GAAP Net Income Attributable to Immersion

stockholders of $28.9 million or $0.89 per diluted share

Non-GAAP Net Income Attributable to Immersion stockholders of

$37.0 million or $1.14 per diluted share

Immersion Corporation (“Immersion”, the “Company”, “we”, “us” or

“our”) (Nasdaq: IMMR), a leading provider of technologies for

haptics, today reported financial results for the second quarter

ended June 30, 2024.

Second Quarter Consolidated Financial Summary1:

•

Total revenues of $99.4 million in the

second quarter of 2024, compared to $7.0 million in the second

quarter of 2023.

•

GAAP net income attributable to Immersion

Corporation stockholders was $28.9 million, or $0.89 per diluted

share in the second quarter of 2024, compared to $7.0 million, or

$0.21 per diluted share, in the second quarter of 2023.

•

GAAP operating expenses of $33.2 million

in the second quarter of 2024, compared to $3.9 million in the

second quarter of 2023. Non-GAAP operating expenses of $25.2

million in the second quarter of 2024, compared to $2.5 million in

the second quarter of 2023.

•

Non-GAAP net income attributable to

Immersion Corporation stockholders was $37.0 million, or $1.14 per

diluted share, in the second quarter of 2024 compared to $8.4

million, or $0.26 per diluted share, in the second quarter of

2023.

•

Total stockholders' equity attributable to

Immersion Corporation stockholders was $230.3 million compared to

$183.1 million as of December 31, 2023.

Second Quarter Immersion Corporation Segment Standalone

Financial Summary:

•

Immersion Corporation royalty and license

revenue was $52.4 million in the second quarter of 2024, compared

to $7.0 million in the second quarter of 2023.

•

Immersion Corporation standalone Non-GAAP

stockholders’ equity increased $53.0 million to $236.1 million as

of June 30, 2024 compared to $183.1 million as of December 31,

2023.

1 On June 10, 2024, the Company closed certain transactions with

Barnes & Noble Education, Inc. (“Barnes & Noble

Education”). As part of the transactions, the Company acquired 42%

of all outstanding common shares of Barnes & Noble Education,

as well as control over Barnes & Noble Education through the

five Immersion-appointed board seats. The financial information

presented in the press release includes the consolidated financial

information of Barnes & Noble Education from the period of June

10, 2024 through June 30, 2024. The Company owns approximately 11

million shares of Barnes & Noble Education's common stock upon

the close of this transaction.

“The second quarter was very strong for the Company,” said Eric

Singer, Chairman and CEO. “We continue to work to protect and

monetize our intellectual property. We were also able to take

advantage of our strong and liquid balance sheet to make an

important investment in Barnes & Noble Education (NYSE: BNED).

Notably, Immersion standalone Non-GAAP stockholders equity has

increased by more than $50 million so far in 2024 to $236.1 million

as of June 30, 20242. We will continue to seek to drive long-term

shareholder value from a position of strength and through

thoughtful capital allocation,” added Singer.

The ninth quarterly dividend, in the amount of $0.045 per share,

will be paid on October 18, 2024 to stockholders of record on

October 4, 2024. Future quarterly dividends will be subject to

further review and approval by the Board of Directors (the “Board”)

in accordance with applicable law. The Board reserves the right to

adjust or withdraw the quarterly dividend in future periods as it

reviews the Company’s capital allocation strategy from

time-to-time.

About Immersion Corporation

Immersion Corporation (Nasdaq: IMMR) was incorporated in 1993 in

California and reincorporated in Delaware in 1999.

The Company is a leading provider of touch feedback technology,

also known as haptics. The Company accelerates and scales haptic

experiences by providing haptic technology for mobile, automotive,

gaming, and consumer electronics. Haptic technology creates

immersive and realistic experiences that enhance digital

interactions by engaging users’ sense of touch. Learn more at

www.immersion.com.

2 See Reconciliation of GAAP total stockholders’ equity

attributable to Immersion Corporation Stockholders to Immersion

standalone Non GAAP stockholders’ equity for more detail.

Use of Non-GAAP Financial Measures

The Company reports all financial information required in

accordance with generally accepted accounting principles (“GAAP”),

but it believes that evaluating its ongoing operating results may

be difficult to understand if limited to reviewing only GAAP

financial measures. The Company discloses certain non-GAAP

information, such as Non-GAAP net income attributable to Immersion

stockholders, Non-GAAP net income per diluted common share

attributable to Immersion stockholders, Non-GAAP operating

expenses, Immersion standalone Non-GAAP stockholders’ equity

because it is useful in understanding the Company’s performance as

it excludes certain non-cash expenses like stock-based compensation

expense, depreciation and amortization of property and equipment,

restructuring expense, business acquisition related costs and other

nonrecurring charges that many investors feel may obscure the

Company’s true operating performance. Likewise, management uses

these non-GAAP financial measures to manage and assess the

profitability of its business. Non-GAAP financial measures should

be viewed in addition to, and not as an alternative for, the

Company’s reported results under GAAP. The non-GAAP financial

measures are not intended to be considered in isolation or as a

substitute for results prepared in accordance with GAAP. Such

non-GAAP financial measures are reconciled to their closest GAAP

financial measures in tables contained in this press release.

Forward-looking Statements

This press release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). The

forward-looking statements involve risks and uncertainties.

Forward-looking statements are identified by words such as

“anticipates,” “believes,” “expects,” “intends,” “may,” “can,”

“will,” “places,” “estimates,” and other similar expressions.

However, these words are not the only way we identify

forward-looking statements. Examples of forward-looking statements

include any expectations, projections, or other characterizations

of future events, or circumstances, including but not limited to

statements about the Company’s focus on protecting its intellectual

property, either through the execution of new or renewal license

agreements or by proactive enforcement continuing to pursue

thoughtful capital allocation to increase long-term stockholder

value, and the timing of any dividend payments.

Because forward-looking statements relate to the future, they

are subject to inherent uncertainties, risks and changes in

circumstances that are difficult to predict and many of which are

outside of our control. Actual results could differ materially from

those projected in the forward-looking statements, therefore we

caution you not to place undue reliance on these forward-looking

statements. Important factors that could cause our actual results

and financial condition to differ materially from those indicated

in the forward-looking statements include, among others, the

following: the inability to predict the outcome of any litigation,

the costs associated with any litigation and the risks related to

our business, both direct and indirect, of initiating litigation,

unanticipated changes in the markets in which the Company operates;

the effects of the current macroeconomic climate; delay in or

failure to achieve adoption of or commercial demand for the

Company’s products or third party products incorporating the

Company’s technologies; the inability of Immersion to renew

existing licensing arrangements, or enter into new licensing

arrangements on favorable terms; the loss of a major customer; the

ability of

Immersion to protect and enforce its intellectual property

rights and other factors. For a more detailed discussion of these

factors, and other factors that could cause actual results to vary

materially, interested parties should review the risk factors

listed in Immersion’s Annual Report on Form 10-K for 2023 as filed

with the U.S. Securities and Exchange Commission (the “SEC”),

Barnes & Noble Education’s Inc.'s Annual Report on Form 10-K

for its fiscal year ended April 27, 2024, as filed with the SEC,

and Immersion’s Quarterly Report on Form 10-Q for the quarter ended

June 30, 2024, as filed with the SEC. Any forward-looking

statements made by us in this press release speak only as of the

date of this press release, and the Company does not intend to

update these forward-looking statements after the date of this

press release, except as required by law.

Immersion, and the Immersion logo are trademarks of Immersion

Corporation in the United States and other countries. All other

trademarks are the property of their respective owners. The use of

the word “partner” or “partnership” in this press release does not

mean a legal partner or legal partnership.

(IMMR – C)

Immersion Corporation

Condensed Consolidated Balance

Sheets

(In thousands)

(Unaudited)

June 30, 2024

December 31, 2023

ASSETS

Current assets

Immersion

Cash and cash equivalents

$

28,932

$

56,071

Investments - current

97,614

104,291

Accounts receivable, net

18,235

2,241

Prepaid expenses and other current

assets

8,647

9,847

153,428

172,450

Barnes &

Noble Education

Cash and cash equivalents

6,855

—

Accounts receivable, net

122,797

—

Merchandise inventories, net

353,454

—

Textbook rental Inventories, net

9,288

—

Prepaid expenses and other current

assets

32,819

—

525,213

—

Total current assets

678,641

172,450

Immersion

Property and equipment, net

166

211

Investments - noncurrent

45,163

33,350

Long-term deposits

6,310

6,231

Deferred tax assets

3,343

3,343

Other assets - noncurrent

33,775

146

88,757

43,281

Barnes &

Noble Education

Property and equipment, net

117,808

—

Intangible assets, net

94,786

—

Goodwill

14,220

—

Operating lease right-of-use assets

182,292

—

Other assets - noncurrent

11,162

—

420,268

—

Total assets

$

1,187,666

$

215,731

Immersion Corporation

Condensed Consolidated Balance

Sheets (Continued)

(In thousands)

(Unaudited)

June 30, 2024

December 31, 2023

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities

Immersion

Accounts payable

$

81

$

47

Accrued compensation

2,850

3,127

Deferred revenue - current

12,082

4,239

Other current liabilities

27,605

11,900

42,618

19,313

Barnes &

Noble Education

Accounts payable

217,173

—

Accrued liabilities

69,638

—

Deferred revenue - current

8,159

—

Operating lease liabilities - current

100,221

—

395,191

—

Total current liabilities

437,809

19,313

Immersion

Deferred revenue - noncurrent

8,665

8,390

Other long-term liabilities

4,959

4,926

13,624

13,316

Barnes &

Noble Education

Deferred tax liabilities - noncurrent

636

—

Operating lease - noncurrent

107,400

—

Other long-term liabilities

12,240

—

Deferred revenue - noncurrent

3,393

—

Long-term borrowings

186,644

—

310,313

—

Total liabilities

761,746

32,629

Total stockholders' equity attributable to

Immersion Corporation stockholders

230,272

183,102

Noncontrolling interest in consolidated

subsidiaries

195,648

—

Total stockholders' equity

425,920

183,102

Total liabilities and stockholders'

equity

$

1,187,666

$

215,731

Immersion Corporation

Condensed Consolidated

Statements of Operations

(In thousands, except per

share amounts)

(Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023

Revenues:

Immersion

Royalty and license

$

52,403

$

6,983

$

96,250

$

14,057

Barnes &

Noble Education

Product and other

45,073

—

45,073

—

Rental income

1,948

—

1,948

—

Total revenues

99,424

6,983

143,271

14,057

Cost of sale (excludes depreciation and

amortization expense):

Barnes &

Noble Education

Product and other

39,675

—

39,675

—

Rental income

1,131

—

1,131

—

40,806

—

40,806

—

Operating expenses:

Immersion

Selling and administrative expenses

14,175

3,870

41,408

7,685

Barnes & Noble Education

Selling and administrative expenses

14,519

—

14,519

—

Depreciation and amortization expense

2,140

—

2,140

Restructuring and other charges

2,378

—

2,378

—

19,037

—

19,037

—

Total operating expenses

33,212

3,870

60,445

7,685

Operating income

25,406

3,113

42,020

6,372

Interest and other income (loss), net

4,609

6,759

12,715

13,285

Interest expense

(901

)

—

(901

)

—

Income before provision for income

taxes

29,114

9,872

53,834

19,657

Provision for income taxes

(8,178

)

(2,844

)

(14,243

)

(4,351

)

Net income

$

20,936

$

7,028

$

39,591

$

15,306

Net loss attributable to noncontrolling

interest

(8,009

)

—

(8,009

)

—

Net income attributable to Immersion

stockholders

$

28,945

$

7,028

$

47,600

$

15,306

Diluted income per common share

attributable to Immersion stockholders

$

0.89

$

0.21

$

1.47

$

0.47

Shares used in calculating diluted net

income per share

32,525

32,810

32,407

32,839

Immersion Corporation

Reconciliation of GAAP net

income attributable to Immersion stockholders to Non-GAAP net

income attributable to Immersion stockholders

(In thousands, except per

share amounts)

(Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

20231

2024

20231

GAAP net income attributable to Immersion

stockholders

$

28,945

$

7,028

$

47,600

$

15,306

Add: Stock-based compensation

1,192

760

2,268

1,707

Depreciation and amortization of property

and equipment

2,155

21

2,173

42

Restructuring expense and other

charges

2,407

125

2,438

312

Business acquisition related costs

2,283

—

2,283

—

Other nonrecurring charges

10

481

53

560

Non-GAAP net income attributable to

Immersion stockholders

$

36,992

$

8,415

$

56,815

$

17,927

Non-GAAP net income per diluted common

share attributable to Immersion stockholder

$

1.14

$

0.26

$

1.75

$

0.55

Shares used in calculating Non-GAAP net

income per diluted share attributable to Immersion stockholder

32,525

32,810

32,407

32,839

1 In order to provide for better comparability between periods

and a better understanding of underlying trends. The Non-GAAP

information above includes an updated presentation of the prior

year 2023.

Immersion Corporation

Reconciliation of GAAP

Operating Expenses to Non-GAAP Operating Expenses

(In thousands)

(Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023

GAAP operating expenses

$

33,212

$

3,870

$

60,445

$

7,685

Adjustments to GAAP operating

expenses:

Stock-based compensation expense

(1,192

)

(760

)

(2,268

)

(1,707

)

Depreciation and amortization expense of

property and equipment

(2,155

)

(21

)

(2,173

)

(42

)

Restructuring expense charges

(2,407

)

(125

)

(2,438

)

(312

)

Business acquisition related costs

(2,283

)

—

(2,283

)

—

Other nonrecurring charges

(10

)

(481

)

(53

)

(560

)

Non-GAAP operating expenses

$

25,165

$

2,483

$

51,230

$

5,064

Immersion Corporation

Reconciliation of GAAP Total

stockholders’ equity attributable to Immersion Corporation

Stockholders to

Non-GAAP Immersion standalone

Non-GAAP stockholders’ equity

(In thousands)

(Unaudited)

June 30, 2024

December 31, 2023

Total stockholders’ equity attributable to

Immersion Corporation stockholders

$

230,272

$

183,102

Adjusted for Barnes & Noble

Education's net loss attributable to Immersion stockholders

5,800

—

Immersion standalone Non-GAAP

stockholders' equity

$

236,072

$

183,102

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240820975596/en/

Investor Contact:

J. Michael Dodson Immersion Corporation

mdodson@immersion.com

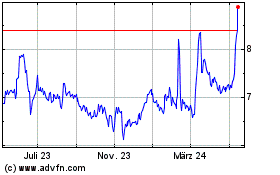

Immersion (NASDAQ:IMMR)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

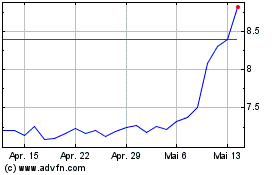

Immersion (NASDAQ:IMMR)

Historical Stock Chart

Von Jan 2024 bis Jan 2025