Filed Pursuant to Rule 424(b)(3)

Registration No. 333-272904

PROSPECTUS SUPPLEMENT NO. 1

To Prospectus Dated July 3, 2023

150,000,000 Shares of Common Stock Issuable

Upon Exercise of Warrants

This prospectus supplement amends and supplements the prospectus, dated

July 3, 2023 (the “Prospectus”), forming a part of the Registration Statement on Form S-1 (No. 333-272904), filed by Inpixon,

a Nevada corporation (the “Company”, “we”, “us” or “our”), with the U.S. Securities and

Exchange Commission (the “SEC”) and declared effective on July 3, 2023 (the “Registration Statement”), and relates

to the resale from time to time by the selling stockholders named in this prospectus supplement and the Prospectus (the “Selling

Stockholders”), including their respective transferees, pledgees or donees, or their respective successors, for their own account,

of up to an aggregate of 150,000,000 shares of our common stock, par value $0.001 per share (the “Common Stock”), issuable

upon the exercise of warrants (as amended, the “Existing Warrants”) or issuable upon exercise of rights for shares of

Common Stock that are issuable to the holders of the Existing Warrants upon exercise of such rights in lieu of Common Stock in accordance

with the terms of the Existing Warrants. Such Existing Warrants were issued by the Company pursuant to that certain Warrant Purchase Agreement,

dated May 15, 2023, by and between the Company and the purchasers signatory thereto.

This prospectus supplement

is being filed to (i) update and supplement the information in the Prospectus with the information contained in our Current Report on

Form 8-K, filed with the SEC on December 15, 2023 (the “Form 8-K”), which among other things, discloses the reduction in the

exercise price of the Existing Warrants, as more fully described below, (ii) update and supplement the selling stockholder table in the

Prospectus with the information contained below and (iii) update the “Experts” section of the Prospectus.

Our Common Stock is listed on the Nasdaq Capital Market (“Nasdaq”)

under the symbol “INPX”. The last reported closing price for our Common Stock on Nasdaq on December 15, 2023 was $0.075 per

share.

This prospectus supplement

updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in

combination with, the Prospectus and any other amendments or supplements thereto. This prospectus supplement should be read in conjunction

with the Prospectus and such amendments and supplements and if there is any inconsistency between the information in the Prospectus and

this prospectus supplement, you should rely on the information in this prospectus supplement.

Investing in our securities

involves a high degree of risk. See “Risk Factors” beginning on page 5 of the Prospectus and in the documents which are incorporated

by reference herein and therein to read about factors you should consider before investing in our securities.

Neither the U.S. Securities

and Exchange Commission nor any state securities commission has approved or disapproved of such securities or passed upon the adequacy

or accuracy of the Prospectus or any other amendments or supplements thereto. Any representation to the contrary is a criminal offense.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

You should carefully consider

the risk factors set forth in the Prospectus, as well as the other information contained, or incorporated by reference, in this prospectus

supplement and the Prospectus. The Prospectus contains forward-looking statements that include, without limitation: statements concerning

litigation or other matters; statements concerning projections, predictions, expectations, estimates or forecasts for our business, financial

and operating results and future economic performance; statements of our management’s goals and objectives; statements concerning

our competitive environment, availability of resources and regulation; trends affecting our financial condition, results of operations

or future prospects; our financing plans or growth strategies; and other similar expressions concerning matters that are not historical

facts. Words such as “may”, “will”, “should”, “could”, “would”, “predicts”,

“potential”, “continue”, “expects”, “anticipates”, “future”, “intends”,

“plans”, “believes” and “estimates,” and variations of such terms or similar expressions, are intended

to identify such forward-looking statements.

Forward-looking statements

should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or

by which, that performance or those results will be achieved. Forward-looking statements are based on information available at the time

they are made and/or management’s good faith belief as of that time with respect to future events and are subject to risks and uncertainties

that could cause actual performance or results to differ materially from what is expressed in or suggested by the forward-looking statement

made or included in this prospectus supplement and the Prospectus.

Forward-looking statements

speak only as of the date they are made. You should not put undue reliance on any forward-looking statements. The Company assumes no obligation

to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking

information, except to the extent required by applicable securities laws. If the Company does update one or more forward-looking statements,

no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements.

REPRICING OF WARRANTS

As previously reported in the

Form 8-K, on December 15, 2023, the Company entered into warrant inducement letter agreements (the “Inducement Agreements”)

with the holders (including their respective successors and assigns, the “Holders”) of the Existing Warrants.

Pursuant to the Inducement Agreements, in consideration for the Holders

exercising an aggregate of 49,131,148 Existing Warrants (the “Warrant Exercise” and such shares of Common Stock to be issued

upon the exercise of the Existing Warrants, the “Exercised Shares”), the Company agreed to (a) reduce the exercise price for

the Exercised Shares from $0.10 to $0.0513 per share (the “New Exercise Price”), which is equal to a 30% discount to the average

closing price of the Common Stock (as reflected on Nasdaq.com) for the five trading days prior to the execution of the Inducement

Agreements, such that the Exercised Shares will be exercised at the New Exercise Price, and (b) issue, upon delivery of the aggregate

exercise price for the Exercised Shares, the Holders new unregistered Common Stock Purchase Warrants (the “New Warrants”)

to purchase up to a number of shares (the “New Warrant Shares”) of Common Stock equal to 100% of the number of Exercised Shares,

exercisable five years from their issuance date with an exercise price per share as described below, provided, however, that the New Warrants

will not be exercisable until the approval of the shareholders of the Company as may be required by the applicable rules and regulations

of the Nasdaq Stock Market (or any successor entity) with respect to the issuance of shares of Common Stock underlying the New Warrants

(the “Shareholder Approval”), provided, however, that if after consultation with the Nasdaq Stock Market it is determined

that Shareholder Approval is not required for the exercise of the New Warrants (on the basis that Shareholder Approval was obtained on

December 8, 2023 via the future financing proposal that was approved for the potential issuances of shares of Common Stock pursuant to

one or more potential non-public transactions in accordance with Nasdaq Listing Rule 5635(d)), such New Warrants will be exercisable at

any time on or after the date on which the Company has provided notice of such determination to the Holders.

The exercise price per share

of the New Warrants will be equal to $0.07324 (the “Exercise Price”); provided, however, that the Company may, subject to

applicable rules and regulations of the Nasdaq Stock Market, reduce the Exercise Price to $0.0513 per share of Common Stock.

The closing of the transactions contemplated by the Inducement Agreements

(i.e., the delivery of the aggregate exercise price for the Exercised Shares and the issuances of the Exercised Shares and the New Warrants)

is expected to occur on or about December 19, 2023. The Company will receive gross proceeds from the exercise of the Existing Warrants

of $2,520,427.88, prior to deducting fees to the Placement Agent (as defined below) and estimated expenses. The Company intends to use

the net proceeds for working capital and general corporate purposes.

The Company engaged Joseph

Gunnar & Co., LLC as the exclusive placement agent (the “Placement Agent”) in connection with the Inducement Agreements

pursuant to an engagement agreement, dated December 13, 2023, by and between the Company and the Placement Agent, and agreed to pay the

Placement Agent a cash fee equal to 5.5% of the aggregate gross proceeds received from the Holders’ exercise of their Existing Warrants

in the Warrant Exercise and to reimburse the Placement Agent up to $25,000 for expenses (inclusive of legal fees) in connection therewith.

The shares of Common Stock

issuable upon exercise of the Existing Warrants were registered pursuant to an effective registration statement on Form S-1 (Registration

No. 333-272904) (the “Resale Registration Statement”). The Company agreed to maintain the effectiveness of the Resale Registration

Statement until such time as all Existing Warrants have been exercised or expired. The New Warrants were sold in a private placement (the

“Private Placement”), exempt from registration pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the

“Securities Act”), and/or Rule 506 promulgated thereunder.

The New Warrants contain standard

adjustments to the Exercise Price including for stock splits and reclassifications. The New Warrants also include certain rights upon

“fundamental transactions” as described in the New Warrants.

The New Warrants include cashless

exercise rights to the extent the shares of Common Stock underlying the New Warrants are not registered under the Securities Act.

Under the Inducement Agreements,

to the extent required under the rules and regulations of the Nasdaq Stock Market, the Company agreed to hold a special or annual meeting

of shareholders no later than the 90th calendar date following the date of the Inducement Agreements for the purpose of seeking the Shareholder

Approval.

Additionally, under the Inducement

Agreements, the Company agreed to, as soon as practicable (and in any event, on or prior to March 31, 2024), to the extent there is not

a registration statement covering the resale of the New Warrant Shares that is effective under the Securities Act, file a registration

statement on Form S-3 (or other appropriate form if the Company is not then S-3 eligible) providing for the resale by the Holders of the

New Warrant Shares issuable upon exercise of the New Warrants; to use commercially reasonable efforts to cause such registration statement

to become effective no later than the later of (i) 30 days following the filing thereof and (ii) 120 days following the date of the Inducement

Agreements; and to keep such registration statement effective at all times until no Holders owns any New Warrants. In addition to the

foregoing, to the extent there is not a registration statement covering the resale of the New Warrant Shares that is effective under the

Securities Act, if at any time following the date of the Inducement Agreements the Company proposes for any reason to register any shares

of Common Stock under the Securities Act (other than pursuant to a registration statement on Form S-4 or Form S-8 (or a similar or successor

form) or a shelf registration statement on Form S-3) with respect to an offering of Common Stock by the Company for its own account or

for the account of any of its stockholders, the Company agreed, at each such time, to promptly give written notice to the holders of the

New Warrants of its intention to do so and, to the extent permitted under the provisions of Rule 415 under the Securities Act, include

in such registration statement the resale of all New Warrant Shares with respect to which the Company has received written requests for

inclusion therein; provided, however, that such piggyback registration rights expire one year after the issuance of the New Warrants.

Under the terms of the New

Warrants, a holder will not be entitled to exercise any portion of any such warrant, if, upon giving effect to such exercise, the aggregate

number of shares of Common Stock beneficially owned by the holder (together with its affiliates, any other persons acting as a group together

with the holder or any of the holder’s affiliates, and any other persons whose beneficial ownership of Common Stock would or could

be aggregated with the holder’s for purposes of Section 13(d) or Section 16 of the Securities Exchange Act of 1934, as amended)

would exceed either 4.99% or 9.99%, at such holder’s election, of the number of shares of Common Stock outstanding immediately after

giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of such warrant, which percentage

may be increased or decreased at the holder’s election upon 61 days’ notice to the Company subject to the terms of such warrants,

provided that such percentage may in no event exceed 9.99%.

The form of each of the Inducement

Agreement and the New Warrant were filed as Exhibits 10.1 and 4.1 to the Form 8-K, respectively.

As of the date of this prospectus supplement, 58,131,148 of the Existing

Warrants have been exercised (including 2,575,686 shares which have not been issued due to beneficial ownership blockers) for gross proceeds

of $4,860,427.88 (of which total amount, 49,131,148 Existing Warrants (including 2,575,686 shares which have not been issued due to beneficial

ownership blockers) were exercised pursuant to the Inducement Agreements for gross proceeds of $2,520,427.88) and there are 91,868,852

unexercised Existing Warrants remaining and an additional 2,575,686 exercised but unissued shares.

SELLING STOCKHOLDERS

The following information is provided to update the selling stockholder

table in the Prospectus to reflect the transfers of Existing Warrants to purchase up to (i) 20,000,000 shares of our Common Stock by Streeterville

Capital, LLC (“Streeterville”) to Walleye Opportunities Master Fund Ltd (the “Walleye Fund”) on September

29, 2023, (ii) 12,670,565 shares of our Common Stock by Streeterville to Kantor Family Investments, Inc. (“Kantor”) on December

15, 2023, (iii) 974,659 shares of our Common Stock by Streeterville to Susan Kantor on December 15, 2023, (iv) 9,746,589 shares of our

Common Stock by Streeterville to Howard Godofsky on December 15, 2023, (v) 1,842,105 shares of our Common Stock by Streeterville to SmartNet

Capital LLC (“SmartNet”) on December 15, 2023, (vi) 4,873,294 shares of our Common Stock by Streeterville to Kellie Price

Rothman on December 15, 2023 and (vii) 20,000,000 shares of our Common Stock by Streeterville to John Nash on December 15, 2023. The table

below replaces and supersedes the selling stockholder table in the Prospectus.

Name and Address of Selling Stockholder | |

No. of

Shares of

Common Stock

Beneficially

Owned

Prior to this

Offering(1) | | |

Percentage of

Outstanding

Shares of

Common Stock

Beneficially

Owned

Prior to this

Offering(2) | | |

No. of

Shares of

Common Stock

Offered by

Selling

Stockholder(1) | | |

No. and

Percentage of

Outstanding

Shares of

Common Stock

Beneficially

Owned

Subsequent to

this Offering(2)(3) | |

| Walleye Opportunities Master Fund Ltd(4) | |

| 17,424,314 | | |

| 9.99 | % | |

| 20,000,000 | | |

| – | |

| Kantor Family Investments, Inc.(5) | |

| 14,153,765 | | |

| 8.12 | % | |

| 12,670,565 | | |

| * | |

| Susan Kantor(6) | |

| 974,659 | | |

| * | | |

| 974,659 | | |

| – | |

| Howard Godofsky(7) | |

| 9,746,589 | | |

| 5.59 | % | |

| 9,746,589 | | |

| – | |

| SmartNet Capital LLC(8) | |

| 1,842,105 | | |

| 1.06 | % | |

| 1,842,105 | | |

| – | |

| Kellie Price Rothman(9) | |

| 4,873,294 | | |

| 2.80 | % | |

| 4,873,294 | | |

| – | |

| John Nash(10) | |

| 17,424,314 | | |

| 9.99 | % | |

| 20,000,000 | | |

| – | |

| Anson(11) | |

| 17,424,314 | | |

| 9.99 | % | |

| 66,000,000 | | |

| – | |

| * |

Represents beneficial ownership of less than 1%. |

| (1) |

Assumes all Warrants are exercised at the New

Exercise Price.

|

| (2) |

The percentage of the Selling Stockholders’ ownership before

and after this offering is based on 174,244,012 shares of Common Stock, which includes 127,688,550 shares of Common Stock outstanding

as of December 15, 2023 and 46,555,462 Exercised Shares to be issued pursuant to the Inducement Agreements.

|

| (3) |

We have assumed that the Selling Stockholders will not acquire beneficial

ownership of any additional securities issued by us during this offering.

|

| (4) |

The number of shares beneficially owned by the Walleye Fund prior to

this offering excludes 2,575,686 shares of Common Stock issuable upon the exercise of the Existing Warrants held by the Walleye Fund,

which are subject to a 9.99% ownership blocker. Walleye Capital LLC is the investment manager of the Walleye Fund and may be deemed to

beneficially own the securities owned by the Walleye Fund. William England is the Chief Executive Officer of Walleye Capital LLC and may

be deemed to have voting and dispositive power over the securities owned by the Walleye Fund. Walleye Capital LLC and William England

each disclaim any beneficial ownership of these securities. The address for Walleye Fund is 2800 Niagara Lane North, Plymouth, Minnesota

55447. |

| (5) | Includes,

prior to this offering, (i) 12,670,565 shares of Common Stock issuable upon the exercise of the Existing Warrants held by Kantor and

(ii) 1,483,200 shares of Common Stock held by Kantor. Brian Kantor has voting and dispositive control over the shares held by Kantor.

The address of Kantor is 21290 N.E. 23rd Ave., Miami, FL 33180. |

| (6) | The

address of Susan Kantor is 20100 Boca West Drive, Apt. 127, Boca Raton, FL 33434. |

| (7) | The

address of Howard Godofsky is 1850 S. Ocean Drive, Unit 2705, Hallandale Beach, FL 33009. |

| (8) | Howard

Gerson has voting and dispositive control over the shares held by SmartNet. The address of SmartNet is 3201 N.E. 183rd Street, #2707,

Aventura, FL 33160. |

| (9) | The

address of Kellie Price Rothman is 3370 N.E. 190th Street, #3900, Aventura, FL 33180. |

| (10) |

The number of shares beneficially owned by John Nash prior to this offering excludes 2,575,686 shares of Common Stock which have been exercised under the Existing Warrants held by Mr. Nash, but remain unissued, as a result of a beneficial ownership blocker. The address of Mr. Nash is 1780 South Post Oak Lane, Houston, TX 77056. |

| (11) | The

number of shares beneficially owned by Anson East Master Fund LP and Anson Investments Master Fund LP (“Anson”), in the aggregate,

excludes 48,575,686 shares of Common Stock issuable upon the exercise of the Existing Warrants held Anson, which are subject to a 9.99%

ownership blocker. Without regard to the ownership blocker, Anson Investments Master Fund LP beneficially owns 52,800,000 shares of Common

Stock issuable upon the exercise of the Existing Warrants and Anson East Master Fund LP beneficially owns 13,200,000 shares of Common

Stock issuable upon the exercise of the Existing Warrants. Anson Advisors Inc and Anson Funds Management LP, the Co-Investment Advisers

of Anson, hold voting and dispositive power over the shares held by Anson. Bruce Winson is the managing member of Anson Management GP

LLC, which is the general partner of Anson Funds Management LP. Moez Kassam and Amin Nathoo are directors of Anson Advisors Inc. Mr.

Winson, Mr. Kassam and Mr. Nathoo each disclaim beneficial ownership of these shares except to the extent of their pecuniary interest

therein. The principal business address of Anson is Maples Corporate Services Limited, PO Box 309, Ugland House, Grand Cayman, KY1-1104,

Cayman Islands. |

EXPERTS

The following paragraph

is added to the “Experts” section of the Prospectus:

The financial statements of

XTI Aircraft Company at December 31, 2022 and 2021, and for each of the years then ended, which are incorporated by reference in this

prospectus and elsewhere in this registration statement, have been audited by BF Borgers CPA PC, independent registered public accounting

firm, as set forth in their report (which contains an explanatory paragraph describing conditions that raise substantial doubt about XTI

Aircraft Company’s ability to continue as a going concern as described in Note 1 to the financial statements), and are included

in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

Except as explicitly set forth

herein, nothing in this prospectus supplement is intended to modify the information set forth in the Prospectus.

Sole Placement Agent

Joseph

Gunnar & Co., LLC

The date of this prospectus

supplement is December 15, 2023

4

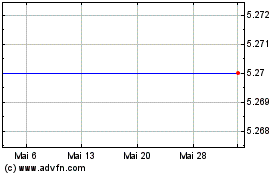

Inpixon (NASDAQ:INPX)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Inpixon (NASDAQ:INPX)

Historical Stock Chart

Von Dez 2023 bis Dez 2024