Company Meets

Q4 2017 Revenue, Gross

Margin, GAAP and Non-GAAP EPS

Guidance

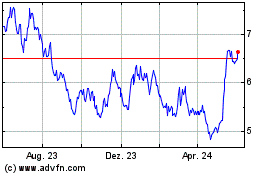

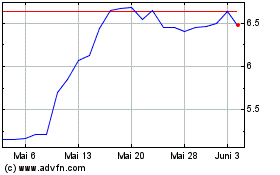

Himax Technologies, Inc. (Nasdaq:HIMX) (“Himax” or “Company”), a

leading supplier and fabless manufacturer of display drivers and

other semiconductor products, announced its financial results for

the fourth quarter and full year ended December 31, 2017.

“The Company’s 2017 fourth quarter revenues,

gross margin, GAAP and non-GAAP earnings per diluted ADS all met

the guidance. Despite the decline in the first half of 2017,

Himax’s driver ICs segment experienced a strong recovery in the

second half from the first half, and WLO business in the non-driver

segments hit inflection in the third quarter when the Company began

mass shipment to an anchor customer. Looking into 2018, the

Company’s growth will come from China panel makers’ increase in

capacity for large panel segment, in-cell TDDI for smartphone,

driver ICs for automotive applications, and increasing

WLO revenue as well as commencement of 3D sensing total

solution shipment. We believe 3D sensing will be our biggest long

term growth engine and, for 2018, a major contributor to both

revenue and profits, consequently creating a more favorable product

mix for Himax starting the second half of 2018. We expect

significant revenue and profit growth this year,” said Mr. Jordan

Wu, President and Chief Executive Officer of Himax.

“Himax jointly with Qualcomm announced SLiM™,

our structure light based 3D sensing total solution, will target

Android based smartphone last August. The solution brings together

Qualcomm’s industry leading 3D algorithm with Himax’s cutting-edge

design and manufacturing capabilities in optics and NIR sensors as

well as unique know-how in 3D sensing system integration. It

represents a very high barrier of entry for any potential

competition and a much higher ASP and profit margin for us. The

Qualcomm/Himax 3D sensing solution is by far the highest quality 3D

sensing total solution available for the Android market right now.

It has the industry’s best performance in all of dimension, 3D

depth accuracy, indoor/outdoor sensitivity and power consumption.

It passes the toughest eye safety standards with a proprietary

glass broken detection mechanism to safeguard the user from any

potential harm. Furthermore, our SLiM™ is the only solution

to offer face recognition for secure online payment, a must-have

feature for high end smartphones. Himax is working with multiple

tier-1 smartphone makers, expecting to launch 3D sensing on their

premium smartphones starting the first half of 2018. SLiM™ solution

will be ready for mass production and shipment by the end of the

first quarter 2018 with an initial capacity of 2 million units per

month. Given that SLiM™ is a highly integrated solution with ASPs

much higher than those of individual components, by the time we

start making shipment, it will be a major growth contributor to our

top and bottom lines,” added Mr. Wu.

Mr. Wu continued, “In an attempt to accelerate

the adoption of 3D sensing for Android phones, in addition to

SLiM™, Himax is also working on stereoscopic type 3D sensing as a

lower cost alternative. Unlike SLiM™ which utilizes structure light

to generate 3D, stereoscopic type uses two cameras to replicate 3D

vision in nature, augmented by coded light for image depth

enhancement. Both types of solutions offered by Himax operate on

active NIR light source with NIR sensors, thus working well under

extreme brightness or total darkness. For 3D sensing purposes,

structure light approach offers better depth precision than

stereoscopic type but the cost is also higher. By introducing

stereoscopic 3D sensing, Himax aims to bring down the cost of 3D

sensing so that it can be afforded by mass market smartphone

models. We are pleased to report that development of stereoscopic

3D sensing total solution for face recognition and 3D features has

been under way. We plan to be mass production and shipment ready by

the fourth quarter 2018 to meet customers’ launch timetable.

Similar to our experience in SLiM™, we are working with some of the

most prominent ecosystem partners in developing our stereoscopic 3D

total solution. We are very excited that this new development will

enable us to expand our 3D total solution portfolio to the high

volume smartphone market in addition to the premium to high-end

models. While lower cost compared to structure light, stereoscopic

3D will still represent a much higher ASP and better gross margin

potential for us.”

“To fulfill strong demands from the WLO anchor

customer and 3D sensing total solution Android smartphone OEMs, we

increased Phase I capex by $25 million from $80 million to $105

million primarily for enhanced manufacturing automation to achieve

higher product yields and better production efficiency to meet

SLiM™ shipment demand from Android OEMs’ 3D sensing smartphone

launches in 1H18 and acceleration in 2H18. We believe a Phase

II capex will soon be required for additional capacity. We are

still gathering customers’ input and finalizing technical details

and will formally announce the Phase II expansion as soon as the

plan is finalized,” further said Mr. Wu.

Fourth Quarter 2017 Financial

Results

The fourth quarter revenues of $181.1 million

represented a decrease of 8.1% sequentially and a decrease of 11.0%

year-over-year. Gross margin was 24.6%, down 0.9% sequentially.

GAAP earnings per diluted ADS were 13.7 cents, compared to the

guidance range of 13.0 to 15.0 cents. Non-GAAP earnings per diluted

ADS were 13.8 cents, compared to the guidance range of 13.2 to 15.2

cents.

Revenue from large display drivers was $58.4

million, up 6.3% sequentially but down 13.7% year-over-year. Large

panel driver ICs accounted for 32.3% of its total revenues for the

fourth quarter, compared to 27.9% in the third quarter of 2017 and

33.3% a year ago. Large panel driver business grew mid-single-digit

sequentially, in line with guidance, driven by ramping of new LCD

fabs in China and strong TV demand ahead of the Chinese New Year

holidays. The year-over-year decline was caused by phase-out of

certain customers’ old models and the misses in certain customers’

new design-in projects as Himax reported in previous earnings

calls. The Company has overcome the engineering hiccup and business

has started to be back on track since the third quarter. Himax is

pleased with its current engineering collaboration and 4K TV

design-in activities in the pipeline. Such activities will lead to

further rebound in future sales.

Revenue for small and medium-sized display

drivers came in at $81.3 million, down 6.8% sequentially and down

18.5% year-over-year. The product segment accounted for 44.9% of

total sales for the fourth quarter, as compared to 44.2% in the

third quarter of 2017 and 49.0% a year ago. As opposed to original

guidance of flattish sequential growth, Himax’s small and

medium-sized panel driver business declined mid-single digit

because of lower-than-expected smartphone driver IC sales. Sales

into smartphones were down 11.5% sequentially and declined more

than 35% year-over-year. The less than satisfactory result in the

fourth quarter was caused mainly by weak sentiment in the China

market as new products failed to attract consumers and therefore

OEMs turned cautious in building inventory. In addition, the

Company’s sales were affected by the shrinking addressable market

for pure TFT-LCD driver ICs, a significant portion of which is

being replaced by TDDI and AMOLED technologies as Himax indicated

in previous earnings calls. The good news is that its TDDI

solutions have started shipping in the fourth quarter.

Small and medium-sized driver IC revenue for

automotive application went up more than 10% sequentially and more

than 25% year-over-year. The quarterly revenue now reached close to

$25 million, a historical high and accounting for over 15% of the

total driver IC revenue. Driver IC sales for tablets were down

17.2% sequentially and declining 24.7% year-over-year due to weak

overall market demand in this product segment.

Revenues from non-driver businesses were $41.4

million, down 24.7% sequentially but up 14.8% versus last year.

Non-driver products accounted for 22.8% of total revenues, as

compared to 27.9% in the third quarter of 2017 and 17.7% a year

ago. The sequential decline was due primarily to certain one-off

customer reimbursements related to its AR goggles business in the

preceding quarter. Excluding the one-off reimbursements, which

totaled $13.3 million, the sequential decrease would have been less

than 1% as compared to the original guidance of 10% growth. Lower

than expected WLO shipment and NRE income contributed to the

sequential sales decline. The year-over-year increase was driven

mainly by WLO product shipment to a leading customer and, to a

lesser extent, increased sales of timing controllers and CMOS image

sensors. The revenue increase was offset by the discontinuation of

LCOS and WLO shipments to one of its major AR device customers who

decided to end the product’s production as the Company reported

before. Himax remains positive on the growth prospect of its WLO

and LCOS product lines, judging by the expanding customer list that

covers some of the world’s biggest tech names and the busy

engineering activities going on with such customers right now.

GAAP gross margin for the fourth quarter was

24.6%, down 90 basis points from 25.5% in the third quarter of 2017

but up 550 basis points from 19.1% for the same period last year.

The sequential margin decline was due mainly to certain one-off

customer reimbursements in Q3. Excluding the above-mentioned

one-off reimbursements in the third quarter, which knocked down

$5.7 million in gross profit, Himax’s fourth quarter gross margin

would have been an increase of 30 basis points versus the third

quarter. The year-over-year increase was due to an additional

inventory write-down totaling $12 million in the fourth quarter

2016. Excluding the additional inventory write-down, the gross

margin for the fourth quarter of 2016 would have been 25.0%.

GAAP operating expenses were $40.5 million in

the fourth quarter, down 13.9% from the preceding quarter but up

26.2% from a year ago. The significant year-over-year increase was

primarily the result of rising R&D expenses in the areas of 3D

sensing, WLO, TDDI, and high-end TV as well as the annual merit

increase. In addition, NT dollar appreciation against the US dollar

caused Himax’s salary expense to increase around $1.0 million as

the Company pays the bulk of its employee salaries in NT dollars.

The sequential expense decrease was primarily the result of the

difference in RSU charge. In accordance with its protocol, Himax

grants annual RSUs to its staff at the end of September each year,

which, given all other things equal, leads to higher third quarter

GAAP operating expenses compared to the other quarters of the year.

The fourth quarter RSU expense was only $0.1 million while it was

$6.5 million in the third quarter. Excluding the RSU expense,

operating expenses decreased 0.4% from the third quarter and

increased 26.7% year-over-year.

GAAP operating margin for the fourth quarter was

2.3%, down from 3.4% for the same period last year and up from 1.7%

in the previous quarter. The GAAP operating income increased 21.3%

sequentially and decreased 39.9% year-over-year. The sequential

increase was primarily a result of lower RSU expense, offset by the

one-time reimbursement from its AR customer in the third quarter.

The year-over-year decline was, however, a result of higher

operating expenses and lower sales, offset by the one-time

inventory write-down in the previous year.

Fourth quarter non-GAAP operating income

was $4.5 million, or 2.5% of sales, down from 3.6% for the same

period last year and down from 5.2% a quarter ago. The non-GAAP

operating income decreased 55.9% sequentially and 38.7% from the

same quarter in 2016.

GAAP net income for the fourth quarter was $23.5

million, or 13.7 cents per diluted ADS, compared to $3.7 million,

or 2.1 cents per diluted ADS, in the previous quarter and $4.4

million, or 2.6 cents per diluted ADS, a year ago. The increase was

mainly the result of an investment gain of $20.7 million in the

fourth quarter as we disposed of a direct investment in September.

The transaction was already closed in Q4. Excluding this one-time

gain, GAAP net income for the fourth quarter was $2.8 million, or

1.6 cents per diluted ADS, a decrease of 36.6% year-over-year and

23.6% from the previous quarter. The sequential decline was caused

by the non-recurrence of the one-time reimbursement from its

customer in the third quarter as discussed earlier.

Fourth quarter non-GAAP net income was $23.8

million, or 13.8 cents per diluted ADS, compared to $9.0 million,

or 5.2 cents per diluted ADS, in the previous quarter and $4.8

million, or 2.8 cents per diluted ADS, a year ago. Again, the

increase was mainly due to the investment gain of $20.7 million in

the quarter.

Full Year 2017 Financial Results

The 2017 full year revenues totaled $685.2

million in 2017, representing a 14.7% decrease over 2016.

Revenues from large panel display drivers

decreased 17.6% year-over-year, representing 32.8% of its total

revenues, as compared to 34.0% in 2016. Large panel driver sales

totaled $224.8 million for the year. The year-over-year decline was

mainly due to phase-out of certain customers’ old models and

certain misses of new design-in activities at the end of the fourth

quarter 2016 and the first quarter of 2017 as reported earlier.

Small and medium-sized driver sales decreased

17.3% year-over-year, representing 44.5% of its total revenues, as

compared to 46.0% in 2016. Sales into the smartphone segment

declined due to overall market weakness, largely caused by the

increasing adoption of TDDI solutions where we had a relatively

slow start. Automotive driver IC sales registered the strongest

growth in our display driver business to increase over 25%

year-over-year.

Non-driver products decreased 3.6%

year-over-year, representing 22.7% of its total sales, as compared

to 20.0% a year ago. This decline was primarily due to

discontinuation of LCOS and WLO shipments to a major AR customer.

Additionally, discrete touch controller is being quickly replaced

by TDDI and mobile booster sales also shrank. Himax would like to

highlight that its WLO business hit inflection in the middle of the

year when it began mass shipment to an anchor customer.

Gross margin in 2017 was 24.4%, a 20 basis-point

increase from 24.2% in 2016.

GAAP operating expenses were $158.9 million, up

$23.8 million or 17.6% compared to last year. The increase was

primarily the result of rising R&D expenses in the areas of 3D

sensing, WLO, TDDI, and high-end TV as well as the annual merit

increases and additional headcount. In addition, NT dollar

appreciation against the US dollar caused the Company’s salary

expense to increase around $3.7 million.

2017 GAAP operating income of $8.2 million

represented an 86.2% decrease versus 2016 for lower sales and

higher operating expenses.

GAAP net income for the year was $28.0 million,

or 16.2 cents per diluted ADS, a decline of 45.1% from last year.

The decrease in GAAP net income was a combination of lower revenue

and higher operating expenses, offset by an investment gain of

$20.7 million and lower income taxes.

Non-GAAP net income for 2017 was $34.3 million,

or 19.9 cents per diluted ADS, down 42.7% year-over-year

Balance Sheet and Cash Flow

Himax had $148.9 million of cash, cash

equivalents and marketable securities as of the end of December

2017, compared to $194.6 million at the same time last year and

$151.6 million a quarter ago. In addition to the cash position,

restricted cash was $147.0 million at the end of the quarter,

little changed from $147.2 million in the preceding quarter and up

from $138.2 million a year ago. The restricted cash is mainly used

to guarantee the Company’s short-term loan for the same amount.

Himax continues to maintain a very strong balance sheet and operate

as a debt-free company.

Himax’s year-end inventories were $135.2

million, up from $130.1 million a quarter ago but down from $149.7

million at the same time last year. Accounts receivable at the end

of December 2017 were $187.6 million as compared to $191.0 million

a year ago and $181.7 million last quarter. DSO was 100 days, as

compared to 87 days a year ago and 98 days at end of the last

quarter.

Net cash inflow from operating activities for

the fourth quarter was $8.3 million as compared to an inflow of

$47.2 million for the same period last year and an inflow of $16.9

million last quarter. Cash inflow from operations in 2017 was $29.4

million as compared to $84.7 million in 2016. The decrease in

operating cash flow is mainly due to lower net profit.

Capital expenditures were on track with the plan

at $15.7 million in the fourth quarter of 2017, versus $2.2 million

a year ago and $10.2 million last quarter. The fourth quarter capex

consisted mainly of ongoing payments for the new building’s

construction, WLO capacity expansion for certain anchor customer,

and another WLO capacity expansion and installation of active

alignment capacity to support its 3D sensing business. Total

capital expenditure for the year was $39.8M versus $7.9M a year

ago.

Share Buyback Update

As of December 31, 2017, Himax had 172.1 million

ADS outstanding, unchanged from last quarter. On a fully diluted

basis, the total ADS outstanding are 172.5 million

2018

Investor Outreach and Conferences

Ms. Jackie Chang, CFO, Ms. Ophelia Lin, internal

IR Deputy Director, Mr. Ken Liu, internal IR, and Mr. Greg

Falesnik, Himax’s US-based IR, will maintain corporate access for

shareholders and attend future investor conferences. If you are

interested in speaking with the management, please contact Himax’s

US or Taiwan-based investor relations contact at the numbers

below.

Business Updates

Himax delivered much improved results in the second half versus

the first half last year. Looking into 2018, the Company’s major

growth engines will be, for large panel segment, China panel

makers’ increase in capacity, for small panel segment, in-cell TDDI

for smartphone and driver ICs for automotive applications, and last

but not the least for non-driver areas, increasing WLO revenue, and

commencement of 3D sensing total solution shipment. 3D sensing will

be Himax’s biggest long term growth engine and, for this year, a

major contributor to both revenues and profit, consequently

creating a more favorable product mix for Himax starting the second

half of the year.

Display

Driver IC

MarketLarge display driver IC

business experienced a strong growth momentum in the second half of

2017 as 4K TV penetration was still on the rise globally and China

continued to ramp brand new advanced generation LCD fabs. In fact,

BOE has just launched the world’s first Gen 10.5 fab a few weeks

ago, while CEC-CHOT’s Gen 8.6 fab and CEC-Panda’s Gen 8.6+ fab will

also go into operation this year. Being a market leader in large

display driver IC business, Himax will benefit from such capacity

expansion. However, the whole market is currently facing a capacity

shortage of 8” foundry where vast majority of large panel driver

ICs are fabricated. While the growth of its large panel driver

business may be limited by the tight 8” foundry capacity during

this year, Himax is starting the early ramp of a newly built 12”

fab in China. Adding the 12” fab into the pool of its foundry

capacity will greatly alleviate the shortage issue of Himax’s

customers. However, the ultimate ramping schedule will depend on

how fast the Company’s customers can go through their customer

qualification, something all its major customers are working very

hard on. For the first quarter, Himax expects a low-single-digit

sequential revenue growth for large display driver ICs.

With the 2020 Tokyo Olympics approaching, the

ecosystem for super-high-resolution TV is being established, hoping

to catch the business opportunity arising from the 8K program

broadcast at the event. At this year’s CES, major TV manufacturers

have unveiled their 8K TV with Himax solutions inside. Himax will

continue working with major panel makers for the development of

next generation 8K TVs.

First quarter sales for smartphone are likely to

decline by approximately 30% sequentially on product transition,

weak market demand and seasonality. Himax has numerous TDDI

design-wins for HD+ and FHD+ projects with top-tier names, yet

shipment has been hindered by the weak overall smartphone market

sentiment. In spite of the short term headwinds, the Company is

confident that its TDDI solutions and display driver IC business

will accelerate starting the second quarter as smartphone makers

begin to replenish inventory for their new product launches in the

second half. On the high side, its new generation FHD+ TDDI with

COF (chip on film) package is in design-in stage with a number of

leading Chinese smartphone brands and panel makers. TDDI with COF

package can enable super-slim bezel design for premium smartphone

models. Himax expects small volume shipment in the first half with

accelerating volume in the second half. Its driver IC business is

also expanding into new areas such as smart home assistant segment.

Such activities will help future rebound in sales momentum.

On AMOLED product line, the Company has been

collaborating closely with leading panel makers across China for

product development. Himax believes AMOLED driver ICs will be one

of the long-term growth engines for its small panel driver IC

business.

As to automotive application, Himax continues to

have further design-wins from prior years going into mass

production this year. It expects Q1 revenue to grow around 10%

sequentially and more than 50% year-over-year. Himax has engaged

all of the major automotive panel manufacturers worldwide for

long-term partnerships and secured many of their key projects

pipelined for the next few years.

Going into the first quarter, due to seasonality

and overall weak smartphone market, the Company expects small and

medium-sized driver IC revenue to be down around 10%

sequentially.

Non-Driver Product

CategoriesThe non-driver IC business segment has been the

Company’s most exciting growth area and a differentiator for the

Company in the past few years.

3D Sensing Total Solution Last

August Himax jointly with Qualcomm announced SLiM™, its structure

light based 3D sensing total solution, will target Android based

smartphone. The solution brings together Qualcomm’s industry

leading 3D algorithm with Himax’s cutting-edge design and

manufacturing capabilities in optics and NIR sensors as well as

unique know-how in 3D sensing system integration.

The majority of the key technologies inside the

SLiMTM total solution is developed and supplied by Himax itself.

These critical technologies include, on the projector end, DOE and

collimator utilizing its world leading WLO technology, a

tailor-made laser driver IC, and high precision active alignment

for the projector assembly; and on the receiver end, a high

efficiency near-infrared CMOS image sensor. Last but not least,

Himax also developed an ASIC by incorporating Qualcomm’s algorithm

for 3D depth map generation. The fact that all of these critical

components are developed in-house puts Himax in a unique leading

position. It represents a very high barrier of entry for any

potential competition and a much higher ASP and profit margin for

the Company.

The Qualcomm/Himax solution is by far the

highest quality 3D sensing total solution available for the Android

market right now. It has the industry’s best performance in all of

dimension, 3D depth accuracy, indoor/outdoor sensitivity and power

consumption. It passes the toughest eye safety standards with a

proprietary glass broken detection mechanism to safeguard the user

from any potential harm. Furthermore, it is the only solution

to offer face recognition for secure online payment, a must-have

feature for high end smartphones of the future. Himax is working

with multiple tier-1 smartphone makers, expecting to launch 3D

sensing on their premium smartphones starting the first half of

2018.

Himax’s SLiM™ solution will be ready for mass

production and shipment by the end of the first quarter, 2018 with

an initial capacity of 2 million units per month. The initial

capacity is part of its Phase I expansion of $80M. The Company has

already achieved pretty satisfactory production yields in its

internal pilot production. Given that SLiM™ is a highly integrated

solution with ASPs much higher than those of individual components,

by the time Himax starts making shipment, it will be a major growth

contributor to Himax’s top and bottom lines.

In an attempt to accelerate the adoption of 3D

sensing for Android phones, in addition to SLiM™, Himax is also

working on stereoscopic type 3D sensing as a lower cost

alternative. Unlike SLiM™ which utilizes structure light to

generate 3D, stereoscopic type uses two cameras to replicate 3D

vision in nature, augmented by coded light for image depth

enhancement. Both types of solutions offered by Himax operate on

active NIR light source with high sensitivity NIR sensors, thus

working well even under extreme brightness or total darkness. For

3D sensing purposes, structure light approach offers better depth

precision than stereoscopic type but the cost is also higher. By

introducing stereoscopic 3D sensing, Himax aims to bring down the

cost of 3D sensing so that it can be afforded by mass market

smartphone models. Himax reports that development of stereoscopic

3D sensing total solution for face recognition and 3D features has

been under way. The Company plans to be mass production and

shipment ready by the fourth quarter of this year to meet

customers’ launch timetable. Similar to its experience in SLiM™,

Himax is working with some of the most prominent ecosystem partners

in developing its stereoscopic 3D total solution. We are very

excited that this new development will enable us to expand our 3D

total solution portfolio to the high volume smartphone market in

addition to the premium to high-end models. While lower cost

compared to structure light, stereoscopic 3D will still represent a

much higher ASP and better gross margin potential for the

Company.

At this year’s CES, many of Himax’s customers

and partners demonstrated 3D sensing applications in IoT,

automotive, AR/VR, and robotic related products with Himax SLiM™

inside and received very positive feedback. 3D sensing can have a

broad range of applications that go beyond smartphone. Himax is

very excited about the growth prospects it represents and believes

3D sensing will be its biggest long term growth engine.

WLOHimax reported that it has

started mass shipment of a highly customized WLO product to an

anchor customer during the third quarter. The production has been

going well as Himax delivers consistent product quality, production

ramp and high yields. Shipment volume to the customer for the

fourth quarter accelerated sequentially. However, lower volume in

the first quarter of 2018 is expected as per the customer’s demand

forecast. The much reduced shipment will negatively impact the

Company’s Q1 gross margin as lower utilization will lead to much

higher equipment depreciation and factory overhead on a per unit

basis. Despite the short term order adjustment, Himax expects

strong rebound in the second half and is more optimistic

than ever about the partnership and growth opportunities it

has with the customer. The R&D projects with the said customer

for their future generation products centers around Himax’s

exceptional design know-how and mass production expertise in WLO

technology for optical devices.

Himax recently announced an acquisition of

certain advanced nano 3D masters manufacturing assets and related

intellectual property and business. The advanced nano 3D

manufacturing masters are primarily used in imprinting or stamping

replication process to fabricate devices such as DOE, diffuser,

collimator lens and micro lens array. This acquisition demonstrates

the Company’s commitment and confidence in the long-term growth

prospects for its WLO and 3D sensing businesses.

New BuildingConstruction of the

new building is one of the major capex projects of 2017. Himax

reports the construction has been completed on schedule. The new

building, located near its current headquarters, will house

additional 8” glass WLO capacity and the new active alignment

equipment needed for its SLiM™ 3D sensing solutions. It will also

provide extra office space. Himax has started moving in equipment

in the past few weeks.

Phase I Capex Update

Himax announced a capex plan of $80M (Phase I

capital expansion) during 2017 which is on top of its regular capex

- an unprecedented move in the Company’s history given its fabless

nature. Phase I capital expansion includes the construction of a

new building, an increase of its WLO capacity for an anchor

customer and an initial monthly capacity of 2 million units for its

SLiMTM solution. Himax is now increasing the Phase I budget from

$80 million to $105 million to meet SLiM™ shipment demand from

Android OEMs’ 3D sensing smartphone launches in 1H18 and

acceleration in 2H18. The addition of $25 million is primarily for

enhanced manufacturing automation and CIM infrastructure to achieve

higher product yields and better production efficiency, an extra

land of 1 hectare and more clean room and office space for future

expansion. The Phase I is being executed as scheduled. Of the $105

million budget, $33 million has been paid out in 2017 with the

remaining $72 million to be paid in 2018.

To fulfill strong demands from the existing WLO

and 3D sensing total solution customers, Himax believes a Phase II

capex will soon be required for additional capacity. The Phase II

capacity will still be located in the same new building, using some

of the clean rooms and office spaces built during the Phase I. In

fact, the new building has sufficient room to house capacity much

in excess of the Phase I and II combined. Himax is still gathering

customers’ input and finalizing technical details and will formally

announce the Phase II expansion as soon as the plan is

finalized.

The capex budget for both phases of expansion

will be funded through Himax’s internal resources and banking

facilities, if so needed.

CMOS Image SensorHimax

continues to make great progress with its two machine vision sensor

product lines, namely, near infrared (“NIR”) sensor and

Always-on-Sensor (“AoSTM”). HImax’s NIR sensor is a critical part

in its SLiMTM total solution. Himax’s NIR sensors’ overall

performance, measured primarily by way of quantum efficiency, is

far ahead of those of its peers for 3D sensing. The Company

currently offers low noise HD, or 1 megapixel, and 5.5 megapixel

NIR sensors and are planning to add more to further enrich its

product portfolio. The Company is also developing the next

generation NIR sensors with quantum efficiency further elevated to

the next level.

On the AoS product line, Himax announced the

launch of the WiseEyeTM IoT sensors together with Emza and DSP

Group, both Isreal-based, in early January. It is the industry’s

first ultra-low power, always-on, fully trainable, AI-based

machine-vision intelligent visual sensor, adding human presence

awareness for consumer appliances and industrial IoT applications.

Emza demonstrated the WiseEyeTM IoT sensors at this year's CES and

successfully generated high interest from key market players,

including smart buildings and security OEMs and makers of home

assistants and home appliances. The Company expects to kick off

some joint product development projects with heavy weight industry

leaders in the second half of the year. Himax owns 45.1% equity in

Emza with an option to acquire the remaining 54.9% and all

outstanding options.

For the traditional human vision segments, the

Company sees strong demands in laptops and increasing shipments for

multimedia applications such as car recorders, surveillance,

drones, home appliances, and consumer electronics, among

others.

LCOSHimax’s main focus areas

are AR goggle devices and head-up-displays (HUD) for automotives

and motorcycles. While AR will take a few years to fully realize

its market potential, the wealth of announcements at CES 2018 say a

lot about the industry's current momentum. Many companies, be the

top name multinationals or new start-ups, are investing heavily to

develop the ecosystem -- applications, software, operating system,

system electronics, and optics. With all these investments, Himax

believes the AR goggle market will be back in an accelerating mode

again. In addition to AR goggle applications, Himax is pleased to

report that the Company continues to make great progress in

developing high-end head-up display for automotives. Himax and its

partners together have secured a few design wins with certain big

names. Timing and major revenue contribution would be 2019 the

earliest. Himax’s technology leadership in this space has little

competition. LCOS represents a significant long term growth

opportunity for the Company.

For non-driver IC business, the Company expects

sequential revenue decline of around 20% in the first quarter.

However, it will still be an increase of close to mid-teens from

the same period last year.

First Quarter

2018 GuidanceThe Company

is providing the following financial guidance for the first quarter

of 2018:

| Net Revenue: |

To decrease 9% to 14%

sequentially, representing a low to mid-single-digit

year-over-year growth |

| Gross Margin: |

To be around 22%

sequentially, depending on final product mix |

| GAAP EPS: |

-2.0 to -3.0 cents per

diluted ADS |

Beginning January 1, 2018, Himax adopted

International Financial Reporting Standards ("IFRS") issued by the

International Accounting Standard Board ("IASB") to prepare its

consolidated financial statements. The Company doesn’t expect the

transition from US GAAP to IFRS to have any significant impact on

its financial results.

The first quarter is traditionally the bottom of

the year in terms of sales because it has fewer working days due to

Chinese Lunar New Year. Himax sees weak seasonality and soft

smartphone market demand, which will lead to sequential revenue

decline in the first quarter. However, the revenue of all three

major product categories will increase from the same period last

year. Himax also expects its gross margin to be under pressure in

the first quarter caused by anticipated WLO shipment reduction as

per the customer’s demand forecast. Nevertheless, Himax believes

shipment of TDDI ICs and WLO will accelerate in the second half

2018. It also expects significant business growth in the Company’s

3D sensing business to contribute to both top and bottom lines as

early as the second half of 2018.

| |

| HIMAX TECHNOLOGIES FOURTH QUARTER

2017 EARNINGS CONFERENCE

CALL |

|

|

|

|

DATE: |

Tuesday, February 13th, 2018 |

|

TIME: |

U.S.

8:00 a.m. EST |

|

|

Taiwan 9:00

p.m. |

|

DIAL IN: |

U.S. +1 (866) 444-9147 |

|

|

INTERNATIONAL +1 (678) 509-7569 |

|

CONFERENCE ID: |

7194699 |

|

WEBCAST: |

https://edge.media-server.com/m6/p/7grrcyuo |

| |

|

A replay of the call will be available beginning

two hours after the call through 10:59 a.m. US EST on February

20th, 2018 (11:59 p.m. Taiwan time, February 20th, 2018) on

www.himax.com.tw and by telephone at +1 (855) 859-2056 (US

Domestic) or +1 (404) 537-3406 (International). The conference ID

number is 7194699. This call is being webcast by Nasdaq and can be

accessed by clicking on this link or Himax’s website, where the

webcast can be accessed through February 13, 2019.

About Himax Technologies, Inc.

Himax Technologies, Inc. (NASDAQ:HIMX) is a

fabless semiconductor solution provider dedicated to display

imaging processing technologies. Himax is a worldwide market leader

in display driver ICs and timing controllers used in TVs, laptops,

monitors, mobile phones, tablets, digital cameras, car navigation,

virtual reality (VR) devices and many other consumer electronics

devices. Additionally, Himax designs and provides controllers for

touch sensor displays, in-cell Touch and Display Driver Integration

(TDDI) single-chip solutions, LED driver ICs, power management ICs,

scaler products for monitors and projectors, tailor-made video

processing IC solutions, silicon IPs and LCOS micro-displays for

augmented reality (AR) devices and heads-up displays (HUD) for

automotive. The Company also offers digital camera solutions,

including CMOS image sensors and wafer level optics for AR devices,

3D sensing and machine vision, which are used in a wide variety of

applications such as mobile phone, tablet, laptop, TV, PC camera,

automobile, security, medical devices and Internet of Things.

Founded in 2001 and headquartered in Tainan, Taiwan, Himax

currently employs around 2,150 people from three Taiwan-based

offices in Tainan, Hsinchu and Taipei and country offices in China,

Korea, Japan and the US. Himax has 3,032 patents granted and 424

patents pending approval worldwide as of December 31st, 2017. Himax

has retained its position as the leading display imaging processing

semiconductor solution provider to consumer electronics brands

worldwide.

http://www.himax.com.tw

Forward Looking Statements

Factors that could cause actual events or

results to differ materially include, but not limited to, general

business and economic conditions and the state of the semiconductor

industry; market acceptance and competitiveness of the driver and

non-driver products developed by the Company; demand for end-use

applications products; reliance on a small group of principal

customers; the uncertainty of continued success in technological

innovations; our ability to develop and protect our intellectual

property; pricing pressures including declines in average selling

prices; changes in customer order patterns; changes in estimated

full-year effective tax rate; shortages in supply of key

components; changes in environmental laws and regulations; exchange

rate fluctuations; regulatory approvals for further investments in

our subsidiaries; our ability to collect accounts receivable and

manage inventory and other risks described from time to time in the

Company's SEC filings, including those risks identified in the

section entitled "Risk Factors" in its Form 20-F for the year ended

December 31, 2016 filed with the SEC, as may be amended.

Company Contacts:

Jackie Chang, CFOHimax

Technologies, Inc.Tel: +886-2-2370-3999 Ext.22300 OrUS Tel:

+1-949-585-9838 Ext.252Fax: +886-2-2314-0877Email:

jackie_chang@himax.com.twwww.himax.com.tw

Ophelia Lin, Investor

RelationsHimax Technologies, Inc.Tel: +886-2-2370-3999

Ext.22202Fax: +886-2-2314-0877 Email:

ophelia_lin@himax.com.twwww.himax.com.tw

Ken Liu, Investor RelationsHimax Technologies,

Inc.Tel: +886-2-2370-3999 Ext.22513Fax: +886-2-2314-0877 Email:

ken_liu@himax.com.twwww.himax.com.tw

Investor Relations - US RepresentativeGreg

Falesnik, Managing DirectorMZ North AmericaTel:

+1-212-301-7130Email: greg.falesnik@mzgroup.us www.mzgroup.us

-Financial Tables-

| |

| Himax Technologies, Inc. |

| Unaudited Condensed Consolidated Statements of

Income |

| (These interim financials do not fully comply

with US GAAP because they omit all interim disclosure required by

US GAAP) |

| (Amounts in Thousands of U.S. Dollars,

Except Share and Per Share

Data) |

| |

|

|

Three Months

Ended December 31, |

|

Three Months Ended

September

30, |

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

Revenues |

$ |

181,081 |

|

|

$ |

203,443 |

|

|

$ |

197,146 |

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

|

Cost of revenues |

|

136,499 |

|

|

|

164,517 |

|

|

|

146,778 |

|

|

Research and development |

|

29,516 |

|

|

|

21,826 |

|

|

|

34,989 |

|

|

General and administrative |

|

5,413 |

|

|

|

4,950 |

|

|

|

6,016 |

|

|

Sales and marketing |

|

5,532 |

|

|

|

5,289 |

|

|

|

5,967 |

|

|

Total costs and expenses |

|

176,960 |

|

|

|

196,582 |

|

|

|

193,750 |

|

|

|

|

|

|

|

|

|

Operating income |

|

4,121 |

|

|

|

6,861 |

|

|

|

3,396 |

|

|

|

|

|

|

|

|

|

Non operating income

(loss): |

|

|

|

|

|

|

Interest income |

|

554 |

|

|

|

399 |

|

|

|

509 |

|

|

Gains on sale of securities, net |

|

23,064 |

|

|

|

5 |

|

|

|

55 |

|

|

Equity in income (losses) of equity method investees |

|

(483 |

) |

|

|

(712 |

) |

|

|

114 |

|

|

Foreign currency exchange gains (losses), net |

|

(277 |

) |

|

|

686 |

|

|

|

(180 |

) |

|

Interest expense |

|

(170 |

) |

|

|

(131 |

) |

|

|

(145 |

) |

|

Other income, net |

|

10 |

|

|

|

2 |

|

|

|

2 |

|

|

|

|

22,698 |

|

|

|

249 |

|

|

|

355 |

|

|

Earnings before income

taxes |

|

26,819 |

|

|

|

7,110 |

|

|

|

3,751 |

|

|

Income tax expense |

|

3,957 |

|

|

|

3,609 |

|

|

|

621 |

|

|

Net income |

|

22,862 |

|

|

|

3,501 |

|

|

|

3,130 |

|

| Net loss

attributable to noncontrolling interests |

|

687 |

|

|

|

938 |

|

|

|

554 |

|

| Net income

attributable to Himax Technologies, Inc. stockholders |

$ |

23,549 |

|

|

$ |

4,439 |

|

|

$ |

3,684 |

|

|

|

|

|

|

|

|

| Basic earnings

per ADS attributable to Himax Technologies, Inc.

stockholders |

$ |

0.137 |

|

|

$ |

0.026 |

|

|

$ |

0.021 |

|

| Diluted

earnings per ADS attributable to Himax Technologies, Inc.

stockholders |

$ |

0.137 |

|

|

$ |

0.026 |

|

|

$ |

0.021 |

|

|

|

|

|

|

|

|

|

Basic Weighted Average Outstanding ADS |

|

172,499 |

|

|

|

172,399 |

|

|

|

172,401 |

|

|

Diluted Weighted Average Outstanding ADS |

|

172,518 |

|

|

|

172,415 |

|

|

|

172,448 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Himax Technologies, Inc. |

| Unaudited Condensed Consolidated Statements of

Income |

| (Amounts in Thousands of U.S. Dollars,

Except Share and Per Share

Data) |

| |

|

|

|

Twelve

Months Ended December

31, |

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

|

|

|

|

|

|

Revenues |

|

|

$ |

685,167 |

|

|

$ |

802,917 |

|

|

|

|

|

|

|

|

| Costs and

expenses: |

|

|

|

|

|

| Cost of

revenues |

|

|

|

518,142 |

|

|

|

608,605 |

|

| Research and

development |

|

|

|

117,757 |

|

|

|

95,820 |

|

| General and

administrative |

|

|

|

20,614 |

|

|

|

20,119 |

|

| Sales and

marketing |

|

|

|

20,504 |

|

|

|

19,138 |

|

|

Total costs and expenses |

|

|

|

677,017 |

|

|

|

743,682 |

|

|

|

|

|

|

|

|

| Operating

income |

|

|

|

8,150 |

|

|

|

59,235 |

|

|

|

|

|

|

|

|

| Non

operating income

(loss): |

|

|

|

|

|

| Interest

income |

|

|

|

2,225 |

|

|

|

1,221 |

|

| Dividend

income |

|

|

|

0 |

|

|

|

700 |

|

| Gains on sale of

securities, net |

|

|

|

23,226 |

|

|

|

10 |

|

| Equity in losses

of equity method investees |

|

|

|

(1,200 |

) |

|

|

(1,277 |

) |

| Foreign currency

exchange gains (losses), net |

|

|

|

(1,517 |

) |

|

|

167 |

|

| Interest

expense |

|

|

|

(565 |

) |

|

|

(633 |

) |

| Other income

(losses), net |

|

|

|

19 |

|

|

|

(5 |

) |

| |

|

|

|

22,188 |

|

|

|

183 |

|

|

Earnings before income

taxes |

|

|

|

30,338 |

|

|

|

59,418 |

|

| Income tax

expense |

|

|

|

4,520 |

|

|

|

10,671 |

|

| Net

income |

|

|

|

25,818 |

|

|

|

48,747 |

|

| Net loss

attributable to noncontrolling interests |

|

|

|

2,149 |

|

|

|

2,165 |

|

| Net

income attributable to Himax

Technologies, Inc.

stockholders |

|

|

$ |

27,967 |

|

|

$ |

50,912 |

|

|

|

|

|

|

|

|

| Basic earnings

per ADS attributable to Himax Technologies,

Inc. stockholders |

|

|

$ |

0.162 |

|

|

$ |

0.295 |

|

| Diluted

earnings per ADS attributable to Himax

Technologies, Inc.

stockholders |

|

|

$ |

0.162 |

|

|

$ |

0.295 |

|

|

|

|

|

|

|

|

|

Basic Weighted Average Outstanding ADS |

|

|

|

172,425 |

|

|

|

172,327 |

|

|

Diluted Weighted Average Outstanding

ADS |

|

|

|

172,452 |

|

|

|

172,362 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Himax Technologies, Inc. |

|

Unaudited Supplemental Financial Information |

|

(Amounts in Thousands of U.S. Dollars) |

| The amount of

share-based compensation included in applicable

statements of income categories is

summarized as follows: |

Three MonthsEnded December 31, |

|

Three MonthsEnded September 30, |

| |

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

| Share-based

compensation |

|

|

|

|

|

| Cost of

revenues |

$ |

24 |

|

|

$ |

25 |

|

|

$ |

130 |

|

| Research and

development |

|

87 |

|

|

|

137 |

|

|

|

4,873 |

|

| General and

administrative |

|

14 |

|

|

|

68 |

|

|

|

713 |

|

| Sales and

marketing |

|

18 |

|

|

|

24 |

|

|

|

877 |

|

|

Income tax benefit |

|

(16 |

) |

|

|

(42 |

) |

|

|

(1,439 |

) |

| Total |

$ |

127 |

|

|

$ |

212 |

|

|

$ |

5,154 |

|

| |

|

|

|

|

|

| The amount

of acquisition-related charges

included in applicable statements of

income categories is summarized as

follows: |

|

|

|

|

|

| |

|

|

|

|

|

| Acquisition-related

charges |

|

|

|

|

|

| Research

and development |

$ |

247 |

|

|

$ |

247 |

|

|

$ |

246 |

|

|

Income tax benefit |

|

(99 |

) |

|

|

(99 |

) |

|

|

(99 |

) |

| Total |

$ |

148 |

|

|

$ |

148 |

|

|

$ |

147 |

|

| |

|

|

|

|

|

|

|

|

Himax Technologies, Inc. |

|

Unaudited Supplemental Financial Information |

|

(Amounts in Thousands of U.S. Dollars) |

| The amount of

share-based compensation included in applicable

statements of income categories is

summarized as follows: |

Twelve Months Ended

December

31, |

| |

|

2017 |

|

|

|

2016 |

|

| Share-based

compensation |

|

|

|

| Cost of

revenues |

$ |

204 |

|

|

$ |

224 |

|

| Research and

development |

|

5,234 |

|

|

|

7,586 |

|

| General and

administrative |

|

865 |

|

|

|

1,210 |

|

| Sales and

marketing |

|

942 |

|

|

|

1,389 |

|

|

Income tax benefit |

|

(1,540 |

) |

|

|

(2,164 |

) |

| Total |

$ |

5,705 |

|

|

$ |

8,245 |

|

| |

|

|

|

| The amount

of acquisition-related charges

included in applicable statements of

income categories is summarized as

follows: |

|

|

|

| |

|

|

|

| Acquisition-related

charges |

|

|

|

| Research

and development |

$ |

985 |

|

|

$ |

985 |

|

|

Income tax benefit |

|

(395 |

) |

|

|

(395 |

) |

| Total |

$ |

590 |

|

|

$ |

590 |

|

| |

|

|

|

| |

| Himax Technologies, Inc. |

| GAAP Unaudited Condensed

Consolidated Balance Sheets |

| (Amounts in Thousands of U.S. Dollars,

Except Share and Per Share

Data) |

| |

| |

|

December 31, 2017 |

|

September 30, 2017 |

|

December 31, 2016 |

|

Assets |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

138,023 |

|

|

$ |

141,482 |

|

|

$ |

184,452 |

|

|

Investments in marketable securities available-for-sale |

|

|

10,879 |

|

|

|

10,124 |

|

|

|

10,157 |

|

| Accounts

receivable, less allowance for doubtful accounts, sales returns and

discounts |

|

|

187,571 |

|

|

|

181,731 |

|

|

|

190,998 |

|

|

Inventories |

|

|

135,200 |

|

|

|

130,112 |

|

|

|

149,748 |

|

| Deferred

income taxes |

|

|

- |

|

|

|

- |

|

|

|

5,065 |

|

|

Restricted cash, cash equivalents and marketable securities |

|

|

147,000 |

|

|

|

147,202 |

|

|

|

138,200 |

|

| Other

receivables from related parties |

|

|

3,250 |

|

|

|

4,150 |

|

|

|

7,150 |

|

| Prepaid

expenses and other current assets |

|

|

39,495 |

|

|

|

18,487 |

|

|

|

17,195 |

|

|

Total current assets |

|

|

661,418 |

|

|

|

633,288 |

|

|

|

702,965 |

|

|

Investment in non-marketable

equity securities |

|

|

3,122 |

|

|

|

12,110 |

|

|

|

12,242 |

|

| Equity method

investments |

|

|

10,739 |

|

|

|

4,231 |

|

|

|

2,362 |

|

|

Property, plant and

equipment, net |

|

|

86,673 |

|

|

|

69,518 |

|

|

|

48,172 |

|

| Deferred income

taxes |

|

|

7,688 |

|

|

|

6,841 |

|

|

|

1,050 |

|

|

Goodwill |

|

|

28,138 |

|

|

|

28,138 |

|

|

|

28,138 |

|

| Other

intangible assets, net |

|

|

2,179 |

|

|

|

2,427 |

|

|

|

3,170 |

|

| Restricted

marketable securities |

|

|

470 |

|

|

|

463 |

|

|

|

124 |

|

| Other

assets |

|

|

1,628 |

|

|

|

1,492 |

|

|

|

1,411 |

|

|

|

|

|

140,637 |

|

|

|

125,220 |

|

|

|

96,669 |

|

|

Total assets |

|

$ |

802,055 |

|

|

$ |

758,508 |

|

|

$ |

799,634 |

|

|

Liabilities, Redeemable

noncontrolling interest and

Equity |

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

|

Short-term debt |

|

$ |

147,000 |

|

|

$ |

147,000 |

|

|

$ |

138,000 |

|

| Accounts

payable |

|

|

139,933 |

|

|

|

125,553 |

|

|

|

142,269 |

|

| Accounts

payable to related party |

|

|

- |

|

|

|

- |

|

|

|

576 |

|

| Income

taxes payable |

|

|

6,798 |

|

|

|

8,633 |

|

|

|

14,155 |

|

| Deferred

income taxes |

|

|

- |

|

|

|

- |

|

|

|

25 |

|

| Other

payable to related party |

|

|

2,200 |

|

|

|

1,350 |

|

|

|

- |

|

| Other

accrued expenses and other current liabilities |

|

|

41,268 |

|

|

|

37,675 |

|

|

|

29,721 |

|

|

Total current liabilities |

|

|

337,199 |

|

|

|

320,211 |

|

|

|

324,746 |

|

| Other

liabilities |

|

|

6,287 |

|

|

|

3,145 |

|

|

|

3,081 |

|

|

Total liabilities |

|

|

343,486 |

|

|

|

323,356 |

|

|

|

327,827 |

|

|

|

|

|

|

|

|

|

|

|

| Redeemable

noncontrolling interest |

|

|

3,656 |

|

|

|

3,656 |

|

|

|

3,656 |

|

|

Equity |

|

|

|

|

|

|

|

|

| Himax

Technologies, Inc.

stockholders’ equity: |

|

|

|

|

|

|

|

|

| Ordinary

shares, US$0.3 par value, 1,000,000,000 shares authorized;

356,699,482 shares issued; and 344,207,492 shares,

344,207,492 shares and 344,007,418 shares outstanding at December

31, 2017, September 30, 2017 and December 31, 2016,

respectively |

|

|

107,010 |

|

|

|

107,010 |

|

|

|

107,010 |

|

|

Additional paid-in capital |

|

|

107,400 |

|

|

|

107,140 |

|

|

|

106,350 |

|

| Treasury

shares, at cost, 12,491,990 shares, 12,491,990 shares and

12,692,064 shares at December 31, 2017, September 30, 2017 and

December 31, 2016, respectively |

|

|

(8,878 |

) |

|

|

(8,878 |

) |

|

|

(9,020 |

) |

|

Accumulated other comprehensive loss |

|

|

(1,430 |

) |

|

|

(1,748 |

) |

|

|

(2,467 |

) |

|

Unappropriated retained earnings |

|

|

252,546 |

|

|

|

228,997 |

|

|

|

265,860 |

|

|

Himax Technologies, Inc. stockholders’

equity |

|

|

456,648 |

|

|

|

432,521 |

|

|

|

467,733 |

|

| Noncontrolling

interests |

|

|

(1,735 |

) |

|

|

(1,025 |

) |

|

|

418 |

|

|

Total equity |

|

|

454,913 |

|

|

|

431,496 |

|

|

|

468,151 |

|

|

Total liabilities,

redeemable noncontrolling

interest and equity |

|

$ |

802,055 |

|

|

$ |

758,508 |

|

|

$ |

799,634 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Himax Technologies, Inc. |

| Unaudited Condensed

Consolidated Statements of Cash Flows |

| (Amounts

in Thousands of

U.S.

Dollars) |

| |

|

|

|

Three Months Ended December

31, |

|

Three Months Ended

September

30, |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

| Net income |

|

$ |

22,862 |

|

|

$ |

3,501 |

|

|

$ |

3,130 |

|

| Adjustments to

reconcile net income to net cash provided by operating

activities: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

5,098 |

|

|

|

3,448 |

|

|

|

4,672 |

|

| Bad debt

expense |

|

|

155 |

|

|

|

620 |

|

|

|

--- |

|

|

Share-based compensation expenses |

|

|

143 |

|

|

|

254 |

|

|

|

446 |

|

| Loss

(gain) on disposals of property and equipment |

|

|

(1 |

) |

|

|

28 |

|

|

|

3 |

|

| Gain on

disposal of investment in non-marketable equity securities |

|

|

(23,038 |

) |

|

|

--- |

|

|

|

--- |

|

| Gain on

disposals of marketable securities, net |

|

|

(26 |

) |

|

|

(5 |

) |

|

|

(55 |

) |

| Equity in

losses (income) of equity method investees |

|

|

483 |

|

|

|

712 |

|

|

|

(114 |

) |

| Deferred

income tax benefit |

|

|

(838 |

) |

|

|

(1,494 |

) |

|

|

(223 |

) |

|

Inventories write downs |

|

|

3,418 |

|

|

|

14,793 |

|

|

|

3,346 |

|

| Changes in: |

|

|

|

|

|

|

| Accounts

receivable |

|

|

(6,138 |

) |

|

|

16,615 |

|

|

|

(23,691 |

) |

|

Inventories |

|

|

(8,506 |

) |

|

|

4,841 |

|

|

|

14,222 |

|

| Prepaid

expenses and other current assets |

|

|

6,498 |

|

|

|

4,739 |

|

|

|

(6,154 |

) |

| Accounts

payable |

|

|

14,380 |

|

|

|

459 |

|

|

|

11,883 |

|

| Accounts

payable to related party |

|

|

--- |

|

|

|

576 |

|

|

|

--- |

|

| Income

taxes payable |

|

|

(1,873 |

) |

|

|

(215 |

) |

|

|

855 |

|

| Other

payable to related party |

|

|

850 |

|

|

|

--- |

|

|

|

1,350 |

|

| Other

accrued expenses and other current liabilities |

|

|

(4,546 |

) |

|

|

(1,690 |

) |

|

|

7,206 |

|

| Other

liabilities |

|

|

(625 |

) |

|

|

33 |

|

|

|

(4 |

) |

|

Net cash provided by

operating activities |

|

|

8,296 |

|

|

|

47,215 |

|

|

|

16,872 |

|

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

| Purchases

of property, plant and equipment |

|

|

(15,712 |

) |

|

|

(2,159 |

) |

|

|

(10,178 |

) |

| Proceeds

from disposal of property and equipment |

|

|

87 |

|

|

|

--- |

|

|

|

--- |

|

| Purchases

of available-for-sale marketable securities |

|

|

(5,690 |

) |

|

|

(6,977 |

) |

|

|

(20,325 |

) |

| Proceeds

from disposals of available-for-sale marketable securities |

|

|

5,088 |

|

|

|

8,956 |

|

|

|

19,014 |

|

| Proceeds

from capital reduction of investment |

|

|

--- |

|

|

|

137 |

|

|

|

132 |

|

| Purchase

of equity method investment |

|

|

(6,945 |

) |

|

|

--- |

|

|

|

--- |

|

| Proceeds

from disposal of investment in non-marketable equity

securities |

|

|

10,000 |

|

|

|

--- |

|

|

|

--- |

|

| Proceeds

from (repayments of) refundable deposits, net |

|

|

(82 |

) |

|

|

56 |

|

|

|

(12 |

) |

| Releases

(pledges) of restricted marketable securities |

|

|

195 |

|

|

|

(197 |

) |

|

|

(4 |

) |

| Cash paid

for loan made to related parties |

|

|

(1,750 |

) |

|

|

(3,150 |

) |

|

|

(1,500 |

) |

| Cash

received from loan made to related party |

|

|

2,650 |

|

|

|

--- |

|

|

|

1,500 |

|

|

Net cash used in

investing activities |

|

|

(12,159 |

) |

|

|

(3,334 |

) |

|

|

(11,373 |

) |

|

|

|

|

|

|

|

|

| |

| |

| Himax Technologies, Inc. |

| Unaudited Condensed

Consolidated Statements of Cash Flows |

| (Amounts

in Thousands of

U.S.

Dollars) |

| |

|

|

|

Three Months Ended December

31, |

|

Three Months Ended September

30, |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

| Payments

of cash dividends |

|

$ |

--- |

|

|

$ |

--- |

|

|

$ |

(41,281 |

) |

| Proceeds

from issuance of new shares by subsidiary |

|

|

105 |

|

|

|

--- |

|

|

|

--- |

|

| Purchases

of subsidiaries shares from noncontrolling interests |

|

|

--- |

|

|

|

(85 |

) |

|

|

(41 |

) |

| Pledges

of restricted cash, cash equivalents and marketable securities (for

borrowing of short-term debt) |

|

|

--- |

|

|

|

--- |

|

|

|

(40,000 |

) |

| Proceeds

from short-term debt |

|

|

27,000 |

|

|

|

31,000 |

|

|

|

70,000 |

|

|

Repayments of short-term debt |

|

|

(27,000 |

) |

|

|

(31,000 |

) |

|

|

(30,000 |

) |

|

Net cash provided by

(used in)

financing activities |

|

|

105 |

|

|

|

(85 |

) |

|

|

(41,322 |

) |

| Effect

of foreign currency exchange rate

changes on cash and cash equivalents |

|

|

299 |

|

|

|

(149 |

) |

|

|

99 |

|

| Net

increase

(decrease) in

cash and cash equivalents |

|

|

(3,459 |

) |

|

|

43,647 |

|

|

|

(35,724 |

) |

| Cash and cash

equivalents at beginning of period |

|

|

141,482 |

|

|

|

140,805 |

|

|

|

177,206 |

|

| Cash and cash

equivalents at end of period |

|

$ |

138,023 |

|

|

$ |

184,452 |

|

|

$ |

141,482 |

|

|

|

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information: |

|

|

|

|

|

|

| Cash paid during

the period for: |

|

|

|

|

|

|

| Interest |

|

$ |

170 |

|

|

$ |

131 |

|

|

$ |

145 |

|

| Income

taxes |

|

$ |

273 |

|

|

$ |

314 |

|

|

$ |

6,371 |

|

| |

|

|

|

|

|

|

| Supplemental

disclosures of investing activities affecting both

cash and non-cash items: |

|

|

|

|

|

|

| Purchases

of property, plant and equipment |

|

$ |

22,072 |

|

|

$ |

1,595 |

|

|

$ |

16,118 |

|

| Decrease

(increase) in payable for purchases of equipment and asset

retirement obligations |

|

|

(6,360 |

) |

|

|

564 |

|

|

|

(5,940 |

) |

| Cash

paid |

|

$ |

15,712 |

|

|

$ |

2,159 |

|

|

$ |

10,178 |

|

| |

|

|

|

|

|

|

| Proceeds

from disposal of investment in non-marketable equity

securities |

|

$ |

32,000 |

|

|

$ |

--- |

|

|

$ |

--- |

|

| Increase

in other current assets for disposal of investment in

non-marketable equity securities |

|

|

(22,000 |

) |

|

|

--- |

|

|

|

--- |

|

| Cash

received |

|

$ |

10,000 |

|

|

$ |

--- |

|

|

$ |

--- |

|

| |

|

|

|

|

|

|

| |

| Himax Technologies, Inc. |

| Unaudited Condensed

Consolidated Statements of Cash Flows |

| (Amounts

in Thousands of

U.S.

Dollars) |

| |

|

|

|

Twelve Months Ended

December

31, |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

25,818 |

|

|

$ |

48,747 |

|

| Adjustments to

reconcile net income to net cash provided by operating

activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

16,680 |

|

|

|

13,756 |

|

| Bad debt

expense |

|

|

155 |

|

|

|

620 |

|

|

Share-based compensation expenses |

|

|

1,098 |

|

|

|

1,186 |

|

| Loss

(gain) on disposals of property and equipment |

|

|

(26 |

) |

|

|

26 |

|

| Gain on

disposal of investment in non-marketable equitysecurities |

|

|

(23,038 |

) |

|

|

--- |

|

- ain on disposals of marketable securities, net

|

|

|

(188 |

) |

|

|

(10 |

) |

| Equity in

losses of equity method investees |

|

|

1,200 |

|

|

|

1,277 |

|

| Deferred

income tax benefit |

|

|

(1,601 |

) |

|

|

(1,978 |

) |

|