UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-A/A

(Amendment No. 1)

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR (g) OF

THE SECURITIES EXCHANGE ACT OF 1934

CLEARSIGN TECHNOLOGIES

CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware |

|

26-2056298 |

| (State of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

| |

|

|

8023 E. 63rd Place, Suite 101

Tulsa, Oklahoma |

|

74133 |

| (Address of principal executive offices) |

|

(Zip Code) |

Securities to be registered pursuant to Section 12(b) of

the Act:

Title of each class

to be so registered |

|

Name of each exchange on which

each class is to be registered |

| Common Stock, par value $0.0001 per share |

|

Nasdaq Stock Market LLC |

If this form relates to the registration of a class of securities pursuant

to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A.(c) or (e), check the following

box. x

If this form relates to the registration of a class of securities pursuant

to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d) or (e), check the following

box. ¨

If this form relates to the registration of a class of securities concurrently

with a Regulation A offering, check the following box. ¨

Securities Act registration statement file number to which this form

relates: None

Securities to be registered pursuant to Section 12(g) of

the Act: None

EXPLANATORY NOTE

This Amendment No. 1

to Form 8-A is being filed in connection with the reincorporation of ClearSign Technologies Corporation (the “Company”)

from the State of Washington to the State of Delaware (the “Reincorporation”) pursuant to a plan of conversion, dated June

14, 2023 (the “Plan of Conversion”). The Reincorporation became effective on June 15, 2023 and was accomplished by the filing

of (i) articles of entity conversion with the Washington Secretary of State; (ii) a certificate of conversion with the Secretary

of State of the State of Delaware; and (iii) a certificate of incorporation with the Secretary of State of the State of Delaware

(the “Certificate of Incorporation”). Pursuant to the Plan of Conversion, the Company also adopted new bylaws (the “Bylaws”).

The Company hereby amends the following items, exhibits or other portions of its Form 8-A originally filed on April 23, 2012 with

the Securities and Exchange Commission (the “SEC”) regarding the description of common stock as set forth herein.

INFORMATION REQUIRED IN REGISTRATION STATEMENT

Item 1. Description of Registrant’s Securities to be Registered.

Our Certificate of Incorporation

authorized capital stock consists of 64,500,000 shares, $0.0001 par value per share, consisting of: (i) 62,500,000 shares of common stock;

and (ii) 2,000,000 shares of preferred stock.

Common Stock

Dividend Rights

The General Corporation Law

of the State of Delaware (the “DGCL”) permits a corporation to declare and pay dividends out of “surplus”

or, if there is no “surplus,” out of its net profits for the fiscal year in which the dividend is declared and/or the preceding

fiscal year. “Surplus” is defined as the excess of the net assets of the corporation over the amount determined to be the

capital of the corporation by the board of directors. The capital of the corporation is typically calculated to be (and cannot be less

than) the aggregate par value of all issued shares of capital stock. Net assets equals the fair value of the total assets minus total

liabilities. The DGCL also provides that dividends may not be paid out of net profits if, after the payment of the dividend, capital is

less than the capital represented by the outstanding stock of all classes having a preference upon the distribution of assets. Delaware

common law also imposes a solvency requirement in connection with the payment of dividends.

Subject to applicable law

and the rights and preferences of any holders of any outstanding series of preferred stock, the holders of common stock will be entitled

to the payment of dividends on the common stock when, as and if declared by the Company’s board of directors (“Board”)

in accordance with applicable law.

Voting Rights

Holders of common stock will

be entitled to one vote for each share held as of the record date for determining stockholders entitled to vote on such matters, except

as otherwise required by law.

Right to Receive Liquidation Distributions

Subject to the rights and

preferences of any holders of any shares of any outstanding series of preferred stock, in the event of any liquidation, dissolution or

winding up of the Company, the funds and assets of the Company that may be legally distributed to the stockholders will be distributed

among the holders of the then outstanding common stock pro rata in accordance with the number of shares of common stock held by each such

holder.

Other Matters

All outstanding shares of

the common stock will be fully paid and nonassessable. The common stock will not be entitled to preemptive rights and will not be subject

to redemption or sinking fund provisions.

Preferred Stock

The

Certificate of Incorporation provides that shares of preferred stock may be issued from time to time in one or more series. The Board

will be authorized to fix the voting rights, if any, designations, powers, preferences, the relative, participating, optional or other

special rights and any qualifications, limitations and restrictions thereof, applicable to the shares of each series. The Board will be

able to, without stockholder approval, issue preferred stock with voting and other rights that could have anti-takeover effects.

The ability of the Board to issue preferred stock without stockholder approval could have the effect of delaying, deferring or preventing

a change of control of us or the removal of existing management. We have no preferred stock outstanding at the date hereof. Although we

do not currently intend to issue any shares of preferred stock, we cannot assure you that we will not do so in the future.

Anti-Takeover Provisions

Certain provisions of Delaware

law, the Certificate of Incorporation, and the Bylaws, which are summarized below, may have the effect of delaying, deferring, or discouraging

another person from acquiring control of the Company. They are also designed, in part, to encourage persons seeking to acquire control

of the Company to negotiate first with the Board.

Removal of Directors

Subject to the special rights

of the holders of one or more outstanding series of preferred stock to elect directors, the Certificate of Incorporation provides that

directors may be removed from office at any time, with or without cause, only by the affirmative vote of the holders of at least a majority

of the voting power of all of the then outstanding shares of voting stock of the Company entitled to vote at an election of directors.

Board of Directors Vacancies

Subject to the special rights

of the holders of one or more outstanding series of preferred stock to elect directors, and except as otherwise provided by law, our Certificate

of Incorporation authorizes only a majority of the remaining members of the Board (other than any directors elected by the separate vote

of one or more outstanding series of preferred stock), even though less than a quorum, to fill vacant directorships, including newly created

seats. In addition, the number of directors constituting the Board will be permitted to be set only by a resolution of the Board. These

provisions would prevent a stockholder from increasing the size of the Board and then gaining control of the Board by filling the resulting

vacancies with its own nominees. This will make it more difficult to change the composition of the Board and will promote continuity of

management.

Stockholder Action; Special Meeting of Stockholders

Our Bylaws provide that the

our stockholders may take any action required or permitted to be taken at an annual or special meeting of stockholders by written consent

in lieu of a meeting. The Certificate of Incorporation and Bylaws further provide that special meetings of the Company’s stockholders

may be called only by the chairman of the Board, the Chief Executive Officer of the Company or the Board pursuant to a resolution adopted

by a majority of Board, and may not be called by any other person, including the Company’s stockholders.

Section 203 of the DGCL

We have opted out of Section

203 of the DGCL under our Certificate of Incorporation. As a result, pursuant to our Certificate of Incorporation, we are prohibited from

engaging in any business combination with any stockholder for a period of three years following the time that such stockholder (the “interested

stockholder”) came to own at least 15% of our outstanding voting stock (the “acquisition”), except if:

| |

● |

The Board approved the acquisition prior to its consummation; |

| |

● |

the interested stockholder owned at least 85% of the outstanding voting stock upon consummation of the acquisition; or |

| |

● |

the acquisition is approved by our board of directors, and by the affirmative vote of at least two-thirds vote of the non-interested stockholders in a meeting. |

The restrictions described

above will apply subject to certain exceptions, including if a stockholder becomes an interested stockholder inadvertently and, as soon

as practicable, divests itself of ownership of such shares so that the stockholder ceases to be an interest stockholder, and, within the

three (3) year period, that stockholder has not become an interested stockholder but for such inadvertent acquisition of ownership. Generally,

a “business combination” or “acquisition” includes any merger, consolidation, asset or stock sale or certain other

transactions resulting in a financial benefit to the interested stockholder. Subject to certain exceptions, an “interested stockholder”

is a person who, together with that person’s affiliates and associates, owns, or within the previous three years owned, 15% or more

of our outstanding voting stock.

Our Certificate of Incorporation

provisions that elect to opt out of Section 203 of the DGCL may make it more difficult for a person who would be an “interested

stockholder” to effect various business combinations with us for a three-year period. This may encourage companies interested in

acquiring us to negotiate in advance with our board of directors because the stockholder approval requirement would be avoided if our

board of directors approves the acquisition which results in the stockholder becoming an interested stockholder. This may also have the

effect of preventing changes in our board of directors and may make it more difficult to accomplish transactions which stockholders may

otherwise deem to be in their best interests.

Advance Notice Requirements for Stockholder

Proposals and Director Nominations

The Bylaws provide that the

Company’s stockholders seeking to bring business before the Company’s annual meeting of stockholders, or to nominate candidates

for election as directors at the Company’s annual or a special meeting of stockholders must provide timely notice of their intent

in writing. To be timely, a stockholder’s notice must be received by the Secretary at the Company’s principal executive offices

(i) in the case of an annual meeting, not later than the close of business on the 90th day nor earlier than the close

of business on the 120th day before the anniversary date of the immediately preceding annual meeting of stockholders (subject

to certain exceptions), and (ii) in the case of a special meeting of stockholders called for the purpose of electing directors, not

later than the close of business on the 10th day following the day on which public announcement of the date of the

special meeting is first made by the Company. The Bylaws also specify certain requirements as to the form and content of a stockholders’

meeting. These provisions may preclude the Company stockholders from bringing matters before an annual meeting of stockholders or from

making nominations for directors at an annual meeting of stockholders.

No Cumulative Voting

The DGCL provides that stockholders

are not entitled to cumulate votes in the election of directors unless a corporation’s Certificate of Incorporation provides otherwise.

Our Certificate of Incorporation does not provide for cumulative voting.

Amendment of Certificate of Incorporation

Provisions

Amendments to the provisions

of the Certificate of Incorporation related to restrictions on any business combination with any interested stockholder and indemnification

of directors and officers of the Company require the affirmative vote of the holders of at least sixty six and two-thirds percent (66

and 2/3%) of the total voting power of all the then outstanding shares of stock of the Company entitled to vote thereon, voting together

as a single class.

Authorized but Unissued Capital Stock

Our authorized but unissued

common stock and preferred stock are available for future issuances without stockholder approval and could be utilized for a variety of

corporate purposes, including future offerings to raise additional capital, acquisitions and employee benefit plans. The existence of

authorized but unissued and unreserved common stock and preferred stock could render more difficult or discourage an attempt to obtain

control of the Company by means of a proxy contest, tender offer, merger or otherwise.

Exclusive Forum

The Certificate of Incorporation

provides that, unless the Company consents in writing to the selection of an alternative forum, the Court of Chancery of the State of

Delaware (or, if the Court of Chancery does not have jurisdiction, the federal district court for the District of Delaware or other state

courts of the State of Delaware) and any appellate court thereof shall, to the fullest extent permitted by law, be the sole and exclusive

forum for: (i) any derivative action, suit or proceeding (“Proceeding”) brought on behalf of the Company; (ii) any

Proceeding asserting a claim of breach of a fiduciary duty owed by any of the Company’s directors, officers, or stockholders to

the Company or its stockholders; (iii) any Proceeding arising pursuant to any provision of the DGCL, Certificate of Incorporation

or the Bylaws, as amended; (iv) any Proceeding as to which the DGCL confers jurisdiction on the Court of Chancery of the State of

Delaware; or (v) any Proceeding asserting a claim against the Company or any current or former director, officer or stockholder governed

by the internal affairs doctrine. This provision would not apply to suits brought to enforce any liability or duty created by apply to

suits brought to enforce any liability or duty created by the Securities Act of 1933, as amended, the Exchange Act of 1934, as amended,

or any other claim for which the federal courts of the United States have exclusive jurisdiction. The Certificate of Incorporation

further provides that, unless the Company consents in writing to the selection of an alternative forum, the federal district courts of

the United States shall be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the

Securities Act. These provisions may have the effect of discouraging lawsuits against the Company or its directors and officers.

Limitations on Liability and Indemnification

of Directors and Officers

The Certificate of Incorporation

provides that no director of the Company shall have any personal liability to the Company or its stockholders for monetary damages for

any breach of fiduciary duty as a director, except to the extent such exemption from liability or limitation thereof is not permitted

under the DGCL. Amendments to these provisions shall not adversely affect any right or protection of a director of the Company in

respect of any act or omission occurring prior to the time of such amendment.

The Certificate of Incorporation

further provides that the Company indemnify directors and officers to the fullest extent permitted by law. The Company is also expressly

authorized to advance certain expenses (including, without limitation, attorneys’ fees) to its directors and officers and to maintain

insurance, at its expense, to protect itself and/or any director, officer, employee or agent of the Company against any expense, liability

or loss, whether or not the Company would have the power to indemnify such person against such expense, liability or loss under the DGCL.

In addition, the Company entered

into separate indemnification agreements with its directors and officers. These agreements, among other things, requires the Company to

indemnify its directors and officers for certain expenses, including attorneys’ fees, judgments, fines and settlement amounts incurred

by a director or officer in any action or proceeding arising out of their services as one of the Company’s directors or officers

or any other company or enterprise to which the person provides services at the Company’s request.

Stockholders’ Derivative Actions

Under the DGCL, any of our

stockholders may bring an action in the Company’s name to procure a judgment in its favor, also known as a derivative action; provided

that the stockholder bringing the action is a holder of our shares at the time of the transaction to which the action relates.

Item 2. Exhibits.

The following exhibits to this Registration Statement

on Form 8-A/A are incorporated by reference from the documents specified, which have been filed with the SEC.

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Exchange

Act of 1934, the Registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereto duly authorized.

| Dated: August 11, 2023 |

CLEARSIGN TECHNOLOGIES CORPORATION |

| |

|

| |

|

| |

By: |

/s/ Colin James Deller |

| |

|

Colin James Deller |

| |

|

Chief Executive Officer |

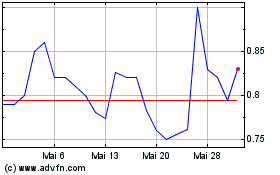

ClearSign Technologies (NASDAQ:CLIR)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

ClearSign Technologies (NASDAQ:CLIR)

Historical Stock Chart

Von Mai 2023 bis Mai 2024