Filed Pursuant

to Rule 424(b)(3)

Registration No. 333-273319

PROSPECTUS SUPPLEMENT NO. 10

(to Prospectus dated July 28, 2023)

Canopy Growth

Corporation

13,218,453 Common

Shares

This prospectus

supplement supplements the prospectus dated July 28, 2023 (the “Prospectus”), which forms a part of our registration statement

on Form S-1 (No. 333-273319). This prospectus supplement is being filed to update and supplement the information in the Prospectus with

the information contained in our Current Report on Form 8-K, filed with the Securities and Exchange Commission (the “SEC”)

on January 2, 2024 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus

and this prospectus supplement relate to the offer and sale, from time to time, of up to 13,218,453 of our common shares (the “Shares”)

by the selling securityholders listed in the section of the Prospectus entitled “Selling Securityholders” (the “Selling

Securityholders”). The Shares were issued to the Selling Securityholders (i) on May 17, 2022 and May 25, 2022 pursuant to an Option

Agreement, dated as of May 17, 2022, by and among us, Canopy Oak LLC (“Canopy Oak”), Lemurian, Inc., a California corporation,

and the other parties thereto; (ii) on May 17, 2022 pursuant to an Option Agreement, dated as of May 17, 2022, by and among Canopy Oak

and the other parties thereto; and (iii) on November 4, 2022 and March 17, 2023 pursuant to the Third Amendment to Tax Receivable Agreement,

dated as of October 24, 2022, by and among us, Canopy USA, LLC, a Delaware limited liability company, Acreage Holdings America, Inc.,

a Nevada corporation, High Street Capital Partners, LLC, a Delaware limited liability company (“HSCP”), and certain members

of HSCP.

Investing

in our common shares (“Common Shares”) involves a high degree of risk. You should review carefully the risks and uncertainties

described under the heading “Item 1A. Risk Factors” beginning on page 29 of our Annual Report on Form 10-K for the year ended

March 31, 2023 (the “Annual Report”), which is incorporated by reference in the Prospectus, as well as the risk factors discussed

in the periodic reports and other documents we file from time to time with the SEC

and with applicable Canadian securities regulators, and which we incorporate into the Prospectus by reference. See also “Risk Factors”

beginning on page 6 of the Prospectus.

Our

Common Shares are listed and posted for trading on the Toronto Stock Exchange (the “TSX”) under the symbol “WEED”

and on the Nasdaq Global Select Market under the symbol “CGC.” On December 29, 2023, the closing price of our Common Shares

on the Nasdaq Global Select Market was US$5.11 per share.

This prospectus

supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized

except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read

in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement,

you should rely on the information in this prospectus supplement.

Neither the

SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or

the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this

prospectus supplement is January 2, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 29, 2023

Canopy Growth Corporation

(Exact name of registrant as specified in its charter)

| Canada |

|

001-38496 |

|

N/A |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1 Hershey Drive

Smiths Falls, Ontario |

K7A

0A8 |

| (Address of principal executive officers) |

(Zip Code) |

(855) 558-9333

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name of each exchange

on which registered |

| Common Shares, no par value |

CGC |

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

Canopy Growth Corporation

(the “Company” or “Canopy Growth”) previously disclosed in a Current Report on Form 8-K filed

with the U.S. Securities and Exchange Commission (the “SEC”) on October 26, 2022 that it entered into an arrangement

agreement dated October 24, 2022, as amended on March 17, 2023, May 31, 2023, August 31, 2023 and October 31,

2023 (the “Floating Share Arrangement Agreement”), with Canopy USA, LLC (“Canopy USA”) and Acreage

Holdings, Inc. (“Acreage”), pursuant to which, subject to the terms and conditions of the Floating Share Arrangement

Agreement, including all closing conditions contained in the arrangement agreement between the Company and Acreage dated April 18,

2019, as amended on May 15, 2019, September 23, 2020 and November 17, 2020 (the “Existing Arrangement Agreement”),

Canopy USA will acquire all of the issued and outstanding Class D subordinate voting shares of Acreage (the “Floating Shares”)

by way of a court-approved plan of arrangement under the Business Corporations Act (British Columbia) at a fixed exchange

ratio of 0.45 of a common share of Canopy Growth for each Floating Share held (the “Floating Share Arrangement”).

On December 29,

2023, the Company, Canopy USA and Acreage entered into a fifth amendment to the Floating Share Arrangement Agreement (the “Amendment”). Pursuant

to the terms of the Amendment, the Company, Canopy USA, and Acreage agreed to amend the Exercise

Outside Date (as defined in the Floating Share Arrangement Agreement) from December 31, 2023 to March 31, 2024. The

completion of the Floating Share Arrangement is subject to satisfaction or, if permitted, waiver of certain closing conditions, including,

among others, completion of the Canopy Capital Reorganization (as defined in the Floating Share Arrangement Agreement) on or prior to

the Exercise Outside Date. There can be no certainty, nor can the Company provide any assurance, that all conditions precedent contained

in the Floating Share Arrangement Agreement and the Existing Arrangement Agreement will be satisfied or waived, which may result in the

acquisition of Acreage not being completed.

The

foregoing description of the Amendment is qualified in its entirety by reference to the full text of the Amendment filed as Exhibit 10.1

to this Current Report on Form 8-K.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CANOPY GROWTH CORPORATION |

| |

|

|

| |

By: |

/s/ Judy Hong |

| |

|

Judy Hong |

| |

|

Chief Financial Officer |

Date: January 2, 2024

Exhibit 10.1

FIFTH AMENDMENT TO ARRANGEMENT AGREEMENT

THIS AMENDMENT is made as of December 29,

2023

BETWEEN:

CANOPY USA, LLC, a limited liability

company existing under the laws of the State of Delaware (“Canopy USA”)

- and -

CANOPY GROWTH CORPORATION, a corporation

existing under the laws of Canada (“Canopy”)

- and -

ACREAGE HOLDINGS, INC., a

corporation existing under the laws of the Province of British Columbia (“Acreage”)

RECITALS:

| A. | Canopy USA, Canopy and Acreage are parties to an arrangement agreement (the “Arrangement Agreement”)

dated October 24, 2022, as amended on March 17, 2023, May 31, 2023, August 31, 2023 and October 31, 2023; and |

| B. | Canopy USA, Canopy and Acreage wish to amend certain terms of the Arrangement Agreement, in accordance

with Section 9.1 of the Arrangement Agreement, as provided in this Amendment. |

THEREFORE, in consideration of the mutual

covenants contained herein (the receipt and sufficiency of which are hereby acknowledged), the Parties agree as follows:

Article 1

Interpretation

Capitalized terms used but not defined in this

Amendment have the meanings given to them in the Arrangement Agreement.

| 1.2 | Interpretation not Affected by Headings |

The division of this Amendment into Articles,

Sections, subsections and paragraphs and the insertion of headings are for convenience of reference only and shall not affect in any way

the meaning or interpretation of this Amendment. Unless the contrary intention appears, references in this Amendment to an Article, Section,

subsection or paragraph or both refer to the Article, Section, subsection or paragraph, respectively, bearing that designation in this

Amendment.

In this Amendment, unless the contrary intention

appears, words importing the singular include the plural and vice versa, and words importing gender shall include all genders.

Article 2

amendments

| 2.1 | Amendments to the Arrangement Agreement |

| (1) | The definition of “Exercise Outside Date” at Section 1.1 of the Arrangement Agreement

is deleted, and replaced with the following: |

“Exercise Outside Date”

means March 31, 2024 or such later date as may be agreed to in writing by the Parties.

Article 3

General Provisions

The Arrangement Agreement, as amended hereby,

remains in full force and effect. Provisions of the Arrangement Agreement that have not been amended or terminated by this Amendment remain

in full force and effect, unamended. All rights and liabilities that have accrued to any Party under the Arrangement Agreement up to the

date of this Amendment remain unaffected by this Amendment.

| 3.2 | Arrangement Agreement Provisions |

The provisions of Article 9 of the Arrangement

Agreement shall apply, mutatis mutandis, to this Amendment.

| 3.3 | Counterparts, Execution |

This Amendment may be executed in one or more

counterparts, each of which shall be deemed to be an original but all of which together shall constitute one and the same instrument.

The Parties shall be entitled to rely upon delivery of an executed facsimile or similar executed electronic copy of this Amendment, and

such facsimile or similar executed electronic copy shall be legally effective to create a valid and binding agreement between the Parties.

[Remainder of page intentionally left

blank]

IN WITNESS WHEREOF Canopy USA, Canopy and

Acreage have caused this Amendment to be executed as of the date first written above by their respective officers thereunto duly authorized.

| |

CANOPY USA, LLC |

| |

|

| |

|

| |

By: |

/s/ David Klein |

| |

|

Name: |

David Klein |

| |

|

Title: |

Authorized Signatory |

| |

|

| |

|

| |

CANOPY GROWTH CORPORATION |

| |

|

| |

|

| |

By: |

/s/ Christelle Gedeon |

| |

|

Name: |

Christelle Gedeon |

| |

|

Title: |

Chief Legal Officer |

| |

|

| |

|

| |

ACREAGE HOLDINGS, INC. |

| |

|

| |

|

| |

By: |

/s/ Dennis Curran |

| |

|

Name: |

Dennis Curran |

| |

|

Title: |

Chief Executive Officer |

[Signature Page to Amendment

to Arrangement Agreement]

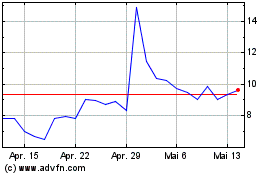

Canopy Growth (NASDAQ:CGC)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Canopy Growth (NASDAQ:CGC)

Historical Stock Chart

Von Mai 2023 bis Mai 2024