American Capital Misses Estimates - Analyst Blog

26 April 2011 - 5:15PM

Zacks

American Capital Agency

Corp. (AGNC), a real estate investment trust (REIT) that

focuses on investments in mortgage pass-through securities and

collateralized mortgage obligations (CMOs), reported earnings of

$1.48 per share during first quarter 2011, compared to $2.13 in the

year-earlier quarter. Excluding one-time items, recurring net

income for the reported quarter was $1.30 per share. The recurring

earnings for first quarter 2011 missed the Zacks Consensus Estimate

by 6 cents.

The company generated total

revenues of $144.5 million during first quarter 2011 compared to

$56.6 million in the year-ago quarter. Total revenues for the

reported quarter were well ahead of the Zacks Consensus Estimate of

$106 million.

American Capital Agency recorded an

annualized return on equity of 22% for the quarter. As of March 31,

2011, the company’s investment portfolio comprised $28.2 billion

worth of agency securities at fair value, including $22.9 billion

of fixed-rate securities, $4.9 billion of adjustable-rate

securities and $0.4 billion of CMOs.

About 18% of the investment

portfolio comprised adjustable-rate securities, 44% of 15-year

fixed-rate securities, 32% of 30-year fixed-rate securities, 5% of

20-year fixed-rate securities and 1% of CMOs backed by fixed and

adjustable-rate securities.

The investment portfolio of

American Capital Agency was financed with $22.0 billion of

repurchase agreements, $3.3 billion of equity capital and $0.1

billion of variable debt resulting in a leverage ratio of 6.6x.

Adjusting for the net payable for agency securities not yet

settled, the leverage ratio was 7.6x as of March 31, 2011. During

the quarter, American Capital Agency raised $1.75 billion of net

proceeds from its equity offering.

American Capital Agency declared a

first quarter dividend of $1.40 per share, which equates to a total

of $499.2 million in dividends or $14.66 per share since its

initial public offering. American Capital Agency is one of only a

few companies to have increased its dividend even during the

recession.

American Capital Agency’s

annualized weighted average yield on average earning assets was

3.39% and its annualized average cost of funds was 0.81%, which

resulted in an annualized net interest rate spread of 2.58% during

the quarter, unchanged from the fourth quarter of 2010. As of March

31, 2011, the company's book value per share was $25.96 compared to

$24.24 at year-end 2010. At quarter-end, American Capital Agency

had cash and cash equivalents of $300.6 million.

We maintain our ‘Neutral’

recommendation on American Capital Agency, which currently has a

Zacks #3 Rank translating into a short-term ‘Hold’ rating. We also

have a ‘Neutral’ recommendation and a Zacks #3 Rank for

Anworth Mortgage Asset Corporation (ANH), a

competitor of American Capital Agency.

AMER CAP AGENCY (AGNC): Free Stock Analysis Report

ANWORTH MTGE (ANH): Free Stock Analysis Report

Zacks Investment Research

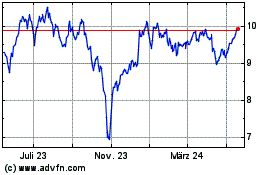

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024