American Capital Agency and ARMOUR Residential REIT -- Large Dividends Buoyed by Net Interest Income

15 Dezember 2011 - 2:16PM

Marketwired

For roughly three years, the central bank has kept overnight

interest rates near zero as unemployment remains relatively high

and housing issues persist. While high yielding REITs such as

American Capital Agency and ARMOUR Residential REIT have benefitted

from the low interest rate environment, some industry player saw

their profits drop last quarter as gains in net interest income

were offset by lower investment income. The Paragon Report examines

the outlook for diversified REITs and provides equity research on

American Capital Agency Corporation (NASDAQ: AGNC) and ARMOUR

Residential REIT, Inc. (NYSE: ARR). Access to the full company

reports can be found at:

www.paragonreport.com/AGNC

www.paragonreport.com/ARR

Earlier this week, the Federal Reserve reiterated its promise to

keep interest rates at "exceptionally low levels... at least

through mid-2013," in a largely pro-forma statement after its last

meeting of the year. "While indicators point to some improvement in

overall labour market conditions, the unemployment rate remains

elevated," the Federal Open Market Committee said in a statement at

the end of the meeting.

The Paragon Report provide investors with an excellent first

step in their due diligence by providing daily trading ideas, and

consolidating the public information available on them. For more

investment research on diversified REITs register with us free at

www.paragonreport.com and get exclusive access to our numerous

stock reports and industry newsletters.

ARMOUR is a Maryland corporation that invests primarily in

hybrid adjustable rate, adjustable rate and fixed rate residential

mortgage-backed securities issued or guaranteed by U.S.

Government-chartered entities. Earlier this month the company

announced that it has priced an underwritten public offering of

8,000,000 shares of common stock. ARMOUR has granted the

underwriter a 30-day option to purchase up to 1,200,000 additional

shares of common stock. ARMOUR pays an annual dividend of $1.32 per

share for a hefty yield of 18.7 percent.

American Capital Agency Corp. is a real estate investment trust

that invests in agency pass-through securities and collateralized

mortgage obligations for which the principal and interest payments

are guaranteed by a U.S. Government agency or a U.S.

Government-sponsored entity. Earlier this week the company

announced that its Board of Directors has declared a cash dividend

of $1.40 per share for the fourth quarter 2011. The dividend is

payable on January 27, 2012 to common shareholders of record as of

December 22, 2011, with an ex-dividend date of December 20,

2011.

The Paragon Report has not been compensated by any of the

above-mentioned publicly traded companies. Paragon Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.paragonreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

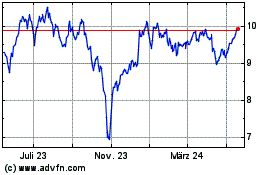

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024