Form 8-K - Current report

01 September 2023 - 10:22PM

Edgar (US Regulatory)

0001634447

false

0001634447

2023-09-01

2023-09-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 1, 2023 (August 30, 2023)

ISUN,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-37707 |

|

47-2150172 |

(State

or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification Number) |

|

400

Avenue D, Suite 10, Williston, Vermont 05495 |

| (Address

of Principal Executive Offices) (Zip Code) |

(802)

658-3378 |

| (Registrant’s

telephone number, including area code) |

|

| (Former

name or former address, if changed since last report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value per share |

|

ISUN |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01. Entry into a Material Definitive Agreement.

On

August 30, 2023, iSun, Inc., a Delaware corporation (the “Company”), entered into a letter agreement (the “First

Letter Agreement”) by and between the Company and each of Anson Investments Master Fund LP and Anson East Master Fund LP (together,

the “Investors”) regarding a modification of the terms of those certain Senior Secured Convertible Promissory Notes issued

to the Investors, dated November 4, 2022 (the “Notes”). The Notes are described in the Company’s Current Report on

Form 8-K, filed with the Commission on November 8, 2022. Under the Notes, the Company covenanted that it meet certain EBITDA targets,

including EBITDA of $500,000 for the quarter ended June 30, 2023. The Company had an EBITDA loss of $617,000 during the quarter ended

June 30, 2023. Under the Notes, a failure to fulfill the EBITDA financial covenant is defined as an Event of Default. For such an Event

of Default, the Investors may accelerate all amounts due under the Notes. The Investors have agreed to a waiver of the Event of

Default upon the terms set forth in the First Letter Agreement, including that the Company shall pay the Investors the aggregate

amount of $1,442,307.69 of the principal amount of the Notes by wire transfer within 30 days of the date of the Letter Agreement, that

the Fixed Conversion Price of the Notes shall be adjusted to $1.00, and that the Company shall issue warrants to the Investors as described

in Item 3.02, below.

On August 30, 2023, the Company entered into a

second letter agreement with the Investors (the “Second Letter Agreement”). The Second Letter Agreement provides that the

Company may complete an Optional Redemption of all of the then outstanding principal balance due under the Notes on or before December

31, 2023, notwithstanding Section 6(a) of the Notes, which permits the Company to effect an Optional Redemption only in the absence of

an existing or imminent Event of Default, and subject to certain other conditions.

Item

3.02. Unregistered Sale of Securities.

Effective

August 30, 2023,

in accordance with the terms of that certain Letter Agreement by and between the Company and the Investors, the Company issued warrants

to acquire an aggregate of 1,000,000 shares of Common Stock (the “Warrants”) to the Investors in satisfaction of the Letter

Agreement in a transaction exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”),

in reliance on Section 4(a)(2) thereof and Rule 506(b) of Regulation D thereunder. Each of the Investors previously represented that

it was an “accredited investor”, as defined in Regulation D, and was acquiring the Warrants

and Warrant Shares for investment only and not

with a view towards, or for resale in connection with, the public sale of distribution thereof. Accordingly, the Warrants and

Warrant Shares have not been registered under

the Securities Act and any applicable state securities laws. Pursuant to the First Letter

Agreement, the Company was obligated to provide the Investors the Warrants with an exercise

price of $1.00 per share and a term of 5 years.

Item

9.01. Exhibits.

| 4.1 |

|

Warrant to Purchase Common Stock, dated August 30, 2023, by and between iSun, Inc. and Anson Investments Master Fund LP. |

| |

|

|

| 4.2 |

|

Warrant to Purchase Common Stock, dated August 30, 2023, by and between iSun, Inc. and Anson East Master Fund LP. |

| |

|

|

| 10.1 |

|

Letter Agreement, dated August 30, 2023, by and between iSun, Inc., Anson Investments Master Fund LP, and Anson East Master Fund LP. |

| |

|

|

| 10.2 |

|

Letter Agreement, dated August 30, 2023, by and between iSun, Inc., Anson Investments Master Fund LP, and Anson East Master Fund LP. |

| |

|

|

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

September 1, 2023

| |

iSun,

Inc. |

| |

|

|

| |

By: |

/s/

Jeffrey Peck |

| |

Name: |

Jeffrey

Peck |

| |

Title: |

Chief

Executive Officer |

Exhibit 4.1

Exhibit 4.2

Exhibit 10.1

Exhibit 10.2

v3.23.2

Cover

|

Sep. 01, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 01, 2023

|

| Entity File Number |

001-37707

|

| Entity Registrant Name |

ISUN,

INC.

|

| Entity Central Index Key |

0001634447

|

| Entity Tax Identification Number |

47-2150172

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

400

Avenue D

|

| Entity Address, Address Line Two |

Suite 10

|

| Entity Address, City or Town |

Williston

|

| Entity Address, State or Province |

VT

|

| Entity Address, Postal Zip Code |

05495

|

| City Area Code |

(802)

|

| Local Phone Number |

658-3378

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value per share

|

| Trading Symbol |

ISUN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

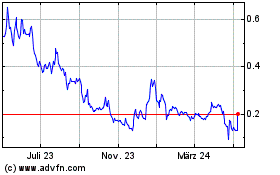

iSun (NASDAQ:ISUN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

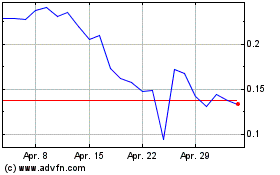

iSun (NASDAQ:ISUN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024