UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2023

Commission File Number 0-19415

MAGIC SOFTWARE ENTERPRISES LTD.

(Translation of Registrant’s name into English)

Terminal Center, 1 Yahadut Canada Street, Or-Yehuda,

Israel 6037501

(Address of Principal Executive Office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

CONTENTS

Quarterly Results of Operations

On August 14, 2023, Magic

Software Enterprises Ltd. (the “Company”, “we” or “us”) announced our financial results for the second

quarter ended June 30, 2023. A copy of our press release announcing our results is furnished as Exhibit 99.1 to this Report

of Foreign Private Issuer on Form 6-K (this “Form 6-K”) and is incorporated herein by reference.

The GAAP financial statements

appended to this Form 6-K in Exhibit 99.1 are hereby incorporated by reference in our Registration Statements on Form S-8 (SEC File

No.’s 333-113552, 333-132221 and 333-149553).

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

MAGIC SOFTWARE ENTERPRISES LTD. |

| |

|

| |

By: |

/s/ Asaf Berenstin |

| |

Name: |

Asaf Berenstin |

| |

Title: |

Chief Financial Officer |

Dated: August 14, 2023

2

Exhibit 99.1

PRESS RELEASE

Magic Software Reports Second Quarter 2023 Financial Results.

Revenues for the second quarter of 2023 increased

by approximately 0.4% to a record-breaking second quarter result of $137.6 million and 4.4% on a constant currency basis, compared

to $137.0 million in the same period of the previous year.

Operating income for the second quarter of

2023 increased by approximately 3.2% to a record-breaking second quarter result of $15.4 million and 7.3% on a constant currency

basis, compared to $15.0 million in the same period of the previous year.

Or Yehuda, Israel, August 14, 2023 –

Magic Software Enterprises Ltd. (NASDAQ and TASE: MGIC) (“the Company”), a global provider of IT consulting

services and end-to-end integration and application development platforms solutions, announced today its financial results for the second

quarter ended June 30, 2023.

Summary Results for the Second Quarter 2023

(USD in millions, except per share data)

| | |

GAAP | | |

| | |

Non-GAAP | | |

| |

| | |

Q2 2023 | | |

Q2 2022 | | |

% Change | | |

Q2 2023 | | |

Q2 2022 | | |

% Change | |

| Revenues | |

$ | 137.6 | | |

$ | 137.0 | | |

| 0.4 | % | |

$ | 137.6 | | |

$ | 137.0 | | |

| 0.4 | % |

| Gross Profit | |

$ | 40.3 | | |

$ | 36.6 | | |

| 10.1 | % | |

$ | 41.6 | | |

$ | 38.2 | | |

| 9.1 | % |

| Gross Margin | |

| 29.3 | % | |

| 26.7 | % | |

| 260 bps | | |

| 30.3 | % | |

| 27.9 | % | |

| 240 bps | |

| Operating Income | |

$ | 15.4 | | |

$ | 15.0 | | |

| 3.2 | % | |

$ | 18.4 | | |

$ | 17.8 | | |

| 3.7 | % |

| Operating Margin | |

| 11.2 | % | |

| 10.9 | % | |

| 30 bps | | |

| 13.4 | % | |

| 13.0 | % | |

| 40 bps | |

| Net Income (*) | |

$ | 11.3 | | |

$ | 9.6 | | |

| 18.2 | % | |

$ | 13.5 | | |

$ | 11.7 | | |

| 15.6 | % |

| Diluted EPS | |

$ | 0.23 | | |

$ | 0.19 | | |

| 21.1 | % | |

$ | 0.28 | | |

$ | 0.24 | | |

| 16.7 | % |

| (*) | Attributable to Magic Software’s shareholders. |

Financial Highlights for the Second Quarter

Ended June 30, 2023

| |

● |

Revenues for the Second quarter of 2023 increased by 0.4% to a record-breaking second quarter result of $137.6 million, compared to $137.0 million in the same period of the previous year. On a constant currency basis (calculated based on average currency exchange rates for the three months ended June 30, 2022), revenues for the second quarter of 2023 would have increased by 4.4% to a record breaking second quarter result of $143.0 million. |

| |

● |

Operating income for the second quarter of 2023 increased by 3.2% to $15.4 million, compared to $15.0 million in the same period of the previous year. On constant currency basis, (calculated based on average currency exchange rates for the three months ended June 30, 2022), operating income for the second quarter of 2023 would have increased by 7.3% to a record breaking second quarter result of $16.1 million. Operating income for the second quarter of 2023 included $0.6 million recorded with respect to cost of share-based payment to employees compared to $0.1 million recorded in the same period of the previous year. |

| |

● |

Non-GAAP operating income for the second quarter of 2023 increased by 3.7% to $18.4 million, compared to $17.8 million in the same period of the previous year. On a constant currency basis (calculated based on average currency exchange rates for the three months ended June 30, 2022), non-GAAP operating income for the second quarter of 2023 would have increased by 7.1% to a second quarter record-breaking result of $19.1 million. |

| |

● |

Net income attributable to Magic Software’s shareholders for the second quarter of 2023 increase by 18.2% to $11.3 million, or $0.23 per fully diluted share, compared to $9.6 million, or $0.19 per fully diluted share, in the same period of the previous year. |

| |

● |

Non-GAAP net income attributable to Magic Software’s shareholders for the second quarter of 2023 increased by 15.6% to $13.5 million, or $0.28 per fully diluted share, compared to $11.7 million, or $0.24 per fully diluted share, in the same period of the previous year. |

| |

● |

Magic is lowering its 2023 annual revenue

guidance range from $585 - $593 million to $570 - $580 million. This revenue change is primarily due to exchange rate headwind of NIS

versus the US Dollar, as well as the continuous slowdown in IT spending which we are currently experiencing versus 2022 across our operations

in North-America impacted by macro environment uncertainty. Based on a constant currency basis of the year 2022, our revenue growth rate

for the year 2023 would have been 4.5%-6.2% with revenues at the range of $592 - $602 million. |

Summary Results for First Half 2023 (USD

in millions, except per share data)

| | |

GAAP | | |

| | |

Non-GAAP | | |

| |

| | |

H1 2023 | | |

H1 2022 | | |

% Change | | |

H1 2023 | | |

H1 2022 | | |

% Change | |

| Revenues | |

$ | 280.0 | | |

$ | 275.7 | | |

| 1.6 | % | |

$ | 280.0 | | |

$ | 275.7 | | |

| 1.6 | % |

| Gross Profit | |

$ | 79.2 | | |

$ | 74.2 | | |

| 6.8 | % | |

$ | 81.8 | | |

$ | 77.1 | | |

| 6.0 | % |

| Gross Margin | |

| 28.3 | % | |

| 26.9 | % | |

| 140 bps | | |

| 29.2 | % | |

| 28.0 | % | |

| 120 bps | |

| Operating Income | |

$ | 30.8 | | |

$ | 31.1 | | |

| -1.0 | % | |

$ | 36.9 | | |

$ | 36.9 | | |

| - | |

| Operating Margin | |

| 11.0 | % | |

| 11.3 | % | |

| (30) bps | | |

| 13.2 | % | |

| 13.4 | % | |

| (20) bps | |

| Net Income (*) | |

$ | 21.4 | | |

$ | 19.3 | | |

| 11.1 | % | |

$ | 26.4 | | |

$ | 24.7 | | |

| 6.8 | % |

| Diluted EPS | |

$ | 0.44 | | |

$ | 0.39 | | |

| 12.8 | % | |

$ | 0.54 | | |

$ | 0.50 | | |

| 8.0 | % |

| (*) | Attributable to Magic Software’s shareholders. |

Financial Highlights for the First Half

Ended June 30, 2023

| |

● |

Revenues for the first half period ended June 30, 2023 increased by 1.6% to $280.0 million compared to $275.7 million in the same period last year. On a constant currency basis, revenues for the first half period ended June 30, 2023, increased by 6.2% compared to the same period of the previous year. |

| |

|

|

| |

● |

Operating income for the

first half ended June 30, 2023 decreased by 1.0% to $30.8 million compared to $31.1 million in the same period last year. On

constant currency basis, (calculated based on average currency exchange rates for the three months ended June 30, 2022), operating

income for the first half period ended June 30, 2023 would have increased by 4.8% to a record breaking first half result of $32.6

million. |

| |

● |

Non-GAAP operating income for the first half ended June 30, 2023, remained constant at $36.9 million compared to the same period last year. On constant currency basis, (calculated based on average currency exchange rates for the three months ended June 30, 2022), Non-GAAP operating income for the first half period ended June 30, 2023 would have increased by 4.9% to a record breaking result of $38.7 million. |

| |

● |

Net income attributable to Magic Software’s shareholders for the first half period ended June 30, 2023 increased by 11.1% to $21.4 million, or $0.44 per fully diluted share, compared to $19.3 million, or $0.39 per fully diluted share, in the same period last year. |

| |

● |

Non-GAAP net income attributable to Magic Software’s shareholders for the first half period ended June 30, 2023 increased by 6.8% to $26.4 million, or $0.54 per fully diluted share, compared to $24.7 million, or $0.50 per fully diluted share, in the same period last year. |

| |

● |

Cash flow from

operating activities for the first half period ended June 30, 2023 amounted to $42.6 million compared to $18.4 million

in the same period last year. Cash flow from operating activities for the first half period ended June 30, 2022 included $3.7 million

for payments of deferred and contingent consideration related to acquisitions. |

| |

|

|

| |

● |

As of June 30, 2023, Magic’s net cash and cash equivalents and short-term bank deposits amounted to $106.0 million. |

Declaration of Dividend for the First Half

of 2023

| ● | In accordance with its dividend distribution

policy, the Company’s board of directors declared a semi-annual cash dividend in an amount of 32.7 cents per share and in an aggregate

amount of approximately $16.1 million, reflecting approximately 75% of its distributable profits for the first half of 2023. |

| ● | The dividend is payable on September 13, 2023,

to all of the Company’s shareholders of record at the close of trading on the NASDAQ Global Select Market on August 30, 2023. |

| ● | In accordance with Israeli tax law, the dividend

is subject to withholding tax at source at the rate of 30% (if the recipient of the dividend is at the time of distribution or was at

any time during the preceding 12-month period the holder of 10% or more of the Company’s share capital) or 25% (for all other dividend

recipients) of the dividend amount payable to each shareholder of record, subject to applicable exemptions. |

| ● | The dividend will be paid in US dollars on the

ordinary shares of Magic Software Enterprises that are traded both on the Tel Aviv Stock Exchange and the NASDAQ Global Select Market |

Guy Bernstein, Chief Executive Officer of Magic

Software, said: “Revenue in the second quarter of 2023 amounted to $137.6 million, up 0.4% from the second quarter of 2022.

On a constant currency basis, our top line growth rate compared to the second quarter of 2022 was 4.4% with non-GAAP operating income

growing by 7.1%. Magic Software’s unique and diversified business model is proven to be strong as we continue to present increasing

levels of profit even during turbulent times of economic challenges.” stated Guy Berenstein, CEO of Magic. “We continue to

operate in Israel and the US in all areas of technology, and especially in areas that are in high demand: digital, data, cyber, cloud,

and core operational systems and to lead complex and strategic projects that are critical for our clients, across multiple sectors while

remaining cautious about the macro-economic environment. As we move forward, we remain committed to executing our strategy to build a

broad portfolio of software products and services that creates value for our customers in managing, streamlining, accelerating and maximizing

their businesses.”

Conference Call Details

Magic Software’s management will host a

conference call on Monday, August 14, 2023, at 9:00 am Eastern Daylight Time (16:00 Israel Daylight Time) to review and discuss Magic

Software’s results.

To participate, please call one of the following

teleconferencing numbers. Please begin placing your calls at least 5 minutes before the conference call commences. If you are unable to

connect using the toll-free numbers, call the international dial-in number.

NORTH AMERICA: +1-866-652-8972

UK: 0-800-917-9141

ISRAEL: 03-918-0650

ALL OTHERS: +972-3-918-0650

For those unable to join the live call, a replay

of the call will be available in the Investor Relations section of Magic Software’s website, www.magicsoftware.com.

Non-GAAP Financial Measures

This press release contains

the following non-GAAP financial measures: non-GAAP gross profit, non-GAAP operating income, non-GAAP net income attributable to Magic

Software’s shareholders and non-GAAP basic and diluted earnings per share.

Magic Software believes

that these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and

business trends relating to Magic Software’s financial condition and results of operations. Magic Software’s management uses

these non-GAAP measures to compare the Company’s performance to that of prior periods for trend analyses, for purposes of determining

executive and senior management incentive compensation and for budgeting and planning purposes. These measures are used in financial reports

prepared for management and in quarterly financial reports presented to the Company’s board of directors. The Company believes that

the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results

and trends and in comparing the Company’s financial measures with other software companies, many of which present similar non-GAAP

financial measures to investors.

Management of the Company

does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP.

The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by

GAAP to be recorded in the Company’s financial statements. In addition, they are subject to inherent limitations as they reflect

the exercise of judgment by management about which expenses and income are excluded or included in determining these non-GAAP financial

measures. In order to compensate for these limitations, management presents non-GAAP financial measures together with GAAP results. Magic

Software urges investors to review the reconciliation of its non-GAAP financial measures to the comparable GAAP financial measures, which

it includes in press releases announcing quarterly financial results, including this press release, and not to rely on any single financial

measure to evaluate the Company’s business.

Non-GAAP measures used in this press release

are included in the financial tables of this release. These non-GAAP measures exclude the following items:

| |

● |

Amortization of purchased intangible assets and other related costs; |

| |

● |

In-process research and development capitalization and amortization; |

| |

● |

Cost of share-based payment; |

| |

● |

Costs related to acquisition of new businesses; |

| |

● |

The related tax, non-controlling interests’ effects of the above items; |

| |

● |

Change in valuation of contingent consideration related to acquisitions; |

| |

● |

Change in deferred tax assets on carry forward tax losses. |

Reconciliation of the

most comparable GAAP financial measures to the non-GAAP financial measures used in this press release are included in the financial tables

of this release.

About Magic Software Enterprises

Magic Software Enterprises

Ltd. (NASDAQ and TASE: MGIC) is a global provider of IT consulting services and end-to-end integration and application development platforms

solutions.

For more information, visit www.magicsoftware.com.

Forward Looking Statements

Some of the statements

in this press release may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act

of 1933, Section 21E of the Securities and Exchange Act of 1934 and the United States Private Securities Litigation Reform Act of 1995.

Words such as “will,” “look forward”, “expect,” “believe,” “guidance” and

similar expressions are used to identify these forward-looking statements (although not all forward-looking statements include such words).

These forward-looking statements, which may include, without limitation, projections regarding our future performance and financial condition,

are made based on management’s current views and assumptions with respect to future events. Any forward-looking statement is not

a guarantee of future performance and actual results could differ materially from those contained in the forward-looking statement. These

statements speak only as of the date they were made, and we undertake no obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise. We operate in a changing environment. New risks emerge from time to

time and it is not possible for us to predict all risks that may affect us. For more information regarding these risks and uncertainties

as well as certain additional risks that we face, you should refer to the Risk Factors detailed in our Annual Report on Form 20-F for

the year ended December 31, 2022, which filed on May 11, 2023, and subsequent reports and filings made from time to time with the Securities

and Exchange Commission.

Magic®

is a registered trademark of Magic Software Enterprises Ltd. All other product and company names mentioned herein are for identification

purposes only and are the property of, and might be trademarks of, their respective owners.

Press Contact:

Ronen Platkevitz

Magic Software Enterprises

ir@magicsoftware.com

MAGIC SOFTWARE ENTERPRISES LTD.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

U.S. Dollars in thousands (except per share data)

| | |

Three months ended | | |

Six months ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Unaudited | | |

Unaudited | |

| Revenues | |

$ | 137,583 | | |

$ | 136,978 | | |

$ | 280,023 | | |

$ | 275,683 | |

| Cost of Revenues | |

| 97,278 | | |

| 100,385 | | |

| 200,833 | | |

| 201,512 | |

| Gross profit | |

| 40,305 | | |

| 36,593 | | |

| 79,190 | | |

| 74,171 | |

| Research and development, net | |

| 2,425 | | |

| 2,596 | | |

| 4,964 | | |

| 4,935 | |

| Selling, marketing and general and administrative expenses | |

| 22,431 | | |

| 19,447 | | |

| 43,595 | | |

| 38,245 | |

| Decrease in valuation of contingent consideration related to acquisitions | |

| - | | |

| (423 | ) | |

| (165 | ) | |

| (106 | ) |

| Total operating costs and expenses | |

| 24,856 | | |

| 21,620 | | |

| 48,394 | | |

| 43,074 | |

| Operating income | |

| 15,449 | | |

| 14,973 | | |

| 30,796 | | |

| 31,097 | |

| Financial expenses, net | |

| (248 | ) | |

| (531 | ) | |

| (812 | ) | |

| (1,345 | ) |

| (Increase) decrease in valuation of consideration related to acquisitions | |

| (68 | ) | |

| 122 | | |

| (203 | ) | |

| (722 | ) |

| Income before taxes on income | |

| 15,133 | | |

| 14,564 | | |

| 29,781 | | |

| 29,030 | |

| Taxes on income | |

| 2,455 | | |

| 3,610 | | |

| 5,268 | | |

| 6,815 | |

| Net income | |

$ | 12,678 | | |

$ | 10,954 | | |

$ | 24,513 | | |

$ | 22,215 | |

| Net income attributable to non-controlling interests | |

| (1,384 | ) | |

| (1,402 | ) | |

| (3,111 | ) | |

| (2,948 | ) |

| Net income attributable to Magic’s shareholders | |

$ | 11,294 | | |

$ | 9,552 | | |

$ | 21,402 | | |

$ | 19,267 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares used in computing net earnings per share | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 49,093 | | |

| 49,093 | | |

| 49,093 | | |

| 49,085 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted | |

| 49,133 | | |

| 49,123 | | |

| 49,133 | | |

| 49,130 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted earnings per share attributable to Magic’s shareholders | |

$ | 0.23 | | |

$ | 0.19 | | |

$ | 0.44 | | |

$ | 0.39 | |

MAGIC SOFTWARE ENTERPRISES LTD.

RECONCILIATION OF GAAP AND NON-GAAP RESULTS

U.S. Dollars in thousands (except per share data)

| | |

Three months ended | | |

Six months ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Unaudited | | |

Unaudited | |

| | |

| | |

| | |

| | |

| |

| GAAP gross profit | |

$ | 40,305 | | |

$ | 36,593 | | |

$ | 79,190 | | |

$ | 74,171 | |

| Amortization of capitalized software and acquired technology | |

| 1,096 | | |

| 1,118 | | |

| 2,071 | | |

| 2,256 | |

| Amortization of other intangible assets | |

| 244 | | |

| 464 | | |

| 489 | | |

| 666 | |

| Non-GAAP gross profit | |

$ | 41,645 | | |

$ | 38,175 | | |

$ | 81,750 | | |

$ | 77,093 | |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP operating income | |

$ | 15,449 | | |

$ | 14,973 | | |

$ | 30,796 | | |

$ | 31,097 | |

| Gross profit adjustments | |

| 1,340 | | |

| 1,582 | | |

| 2,560 | | |

| 2,922 | |

| Amortization of other intangible assets | |

| 1,666 | | |

| 2,280 | | |

| 3,730 | | |

| 4,382 | |

| Decrease in valuation of contingent consideration related to acquisitions | |

| - | | |

| (423 | ) | |

| (165 | ) | |

| (106 | ) |

| Capitalization of software development | |

| (723 | ) | |

| (734 | ) | |

| (1,434 | ) | |

| (1,605 | ) |

| Costs related to acquisitions | |

| 107 | | |

| 49 | | |

| 181 | | |

| 59 | |

| Stock-based compensation | |

| 609 | | |

| 70 | | |

| 1,231 | | |

| 140 | |

| Non-GAAP operating income | |

$ | 18,448 | | |

$ | 17,797 | | |

$ | 36,899 | | |

$ | 36,889 | |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP net income attributable to Magic’s shareholders | |

$ | 11,294 | | |

$ | 9,552 | | |

$ | 21,402 | | |

$ | 19,267 | |

| Operating income adjustments | |

| 2,999 | | |

| 2,824 | | |

| 6,103 | | |

| 5,792 | |

| Expenses attributed to non-controlling interests and redeemable non-controlling interests | |

| (377 | ) | |

| (168 | ) | |

| (524 | ) | |

| (320 | ) |

| Changes in unsettled fair value of contingent consideration related to acquisitions | |

| 68 | | |

| (122 | ) | |

| 203 | | |

| 722 | |

| Deferred taxes on the above items | |

| (444 | ) | |

| (372 | ) | |

| (791 | ) | |

| (743 | ) |

| Non-GAAP net income attributable to Magic’s shareholders | |

$ | 13,540 | | |

$ | 11,714 | | |

$ | 26,393 | | |

$ | 24,718 | |

| | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP basic and diluted net earnings per share | |

$ | 0.28 | | |

$ | 0.24 | | |

$ | 0.54 | | |

$ | 0.50 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares used in computing basic net earnings per share | |

| 49,093 | | |

| 49,093 | | |

| 49,093 | | |

| 49,085 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares used in computing diluted net earnings per share | |

| 49,137 | | |

| 49,138 | | |

| 49,137 | | |

| 49,146 | |

Summary of Non-GAAP Financial Information

U.S. Dollars in thousands (except per share data)

| | |

Three months ended | | |

Six months ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Unaudited | | |

Unaudited | | |

Unaudited | | |

Unaudited | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 137,583 | | |

| 100 | % | |

$ | 136,978 | | |

| 100 | % | |

$ | 280,023 | | |

| 100 | % | |

$ | 275,683 | | |

| 100 | % |

| Gross profit | |

| 41,645 | | |

| 30.3 | % | |

| 38,175 | | |

| 27.9 | % | |

| 81,750 | | |

| 29.2 | % | |

| 77,093 | | |

| 28.0 | % |

| Operating income | |

| 18,448 | | |

| 13.4 | % | |

| 17,797 | | |

| 13.0 | % | |

| 36,899 | | |

| 13.2 | % | |

| 36,889 | | |

| 13.4 | % |

| Net income attributable to Magic’s

shareholders | |

| 13,540 | | |

| 9.8 | % | |

| 11,714 | | |

| 8.6 | % | |

| 26,393 | | |

| 9.4 | % | |

| 24,718 | | |

| 9.0 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted earnings per share | |

$ | 0.28 | | |

| | | |

$ | 0.24 | | |

| | | |

$ | 0.54 | | |

| | | |

$ | 0.50 | | |

| | |

MAGIC SOFTWARE ENTERPRISES LTD.

CONDENSED CONSOLIDATED BALANCE SHEETS

U.S. Dollars in thousands

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

Unaudited | | |

| |

| ASSETS | |

| | |

| |

| CURRENT ASSETS: | |

| | |

| |

| Cash and cash equivalents | |

$ | 104,619 | | |

$ | 83,062 | |

| Short-term bank deposits | |

| 1,405 | | |

| 3,904 | |

| Trade receivables, net | |

| 134,252 | | |

| 148,480 | |

| Other accounts receivable and prepaid expenses | |

| 18,769 | | |

| 13,652 | |

| Total current assets | |

| 259,045 | | |

| 249,098 | |

| | |

| | | |

| | |

| LONG-TERM ASSETS: | |

| | | |

| | |

| Deferred tax assets | |

| 5,111 | | |

| 3,618 | |

| Right-of-use assets | |

| 24,690 | | |

| 27,536 | |

| Other long-term receivables | |

| 6,409 | | |

| 5,795 | |

| Property and equipment, net | |

| 7,854 | | |

| 8,338 | |

| Intangible assets and goodwill, net | |

| 226,648 | | |

| 210,756 | |

| Total long-term assets | |

| 270,712 | | |

| 256,043 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 529,757 | | |

$ | 505,141 | |

| | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Short-term debt | |

$ | 30,933 | | |

$ | 20,755 | |

| Trade payables | |

| 25,740 | | |

| 27,598 | |

| Accrued expenses and other accounts payable | |

| 44,412 | | |

| 46,842 | |

| Current maturities of lease liabilities | |

| 4,311 | | |

| 4,591 | |

| Liability in respect of business combinations | |

| 6,685 | | |

| 19,287 | |

| Put options of non-controlling interests | |

| 21,700 | | |

| 27,172 | |

| Deferred revenues and customer advances | |

| 14,145 | | |

| 9,808 | |

| Total current liabilities | |

| 147,926 | | |

| 156,053 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES: | |

| | | |

| | |

| Long-term debt | |

| 58,662 | | |

| 30,412 | |

| Deferred tax liability | |

| 10,658 | | |

| 10,686 | |

| Long-term lease liabilities | |

| 21,799 | | |

| 24,282 | |

| Long-term liability in respect of business combinations | |

| 991 | | |

| 5,376 | |

| Put options of non-controlling interests | |

| 1,066 | | |

| 1,120 | |

| Accrued severance pay, net | |

| 1,045 | | |

| 901 | |

| Total long-term liabilities | |

| 94,221 | | |

| 72,777 | |

| | |

| | | |

| | |

| EQUITY: | |

| | | |

| | |

| Magic Software Enterprises shareholders’ equity | |

| 262,427 | | |

| 262,927 | |

| Non-controlling interests | |

| 25,183 | | |

| 13,384 | |

| Total equity | |

| 287,610 | | |

| 276,311 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND EQUITY | |

$ | 529,757 | | |

$ | 505,141 | |

MAGIC SOFTWARE ENTERPRISES LTD.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

U.S. Dollars in thousands

| | |

Six months ended

June 30, | |

| | |

2023 | | |

2022 | |

| | |

Unaudited | | |

Unaudited | |

| | |

| | |

| |

| Cash flows from operating activities: | |

| | |

| |

| | |

| | |

| |

| Net income | |

$ | 24,513 | | |

$ | 22,215 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 9,917 | | |

| 10,334 | |

| Cost of share-based payment | |

| 1,231 | | |

| 140 | |

| Change in deferred taxes, net | |

| (2,257 | ) | |

| (1,163 | ) |

| Payments of deferred and contingent consideration related to acquisitions | |

| (40 | ) | |

| (3,748 | ) |

| Capital gain on sale of fixed assets | |

| (5 | ) | |

| - | |

| Amortization of marketable securities premium and accretion of discount | |

| (49 | ) | |

| 93 | |

| Effect of exchange rate on of cash and cash equivalents held in currencies other than the functional currency | |

| 906 | | |

| 1,662 | |

| Changes in value of short-term and long-term loans from banks and others and deposits, net | |

| 499 | | |

| (1,210 | ) |

| Working capital adjustments: | |

| | | |

| | |

| Trade receivables | |

| 17,315 | | |

| (5,011 | ) |

| Other current and long-term accounts receivable | |

| (8,423 | ) | |

| (1,875 | ) |

| Trade payables | |

| (1,333 | ) | |

| (4,164 | ) |

| Accrued expenses and other accounts payable | |

| (4,072 | ) | |

| (1,991 | ) |

| Deferred revenues | |

| 4,439 | | |

| 3,075 | |

| Net cash provided by operating activities | |

| 42,641 | | |

| 18,357 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Capitalized software development costs | |

| (1,434 | ) | |

| (1,605 | ) |

| Purchase of property and equipment | |

| (625 | ) | |

| (2,206 | ) |

| Cash paid in conjunction with acquisitions, net of acquired cash | |

| (15,585 | ) | |

| (12,289 | ) |

| Payments of deferred and contingent consideration related to acquisitions | |

| (17,330 | ) | |

| (4,616 | ) |

| Proceeds from sale of property and equipment | |

| 10 | | |

| - | |

| Proceeds from repayment of loan receivables | |

| 541 | | |

| - | |

| Investment in long-term bank deposit | |

| (528 | ) | |

| - | |

| Purchase of intangible asset | |

| - | | |

| (219 | ) |

| Proceeds from short-term bank deposits | |

| 3,532 | | |

| 2,565 | |

| Net cash used in investing activities | |

| (31,419 | ) | |

| (18,370 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Dividend to Magic’s shareholders | |

| (14,739 | ) | |

| (10,604 | ) |

| Dividend paid to non-controlling interests | |

| (2,733 | ) | |

| (2,088 | ) |

| Repayment of lease liabilities | |

| (2,720 | ) | |

| (2,511 | ) |

| Short-term and long-term loans received | |

| 49,463 | | |

| 26,501 | |

| Purchase of redeemable non-controlling interest | |

| (5,073 | ) | |

| - | |

| Repayment of short-term and long-term loans | |

| (10,742 | ) | |

| (4,841 | ) |

| Net cash provided by financing activities | |

| 13,456 | | |

| 6,457 | |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

| (3,121 | ) | |

| (6,282 | ) |

| | |

| | | |

| | |

| Increase in cash and cash equivalents | |

| 21,557 | | |

| 163 | |

| Cash and cash equivalents at the beginning of the period | |

| 83,062 | | |

| 88,090 | |

| Cash and cash equivalents at end of the period | |

$ | 104,619 | | |

$ | 88,253 | |

10

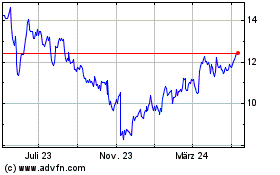

Magic Software Enterprises (NASDAQ:MGIC)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

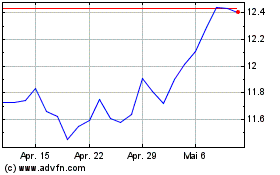

Magic Software Enterprises (NASDAQ:MGIC)

Historical Stock Chart

Von Nov 2023 bis Nov 2024