Dividend Investors Set to Face Major Dividend Tax Increase in 2013

10 Dezember 2012 - 2:20PM

Marketwired

Real Estate Investment Trusts (REITs) by law are required to pay

out a minimum of 90 percent of their taxable income through

dividends. A dividend tax increase has been a major concern for

investors as current top tax rate is set to expire in the New Year.

Five Star Equities examines the outlook for dividend yielding

companies and provides equity research on American Capital Agency

Corp. (NASDAQ: AGNC) and Annaly Capital Management, Inc. (NYSE:

NLY).

Access to the full company reports can be found at:

www.FiveStarEquities.com/AGNC www.FiveStarEquities.com/NLY

The current top tax rate on dividends, which was set in the

Bush-era, will expire in January. If lawmakers fail to take action

dividends will be taxed at the same level as wages and salaries in

2013. President Obama's plan would see the top tax rate on

dividends rise to from 15 percent to 39.6 percent for high-income

earners, which doesn't include the new 3.8 percent tax on

investment income added by Obama's health-care law. Since mREITs

are already taxed as ordinary income they are likely to see just a

slight increase in taxation, compared to almost triple for other

high yielding companies.

"The prevailing fear is that if taxes for dividends increase,

dividend yielding companies could grow less attractive and could

see a multiple de-rating," said Savita Subramanian, a strategist at

Bank of America Merrill Lynch.

Five Star Equities releases regular market updates on dividend

yielding companies so investors can stay ahead of the crowd and

make the best investment decisions to maximize their returns. Take

a few minutes to register with us free at www.FiveStarEquities.com

and get exclusive access to our numerous stock reports and industry

newsletters.

American Capital, both directly and through its asset management

business, originates, underwrites and manages investments in middle

market private equity, leveraged finance, real estate and

structured products. The company offers investors an annual

dividend of $5.00 per share for a dividend yield of approximately

16.0 percent.

Annaly's principal business objective is to generate net income

for distribution to its shareholders from its Investment Securities

and from dividends it receives from its subsidiaries. The company

offers investors an annual dividend $2.00 per share for a dividend

yield of approximately 13.85 percent.

Five Star Equities provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. Five Star Equities has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

www.FiveStarEquities.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

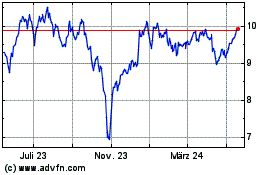

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024