These are unusual times for the U.S Real Estate Investment Trust

(REIT) industry. After a remarkable run in the first four months of

the year, the REIT industry has nosedived since May, and the

volatility continues.

Prior to the recent uptrend in interest rates, the demand for these

high-dividend-paying stocks remained sky high. In 2012, the

industry delivered a solid performance with the stocks beating the

broader equity market for the 4th straight year.

However, with the increasing yields on the U.S. Treasury 10-year

note (2.55% as of Jun 24, 2013, compared with 1.68% at the end of

April), investors are turning their focus away from REITs

(primarily the mortgage REITs, commonly known as mREITs). Moreover,

rising interest rate environment is a growing concern for the REIT

stocks as investors are concerned about the negative impact on the

book values and financing costs.

In May, on a total return basis, the FTSE NAREIT All REITs Index

lost 6.56% and the FTSE NAREIT All Equity REITs Index lost 5.90%

compared with the S&P 500 that gained 2.34%.

The June data looks disappointing as of now, since the FTSE NAREIT

All REITs Index lost 6.62% and the FTSE NAREIT All Equity REITs

Index lost 6.54% (as of Jun 24, 2013) compared with 4.10% loss for

the S&P 500.

Dividends Still Remain an Attraction

With the U.S. law requiring REITs to distribute 90% of their annual

taxable income in the form of dividends to shareholders,

yield-seeking investors continue to prefer these stocks. This has

aided the industry to stand out and gain a strong foothold over the

past 15-20 years.

As of May 31, the dividend yield of the FTSE NAREIT All REITs Index

was 4.19%, and the dividend yield of the FTSE NAREIT All Equity

REITs Index was 3.35%. Moreover, the dividend yield of the

FTSE NAREIT Mortgage REITs Index was 12.55% as of that date

compared with 2.14% for the S&P 500.

Capital Access

Accessibility to capital is a prime factor in the REIT Industry.

After raising $51.3 billion capital in 2011 and a total of $73.3

billion in 2012, REITs raised $40.5 billion in the first five

months of 2013.

During the latest downturn, REITs were able to acquire premium

properties from highly leveraged investors at heavy discounts.

Furthermore, REITs typically have a large unencumbered pool of

assets, which could provide an additional avenue to raise cash

during crisis. These assets, in turn, have provided the requisite

wherewithal to the REIT industry to grow through strategic

acquisitions over time.

Zacks Industry Rank

Within the Zacks Industry classification, REITs are broadly grouped

into the Finance sector (one of 16 Zacks sectors) and further

sub-divided into four industries at the expanded level: REIT Equity

Trust - RETAIL, REIT Equity Trust - Residential, REIT Equity Trust

- Other and REIT Mortgage Trust.

We rank all the 260 plus industries in the 16 Zacks sectors based

on the earnings outlook and fundamental strength of the constituent

companies in each industry. To learn more visit: About Zacks

Industry Rank

As a point of reference, the outlook for industries with Zacks

Industry Rank #88 and lower is 'Positive,' between #89 and #176 is

'Neutral' and #177 and higher is 'Negative.'

The Zacks Industry Rank for REIT Equity Trust - Retail is #82, REIT

Equity Trust - Other is #84, REIT Mortgage Trust is #167, while the

REIT Equity Trust - Residential is #180. Analyzing the Zacks

Industry Rank for different REIT segments, it is obvious that while

the outlook for mortgage trusts and residential equity trusts is

leaning towards the negative side, retail equity trusts and other

equity trusts remain at the low end of the positive side.

Earnings Trends

The broader Finance sector, of which REITs are a part, remains in

excellent earnings shape. The first quarter 2013 results for the

sector were impressive in terms of both beat ratios (percentage of

companies coming out with positive surprises) and growth.

The earnings "beat ratio" was 73.4% while the revenue "beat

ratio" was 51.9%. Total earnings for this sector were up 7.7%,

slightly moderating from the 10.0% growth in the fourth quarter of

2012. Total revenues moved north 5.5% in the quarter verses 23.1%

growth in the prior quarter.

Looking at the consensus earnings expectations for the rest of the

year, we remain encouraged since earnings are expected to grow

19.1% in the second quarter, 7.6% in the third quarter and 27.6% in

the fourth quarter, thereby registering full-year 2013 growth of

14.0%.

OPPORTUNITIES

Retail REITs: Being a leader, the U.S. retail industry

provides adequate growth prospects for these REITs. Despite the

rise in online shopping through the Internet, mobile phones and

tablets, it is the physical interaction that the millennial

generation stills prefers while shopping. Hence, amid the

technological advancements, in order to increase their market

dominance, the retail industry keeps on reinventing, redesigning

and revamping their physical stores.

With retail properties in premium locations, companies like

Kimco Realty Corporation (KIM), The

Macerich Company (MAC) and Acadia Realty

Trust

(AKR) remain our primary choiceS.

Healthcare REIT: Relatively immune to the macroeconomic

problems, these REITs are expected to benefit from rising national

health expenditures that are projected to grow 3.8% in 2013 and

7.4% in 2014, according to Centers for Medicare and Medicaid

Services. Also, the federal agency projects average compounded

annual growth rate of health expenditures of 6.2% over 2015 through

2021.

Moreover, though the forthcoming wave of retiring baby boomers is

often cited as a threat to the U.S. economy, this is a boon for the

healthcare sector as senior citizens spend 200% more than the

average population.

Hence, we believe that Healthcare REITs like HCP

Inc. (HCP), Health Care REIT, Inc. (HCN)

and Healthcare Realty Trust Inc. (HR) can

capitalize on this trend.

Industrial/Storage REITs: With a larger customer base,

rise in e-Commerce application and supply chain consolidation, the

demand for logistics infrastructure and efficient distribution

networks have risen.

This has lead to a rising need for industrial/storage facilities

and the stocks to consider include Extra Space Storage

Inc. (EXR), DCT Industrial Trust Inc.

(DCT) and CubeSmart (CUBE).

Lodging/Resorts REITs: With the improving U.S. business and strong

international travel and tourism volumes, the lodging sector is

expected to continue with its recovery. Particularly, the North

America market is anticipated to significantly benefit with limited

supply and rising demands.

Stocks that worth a look include are Sunstone Hotel

Investors Inc. (SHO), Diamondrock Hospitality

Co. (DRH) and Host Hotels & Resorts

Inc. (HST).

Apartment REITs: With the lack of stability in the job

market along with mounting student debt, the home ownership in the

under-35 age cohort continues to decline. Since renting has emerged

as the only viable option for customers who cannot avail mortgage

loans or are unwilling to buy a house at present, we expect the

apartment sector to remain comparatively steady in the coming

quarters.

We favor stocks like Select Income REIT (SIR),

Apartment Investment & Management Co. (AIV)

and Equity Residential (TM).

WEAKNESSES

For the sector as a whole, rising interest rates are a looming

concern. High capital costs erode their profit level and hence

trigger a fall in the dividend yield that the investors primarily

look for while investing in REIT stocks. Considering individual

segments, we believe that the current macroeconomic environment

remains a menace for the following sectors.

Mortgage REITs: In the past couple of years, with low

short-term rates and quantitative easing policies (QE), mREITs have

benefited from lower borrowing costs, leading to higher yields

(they invest in mortgage backed securities and use short-term debt

for financing their purchases making money from the spread).

Amid the increasing yields on the U.S. Treasury 10-year note and

apprehensions that the Fed will soon pull out its QE program,

mREITs stocks are continuing to lose their shine. Subsequently, the

FTSE NAREIT Mortgage REITs total returns dropped 17.25% from the

beginning of the second quarter till Jun 20, 2013.

In the recent past, mREITs like American Capital Agency

Corp. (AGNC) and American Capital Mortgage

Investment Corp. (MTGE) slashed their dividends. The other

stocks that we would like to avoid are Hatteras Financial

Corp. (HTS) and Newcastle Investment

Corp. (NCT).

Another division which may underperform is the Office REIT. With

the U.S. economy still registering sluggish growth, the demand for

office properties, particularly in the suburban market still lacks

luster. As such, companies like Mack-Cali Realty

Corp. (CLI) have started to trim their office properties

and diversify into the relatively stable multifamily apartment

sector.

Conclusion

The macroeconomic issues and the political situation have been

affecting the market, but we believe that with the economic

recovery gaining momentum, rents and occupancies would improve

further. Moving forward, limited supply of new construction coupled

with the growing demand for premium properties bode well for the

REITs, in particular for those that have assets in high

barriers-to-entry markets.

AMER CAP AGENCY (AGNC): Free Stock Analysis Report

APARTMENT INVT (AIV): Free Stock Analysis Report

ACADIA RLTY TR (AKR): Free Stock Analysis Report

MACK CALI CORP (CLI): Free Stock Analysis Report

CUBESMART (CUBE): Free Stock Analysis Report

DCT INDUSTRIAL (DCT): Free Stock Analysis Report

DIAMONDROCK HOS (DRH): Free Stock Analysis Report

EQUITY RESIDENT (EQR): Free Stock Analysis Report

EXTRA SPACE STG (EXR): Free Stock Analysis Report

HEALTH CR REIT (HCN): Free Stock Analysis Report

HCP INC (HCP): Free Stock Analysis Report

HEALTHCARE RLTY (HR): Free Stock Analysis Report

HOST HOTEL&RSRT (HST): Free Stock Analysis Report

HATTERAS FIN CP (HTS): Free Stock Analysis Report

KIMCO REALTY CO (KIM): Free Stock Analysis Report

MACERICH CO (MAC): Free Stock Analysis Report

AMER CAP MTGE (MTGE): Free Stock Analysis Report

NEWCASTLE INV (NCT): Free Stock Analysis Report

SUNSTONE HOTEL (SHO): Free Stock Analysis Report

SELECT INCOME (SIR): Free Stock Analysis Report

To read this article on Zacks.com click here.

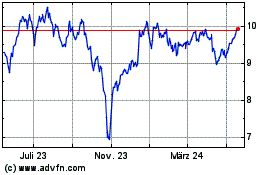

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024