false

0001513818

0001513818

2023-08-02

2023-08-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 2, 2023

Aravive, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-36361

|

|

26-4106690

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

River Oaks Tower

3730 Kirby Drive, Suite 1200

Houston, Texas 77098

(Address of principal executive offices)

(936) 355-1910

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common stock, par value $0.0001 per share

|

|

ARAV

|

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operation and Financial Condition.

Although it has not yet finalized its full financial results for the second quarter ended June 30, 2023, Aravive, Inc. (the “Company”), announced in a press release on August 2, 2023, that it had cash of approximately $18 million at the end of Q2 that is expected to be sufficient to fund operations into early Q4 2023.

The estimated cash figure is preliminary and unaudited, represents a management estimate as of the date of this Current Report on Form 8-K and is subject to completion of the Company’s financial closing procedures. The Company’s independent registered public accounting firm has not conducted an audit or review of, and does not express an opinion or any other form of assurance with respect to, the estimated cash figure.

The information in this Item 2.02 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02 shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission (the “SEC”) made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 7.01. Regulation FD Disclosure.

On August 2, 2023, the Company issued a press release announcing the presentation of top-line results from its Phase 3 AXLerate-OC Study of Batiraxcept in Platinum-Resistant Ovarian Cancer (“AXLerate”). The AXLerate trial evaluating the safety and efficacy of batiraxcept in platinum-resistant ovarian cancer did not meet its primary endpoint of progression-free survival (“PFS”) in the pre-specified subset of patients naïve to prior bevacizumab treatment. The trial did not show any difference between the two arms in the overall population (which included patients previously treated with bevacizumab).

AXLerate enrolled 366 patients, and randomization was stratified for prior bevacizumab treatment; 50% of patients received bevacizumab prior to study entry. The statistical analysis plan called for a hierarchical approach for the assessment of PFS first in the bevacizumab-naïve population and then in the overall cohort of patients. In the bevacizumab-naïve population (n=179), the median PFS in the batiraxcept plus paclitaxel arm was 5.4 months, compared to 5.4 months in the paclitaxel arm. In the overall population, the median PFS in the batiraxcept plus paclitaxel arm was 5.1 months, compared to 5.5 months in the paclitaxel arm. None of these differences were statistically different.

The information in this Item 7.01 and in the press release furnished as Exhibit 99.1 to this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended and shall not be incorporated by reference into any filing with the SEC made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

The press release furnished as Exhibit 99.1 to this Current Report on Form 8-K includes “safe harbor” language pursuant to the Private Securities Litigation Reform Act of 1995, as amended, indicating that certain statements contained therein are “forward-looking” rather than historical.

Item 8.01. Other Events.

On August 2, 2023, the Company presented top-line results from its Phase 3 AXLerat trial. The AXLerate trial evaluating the safety and efficacy of batiraxcept in platinum-resistant ovarian cancer did not meet its primary endpoint of PFS in the pre-specified subset of patients naïve to prior bevacizumab treatment. The trial did not show any difference between the two arms in the overall population (which included patients previously treated with bevacizumab).

AXLerate enrolled 366 patients, and randomization was stratified for prior bevacizumab treatment; 50% of patients received bevacizumab prior to study entry. The statistical analysis plan called for a hierarchical approach for the assessment of PFS first in the bevacizumab-naïve population and then in the overall cohort of patients. In the bevacizumab-naïve population (n=179), the median PFS in the batiraxcept plus paclitaxel arm was 5.4 months, compared to 5.4 months in the paclitaxel arm. In the overall population, the median PFS in the batiraxcept plus paclitaxel arm was 5.1 months, compared to 5.5 months in the paclitaxel arm. None of these differences were statistically different.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are filed with this Current Report on Form 8-K:

|

Exhibit

|

|

Description

|

|

99.1

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: August 2, 2023

|

ARAVIVE, INC.

(Registrant)

|

| |

|

|

| |

By:

|

/s/ Gail McIntyre

|

| |

Name:

|

Gail McIntyre

|

| |

Title:

|

Chief Executive Officer

|

Exhibit 99.1

Aravive Announces Top-Line Results from Phase 3 AXLerate-OC Study of Batiraxcept in Platinum-Resistant Ovarian Cancer

| |

●

|

Trial did not meet primary endpoint of progression-free survival

|

| |

●

|

Cash at the end of Q2 of approximately $18M (unaudited) is expected to be sufficient to fund operations into early Q4 2023

|

HOUSTON, August 2, 2023 (GLOBE NEWSWIRE) – Aravive, Inc. (Nasdaq: ARAV, “the Company”), a late clinical-stage oncology company developing targeted therapeutics to treat metastatic disease, today announced that its Phase 3 AXLerate-OC trial evaluating the safety and efficacy of batiraxcept in platinum-resistant ovarian cancer did not meet its primary endpoint of progression-free survival (PFS) in the pre-specified subset of patients naïve to prior bevacizumab treatment. The trial did not show any difference between the two arms in the overall population (which included patients previously treated with bevacizumab). The Company will continue to evaluate the complete dataset and determine next steps in the development of batiraxcept.

“We are conducting additional analyses on the AXLerate-OC Phase 3 trial to further evaluate the results of this study and determine the best path forward with our two other planned indications in renal cell carcinoma and pancreatic cancer,” said Gail McIntyre, Ph.D., DABT, Aravive’s President and Chief Executive Officer. “We want to thank the patients who participated in this trial, the clinical investigators, and the Aravive team for their hard work, as we continue to pursue our goal of finding innovative cancer treatments for patients in need.”

Key Findings from AXLerate-OC Study

AXLerate-OC enrolled 366 patients, and randomization was stratified for prior bevacizumab treatment; 50% of patients received bevacizumab prior to study entry. The statistical analysis plan called for a hierarchical approach for the assessment of PFS first in the bevacizumab-naïve population and then in the overall cohort of patients. In the bevacizumab-naïve population (n=179), the median PFS in the batiraxcept plus paclitaxel arm was 5.4 months, compared to 5.4 months in the paclitaxel arm. In the overall population, the median PFS in the batiraxcept plus paclitaxel arm was 5.1 months, compared to 5.5 months in the paclitaxel arm. None of these differences were statistically different.

The safety profile of batiraxcept was as expected from previous studies. No new safety signals were identified.

“Although AXLerate-OC did not meet the primary endpoint, I look forward to working with Aravive to analyze the Phase 3 data and determine the most appropriate path to bring batiraxcept to those patients who may benefit most,” said Dr. Katherine Fuh, Associate Professor, UCSF Division of Gynecologic Oncology.

About the Phase 3 PROC Trial

The global, randomized, double-blind, placebo-controlled adaptive trial (GOG-3059/ENGOT OV-66) is designed to evaluate efficacy and safety of batiraxcept at a dose of 15 mg/kg in combination with paclitaxel. The trial enrolled 366 patients with high-grade serous ovarian cancer who have received one to four prior lines of therapy at approximately 165 sites in the U.S. and Europe. The primary endpoint for the trial is progression free survival and the secondary endpoint is overall survival. Exploratory endpoints include objective response rate, duration of response, quality of life, clinical benefit rate, pharmacokinetic and pharmacodynamic profile, and sAXL/GAS6 ratio. This trial was conducted in partnership with The GOG Foundation, Inc. (GOG-F), through the GOG Partners program in the USA and in partnership with the European Network for Gynecological Oncological Trial (ENGOT) groups in Europe. The Phase 3 trial is listed on clinicaltrials.gov NCT04729608.

About Aravive

Aravive, Inc. is a late clinical-stage oncology company developing targeted therapeutics to treat metastatic disease. Batiraxcept (formerly AVB-500), is an ultra-high affinity decoy protein that binds to GAS6, the sole ligand that activates AXL, thereby inhibiting metastasis and tumor growth, and restoring sensitivity to anti-cancer agents. Batiraxcept has been granted Fast Track Designation by the U.S. FDA for both clear cell renal cell carcinoma and platinum-resistant ovarian cancer and Orphan Drug Designation by the European Commission in platinum resistant recurrent ovarian cancer. The Company is based in Houston, Texas and received a Product Development Award from the Cancer Prevention & Research Institute of Texas (CPRIT) in 2016. Additional information at www.aravive.com.

Forward Looking Statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, forward-looking statements can be identified by terminology such as "may," "should," "potential," "continue," "expects," "anticipates," "intends," "plans," "believes," "estimates," and similar expressions and includes statements regarding continuing to evaluate the complete dataset and determine next steps in the development of batiraxcept and continuing to pursue the Company’s goal of finding innovative cancer treatments for patients in need. Forward-looking statements are based on current beliefs and assumptions, are not guarantees of future performance and are subject to risks and uncertainties that could cause actual results to differ materially from those contained in any forward-looking statement as a result of various factors, including, but not limited to, risks and uncertainties related to the ability to continue to develop batiraxcept and pursue the Company’s goal of finding innovative cancer treatments for patients in need, the ability to enroll patients as anticipated, the ability to provide data when anticipated and to continue ongoing trials; the Company's dependence upon batiraxcept; batiraxcept's ability to have favorable results in clinical trials; the clinical trials of batiraxcept having results that are as favorable as those of preclinical and clinical trials; the ability to receive regulatory approval, potential delays in the Company's clinical trials due to regulatory requirements or difficulty identifying qualified investigators or enrolling patients; the risk that batiraxcept may cause serious side effects or have properties that delay or prevent regulatory approval or limit its commercial potential; the risk that the Company may encounter difficulties in manufacturing batiraxcept; if batiraxcept is approved, risks associated with its market acceptance, including pricing and reimbursement; potential difficulties enforcing the Company's intellectual property rights; and the Company's reliance on its licensor of intellectual property and financing needs, the ability to obtain financing and the cash runway being sufficient to sustain operations into the fourth quarter of 2023. The foregoing review of important factors that could cause actual events to differ from expectations should not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the risk factors included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2022, recent Current Reports on Form 8-K and subsequent filings with the SEC. Except as required by applicable law, the Company undertakes no obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

Investor Relations Contact:

Corey Davis, Ph.D.

LifeSci Advisors, LLC

212-915-2577

cdavis@lifesciadvisors.com

v3.23.2

Document And Entity Information

|

Aug. 02, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Aravive, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 02, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-36361

|

| Entity, Tax Identification Number |

26-4106690

|

| Entity, Address, Address Line One |

River Oaks Tower

|

| Entity, Address, Address Line Two |

3730 Kirby Drive, Suite 1200

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77098

|

| City Area Code |

936

|

| Local Phone Number |

355-1910

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

ARAV

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001513818

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

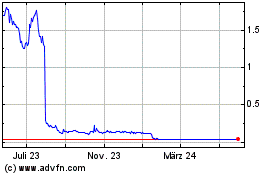

Aravive (NASDAQ:ARAV)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

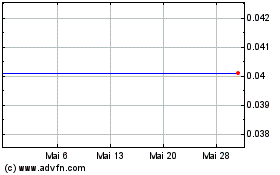

Aravive (NASDAQ:ARAV)

Historical Stock Chart

Von Feb 2024 bis Feb 2025