Purchase price of $1.97 per share represents

over 120% premium to latest closing price

All-cash transaction subject to customary

closing conditions, regulatory approvals, and approval of GAN

shareholders

GAN Limited (the “Company” or “GAN”) (NASDAQ: GAN), a leading

North American B2B technology provider of real money internet

gaming solutions and a leading International B2C operator of

Internet sports betting, today announced that the Company has

entered into a definitive Agreement and Plan of Merger (the “Merger

Agreement”) with Sega Sammy Creation Inc., (“SSC”), a wholly-owned

subsidiary of Sega Sammy Holdings, Inc. (“Sega Sammy”) an

international conglomerate operating in the entertainment, gaming

and resorts businesses.

Under the Merger Agreement, at the effective time of the merger,

each of GAN’s issued ordinary shares will be converted into the

right to receive in cash $1.97 per share, which reflects a premium

of 121% over the closing price of GAN’s ordinary shares on November

7, 2023, the last trading day prior to the date of this

announcement.

Seamus McGill, Chairman and Interim Chief Executive Officer

of GAN, commented:

"After a thoughtful review of value creation opportunities

available to us, we are pleased to have reached this agreement with

SSC. Market share concentration in the U.S. B2C space, a slower

than expected adoption of regulated online gaming in the U.S.,

along with changes to key customer contracts make the near-term

operating environment challenging without ample capital resources.

Sega Sammy has those resources and GAN is a strategic complement to

their existing gaming portfolio. We believe this all-cash offer, at

a substantial premium to recent trading prices, is the

value-maximizing path for our shareholders.”

Approvals and Timing

The proposed merger is subject to the approval of GAN

shareholders. The Company will ask its shareholders to consider and

vote to approve the Merger Agreement at a Special Meeting of

Shareholders, which is expected to be held no later than March 31,

2024.

Completion of the merger is not subject to a financing condition

but is subject to the accuracy of the representations and

warranties, performance of the covenants and other agreements

included in the Merger Agreement, and customary closing conditions

for a transaction of this type, including notification or approval

with various gaming regulatory authorities. Assuming satisfaction

of those conditions, the Company expects the merger to close during

the fourth quarter of 2024.

Effects of the Merger

If the merger is approved by GAN’s shareholders and is

completed, all outstanding GAN ordinary shares will be acquired for

$1.97 per share in cash; GAN’s ordinary shares will no longer be

subject to public reporting requirements under the Securities

Exchange Act of 1934; and its ordinary shares will no longer trade

on any market. Upon completion of the merger, GAN will become a

wholly owned subsidiary of SSC.

Board Approval and Advisors

The GAN board of directors formed a special committee, comprised

solely of independent directors, to consider the transaction and to

negotiate the price per shares and the terms of the Merger

Agreement, with the assistance of financial and legal advisors.

Based on the unanimous recommendation of the special committee, the

GAN board of directors determined that the $1.97 price per share

constitutes fair value for each Company ordinary share, and

determined that the terms of the Agreement, the merger and the

other agreements and transactions contemplated by the Merger

Agreement are in the best interests of the Company and its

shareholders.

B. Riley Securities, Inc. served as the Company’s financial

advisor throughout the strategic review process and Sheppard Mullin

Richter & Hampton is serving as legal counsel to GAN. SMBC

Nikko Securities is acting as Sega Sammy’s sole financial advisor

and Greenberg Traurig is acting as Sega Sammy’s legal counsel.

Additional Information

Further details of the Merger Agreement are contained in a

Current Report on Form 8-K to be filed by the Company on Wednesday,

November 8, 2023, with the Securities and Exchange Commission.

About GAN Limited

GAN is a leading business-to-business supplier of internet

gambling software-as-a-service solutions predominantly to the U.S.

land-based casino industry and is a market-leading

business-to-consumer operator of proprietary online sports betting

technology internationally with market leadership positions in

selected European and Latin American markets. In its B2B segment,

GAN has developed a proprietary internet gambling enterprise

software system, GameSTACK™, which it licenses to land-based U.S.

casino operators as a turnkey technology solution for regulated

real money internet gambling, encompassing internet gaming,

internet sports betting, and social casino gaming branded as

'Simulated Gaming.'

About Sega Sammy Holdings Inc.

The Sega Sammy Holdings, Inc. the holding company for a group of

companies comprising the Entertainment Contents Business, which

offers a diversity of fun through consumer and arcade game content,

toys and animation; the Pachislot and Pachinko Machines Business,

which conducts everything from development to sales of

Pachinko/Pachislot machines; and the Resort Business, which

develops and operates hotels.

About Sega Sammy Creation Inc.

Sega Sammy Creation Inc. is a gaming machine manufacturer that

utilizes its wealth of creativity, entertainment experience and

technology to produce products that offer new and exciting

experiences. With these products, Sega Sammy looks to surpass

anything seen thus far and breathe new life into the global gaming

market.

Forward-Looking Statements

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

All statements contained in this release that do not relate to

matters of historical fact should be considered forward-looking

statements, including statements regarding the expecting benefits

or the timing or completion of the proposed merger as well as

statements that include the words "expect," "intend," "plan,"

"believe," "project," "forecast," "estimate," "may," "should,"

"anticipate" and similar statements of a future or forward-looking

nature. These forward-looking statements are based on management's

current expectations. These statements are neither promises nor

guarantees, but involve known and unknown risks, uncertainties and

other important factors that may cause actual results, performance

or achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. Please refer to the Company's annual,

quarterly and current reports filed on Forms 10-K, 10-Q and 8-K

from time to time with the Securities and Exchange Commission for a

further discussion of the factors and risks associated with the

business. Readers are cautioned not to place undue reliance on any

forward-looking statements, which speak only as of the date on

which they are made. The Company undertakes no obligation to update

or revise any forward-looking statements for any reason except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231107579041/en/

Investor: GAN Robert Shore Vice President, IR and

Capital Markets (610) 812-3519 rshore@GAN.com

Alpha IR Group Ryan Coleman or Davis Snyder (312)

445-2870 GAN@alpha-ir.com

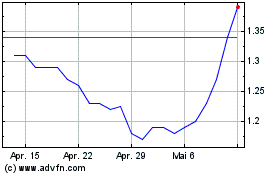

GAN (NASDAQ:GAN)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

GAN (NASDAQ:GAN)

Historical Stock Chart

Von Nov 2023 bis Nov 2024