HF Foods Group Inc. (NASDAQ: HFFG) (“HF Foods”, or the “Company”),

a leading food distributor to Asian restaurants across the United

States, reported unaudited financial results for the fourth quarter

and full year ended December 31, 2023.

Fourth Quarter 2023 Financial

Results

- Net revenue

decreased 3.8% to $280.9 million compared to $291.9 million in the

prior year.

- Gross profit

increased 3.0% to $52.3 million compared to $50.7 million in the

prior year. Gross profit margin increased to 18.6% compared to

17.4% in the prior year.

- Net income (loss)

increased to net income of $2.7 million compared to net loss of

$3.5 million in the prior year.

- Adjusted EBITDA

increased 372.6% to $20.4 million compared to $4.3 million in the

prior year.

Full Year 2023 Financial

Results

- Net revenue

decreased 1.9% to $1,148.5 million compared to $1,170.5 million in

the prior year.

- Gross profit

decreased 0.7% to $204.0 million compared to $205.5 million in the

prior year, Gross profit margin increased to 17.8% compared to

17.6% in the prior year.

- Net (loss) income

decreased to a net loss of $2.7 million compared to net income of

$0.2 million in the prior year.

- Adjusted EBITDA

increased 11.1% to $44.6 million compared to $40.1 million in the

prior year.

Management Commentary

“We are excited by the progress we have made on

our operational transformation plan that we expect to help us drive

long-term growth and profitability,” said Peter Zhang, Chief

Executive Officer of HF Foods. “We successfully expanded our margin

through centralized purchasing for Seafood and exited low margin

chicken processing businesses with a focus on our core operations

in 2023. Our focus on centralized purchasing and improving overall

operation efficiency will see us drive additional savings in other

key categories. We have also recently entered into a partnership

with a large and reputable national transportation provider with a

focus on driving efficiency in our fleet upgrade, maintenance and

fuel programs. We have already seen improvements in our key

profitability metrics as a result of our optimization efforts, and

look forward to these metrics continuing to reflect our progress.

As the only scaled, nationwide operator dedicated to serving the

growing Asian foodservice market, our deep customer loyalty and the

incredible work of our entire team to execute our transformation

initiative gives me more confidence than ever that we are well

positioned to capitalize on these improvements in the near and long

term.”

Fourth Quarter 2023 Results

Net revenue was $280.9 million for the fourth

quarter of 2023 compared to $291.9 million in the prior year

period, a decrease of $11.0 million, or 3.8%. The decline was

primarily attributable to deflationary pricing in certain key

commodities, and to a lesser extent the loss in revenue driven by

the exit of the Company’s chicken processing businesses in the

second and third quarters of 2023, partially offset by higher

volume.

Gross profit was $52.3 million for the fourth

quarter of 2023 compared to $50.7 million in the prior year period,

an increase of $1.5 million, or 3.0%. Gross profit margin increased

to 18.6% from 17.4% in the prior year period. The gross profit

margin benefited from the Company’s exit from its lower margin

chicken processing businesses and the successful execution of its

Seafood centralized purchasing program.

Distribution, selling and administrative

expenses decreased by $13.1 million to $41.0 million, primarily due

to a decrease of $14.5 million in professional fees, partially

offset by higher payroll and related labor costs. During the fourth

quarter of 2023, the Company received net settlement amounts

totaling $10.0 million which reduced professional fees.

Distribution, selling and administrative expenses as a percentage

of net revenue decreased to 14.6% from 18.5% in the prior year

period primarily due to lower professional fees, partially offset

by increased headcount.

Net income (loss) increased to net income of

$2.7 million for the fourth quarter of 2023 compared to a net loss

of $3.5 million in the prior year period. The increase was

primarily attributable to the decreased distribution, selling and

administrative costs and higher gross profit, partially offset by

the $3.6 million change in the fair value of interest rate

swap contracts, higher interest expense, and decreased tax

benefit.

Adjusted EBITDA increased 372.6% to $20.4

million for the fourth quarter of 2023 compared to $4.3 million in

the prior year. Adjusted EBITDA benefited from the $10.0 million of

total net settlement amount.

Full Year 2023 Results

Net revenue was $1,148.5 million for the year

ended December 31, 2023 compared to $1,170.5 million in the prior

year. The decline was primarily attributable to deflationary

pricing in Seafood, Meat and Poultry, Asian Specialty and Packaging

and Other. The revenue decrease due to pricing was partially offset

by higher volume and the Seafood revenue generated due to the

Sealand Food, Inc. acquisition (“Sealand Acquisition”) which

had a full year of revenue in 2023 compared to a partial year in

2022.

Gross profit was $204.0 million for the year

ended December 31, 2023 compared to $205.5 million in the prior

year period. The decline was primarily attributable to decreases in

revenue from Meat and Poultry, and to a lesser extent, Packaging

and Other, partially offset by the increased Asian Specialty

revenue and the additional Seafood revenue generated due to the

Sealand Acquisition and the successful execution of the Seafood

centralized purchasing program. In 2023, poultry pricing declined

from elevated levels that benefited the Company’s gross profit in

2022. Gross profit margin of 17.8% represented an increase from

17.6% in the prior year.

Distribution, selling and administrative

expenses for the year ended December 31, 2023 remained consistent

with the prior year, having increased by $0.1 million to $195.1

million, primarily due to a decrease in professional fees as a

result of $10.0 million in net settlement amounts received during

2023, partially offset by increases of $7.3 million in payroll

and related labor costs, inclusive of the additional costs due to

the Sealand Acquisition, and $2.0 million in insurance related

costs. Professional fees decreased $12.9 million, or $2.9

million net of the settlement amounts received, to

$13.9 million for the year ended December 31, 2023, from

$26.8 million for the year ended December 31, 2022. In

addition, the Company recognized an asset impairment of

$1.2 million related to the exit of its chicken processing

facility in 2023. Distribution, selling and administrative expenses

as a percentage of net revenue increased to 17.0% for the year

ended December 31, 2023 from 16.7% in the same period in

2022.

Net (loss) income for the year ended December

31, 2023 decreased to a net loss of $2.7 million compared to net

income of $0.2 million in the prior year. The decrease was

primarily attributable to a $4.0 million increase in interest

expense, as well as a change in fair value of interest rate swap

contracts of $2.4 million, partially offset by a change in lease

guarantee expense of $6.1 million.

Adjusted EBITDA for the year ended December 31,

2023 increased 11.1% to $44.6 million compared to $40.1 million in

the prior year. Adjusted EBITDA benefited from the $10.0 million of

total net settlement amount.

Cash Flow and Liquidity

Cash flow from operating activities decreased to

$15.8 million for 2023, compared to $31.3 million in the prior

year. The decrease in cash flow from operating activities was

primarily due to the timing of working capital outlays. As of

December 31, 2023, the Company had a cash balance of $15.2 million

and access to approximately $37.6 million in additional funds

through its $100.0 million line of credit, subject to a borrowing

base calculation.

The following table summarizes our unaudited

condensed consolidated statements of cash flows:

| |

Year Ended December 31, |

|

(In thousands) |

|

2023 |

|

|

|

2022 |

|

|

Net (loss) income |

$ |

(2,662 |

) |

|

$ |

235 |

|

|

Non-cash adjustments to net (loss) income |

|

23,373 |

|

|

|

29,461 |

|

|

Changes in operating assets and liabilities (excluding effects of

acquisitions) |

|

(4,907 |

) |

|

|

1,588 |

|

|

Net cash provided by operating activities |

|

15,804 |

|

|

|

31,284 |

|

|

Net cash used in investing activities |

|

(1,514 |

) |

|

|

(50,786 |

) |

|

Net cash (used in) provided by financing activities |

|

(23,347 |

) |

|

|

28,999 |

|

|

Net (decrease) increase in cash |

|

(9,057 |

) |

|

|

9,497 |

|

|

Cash at beginning of the year |

|

24,289 |

|

|

|

14,792 |

|

|

Cash at end of the year |

$ |

15,232 |

|

|

$ |

24,289 |

|

Earnings Call and Webcast

A pre-recorded call and webcast with HF Foods’

management team discussing the results is now available on the

Investor Relations section of the Company’s website at

https://investors.hffoodsgroup.com/.

About HF Foods Group Inc.

HF Foods Group Inc. is a leading marketer and

distributor of fresh produce, frozen and dry food, and non-food

products to primarily Asian/Chinese restaurants and other

foodservice customers throughout the United States. HF Foods aims

to supply the increasing demand for Asian American restaurant

cuisine, leveraging its nationwide network of distribution centers

and its strong relations with growers and suppliers of fresh,

high-quality specialty restaurant food products and supplies in the

US, South America, and China. Headquartered in Las Vegas, Nevada,

HF Foods trades on Nasdaq under the symbol “HFFG”. For more

information, please visit www.hffoodsgroup.com.

Investor Relations Contact:

HFFG Investor Relations

hffoodsgroup@icrinc.com

Forward-Looking Statements

All statements in this news release other than

statements of historical facts are forward-looking statements which

contain our current expectations about our future results. We have

attempted to identify any forward-looking statements by using words

such as “aims,” “continues,” “expects,” “plans,” “will,” and other

similar expressions. Although we believe that the expectations

reflected in all of our forward-looking statements are reasonable,

we can give no assurance that such expectations will prove to be

correct. Such statements are not guarantees of future performance

or events and are subject to known and unknown risks and

uncertainties that could cause the Company’s actual results, events

or financial positions to differ materially from those included

within or implied by such forward-looking statements. Such factors

include, but are not limited to, the factors disclosed under the

caption “Risk Factors” in our Annual Report on Form 10-K for the

year ended December 31, 2023 and other filings with the SEC.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date made.

Except as required by law, we undertake no obligation to disclose

any revision to these forward-looking statements.

Non-GAAP Financial Measures

Discussion of our results includes certain

non-GAAP financial measures, including EBITDA, adjusted EBITDA and

non-GAAP net income (loss) attributable to HF Foods Group Inc.,

that we believe provides an additional tool for investors to use in

evaluating ongoing operating results and trends and in comparing

our financial performance with other companies in the same

industry, many of which present similar non-GAAP financial measures

to investors. The definitions of EBITDA, adjusted EBITDA and

non-GAAP net income (loss) attributable to HF Foods Group Inc. may

not be the same as similarly titled measures used by other

companies in the industry. EBITDA, adjusted EBITDA and non-GAAP net

income (loss) attributable to HF Foods Group Inc. are not defined

under GAAP and are subject to important limitations as analytical

tools and should not be considered in isolation or as substitutes

for analysis of our financial results as reported under GAAP.

We use non-GAAP financial measures to supplement

our GAAP financial results. Management uses EBITDA, defined as net

income (loss) before interest expense, interest income, income

taxes, and depreciation and amortization to measure operating

performance. In addition, management uses Adjusted EBITDA, defined

as net income (loss) before interest expense, interest income,

income taxes, and depreciation and amortization, further adjusted

to exclude certain unusual, non-cash, or non-recurring expenses. We

believe that Adjusted EBITDA is less susceptible to variances in

actual performance resulting from non-recurring expenses, and other

non-cash charges, provides useful information for our investors and

is more reflective of other factors that affect our operating

performance.

We believe non-GAAP net income (loss)

attributable to HF Foods Group Inc. is a useful measure of

operating performance because it excludes certain items not

reflective of our core operating performance. Non-GAAP net income

(loss) attributable to HF Foods Group Inc. is defined as net income

(loss) attributable to HF Foods Group Inc. adjusted for

amortization of intangibles, change in fair value of interest rate

swaps, stock based compensation, transaction related costs,

transformational project costs and certain unusual, non-cash, or

non-recurring expenses. We believe that non-GAAP net income (loss)

attributable to HF Foods Group Inc. facilitates period-over-period

comparisons and provides additional clarity for investors to better

evaluate our operating results. We present EBITDA, adjusted EBITDA,

non-GAAP net income (loss) attributable to HF Foods Group Inc. in

order to provide supplemental information that we consider relevant

for the readers of our consolidated financial statements included

elsewhere in its reports filed with the SEC, including its current

Quarterly Report on Form 10Q, and such information is not meant to

replace or supersede U.S. GAAP measures. Reconciliations of the

non-GAAP financial measures to their most comparable GAAP financial

measures are included in the schedules attached to this press

release.

|

HF FOODS GROUP INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(In

thousands)(Unaudited) |

| |

| |

December 31, 2023 |

|

December 31, 2022 |

|

ASSETS |

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

Cash |

$ |

15,232 |

|

|

$ |

24,289 |

|

|

Accounts receivable, net |

|

47,832 |

|

|

|

44,399 |

|

|

Inventories |

|

105,618 |

|

|

|

120,291 |

|

|

Other current assets |

|

10,145 |

|

|

|

8,937 |

|

|

TOTAL CURRENT ASSETS |

|

178,827 |

|

|

|

197,916 |

|

|

Property and equipment, net |

|

133,136 |

|

|

|

140,330 |

|

|

Operating lease right-of-use assets |

|

12,714 |

|

|

|

14,164 |

|

|

Long-term investments |

|

2,388 |

|

|

|

2,679 |

|

|

Customer relationships, net |

|

147,181 |

|

|

|

157,748 |

|

|

Trademarks, trade names and other intangibles, net |

|

30,625 |

|

|

|

36,343 |

|

|

Goodwill |

|

85,118 |

|

|

|

85,118 |

|

|

Other long-term assets |

|

6,531 |

|

|

|

3,231 |

|

|

TOTAL ASSETS |

$ |

596,520 |

|

|

$ |

637,529 |

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

Checks issued not presented for payment |

$ |

4,494 |

|

|

$ |

21,946 |

|

|

Line of credit |

|

58,564 |

|

|

|

53,056 |

|

|

Accounts payable |

|

52,014 |

|

|

|

57,044 |

|

|

Current portion of long-term debt, net |

|

5,450 |

|

|

|

6,266 |

|

|

Current portion of obligations under finance leases |

|

1,749 |

|

|

|

2,254 |

|

|

Current portion of obligations under operating leases |

|

3,706 |

|

|

|

3,676 |

|

|

Accrued expenses and other liabilities |

|

17,287 |

|

|

|

19,648 |

|

|

TOTAL CURRENT LIABILITIES |

|

143,264 |

|

|

|

163,890 |

|

|

Long-term debt, net of current portion |

|

108,711 |

|

|

|

115,443 |

|

|

Obligations under finance leases, non-current |

|

11,229 |

|

|

|

11,441 |

|

|

Obligations under operating leases, non-current |

|

9,414 |

|

|

|

10,591 |

|

|

Deferred tax liabilities |

|

29,028 |

|

|

|

34,443 |

|

|

Other long-term liabilities |

|

6,891 |

|

|

|

5,472 |

|

|

TOTAL LIABILITIES |

|

308,537 |

|

|

|

341,280 |

|

|

Commitments and contingencies |

|

|

|

|

SHAREHOLDERS’ EQUITY: |

|

|

|

|

Preferred stock |

|

— |

|

|

|

— |

|

|

Common stock |

|

5 |

|

|

|

5 |

|

|

Treasury stock |

|

(7,750 |

) |

|

|

— |

|

|

Additional paid-in capital |

|

603,094 |

|

|

|

598,322 |

|

|

Accumulated deficit |

|

(308,688 |

) |

|

|

(306,514 |

) |

|

TOTAL SHAREHOLDERS’ EQUITY ATTRIBUTABLE TO HF FOODS GROUP

INC. |

|

286,661 |

|

|

|

291,813 |

|

|

Noncontrolling interests |

|

1,322 |

|

|

|

4,436 |

|

|

TOTAL SHAREHOLDERS’ EQUITY |

|

287,983 |

|

|

|

296,249 |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

$ |

596,520 |

|

|

$ |

637,529 |

|

|

HF FOODS GROUP INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(In thousands, except share and per

share data)(Unaudited) |

| |

| |

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Net revenue |

$ |

280,873 |

|

|

$ |

291,899 |

|

|

$ |

1,148,493 |

|

|

$ |

1,170,467 |

|

|

Cost of revenue |

|

228,605 |

|

|

|

241,177 |

|

|

|

944,462 |

|

|

|

964,955 |

|

|

Gross profit |

|

52,268 |

|

|

|

50,722 |

|

|

|

204,031 |

|

|

|

205,512 |

|

| |

|

|

|

|

|

|

|

|

Distribution, selling and administrative expenses |

|

41,049 |

|

|

|

54,113 |

|

|

|

195,062 |

|

|

|

194,953 |

|

|

Income (loss) from operations |

|

11,219 |

|

|

|

(3,391 |

) |

|

|

8,969 |

|

|

|

10,559 |

|

| |

|

|

|

|

|

|

|

|

Other (income) expenses: |

|

|

|

|

|

|

|

|

Interest expense |

|

3,048 |

|

|

|

2,356 |

|

|

|

11,478 |

|

|

|

7,457 |

|

|

Other income |

|

(246 |

) |

|

|

(428 |

) |

|

|

(1,091 |

) |

|

|

(1,829 |

) |

|

Change in fair value of interest rate swap contracts |

|

3,674 |

|

|

|

33 |

|

|

|

1,580 |

|

|

|

(817 |

) |

|

Lease guarantee (income) expense |

|

(72 |

) |

|

|

(87 |

) |

|

|

(377 |

) |

|

|

5,744 |

|

|

Total Other expenses, net |

|

6,404 |

|

|

|

1,874 |

|

|

|

11,590 |

|

|

|

10,555 |

|

|

Income (loss) before income taxes |

|

4,815 |

|

|

|

(5,265 |

) |

|

|

(2,621 |

) |

|

|

4 |

|

| |

|

|

|

|

|

|

|

|

Income tax expense (benefit) |

|

2,094 |

|

|

|

(1,760 |

) |

|

|

41 |

|

|

|

(231 |

) |

|

Net income (loss) |

|

2,721 |

|

|

|

(3,505 |

) |

|

|

(2,662 |

) |

|

|

235 |

|

|

Less: net loss attributable to noncontrolling interests |

|

(4 |

) |

|

|

(151 |

) |

|

|

(488 |

) |

|

|

(225 |

) |

|

Net income (loss) attributable to HF Foods Group Inc. |

$ |

2,725 |

|

|

$ |

(3,354 |

) |

|

$ |

(2,174 |

) |

|

$ |

460 |

|

| |

|

|

|

|

|

|

|

|

Earnings (loss) per common share - basic |

$ |

0.05 |

|

|

$ |

(0.06 |

) |

|

$ |

(0.04 |

) |

|

$ |

0.01 |

|

|

Earnings (loss) per common share - diluted |

$ |

0.05 |

|

|

$ |

(0.06 |

) |

|

$ |

(0.04 |

) |

|

$ |

0.01 |

|

| |

|

|

|

|

|

|

|

|

Weighted average shares - basic |

|

53,502,052 |

|

|

|

53,813,772 |

|

|

|

53,878,237 |

|

|

|

53,757,162 |

|

|

Weighted average shares - diluted |

|

53,961,698 |

|

|

|

53,813,772 |

|

|

|

53,878,237 |

|

|

|

53,863,448 |

|

|

HF FOODS GROUP INC. AND

SUBSIDIARIESRECONCILIATION OF NET (LOSS) INCOME TO

EBITDA AND ADJUSTED EBITDA(In

thousands)(Unaudited) |

| |

| |

|

Three Months EndedDecember

31, |

|

|

| |

|

|

2023 |

|

|

|

2022 |

|

|

Change |

|

Net income (loss) |

|

$ |

2,721 |

|

|

$ |

(3,505 |

) |

|

$ |

6,226 |

|

|

Interest expense |

|

|

3,048 |

|

|

|

2,356 |

|

|

|

692 |

|

|

Income tax expense (benefit) |

|

|

2,094 |

|

|

|

(1,760 |

) |

|

|

3,854 |

|

|

Depreciation and amortization |

|

|

6,367 |

|

|

|

6,691 |

|

|

|

(324 |

) |

|

EBITDA |

|

|

14,230 |

|

|

|

3,782 |

|

|

|

10,448 |

|

|

Lease guarantee income |

|

|

(72 |

) |

|

|

(87 |

) |

|

|

15 |

|

|

Change in fair value of interest rate swaps |

|

|

3,674 |

|

|

|

33 |

|

|

|

3,641 |

|

|

Stock-based compensation expense |

|

|

747 |

|

|

|

584 |

|

|

|

163 |

|

|

Business transformation costs(1) |

|

|

527 |

|

|

|

— |

|

|

|

527 |

|

|

Other non-routine expense (2) |

|

|

1,274 |

|

|

|

— |

|

|

|

1,274 |

|

|

Adjusted EBITDA |

|

$ |

20,380 |

|

|

$ |

4,312 |

|

|

$ |

16,068 |

|

| |

Year EndedDecember 31, |

|

|

| |

|

2023 |

|

|

|

2022 |

|

|

Change |

|

Net (loss) income |

$ |

(2,662 |

) |

|

$ |

235 |

|

|

$ |

(2,897 |

) |

|

Interest expense |

|

11,478 |

|

|

|

7,457 |

|

|

|

4,021 |

|

|

Income tax expense (benefit) |

|

41 |

|

|

|

(231 |

) |

|

|

272 |

|

|

Depreciation and amortization |

|

25,918 |

|

|

|

24,936 |

|

|

|

982 |

|

|

EBITDA |

|

34,775 |

|

|

|

32,397 |

|

|

|

2,378 |

|

|

Lease guarantee (income) expense |

|

(377 |

) |

|

|

5,744 |

|

|

|

(6,121 |

) |

|

Change in fair value of interest rate swaps |

|

1,580 |

|

|

|

(817 |

) |

|

|

2,397 |

|

|

Stock-based compensation expense |

|

3,352 |

|

|

|

1,257 |

|

|

|

2,095 |

|

|

Business transformation costs (1) |

|

929 |

|

|

|

— |

|

|

|

929 |

|

|

Acquisition-related costs |

|

— |

|

|

|

1,130 |

|

|

|

(1,130 |

) |

|

Other non-routine expense (2) |

|

3,124 |

|

|

|

— |

|

|

|

3,124 |

|

|

Asset impairment charges |

|

1,200 |

|

|

|

422 |

|

|

|

778 |

|

|

Adjusted EBITDA |

$ |

44,583 |

|

|

$ |

40,133 |

|

|

$ |

4,450 |

|

____________

(1) Represents

non-recurring expenses associated with the launch of strategic

projects including supply chain strategy improvements and

technology infrastructure initiatives.(2) Includes contested proxy

and related legal and consulting costs and facility closure

costs.

|

HF FOODS GROUP INC. AND

SUBSIDIARIESRECONCILIATION OF NET INCOME (LOSS)

ATTRIBUTABLE TO HF FOODS GROUP INC. TO NON-GAAP

NET INCOME ATTRIBUTABLE TO HF FOODS GROUP INC. (In

thousands)(Unaudited) |

| |

| |

|

Three Months Ended December 31, |

|

|

| |

|

|

2023 |

|

|

|

2022 |

|

|

Change |

|

Net income (loss) attributable to HF Foods Group Inc. |

|

$ |

2,725 |

|

|

$ |

(3,354 |

) |

|

$ |

6,079 |

|

|

Amortization of intangibles |

|

|

4,072 |

|

|

|

4,044 |

|

|

|

28 |

|

|

Lease guarantee income |

|

|

(72 |

) |

|

|

(87 |

) |

|

|

15 |

|

|

Change in fair value of interest rate swaps |

|

|

3,674 |

|

|

|

33 |

|

|

|

3,641 |

|

|

Stock-based compensation expense |

|

|

747 |

|

|

|

584 |

|

|

|

163 |

|

|

Business transformation costs (1) |

|

|

527 |

|

|

|

— |

|

|

|

527 |

|

|

Other non-routine expense (2) |

|

|

1,274 |

|

|

|

— |

|

|

|

1,274 |

|

|

Aggregate adjustment for income taxes |

|

|

206 |

|

|

|

(889 |

) |

|

|

1,095 |

|

|

Non-GAAP net income attributable to HF Foods Group Inc. |

|

$ |

13,153 |

|

|

$ |

331 |

|

|

$ |

12,822 |

|

| |

|

Year EndedDecember 31, |

|

|

| |

|

|

2023 |

|

|

|

2022 |

|

|

Change |

|

Net (loss) income attributable to HF Foods Group Inc. |

|

$ |

(2,174 |

) |

|

$ |

460 |

|

|

$ |

(2,634 |

) |

|

Amortization of intangibles |

|

|

16,285 |

|

|

|

15,744 |

|

|

|

541 |

|

|

Lease guarantee (income) expense |

|

|

(377 |

) |

|

|

5,744 |

|

|

|

(6,121 |

) |

|

Change in fair value of interest rate swaps |

|

|

1,580 |

|

|

|

(817 |

) |

|

|

2,397 |

|

|

Stock-based compensation expense |

|

|

3,352 |

|

|

|

1,257 |

|

|

|

2,095 |

|

|

Business transformation costs (1) |

|

|

929 |

|

|

|

— |

|

|

|

929 |

|

|

Acquisition-related costs |

|

|

— |

|

|

|

1,130 |

|

|

|

(1,130 |

) |

|

Other non-routine expense (2) |

|

|

3,124 |

|

|

|

— |

|

|

|

3,124 |

|

|

Asset impairment charges |

|

|

1,200 |

|

|

|

422 |

|

|

|

778 |

|

|

Aggregate adjustment for income taxes |

|

|

527 |

|

|

|

(4,564 |

) |

|

|

5,091 |

|

|

Non-GAAP net income attributable to HF Foods Group Inc. |

|

$ |

24,446 |

|

|

$ |

19,376 |

|

|

$ |

5,070 |

|

____________

(1) Represents

non-recurring expenses associated with the launch of strategic

projects including supply chain strategy improvements and

technology infrastructure initiatives.(2) Includes contested proxy

and related legal and consulting costs and facility closure

costs.

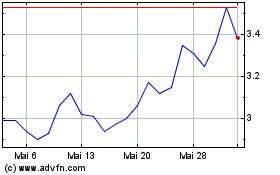

HF Foods (NASDAQ:HFFG)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

HF Foods (NASDAQ:HFFG)

Historical Stock Chart

Von Jan 2024 bis Jan 2025