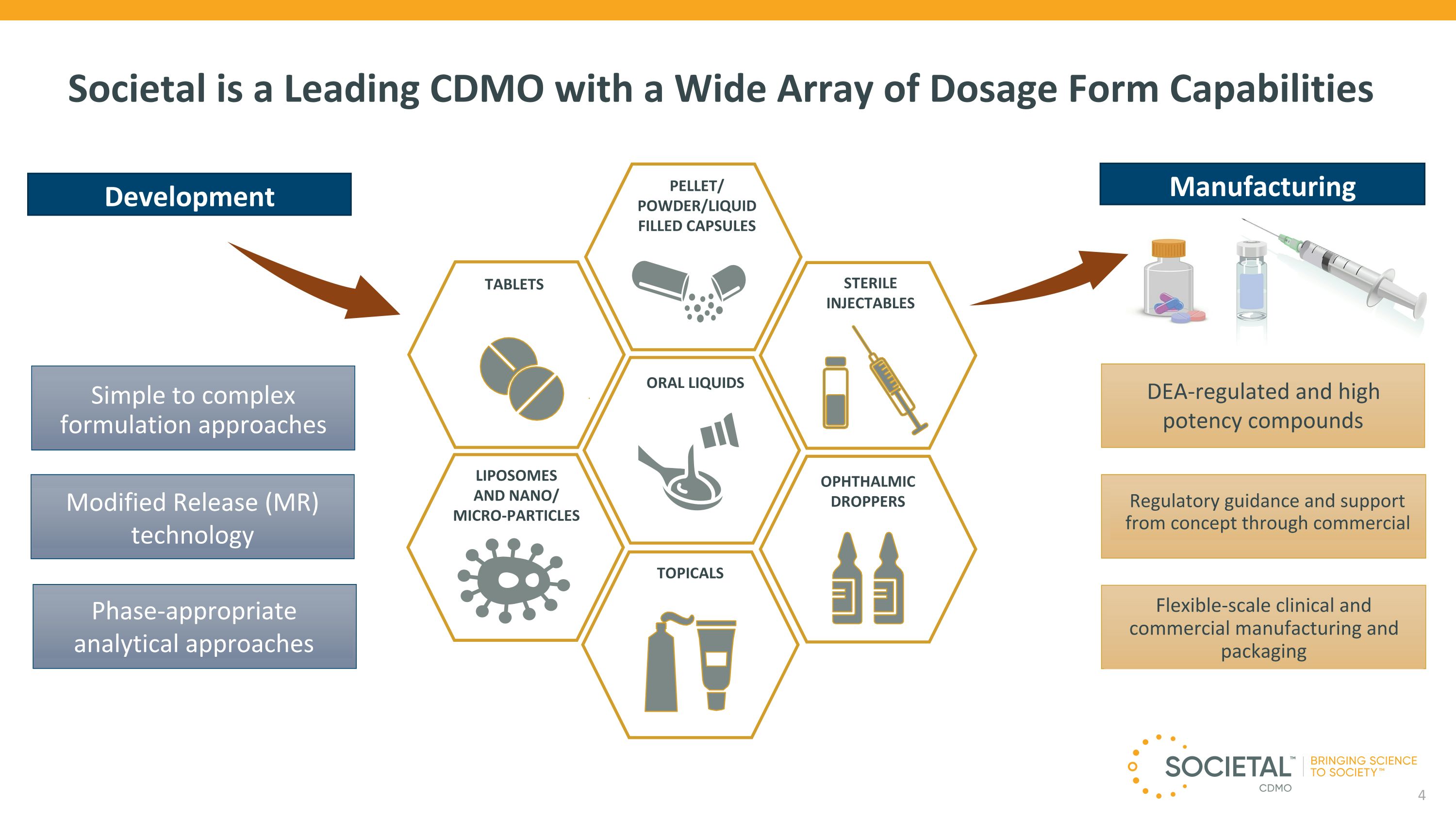

Societal is a Leading CDMO with a Wide Array of Dosage Form Capabilities DEA-regulated and high �potency compounds Regulatory guidance and support �from concept through commercial Flexible-scale clinical and commercial manufacturing and packaging Simple to complex formulation approaches Modified Release (MR) technology Phase-appropriate analytical approaches LIPOSOMES �AND NANO/�MICRO-PARTICLES PELLET/ POWDER/LIQUID �FILLED CAPSULES ORAL LIQUIDS TABLETS OPHTHALMIC DROPPERS STERILE INJECTABLES TOPICALS Manufacturing Development 4

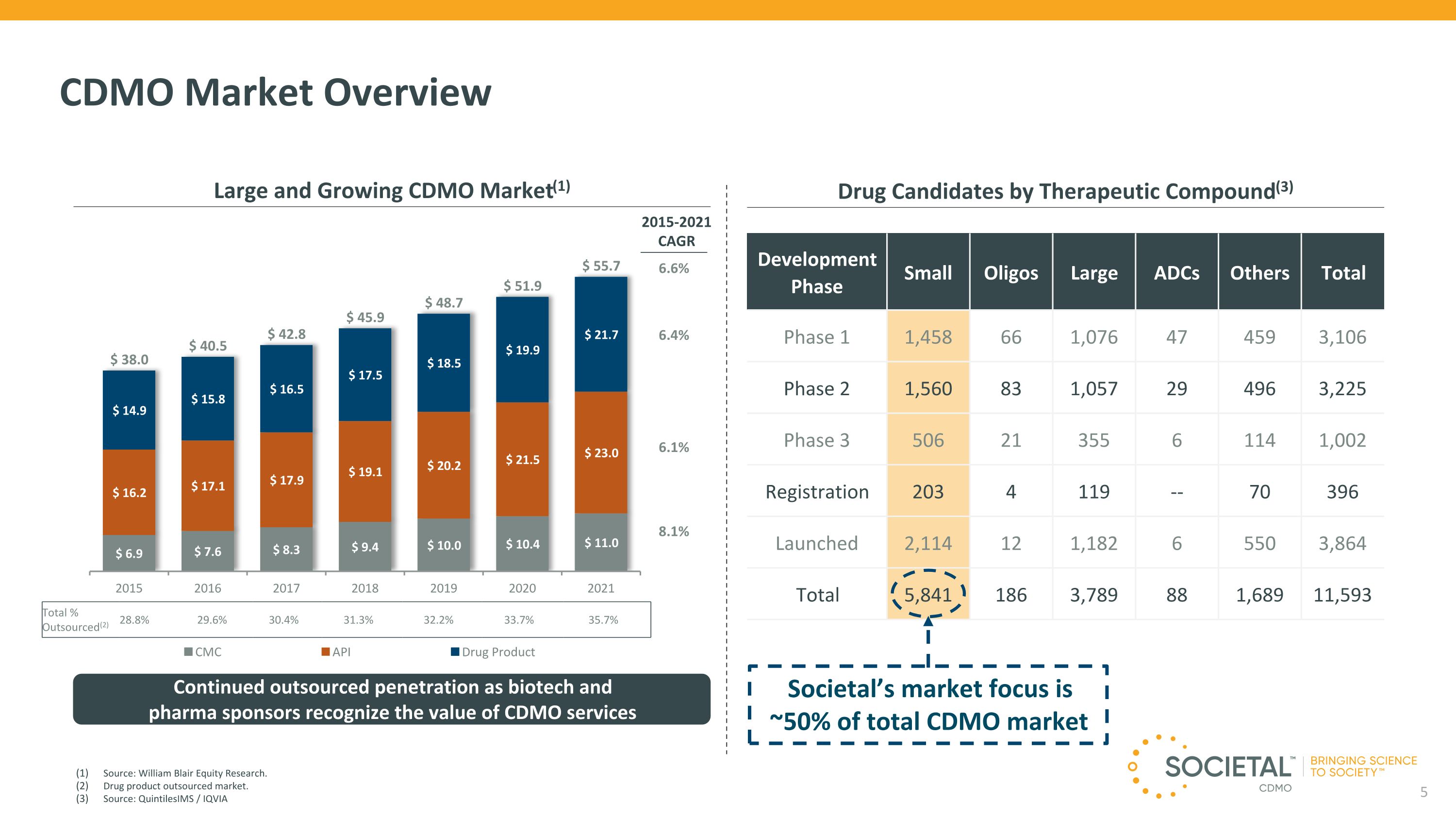

14 CDMO Market Overview Drug Candidates by Therapeutic Compound(3) Total % Outsourced(2) 28.8% 29.6% 30.4% 31.3% 32.2% 33.7% 35.7% Continued outsourced penetration as biotech and �pharma sponsors recognize the value of CDMO services 6.6% 6.4% 6.1% 8.1% 2015-2021 CAGR Large and Growing CDMO Market(1) Source: William Blair Equity Research. Drug product outsourced market. Source: QuintilesIMS / IQVIA Societal’s market focus is ~50% of total CDMO market Development Phase Small Oligos Large ADCs Others Total Phase 1 1,458 66 1,076 47 459 3,106 Phase 2 1,560 83 1,057 29 496 3,225 Phase 3 506 21 355 6 114 1,002 Registration 203 4 119 -- 70 396 Launched 2,114 12 1,182 6 550 3,864 Total 5,841 186 3,789 88 1,689 11,593 5

Elements of 1-3 Year Strategic Plan - 2023 The Company’s Strategic Plan is broken into five categories, each with three sub-categories: Market Segmentation & Corporate Identity Differentiated Sales Strategies Geographical (US) Advantage Strengthened Brand Identity Capabilities Optimization & Expansion Fill Existing Capacities Scalable, Successful Ways of Working Expanded Capabilities Client Experience & Trust Superior Client Experience Trusted, Phase Appropriate Quality System Leverage Regulatory, Supply Chain Expertise Employee Experience & Culture Excellent Employee Experience Inspiring Culture Supportive Environment Financial Strength Revenue, EBITDA growth Cash Management Investor Relations

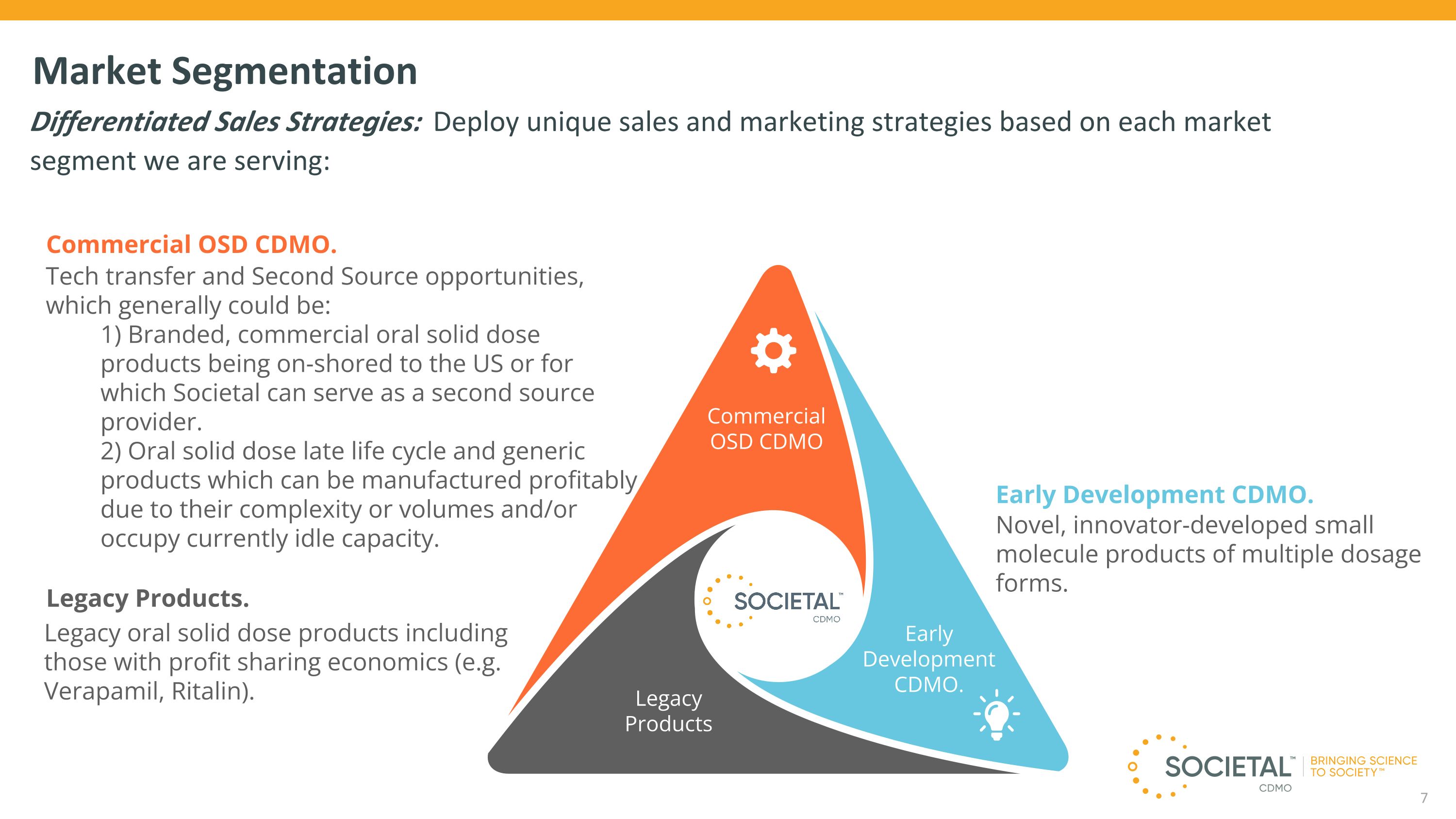

Market Segmentation Differentiated Sales Strategies: Deploy unique sales and marketing strategies based on each market segment we are serving: 7 Legacy oral solid dose products including those with profit sharing economics (e.g. Verapamil, Ritalin). Commercial OSD CDMO. Tech transfer and Second Source opportunities, which generally could be: 1) Branded, commercial oral solid dose products being on-shored to the US or for which Societal can serve as a second source provider. 2) Oral solid dose late life cycle and generic products which can be manufactured profitably due to their complexity or volumes and/or occupy currently idle capacity. Legacy Products. Legacy Products Early Development CDMO. Commercial OSD CDMO Novel, innovator-developed small molecule products of multiple dosage forms. Early Development CDMO.

Branded Commercial Tablet Product Exclusive U.S. based Manufacturer Long term Contractual Master Services & Supply Agreement Annual minimum purchase requirements Expanding Base of Commercial Customers End-to-end solutions for customers from early-stage development to scaled commercial production Verapamil PM/Verelan™ SR/PM Societal owns NDA and DMF In event of termination Societal can switch distributors within a few months Branded & authorized generic sustained release capsules Complex formulation and manufacturing – proprietary know-how Exclusive sole supplier Mature single player market Verapamil SR Societal owns NDA and DMF Authorized generic sustained release capsules, including an exclusive dosage form Complex formulation and manufacturing–proprietary ‘know-how’ Exclusive sole supplier Mature two player market – Teva maintains ~70% market share Ritalin LA ™/Focalin XR Societal owns DMF Branded & authorized generic sustained release capsules – sold US/OUS Complex formulation and manufacturing Exclusive sole supplier Mature multi-player market Regulatory & tech transfer risk and cost given Societal quality track record and lifecycle of product Donnatal® Elixir and Tablets Exclusive sole supplier, 5yr agreement through beginning of 2025 4 APIs and multi-step manufacturing process Annual purchase requirements 8 Strong commercial customer base stabilizes business and minimizes fluctuations in revenues Long-term relationships (20+ years) with key commercial partners and fully contracted through 2024 (Verapamil) – 2025 (Ritalin/Focalin) Commercial customer forecasts (generally 12-to-24-month projections) with binding PO’s typically for first three months, provides demand visibility and helps optimize supply chain execution Tech Transfers in Process Two unnamed Oral Solid Dose Tech Transfers Two development programs Three proposals for additional commercial programs Ritalin® IR tablets

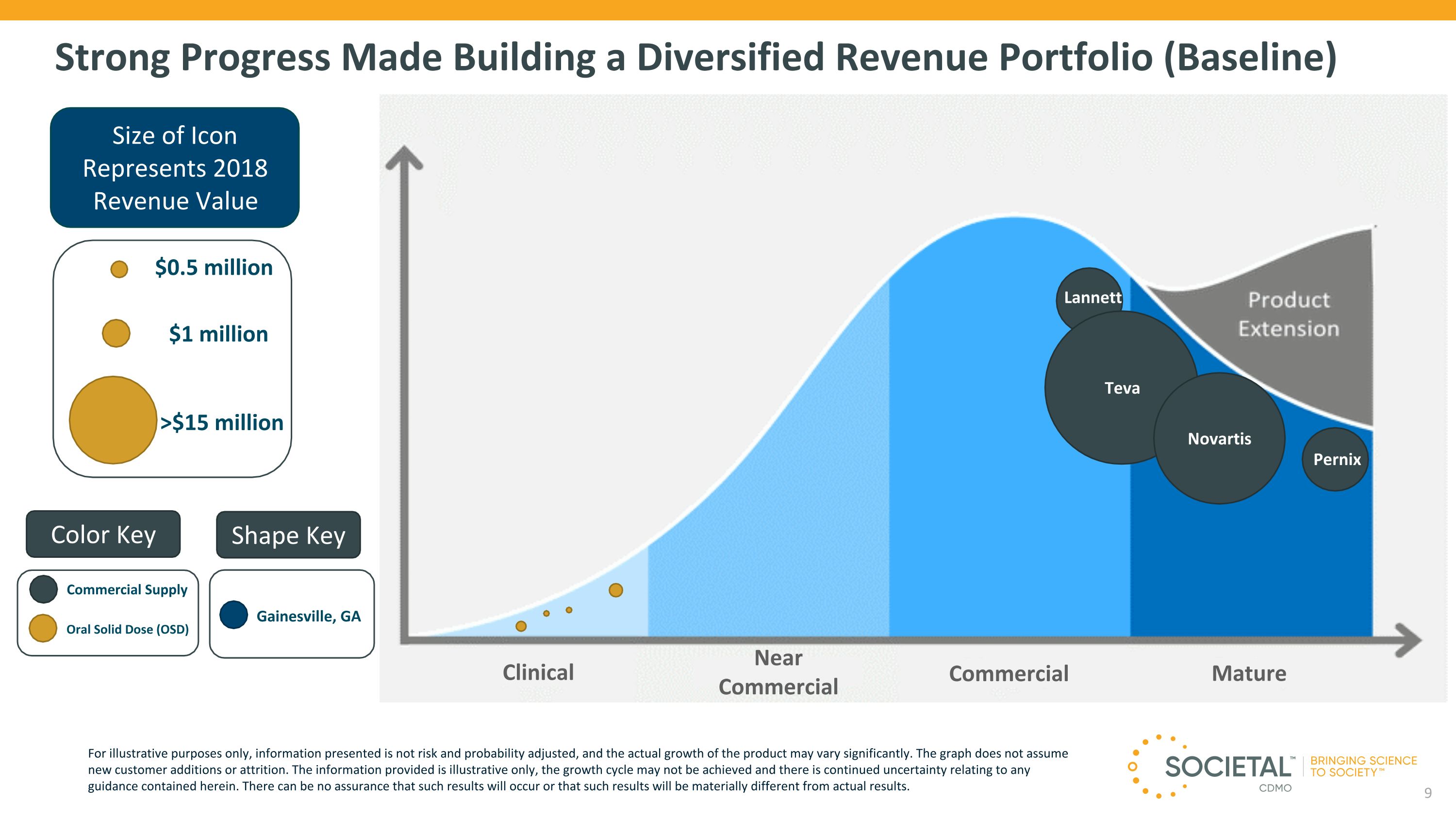

Strong Progress Made Building a Diversified Revenue Portfolio (Baseline) Size of Icon Represents 2018 Revenue Value $1 million >$15 million $0.5 million Teva Novartis Clinical Color Key Shape Key Gainesville, GA Oral Solid Dose (OSD) Near Commercial Commercial Mature Commercial Supply Lannett Pernix For illustrative purposes only, information presented is not risk and probability adjusted, and the actual growth of the product may vary significantly. The graph does not assume new customer additions or attrition. The information provided is illustrative only, the growth cycle may not be achieved and there is continued uncertainty relating to any guidance contained herein. There can be no assurance that such results will occur or that such results will be materially different from actual results.

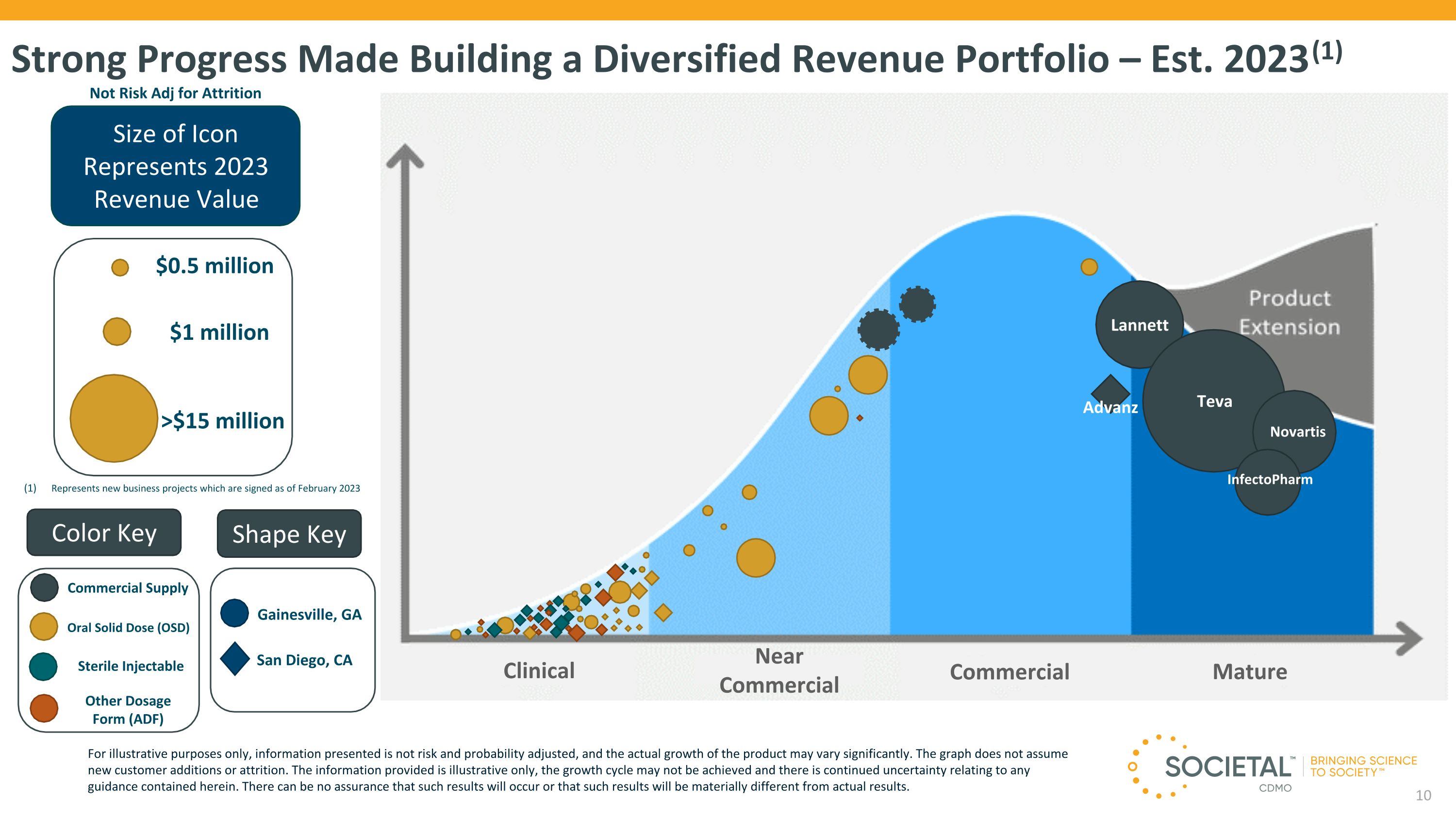

Strong Progress Made Building a Diversified Revenue Portfolio – Est. 2023 (1) Size of Icon Represents 2023 Revenue Value $1 million >$15 million $0.5 million Not Risk Adj for Attrition Lannett Teva Advanz Clinical Color Key Shape Key Gainesville, GA Sterile Injectable Oral Solid Dose (OSD) Other Dosage Form (ADF) San Diego, CA Near Commercial Commercial Mature Commercial Supply For illustrative purposes only, information presented is not risk and probability adjusted, and the actual growth of the product may vary significantly. The graph does not assume new customer additions or attrition. The information provided is illustrative only, the growth cycle may not be achieved and there is continued uncertainty relating to any guidance contained herein. There can be no assurance that such results will occur or that such results will be materially different from actual results. InfectoPharm Represents new business projects which are signed as of February 2023 Novartis

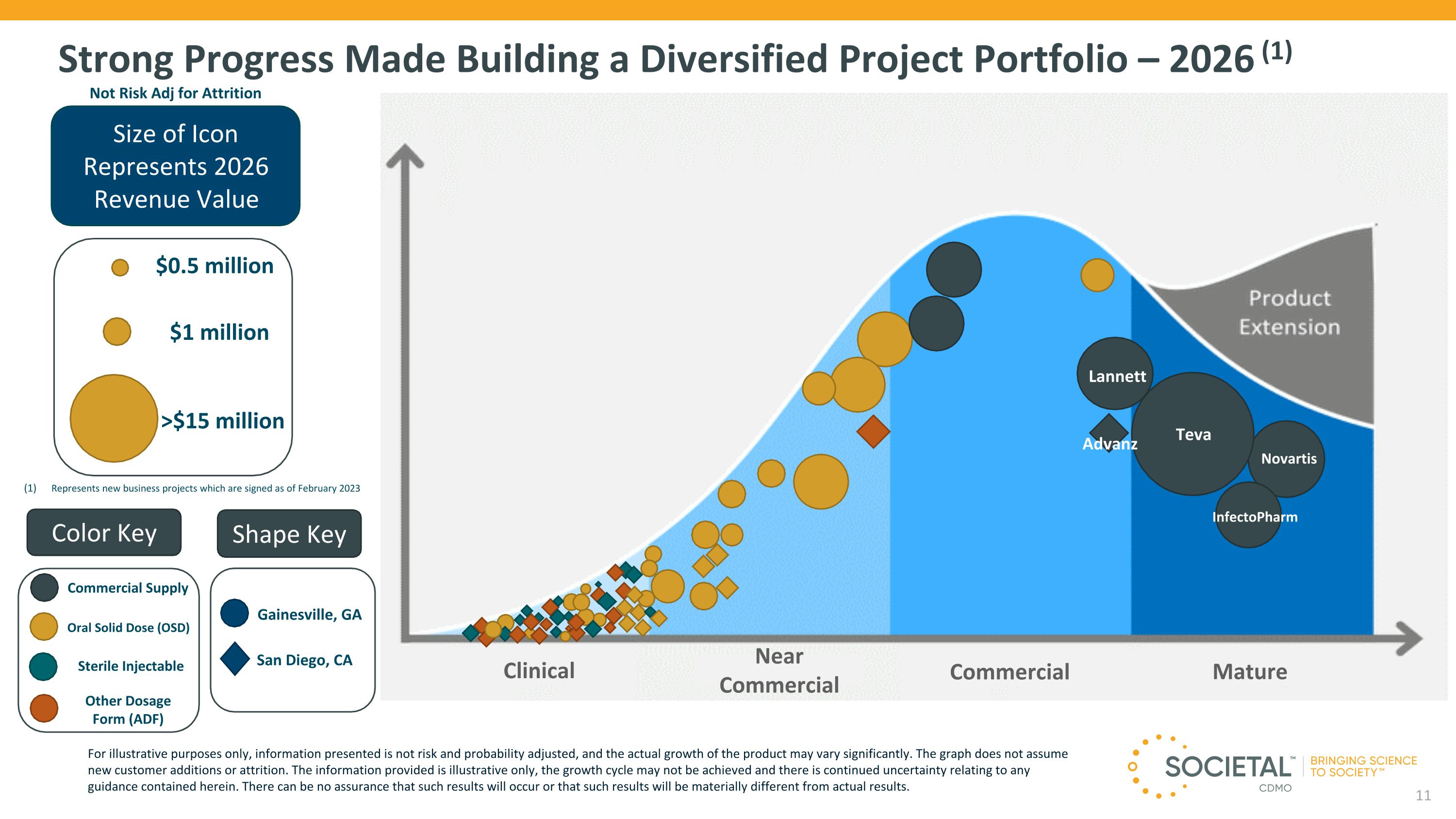

Strong Progress Made Building a Diversified Project Portfolio – 2026 (1) Size of Icon Represents 2026 Revenue Value $1 million >$15 million $0.5 million Not Risk Adj for Attrition Clinical Color Key Shape Key Gainesville, GA Sterile Injectable Oral Solid Dose (OSD) Other Dosage Form (ADF) San Diego, CA Near Commercial Commercial Mature Commercial Supply For illustrative purposes only, information presented is not risk and probability adjusted, and the actual growth of the product may vary significantly. The graph does not assume new customer additions or attrition. The information provided is illustrative only, the growth cycle may not be achieved and there is continued uncertainty relating to any guidance contained herein. There can be no assurance that such results will occur or that such results will be materially different from actual results. Represents new business projects which are signed as of February 2023 Teva InfectoPharm Advanz Lannett Novartis

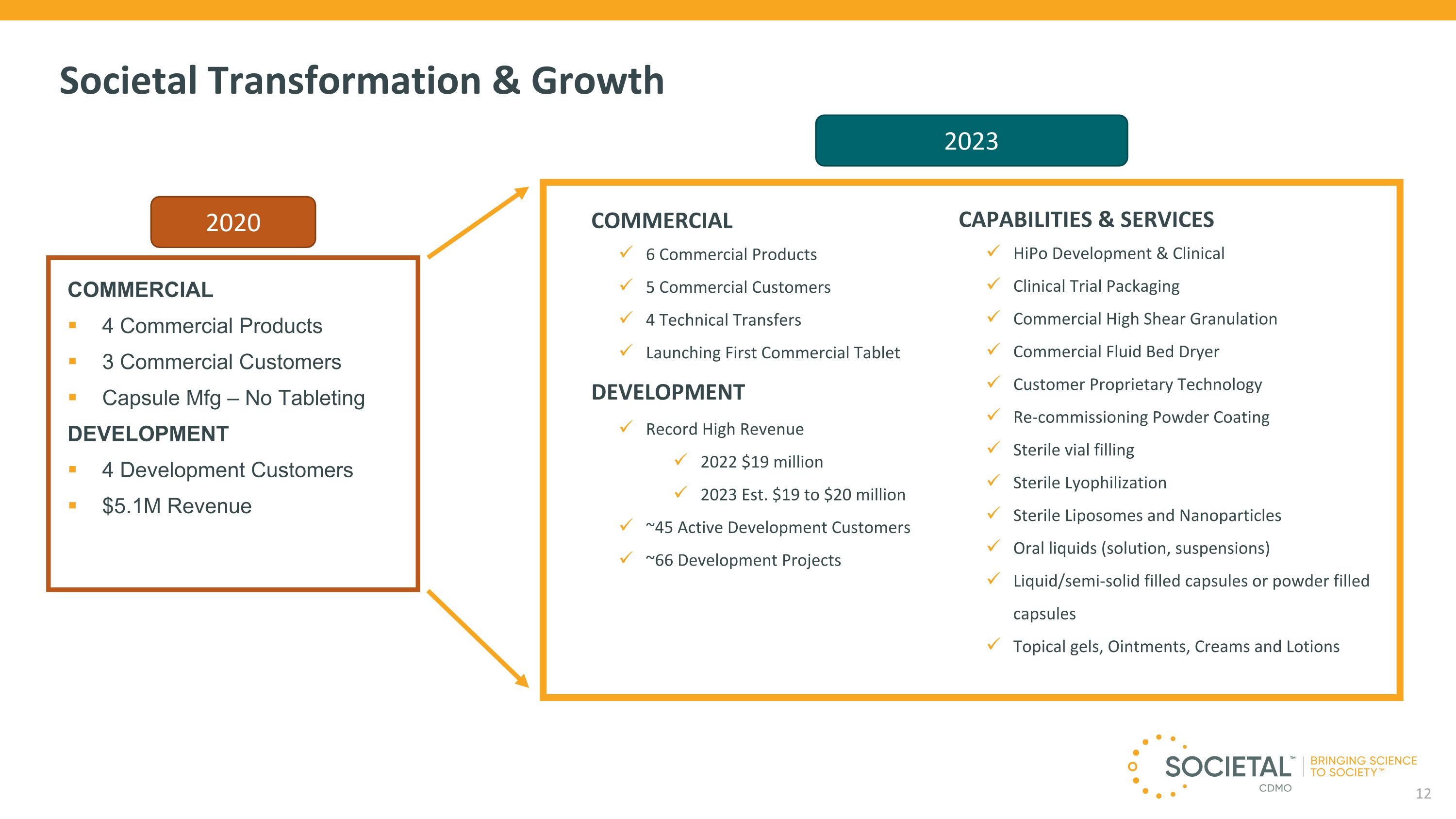

COMMERCIAL 4 Commercial Products 3 Commercial Customers Capsule Mfg – No Tableting DEVELOPMENT 4 Development Customers $5.1M Revenue Societal Transformation & Growth CAPABILITIES & SERVICES HiPo Development & Clinical Clinical Trial Packaging Commercial High Shear Granulation Commercial Fluid Bed Dryer Customer Proprietary Technology Re-commissioning Powder Coating Sterile vial filling Sterile Lyophilization Sterile Liposomes and Nanoparticles Oral liquids (solution, suspensions) Liquid/semi-solid filled capsules or powder filled capsules Topical gels, Ointments, Creams and Lotions COMMERCIAL 6 Commercial Products 5 Commercial Customers 4 Technical Transfers Launching First Commercial Tablet DEVELOPMENT Record High Revenue 2022 $19 million 2023 Est. $19 to $20 million ~45 Active Development Customers ~66 Development Projects 2020 2023 12

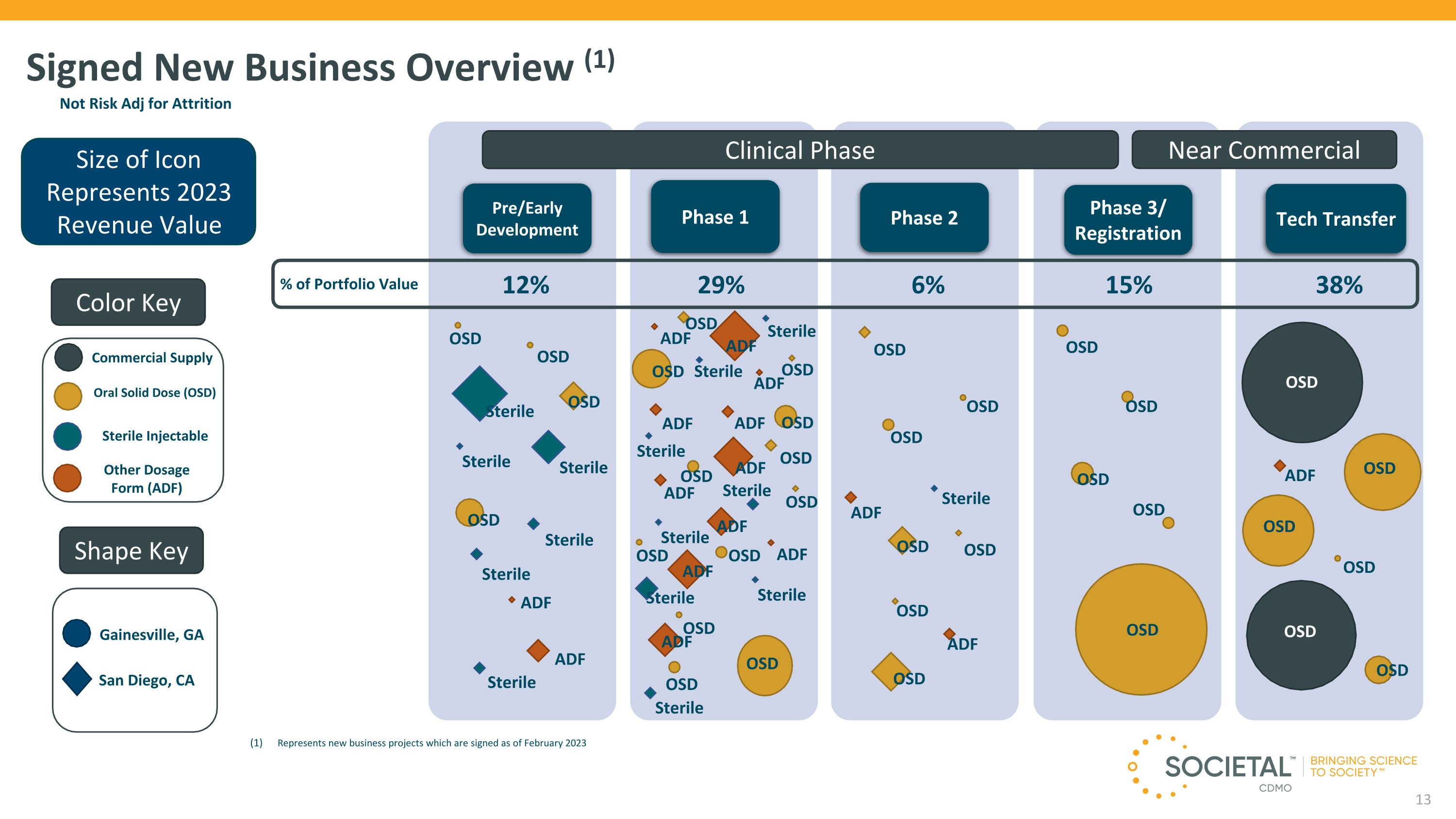

Signed New Business Overview (1) Size of Icon Represents 2023 Revenue Value Pre/Early Development Phase 1 Phase 2 Phase 3/ Registration Tech Transfer OSD Sterile OSD OSD OSD ADF ADF ADF OSD OSD OSD OSD Sterile Sterile Color Key Shape Key Gainesville, GA Sterile Injectable Oral Solid Dose (OSD) Other Dosage Form (ADF) San Diego, CA Commercial Supply Clinical Phase Near Commercial 12% 29% 6% 15% 38% % of Portfolio Value Represents new business projects which are signed as of February 2023 OSD Sterile 13 OSD OSD OSD OSD ADF Sterile Sterile OSD OSD OSD OSD OSD OSD OSD Sterile ADF OSD ADF ADF ADF ADF ADF ADF ADF ADF ADF ADF ADF Sterile Sterile Sterile Sterile Sterile Sterile Sterile Sterile OSD OSD OSD OSD OSD OSD OSD OSD OSD OSD OSD OSD OSD Not Risk Adj for Attrition

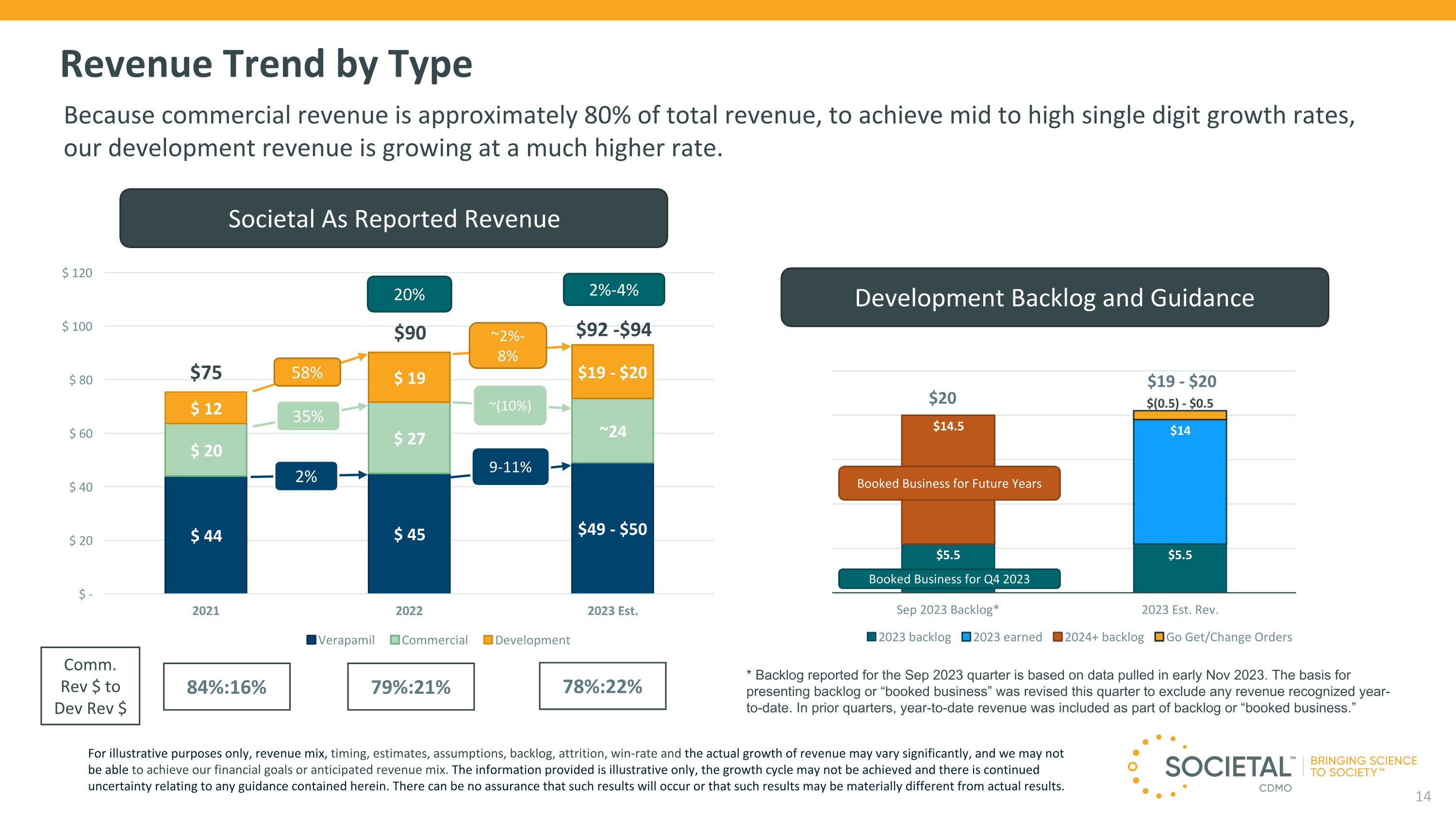

$92 -$94 $75 Revenue Trend by Type Societal As Reported Revenue 58% ~2%-8% ~(10%) 35% 84%:16% 79%:21% 78%:22% Comm. Rev $ to Dev Rev $ 20% 2%-4% Because commercial revenue is approximately 80% of total revenue, to achieve mid to high single digit growth rates, our development revenue is growing at a much higher rate. For illustrative purposes only, revenue mix, timing, estimates, assumptions, backlog, attrition, win-rate and the actual growth of revenue may vary significantly, and we may not be able to achieve our financial goals or anticipated revenue mix. The information provided is illustrative only, the growth cycle may not be achieved and there is continued uncertainty relating to any guidance contained herein. There can be no assurance that such results will occur or that such results may be materially different from actual results. Development Backlog and Guidance $20 Booked Business for Future Years Booked Business for Q4 2023 $19 - $20 * Backlog reported for the Sep 2023 quarter is based on data pulled in early Nov 2023. The basis for presenting backlog or “booked business” was revised this quarter to exclude any revenue recognized year-to-date. In prior quarters, year-to-date revenue was included as part of backlog or “booked business.” 2% 9-11% $90

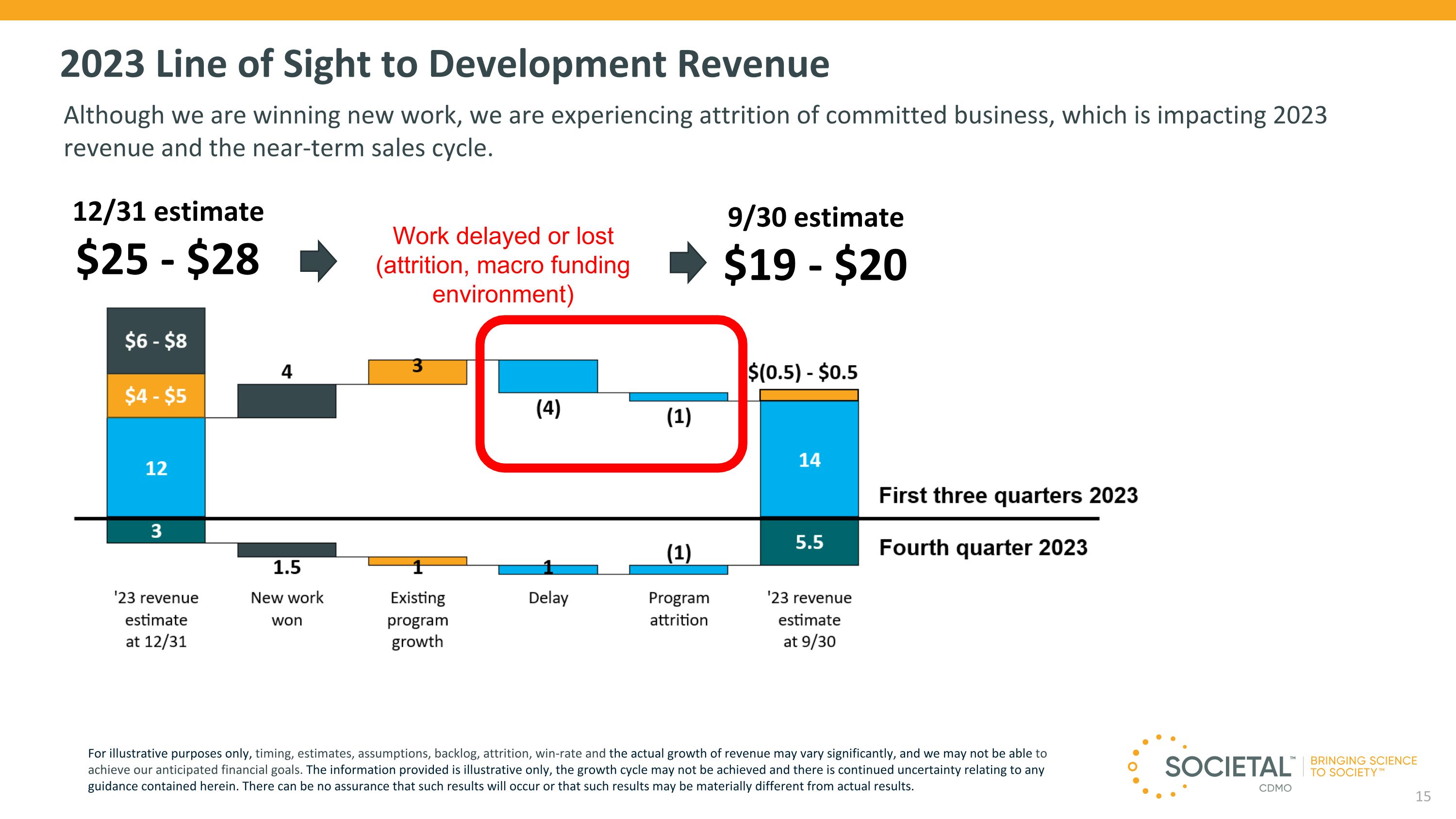

2023 Line of Sight to Development Revenue Although we are winning new work, we are experiencing attrition of committed business, which is impacting 2023 revenue and the near-term sales cycle. Work delayed or lost (attrition, macro funding environment) 12/31 estimate $25 - $28 9/30 estimate $19 - $20 For illustrative purposes only, timing, estimates, assumptions, backlog, attrition, win-rate and the actual growth of revenue may vary significantly, and we may not be able to achieve our anticipated financial goals. The information provided is illustrative only, the growth cycle may not be achieved and there is continued uncertainty relating to any guidance contained herein. There can be no assurance that such results will occur or that such results may be materially different from actual results.

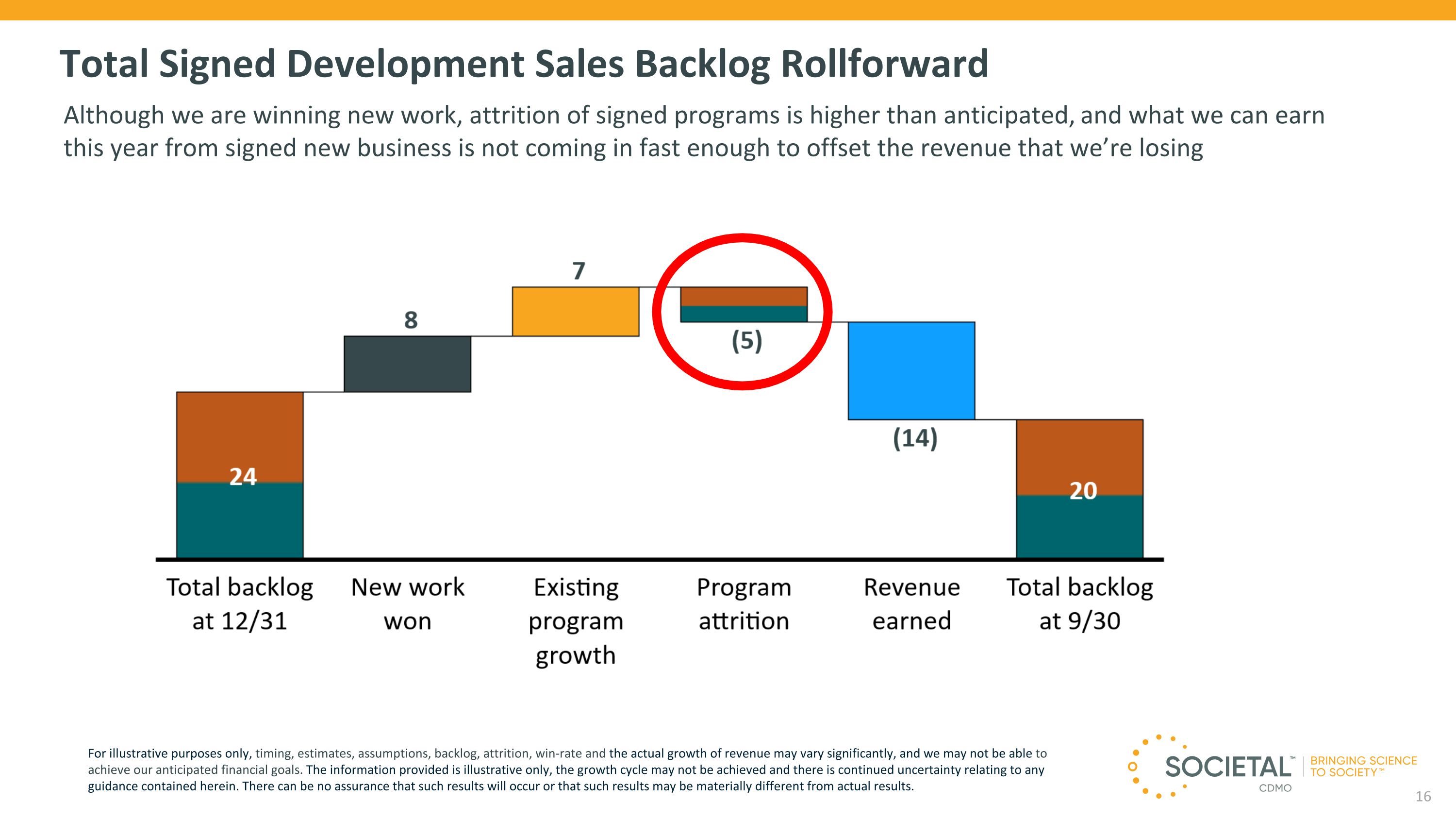

Total Signed Development Sales Backlog Rollforward Although we are winning new work, attrition of signed programs is higher than anticipated, and what we can earn this year from signed new business is not coming in fast enough to offset the revenue that we’re losing For illustrative purposes only, timing, estimates, assumptions, backlog, attrition, win-rate and the actual growth of revenue may vary significantly, and we may not be able to achieve our anticipated financial goals. The information provided is illustrative only, the growth cycle may not be achieved and there is continued uncertainty relating to any guidance contained herein. There can be no assurance that such results will occur or that such results may be materially different from actual results.

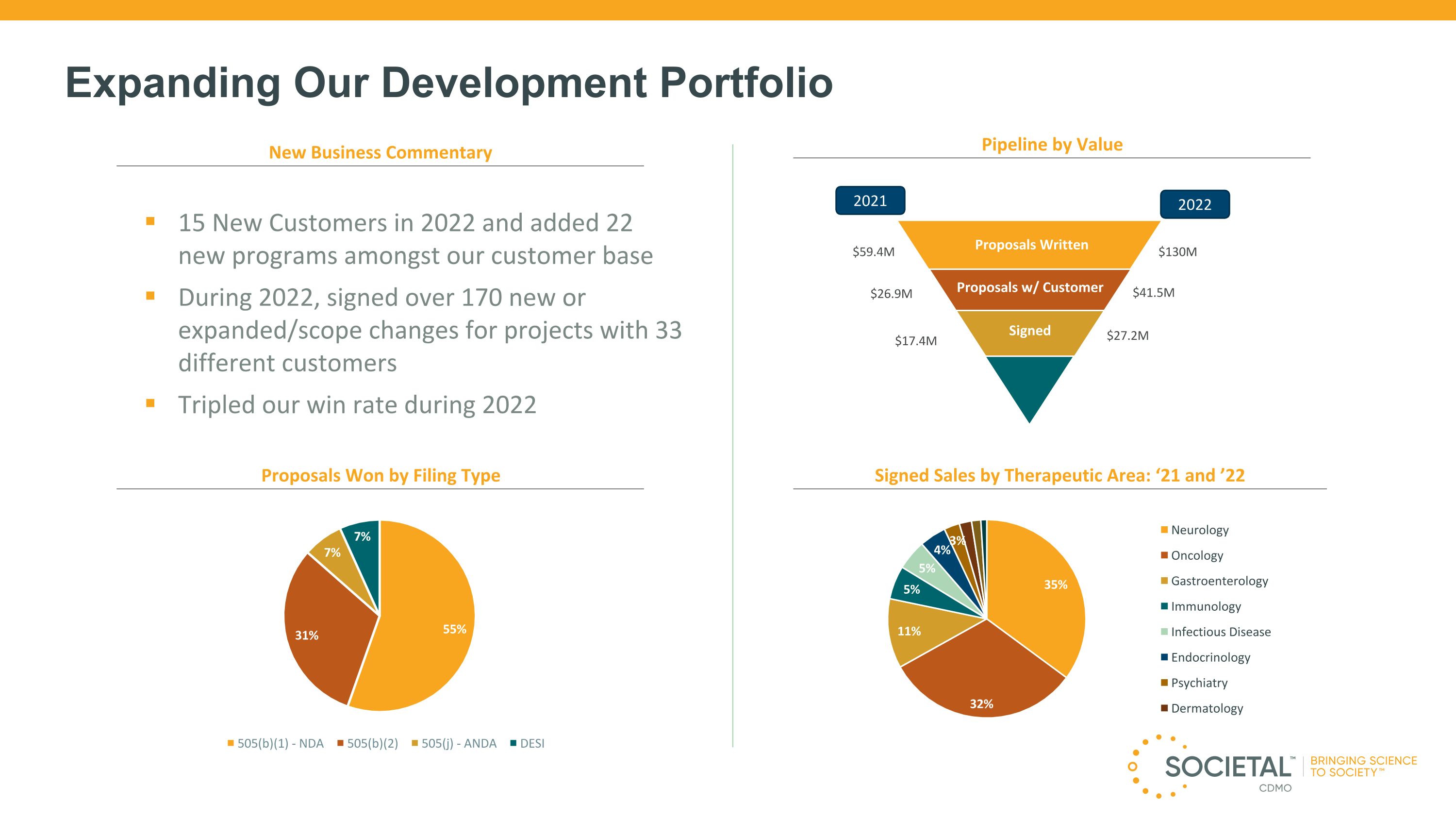

New Business Commentary Pipeline by Value Proposals Won by Filing Type Signed Sales by Therapeutic Area: ‘21 and ’22 15 New Customers in 2022 and added 22 new programs amongst our customer base During 2022, signed over 170 new or expanded/scope changes for projects with 33 different customers Tripled our win rate during 2022 Proposals w/ Customer Signed Proposals Written $27.2M $41.5M $130M 71 Expanding Our Development Portfolio $17.4M $26.9M $59.4M 2021 2022

State-of-the-Art Facilities Societal™ CDMO – Gould Facility Located in Gainesville, GA Size: 24,000 ft2 ~35 FTEs Opened 2018 Current capacity (single shift): ~30-40% Leased through 2025 with renewal options Located in Gainesville, GA Size: 97,000 ft2 ~190 FTEs Opened ~1985 Current capacity (single shift): ~60% Leased through 2042 with renewal options Chestnut performs development and cGMP (pre-commercial) development manufacturing before tech transfer to Gould site. High potency commercial production remains at Chestnut Significant experience transitioning projects from �late-phase development to robust, long-term �commercial production Societal™ CDMO – Chestnut Facility Societal™ CDMO – San Diego Located in San Diego, CA Size: 24,500 ft2 ~40 FTEs Opened 2014 Current capacity (single shift): ~30-40%(1) State of the art facility, FDA and FDB (CA) inspected San Diego performs development work, focusing on Advanced Dosage Forms – Development Services (aseptic fill / finish, inhalation, etc.) Commercial Development California is the #1 state for life sciences VC investment(2) Excludes new vial filler and lyophilizer services. Source: California Life Science Association and PWC’s California Life Sciences Report 2020. 18

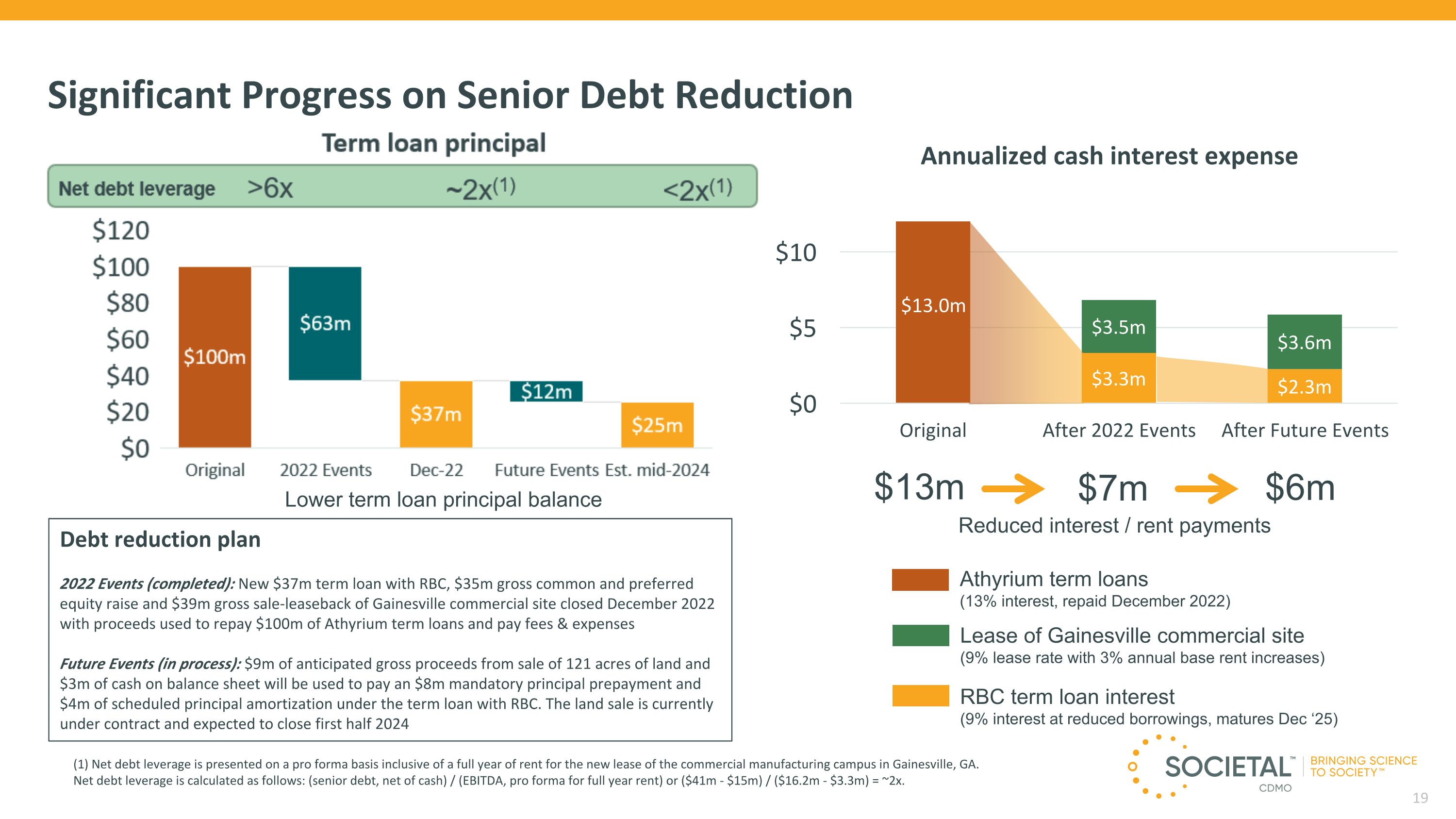

Significant Progress on Senior Debt Reduction Reduced interest / rent payments $13m $7m $6m Term loan principal Annualized cash interest expense Lower term loan principal balance Debt reduction plan 2022 Events (completed): New $37m term loan with RBC, $35m gross common and preferred equity raise and $39m gross sale-leaseback of Gainesville commercial site closed December 2022 with proceeds used to repay $100m of Athyrium term loans and pay fees & expenses Future Events (in process): $9m of anticipated gross proceeds from sale of 121 acres of land and $3m of cash on balance sheet will be used to pay an $8m mandatory principal prepayment and $4m of scheduled principal amortization under the term loan with RBC. The land sale is currently under contract and expected to close first half 2024 Lease of Gainesville commercial site (9% lease rate with 3% annual base rent increases) RBC term loan interest (9% interest at reduced borrowings, matures Dec ‘25) Athyrium term loans (13% interest, repaid December 2022) Net debt leverage >6x ~2x(1) <2x(1) (1) Net debt leverage is presented on a pro forma basis inclusive of a full year of rent for the new lease of the commercial manufacturing campus in Gainesville, GA. Net debt leverage is calculated as follows: (senior debt, net of cash) / (EBITDA, pro forma for full year rent) or ($41m - $15m) / ($16.2m - $3.3m) = ~2x.

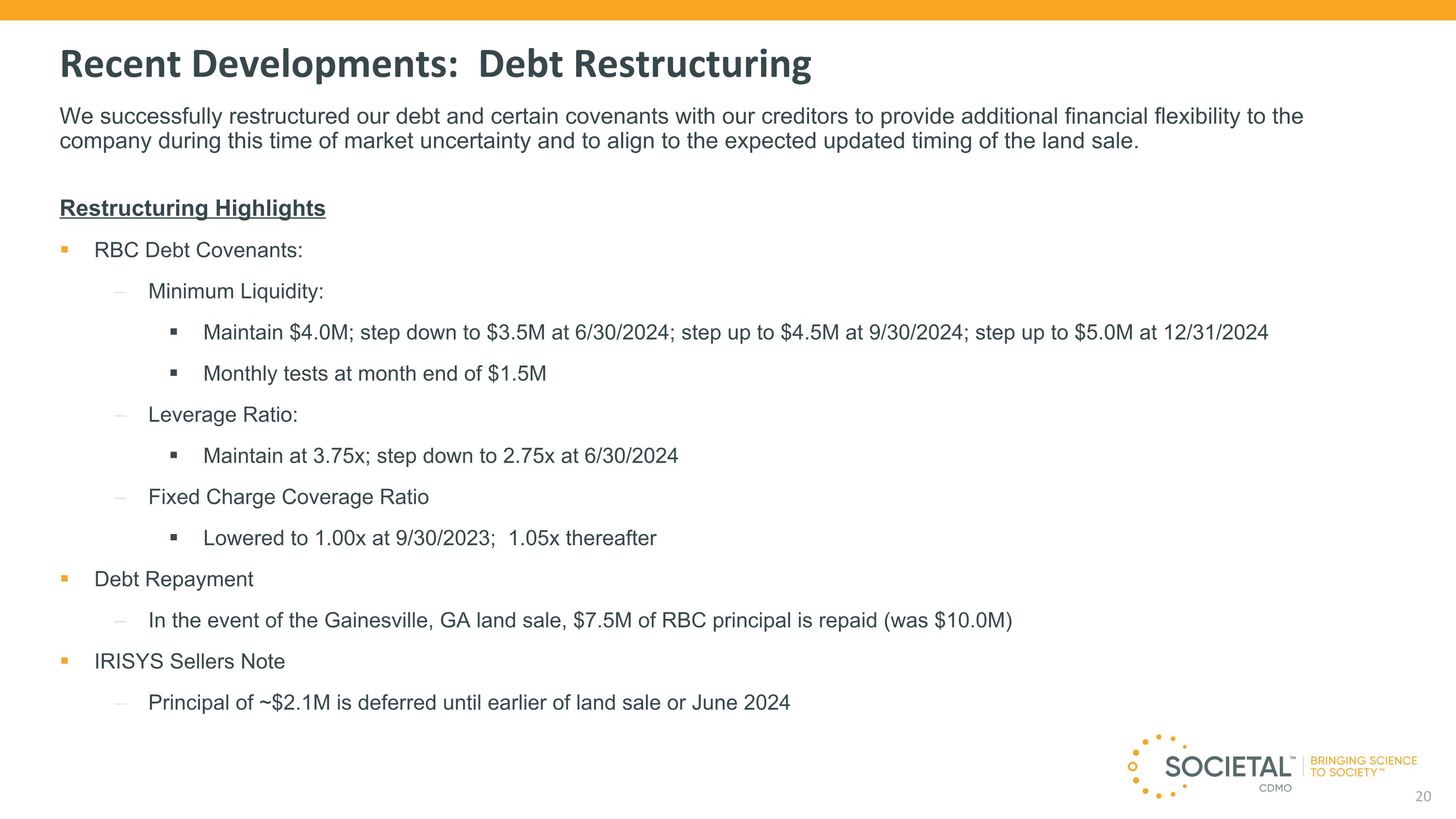

Recent Developments: Debt Restructuring We successfully restructured our debt and certain covenants with our creditors to provide additional financial flexibility to the company during this time of market uncertainty and to align to the expected updated timing of the land sale. Restructuring Highlights RBC Debt Covenants: Minimum Liquidity: Maintain $4.0M; step down to $3.5M at 6/30/2024; step up to $4.5M at 9/30/2024; step up to $5.0M at 12/31/2024 Monthly tests at month end of $1.5M Leverage Ratio: Maintain at 3.75x; step down to 2.75x at 6/30/2024 Fixed Charge Coverage Ratio Lowered to 1.00x at 9/30/2023; 1.05x thereafter Debt Repayment In the event of the Gainesville, GA land sale, $7.5M of RBC principal is repaid (was $10.0M) IRISYS Sellers Note Principal of ~$2.1M is deferred until earlier of land sale or June 2024

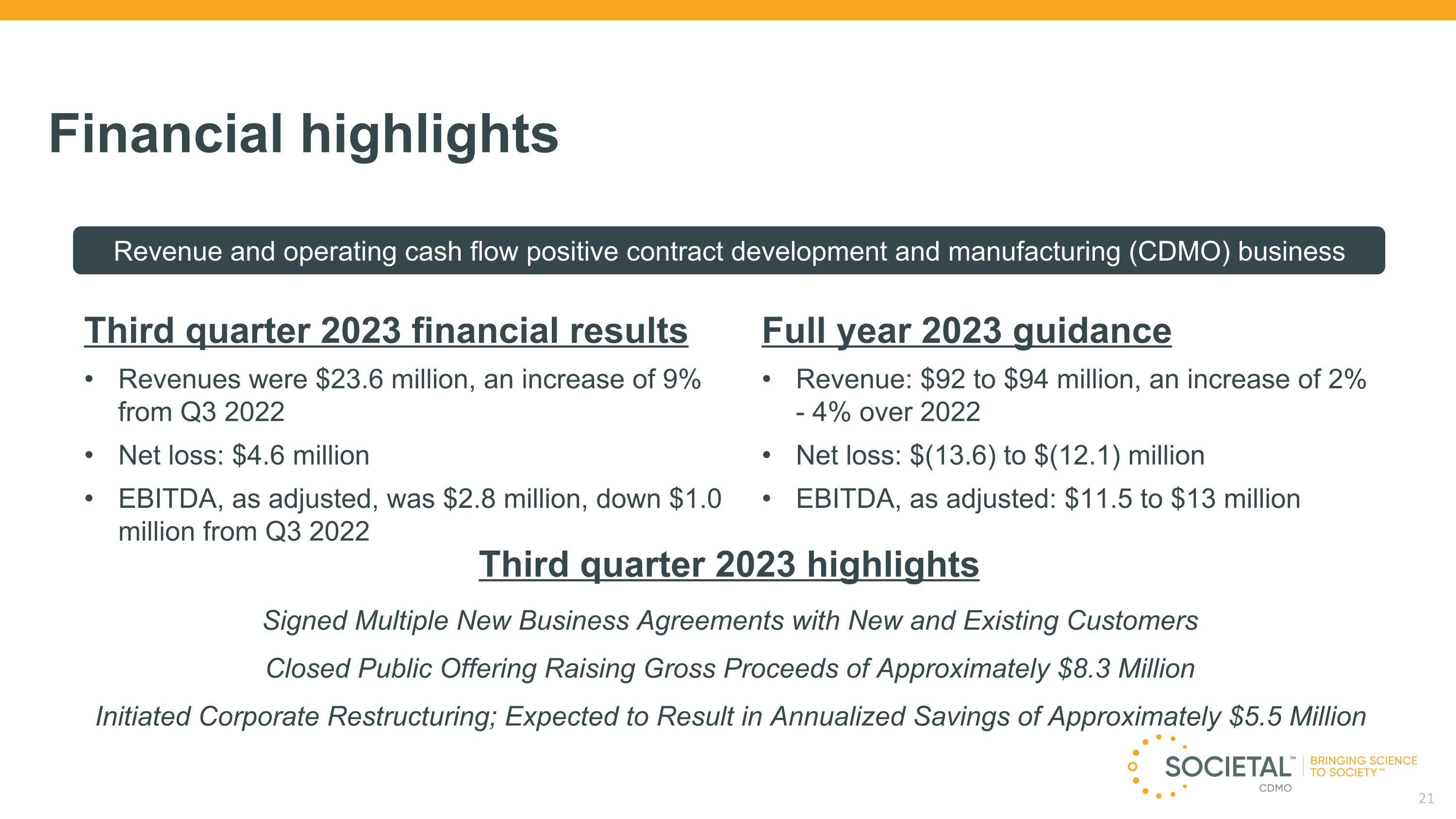

Financial highlights Full year 2023 guidance Revenue: $92 to $94 million, an increase of 2% - 4% over 2022 Net loss: $(13.6) to $(12.1) million EBITDA, as adjusted: $11.5 to $13 million Revenue and operating cash flow positive contract development and manufacturing (CDMO) business Third quarter 2023 financial results Revenues were $23.6 million, an increase of 9% from Q3 2022 Net loss: $4.6 million EBITDA, as adjusted, was $2.8 million, down $1.0 million from Q3 2022 Third quarter 2023 highlights Signed Multiple New Business Agreements with New and Existing Customers Closed Public Offering Raising Gross Proceeds of Approximately $8.3 Million Initiated Corporate Restructuring; Expected to Result in Annualized Savings of Approximately $5.5 Million

Third quarter 2023 results: Quarter ended September 30, (amounts in thousands) 2023 2022 Net loss (GAAP) $ (4,592 ) $ (3,329 ) Interest expense, net 2,832 3,544 Income tax expense 3 — Depreciation 2,105 1,923 Amortization of intangible assets 168 244 Stock-based compensation 1,179 1,260 Refinancing, deal and integration costs (a) 82 174 Restructuring (b) 1,059 — EBITDA, as adjusted $ 2,836 $ 3,816 Reconciliation of Non-GAAP Financial Measures (unaudited) To supplement the company’s financial results determined by U.S. generally accepted accounting principles (“GAAP”), the company has disclosed in the tables below the following non-GAAP information about EBITDA, as adjusted. EBITDA, as adjusted, is net income or loss as determined under GAAP excluding interest expense, income tax expense, depreciation, amortization, non-cash stock-based compensation, costs related to the acquisition and integration of IriSys, costs related to the debt refinancing, and costs related to the corporate restructuring. The company believes that non-GAAP financial measures, such as EBITDA, as adjusted, are helpful in understanding its business as it is useful to investors in allowing for greater transparency of supplemental information used by management. EBITDA, as adjusted is used by investors, as well as management in assessing the company’s performance. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, reported GAAP results. Further, non-GAAP financial measures, even if similarly titled, may not be calculated in the same manner by all companies, and therefore should not be compared. Costs related to the December 2022 debt refinancing and the acquisition and integration of IriSys. Costs related to the September 2023 corporate restructuring Full year 2023 guidance vs. 2022: Year ending / ended December 31, (amounts in thousands) 2023 2022 Net loss (GAAP) $ (13,600) – (12,100 ) $ (19,881 ) Interest expense, net 9,500 14,059 Income tax expense 200 1,105 Depreciation 8,100 7,413 Amortization of intangible assets 700 905 Stock-based compensation 5,000 5,426 Refinancing, deal and integration costs (a) 200 7,774 Restructuring (b) 1,400 — EBITDA, as adjusted $ 11,500 – 13,000 $ 16,801

v3.23.3

Document And Entity Information

|

Nov. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 08, 2023

|

| Entity Registrant Name |

Societal CDMO, Inc.

|

| Entity Central Index Key |

0001588972

|

| Entity Emerging Growth Company |

false

|

| Securities Act File Number |

001-36329

|

| Entity Incorporation, State or Country Code |

PA

|

| Entity Tax Identification Number |

26-1523233

|

| Entity Address, Address Line One |

1 E. Uwchlan Ave, Suite 112

|

| Entity Address, City or Town |

Exton

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19341

|

| City Area Code |

770

|

| Local Phone Number |

534-8239

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01

|

| Trading Symbol |

SCTL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Societal CDMO (NASDAQ:SCTL)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Societal CDMO (NASDAQ:SCTL)

Historical Stock Chart

Von Mai 2023 bis Mai 2024