TAINAN, Taiwan, Aug. 9 /PRNewswire-FirstCall/ -- Himax

Technologies, Inc. ("Himax" or "Company")(NASDAQ:HIMX) today

reported financial results for the second quarter ended June 30,

2006. Net revenue for the second quarter of 2006 was $171.7

million, a 53.8% increase as compared to $111.6 million for the

second quarter of 2005, and a 1.8% decrease as compared to $174.9

million in the first quarter of 2006. Net income for the second

quarter of 2006 was $19.5 million, or $0.10 per diluted share,

representing a 49.4% increase compared to net income of $13.1

million, or $0.07 per diluted share in the second quarter of 2005,

and an 11.0% decrease compared to $21.9 million, or $0.12 per

diluted share in the first quarter of 2006. Share-based

compensation was $1.1 million, $1.5 million and $1.1 million in the

second quarter of 2006, the second quarter of 2005 and the first

quarter of 2006, respectively. Gross margin in the second quarter

of 2006 was 19.2%, as compared to 22.8% in the second quarter of

2005, and 21.5% in the first quarter of 2006. Operating margin was

11.0% in the second quarter of 2006, as compared to 12.8% in the

second quarter of 2005, and 13.5% in the first quarter of 2006.

Excluding share-based compensation, gross margin was 19.2% in the

second quarter of 2006, 22.8% in the second quarter of 2005, and

21.5% in the first quarter of 2006, with an operating margin of

11.6% 14.1%, and 14.1%, respectively. A reconciliation of our gross

margin and operating margin excluding share-based compensation, a

non-GAAP financial measure, to GAAP gross margin and GAAP operating

margin, our most comparable GAAP figure, is set out in the attached

reconciliation schedule. Jordan Wu, President and Chief Executive

Officer of Himax, commented, "The second quarter was a challenging

one for panel and component manufacturers alike. We achieve

revenues which was in line with prior guidance notwithstanding the

negative business environment. Notably, while our revenue from

related parties declined in the quarter due to short-term inventory

adjustments, our revenue from non-affiliate parties increased.

Overall, we think our more diversified customer mix puts us in a

stronger position now than before." Max Chan, Chief Financial

Officer of Himax, said, "Our operating income for the second

quarter increased 32.4% to $18.9 million from $14.3 million for the

same period a year ago and decreased 20.0% compared to $23.6

million in the first quarter 2006. This primarily reflects the

above average price pressure facing the industry. Due to the

difficult market conditions in the second quarter, our blended

gross margin came in at the low-end of our historical range."

Looking forward, Mr. Wu added, "We expect the business environment

in the third quarter of 2006 will be slightly better than the

second quarter of 2006. Overall, we expect net revenue in the third

quarter of 2006 to grow in the range of mid to high single digit

rate as compared to the second quarter of 2006. Our Non-GAAP

diluted EPS, excluding share-based compensation is expected to be

at a similar level as that of the second quarter. We expect diluted

GAAP EPS to be in the range of $0.03 to $0.04. This includes a

charge of share-based compensation of approximately $12 to $14

million, or $0.06 to $0.07 per diluted share. The expected increase

in share-based compensation is due to new grants of restricted

share units, which is expected to occur at the end of September

2006." A reconciliation of our diluted EPS excluding share-based

compensation, a non-GAAP financial measure, to diluted GAAP EPS,

our most comparable GAAP figure, is set out in the attached

reconciliation schedule. Investor Conference Call / Webcast Details

The Company's management will review detailed second quarter 2006

results on Wednesday, August 9, 2006 at 7:00 PM EST (7:00 AM,

August 10, Taiwan time). The conference call-in number is

+1-201-689-8560 (international) and +1-877-407-0784 (U.S.

domestic). A live webcast of the conference call will be available

on the Company's website at http://www.himax.com.tw/. The playback

will be available beginning two hours after the conclusion of the

conference call and will be accessible by dialing +1-201-612-7415

(international) and 1-877-660-6853 (U.S. domestic). The account

number to access the replay is 3055 and the confirmation ID number

is 207865. About Himax Technologies, Inc. Himax Technologies, Inc.

designs, develops and markets semiconductors that are critical

components of flat panel displays. The Company's principal products

are display drivers for large-sized TFT-LCD panels, which are used

in desktop monitors, notebook computers and televisions, and

display drivers for small- and medium-sized TFT-LCD panels, which

are used in mobile handsets and consumer electronics products such

as digital cameras, mobile gaming devices and car navigation

displays. In addition, the Company is expanding its product

offering to include LCD TV chipset solutions and LCOS

microdisplays. Based in Tainan, Taiwan, the Company has regional

offices in Hsinchu and Taipei, Taiwan; Suzhou and Shenzhen, China;

Yokohama, Japan and Anyangsi Kyungkido, South Korea. Contacts: Max

Chan Jackson Ko Chief Financial Officer Investor Relations Himax

Technologies, Inc. Himax Technologies, Inc. +886-2-3393-0877

+886-2-3393-0877 Ext. 22300 Ext. 22240 In the U.S. David Pasquale

The Ruth Group 646-536-7006 Forward-Looking Statements: Certain

statements in this press release, including statements regarding

expected future financial results and industry growth, are

forward-looking statements that involve a number of risks and

uncertainties that could cause actual events or results to differ

materially from those described in this press release. Factors that

could cause actual results to differ include general business and

economic conditions and the state of the semiconductor industry;

level of competition; demand for end-use applications products;

reliance on a small group of principal customers; continued success

in technological innovations; development of alternative flat panel

display technologies; ability to develop and protect our

intellectual property; pricing pressures including declines in

average selling prices; changes in customer order patterns;

shortages in supply of key components; changes in environmental

laws and regulations; exchange rate fluctuations; regulatory

approvals for further investments in our subsidiaries; and other

risks described from time to time in the Company's SEC filings,

including its Form F-1 dated March 13, 2006, as amended. We

undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise. Himax Technologies, Inc. Unaudited

Condensed Consolidated Statements of Income (These interim

financials do not fully comply with US GAAP because they omit all

interim disclosure required by US GAAP.) (Figures in Thousands of

U.S. Dollars, Except Per Share Data) Three Months Three Months

Ended Ended June 30, Mar 31, 2006 2005 2006 Revenues Revenues from

third parties, net $84,634 $42,790 $65,427 Revenues from related

parties, net 87,041 68,843 109,432 171,675 111,633 174,859 Costs

and expenses: Cost of revenues 138,766 86,214 137,298 Research and

development 11,603 8,896 10,902 General and administrative 1,334

1,392 2,058 Sales and marketing 1,097 873 1,007 Total costs and

expenses 152,800 97,375 151,265 Operating income 18,875 14,258

23,594 Non operating income (loss): Interest income 1,843 48 205

Impairment loss on an investment (1,500) --- --- Foreign exchange

gains (losses), net 1,398 676 (232) Interest expense (27) --- (284)

Other income, net 58 87 55 1,772 811 (256) Income before income

taxes and minority interest 20,647 15,069 23,338 Income tax expense

1,246 2,047 1,491 Income before minority interest 19,401 13,022

21,847 Minority interest, net of tax 124 47 92 Net income $19,525

$13,069 $21,939 Basic earnings per ordinary share and ADS $0.10

$0.07 $0.12 Diluted earnings per ordinary share and ADS $0.10 $0.07

$0.12 Basic Weighted Average Outstanding Shares 195,535 175,660

178,575 Diluted Weighted Average Outstanding Shares 198,512 180,464

182,271 Himax Technologies, Inc. Unaudited Supplemental Financial

Information (Figures in Thousands of U.S. Dollars) Three Months

Three Months Ended Ended June 30, Mar 31, The amount of share-based

compensation included in applicable costs and expenses categories

is summarized as follows: 2006 2005 2006 Share-based compensation

Cost of revenues $18 $33 $24 Research and development 818 1,126 864

General and administrative 98 166 105 Sales and marketing 129 203

145 Total $1,063 $1,528 $1,138 Himax Technologies, Inc. Unaudited

Condensed Consolidated Statements of Income (Figures in Thousands

of U.S. Dollars, Except Per Share Data) Six Months Ended June 30,

2006 2005 Revenues Revenues from third parties, net $150,061

$73,041 Revenues from related parties, net 196,473 135,009 346,534

208,050 Costs and expenses: Cost of revenues 276,064 161,241

Research and development 22,505 17,087 General and administrative

3,392 2,579 Sales and marketing 2,104 1,691 Total costs and

expenses 304,065 182,598 Operating income 42,469 25,452 Non

operating income (loss): Interest income 2,048 50 Impairment loss

on an investment (1,500) --- Foreign exchange gains, net 1,166 484

Interest expense (311) (7) Other income, net 113 131 1,516 658

Income before income taxes and minority interest 43,985 26,110

Income tax expense 2,737 3,008 Income before minority interest

41,248 23,102 Minority interest, net of tax 216 100 Net income

$41,464 $23,202 Basic earnings per ordinary share and ADS $0.22

$0.13 Diluted earnings per ordinary share and ADS $0.22 $0.13 Himax

Technologies, Inc. Unaudited Condensed Consolidated Balance Sheets

(Figures in Thousands of U.S. Dollars) Jun 30, Mar 31, Dec 31, 2006

2006 2005 Assets Current assets: Cash and cash equivalents $166,884

$31,247 $7,086 Marketable securities available-for-sale 1,930 3,150

3,989 Restricted cash equivalents and marketable securities 395

14,558 14,053 Accounts receivable, less allowance for sales returns

and discounts 86,907 73,178 80,158 Accounts receivable from related

parties 66,434 71,540 69,688 Inventories 99,605 99,539 105,004

Deferred income taxes 11,331 9,645 8,965 Prepaid expenses and other

current assets 16,142 10,328 11,113 Total current assets $449,628

$313,185 $300,056 Property and equipment, net 29,128 25,943 24,426

Deferred income taxes 135 145 151 Intangible assets, net 68 74 81

Investments in non-marketable securities 313 1,813 1,813 Refundable

deposits 511 488 712 30,155 28,463 27,183 Total assets $479,783

$341,648 $327,239 Liabilities and stockholders' equity Current

liabilities: Short-term debt $--- $38,577 $27,274 Current portion

of long-term debt --- --- 89 Accounts payable 98,015 85,489 105,801

Income tax payable 12,858 15,915 13,625 Other accrued expenses and

other current liabilities 11,985 12,167 13,995 Total current

liabilities $122,858 $152,148 $160,784 Minority interest $449 $609

$624 Stockholders' equity: Ordinary share, US$0.0001 par value,

500,000,000 shares authorized 19 18 18 Additional paid-in capital

247,653 99,570 98,450 Accumulated other comprehensive income 13 37

36 Unappropriated earnings 108,791 89,266 67,327 Total

stockholders' equity $356,476 $188,891 $165,831 Total liabilities

and stockholders' equity $479,783 $341,648 $327,239 Himax

Technologies, Inc. Unaudited Condensed Consolidated Statements of

Cash Flows (Figures in Thousands of U.S. Dollars) Three Months

Three Months Ended Ended June 30, March 31, 2006 2005 2006 Cash

flows from operating activities: Net income $19,525 $13,069 $21,939

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 1,204 892 1,218

Share-based compensation expenses 1,063 1,528 1,138 Minority

interest, net of tax (124) (47) (92) Loss on disposal of property

and equipment 5 --- 31 Gain on sale of marketable securities, net

(55) (80) (58) Impairment loss on an investment 1,500 --- ---

Deferred income taxes (1,677) (749) (679) Changes in operating

assets and liabilities: Accounts receivable (13,672) (15,520) 6,998

Accounts receivable from related parties 5,076 (4,633) (1,879)

Inventories (4,009) 1,972 5,464 Prepaid expenses and other current

assets (2,838) (1,823) 1,801 Accounts payable 12,525 18,716

(20,312) Income tax payable (3,056) 1,764 2,333 Other accrued

expenses and other current liability (195) 678 (1,746) Net cash

provided by operating activities 15,272 15,767 16,156 Cash flows

from investing activities: Purchase of land, property and equipment

(4,065) (1,060) (3,886) Purchase of available-for-sales marketable

securities (8,625) (13,801) --- Sales and maturities of

available-for-sale marketable securities 9,830 19,785 878 Proceeds

from sale of subsidiary shares by Himax Technologies Limited 55 ---

124 Purchase of subsidiary shares from minority interest (84) (11)

(23) Return of (increase in) refundable deposits (23) (336) 223

Release (pledge) of restricted cash equivalents and marketable

securities 14,101 42 (505) Net cash provided by (used in) investing

activities 11,189 4,619 (3,189) Himax Technologies, Inc. Unaudited

Condensed Consolidated Statements of Cash Flows (Figures in

Thousands of U.S. Dollars) Three Months Three Months Ended Ended

June 30, March 31, 2006 2005 2006 Cash flows from financing

activities: Proceeds from issuance of ordinary shares 147,813 ---

--- Proceeds from borrowing of short-term debt --- --- 11,303

Repayment of short-term debt (38,577) --- --- Repayment of

long-term debt --- (46) (89) Net cash provided by (used in)

financing activities 109,236 (46) 11,214 Effect of exchange rate

changes on cash and cash equivalents (60) --- (20) Net increase in

cash and cash equivalents 135,637 20,340 24,161 Cash and cash

equivalents at beginning of period 31,247 7,822 7,086 Cash and cash

equivalents at end of period $166,884 $28,162 $31,247 Supplemental

disclosures of cash flow information: Cash paid during the period

for: Interest $28 $--- $283 Income taxes $5,549 $1,090 $15

Supplemental disclosures of non-cash investing and financing

activities: Increase (decrease) in payable for purchase of

equipment and construction in progress $(18) $(191) $893 Himax

Technologies, Inc. Unaudited Supplemental Data - Reconciliation

Schedule (Figures in Thousands of U.S. Dollars, Except Per Share

Data) Gross Margin and Operating Margin Excluding Share-based

Compensation: Three Months Three Months Ended Ended June 30, Mar

31, 2006 2005 2006 Revenues $171,675 $111,633 $174,859 Gross profit

32,909 25,419 37,561 Add: Share-based compensation - Cost of

revenues 18 33 24 Gross profit excluding share-based compensation

32,927 25,452 37,585 Gross margin excluding share-based

compensation 19.2 % 22.8 % 21.5 % Operating income 18,875 14,258

23,594 Add: Share-based compensation 1,063 1,528 1,138 Operating

income excluding share-based compensation 19,938 15,786 24,732

Operating margin excluding share-based compensation 11.6 % 14.1 %

14.1 % * Gross margin excluding share-based compensation equals

gross profit excluding share-based compensation divided by revenues

* Operating margin excluding share-based compensation equals

operating income excluding share-based compensation divided by

revenues Diluted Earnings Per Share Excluding Share-based

Compensation: Three Months Ended June 30, 2006 Diluted GAAP EPS

$0.10 Add: Estimated share-based compensation per diluted share

$0.01 Diluted non GAAP EPS excluding share-based compensation $0.10

Numbers do not add up due to rounding DATASOURCE: Himax

Technologies, Inc. CONTACT: Max Chan, Chief Financial Officer,

+886-2-3393-0877 Ext. 22300, , or Jackson Ko, Investor Relations,

+886-2-3393-0877 Ext. 22240, , both of Himax Technologies, Inc.; or

In the U.S.: David Pasquale of The Ruth Group, +1-646-536-7006, ,

for Himax Technologies, Inc. Web site: http://himax.com.tw/

Copyright

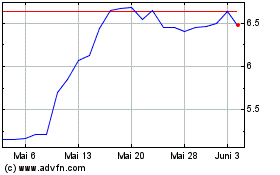

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

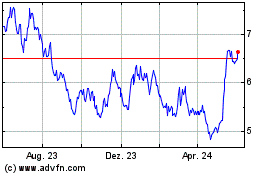

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

Von Jul 2023 bis Jul 2024