false

0001841024

0001841024

2024-02-02

2024-02-02

0001841024

LCAA:UnitsEachConsistingOfOneClassAOrdinaryShare0.0001ParValueAndOneThirdOfOneRedeemableWarrantMember

2024-02-02

2024-02-02

0001841024

us-gaap:CommonClassAMember

2024-02-02

2024-02-02

0001841024

LCAA:RedeemableWarrantsIncludedAsPartOfUnitsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member

2024-02-02

2024-02-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported): February 2, 2024

L Catterton Asia Acquisition Corp

(Exact

name of registrant as specified in its charter)

| Cayman Islands |

001-40196 |

98-1577355 |

| |

|

|

| (State or other jurisdiction of |

(Commission |

(I.R.S. Employer |

| incorporation or organization) |

File Number) |

Identification Number) |

| 8 Marina View, Asia Square Tower 1 |

|

|

| #41-03, Singapore |

|

018960 |

| |

|

|

| (Address of principal executive offices) |

|

(Zip Code) |

+65 6672

7600

Registrant’s

telephone number, including area code

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| |

|

Trading |

|

Name of each exchange on |

| Title

of each class |

|

Symbol(s) |

|

which registered |

| Units, each consisting of one Class A Ordinary Share, $0.0001

par value, and one-third of one redeemable warrant |

|

LCAAU |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Class A Ordinary Shares included as part of the units |

|

LCAA |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Redeemable warrants included as part of the units, each whole warrant

exercisable for one Class A Ordinary Share at an exercise price of $11.50 |

|

LCAAW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange

Act of 1934.

Emerging growth company x

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new

or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 5.07 | Submission

of Matters to a Vote of Security Holders. |

On February 2, 2024, L Catterton

Asia Acquisition Corp (“LCAA”) held an Extraordinary General Meeting of shareholders (the “Extraordinary General Meeting”).

At the Extraordinary General Meeting, a total of 20,635,341 (approximately 71.29%) of LCAA’s issued and outstanding ordinary shares

(“Ordinary Shares”) held of record as of December 18, 2023, the record date for the Extraordinary General Meeting, were

present either in person or by proxy, which constituted a quorum for the transaction of business. LCAA’s shareholders voted on

the following proposals at the Extraordinary General Meeting, which are described in more detail in the final prospectus/definitive proxy

statement filed with the Securities Exchange Commission (the “SEC”) on January 12, 2024 (as supplemented, amended or

updated from time to time, the “Proxy Statement/Prospectus”).

Proposal

No. 1 — The NTA Proposal — to consider and vote upon, as a special resolution, a proposal (the “NTA

Proposal”) to approve and adopt the amendment to the second amended and restated memorandum and articles of association of LCAA

(the “LCAA Articles”), which amendment shall become effective immediately prior to the consummation of the proposed Business

Combination (as defined below), to remove from the LCAA Articles the prohibition on redemptions of LCAA Class A ordinary shares in

an amount that would cause LCAA’s net tangible assets to be less than $5,000,001 in connection with any vote held to approve a proposed

business combination. The NTA Proposal is conditioned upon the approval of Proposal No. 2 - The Business Combination Proposal as

below. Therefore, if the Business Combination Proposal (as defined below) is not approved, then the NTA Proposal will have no effect,

even if approved by the shareholders.

| | For | | |

| Against | | |

| Abstain | |

| | 20,635,125 | | |

| 12 | | |

| 204 | |

Proposal

No. 2 – The Business Combination Proposal – to consider and vote upon, as an ordinary resolution, a proposal

(the “Business Combination Proposal”) to approve and authorize the Agreement and Plan of Merger, dated as of January 31,

2023 (as amended and restated by the First Amended and Restated Agreement and Plan of Merger, dated as of October 11, 2023, the “Merger

Agreement”), by and among LCAA, Lotus Technology Inc., an exempted company limited by shares incorporated under the laws of the

Cayman Islands (“LTC” or “Lotus Tech”), Lotus Temp Limited, an exempted company limited by shares incorporated

under the laws of the Cayman Islands and a wholly-owned subsidiary of LTC (“Merger Sub 1”), and Lotus EV Limited, an exempted

company limited by shares incorporated under the laws of the Cayman Islands and a wholly-owned subsidiary of LTC (“Merger Sub 2”),

and the transactions contemplated therein, including the business combination whereby Merger Sub 1 will merge with and into LCAA (the

“First Merger”), with LCAA surviving the First Merger as a wholly-owned subsidiary of LTC (such company, as the surviving

entity of the First Merger, “Surviving Entity 1”), and immediately following the consummation of the First Merger, Surviving

Entity 1 will merge with and into Merger Sub 2 (the “Second Merger,” and together with the First Merger and the other transactions

contemplated by the Merger Agreement, the “Business Combination”), with Merger Sub 2 surviving the Second Merger as a wholly-owned

subsidiary of LTC.

| | For | | |

| Against | | |

| Abstain | |

| | 19,869,203 | | |

| 765,938 | | |

| 200 | |

Proposal

No. 3 – The Merger Proposal – to consider and vote upon, as a special resolution, a proposal to approve and

authorize the First Merger and the plan of merger for the First Merger.

| | For | | |

| Against | | |

| Abstain | |

| | 19,869,203 | | |

| 765,938 | | |

| 200 | |

Proposal

No. 4 – The Adjournment Proposal – to consider and vote upon, as an ordinary resolution, a proposal to adjourn

the extraordinary general meeting to a later date or dates, to, among other things, permit further solicitation and vote of proxies in

the event that there are insufficient votes for the approval of one or more proposals at the extraordinary general meeting or if holders

of LCAA Class A ordinary shares have elected to redeem an amount of LCAA Class A ordinary shares such that the minimum available

cash condition or the net tangible assets condition contained in the Merger Agreement would not be satisfied. The Adjournment Proposal

was not submitted to LCAA’s shareholders for approval at the Extraordinary General Meeting as there were sufficient votes to approve

the Proposals No. 1, No. 2 and No. 3.

| Item 7.01 | Regulation FD Disclosure. |

On

February 2, 2024, LCAA and LTC issued a press release announcing the approval of the Business Combination and other related proposals

by LCAA’s shareholders. A copy of the press release is furnished as Exhibit 99.1 to this current report (the “Current

Report”).

The information in this

Item 7.01, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section,

and shall not be deemed to be incorporated by reference into the filings of LCAA under the Securities Act of 1933, as amended (the “Securities

Act”), or the Exchange Act, regardless of any general incorporation language in such filings.

20,818,519

Ordinary Shares were redeemed in connection with the Extraordinary General Meeting.

Forward-Looking Statements

This Current Report contains forward-looking statements

within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act, that are based on beliefs and

assumptions and on information currently available to Lotus Tech and LCAA. All statements other than statements of historical fact contained

in this Current Report are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such

as “may”, “should”, “expect”, “intend”, “will”, “estimate”, “anticipate”,

“believe”, “predict”, “potential”, “forecast”, “plan”, “seek”,

“future”, “propose” or “continue”, or the negatives of these terms or variations of them or similar

terminology although not all forward-looking statements contain such terminology. Such forward-looking statements are subject to risks,

uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward

looking statements.

These forward-looking statements are based upon

estimates and assumptions that, while considered reasonable by LCAA and its management, and Lotus Tech and its management, as the case

may be, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are

not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of definitive

agreements with respect to the proposed Business Combination between LCAA, Lotus Tech and the other parties thereto; (2) the outcome

of any legal proceedings that may be instituted against LCAA, the combined company or others following the announcement of the Business

Combination and any definitive agreements with respect thereto; (3) the amount of redemption requests made by LCAA public shareholders

and the inability to complete the Business Combination due to the failure to obtain approval of the shareholders of LCAA, to obtain financing

to complete the Business Combination or to satisfy other conditions to the Closing; (4) changes to the proposed structure of the

Business Combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining

regulatory approval of the Business Combination; (5) the ability to meet stock exchange listing standards following the consummation

of the Business Combination; (6) the risk that the Business Combination disrupts current plans and operations of the Company as a

result of the announcement and consummation of the Business Combination; (7) the ability to recognize the anticipated benefits of

the Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage

growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (8) costs related

to the Business Combination; (9) risks associated with changes in applicable laws or regulations and the Company’s international

operations; (10) the possibility that the Company or the combined company may be adversely affected by other economic, business,

and/or competitive factors; (11) the Company’s estimates of expenses and profitability; (12) the Company’s ability

to maintain agreements or partnerships with its strategic partner Geely and to develop new agreements or partnerships; (13) the Company’s

ability to maintain relationships with its existing suppliers and strategic partners, and source new suppliers for its critical components,

and to complete building out its supply chain, while effectively managing the risks due to such relationships; (14) the Company’s

reliance on its partnerships with vehicle charging networks to provide charging solutions for its vehicles and its strategic partners

for servicing its vehicles and their integrated software; (15) the Company’s ability to establish its brand and capture additional

market share, and the risks associated with negative press or reputational harm, including from lithium-ion battery cells catching

fire or venting smoke; (16) delays in the design, manufacture, launch and financing of the Company’s vehicles and the Company’s

reliance on a limited number of vehicle models to generate revenues; (17) the Company’s ability to continuously and rapidly

innovate, develop and market new products; (18) risks related to future market adoption of the Company’s offerings; (19) increases

in costs, disruption of supply or shortage of materials, in particular for lithium-ion cells or semiconductors; (20) the

Company’s reliance on its partners to manufacture vehicles at a high volume, some of which have limited experience in producing

electric vehicles, and on the allocation of sufficient production capacity to the Company by its partners in order for the Company to

be able to increase its vehicle production capacities; (21) risks related to the Company’s distribution model; (22) the

effects of competition and the high barriers to entry in the automotive industry, and the pace and depth of electric vehicle adoption

generally on the Company’s future business; (23) changes in regulatory requirements, governmental incentives and fuel and energy

prices; (24) the impact of the global COVID-19 pandemic on LCAA, the Company, the Company’s post business combination’s

projected results of operations, financial performance or other financial metrics, or on any of the foregoing risks; and (25) other

risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking

Statements” in LCAA’s final prospectus relating to its initial public offering (File No. 333-253334) declared

effective by the SEC on March 10, 2021, and other documents filed, or to be filed, with the SEC by LCAA or Lotus Tech, including

the Registration/Proxy Statement. There may be additional risks that neither LCAA nor Lotus Tech presently know or that LCAA or Lotus

Tech currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements.

Nothing in this Current Report should be regarded

as a representation by any person that the forward-looking statements set forth herein will be achieved in any specified timeframe, or

at all, or that any of the contemplated results of such forward-looking statements will be achieved in any specified timeframe, or at

all. The forward-looking statements in this Current Report represent the views of LCAA and Lotus Tech as of the date they are made. While

LCAA and Lotus Tech may update these forward-looking statements in the future, LCAA and Lotus Tech specifically disclaim any obligation

to do so, except to the extent required by applicable law. You should not place undue reliance on forward-looking statements.]

(d) Exhibits.

| No. |

|

Description |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Dated: February 2, 2024

| |

L CATTERTON ASIA ACQUISITION CORP |

| |

|

|

| |

By: |

/s/ Chinta

Bhagat |

| |

Name: |

Chinta Bhagat |

| |

Title: |

Co-Chief Executive Officer and Chairman |

v3.24.0.1

Cover

|

Feb. 02, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 02, 2024

|

| Entity File Number |

001-40196

|

| Entity Registrant Name |

L Catterton Asia Acquisition Corp

|

| Entity Central Index Key |

0001841024

|

| Entity Tax Identification Number |

98-1577355

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

8 Marina View, Asia Square Tower 1

|

| Entity Address, Address Line Two |

#41-03

|

| Entity Address, Country |

SG

|

| Entity Address, Postal Zip Code |

018960

|

| City Area Code |

+65

|

| Local Phone Number |

6672

7600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A Ordinary Share, $0.0001 par value, and one-third of one redeemable warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Units, each consisting of one Class A Ordinary Share, $0.0001

par value, and one-third of one redeemable warrant

|

| Trading Symbol |

LCAAU

|

| Security Exchange Name |

NASDAQ

|

| Common Class A [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A Ordinary Shares included as part of the units

|

| Trading Symbol |

LCAA

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants included as part of the units, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable warrants included as part of the units, each whole warrant

exercisable for one Class A Ordinary Share at an exercise price of $11.50

|

| Trading Symbol |

LCAAW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LCAA_UnitsEachConsistingOfOneClassAOrdinaryShare0.0001ParValueAndOneThirdOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LCAA_RedeemableWarrantsIncludedAsPartOfUnitsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

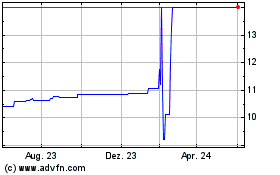

L Catterton Asia Acquisi... (NASDAQ:LCAAU)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

L Catterton Asia Acquisi... (NASDAQ:LCAAU)

Historical Stock Chart

Von Feb 2024 bis Feb 2025