Franchise Group, Inc. Announces the Launch of a $200 Million Add-on to Its Existing Term Loan

24 Januar 2023 - 10:01PM

Franchise Group, Inc. (NASDAQ: FRG) (“Franchise Group,” “FRG” or

the “Company”) today announced that it has launched a $200 million

non-fungible add-on to its existing first lien term loan due in

March 2026. Proceeds from the transaction are expected to be used

to pay down existing debt under the Company’s ABL credit facility.

The Company also announced that it expects to

report fiscal 2022 results in line with or exceeding the financial

outlook it previously provided on November 3, 2022, which indicated

that the Company’s total reported revenue is expected to be

approximately $4.3 billion and Adjusted EBITDA is expected to be at

least $350 million.

JPMorgan Chase Bank, N.A. is acting as lead

arranger of the financing.

The Company does not provide a quantitative

reconciliation of forward-looking, Non-GAAP financial measures such

as forecasted Adjusted EBITDA to the most directly comparable GAAP

financial measures because it is difficult to reliably predict or

estimate the relevant components without unreasonable effort due to

future uncertainties that may potentially have significant impact

on such calculations, and providing them may imply a degree of

precision that would be confusing or potentially misleading.

Estimates exclude potential acquisitions, divestitures or

refranchising activities. See “Non-GAAP Financial Measures and Key

Metrics.”

About Franchise Group,

Inc.Franchise Group is an owner and operator of franchised

and franchisable businesses that continually looks to grow its

portfolio of brands while utilizing its operating and capital

allocation philosophy to generate strong cash flow for its

shareholders. Franchise Group’s business lines include Pet Supplies

Plus, Wag N’ Wash, American Freight, The Vitamin Shoppe, Badcock

Home Furniture & More, Buddy’s Home Furnishings and Sylvan

Learning. On a combined basis, Franchise Group currently operates

over 3,000 locations predominantly located in the U.S. that are

either Company-run or operated pursuant to franchising and dealer

agreements.

Non-GAAP Financial Measures and Key

MetricsAdjusted EBITDA is a financial measure that is not

prepared in accordance with GAAP. Management believes the

presentation of this measure is useful to investors as a

supplemental measure in evaluating the aggregate performance of the

Company’s operating businesses and in comparing its results from

period to period because it excludes items that the Company does

not believe are reflective of its core or ongoing operating

results. This measure is used by management to evaluate the

Company’s performance and make resource allocation decisions each

period. This metric is also used in the determination of executive

management's compensation. Adjusted EBITDA should not be considered

in isolation or as a substitute for net income or other income

statement information prepared in accordance with GAAP and our

presentation of this non-GAAP measure may not be comparable to

similarly titled measures used by other companies.

Management defines and calculates Adjusted

EBITDA as net income (loss) from continuing operations before

interest, income taxes, depreciation and amortization adjusted for

certain non-core or non-operational items related to executive

severance and related costs, stock-based compensation, shareholder

litigation costs, corporate governance costs, accrued judgments and

settlements, net of estimated revenue, store closures, rebranding

costs, acquisition costs, inventory fair value step up amortization

and prepayment penalty on early debt repayment. Adjusted EBITDA is

a financial measure that is not prepared in accordance with

GAAP.

Forward-Looking StatementsThis

press release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include, without limitation,

projections, predictions, expectations, or beliefs about future

events or results and are not statements of historical fact. Such

statements may include statements regarding the Company’s results

of operation and financial condition, statements regarding the

expected use of proceeds in connection with the add-on to its

existing first lien term loan and statements regarding its outlook

for fiscal 2022. Such forward-looking statements are based on

various assumptions as of the time they are made, and are

inherently subject to known and unknown risks, uncertainties and

other factors that may cause actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements. Forward-looking statements are often

accompanied by words that convey projected future events or

outcomes such as “expect,” “believe,” “estimate,” “plan,”

“project,” “anticipate,” “intend,” “will,” “may,” “view,”

“opportunity,” “potential,” or words of similar meaning or other

statements concerning opinions or judgment of the Company or its

management about future events. Although the Company believes that

its expectations with respect to forward-looking statements are

based upon reasonable assumptions within the bounds of its existing

knowledge of its business and operations, there can be no assurance

that actual results, performance, or achievements of the Company

will not differ materially from any projected future results,

performance or achievements expressed or implied by such

forward-looking statements. Actual future results, performance or

achievements may differ materially from historical results or those

anticipated depending on a variety of factors, many of which are

beyond the control of the Company. The Company refers you to the

“Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” sections of the

Company’s Form 10-K for the fiscal year ended December 25, 2021,

and comparable sections of the Company’s Quarterly Reports on Form

10-Q and other filings, which have been filed with the SEC and are

available on the SEC’s website at www.sec.gov. All of the

forward-looking statements made in this press release are expressly

qualified by the cautionary statements contained or referred to

herein. The actual results or developments anticipated may not be

realized or, even if substantially realized, they may not have the

expected consequences to or effects on the Company or its business

or operations. Readers are cautioned not to rely on the

forward-looking statements contained in this press release.

Forward-looking statements speak only as of the date they are made

and the Company does not undertake any obligation to update, revise

or clarify these forward-looking statements, whether as a result of

new information, future events or otherwise.

Investor Relations Contact:Andrew F.

KaminskyEVP & Chief Administrative OfficerFranchise Group,

Inc.akaminsky@franchisegrp.com(914) 939-5161

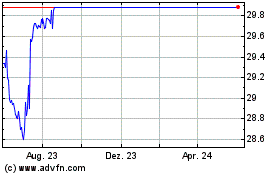

Franchise (NASDAQ:FRG)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

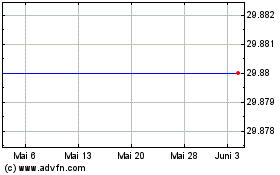

Franchise (NASDAQ:FRG)

Historical Stock Chart

Von Dez 2023 bis Dez 2024